Академический Документы

Профессиональный Документы

Культура Документы

Alcoholic Beverages / Marketing Strategies Michael Spandern

Загружено:

api-26914446Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Alcoholic Beverages / Marketing Strategies Michael Spandern

Загружено:

api-26914446Авторское право:

Доступные форматы

Alcoholic Beverages / Marketing Strategies

Michael Spandern

Promoting Alcoholic Beverages:

The Effectiveness of Various Marketing Strategies

Michael Bruno Spandern

Agribusiness Consulting

Bahnhofst. 81, 24582 Bordesholm

Germany

mike@spandern.com

1 Introduction

The promotion of alcoholic beverages is most obviously dominated by branding efforts of various

large producers1. Most campaigns noticeable to the consumer are either re-launches of already

existing products aiming to adapt the image of a product to a shifting target by simply changing the

product appearance (i.e. logos, colours, packaging, slogans, strap line) or the continuous output of

new or seemingly new products at a high frequency. The latter generally is the domain of larger

companies using the power of their company brand and market penetration and it represents a

severe challenge for small producers trying to sustain their market share. Despite the tremendous

success of single products this approach has lead to a continuously decreasing lifespan of products,

increasing costs of entering the market and protecting innovations. Several authors believe this

product orientated behaviour is even responsible for the severe losses of product groups with a

rather traditional image such as beer and whisky in Western Europe. Accelerating product variety

within one product category might have lead to the shift of consumers to completely different

product ranges2.

There is need for discussion regarding the dangers of alcohol consumption and regular moderate

consumption by healthy adults must be strictly separated from alcohol abuse.

The marketing of products, such as alcoholic drinks, needs greater care and responsibility than

others particularly with reference to their availability to young people. The advertising of alcohol is

usually subject to specific rules in addition to general codes3. It is therefore crucial to evaluate the

effectiveness of various marketing strategies with regard to the success of a single product or

company within the context of the overall trend of consumer behaviour. The following will discuss

the observations for beer and spirits.

2 Marketing strategies in the beverage industry

In past years, the alcoholic beverage industry was not known for its high degree of creativity or

innovation4. Consequently the traditional established beverage market is stagnating1. However, as

-1-

Spandern Agribusiness Consulting

www.spandern.com

Alcoholic Beverages / Marketing Strategies

Michael Spandern

sales in Western Europe started to lag and even fall in some cases, and competing beverages took

away market share, the companies with leading brands began to satisfy consumer demand with

more new products and extensions. In addition, some companies have initiated aggressive marketing

and promotional programs to acquaint potential consumers with the pleasures of consuming

alcoholic beverages.

Some of the changes include using new types of ingredients, using organic ingredients, adding

flavours to drinks previously only known unflavoured, creating products from a single malt or barrel,

and creating healthy versions. In addition, companies use such strategies as niche marketing,

packaging innovations, and tie-in promotions for sports events and social causes.

To overcome the risks of the pure product orientated “tunnel view”5 most classical marketing

textbooks often demand the development and implementation of a combination of various

marketing strategies or a specific marketing package6. This in practice is mostly not the case

because of the lack of scientifically proven standard processes for the selection of suitable

strategies2. No generally recognised system of methods or procedures is described7. Finding the

right strategy to market agricultural goods and food products and putting such a strategy into

action, is not mathematically formalisable. Strategic planning is rather a creative, often

spontaneous process and very dependant on the personality of the planer or decision taker2. In this

context ROVENTA8 describes two typical characters:

1. The manager depicted as an entrepreneur is controlling his environment, actively searching

for significant opportunities and relating them to his vision of strategy9.

2. The manager “mudding through”, is only acting when forced to and the can only consider a

few convenient alternatives, each of which will only cause small non-disruptive changes in

his/her organisation5,10, 11.

The British “Beer-Naturally”- campaign as an example is doubtlessly aiming at the more committed

style of management, willing and able to communicate the company’s vision.

Basically for main directions of market orientated product strategies are known12, 13:

1. Market penetration: existing product for existing market

2. Market development: existing product for new market

3. Product development: new product for existing market

4. Diversification: new product for new market

All of the above are also found as classical tools of strategic planning within the food and beverage

industries but not all techniques are used for all product groups and there is a strong regional

variation, especially between Eastern and Western Europe. Similar to other consumer driven

markets the success of marketing campaigns for alcoholic beverages underlies overall trends and

temporary fashion phenomena. But amongst all foods alcoholic beverages are probably the one

product group most affected by legislative interventions14, whether through restrictions in

-2-

Spandern Agribusiness Consulting

www.spandern.com

Alcoholic Beverages / Marketing Strategies

Michael Spandern

production, such as quotas and state monopolies, or through restrictions in advertising means, such

as claims and free choice of media.

