Академический Документы

Профессиональный Документы

Культура Документы

Scheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical Supplement

Загружено:

Abhishek BiswasОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Scheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical Supplement

Загружено:

Abhishek BiswasАвторское право:

Доступные форматы

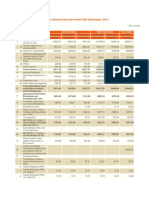

RESERVE BANK OF INDIA BULLETIN WEEKLY STATISTICAL SUPPLEMENT

4. Scheduled Commercial Banks - Business in India

(` Billion)

Outstanding

as on Jan. 9,

2015

1

Item

1 Liabilities to the Banking System

1.1 Demand and Time Deposits from Banks

1.2 Borrowings from Banks

1.3 Other Demand and Time Liabilities

2 Liabilities to Others

2.1 Aggregate Deposits

2.1a Growth (Per cent)

2.1.1 Demand

2.1.2 Time

2.2 Borrowings

2.3 Other Demand and Time Liabilities

3. Borrowings from Reserve Bank

4 Cash in Hand and Balances with Reserve Bank

4.1 Cash in hand

4.2 Balances with Reserve Bank

5 Assets with the Banking System

5.1 Balances with Other Banks

5.2 Money at Call and Short Notice

5.3 Advances to Banks

5.4 Other Assets

6 Investments

6.1a Growth (Per cent)

6.1 Government Securities

6.2 Other Approved Securities

7 Bank Credit

7.1a Growth (Per cent)

7a.1 Food Credit

7a.2 Non-food credit

7b.1 Loans, Cash credit and Overdrafts

7b.2 Inland Bills Purchased

7b.3 Discounted

7b.4 Foreign Bills Purchased

7b.5 Discounted

Fortnight

2

Variation over

Financial year so far

2013-14

2014-15

3

4

Year-on-Year

2014

2015

5

6

1,065.1

365.9

57.4

3.8

17.0

2.8

130.6

96.4

0.5

287.9

16.2

77.6

75.9

11.7

21.4

349.1

68.7

33.0

84,157.3

795.5

1.0

318.2

1,113.8

6.5

156.9

79.5

93.6

52.8

40.8

7,723.8

11.4

39.5

7,684.2

132.4

50.6

198.4

410.5

28.0

382.5

7,101.7

9.2

254.0

6,847.7

187.8

164.1

425.1

303.4

49.1

254.3

9,905.0

15.2

631.3

9,273.7

193.9

204.3

197.3

257.3

32.6

224.7

8,929.0

11.9

730.8

8,198.3

326.5

153.5

427.0

287.5

74.9

212.6

41.9

25.1

11.0

52.9

559.0

2.3

559.0

0.1

443.3

0.7

9.1

434.3

370.4

22.1

19.1

28.5

3.3

43.0

78.5

6.9

404.6

2,194.2

10.9

2,201.7

7.5

5,114.1

9.7

172.9

4,941.3

4,960.1

150.3

71.8

43.5

32.0

242.5

86.8

2.1

102.7

2,828.5

12.8

2,824.7

3.8

3,969.3

6.6

107.5

3,861.8

3,972.6

35.5

70.7

1.1

39.6

110.6

7.1

39.1

285.2

2,476.3

12.5

2,482.3

6.0

7,305.4

14.5

72.9

7,232.5

7,023.0

170.4

33.4

44.1

34.6

387.0

26.3

35.8

71.1

2,701.4

12.1

2,698.4

3.0

6,191.5

10.7

44.8

6,236.3

6,111.5

50.1

153.7

5.6

29.2

7,393.3

76,764.1

2,022.6

4,219.2

841.2

3,925.5

507.8

3,417.7

1,304.8

191.3

169.5

340.0

24,956.7

24,936.6

20.0

63,910.3

1,092.3

62,818.0

61,663.4

348.9

1,176.5

264.0

457.5

5. Ratios and Rates

(Per cent)

2014

Item/Week Ended

Ratios

Cash Reserve Ratio

Statutory Liquidity Ratio

Cash-Deposit Ratio

Credit-Deposit Ratio

Incremental Credit-Deposit Ratio

Investment-Deposit Ratio

Incremental Investment-Deposit Ratio

Rates

Policy Repo Rate

Reverse Repo Rate

Marginal Standing Facility (MSF) Rate

Bank Rate

Base Rate

Term Deposit Rate >1 Year

Savings Deposit Rate

Call Money Rate (Weighted Average)

91-Day Treasury Bill (Primary) Yield

182-Day Treasury Bill (Primary) Yield

364-Day Treasury Bill (Primary) Yield

10-Year Government Securities Yield

RBI Reference Rate and Forward Premia

INR-US$ Spot Rate ( ` Per Foreign Currency)

INR-Euro Spot Rate ( ` Per Foreign Currency)

Forward Premia of US$ 1-month

3-month

6-month

Jan. 24

1

2015

Dec. 26

2

Jan. 2

3

Jan. 9

4

Jan. 16

5

Jan. 23

6

4.00

23.00

4.88

76.70

66.37

29.37

26.40

4.00

22.00

4.82

76.13

55.91

29.27

35.99

4.00

22.00

..

