Академический Документы

Профессиональный Документы

Культура Документы

BIR Ruling Digest

Загружено:

Arjam B. BonsucanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BIR Ruling Digest

Загружено:

Arjam B. BonsucanАвторское право:

Доступные форматы

BIR Ruling [DA (C-019) 090-10]

Facts:

Top Rate Construction and General Services Incorporated (Top Rate for brevity), a

corporation engage in the business as a contractor for construction work and

providing general services to the public covering janitorial and messengerial work,

requested that RMC 39-2007 be applicable to independent contractors like Top Rate

insofar as the treatment of agency fees/gross receipts is concerned.

The ruling:

It is basic in statutory construction that when the words of a statute are clear and

unambiguous, they must be held to mean what they plainly express. Statutes

creating a new liability increasing an existing liability shall be construed strictly. Tax

laws operate to impose burdens on the public or to restrict enjoyment of their

property. Thus, in the interpretation of such statutes it is the established rule not to

extend their provisions by implication, beyond the clear import of the language

employed, or to enlarge their scope as to include matters not specifically pointed

out.

There is nothing in the context of RMC 39-2007 which would suggest to have the

RMC applicable to manpower agencies OTHER THAN THE SECURITY AGENCIES.

Under the revised rules and regulations implemented RA 5487, the primary

obligation to pay the salaries of the security guards was placed to the clients. It is

required that the monies received by the security agency representing salaries shall

be earmarked for the security guard and shall not form part of the agencys gross

income. On such basis, the security agency is placed on a tax situation different

from other service providers

Вам также может понравиться

- Department of Labor and EmploymentДокумент1 страницаDepartment of Labor and EmploymentArjam B. BonsucanОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

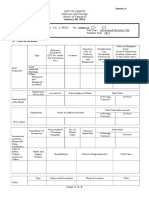

- List of AssetsДокумент3 страницыList of AssetsArjam B. Bonsucan80% (5)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- 14-2001 - Requirements For Tax ExemptionДокумент7 страниц14-2001 - Requirements For Tax ExemptionArjam B. BonsucanОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Natural ResourcesДокумент10 страницNatural ResourcesElaine Llarina-RojoОценок пока нет

- Civil 2011-2015Документ12 страницCivil 2011-2015Arjam B. BonsucanОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Sample SMRДокумент3 страницыSample SMRArjam B. BonsucanОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- 2424rmo03 15 AnnexesДокумент1 страница2424rmo03 15 AnnexesArjam B. BonsucanОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- DAR v. Sarangani ScriptДокумент2 страницыDAR v. Sarangani ScriptArjam B. BonsucanОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- 2424rmo03 15 AnnexesДокумент1 страница2424rmo03 15 AnnexesArjam B. BonsucanОценок пока нет

- Civil Code of The PhilippinesДокумент29 страницCivil Code of The PhilippinesEnrryson SebastianОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Section 24Документ24 страницыSection 24Tanisha SolankiОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Statutory Construction Atty - Sabile DavidДокумент6 страницStatutory Construction Atty - Sabile DavidEugene ValmonteОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Legal Maxim CompilationДокумент45 страницLegal Maxim CompilationVampire Cat100% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Ang Bagong Bayani-OfW Labor Party vs. Commission On Elections, 359 SCRA 698, G.R. No. 147589, G.R. No. 147613 June 26, 2001Документ64 страницыAng Bagong Bayani-OfW Labor Party vs. Commission On Elections, 359 SCRA 698, G.R. No. 147589, G.R. No. 147613 June 26, 2001Alexiss Mace JuradoОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Chua v. CSCДокумент11 страницChua v. CSCKristanne Louise YuОценок пока нет

- Appeal Memo - CHEd ScholarsДокумент25 страницAppeal Memo - CHEd Scholarsgilberthufana446877Оценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Statutory Construction and Interpretation: General Principles and Recent Trends; Statutory Structure and Legislative Drafting Conventions; Drafting Federal Grants Statutes; and Tracking Current Federal Legislation and RegulationsДокумент96 страницStatutory Construction and Interpretation: General Principles and Recent Trends; Statutory Structure and Legislative Drafting Conventions; Drafting Federal Grants Statutes; and Tracking Current Federal Legislation and RegulationsTheCapitol.Net100% (3)

