Академический Документы

Профессиональный Документы

Культура Документы

2Q 15 Vcsurvey

Загружено:

BayAreaNewsGroupОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2Q 15 Vcsurvey

Загружено:

BayAreaNewsGroupАвторское право:

Доступные форматы

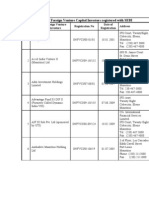

Venture Capital Funding Survey, Second Quarter 2015

VENTURE CAPITAL FUNDING, SECOND QUARTER 2015

This is a listing of many of the Bay Area firms that received venture capital financing between

April 1 and June 30, 2015. Most of the data was compiled from a survey conducted by

PricewaterhouseCoopers, Thomson Venture Economics and the National Venture Capital Association

in conjunction with the Mercury News.

In the case of some investments there may have been other participants in the round who are not

credited. Also, the amounts listed may not include all venture funding the company received during

the quarter.

*Indicates this is a seed or first-round infusion of money from venture capitalists. These

companies may have received money previously from other investors and aren't necessarily startups.

BIOTECHNOLOGY / HEALTH

Name

Aduro BioTech

City

Berkeley

Advanced Cell Diagnostics Hayward

Aegea Medical

Autonomic Technologies

Redwood City

Redwood City

Stage

Later Stage

Amount

Investors

$200,000,000 Undisclosed firm

Description

Clinical research services

Later Stage

Kenson Ventures, Morningside

Technologies, New Leaf Venture Cell and tissue-based

$22,000,000 Partners, Summit Partners

diagnostic tests

Expansion

Alloy Ventures, Covidien

Ventures, Delphi Ventures,

$36,000,000 undisclosed firm

Manufactures surgical and

medical instruments

Later Stage

Aberdare Ventures, Edmond de

Rothschild Investment Partners

SAS, Forbion Capital Partners,

InterWest Partners, Kleiner

Perkins Caufield & Byers,

Novartis Venture Funds,

$43,199,800 undisclosed firm

Miniaturized implantable

neurostimulation device

Early Stage

Canaan Partners, Deerfield

Management Company, Tekla

Healthcare Investors,

undisclosed firms, Venrock,

Wellington Management

$70,000,100 Company

Biotechnology company

Arch Venture Partners, Fidelity

Biosciences, Flagship Ventures,

$217,000,000 undisclosed firm

Biotechnology company

CytomX Therapeutics

South San

Francisco

Denali Therapeutics*

South San

Francisco

Early Stage

First Aid Shot Therapy

Burlingame

Expansion

$20,332,000 Sofinnova Ventures

Page 1 of 11

Consumer healthcare

company

Venture Capital Funding Survey, Second Quarter 2015

Kezar Life Sciences*

South San

Francisco

Metabiota*

San Francisco

MyoKardia

South San

Francisco

Discovery and

development of drugs

targeting protein

homeostasis for

autoimmune disorders

Early Stage

Aju IB Investment Co., EcoR1

Capital, Morningside

Technologies, Omega Fund

$28,369,200 Management, undisclosed firms

Expansion

Capricorn Investment Group,

Data Collective, Industry

Ventures, Rosemont Seneca

Builds a framework to

Technology Partners, WP Global identify, analyze and

$30,200,000 Partners

investigate health threats

Early Stage

Sanofi-Sunrise, undisclosed

$46,000,000 firms

Developing a pipeline of

small molecule

therapeutics

Natera

San Carlos

Later Stage

Franklin Templeton

Investimentos Brasila, HealthCor

Partners Management, OrbiMed

Advisors, RA Capital

Management, Sofinnova

$55,500,200 Ventures, undisclosed firm

Genetic testing company

Outset Medical

San Jose

Expansion

CRG, undisclosed firms, Vertical

$59,594,000 Group, Warburg Pincus

Hemodialysis solutions

Scanadu

Moffett Field

Expansion

AME Cloud Ventures, CBC

Capital, Relay Ventures, Tencent

Collaboration Fund, undisclosed Consumer medical device

