Академический Документы

Профессиональный Документы

Культура Документы

Disposal or Appropriation of Profits

Загружено:

navinkapilОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Disposal or Appropriation of Profits

Загружено:

navinkapilАвторское право:

Доступные форматы

Disposal or Appropriation of Profits

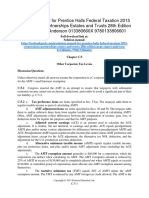

Profit & Loss Appropriation Account

Particulars

To General Reserve a/c

To Proposed Preference Share

Dividend a/c

To Proposed Tax on Preference

Dividend a/c

(Corporate Dividend Tax)

To Proposed Equity Share Dividend

a/c

To Proposed Tax on Equity Dividend

a/c (CDT)

To Proposed Bonus to Employees or

Shareholders a/c

To Proposed Additions to Reserves

a/c

To Interim Dividend a/c

To Tax on Dividend a/c (CDT)

To Balance c/f

Total

Total

xxx

xxx

Particulars

By Balance b/d

By Net Profit of Current

Year

Total

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

xxx

Total

xxx

Transfer to Reserves:After Charging Current Tax & Depreciation from Profit, Company has to Transfer in

General Reserve from Profit. And This Depend on Proposed Equity Dividend Rate. If

Company dont want to give Dividend or giving less than 10% than it is not

compulsory to transfer to Reserves.

Proposed Dividend Rate

Transfers Rate

10% - 12.5%

2.5%

12.5% - 15%

5%

15% - 20%

7.5%

More than 20%

10%

If Company wants to transfer to Reserves more than the above rates therefore:1. Dividend is declared & The Profit adequate that it equivalent to Average of

Dividend of Preceding Three Years. But if it is less than 20% or more than as of profit

after deducting Tax of Last two years & Current Year Tax thus it is not compulsory to

give even minimum Dividend & Company can transfer to Reserves by additional

rates.

2. If Company want to transfer to Reserves without giving dividend then this

Amount should not more than The Average of Dividend of Preceding three years in

any way.

Вам также может понравиться

- Chapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionДокумент4 страницыChapter - 2: 14 15 Accounts-XII Quick Revision 14 15 Accounts-XII Quick RevisionIqra MughalОценок пока нет

- Chapter 12Документ15 страницChapter 12Cooper89Оценок пока нет

- Integrated Communication PlanДокумент37 страницIntegrated Communication PlanAnuruddha RajasuriyaОценок пока нет

- Accounting For Partnership Firm-FundamentalsДокумент28 страницAccounting For Partnership Firm-FundamentalsTushОценок пока нет

- 25 Questions on DCF ValuationДокумент4 страницы25 Questions on DCF ValuationZain Ul AbidinОценок пока нет

- Accounting For Income TaxДокумент26 страницAccounting For Income TaxNicole Andrea TuazonОценок пока нет

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)От EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Рейтинг: 3.5 из 5 звезд3.5/5 (17)

- PAS12 mcq4Документ17 страницPAS12 mcq4Margaux CornetaОценок пока нет

- Chapter - 3: 18 19 Accounts-XII Quick Revision 18 19 Accounts-XII Quick RevisionДокумент5 страницChapter - 3: 18 19 Accounts-XII Quick Revision 18 19 Accounts-XII Quick Revisions_shreya955122Оценок пока нет

- Income Tax 1Документ12 страницIncome Tax 1You're Welcome0% (1)

- DCF Step 1: Project 3 Financial Statements Across 5 YearsДокумент1 страницаDCF Step 1: Project 3 Financial Statements Across 5 YearsAaron ChiaОценок пока нет

- 7 Types of Profit Sharing Plans for Financial PlannersДокумент19 страниц7 Types of Profit Sharing Plans for Financial PlannersHimaKumariОценок пока нет

- Accounting For Income TaxДокумент26 страницAccounting For Income TaxKelly Ng67% (6)

