Академический Документы

Профессиональный Документы

Культура Документы

Behavior Management Program

Загружено:

api-270000679Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Behavior Management Program

Загружено:

api-270000679Авторское право:

Доступные форматы

BEHAVIOR MANANGEMENT PROGRAM

Lauren N. Seifers

Behavior Management Program

PSYS 371 Ball State University

BEHAVIOR

A. Introduction

The following behavior management program will help a client cut back on impulsive

spending so he/she can save a total of $300 in an 8-week period. Impulsive spending is to be

defined as any purchase the client makes which is not deemed as a necessity.

B. Assessment Procedure

Before baseline data is taken, an intake screening will be done to assess the clients

current spending habits before treatment. Indirect baseline data will include the client selfmonitoring his/her current spending habits, as well as all bank statements from 12 months prior.

Bank statements will allow the therapist as well as the client identify exactly what his/her money

is being spent on each week/month.

Even though the therapist cannot physically observe any direct baseline data, the amount

of the target behavior (frequency, duration, and intensity) should be noted from either the client

or from the bank statements. For example, frequency should include how often the client is

impulsively spending, and duration should indicate how long this behavior has been happening.

Time sampling will record specifically when the behavior occurs, as well as when it does not

occur. This data can be recorded each time the client plans to spend money. Observer reliability

will not be an issue, considering the bank statements tell exactly when and where the impulsive

spending occurred.

C. Program Design

The goal of the behavior management program is to identify the stimuli within the

environment that encourages the behavior of impulsive spending. The target behavior in this

program is the impulsive spending.

BEHAVIOR

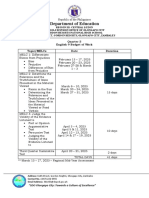

The intervention to be used will be a general budget plan that should be filled out every

week. The purpose of the budget plan is to calculate exactly what the client is spending his/her

money on. Both the therapist and the client will understand that filling out the budget plan is not

a guideline, but a rule for the program.

D. Implementation Strategies

The therapist will implement the data collection, which will occur over an 8-week period.

A differential reinforcement at low rates schedule (DRL) will be used to cease the behavior of

impulsive spending. Fading will also be used to gradually withdraw from the behavior of

impulsive spending.

At the end of each week if the client has not made any unnecessary, impulsive purchases,

he/she will be allowed exactly $10 to use to go out with friends. Since the reinforcer will only

occur at the end of each week if the client succeeds at meeting the goals of saving money, the

reinforcer is on a fixed ratio schedule. The $10 will be the conditioned, delayed positive

reinforcement each week in hopes of increasing the behavior of saving money.

If, however, the client makes unnecessary, impulsive purchases during the week and does

not follow budget, they will not be rewarded with the $10, therefore making the reward

contingent. To avoid impulsive spending, the clients debit card will have a maximum spending

amount, which will serve as a stimuli for extinction (S^). The reward is only $10 each week so

satiation does not occur. Besides the possibility of $10 at the end of each week, an intrinsic

positive reinforcer will be the fact that the client is saving more and spending less.

After the end of the 8-week program, there will be three follow-up appointments. The

first will be in office, one month after. The second will also be in office, six months after the first

appointment. The last follow-up will occur one year from the start of the behavior program.

BEHAVIOR

However, this follow-up will occur via telephone. The purpose of these follow-up appointments

is to make sure the client is still successfully applying the behavior techniques learned from

therapy to real-world situations.

E. Ethical Issues

The ethical concerns within this behavior management program will include the client

signing an informed consent form, which will give permission for therapy to occur. The client

will need to physically sign and verbally commit to the therapist accessing his/her previous and

current bank statements. The bank should be informed of the program taking place. Besides the

previous concerns, no ethical issues will result from this program.

F. Program Evaluation

The goal of this program is to cut back on impulsive spending as well as save $300 in a

period of 8 weeks. The therapist and client will know if the program was successful by how

much money the client saved at the end of the program. Also, if weekly budget plans indicate the

client has drastically cut back on impulsive purchases, the therapist and client will know the

program was successful. However, if the client does not save a total of $300 at the end of the 8week program and weekly budget plans indicate the client has not cut back on impulsive

purchases, the therapist and client will know the program was unsuccessful.

If an extinction burst or spontaneous recovery occurs, it will be understood by the

therapist and the client that mistakes are made to learn from, and to continue with the program.

However, the therapist will use reprimands if the client makes impulsive purchases during the

week.