$34,850,400 firms, iGlobe Partners

products

SFJ Pharmaceuticals

Pleasanton

Expansion

$27,311,000 Undisclosed firms

Specialty pharma company

Intravascular devices for

calcified cardiovascular

disease

Shockwave Medical

Fremont

Early Stage

Ally Bridge Group Capital

Partners II, Deerfield

Management Company, RA

Capital Management, Sectoral

Asset Management, Sofinnova

Partners SAS, undisclosed firm,

$39,843,200 Venrock

SI-Bone

San Jose

Expansion

Sacroiliac joint medical

$21,000,000 Redline Capital Management SA device company

Page 2 of 11

Venture Capital Funding Survey, Second Quarter 2015

True North Therapeutics

Twelve

South San

Francisco

Redwood City

Twist Bioscience

Zymergen*

San Francisco

Emeryville

Early Stage

Baxter Ventures, Kleiner Perkins therapies that inhibit the

Caufield & Byers, MPM Capital, complement system to

$35,000,000 OrbiMed Advisors, Sr One

treat rare disease

Early Stage

Domain Associates, Longitude

Capital Management Co.,

Morgenthaler Ventures, Versant

$35,250,000 Ventures

Medical device incubator

Early Stage

Applied Ventures, Arch Venture

Partners, Foresite Capital

Management, Paladin Capital

$36,999,900 Management, undisclosed firms

DNA production and drug

development

Early Stage

AME Cloud Ventures, Data

Collective, Draper Fisher

Jurvetson, Innovation

Endeavors, Obvious Ventures

Management, True Ventures,

Two Sigma Investments,

$44,143,200 undisclosed firm

Designs and creates

microbial strains

BUSINESS SERVICES

Name

Adallom

Bill.Com

Coho Data

Docker

City

Palo Alto

Palo Alto

Palo Alto

San Francisco

Stage

Amount

Investors

Description

Early Stage

Hewlett-Packard Ventures, Index

Ventures, Rembrandt Venture

Content security services

$24,300,000 Management, Sequoia Capital

provider

Later Stage

Emergence Capital Partners,

$30,000,000 TTV Capital

Offers bill payment,

invoicing and cash flow

management solutions

Expansion

Andreessen Horowitz, HewlettPackard Ventures, Ignition

Partners, Intel Capital, March

$30,000,100 Capital Partners GP

Storage for the cloud

generation

Expansion

AME Cloud Ventures,

Benchmark Capital Management

Gesellschaft MBH In Liqu,

Coatue Management, Goldman

Sachs & Co., Greylock Partners,

Insight Venture Partners,

Sequoia Capital, Trinity Ventures, Open platform for

$95,000,400 undisclosed firm

distributed applications

Page 3 of 11

Venture Capital Funding Survey, Second Quarter 2015

Instart Logic

Jelli

Palo Alto

San Mateo

Expansion

Andreessen Horowitz, Four

Rivers Partners, Hermes Growth

Partners, Kleiner Perkins

Caufield & Byers, Tenaya

Cloud application delivery

$43,000,200 Capital, undisclosed firm

service

Expansion

First Round Capital, Intel Capital,

Relay Ventures, undisclosed

$21,000,000 firms

Social radio platform

Payment protocol and

exchange network

Ripple Labs

San Francisco

Early Stage

AME Cloud Ventures, China

Growth Capital, ChinaRock

Capital Management, Core

Innovation Capital I, IDG Capital

Partners, Liquidity Ventures I,

RRE Ventures, Route 66

Ventures, Seagate Technology

PLC, undisclosed firms, Vast

Ventures, venture51 Capital

$27,999,400 Fund

Saama Technologies*

Campbell

Later Stage

Carrick Capital Management

$35,753,000 Company

Big Data solutions and

services company

Expansion

August Capital Management,

Continental Investors, Financial

Technology Ventures, Highland

Capital Partners, Ignition

$40,000,000 Partners, Rakuten Ventures

Online payment service

provider

Wepay

Palo Alto

CONSUMER GOODS / SERVICES

Name

AirBnB

City

San Francisco

Stage

Expansion

Amount

Investors

Description

CBC Capital, Fidelity Investment

Funds II, GGV Capital, General

Atlantic, Hillhouse Capital