2.1 Marketing beer

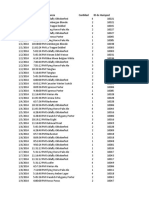

Beer is the most dominant alcoholic beverage throughout Europe. An average of around 40 % of the

alcohol consumed annually comes out of beer (chart 1). Beers include lagers and ales. Lagers are

marketed as super premium, premium, specialty, light/lite, dry, ice, malt liquor and flavoured. Ales

are marketed as super premium, premium, specialty and flavoured. Beers have always been

produced with different brewing styles, but the current trend is to use new types of grains such as

all barley or all wheat, particularly by marketers of specialty beers and microbrews; or hops

imported from different parts of the world; or to add sweet, fruit or spicy flavours. Hemp

(cannabis) as an additive or even as a replacement for hops and seasonal beers also provide new

taste experiences for consumers7.

Recently the especially brewing industry in Europe puts most efforts into product development to

compete with the rapidly growing group of ready-to-drink (RTD) spirits, or “alco-pops”, and uses

advertising techniques clearly addressed to young people. To influence the drinking preferences of

consumers between 18 and 30 is crucial for reliable predictions. It is the background for sales

developments once these consumers reach an age of higher disposable income. It is noticeable, in

this context, that during the past decade the consumption of beer has declined in several Western

European countries (chart 2) and whilst the overall consumption of alcoholic beverages has

stagnated or even increased (chart 3).

15

Chart1: Alcohol out of Beer in percent of total Alcohol Consumption

-3-

Spandern Agribusiness Consulting

www.spandern.com

Alcoholic Beverages / Marketing Strategies

Michael Spandern

Chart 2: Change in Beer Consumption

Chart 3: Change in Alcohol Consumption.

The roots of beer production go back to the first agrarian societies where beer was noarmal part of

the daily diet16. Laws that regulate the production of beer and protect the identity of the product

-4-

Spandern Agribusiness Consulting

www.spandern.com

Alcoholic Beverages / Marketing Strategies

Michael Spandern

have always played an essential role in the brewing trade. One of these regulations was laid down

by the Bavarian dukes Wilhelm IV and Ludwig X at the State Parliament at Ingolstadt, Germany on

April 23, 1516; the law was accepted and today is internationally well recognised as the German

Purity Law (Reinheitsgebot). Today consumer protection and traceability are key words in the food

chain and pay an essential role in marketing strategies for beer all over the world17.

The “Beer-Naturally”-campaign in the UK is using this background trying to reverse the decline in

beer sales17. It is understood that brewing companies had considerable success promoting their

individual brand but paid less attention promoting the beer category1. The campaign has two main

strands: enhancing the public perception for beer and improving the drinkers experience when it is

drunk. But keeping these goals in mind, the British Beer Naturally campaign primarily acts within

the brewing companies themselves instead of launching new advertising series. The concept is

based on clear communication of company goals, assuming that employees highly committed to

their trade lead to a more confident appearance of the product category.

Keeping in mind that marketing beer is commonly based on a reputation of being natural and pure,

the new group of ready-mixed or flavoured beer products is surprisingly successful1. Especially in

Germany where there is a strong consumer perception against any ingredients in beer not complying

with the Reinheitsgebot, ready mixed beer-and-lemonade or beer-and-spirit products occupy an

extremely rapid growing market segment. Often the image of these products is built upon the

parent’s brand of both the beer and the added lemonade or spirit simultaneously1.

An advantage of blending beer with other products seen by the brewing industry is that there is no

need to change the image of the traditional product beer, and risk consumer loyalty, whilst moving

into new image segments. The new product category allows the brewing industry to pick up trends

with short life-cycles, such as ready mixed beer-and-caipirinjah referring to the feel of the summer

holiday season and the contemporary success of Latino music in Europe1.

Because beer contains alcohol and alcoholism is a matter of concern as well as alcohol related

accidents, crime and various social problems this beverage falls into the category of products

bearing a potential danger to the society or single individuals. General observations comparing beer

to other alcoholic drinks show that both the industry and most consumers have a sensible and

1,2,3,4,5

responsive behaviour when handling beer .