BEHAVIOR

G. Other Concerns/Issues

One concern with this behavior program is the therapist and the client coming to a mutual

agreement on which purchases are necessary and which are impulsive and unnecessary. For

example, the client may purchase a box of hair dye and believe that is a necessity. However, the

therapist may not agree that hair dye is a necessity and may deem the purchase as impulsive.

Categories within the weekly budget plan should be agreed upon as necessary or impulsive by

both the therapist and client beforehand.

BEHAVIOR

6

References

http://www.printablepaper.net

Вам также может понравиться

- Issa Transformational SpecialistДокумент2 страницыIssa Transformational SpecialistCandice Suzanne Grivet80% (5)

- Financial Literacy Reflection - Lesson 14 - Natalie CotaДокумент2 страницыFinancial Literacy Reflection - Lesson 14 - Natalie Cotaapi-591702258Оценок пока нет

- ECONOMÍA UNIT 5 NДокумент6 страницECONOMÍA UNIT 5 NANDREA SERRANO GARCÍAОценок пока нет

- Step-By-Step Guide On How To Make A BudgetДокумент16 страницStep-By-Step Guide On How To Make A Budgetrizwan ahmedОценок пока нет

- Supply What Is Being Asked Below.: BudgetДокумент5 страницSupply What Is Being Asked Below.: BudgetPrincess Eunnah O. DaydayОценок пока нет

- economisesti baniДокумент4 страницыeconomisesti baniCrispy CristiОценок пока нет

- Budget DiscussionДокумент4 страницыBudget DiscussionLester AgoncilloОценок пока нет

- Finance - slash your money expensesДокумент5 страницFinance - slash your money expensesHarris ArifinОценок пока нет

- Things We Wish We Knew at 23: 8 Financial Tips To Start YoungДокумент10 страницThings We Wish We Knew at 23: 8 Financial Tips To Start Youngrk singhОценок пока нет

- How to Control Your Finances: Save Money, Increase Income, Invest, & Grow your NetworthОт EverandHow to Control Your Finances: Save Money, Increase Income, Invest, & Grow your NetworthОценок пока нет

- Q3 4 Personal Finance EditedДокумент11 страницQ3 4 Personal Finance Editedbeavivo1Оценок пока нет

- Nursing ProcessДокумент26 страницNursing Processprema100% (3)

- Project On BudgetДокумент11 страницProject On BudgetRama GОценок пока нет

- 1 Managing Your FinancesДокумент24 страницы1 Managing Your FinancesSarang HamedaОценок пока нет

- Budget Like a Boss: Take Control of Your Finances with Simple Budgeting and Saving StrategiesОт EverandBudget Like a Boss: Take Control of Your Finances with Simple Budgeting and Saving StrategiesОценок пока нет

- Class Notes of Unit 4 - Fashion MerchandisingДокумент38 страницClass Notes of Unit 4 - Fashion MerchandisingISHITAОценок пока нет

- Managing Personal FinanceДокумент7 страницManaging Personal FinanceCarl Joseph BalajadiaОценок пока нет

- Become A Millionaire: 15 Simple Steps To Grow Your Wealth TodayДокумент26 страницBecome A Millionaire: 15 Simple Steps To Grow Your Wealth TodayDevin HickmanОценок пока нет

- Financial LiteracyДокумент50 страницFinancial LiteracyAnonymous XYzsI6YeX100% (1)

- Principle 1: Personal Financial ManagementДокумент12 страницPrinciple 1: Personal Financial Managementapi-315024834Оценок пока нет

- MPF - Module 1 - Part 1Документ18 страницMPF - Module 1 - Part 1Dipesh BajajОценок пока нет

- The Best Laid Plans of Dogs and Vets: Transform Your Veterinary Practice Through Pet Health Care PlansОт EverandThe Best Laid Plans of Dogs and Vets: Transform Your Veterinary Practice Through Pet Health Care PlansОценок пока нет

- 1Документ4 страницы1Rohan ShresthaОценок пока нет

- Mastering Your Money: A Step-by-Step Plan for Paying Off DebtОт EverandMastering Your Money: A Step-by-Step Plan for Paying Off DebtОценок пока нет

- Money Saving Strategies: Laura Connerly, PH.D., Assistant Professor - Family and Consumer EconomicsДокумент5 страницMoney Saving Strategies: Laura Connerly, PH.D., Assistant Professor - Family and Consumer EconomicsAhmedinОценок пока нет

- Task 2Документ4 страницыTask 2Krishna BhattaОценок пока нет

- Zero-Based BudgetingДокумент4 страницыZero-Based Budgetingnaren6299Оценок пока нет

