Академический Документы

Профессиональный Документы

Культура Документы

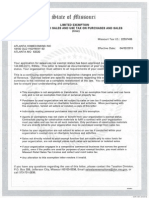

AVFD Sales Tax Exemption Letter

Загружено:

Aaron Baker0 оценок0% нашли этот документ полезным (0 голосов)

38 просмотров1 страницаSales tax exemption letter from Missouri Department of Revenue only to be used for purchases for the Atlanta Volunteer Fire Department.

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документSales tax exemption letter from Missouri Department of Revenue only to be used for purchases for the Atlanta Volunteer Fire Department.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

38 просмотров1 страницаAVFD Sales Tax Exemption Letter

Загружено:

Aaron BakerSales tax exemption letter from Missouri Department of Revenue only to be used for purchases for the Atlanta Volunteer Fire Department.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

State of Missouri

LIMITED EXEMPTION

FROM MISSOURI SALES AND USE TAX ON PURCHASES AND SALES

(Civic)

Issued to: Missouri Tax .D.: 12671592

ATLANTA VOLUNTEER FIRE DEPT

107 W MAIN ST Effective Date: 12/01/2014

ATLANTA MO 63530

Your application for sales/use tax exempt status has been approved pursuant to Section

144.030,2(21), RSMo. This letter is issued as documentation of your organization's exempt i

status. Your organization must adhere to all requirements of your exempt status.

This is a continuing exemption subject to legislative changes and review by the Director

of Revenue. Outlined below are specific requirements regarding this exemption. This

summary is not intended as a complete restatement of the law. You should review the

law to ensure your understanding and compliance.

‘© This exemption is not assignable or transferable. It is an exemption from sales and use taxes

only and is not an exemption from real or personal property tax.

* Purchases by your organization are not subject to sales or use tax if conducted within your

organization's exempt civic or charitable functions and activities. When purchasing with

this exemption, furnish all sellers or vendors a copy of this letter.

Individuals making personal purchases may not use this exemption.

‘* Agents or contractors may not claim or benefit from your organization’s exempt status.

Contractors paying for construction materials to fulfil a contract with your organization

must pay sales and use tax on all such materials. Only purchases of construction materials,

that are directly billed to your organization may be purchased exempt from sales tax.

* Sales by your organization are not subject to sales o use tax if conducted within your

organization’s exempt civic or charitable functions and activities.

* Sales not directly related to your exempt function that are made only to raise funds for

your organization, are not exempt unless such sales are occasional or isolated sales.

‘If your organization engages in a competitive commercial business that serves the general

Public, even if the profits are used for purposes of your exempt function, you must obtain a

Missouri Rotail Sales Tax License and collect and remit sales tax.

* Any alteration to this exemption letter renders it invalid.

If you have any questions regarding the use of this letter, please contact the Taxation Division,

P.O, Box 358, Jefferson City, Missouri 65105-0358, Email salestaxexemptions@dor.mo.gov, or

call 573-751-2836,

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

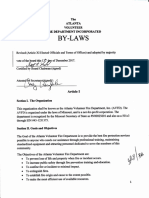

- Proposed by Laws Updates For The Atlanta Volunteer Fire DepartmentДокумент18 страницProposed by Laws Updates For The Atlanta Volunteer Fire DepartmentAaron BakerОценок пока нет

- Updated by Laws For The Atlanta Volunteer Fire Department.Документ16 страницUpdated by Laws For The Atlanta Volunteer Fire Department.Aaron BakerОценок пока нет

- Atlanta Fire 2017 NewsletterДокумент4 страницыAtlanta Fire 2017 NewsletterAaron BakerОценок пока нет

- 2021 Atlanta Homecoming Public ScheduleДокумент1 страница2021 Atlanta Homecoming Public ScheduleAaron BakerОценок пока нет

- 2016 Atlanta Ball Association FormsДокумент1 страница2016 Atlanta Ball Association FormsAaron BakerОценок пока нет

