Академический Документы

Профессиональный Документы

Культура Документы

American Minerals Group - 2015 Portfolio Plans Word v1

Загружено:

api-289653586Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

American Minerals Group - 2015 Portfolio Plans Word v1

Загружено:

api-289653586Авторское право:

Доступные форматы

AMERICAN MINERALS GROUP - 2015 PORTFOLIO PLANS

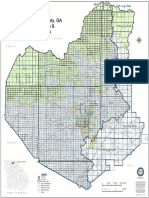

1. TALIHINA GAS DRILLING PROJECT LeFlore County, Oklahoma

AMG has negotiated a farmout of 12,000 + acres in a contiguous block for

gas development in two formations. The Stanley Sand is secondary target at

depths beginning at 2,800 ft. and costs $250,000 each and I.P. should be 250

mcfg/day per well.

The Jackfork Sand is the primary target formation and will show up on the

north end of the project acreage at 5,900 ft. and AMG will probably drill to 8,000

ft. There is expected to be at least 1,000 ft. of Jackfork with 15 to 20 pay intervals

in the zone. AMG will drill first well on the location picked by Newfield Exploration

that had seismic data directing this spot as their primary first target well.

Location is already built so AMG can move in and get started easily.

The expected Initial Production is 1.5 to 3 million mcf gas per day.

Although, Newfield engineers have indicated that there could be as much as 10

Million CFGD per well from this area. AMG will acquire right of way to lay a 3 mile

8" steel pipeline to the 32" trunk line that runs through the AMG acreage.

*****AMG Proposes to drill 2 initial Jackfork Wells to 8,000 ft. and prove the

acreage then lay the pipeline and continue drilling up more acreage on

checkerboard pattern. Each Jackfork well should cost approximately $3.5 Million

to drill and complete x 2 = $7 Million.

The Right of Way and Steel Pipeline may costs as much as $1.5 Million.....

$8.5 Million Total project start cost. There will be sufficient acreage to drill up to

60 additional wells, but AMG will probably only drill 4 to 8 wells and then sell the

remaining drilling acreage and the BIG Gas Reserves to a public company for

their upside potential book values.

:

Drilling and Completion rigs and ancillary tangible equipment. Production

equipment for production string, tubing, tank batteries and other surface

equipment for efficient production operations. Since these wells be gas only - no

oil or water expected, there will not be a need for pumping units or any disposal

wells.

EQUIPMENT & PROCEDURES REQUIRED

PROJECT COST ESTIMATES: $8,500,000

2.

AM Development Drilling Project

Phase I

American #1 & #2

Phase II

American 3, 4, 5

Grimes County, Texas

AMG will Drill 2 wells on initial 60 acres to a depth of less than 3,000 feet. (20 Acre

Spacing) AMG has acquired an acreage position in Grimes County that is in a shallow oil and

gas trend in the Yegua Sands. This field was first drilled by Santa Rosa Operating in 2011. Their

initial wells had initial production rates of over 100 bbls per day and produced 30,000 barrels of oil

until the well switched to producing gas instead. The initial gas rates were approximately 1 million

cubic feet of gas per day.

They subsequently have drilled 3 more offset wells that all produced similarly. AMG plans to

drill 2 to 5 wells offsetting the Santa Rosa wells to the west about 1/2 mile. AMG believes that this

trend in widespread and prolific in the area around these proved producing wells. AMG feels that

as many as 10 to 15 wells could be drilled in the known producing Area of Mutual Interest and

could spread out further. Gas marketing facilities and pipeline are within 1 1/2 mile from farthest

well planned.

EQUIPMENT & PROCEDURES REQUIRED

Drilling and Completion rigs and ancillary tangible equipment. Production

equipment for production string, tubing, rods, pumping units, tank batteries and

other surface equipment for efficient production operations.

PROJECT COST ESTIMATES: $600,000

3. NON-OPERATED OIL & GAS PROPERTIES

Texas Oklahoma New Mexico Colorado North Dakota Louisiana

AMG proposes to follow the program that has proven very successful

providing low risks and much better than average "Return Of Investment /

Return On Investment" when compared to the majority of other oil and gas

drilling programs. AMG management has the experience and contacts to locate

individual drilling projects that are prime investments with great opportunity for

capital growth. The "Non-Op" program will basically be described as follows:

1) Locate and Negotiate prime prospects with experienced Oil Operators who

AMG can participate in their prospects at a low promoted or no promoted costs to

AMG.

2) AMG will participate in each Non-Op well at 1% to possibly 10%

3) These Non-Op wells will be Diversified Operators, Diversified Areas (Texas &

Oklahoma primarily), Diversified known and prolific producing zones (Oil & Gas).

4) Majority of wells will be Horizontal drilled but some will also be Vertical drilled.