2.2. Marketing spirits

Spirits include white spirits which include vodka, tequila, gin, and rum; and brown spirits which

include whisky/whiskey (American, Scotch, Irish, and Canadian), brandy/cognac, and

cordials/liqueurs. Spirit consumers, do not expect many new products, and experimentation might

-5-

Spandern Agribusiness Consulting

www.spandern.com

Alcoholic Beverages / Marketing Strategies

Michael Spandern

require some degree of information-gathering before their higher prices are paid. Some spirits

producers are using single sources to make their products, such as single malt whiskeys and single

barrel bourbons, in an effort to provide unique tastes and create a super premium product. Spirits

producers are also adding flavours to some drinks in an effort to attract new younger, female

drinkers18. A great challenge which always limited the success of marketing spirit was the paradigm

of spirits being regarded as ingredients bringing a portion of alcohol into cocktails19.

Vodka is probably the most predominant spirit20, Scotch, especially the single malt, is the standard

bearer, congnac is the luxury spirit, and bourbon and tequila are serving a rather flat market. The

turnover of gin and martini is permanently fluctuating with trends. But rum and other spirit made

from molasses currently experience the greatest growth21. The market for spirits is generally

dominated by large brands. Most innovations entering the market seldom represent new producers

and their concepts rather than carrying the names of internationally recognised makes representing

the diversification of their product range.

The ready-to-drink products as an ideal example of diversification penetrate a market segment

which is new to spirits and traditionally is occupied by beer. Small units of finished product at a

price comparable to beer are directly to be enjoyed out of the bottle. These products now reach

consumers who usually do not regularly purchase spirit drinks but are well aware of the various

large international brands of whiskies, vodkas and rums. The “RTDs” or “alco-pops” and other ready

mixed drinks on the one hand enabled a younger group of consumers to take participate in a world

of famous brands which normally was only accessible to people with a higher disposable income, on

the other they moved from “special occasions” and gave way to everyday drinking. The challenge

for the producers of this new product category was to build up completely different and a more

complex marketing strategy than the traditional promotion of mixed drinks. To be fully successful,

the producer would have to build a solid business for the ready-to-drink products whilst maintaining

or even rebuilding the parent’s brand reputation22.

Sprits underlie significant governmental interventions is most markets. To overcome the obstacles

of the national intervention by the German state monopoly “Bundesmonopol” the German “Korn”

schnaps distillers have founded a central marketing agency the Deutsche Kornbrand

Vermarktungsgesellschaft, DKV. In its activities as a private enterprise, the DKV represents interests

of approximately 300 “Korn” distillers under public law. Its most important task is to take deliveries

of the raw "Korn" alcohol from the distilleries. After distilling it to an alcoholic content of about 96%

vol., the DKV sells its potable spirits to the producers of "Korn" schnapps or other spirits based on

"Korn" alcohol. As the central link between production and marketing, it also represents "Korn"

schnapps in politically and socially relevant bodies and contributes to the public relations work for

German "Korn" schnapps23.

-6-

Spandern Agribusiness Consulting

www.spandern.com

Alcoholic Beverages / Marketing Strategies

Michael Spandern

3 Conclusion

As in other businesses the marketing strategies of the beverage industries follow typical patterns of

consolidation and diversification. The market is characterised by an accelerated movement towards

convenience and an increasing consumer demand for transparency and safety. Under these

conditions large globally acting corporations use their financial strength and the power of their

brands to find new sales opportunities. Generally it can be seen that this strategy is very successful.

It allows some global players even to act trend setters. Simultaneously as strongly branded

international products are available as standards around the world, regional specialties gain

popularity.

With very few exemptions all campaigns miss to promote the product category as a whole and

educate consumers about the product background. Branding efforts drive all strategic planning.

Similar to global fast food chains not promoting beef in general but rather their finished restaurant

product, or like the dairy industry failing to stabilise milk prices and sales, the various producers of

alcoholic drinks seam to fear investments that might benefit the whole industry. One explanation

might be found investigating the companies’ financial structures showing that many larger

producers belong to global conglomerates of investors where alcoholic beverage is only one aspect

of the business.

Michael Spandern

mike@spandern.com

1

CLAUSNITZER, T. 2002. Das Geheimns der Markenführung. Getränke, Technologie und Marketing. Feb. MSU Consulting, Hamburg Germany.