- 2016 Atlanta Homecoming ScheduleДокумент1 страница2016 Atlanta Homecoming ScheduleAaron BakerОценок пока нет

- 2015 McDuffee Family Reunion FlyerДокумент2 страницы2015 McDuffee Family Reunion FlyerAaron BakerОценок пока нет

- Atlanta Homecoming Sales Tax LetterДокумент1 страницаAtlanta Homecoming Sales Tax LetterAaron BakerОценок пока нет

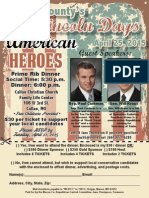

- Macon County Lincoln DaysДокумент2 страницыMacon County Lincoln DaysAaron BakerОценок пока нет

- 2017 Atlanta Homecoming Public ScheduleДокумент1 страница2017 Atlanta Homecoming Public ScheduleAaron BakerОценок пока нет

- AVFD Sales Tax Exemption LetterДокумент1 страницаAVFD Sales Tax Exemption LetterAaron BakerОценок пока нет

- Newsletter - Atlanta Volunteer Fire DepartmentДокумент4 страницыNewsletter - Atlanta Volunteer Fire DepartmentAaron BakerОценок пока нет

- 2015 Women of Joy Letter and ScheduleДокумент2 страницы2015 Women of Joy Letter and ScheduleAaron BakerОценок пока нет

- 2014 Xtreme Winter Conference Letter To ParticipantsДокумент5 страниц2014 Xtreme Winter Conference Letter To ParticipantsAaron BakerОценок пока нет

- 2014 Xtreme Winter Conference Letter To ParticipantsДокумент5 страниц2014 Xtreme Winter Conference Letter To ParticipantsAaron BakerОценок пока нет

- 2014 Church WithOut Walls Reunion InvitationДокумент1 страница2014 Church WithOut Walls Reunion InvitationAaron BakerОценок пока нет

- By-Laws For The Atlanta Volunteer Fire DepartmentДокумент17 страницBy-Laws For The Atlanta Volunteer Fire DepartmentAaron BakerОценок пока нет

- 2015 Women of Joy Letter and ScheduleДокумент2 страницы2015 Women of Joy Letter and ScheduleAaron BakerОценок пока нет

- Crossroads Christian Church - Children's MinisterДокумент2 страницыCrossroads Christian Church - Children's MinisterAaron BakerОценок пока нет

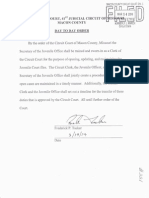

- Rick Tucker Order For Child Support 2014Документ1 страницаRick Tucker Order For Child Support 2014Aaron BakerОценок пока нет

- 2014 Big Wheels FlyerДокумент1 страница2014 Big Wheels FlyerAaron BakerОценок пока нет

- 2014 Letter For Women of JoyДокумент2 страницы2014 Letter For Women of JoyAaron BakerОценок пока нет

- 2013-12-12. Snuggle Up and Read NightДокумент1 страница2013-12-12. Snuggle Up and Read NightAaron BakerОценок пока нет

- 2014 Callao Harvest FiestaДокумент1 страница2014 Callao Harvest FiestaAaron BakerОценок пока нет

- 2014 McDuffee Family Reunion FlyerДокумент1 страница2014 McDuffee Family Reunion FlyerAaron BakerОценок пока нет

- God's Not Dead FlyerДокумент1 страницаGod's Not Dead FlyerAaron BakerОценок пока нет

- 2014 Atlanta Homecoming ScheduleДокумент1 страница2014 Atlanta Homecoming ScheduleAaron BakerОценок пока нет

- 2013 Xtreme Winter Conference Letter To ParticipantsДокумент5 страниц2013 Xtreme Winter Conference Letter To ParticipantsAaron BakerОценок пока нет

- 2013 Atlanta Fun DayДокумент1 страница2013 Atlanta Fun DayAaron BakerОценок пока нет