Management, Horizon Ventures,

Kleiner Perkins Caufield & Byers,

T. Rowe Price Threshold

Partnerships, Temasek Holdings

(Private), Tiger Global

$1,500,000,000 Management, undisclosed firms Community marketplace

AltSchool

San Francisco

Early Stage

Andreessen Horowitz, First

Round Capital, Founders Fund,

The, Learn Capital Venture

Partners, Omidyar Network

$100,000,000 Commons, undisclosed firms

Blue Bottle Coffee

Oakland

Later Stage

$74,959,000 Index Ventures, True Ventures

Page 4 of 11

Network of micro-schools

Coffee roasting and

retailing

Venture Capital Funding Survey, Second Quarter 2015

Credit Karma

Honor Technology*

Joyus

Munchery

Naturebox

San Francisco

San Francisco

San Francisco

San Francisco

San Carlos

Later Stage

Tiger Global Management,

$174,999,900 undisclosed firm

Offers credit scores and

recommendations for loans

and insurance products

Early Stage

Andreessen Horowitz, Kapor

$20,000,100 Capital, undisclosed firm

Offers online service that

connects in-home

caregivers and seniors

Expansion

Accel Partners & Co., InterWest

Partners, Marker Financial

Advisors, Steamboat Ventures,

$24,000,000 Time Warner Investments

Online video shopping

platform

Expansion

137 Ventures, Greycroft

Partners, Menlo Ventures,

Northgate Capital,

SherpaVentures, undisclosed

$86,590,000 firm, e.ventures

Food marketplace platform

provider

Early Stage

Canaan Partners, General

Catalyst Partners, Global

Founders Capital Management

GmbH, Kensington Capital

Partners, Neuberger Berman,

Softbank Capital Partners, Valley Delivers boxes filled with

$29,999,900 Oak Investments

snacks

Nerdwallet*

San Francisco

Expansion

Institutional Venture Partners,

RRE Ventures, undisclosed firm, Financial education and

$64,000,000 iGlobe Partners

empowerment

PAX Labs*

San Francisco

Later Stage

Sand Hill Angels, Tao Capital

$46,685,800 Partners, undisclosed firms

Poshmark

Prosper Marketplace

San Francisco

Menlo Park

San Francisco

Expansion

Expansion

Later Stage

Vaporization delivery

systems for smokers

Andreessen Horowitz, Bessemer

Venture Partners, Fidelity

Investment Funds II, FirstMark

Capital, Goldman Sachs & Co.,

SV Angel II Q, undisclosed firm,

Wellington Management

Internet scrapbooking

$186,000,000 Company

company

Inventus Capital Partners Fund I,

J. F. Shea Co., Mayfield Fund,

Menlo Ventures, Softtech VC,

Buying and selling

Union Grove Venture Partners

fashionable closets from

$25,000,200 2014

the iPhone

BBVA Ventures, Breyer Capital,

Credit Suisse Private Equity,

Neuberger Berman, Passport

$165,000,000 Capital, USAA, undisclosed firm

Page 5 of 11

Peer-to-peer lending

marketplace

Venture Capital Funding Survey, Second Quarter 2015

Sprig

San Francisco

Expansion

500 Startups, Accel Partners &

Co., Battery Ventures, Greylock

Partners, IDG Ventures USA,

Ludlow Ventures, Lumia Capital,

Social+Capital Partnership, Sozo Food delivery service

$44,660,200 Ventures, undisclosed firms

company

Online learning

marketplace

Health and beauty

products company

Udemy

San Francisco

Expansion

Insight Venture Partners,

Norwest Venture Partners,

$65,000,000 Stripes Group

Walker & Company

Brands

Palo Alto

Early Stage

Andreessen Horowitz,

$22,000,000 undisclosed firm

HARDWARE / INSTRUMENTS

Name

Tegile Systems

City

Newark

Stage

Expansion

Amount

Investors

August Capital Management,

Capricorn Investment Group,

Cross Creek Capital, Meritech

Capital Partners, undisclosed

$70,000,000 firms

Description

Flash-driven storage

arrays for database

NETWORKING / TELECOMMUNICATIONS

Name

Planet Labs

City

San Francisco

Stage

Expansion

Amount

Investors