..

..

..

..

4.00

22.00

4.66

75.94

55.89

29.65

39.83

4.00

22.00

..

..

..

..

..

4.00

22.00

..

..

..

..

..

7.75

6.75

8.75

8.75

10.00/10.25

8.00/9.10

4.00

8.11

8.69

..

8.67

8.78

8.00

7.00

9.00

9.00

10.00/10.25

8.00/9.00

4.00

8.10

8.35

..

8.22

8.01

8.00

7.00

9.00

9.00

10.00/10.25

8.00/9.00

4.00

8.22

8.31

8.36

..

7.90

8.00

7.00

9.00

9.00

10.00/10.25

8.00/8.75

4.00

8.03

8.39

..

8.18

7.89

7.75

6.75

8.75

8.75

10.00/10.25

8.00/8.75

4.00

7.94

8.39

8.25

..

7.75

7.75

6.75

8.75

8.75

10.00/10.25

8.00/8.75

4.00

7.85

8.19

..

7.91

7.74

62.18

85.09

8.59

8.49

8.14

63.64

77.74

7.92

7.23

7.13

63.29

76.31

7.96

7.58

7.39

62.40

73.61

8.08

7.76

7.50

61.89

72.01

7.95

7.63

7.21

61.50

69.62

7.61

7.74

7.32

January 30, 2015

Вам также может понравиться

- Scheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical SupplementДокумент1 страницаScheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical SupplementmkmanojdevilОценок пока нет

- Scheduled Commercial Banks - Business in India: (? Billion)Документ1 страницаScheduled Commercial Banks - Business in India: (? Billion)sasirekaarumugamОценок пока нет

- Scheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical SupplementДокумент1 страницаScheduled Commercial Banks - Business in India: Reserve Bank of India Bulletin Weekly Statistical Supplementb_nagarjuna5814Оценок пока нет

- Scheduled Commercial Banks - Business in India: (' Billion)Документ1 страницаScheduled Commercial Banks - Business in India: (' Billion)AkashОценок пока нет

- RBI Bulletin Weekly Statistical SupplementДокумент1 страницаRBI Bulletin Weekly Statistical SupplementnisteelroyОценок пока нет

- Mod 5 Topic 1 PDFДокумент1 страницаMod 5 Topic 1 PDFManipalGlobalОценок пока нет

- Financial Data Highlights of Scheduled Commercial Banks in IndiaДокумент2 страницыFinancial Data Highlights of Scheduled Commercial Banks in Indiansgowrish007Оценок пока нет

- Constituents of Balance Sheet: Team-3Документ45 страницConstituents of Balance Sheet: Team-3AnilKumarОценок пока нет

- Master Circular - CRR and SLR - 2010Документ24 страницыMaster Circular - CRR and SLR - 2010prathi05Оценок пока нет

- Annex - I: Sources of DataДокумент4 страницыAnnex - I: Sources of Dataankit71420Оценок пока нет

- RBI's 2005-06 Annual ReportДокумент10 страницRBI's 2005-06 Annual ReportporuterОценок пока нет

- Reserve Bank of India - Liabilities and AssetsДокумент1 страницаReserve Bank of India - Liabilities and Assetsbookie101Оценок пока нет

- Vol. 28 SEPTEMBER 27, 2013 No. 39: 1. Reserve Bank of India - Liabilities and AssetsДокумент2 страницыVol. 28 SEPTEMBER 27, 2013 No. 39: 1. Reserve Bank of India - Liabilities and AssetsKaran ShoorОценок пока нет

- CRR-SLR in BanksДокумент25 страницCRR-SLR in BanksPrashant GargОценок пока нет

- RBI Weekly Statistical Supplement GuideДокумент38 страницRBI Weekly Statistical Supplement Guidemohitvishal34Оценок пока нет

- CRR and SLR MCДокумент26 страницCRR and SLR MCNagaratnam ChandrasekaranОценок пока нет

- Cash Reserve Ratio (CRR) & Statutory Liquidity Ratio (SLR) Cash Reserve Ratio (CRR)Документ4 страницыCash Reserve Ratio (CRR) & Statutory Liquidity Ratio (SLR) Cash Reserve Ratio (CRR)Sushil KumarОценок пока нет