- BUENASEDA V FLAVIERДокумент7 страницBUENASEDA V FLAVIERTimothy JamesОценок пока нет

- 27 Frivalado Vs ComelecДокумент29 страниц27 Frivalado Vs ComelecJaerick RamosОценок пока нет

- Office of The Ombudsman, Petitioner, vs. Uldarico P. ANDUTAN, JR., RespondentДокумент18 страницOffice of The Ombudsman, Petitioner, vs. Uldarico P. ANDUTAN, JR., RespondentRoland Joseph MendozaОценок пока нет

- PP V Saari JusohДокумент32 страницыPP V Saari JusohMohamad MursalinОценок пока нет

- Breyer Confirmation HearingДокумент691 страницаBreyer Confirmation HearingjoshblackmanОценок пока нет

- G.R. No. 177333Документ8 страницG.R. No. 177333Ged VenturaОценок пока нет

- LOBRIGOДокумент19 страницLOBRIGOSpencerОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Illustrative Case: Federation of Free Farmers vs. CA, GR 41161. September 10, 1981 - Intent Prevails The Text of The LawДокумент6 страницIllustrative Case: Federation of Free Farmers vs. CA, GR 41161. September 10, 1981 - Intent Prevails The Text of The LawAlrezaJanОценок пока нет

- Ponente's View (Justice Mendoza) : Article II, Section 12 of The Constitution States: "The State Recognizes TheДокумент5 страницPonente's View (Justice Mendoza) : Article II, Section 12 of The Constitution States: "The State Recognizes TheChristiane Marie BajadaОценок пока нет

- Ios2601 - Exam - Questions - and - Answers - PDF - 2016Документ15 страницIos2601 - Exam - Questions - and - Answers - PDF - 2016irvinОценок пока нет

- Interpretation of StatutesДокумент29 страницInterpretation of StatutesarunОценок пока нет

- Pcfi VS NTC GR L No 63318 2ND Part Case DigestДокумент2 страницыPcfi VS NTC GR L No 63318 2ND Part Case DigestKrystel Mae VenterezОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Commissioner of Internal Revenue vs. Esso Standard Eastern, Inc.Документ9 страницCommissioner of Internal Revenue vs. Esso Standard Eastern, Inc.Jayson FranciscoОценок пока нет

- JURISPRUDENCE - General Vs SpecificДокумент4 страницыJURISPRUDENCE - General Vs SpecificBey VillanuevaОценок пока нет

- Linguistic Canons of InterpretationДокумент73 страницыLinguistic Canons of InterpretationPhi SalvadorОценок пока нет

- HONASAN Vs DOJДокумент37 страницHONASAN Vs DOJEvan PavonОценок пока нет

- 4 Cir V CaДокумент4 страницы4 Cir V CaCai CarpioОценок пока нет

- D'Emden V Pedder (1904) HCA 1 (1904) 1 CLR 91 (24 February 1904)Документ11 страницD'Emden V Pedder (1904) HCA 1 (1904) 1 CLR 91 (24 February 1904)Erica ZhangОценок пока нет

- Arizona Supreme Court Abortion Law RulingДокумент47 страницArizona Supreme Court Abortion Law RulingNational Content Desk100% (1)

- Nikhil Parthsarthi, Batch-XIV. Sem IX. CPCДокумент16 страницNikhil Parthsarthi, Batch-XIV. Sem IX. CPCLОценок пока нет

- Ethics CasesДокумент337 страницEthics CasesJeffrey FuentesОценок пока нет

- Pelizloy Realty Corp. Vs Province of Benguet, GR No. 183137, 10 April 2013Документ2 страницыPelizloy Realty Corp. Vs Province of Benguet, GR No. 183137, 10 April 2013Catherine Dawn Maunes100% (1)