2

BIRNBAUM, G., Consumer insights – consumer shopping behaviour in the beverage markets. 29th EBC – Congress Dublin. 17. – 22. May. 2003. Lecture No: 60.

3

INGHAM, A., BAKER, KBOURNE, H. BODNAR, A., BROWN, A., 2002. Responsible Marketing of Alcoholic Drinks: Regulations and Enforcement. An Overview of the Regulatory

Environment for Commercial Communication of Alcoholic Beverages in Europe. Canadean Limited, Hants, UK, www.canadean.com.

4

KROLL, D., 1996, The Evolving Alcoholic Beverage Industry

5

KOTLER, P., 1982. Marketing Management, 4th Ed. H.Reber, Stuttgart .

6

HAMM, U., 1991. Landwirtschaftliches Marketing, „Agricultural Marketing“, Grundlagen des marketing für Landwirtschaftliche Unternehmen. UTB für Wissenschaft, Band 1620,

Ulmer, Stuttgart.

7

BECKER, J. 1988. Marketing-Konzeption. 2. Ed. Munich.

8

ROVENTA, P., 1979. Portfolio Anaylsis of Strategic Marketing. Munich.

9

MINTZBERG, H., 1975. The Science of Strategie Marketing. In: McCarthy et al. S. 293 – 310.

10

LINDBLOM, C., E., 1964. The Sciene of “Mudding Trough”. In: Leavitt and Pondy. 61 – 79.

11

DRIVER, J., 2004. Canging Perceptions in Makreting Spirits. Chapter 4 in BRYCE. J.H. and STEWART, G.G. (Ed.) “Distilled Spirits” Nottingham University Press, Nottingham, UK.

12

ANSOFF, H.I, 1966. Management Strtegie. Munich, 1996

13

MEFFERT,B., BRUHN, M., SCHUBERT, F. and WALTER, T., 1986. Marketing und ökologie – Chancen und Risiken Umweltorientierter Absatzstrategien der Unternehmungen. In:

Die Betriebswirtschaft. 140 – 159).

14

LONG, D., 2003. Food Savety in the breing sector: meeting the challenges of legislative developements and consumer behaviour. 29th EBC – Congress Dublin. 17. – 22. May. 2003.

Lecture No: 60.

15

CANADEAN LIMITED, 2002. Responsible Marketing of Alcoholic Drinks: Regulation and Enforcement. June. www.canadean.com.

16

HACKEL-STEHR, K., 1987. Das Brauwesen in Bayern. Entsehung und Entwicklung des Reinheitsgebotes (1516). Disseratation. Technische Universität Berlin.

17

HEGARTY, P., 2003. Beer Naturally – a passion for beer. 29th EBC – Congress Dublin. 17. – 22. May. 2003. Lecture No: 59.

18

TIMMONS, B. & HEAD, A., 2003. From liqueurs to malternatives: the art of flavouring and compounding alcohol. The Alcohol Textbook, 4th Ed., JACQUES, K., LYONS, T.P.,

KELSALL, D. ed., Nottingham University Press, Nottingham, UK, p193

19

DRIVER, J., 2004. Canging Perceptions in Makreting Spirits. Chapter 4 in BRYCE. J.H. and STEWART, G.G. (Ed.) “Distilled Spirits” Nottingham University Press, Nottingham, UK.

20

DELVANTE, M.P., 2004. Rum – the commercial and technical aspects. Chapter 29 in BRYCE. J.H. and STEWART, G.G. (Ed.) “Distilled Spirits” Nottingham University Press,

Nottingham, UK

21

DELVANTE, M.P., 2004. Rum – the commercial and technical aspects. Chapter 29 in BRYCE. J.H. and STEWART, G.G. (Ed.) “Distilled Spirits” Nottingham University Press,

Nottingham, UK

22

DRIVER, J., 2004. Canging Perceptions in Makreting Spirits. Chapter 4 in BRYCE. J.H. and STEWART, G.G. (Ed.) “Distilled Spirits” Nottingham University Press, Nottingham, UK.

23

DKV, Deutsche Kornbrand Vermarktungsgesellschaft,. 2004.2 If You have rights”. D-59348 Lüdinghausen Website: www.dkv-korn.de.