- Assessment of Firm: Important Provisions For Case Studies On ITR 5Документ8 страницAssessment of Firm: Important Provisions For Case Studies On ITR 5bindu tewatiaОценок пока нет

- C Corporations Tax Return and DeductionsДокумент9 страницC Corporations Tax Return and DeductionssheldonОценок пока нет

- Cash Flow Statement: Transfer To Reserves: Any Transfer of Profit From P & L A/c To Reserves Will Be AddedДокумент9 страницCash Flow Statement: Transfer To Reserves: Any Transfer of Profit From P & L A/c To Reserves Will Be AddedKhalid MahmoodОценок пока нет

- Adjustment of CapitalДокумент4 страницыAdjustment of CapitalfiroozdasmanОценок пока нет

- 2020 Grade 12 Accounting Learner Assistance Revision DocumentДокумент120 страниц2020 Grade 12 Accounting Learner Assistance Revision DocumentnthabelengtsoaneloОценок пока нет

- Prentice Halls Federal Taxation 2015 Comprehensive 28th Edition Pope Solutions Manual 1Документ36 страницPrentice Halls Federal Taxation 2015 Comprehensive 28th Edition Pope Solutions Manual 1jessicaherreraqaygjmksnp100% (26)

- Ias 19Документ9 страницIas 19Hammad SarwarОценок пока нет

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap010 PDFДокумент51 страницаSolution Manual Advanced Financial Accounting 8th Edition Baker Chap010 PDFYopie ChandraОценок пока нет

- Trial Balance To Profit & Loss A/c and Balance Sheet For Corporate & Non-Corporate EntitiesДокумент24 страницыTrial Balance To Profit & Loss A/c and Balance Sheet For Corporate & Non-Corporate EntitiesChintan PatelОценок пока нет

- Partnership Final Accounts GuideДокумент6 страницPartnership Final Accounts Guideprabodhcms0% (1)

- Partnership Firms- Part5 Guarantee and Past AdjustmentДокумент15 страницPartnership Firms- Part5 Guarantee and Past AdjustmentDeepti BistОценок пока нет

- Pope Phft2015 Corp PP Stu 05Документ34 страницыPope Phft2015 Corp PP Stu 05yennhi22690Оценок пока нет

- Advanced Financial Accounting 10th Edition Christensen Solutions Manual DownloadДокумент50 страницAdvanced Financial Accounting 10th Edition Christensen Solutions Manual DownloadCecil Lombardo100% (17)

- 15 Byrdchen Ctp22 PP Ch15 Summer 2022Документ75 страниц15 Byrdchen Ctp22 PP Ch15 Summer 2022peeyush aggarwalОценок пока нет

- IAS 19 Employee Benefits Accounting Standard ExplainedДокумент3 страницыIAS 19 Employee Benefits Accounting Standard ExplainedWaqas Ahmad KhanОценок пока нет

- Prentice Halls Federal Taxation 2015 Corporations Partnerships Estates and Trusts 28th Edition Pope Solutions Manual 1Документ36 страницPrentice Halls Federal Taxation 2015 Corporations Partnerships Estates and Trusts 28th Edition Pope Solutions Manual 1jessicaherreraqaygjmksnp100% (28)

- Submitted By: Varuchi Malhotra, Kartik, Anup Submitted To: Mrs Pooja PurohitДокумент23 страницыSubmitted By: Varuchi Malhotra, Kartik, Anup Submitted To: Mrs Pooja Purohit22rikearthОценок пока нет

- FS ANALYSIS: ACCOUNTING INCOME & ASSETSДокумент6 страницFS ANALYSIS: ACCOUNTING INCOME & ASSETSKrishna PrasadОценок пока нет

- Consolidation ProceduresДокумент7 страницConsolidation ProceduresharoonacmaОценок пока нет

- Description of The Account Based On The San Miguel CorporationДокумент5 страницDescription of The Account Based On The San Miguel CorporationMARRIETTE JOY ABADОценок пока нет

