Академический Документы

Профессиональный Документы

Культура Документы

MQUA06189 - SalarySlipwithTaxDetails May2015

Загружено:

UtsabОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

MQUA06189 - SalarySlipwithTaxDetails May2015

Загружено:

UtsabАвторское право:

Доступные форматы

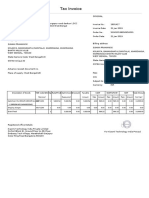

QUATRRO GLOBAL SERVICES PRIVATE LIMITED

Basement, 24, C- Block, Community Centre, Janak Puri, DELHI 110058

NEW DELHI

Pay Slip for the month of May 2015

All amounts in INR

Location

:GURGAON

Bank/MICR :110234004

Bank A/c No.:100028735879 (INDUSIND BANK LTD)

Cost Center :QBPO

PAN

:AWCPJ1306J

PF No.

:HR/GGN/29073/6104

DOJ:05 May 2014 Payable Days:31.00

ESI No.

:

UAN

:100007110856

Earnings

Deductions

Rate

Monthly

Arrear

Total

Description

Amount

10838.00

10838.00

0.00

10838.00 PF

1301.00

5325.00

5325.00

0.00

5325.00 LWF

10.00

2500.00

2500.00

0.00

2500.00

600.00

600.00

0.00

600.00

130.00

0.00

130.00

19263.00 19393.00

0.00 19393.00

GROSS DEDUCTIONS

1311.00

Net Pay : 18082.00 (EIGHTEEN THOUSAND EIGHTY TWO ONLY)

Emp Code :QUA06189

Emp Name :MOHIT JHA

Department:Technical Solutions Group

Designation:SOLUTION ENGINEER

Grade

:1AB

DOB

:02 Jan 1989

Description

BASIC

HRA

CBPB(Bonus)

MED ALL

INCENTIVE

GROSS EARNINGS

Income Tax Worksheet for the Period April 2015 - March 2016

Description

BASIC

HRA

CBPB(Bonus)

MED ALL

INCENTIVE

Gross

130056.00

63900.00

5000.00

7200.00

130.00

Exempt

Taxable

0.00 130056.00

0.00 63900.00

0.00

5000.00

7200.00

0.00

0.00

130.00

Deduction Under Chapter VI-A

Investments u/s 80C

Provident Fund

15608.00

Gross

206286.00 7200.00 199086.00

Deductions

Previous Employer Taxable Income

0.00

Previous Employer Professional Tax

0.00

Professional Tax

0.00

Under Chapter VI-A

15608.00

Any Other Income

0.00

Taxable Income

183478.00

Total Tax

0.00

Tax Rebate u/s 87a

0.00

Surcharge

0.00

Tax Due

0.00

Educational Cess

0.00

Net Tax

0.00

Tax Deducted (Previous Employer)

0.00

Tax Deducted on Perq.

0.00

Tax Deducted on Any Other Income.

0.00

Tax Deducted Till Date

0.00

Tax to be Deducted

0.00

Tax/Month

0.00

Tax on Non-Recurring Earnings

0.00

Tax Deduction for this month

0.00

Total Investments u/s 80C

15608.00

U/S 80C

15608.00

Total Ded Under Chapter VI-A15608.00

Total Any Other Income

Taxable HRA Calculation(Non-Metro)

Rent Paid

0.00

From

01/04/2015

To

31/03/2016

1. Actual HRA

63900.00

2. 40% or 50% of Basic

52022.00

3. Rent > 10% Basic

0.00

Least of above is exempt

0.00

Taxable HRA

63900.00

TDS Deducted Monthly

Month

April-2015

May-2015

Tax Deducted on Perq.

Total

0.00

Personal Note: This is a system generated payslip, does not require any signature.

Amount

0.00

0.00

0.00

0.00

Вам также может понравиться

- Money Matters: Local Government Finance in the People's Republic of ChinaОт EverandMoney Matters: Local Government Finance in the People's Republic of ChinaОценок пока нет

- MQUA06189 - SalarySlipwithTaxDetails April 2015 PDFДокумент1 страницаMQUA06189 - SalarySlipwithTaxDetails April 2015 PDFUtsabОценок пока нет

- QUA05123 SalarySlip-July15Документ1 страницаQUA05123 SalarySlip-July15RajdipmahantaОценок пока нет

- MQUA06189 - SalarySlipwithTaxDetails June15Документ1 страницаMQUA06189 - SalarySlipwithTaxDetails June15UtsabОценок пока нет

- June SalaryДокумент1 страницаJune SalaryVivek KumarОценок пока нет

- QUA06184 SalarySlipwithTaxDetails2 PDFДокумент1 страницаQUA06184 SalarySlipwithTaxDetails2 PDFVivek KumarОценок пока нет