- Financial LiteracyДокумент14 страницFinancial LiteracyMa Althea PedronanОценок пока нет

- Articles: Name: Waliza Marri (1811316) Class: Bba 4-C Subject: Consumer BehaviorДокумент6 страницArticles: Name: Waliza Marri (1811316) Class: Bba 4-C Subject: Consumer Behaviorhasnain bhuttoОценок пока нет

- Cost ProjectДокумент48 страницCost ProjectBhavyaОценок пока нет

- DQVL ProjectДокумент48 страницDQVL Project2K21/BMBA/17 Priyam UpretiОценок пока нет

- Case Studies On Customer Service 30102023 Part 2Документ6 страницCase Studies On Customer Service 30102023 Part 2chiranzbОценок пока нет

- Eschool Ela Career Development Unit 3-Module 1 Assessment - BudgetingДокумент2 страницыEschool Ela Career Development Unit 3-Module 1 Assessment - Budgetingapi-463243923Оценок пока нет

- The Average Joe’s Guide to Budgeting: The Only Guide You Will Need to Start Budgeting Properly, Get Rid of Debt, And Attain Your Financial Peace of MindОт EverandThe Average Joe’s Guide to Budgeting: The Only Guide You Will Need to Start Budgeting Properly, Get Rid of Debt, And Attain Your Financial Peace of MindОценок пока нет

- ALL ABOUT STUDENT LOANДокумент28 страницALL ABOUT STUDENT LOANhey.halstonОценок пока нет

- Financial Behavior Modification Starter Guide: A Simple Guide to Managing Your FinancesОт EverandFinancial Behavior Modification Starter Guide: A Simple Guide to Managing Your FinancesРейтинг: 3 из 5 звезд3/5 (1)

- Audits - A1 Answers - RevДокумент3 страницыAudits - A1 Answers - RevAmerica's Service CommissionsОценок пока нет

- Budgetary Control Is The Process by Which Financial Control Is Exercised Within AnДокумент6 страницBudgetary Control Is The Process by Which Financial Control Is Exercised Within AnShaijan MathewОценок пока нет

- Lesson 4 10 Tips For Managing Your Money As A College StudentДокумент9 страницLesson 4 10 Tips For Managing Your Money As A College StudentAndrew BantiloОценок пока нет

- Functional Medicine Practice Growth Playbook - Double or Triple Your Bottom LineДокумент12 страницFunctional Medicine Practice Growth Playbook - Double or Triple Your Bottom LineAshtonОценок пока нет

- Braving BudgetsДокумент23 страницыBraving Budgetsjoemar estreraОценок пока нет

- ASI Treatment Planning ManualДокумент22 страницыASI Treatment Planning Manualdrmss100% (1)

- Financial Planning Process GuideДокумент54 страницыFinancial Planning Process GuideSham Salonga PascualОценок пока нет

- Dear Colleagues,: For Internal Use OnlyДокумент7 страницDear Colleagues,: For Internal Use Onlyprateek2602657Оценок пока нет

- How starting pay and career choices impact financesДокумент2 страницыHow starting pay and career choices impact financesrodrigo baltazarОценок пока нет

- Achieve Financial Independence with TESDA's Managing Personal Finances CourseДокумент14 страницAchieve Financial Independence with TESDA's Managing Personal Finances CourseDinah Faye Redulla100% (3)

- Financial Literacy ReflectionДокумент1 страницаFinancial Literacy Reflectionapi-607918645Оценок пока нет

- 7 Steps To Financial LiteracyДокумент16 страниц7 Steps To Financial Literacyjoshua mugwisiОценок пока нет

- BUSINESS FINANCE Week 15Документ8 страницBUSINESS FINANCE Week 15Ace San GabrielОценок пока нет

- 170785remain in Control of Your Financial Resources With Activ Gift Card Balance: Top Tips For Effective BudgetingДокумент4 страницы170785remain in Control of Your Financial Resources With Activ Gift Card Balance: Top Tips For Effective Budgetingt.u.an.pksd03Оценок пока нет

- BSBFIM501 - Task 3 - FeliciaДокумент5 страницBSBFIM501 - Task 3 - FeliciasharingdaastradingОценок пока нет

- Monitoring & Scheduling & Pleasant Activities - Russ Harris - ACT Made Simple Extra BitsДокумент3 страницыMonitoring & Scheduling & Pleasant Activities - Russ Harris - ACT Made Simple Extra BitsRaphaele ColferaiОценок пока нет