$69,877,000 International Financeoration

Description

Space and analytics

company

ENERGY / INDUSTRIAL

Name

Bolt Threads

City

Emeryville

Stage

Early Stage

Amount

Investors

Alafi Capital Co., Formation 8

Partners, Foundation Capital,

$32,385,200 Founders Fund, The

Description

Fibers and fabrics for

textile industry

SEMICONDUCTORS

Name

City

Stage

Amount

Investors

Aquantia

Milpitas

Later Stage

Greylock Partners, Lightspeed

Management Company, New

Enterprise Associates, .,

Rossiyskaya Korporatsiya

$25,250,000 Nanotekhnologiy GK

Samsara Networks*

San Francisco

Early Stage

Andreessen Horowitz,

$25,000,000 undisclosed firm

Description

Ethernet connectivity

solutions

Internet connected sensor

system products

SOFTWARE

Name

Actiance

City

Redwood City

Stage

Later Stage

Amount

Investors

Credit Suisse Private Equity,

Golub Capital Master Funding,

JK&B Capital, Scale Venture

Partners, Sutter Hill Ventures,

$28,000,200 undisclosed firm

Page 6 of 11

Description

Communications solution

provider

Venture Capital Funding Survey, Second Quarter 2015

Adaptive Insights

Palo Alto

Later Stage

Bessemer Venture Partners,

Cardinal Venture Capital,

Information Venture Partners,

JMI Management, Monitor

Venture Associates, Norwest

Venture Partners, ONSET

$74,999,800 Ventures

Appirio

San Francisco

Later Stage

$35,000,000 Undisclosed firm

Global cloud consultancy

and services company

Automatic Labs

San Francisco

Expansion

Comcast Ventures, USAA,

$24,000,000 undisclosed firm

Driver assistance software

applications

Banjo

Redwood City

Expansion

Bluerun Ventures, Softbank

$100,000,000 Capital Partners

Expansion

Foundation Capital, Polaris

Venture Partners, Translink

$24,000,000 Capital, undisclosed firm

Early Stage

Bain Capital Venture Partners,

Charles River Ventures, Mayfield

$25,000,000 Fund

Networking company

Early Stage

Accel Partners &Co, Artis

Ventures, Battery Ventures,

Google Ventures, Qualcomm

Ventures, Trinity Ventures, Wing

$70,000,000 Venture Partners

Data platform for

converged secondary

storage

Later Stage

Battery Ventures, Crosslink

Capital, El Dorado Ventures,

Mohr Davidow Ventures, Rally

Ventures, T. Rowe Price

Threshold Partnerships,

$80,000,000 undisclosed firm

Cloud-based spend

management solutions

Early Stage

AME Cloud Ventures, Index

Ventures, Qualcomm Ventures,

Sutter Hill Ventures, undisclosed Applications that allow

$25,000,000 firm

consumers to buy products

Expansion

Foundation Capital, Matrix

Partners, Sapphire Ventures,

$30,000,000 Trinity Ventures

Advanced threat

monitoring and mitigation

platform

Early Stage

Jump Capital, Qualcomm

Ventures, Shasta Ventures,

Tenaya Capital, undisclosed

$48,500,000 firms, Venrock

Video consultation services

CliQr Technologies

Cloudgenix

Cohesity

Coupa Software

Curbside

Cyphort

Doctor On Demand

Santa Clara

Santa Clara

Santa Clara

San Mateo

Palo Alto

San Jose

San Francisco

Page 7 of 11

Cloud-based business

analytics solutions

Social discovery

application

Hybrid cloud-application

migration and

management solutions

Venture Capital Funding Survey, Second Quarter 2015

DocuSign

Freshdesk

Grab A Bucket

Guavus

HackerOne

HyTrust

Illumio

Jiff

San Francisco

San Francisco

San Francisco

San Mateo

San Francisco

Mountain View

Sunnyvale

Palo Alto

Later Stage

Bain Capital Venture Partners,

Brookside International, Dell

Ventures, Generation Investment

Management, Ignition Partners,

Intel Capital, Kleiner Perkins

Caufield & Byers, Sands Capital

Management, Scale Venture

Offers e-Signature

Partners, undisclosed firm,

transaction management

$278,099,900 Wellington Management Co.