- NDTLДокумент13 страницNDTLPradeep PoojariОценок пока нет

- CRR and SLR Requirements for BanksДокумент25 страницCRR and SLR Requirements for BanksSamhitha KandlakuntaОценок пока нет

- Banking Statistics GuideДокумент63 страницыBanking Statistics GuideKirubaker PrabuОценок пока нет

- CRR, SLR Requirements ExplainedДокумент4 страницыCRR, SLR Requirements ExplainedBabul YumkhamОценок пока нет

- NPA History of IDBI Bank MainДокумент7 страницNPA History of IDBI Bank MainMonish SelvanayagamОценок пока нет

- Returns To Be Submitted To RBIДокумент106 страницReturns To Be Submitted To RBIAbhishek RastogiОценок пока нет

- Bank Balance Sheets and Income StatementsДокумент61 страницаBank Balance Sheets and Income StatementsAniket BardeОценок пока нет

- BSISДокумент61 страницаBSISMahmood KhanОценок пока нет

- Introduction To Asset Liability and Risk MGMTДокумент147 страницIntroduction To Asset Liability and Risk MGMTMani ManandharОценок пока нет

- 'CC (CCC" CCC CCCCCCДокумент14 страниц'CC (CCC" CCC CCCCCCGopi KrishnaОценок пока нет

- TOI - How RBI - Bring Dollars - Arrest Rupee's SlideДокумент5 страницTOI - How RBI - Bring Dollars - Arrest Rupee's Slidekarthik sОценок пока нет

- Presentation On NPA Problem: by Anshika AditiДокумент18 страницPresentation On NPA Problem: by Anshika AditiAnshika SharmaОценок пока нет

- NCCBLДокумент69 страницNCCBLMd.Azam KhanОценок пока нет

- Audit of BankingДокумент16 страницAudit of BankingyashsuyawanshiОценок пока нет

- Essar Steel Creditors ListДокумент57 страницEssar Steel Creditors Listvarinder kumar0% (1)

- A Study On NPA of Public Sector Banks in India: January 2014Документ10 страницA Study On NPA of Public Sector Banks in India: January 2014rajesh nimodiaОценок пока нет

- A Guide To RBIs Weekly Statistical Supplement - Part IIДокумент11 страницA Guide To RBIs Weekly Statistical Supplement - Part IIparthasarathi_inОценок пока нет

- Unaudited Financial Results Q2 2014Документ4 страницыUnaudited Financial Results Q2 2014Dhruba DebnathОценок пока нет

- DJ WorkДокумент49 страницDJ WorkPratik GhadeОценок пока нет

- RBI Master Circular on Reporting Wilful DefaultersДокумент21 страницаRBI Master Circular on Reporting Wilful DefaultersShaeqОценок пока нет

- CRR, SLR: Dr.S.C.BihariДокумент16 страницCRR, SLR: Dr.S.C.BihariAbhi2636100% (1)

- Annual Report 2006Документ116 страницAnnual Report 2006Enamul HaqueОценок пока нет

- Money and BankingДокумент10 страницMoney and BankingSahil ChadhaОценок пока нет

- FRA AssignmentДокумент56 страницFRA AssignmentJenika SolankiОценок пока нет

- Monthly Test - February 2020Документ7 страницMonthly Test - February 2020Keigan ChatterjeeОценок пока нет

- Annual Report 2007Документ118 страницAnnual Report 2007Enamul HaqueОценок пока нет

- Current Macroeconomic Situation (English) - 2071-08 Tables 46 (Based On Three Months Data of 2071-72) - NewДокумент46 страницCurrent Macroeconomic Situation (English) - 2071-08 Tables 46 (Based On Three Months Data of 2071-72) - NewChandeshwor ShahОценок пока нет

- Circular For Interest PaymentДокумент3 страницыCircular For Interest PaymentVibhu SinghОценок пока нет

- Non-Performing AssetsДокумент20 страницNon-Performing AssetsSagar PawarОценок пока нет

- Beepedia Weekly Current Affairs (Beepedia) 1st-8th December 2023Документ48 страницBeepedia Weekly Current Affairs (Beepedia) 1st-8th December 2023SHANTANU MISHRAОценок пока нет

- Understanding Bank Financial StatementsДокумент49 страницUnderstanding Bank Financial StatementsRajat MehtaОценок пока нет

- Rural Banking: Assignment 1Документ13 страницRural Banking: Assignment 1skybantiОценок пока нет

- SLR CRRДокумент25 страницSLR CRRSaketGiriОценок пока нет

- HSBC Bank India's Annual ReportДокумент40 страницHSBC Bank India's Annual ReportRavi RajaniОценок пока нет

- Assignment On Non Performing AssetsДокумент12 страницAssignment On Non Performing AssetsAditya Anshuman DashОценок пока нет