-7-

Spandern Agribusiness Consulting

www.spandern.com

Вам также может понравиться

- DistДокумент9 страницDistkeithguruОценок пока нет

- L'OREAL Cosmetics: Marketing PlanДокумент12 страницL'OREAL Cosmetics: Marketing Plansly westОценок пока нет

- Marketing Plan CircusДокумент28 страницMarketing Plan CircusNauman MalikОценок пока нет

- BA903158 Ashfaq Ahmed LSST UWL BEДокумент15 страницBA903158 Ashfaq Ahmed LSST UWL BENazmus SaifОценок пока нет

- Marketing ProjectДокумент9 страницMarketing ProjectkherasiddharthОценок пока нет

- Marketing Plan FinalДокумент18 страницMarketing Plan FinalAnkur PrakashОценок пока нет

- The Study of Marketing Strategy of Coca Cola in ChinaДокумент24 страницыThe Study of Marketing Strategy of Coca Cola in ChinaPradeep Singh BhadanaОценок пока нет

- Starbucks International Marketing StrategyДокумент9 страницStarbucks International Marketing StrategyKrishna NaОценок пока нет

- Assignment Marketing - DBFA 2009-37 LatestДокумент23 страницыAssignment Marketing - DBFA 2009-37 Latestcjayaneththi100% (3)

- Dan Berciu - Coca Cola Marketing ReportДокумент33 страницыDan Berciu - Coca Cola Marketing Reportberciu.dan7514Оценок пока нет

- Haighs Chocolates E-Marketing PlanДокумент16 страницHaighs Chocolates E-Marketing PlanYusef ShaqeelОценок пока нет

- Marketing Plan of Dilson CigaretteДокумент10 страницMarketing Plan of Dilson CigaretteSada Moner Manus100% (4)

- Cadbury Marketing PlanДокумент25 страницCadbury Marketing PlanArnobОценок пока нет

- Report On Aarong-Part TwoДокумент42 страницыReport On Aarong-Part TwoRakib HassanОценок пока нет

- Marketing Strategy: Prime Research & Consultancy CONTACT: 0088-01734449991Документ20 страницMarketing Strategy: Prime Research & Consultancy CONTACT: 0088-01734449991Sohail SherОценок пока нет

- Red BullДокумент15 страницRed BullVishakha TyagiОценок пока нет

- Red BullДокумент22 страницыRed BullGaurav OjhaОценок пока нет

- Strategic Message PlannerДокумент5 страницStrategic Message Plannerapi-524965037Оценок пока нет

- Int MKT AssignmentДокумент66 страницInt MKT AssignmentHafeez AfzalОценок пока нет

- L'Oréal: SECTOR - Consumer StaplesДокумент11 страницL'Oréal: SECTOR - Consumer StaplesMaria AlexandraОценок пока нет

- Market Segmentation AssignmentДокумент18 страницMarket Segmentation AssignmentVrindha Vijayan100% (1)

- Marketing Strategies and Policies: Scientific Coordinator: Conf. Univ. Dr. Amalia DUȚUДокумент30 страницMarketing Strategies and Policies: Scientific Coordinator: Conf. Univ. Dr. Amalia DUȚUAlin ApostolescuОценок пока нет

- Dove (My Part)Документ9 страницDove (My Part)Naimul Haque NayeemОценок пока нет

- Marketing Plan: Course Title: Submitted To: Submitted byДокумент33 страницыMarketing Plan: Course Title: Submitted To: Submitted byshahzada 1Оценок пока нет

- Cadbury Marketing PlanДокумент30 страницCadbury Marketing PlanSamuel100% (2)

- Wiki P&GДокумент9 страницWiki P&Graj_mduОценок пока нет

- PESTEL Analysis of Sri LankaДокумент15 страницPESTEL Analysis of Sri LankaGayan Nayanapriya Heva Masmulla67% (3)

- Bachelor Thesis: Red BullДокумент32 страницыBachelor Thesis: Red BullKhushbooОценок пока нет

- Ricoh ReportДокумент4 страницыRicoh Reportapi-352787809Оценок пока нет

- International Marketing PlanДокумент23 страницыInternational Marketing Planحسيب مرتضي98% (46)

- Sweden PESTELДокумент10 страницSweden PESTEL李沁恩Оценок пока нет

- Starbucks Marketing Mix 2Документ4 страницыStarbucks Marketing Mix 2Faiz RezalОценок пока нет

- L'oreal ProjectДокумент6 страницL'oreal ProjectRita E. RadyОценок пока нет

- An Over View of The Godiva Chocolatier Company Marketing EssayДокумент10 страницAn Over View of The Godiva Chocolatier Company Marketing EssayHND Assignment Help0% (1)