solutions

Expansion

Accel Partners & Co., Google

Capital Management Company,

$50,000,100 Tiger Global Management

Early Stage

Bessemer Venture Partners,

Norwest Venture Partners, Trinity Allows users to have their

$30,000,000 Ventures

cars valeted from locations

Later Stage

Artiman Management, Investor

Growth Capital, Sofinnova

Ventures, Translink Capital,

$50,875,900 undisclosed firm

Early Stage

Benchmark Capital Management

Gesellschaft MBH In Liqu, New

$25,000,000 Enterprise Associates

Security firm

Later Stage

Accelerate-IT Ventures

Management, Cisco Systems,

Epic Ventures, Granite Ventures,

Intel Capital, Trident Capital,

undisclosed firm, Vanedge

Cloud security automation

$25,000,200 Capital

company

Early Stage

Accel Partners & Co.,

Andreessen Horowitz,

BlackRock, Formation 8

Partners, General Catalyst

$100,531,200 Partners, undisclosed firm

Cloud-based customer

support software

Big Data analytics

solutions

Cloud security company

Expansion

Aberdare Ventures, Aeris Capital Social network and digital

AG, GE Ventures, Rosemark

health applications

$23,450,000 Capital Group, Venrock

platform

Lattice Engines

San Mateo

Later Stage

Blue Cloud Ventures, New

Enterprise Associates, Piper

Jaffray Ventures, River Cities

$28,300,100 Capital Funds, Sequoia Capital

Lyft

San Francisco

Later Stage

Fontinalis Partners, undisclosed

$150,000,000 firm

Page 8 of 11

Offers data-driven

business applications

Offers a peer-to-peer realtime ride matching platform

Venture Capital Funding Survey, Second Quarter 2015

MarkLogic

Matterport

Menlo Security

San Carlos

Mountain View

Menlo Park

Later Stage

Northgate Capital, Sequoia

Capital, Tenaya Capital,

undisclosed firms, Wellington

$102,277,800 Management Company

Expansion

Felicis Ventures, Gic Special

Investments Pte, Qualcomm

$30,000,000 Ventures, undisclosed firm

Solutions for 3-D scanning

of spaces and objects

Early Stage

Engineering Capital, General

Catalyst Partners, Osage

$25,000,000 Partners, Sutter Hill Ventures

Offers protection to

organizations from cyberattacks

Enterprise NoSQL

database platform

Bay Partners, Cisco Investments,

Hummer Winblad Venture

Partner, Lightspeed

Management Company, Meritech

Capital Partners, Morgenthaler

Ventures, New Enterprise

Associates, Salesforce Ventures,

Sands Capital Management,

Ontegration platform for

Sapphire Ventures, undisclosed connecting SaaS and

$128,299,500 firms

applications

MuleSoft

San Francisco

Later Stage

Nexenta Systems

Santa Clara

Later Stage

Sierra Ventures, Translink

$30,000,000 Capital, undisclosed firm

Software-defined Storage

solutions

Niara

Sunnyvale

Early Stage

Index Ventures, New Enterprise

$20,000,100 Associates, Venrock

Stealth security analytics

company

Postmates

San Francisco

Expansion

$73,176,000 Tiger Global Management

On-demand delivery

services

Expansion

Accel Partners & Co., Bessemer

Venture Partners, Cisco

Investments, Disruptive,

Innovation Endeavors, Redpoint

$25,000,000 Ventures, undisclosed firm

Transparent and video

delivery solutions

Later Stage

Activant Capital Group, August

Capital Management, Commerce

One Ventures, Nokia Growth

Partners, Pereg Ventures,

Qualcomm Ventures, Siguler

Guff & Co., StarVest Partners,

Retail analytics for brick$29,003,400 undisclosed firm

and-mortar stores

Early Stage

Index Ventures, New Enterprise

Associates, Ribbit Capital, Social

$50,000,000 Leverage, Vaizra Investments

Broker-dealer

Qwilt

RetailNext

Robinhood Markets

Redwood City

San Jose

Palo Alto

Page 9 of 11

Venture Capital Funding Survey, Second Quarter 2015

Rubrik

Palo Alto

Early Stage

Greylock Partners, Lightspeed

Management Company,

$41,000,100 undisclosed firm

Live data access for

recovery and application

development

Mobile application for

shipping needs

Enterprise security

company

Shyp

San Francisco

Early Stage

Homebrew, Kleiner Perkins

Caufield & Byers,

SherpaVentures, undisclosed

$43,644,000 firm

Skyport Systems*

Mountain View

Expansion

Index Ventures, Intel Capital,

$30,000,000 Sutter Hill Ventures