- QUA06194 SalarySlipwithTaxDetails9Документ1 страницаQUA06194 SalarySlipwithTaxDetails9UtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails PDFUtsabОценок пока нет

- QUA06184 SalarySlipwithTaxDetails1 PDFДокумент1 страницаQUA06184 SalarySlipwithTaxDetails1 PDFVivek KumarОценок пока нет

- QUA06184 SalarySlipwithTaxDetails PDFДокумент1 страницаQUA06184 SalarySlipwithTaxDetails PDFVivek KumarОценок пока нет

- QUA05432 SalarySlipwithTax JAN 15Документ1 страницаQUA05432 SalarySlipwithTax JAN 15Deepak KumarОценок пока нет

- QUA06194 SalarySlipwithTaxDetails14Документ1 страницаQUA06194 SalarySlipwithTaxDetails14UtsabОценок пока нет

- QUA04354 SalarySlipwithTaxDetailsmarchДокумент1 страницаQUA04354 SalarySlipwithTaxDetailsmarchrajanОценок пока нет

- QUA06194 SalarySlipwithTaxDetails20 PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails20 PDFUtsabОценок пока нет

- QUA06673 Oct-2015 PDFДокумент1 страницаQUA06673 Oct-2015 PDFAmitОценок пока нет

- QUA05432 SalarySlipwithTax FEB15Документ1 страницаQUA05432 SalarySlipwithTax FEB15Deepak KumarОценок пока нет

- QUA04354 - SalarySlipwithTaxDetails 1Документ1 страницаQUA04354 - SalarySlipwithTaxDetails 1rajanОценок пока нет

- QUA06673 Nov-2015Документ1 страницаQUA06673 Nov-2015AmitОценок пока нет

- QUA05432 SalarySlip March 15Документ1 страницаQUA05432 SalarySlip March 15Deepak KumarОценок пока нет

- QUA04047 Jul15Документ1 страницаQUA04047 Jul15Mehtab saifiОценок пока нет

- QUA06708 SalarySlipwith OctoberTaxDetailsДокумент1 страницаQUA06708 SalarySlipwith OctoberTaxDetailssonu mackОценок пока нет

- QUA05123 SalarySlip-June15Документ1 страницаQUA05123 SalarySlip-June15RajdipmahantaОценок пока нет

- QUA04047 Mar15Документ1 страницаQUA04047 Mar15Mehtab saifiОценок пока нет

- MQUA06189 SalarySlipwithTaxDetails JulyДокумент1 страницаMQUA06189 SalarySlipwithTaxDetails JulyUtsabОценок пока нет

- Quatrro Global Services Private LimitedДокумент1 страницаQuatrro Global Services Private LimitedHimalОценок пока нет

- MQUA06189 SalarySlipwithTaxDetails AugustДокумент1 страницаMQUA06189 SalarySlipwithTaxDetails AugustUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails3Документ1 страницаQUA06194 SalarySlipwithTaxDetails3UtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails4Документ1 страницаQUA06194 SalarySlipwithTaxDetails4UtsabОценок пока нет

- Qua05242 Salaryslip AugustДокумент1 страницаQua05242 Salaryslip AugustsaurabhОценок пока нет

- QUA04047 Jan15Документ1 страницаQUA04047 Jan15Mehtab saifiОценок пока нет

- QUA06194 SalarySlipwithTaxDetailsДокумент1 страницаQUA06194 SalarySlipwithTaxDetailsUtsabОценок пока нет

- Ju Un Neesa Laaa RryДокумент1 страницаJu Un Neesa Laaa RryRohit JoshiОценок пока нет

- Quatrro Global Services Private LimitedДокумент1 страницаQuatrro Global Services Private LimitedZubairsaeedОценок пока нет

- QUA04047 Feb15Документ1 страницаQUA04047 Feb15Mehtab saifiОценок пока нет

- QUA05890 SalarySlipwithTaxDetails JulДокумент1 страницаQUA05890 SalarySlipwithTaxDetails Julnitinsh189Оценок пока нет

- QUA06194 SalarySlipwithTaxDetails2Документ1 страницаQUA06194 SalarySlipwithTaxDetails2UtsabОценок пока нет

- QUA06702 SalarySlipwithTaxDetailsДокумент1 страницаQUA06702 SalarySlipwithTaxDetailsZubairsaeedОценок пока нет

- JuullyytsalaaarryДокумент1 страницаJuullyytsalaaarryRohit JoshiОценок пока нет

- QUA06708 SalarySlipwithTaxDetailsДокумент1 страницаQUA06708 SalarySlipwithTaxDetailssonu mackОценок пока нет