- Marketing StrategiesДокумент15 страницMarketing Strategieshui yiОценок пока нет

- APPLE INC AnalysisДокумент10 страницAPPLE INC AnalysisKing ThameОценок пока нет

- Unit 2 Marketing Process and EnvironmentДокумент29 страницUnit 2 Marketing Process and EnvironmentBHAKT Raj BhagatОценок пока нет

- Marketing Plan RedbullДокумент3 страницыMarketing Plan RedbullabdОценок пока нет

- Strategic Management - MGMT 689Документ20 страницStrategic Management - MGMT 689Mohammed ZamanОценок пока нет

- Assignment For Coca ColaДокумент14 страницAssignment For Coca ColaJessica Ramoutar0% (1)

- Symphony MobileДокумент6 страницSymphony MobileNaimul Haque NayeemОценок пока нет

- Pestel Analysis of Coca ColaДокумент4 страницыPestel Analysis of Coca Colatejaskamble450% (1)

- HSBC BankДокумент19 страницHSBC BankNavonil NagОценок пока нет

- Target Marketing PlanДокумент17 страницTarget Marketing PlankkellerrОценок пока нет

- International Marketing PlanДокумент21 страницаInternational Marketing Planredheattauras86% (7)

- Clients and Regulatory Body of Advertising: ADVERTISING MEDIA OF BANGLADESH: TV, Radio, Newspaper, Internet, SmsДокумент4 страницыClients and Regulatory Body of Advertising: ADVERTISING MEDIA OF BANGLADESH: TV, Radio, Newspaper, Internet, SmsAbdullah ArafatОценок пока нет

- John Lewis Marketing Report MBA 2017Документ20 страницJohn Lewis Marketing Report MBA 2017adamОценок пока нет

- Cola - PestelДокумент35 страницCola - PestelVeysel100% (1)

- Presented By:-Nikita KoliДокумент29 страницPresented By:-Nikita KoliMustika ZakiahОценок пока нет

- Marketing Plan For Organic ValleyДокумент21 страницаMarketing Plan For Organic ValleyKunal Gudhka100% (1)

- Bath and Body WorksДокумент2 страницыBath and Body WorkssaloniОценок пока нет

- SWOT Analysis of The Body ShopДокумент4 страницыSWOT Analysis of The Body ShopSyafira Nida IsyaraniОценок пока нет

- Market SegmentationДокумент23 страницыMarket SegmentationRahul AroraОценок пока нет

- International Business by Daniels and Radebaugh SlidesДокумент16 страницInternational Business by Daniels and Radebaugh SlidesSaad AliОценок пока нет

- Strategic Marketing Plan For Red Bull - Elvis Asiedu - Academia - Edu PDFДокумент23 страницыStrategic Marketing Plan For Red Bull - Elvis Asiedu - Academia - Edu PDFThomas Diwo0% (1)

- ASA Alcoholic Drinks Report Dec 1996 PDFДокумент18 страницASA Alcoholic Drinks Report Dec 1996 PDFrtkobОценок пока нет

- Case SM1 Updated v1Документ15 страницCase SM1 Updated v1Divya ChaudharyОценок пока нет

- Alcoholic Beverages: Overview: Cagr ofДокумент4 страницыAlcoholic Beverages: Overview: Cagr ofYana JoshiОценок пока нет

- Alcohol Promotion and The Marketing Industry Trends, Tactics, and Public HealthДокумент21 страницаAlcohol Promotion and The Marketing Industry Trends, Tactics, and Public HealthDipanjan DasОценок пока нет

- Heineken - Global Branding and AdvertisingДокумент9 страницHeineken - Global Branding and Advertisingpesce_giuseppe679Оценок пока нет

- Margarita Cocktail Quest ResearchДокумент19 страницMargarita Cocktail Quest ResearchGeorge SinclairОценок пока нет

- Los Vascos Cab Sauv 2015 Tech Sheet TFSДокумент1 страницаLos Vascos Cab Sauv 2015 Tech Sheet TFSrafael antonio pico valenciaОценок пока нет

- Beer in ColombiaДокумент4 страницыBeer in ColombiaAlvaro AcunaОценок пока нет

- Wine ListДокумент1 страницаWine ListeatlocalmenusОценок пока нет

- Expensive Alcoholic BeverageДокумент39 страницExpensive Alcoholic BeverageChiranjivi SapkotaОценок пока нет