- 28905cpt Fa SM Cp8 Part3Документ46 страниц28905cpt Fa SM Cp8 Part3Nishant MishraОценок пока нет

- Accounting For Income TaxДокумент26 страницAccounting For Income TaxFranz Ana Marie CuaОценок пока нет

- Accounting For Income TaxesДокумент25 страницAccounting For Income TaxesKulet AkoОценок пока нет

- Cash Flow Statement SummaryДокумент9 страницCash Flow Statement SummaryNezer Byl P. VergaraОценок пока нет

- LXL Gr12Acc 01 Cash-Flow-Statement 16apr2015Документ9 страницLXL Gr12Acc 01 Cash-Flow-Statement 16apr2015Nezer Byl P. VergaraОценок пока нет

- 1 - Accounting For Partnership Firms - FundamentalsДокумент12 страниц1 - Accounting For Partnership Firms - FundamentalsAnkit RoyОценок пока нет

- Calculate Profit and Comprehensive IncomeДокумент7 страницCalculate Profit and Comprehensive IncomeSyed Hamzah Al-IdrusОценок пока нет

- REVISION Retirement BenefitsДокумент23 страницыREVISION Retirement BenefitsREGIОценок пока нет

- Advanced Financial Accounting 12th Edition Christensen Solutions ManualДокумент38 страницAdvanced Financial Accounting 12th Edition Christensen Solutions Manualpottpotlacew8mf1t100% (13)

- Advanced Financial Accounting 12th Edition Christensen Solutions Manual Full Chapter PDFДокумент67 страницAdvanced Financial Accounting 12th Edition Christensen Solutions Manual Full Chapter PDFSandraMurraykean100% (12)

- General Instruction: Good Luck!Документ6 страницGeneral Instruction: Good Luck!Regasa GutemaОценок пока нет

- CCP102Документ22 страницыCCP102api-3849444Оценок пока нет

- Prentice Halls Federal Taxation 2016 Corporations Partnerships Estates and Trusts 29th Edition Pope Solutions Manual 1Документ36 страницPrentice Halls Federal Taxation 2016 Corporations Partnerships Estates and Trusts 29th Edition Pope Solutions Manual 1angelamayqbygsdmeki100% (22)

- CaseДокумент5 страницCaseSwapnil KumthekarОценок пока нет

- Capital Budgeting, Cash Flows & Decision Making ProcessДокумент47 страницCapital Budgeting, Cash Flows & Decision Making ProcessAnifahchannie PacalnaОценок пока нет

- ADJUSTMENTS AT FINANCIAL PERIOD ENDДокумент18 страницADJUSTMENTS AT FINANCIAL PERIOD ENDTevabless Suoived SpotlightbabeОценок пока нет

- Final PB ToaДокумент6 страницFinal PB ToaYaj CruzadaОценок пока нет

- ISSM 541 Winter 2015 Assignment 5Документ5 страницISSM 541 Winter 2015 Assignment 5Parul KhannaОценок пока нет

- Ntermediate: M.K.Gupta Ca EducationДокумент164 страницыNtermediate: M.K.Gupta Ca EducationChhaya JajuОценок пока нет

- Chap 010Документ50 страницChap 010mas azizОценок пока нет

- Partnership AccountsДокумент4 страницыPartnership AccountsManoj Kumar GeldaОценок пока нет

- CFA Level 2 FSAДокумент3 страницыCFA Level 2 FSA素直和夫Оценок пока нет

- Final Accounts AdjustmentsДокумент48 страницFinal Accounts AdjustmentsArsalan QaziОценок пока нет

- 499179Документ55 страниц499179Shofiana IfadaОценок пока нет

- Tax Accounting Jones CH 4 HW SolutionsДокумент7 страницTax Accounting Jones CH 4 HW SolutionsLolaLaTraileraОценок пока нет