- QUA06194 SalarySlipwithTaxDetails21 PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails21 PDFUtsabОценок пока нет

- QUA06702 SalarySlipwithTaxDetailsДокумент1 страницаQUA06702 SalarySlipwithTaxDetailsZubairsaeedОценок пока нет

- QUA05890 SalarySlipwithTaxDetails AugДокумент1 страницаQUA05890 SalarySlipwithTaxDetails Augnitinsh189Оценок пока нет

- JUN 15 SalarySlipwithTaxDetailsДокумент1 страницаJUN 15 SalarySlipwithTaxDetailsAmit BaraiОценок пока нет

- QUA06596 SalarySlip March withTaxDetails PDFДокумент1 страницаQUA06596 SalarySlip March withTaxDetails PDFVijay KumarОценок пока нет

- QUA06673 June-2015Документ1 страницаQUA06673 June-2015AmitОценок пока нет

- QUA06708 SalarySlipwithTaxDetails FebДокумент1 страницаQUA06708 SalarySlipwithTaxDetails Febsonu mackОценок пока нет

- AugussttsalaaarryДокумент1 страницаAugussttsalaaarryRohit JoshiОценок пока нет

- QUA06596 SalarySlipwithTaxDetails PDFДокумент1 страницаQUA06596 SalarySlipwithTaxDetails PDFVijay KumarОценок пока нет

- QUA06708 SalarySlipwithTaxDetails AprilДокумент1 страницаQUA06708 SalarySlipwithTaxDetails Aprilsonu mackОценок пока нет

- JAN 15 SalarySlipwithTaxDetailsДокумент1 страницаJAN 15 SalarySlipwithTaxDetailsAmit BaraiОценок пока нет

- MAY 15 SalarySlipwithTaxDetailsДокумент1 страницаMAY 15 SalarySlipwithTaxDetailsAmit BaraiОценок пока нет

- QUA06596 SalarySlip Feb withTaxDetails PDFДокумент1 страницаQUA06596 SalarySlip Feb withTaxDetails PDFVijay KumarОценок пока нет

- Quatrro Global Services Private LimitedДокумент1 страницаQuatrro Global Services Private LimitedHimalОценок пока нет

- QUA06673 May-2015Документ1 страницаQUA06673 May-2015AmitОценок пока нет

- QUA06673 Feb-2015Документ1 страницаQUA06673 Feb-2015AmitОценок пока нет

- QUA06673 Mar-2015Документ1 страницаQUA06673 Mar-2015AmitОценок пока нет

- APR 15 SalarySlipwithTaxDetailsДокумент1 страницаAPR 15 SalarySlipwithTaxDetailsAmit BaraiОценок пока нет

- QUA06673 Apr-2015 PDFДокумент1 страницаQUA06673 Apr-2015 PDFAmitОценок пока нет

- FEB 15 SalarySlipwithTaxDetailsДокумент1 страницаFEB 15 SalarySlipwithTaxDetailsAmit BaraiОценок пока нет

- QUA06673 Dec-2015Документ1 страницаQUA06673 Dec-2015AmitОценок пока нет

- QUA06194 SalarySlipwithTaxDetails23 PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails23 PDFUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails22 PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails22 PDFUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails24 PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails24 PDFUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetailsДокумент1 страницаQUA06194 SalarySlipwithTaxDetailsUtsabОценок пока нет

- QUA06271 SalarySlipwithTaxDetailsДокумент1 страницаQUA06271 SalarySlipwithTaxDetailsUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails21 PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails21 PDFUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails20 PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails20 PDFUtsabОценок пока нет

- MQUA06189 SalarySlipwithTaxDetails AugustДокумент1 страницаMQUA06189 SalarySlipwithTaxDetails AugustUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails14Документ1 страницаQUA06194 SalarySlipwithTaxDetails14UtsabОценок пока нет

- MQUA06189 SalarySlipwithTaxDetails JulyДокумент1 страницаMQUA06189 SalarySlipwithTaxDetails JulyUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails9Документ1 страницаQUA06194 SalarySlipwithTaxDetails9UtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails4Документ1 страницаQUA06194 SalarySlipwithTaxDetails4UtsabОценок пока нет

- DetailДокумент5 страницDetailUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails2Документ1 страницаQUA06194 SalarySlipwithTaxDetails2UtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails3Документ1 страницаQUA06194 SalarySlipwithTaxDetails3UtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails PDFUtsabОценок пока нет