Expansion

Accel Partners & Co.,

Andreessen Horowitz, Google

Ventures, Horizons Ventures,

Index Ventures, Institutional

Venture Partners, Kleiner

Perkins Caufield & Byers,

Mail.Ru Group, Social+Capital

$160,000,000 Partnership, Spark Capital

Expansion

Adams Street Partners,

Bessemer Venture Partners,

Shasta Ventures, undisclosed

$26,045,200 firm

Early Stage

Altimeter Capital Management,

Redpoint Ventures, Sutter Hill

$45,000,000 Ventures, Wing Venture Partners Data warehouse

Expansion

Accel Partners & Co., Draper

Fisher Jurvetson, Greylock

Partners, Institutional Venture

Partners, Sequoia Capital, Sutter Cloud-based machine data

$80,100,000 Hill Ventures

analytics service

Expansion

Andreessen Horowitz, Felicis

Ventures, Google Ventures,

SoftBank Group, undisclosed

$34,999,800 firm

Early Stage

Carmel Ventures IV Principals

Fund, Doll Capital Management,

Khosla Ventures, Kinzon Capital,

$22,000,000 Qualcomm Ventures

Mobile shopping platform

Expansion

Andreessen Horowitz, Greylock

Partners, Redpoint Ventures,

Tenaya Capital, ., undisclosed

$25,000,000 firm

Slack Technologies

Smule

Snowflake Computing

Sumo Logic

Switch Communications

Tapingo

Tidemark Systems

San Francisco

San Francisco

San Mateo

Redwood City

San Francisco

San Francisco

Redwood City

Page 10 of 11

Platform for team

communication

Social music making

applications

Online accelerator engine

provider

Set of enterprise

performance management

(EPM) applications

Venture Capital Funding Survey, Second Quarter 2015

Twilio

San Francisco

Expansion

Bessemer Venture Partners,

Draper Fisher Jurvetson,

$100,000,000 undisclosed firm

Business communications

solutions

Vessel Group

San Francisco

Early Stage

Benchmark Capital Management

Gesellschaft MBH In Liqu, Bezos

Expeditions, Greylock Partners, Service to consumers and

$58,000,000 Institutional Venture Partners

content creators

Vlocity*

San Francisco

Early Stage

Salesforce Ventures,

$42,800,000 undisclosed firm

Expansion

Gemini Capital Fund

Management, Giza Venture

Capital, Greenspring Associates, interactive online guidance

$25,000,000 Scale Venture Partners

system

Walkme

Zenefits Insurance

Services

ZenPayroll

San Francisco

San Francisco

San Francisco

Early Stage

Expansion

Andreessen Horowitz, Fidelity

Ventures, Founders Fund, The,

Insight Venture Partners,

Institutional Venture Partners,

Khosla Ventures, Tpg Growth,

$499,999,600 undisclosed firms

HR software that manages

payroll, benefits, and

compliance

Emergence Capital Partners,

General Catalyst Partners,

Google Capital Management

Company, Google Ventures,

Kleiner Perkins Caufield & Byers, Cloud-based payroll

$41,600,000 Ribbit Capital

provider

Page 11 of 11

Вам также может понравиться

- VC Funding Survey, 3Q 2015Документ11 страницVC Funding Survey, 3Q 2015BayAreaNewsGroupОценок пока нет

- 2Q 15 Vcsurvey PDFДокумент11 страниц2Q 15 Vcsurvey PDFBayAreaNewsGroupОценок пока нет

- Venture Capital Q2 2016Документ1 страницаVenture Capital Q2 2016BayAreaNewsGroup100% (2)

- Venture Capital Funding Survey, 1Q 2016Документ10 страницVenture Capital Funding Survey, 1Q 2016BayAreaNewsGroupОценок пока нет

- Europes Most Active Business Angels 2018.compressedДокумент100 страницEuropes Most Active Business Angels 2018.compressedEnrique SobriniОценок пока нет

- MeetFounders UK EU August 2021 HandoutДокумент13 страницMeetFounders UK EU August 2021 HandoutAndrew BottОценок пока нет

- Fintech VC Panels & Pitches HandoutДокумент7 страницFintech VC Panels & Pitches HandoutAndrew BottОценок пока нет

- Zodius Capital II Fund Launch 070414Документ2 страницыZodius Capital II Fund Launch 070414avendusОценок пока нет

- Ecommerce & Marketplace VC Panels & Pitches HandoutДокумент6 страницEcommerce & Marketplace VC Panels & Pitches HandoutAndrew BottОценок пока нет

- List of VCFsДокумент3 страницыList of VCFspoddar_ruchitaОценок пока нет

- List of VCFsДокумент3 страницыList of VCFspoddar_ruchitaОценок пока нет

- Investors ContactsДокумент5 страницInvestors ContactsGoli Vamshi KrishnaОценок пока нет