- C-Corp Tax Return and Consolidated ReturnsДокумент5 страницC-Corp Tax Return and Consolidated ReturnssheldonОценок пока нет

- The India Succession Act 1925Документ99 страницThe India Succession Act 1925navinkapil100% (1)

- Truth Behind NamaskarДокумент16 страницTruth Behind NamaskarnavinkapilОценок пока нет

- Company Law Lecture NotesДокумент47 страницCompany Law Lecture NotesMandy Neoh76% (17)

- Bank GuaranteeДокумент1 страницаBank GuaranteesridharalladaОценок пока нет

- Companies Donation To National Fund Act 1951Документ1 страницаCompanies Donation To National Fund Act 1951Latest Laws TeamОценок пока нет

- The Indian Christian Marriage Act 1872Документ18 страницThe Indian Christian Marriage Act 1872navinkapilОценок пока нет

- The Indian Christian Marriage Act 1872Документ18 страницThe Indian Christian Marriage Act 1872navinkapilОценок пока нет

- Prohibition of Indecent Representation of Women ActДокумент3 страницыProhibition of Indecent Representation of Women ActnavinkapilОценок пока нет

- Prohibition of Indecent Representation of Women ActДокумент3 страницыProhibition of Indecent Representation of Women ActnavinkapilОценок пока нет

- The Indian Trust Act 1882Документ25 страницThe Indian Trust Act 1882navinkapilОценок пока нет

- The Indian Criminal Law Amendment Act 1908Документ9 страницThe Indian Criminal Law Amendment Act 1908navinkapilОценок пока нет

- The Indian Criminal Law Amendment Act 1908Документ9 страницThe Indian Criminal Law Amendment Act 1908navinkapilОценок пока нет

- The Indian Electricity Act 1910Документ42 страницыThe Indian Electricity Act 1910navinkapilОценок пока нет

- The Indian Forest Act 1927Документ21 страницаThe Indian Forest Act 1927navinkapilОценок пока нет

- The Industrial Employment (Standing Orders) Act 1946Документ8 страницThe Industrial Employment (Standing Orders) Act 1946navinkapilОценок пока нет

- The Inflammable Substance Act 1952Документ2 страницыThe Inflammable Substance Act 1952navinkapilОценок пока нет

- The Industrial Disputes Act 1947Документ47 страницThe Industrial Disputes Act 1947navinkapilОценок пока нет

- The Foreign Exchange Management Act 1999Документ21 страницаThe Foreign Exchange Management Act 1999navinkapilОценок пока нет

- The Indian Telegraphy Act 1885Документ3 страницыThe Indian Telegraphy Act 1885navinkapilОценок пока нет

- The Hindu Disposition of Property Act 1916Документ1 страницаThe Hindu Disposition of Property Act 1916navinkapilОценок пока нет

- The Recovery of Debts Due To Banks and Financial Institutions Act 1993Документ13 страницThe Recovery of Debts Due To Banks and Financial Institutions Act 1993navinkapilОценок пока нет

- The Indian Stamp Act 1899Документ55 страницThe Indian Stamp Act 1899navinkapil100% (1)

- The Foreign Marriage Act 1969Документ10 страницThe Foreign Marriage Act 1969navinkapilОценок пока нет

- The Guardians and Wards Act 1890Документ15 страницThe Guardians and Wards Act 1890navinkapil100% (1)

- Compensation Act families loss death actionable wrongДокумент2 страницыCompensation Act families loss death actionable wrongnavinkapilОценок пока нет

- The Guardians and Wards Act 1890Документ15 страницThe Guardians and Wards Act 1890navinkapil100% (1)

- The Factories Act 1948Документ62 страницыThe Factories Act 1948navinkapilОценок пока нет

- The Explosives Act 1884Документ10 страницThe Explosives Act 1884navinkapilОценок пока нет

- The Explosive Substances Act 1908Документ2 страницыThe Explosive Substances Act 1908navinkapilОценок пока нет