- Aries Marine Private Limited JLN - Sekoci No.110 Alur Laut, Jakarta Utara No 21 Ubi Road 1 408724 Singapore Rampun, Hendra TikuДокумент1 страницаAries Marine Private Limited JLN - Sekoci No.110 Alur Laut, Jakarta Utara No 21 Ubi Road 1 408724 Singapore Rampun, Hendra Tikuhendra tiku rampunОценок пока нет

- Slip PDFДокумент4 страницыSlip PDFputri endah rahmawatiОценок пока нет

- Ca Gaurav Gupta: 507 B, D-Mall, Netaji Subhash Place, Pitampura, Delhi - 110034 P: 011 - 32962487, 9811013940Документ2 страницыCa Gaurav Gupta: 507 B, D-Mall, Netaji Subhash Place, Pitampura, Delhi - 110034 P: 011 - 32962487, 9811013940Gaurav GuptaОценок пока нет

- Pay Slip - 604316 - Nov-22Документ1 страницаPay Slip - 604316 - Nov-22ArchanaОценок пока нет

- Translation Taxslipf28Документ1 страницаTranslation Taxslipf28Ya LiОценок пока нет

- Rep LWS000203140Документ1 страницаRep LWS000203140ATОценок пока нет

- TDS ChallanДокумент2 страницыTDS ChallanRamachandran Mahendran60% (5)

- Test - 2 PDFДокумент6 страницTest - 2 PDFHåris Khån MøhmånďОценок пока нет

- Efiling Registration OutcomeДокумент1 страницаEfiling Registration OutcomeVovo SolutionsОценок пока нет

- HCL PayslipДокумент1 страницаHCL PayslipkrishnaОценок пока нет

- Salary Slip (32119327 April, 2019)Документ1 страницаSalary Slip (32119327 April, 2019)Hassan RanaОценок пока нет

- InstructionsДокумент15 страницInstructionsWeslley Reis ChagasОценок пока нет

- Tax Invoice: FromДокумент1 страницаTax Invoice: FromSUMAN PRAMANICKОценок пока нет

- Income Tax Department: Computerized Payment Receipt (CPR - It)Документ2 страницыIncome Tax Department: Computerized Payment Receipt (CPR - It)Mian EnterprisesОценок пока нет

- Hawk Credit ApplicationДокумент2 страницыHawk Credit ApplicationDave CalhounОценок пока нет

- May 17Документ1 страницаMay 17Bhanu Pratap ChoudhuryОценок пока нет

- Sunita Sobers QuestionДокумент1 страницаSunita Sobers Questionzhart1921Оценок пока нет

- Roscoe Corp Was Organized On January 2 2015 It WasДокумент1 страницаRoscoe Corp Was Organized On January 2 2015 It WasMuhammad ShahidОценок пока нет

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSai SanthoshОценок пока нет

- Bills Material PurchaseДокумент2 страницыBills Material PurchaseChanchal PathakОценок пока нет

- Hamilton Housewares Pvt. Ltd.-Rakholi: Salary Slip For The Month of February 2020Документ1 страницаHamilton Housewares Pvt. Ltd.-Rakholi: Salary Slip For The Month of February 2020KRISHNA SINGHОценок пока нет

- Itax Form 2006Документ4 страницыItax Form 2006AliMuzaffarОценок пока нет

- Affidavit of Non Filing of Income TaxДокумент2 страницыAffidavit of Non Filing of Income TaxMae Gnela50% (2)

- Solution Manual For Corporate Partnership Estate and Gift Taxation 2013 7th Edition by PrattДокумент15 страницSolution Manual For Corporate Partnership Estate and Gift Taxation 2013 7th Edition by PrattMariaMasontwfj100% (40)

- Bharatbhai Tax Bill Godown No-7Документ1 страницаBharatbhai Tax Bill Godown No-7VaghasiyaBipinОценок пока нет

- An Introduction To GST: Himanshu Kushwaha Assistant Professor, Malda College, Malda, West BengalДокумент18 страницAn Introduction To GST: Himanshu Kushwaha Assistant Professor, Malda College, Malda, West Bengalneha pandeyОценок пока нет

- Autoland Subic MotorsДокумент2 страницыAutoland Subic MotorsGuile Gabriel AlogОценок пока нет

- AC 3101 CHAPTER 10 NotesДокумент2 страницыAC 3101 CHAPTER 10 NotesKemuel TantuanОценок пока нет

- USLAI Financial SchedulesДокумент1 страницаUSLAI Financial SchedulesDavid FlowersОценок пока нет

- Exhibit 56 November 28 2023 Tax LetterДокумент8 страницExhibit 56 November 28 2023 Tax LetterAnthony TalcottОценок пока нет