- ZTBL Annual ReportДокумент64 страницыZTBL Annual ReportHaris NaseemОценок пока нет

- GK Power Capsule NICL AO Assistant 2015Документ45 страницGK Power Capsule NICL AO Assistant 2015Abbie HudsonОценок пока нет

- Analysis of NPA trends in public sector banksДокумент9 страницAnalysis of NPA trends in public sector banksSunil Kumar PalikelaОценок пока нет

- Assets and Liability ManagementДокумент42 страницыAssets and Liability Managementssubha123100% (4)

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsОт EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsОценок пока нет

- Regional Rural Banks of India: Evolution, Performance and ManagementОт EverandRegional Rural Banks of India: Evolution, Performance and ManagementОценок пока нет

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaОт EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaОценок пока нет

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteОт EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteОценок пока нет

- Deficiencies in Agricultural Marketing and Input Delivery System: A View From The FieldДокумент6 страницDeficiencies in Agricultural Marketing and Input Delivery System: A View From The FieldMukul BabbarОценок пока нет

- MarketingДокумент13 страницMarketingquintupleОценок пока нет

- Rahul ReportДокумент57 страницRahul ReportMukul BabbarОценок пока нет

- Role and Importance of Capital Market in IndiaДокумент9 страницRole and Importance of Capital Market in IndiaMukul Babbar50% (4)

- Air ConditionerДокумент54 страницыAir ConditionerMukul BabbarОценок пока нет

- HDFC 130929223332 Phpapp01Документ77 страницHDFC 130929223332 Phpapp01ManojPatelОценок пока нет

- Ad-Mad ShowДокумент43 страницыAd-Mad ShowMukul BabbarОценок пока нет

- Agriculture MKTДокумент60 страницAgriculture MKTMukul Babbar100% (1)

- AAEC 3301 - Lecture 1Документ22 страницыAAEC 3301 - Lecture 1Mukul BabbarОценок пока нет

- Indian Capital Market: An OverviewДокумент4 страницыIndian Capital Market: An OverviewMukul BabbarОценок пока нет

- 09 - Chapter 3 Literature ReviewДокумент40 страниц09 - Chapter 3 Literature ReviewAbdul AmeenОценок пока нет

- Collective Bargaining & Negotiation: Khushdeep Class Mba (F) Roll No 36Документ32 страницыCollective Bargaining & Negotiation: Khushdeep Class Mba (F) Roll No 36Mukul BabbarОценок пока нет

- Fdi Current StatusДокумент2 страницыFdi Current StatusMukul BabbarОценок пока нет

- Icici Bank Comparison With Other BanksДокумент13 страницIcici Bank Comparison With Other BanksMukul BabbarОценок пока нет

- A Study On The Impact of Packging On Purchasing Decision ofДокумент57 страницA Study On The Impact of Packging On Purchasing Decision ofpawan0123Оценок пока нет

- Submitted To: Pradeepika Ma'am Submitted By: Khushdeep (36) SargamДокумент19 страницSubmitted To: Pradeepika Ma'am Submitted By: Khushdeep (36) SargamMukul BabbarОценок пока нет

- IFM BIS Triennal Survey 2013Документ24 страницыIFM BIS Triennal Survey 2013Roshan ManandharОценок пока нет

- Bilt ProjectДокумент124 страницыBilt ProjectMukul BabbarОценок пока нет

- QuestionnaireДокумент13 страницQuestionnaireAzlina ZaineОценок пока нет

- Submitted To: Pradeepika Ma'am Submitted By: Khushdeep (36) SargamДокумент19 страницSubmitted To: Pradeepika Ma'am Submitted By: Khushdeep (36) SargamMukul BabbarОценок пока нет

- "Popularity of Branded Apparels" - Appeal To The Youth & Loyalty Towards ItДокумент34 страницы"Popularity of Branded Apparels" - Appeal To The Youth & Loyalty Towards ItMuhammad Siddique KhanОценок пока нет

- Golden BirdДокумент15 страницGolden BirdMukul BabbarОценок пока нет

- Currency DerivativeДокумент48 страницCurrency DerivativeKrishna Chaitanya TummalaОценок пока нет

- Jindal Stainless LTD History of GroupДокумент3 страницыJindal Stainless LTD History of GroupMukul BabbarОценок пока нет

- FWD & FutureДокумент24 страницыFWD & FutureAnantha NagОценок пока нет

- JSL Working Cap MGTДокумент120 страницJSL Working Cap MGTMukul BabbarОценок пока нет

- NBFCs: Non-Banking Financial Companies ExplainedДокумент37 страницNBFCs: Non-Banking Financial Companies ExplainedMukul Babbar100% (2)

- Ethical Advertising IssuesДокумент13 страницEthical Advertising IssuesRuby ChandaОценок пока нет