- PE Final)Документ30 страницPE Final)Satbir SinghОценок пока нет

- Corporate Governance and Finance Department: List of Investment Companies/Mutual Funds (71) As of June 30 2019Документ3 страницыCorporate Governance and Finance Department: List of Investment Companies/Mutual Funds (71) As of June 30 2019Sui KixОценок пока нет

- List of Merchant BankersДокумент10 страницList of Merchant Bankersnikee patelОценок пока нет

- Initial Report of SIPДокумент32 страницыInitial Report of SIPbhuaryanОценок пока нет

- Consulting Hy uPE I - Bank VC ListДокумент41 страницаConsulting Hy uPE I - Bank VC ListsandeepntcОценок пока нет

- Aibi Summit 2016Документ48 страницAibi Summit 2016Anonymous KRErbYM7Оценок пока нет

- List of Foreign Venture Capital Investors Registered With SEBISДокумент19 страницList of Foreign Venture Capital Investors Registered With SEBISDisha NagraniОценок пока нет

- IVCA PE & VC Report - 2023-7158010123170753609Документ37 страницIVCA PE & VC Report - 2023-7158010123170753609Neelaj MaityОценок пока нет

- Cancelled NBFCДокумент336 страницCancelled NBFCAAОценок пока нет

- List of Malaysia Investors in Timor-LesteДокумент6 страницList of Malaysia Investors in Timor-LesteHernanio MoratoОценок пока нет

- Accelerators: List of Start-Up Incubators and AcceleratorsДокумент2 страницыAccelerators: List of Start-Up Incubators and AcceleratorsnamanОценок пока нет

- Indian Investors in AfricaДокумент3 страницыIndian Investors in Africajoenathan ebenezerОценок пока нет

- List of Registered Venture Capital FundsДокумент11 страницList of Registered Venture Capital FundsMushtakh Ahmed MussuОценок пока нет

- FDI Investors in India Top10 CountriesДокумент11 страницFDI Investors in India Top10 CountriesJhunjhunwalas Digital Finance & Business Info LibraryОценок пока нет

- Vivriti Capital 30sep2019Документ12 страницVivriti Capital 30sep2019Gajendra AudichyaОценок пока нет

- S. No. Company Name Address: 1 Nationwide Business CentreДокумент10 страницS. No. Company Name Address: 1 Nationwide Business CentreAyesha NasirОценок пока нет

- UntitledДокумент1 страницаUntitledapi-260945806Оценок пока нет

- San Diego Venture Capital FirmsДокумент4 страницыSan Diego Venture Capital FirmsJoseph KymmОценок пока нет

- Guide-to-Venture-Capital IVA PDFДокумент90 страницGuide-to-Venture-Capital IVA PDFNaveen AwasthiОценок пока нет

- Top Consultancy ListДокумент1 страницаTop Consultancy ListKannanОценок пока нет

- VC ListДокумент4 страницыVC ListSaaf suthraОценок пока нет

- Gaju HumairaДокумент431 страницаGaju Humairagaju619Оценок пока нет

- List of Registered Venture Capital FundsДокумент25 страницList of Registered Venture Capital FundsjvreddiОценок пока нет

- Healthcare FundДокумент2 страницыHealthcare Fundluvisfact7616Оценок пока нет

- PS - DATA - 2016 BatchДокумент282 страницыPS - DATA - 2016 Batchpriyanshu guptaОценок пока нет

- IVCA Members - Alphabetical ListingДокумент5 страницIVCA Members - Alphabetical ListingRajesh PaniОценок пока нет

- VCs in IndiaДокумент25 страницVCs in IndiaBreejОценок пока нет

- The Best Independent Financial Advisors ListДокумент4 страницыThe Best Independent Financial Advisors ListMichelle JeanneОценок пока нет

- ICT BusinessDirectoryДокумент143 страницыICT BusinessDirectoryapi-3708437Оценок пока нет

- A-List of Foreign Venture Capital Investors Registered With SEBIДокумент24 страницыA-List of Foreign Venture Capital Investors Registered With SEBIVipul ParekhОценок пока нет

- SIDBI Fund ListДокумент13 страницSIDBI Fund ListYash50% (2)

- Flo Biz - Sample DeckДокумент8 страницFlo Biz - Sample DeckRishivanth ThulasiramanОценок пока нет

- HNIДокумент5 страницHNIAmrita MishraОценок пока нет

- Dow Jones VentureSource 2Q15 EMEA Venture Capital ReportДокумент17 страницDow Jones VentureSource 2Q15 EMEA Venture Capital ReportCrowdfundInsiderОценок пока нет