- Crim Rev - 5Документ35 страницCrim Rev - 5Ross Camille SalazarОценок пока нет

- Booking 03 28Документ9 страницBooking 03 28Bryan FitzgeraldОценок пока нет

- Defense MechanismДокумент19 страницDefense MechanismMaricar Corina Canaya100% (1)

- Octapace InstrumentДокумент2 страницыOctapace InstrumentAsha DesaiОценок пока нет

- 99 Negotiating StrategiesДокумент143 страницы99 Negotiating StrategiesAnimesh KumarОценок пока нет

- Leadership Is A Process of Getting Things Done Through PeopleДокумент10 страницLeadership Is A Process of Getting Things Done Through PeopleerabbiОценок пока нет

- Digital Detox Reality British English Upper Intermediate Advanced Group PDFДокумент3 страницыDigital Detox Reality British English Upper Intermediate Advanced Group PDFMagyarosi Szabo ZsuzsannaОценок пока нет

- Introduction To Irony in FilmДокумент18 страницIntroduction To Irony in FilmJames MacDowellОценок пока нет

- Hard-Boiled Detective Fiction As A Vehicle of Social CommentaryДокумент10 страницHard-Boiled Detective Fiction As A Vehicle of Social CommentaryMatt Jenkins100% (2)

- Analyzing Creation MythsДокумент2 страницыAnalyzing Creation MythsAbdur SheikhОценок пока нет

- Torres-Madrid Brokerage v. FEB Mitsui InsuranceДокумент2 страницыTorres-Madrid Brokerage v. FEB Mitsui InsuranceJoshua OuanoОценок пока нет

- FIFA To MFA - Temporary CommitteeДокумент2 страницыFIFA To MFA - Temporary CommitteeFabrice FlochОценок пока нет

- Tesla's Innovative Organizational Culture Enables Cutting-Edge ProductsДокумент6 страницTesla's Innovative Organizational Culture Enables Cutting-Edge ProductsGabriel GomesОценок пока нет

- Leadership Outcomes Inventory SolcДокумент12 страницLeadership Outcomes Inventory Solcapi-254318887Оценок пока нет

- Case For Analysis 6Документ2 страницыCase For Analysis 6Micka OahОценок пока нет

- Professional Services AgreementДокумент4 страницыProfessional Services AgreementsharengОценок пока нет

- Peace Not War BY: Patricia Lithuanian: Reader'S Theathre/Speech Choir GRADES 10-12Документ2 страницыPeace Not War BY: Patricia Lithuanian: Reader'S Theathre/Speech Choir GRADES 10-12dump account qОценок пока нет

- Abubakar v. Auditor GeneralДокумент1 страницаAbubakar v. Auditor GeneralsectionbcoeОценок пока нет

- Subjective Relativism: "Truth Depends Solely On What Someone Believes" Komla DamoinДокумент16 страницSubjective Relativism: "Truth Depends Solely On What Someone Believes" Komla DamoinMaurice DamoinОценок пока нет

- Pötscher W. Theophrastos, Peri EusebeiasДокумент197 страницPötscher W. Theophrastos, Peri EusebeiasalverlinОценок пока нет

- Sabina Shcherbakova Resume #1Документ2 страницыSabina Shcherbakova Resume #1sabinaistОценок пока нет

- Architects Code of EthicsДокумент2 страницыArchitects Code of EthicslynhareeОценок пока нет

- English 9 Quarter 3 Budget of WorkДокумент2 страницыEnglish 9 Quarter 3 Budget of WorkChello Ann AsuncionОценок пока нет

- Personal Details: Vikas Kisan Raut 9637790142Документ2 страницыPersonal Details: Vikas Kisan Raut 9637790142Vikas RautОценок пока нет

- Understanding the International Covenant on Economic, Social and Cultural Rights (ICESCRДокумент27 страницUnderstanding the International Covenant on Economic, Social and Cultural Rights (ICESCRBeboy Paylangco Evardo100% (2)

- Philippine Foreign Relations (Autosaved)Документ15 страницPhilippine Foreign Relations (Autosaved)Roby Jane CastilloОценок пока нет

- AssessmentДокумент2 страницыAssessmentAsyirin KamimОценок пока нет

- Pinner Wood Staff Handbook 2009-10Документ18 страницPinner Wood Staff Handbook 2009-10msheldrake4851Оценок пока нет

- Social Inclusion For People With Intellectual DisabilityДокумент112 страницSocial Inclusion For People With Intellectual DisabilityRonnie Mac100% (1)

- Predictiv 5Документ2 страницыPredictiv 5SimonaОценок пока нет