- Cognac SupplementДокумент30 страницCognac Supplementkovacevic_veljkoОценок пока нет

- Video3.1-Mid EspДокумент314 страницVideo3.1-Mid EspAlex BaudelaireОценок пока нет

- Name: Renee Jane O. Caballero Course/Year/Section: BSHM 1-B Activity # 5Документ3 страницыName: Renee Jane O. Caballero Course/Year/Section: BSHM 1-B Activity # 5Jessie CasipongОценок пока нет

- Funds. Brewing-Package Beer Syllabus IBDДокумент21 страницаFunds. Brewing-Package Beer Syllabus IBDiq_gallegosОценок пока нет

- WSET L3 Wines Sample Paper Marking KeyДокумент17 страницWSET L3 Wines Sample Paper Marking KeyTM Clarke100% (2)

- Sallys Fruit Punch 2Документ2 страницыSallys Fruit Punch 2agrygorukОценок пока нет

- Pineapplewine PDFДокумент2 страницыPineapplewine PDFAdrian Ellarma RamosОценок пока нет

- BottleFork BarCard FINALДокумент2 страницыBottleFork BarCard FINALDaniel GerzinaОценок пока нет

- TWD Beverage DistributorsДокумент21 страницаTWD Beverage Distributorsscott.maisonОценок пока нет

- Hehrs3-Introduction To Barista (Bartending 3,4) : After - Dinner Cocktail: White Russian and Golden CadillacДокумент12 страницHehrs3-Introduction To Barista (Bartending 3,4) : After - Dinner Cocktail: White Russian and Golden CadillacOliver FabonОценок пока нет

- Cocktail Ingredients Item Selling Unit Item Exact Name Serial No. Picture Scope Sellin G Price Bottle SizeДокумент209 страницCocktail Ingredients Item Selling Unit Item Exact Name Serial No. Picture Scope Sellin G Price Bottle SizeNeonNights HRОценок пока нет

- Cat's Meow Home Brewing 13 Historical RecipesДокумент8 страницCat's Meow Home Brewing 13 Historical RecipesnawickОценок пока нет

- Industrial Biotechnology 2Документ12 страницIndustrial Biotechnology 2Techno India UniversityОценок пока нет

- Chocolate MeadДокумент2 страницыChocolate MeadnorthofthewallОценок пока нет

- Global Spirits Market Briefing 2023 Including - Whiskey Vodka Rum Tequila Gin Other SpiritsДокумент24 страницыGlobal Spirits Market Briefing 2023 Including - Whiskey Vodka Rum Tequila Gin Other Spiritsshivangi guptaОценок пока нет

- Appalachian Corn Moonshine Life Recipes1607717442Документ2 страницыAppalachian Corn Moonshine Life Recipes1607717442Clinton EbanksОценок пока нет

- 2015 Case 1 MolsonCoors 2Документ19 страниц2015 Case 1 MolsonCoors 2Gautam GuptaОценок пока нет

- ReVerse Drinks MenuДокумент2 страницыReVerse Drinks Menusupport_local_flavorОценок пока нет

- Daly's Bartending Encyclopedia (1903), Tim DalyДокумент128 страницDaly's Bartending Encyclopedia (1903), Tim DalyDarioflair100% (2)

- Kingfisher Premium Kingfisher Strong Kingfisher Ultra Kingfisher Ultra Max Kingfisher Ultra Witbier Kingfisher Storm Kingfisher Blue KingfisherДокумент3 страницыKingfisher Premium Kingfisher Strong Kingfisher Ultra Kingfisher Ultra Max Kingfisher Ultra Witbier Kingfisher Storm Kingfisher Blue Kingfishersarat krishnaОценок пока нет

- Lista Abel Gallegos Wine HouseДокумент3 страницыLista Abel Gallegos Wine HouseCopiredОценок пока нет

- Parkin, Shellhammer - 2017 - Toward Understanding The Bitterness of Dry-Hopped BeerДокумент6 страницParkin, Shellhammer - 2017 - Toward Understanding The Bitterness of Dry-Hopped BeerPablo Perez DonosoОценок пока нет

- Wine Appreciation: By: Shiela Mae Reforba (12-GA 4)Документ14 страницWine Appreciation: By: Shiela Mae Reforba (12-GA 4)Manoy KulaОценок пока нет

- SopДокумент5 страницSopsureshkumarj76Оценок пока нет