5) Other Non-Op Programs that AMG team members has managed and

participated in have a track record of no dry holes, quick payouts, experienced

operators that know their area of operations and know how to drill, complete and

PRODUCE high quality properties. 6) AMG has the philosophy of utilizing our

many years of Industry contacts and experienced operators "To Ride On Their

Coattails" so to speak and participate in projects that these other quality

operators have already provided the geological research evaluations, land title

and leasing legalities, administrative work with landowners and regulatory

agencies, and engineering procedures to achieve successful drilling, completion

and production phases in these prime prospects. This NON-OP Investment

Program will begin when AMG has committed funds to participate a specified

amount of capital to pull the trigger on available prospects that AMG locates and

performs due diligence for a commitment in participation. AMG would like to

begin the "NON-OP PROGRAM" with an annual budget commitment of $3 Million

for this segment of AMG's Investment Portfolio

EQUIPMENT & PROCEDURES REQUIRED:

Cash Credit Line or Cash Commitment of funds when participation in prospect is

confirmed.

PROJECT COST ESTIMATES: $3,000,000 initial target commitment

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Himalayas - Wikipedia, The Free EncyclopediaДокумент9 страницHimalayas - Wikipedia, The Free EncyclopediaJayakumar VenkataramanОценок пока нет

- Fundamentals of Petroleum Exploration V1Документ5 страницFundamentals of Petroleum Exploration V1solvedcareОценок пока нет

- Earth Science: Quarter 1 - Module 3Документ36 страницEarth Science: Quarter 1 - Module 3Adrian Valdez100% (2)

- BCM Notes Unit IIIДокумент10 страницBCM Notes Unit IIIMahesh RamtekeОценок пока нет

- CE 352 - Groundwater HydrologyДокумент59 страницCE 352 - Groundwater HydrologyPamela MadeloОценок пока нет

- Stratigraphic Constraints On Suture Models For Eastern IndonesiaДокумент19 страницStratigraphic Constraints On Suture Models For Eastern IndonesiaPaksindra ArganantaОценок пока нет

- GWP ManualДокумент276 страницGWP ManualSunita ChaurasiaОценок пока нет

- WMP 2011 2015Документ96 страницWMP 2011 2015Asti Amelia NovitaОценок пока нет

- Lumpkin County Georgia Land Lot and District MapДокумент1 страницаLumpkin County Georgia Land Lot and District MapAnonymous PMb2vbrОценок пока нет

- ENG 10 ArgДокумент4 страницыENG 10 ArgShyrill Mae MarianoОценок пока нет

- Use and Misuse of Rock Mass Classification Systems With Particular Reference To The Q-SystemДокумент19 страницUse and Misuse of Rock Mass Classification Systems With Particular Reference To The Q-SystemLina CardonaОценок пока нет

- Neoweb Channel Protection Systems-V00Документ10 страницNeoweb Channel Protection Systems-V00Diego FlórezОценок пока нет

- Groundwater Prospecting: A Hydro-Geophysical StudiesДокумент60 страницGroundwater Prospecting: A Hydro-Geophysical StudiesGunzo MiguelОценок пока нет

- Chapter 1Документ11 страницChapter 1johnОценок пока нет

- Chromite Ore Deposit and Its Uses: MS AssignmentДокумент9 страницChromite Ore Deposit and Its Uses: MS AssignmentayeshamajidОценок пока нет

- Selenium in Food and Health 2nd EdДокумент220 страницSelenium in Food and Health 2nd EdexpendosОценок пока нет

- Case Study On Soft Soil Improvement Using Innovative and Cost-Effective Reinforcing TechniquesДокумент11 страницCase Study On Soft Soil Improvement Using Innovative and Cost-Effective Reinforcing TechniquesindahОценок пока нет

- Vision Ias Test 3 SolutionДокумент37 страницVision Ias Test 3 SolutionA-Kash KarotiyaОценок пока нет

- 2014 Yin GSLSZ GJIДокумент22 страницы2014 Yin GSLSZ GJIAssia Yahia boudharОценок пока нет

- Folds and Their ClassificationДокумент27 страницFolds and Their ClassificationHafizah FadilОценок пока нет

- 15 Tosdal Dilles Cooke ElementsДокумент8 страниц15 Tosdal Dilles Cooke ElementsCristhian MendozaОценок пока нет

- The Metallic and Non-Metallic Minerals Found in The Various Parts of The PhilippinesДокумент2 страницыThe Metallic and Non-Metallic Minerals Found in The Various Parts of The PhilippinesCalilap ShanleyОценок пока нет

- Spectrum 1 - Resource & Tests Multi-ROM - Tests Unit 8 1 StarДокумент3 страницыSpectrum 1 - Resource & Tests Multi-ROM - Tests Unit 8 1 StarChiaky75% (4)

- HPHT Well NorwayДокумент3 страницыHPHT Well NorwayNagaraju Jalla100% (1)

- Prakoso 2013 QIR Paper Rev1Документ7 страницPrakoso 2013 QIR Paper Rev1wadipraОценок пока нет

- Social Science-7 (DAV)Документ47 страницSocial Science-7 (DAV)Sanket Rout100% (1)

- BehyДокумент25 страницBehyStuart RathboneОценок пока нет

- SCMD 09 CH07 Flow in Open ChannelsДокумент71 страницаSCMD 09 CH07 Flow in Open ChannelssmrtnickОценок пока нет

- Is 10751-1994Документ16 страницIs 10751-1994Parmod GodaraОценок пока нет

- Company Profile Wahana Adya (Eng) 2010 - CetakДокумент13 страницCompany Profile Wahana Adya (Eng) 2010 - CetakAgungNurFauzi100% (2)