- Venture Capital Funds in IndiaДокумент17 страницVenture Capital Funds in IndialipsaОценок пока нет

- Venture CapitalДокумент20 страницVenture CapitalAshika Khanna 1911165Оценок пока нет

- List of Major Foreign Investors in Poland 2011-CommentsДокумент128 страницList of Major Foreign Investors in Poland 2011-Commentsmihaisoric16170% (1)

- MD and Ceo of BanksДокумент8 страницMD and Ceo of Banksnarra gowthamОценок пока нет

- Banks Calling ListДокумент6 страницBanks Calling Listsatendra singhОценок пока нет

- Venture ListsДокумент8 страницVenture ListsRavi Singh BishtОценок пока нет

- Europe Hedge FundsДокумент126 страницEurope Hedge Fundsheedi0Оценок пока нет

- Venture Capital List - SEBIДокумент40 страницVenture Capital List - SEBImitalisorthi100% (1)

- Startup Ecosytem Survey PuneДокумент32 страницыStartup Ecosytem Survey Punepavan reddyОценок пока нет

- 2008 Global Private Equity & Venture Capital Contact DirectoryДокумент3 страницы2008 Global Private Equity & Venture Capital Contact Directorywww.gazhoo.com100% (5)

- MeetFounders UK-EU MARCH 2021 HandoutДокумент21 страницаMeetFounders UK-EU MARCH 2021 HandoutAndrew BottОценок пока нет

- Sample: Indian Institute of Skill Development TrainingДокумент1 страницаSample: Indian Institute of Skill Development TrainingSree AromalОценок пока нет

- 3Q-14 VCchart PDFДокумент21 страница3Q-14 VCchart PDFBayAreaNewsGroupОценок пока нет

- Venture Capital Funding, Fourth Quarter 2015Документ10 страницVenture Capital Funding, Fourth Quarter 2015BayAreaNewsGroupОценок пока нет

- Follow-Up Letter To SCC Re 16 Uncounted VotesДокумент3 страницыFollow-Up Letter To SCC Re 16 Uncounted VotesBayAreaNewsGroupОценок пока нет

- Santa Clara Findings Report FinalДокумент11 страницSanta Clara Findings Report FinalBayAreaNewsGroup100% (3)

- 4.28.23 Santa Clara County SSA DFCS Response Letter Re Site VisitДокумент21 страница4.28.23 Santa Clara County SSA DFCS Response Letter Re Site VisitBayAreaNewsGroupОценок пока нет

- Pac-12 Settlement AgreementДокумент31 страницаPac-12 Settlement AgreementBayAreaNewsGroupОценок пока нет

- What We Watched A Netflix Engagement Report 2023Jan-JunДокумент849 страницWhat We Watched A Netflix Engagement Report 2023Jan-JunBayAreaNewsGroupОценок пока нет

- Cupertino City Attorney ResponseДокумент3 страницыCupertino City Attorney ResponseBayAreaNewsGroupОценок пока нет

- Darcy Paul Attorney LetterДокумент3 страницыDarcy Paul Attorney LetterBayAreaNewsGroupОценок пока нет

- Read Trump Indictment Related To Hush Money PaymentДокумент16 страницRead Trump Indictment Related To Hush Money PaymentBayAreaNewsGroup100% (1)

- Brian Doyle Vs City of Santa ClaraДокумент13 страницBrian Doyle Vs City of Santa ClaraBayAreaNewsGroupОценок пока нет

- Complaint For Breach of Pac-12 BylawsДокумент16 страницComplaint For Breach of Pac-12 BylawsBayAreaNewsGroup100% (2)

- George Santos IndictmentДокумент20 страницGeorge Santos IndictmentBayAreaNewsGroupОценок пока нет

- Read Trump Indictment Statement of Facts Related To Hush Money PaymentДокумент13 страницRead Trump Indictment Statement of Facts Related To Hush Money PaymentBayAreaNewsGroup100% (1)

- Antioch Mayor Calls For Immediate Firing of Officers Involved in Racist Text ScandalДокумент2 страницыAntioch Mayor Calls For Immediate Firing of Officers Involved in Racist Text ScandalBayAreaNewsGroupОценок пока нет

- Wish Book Donation FormДокумент1 страницаWish Book Donation FormBayAreaNewsGroupОценок пока нет

- Los MeDanos Community Healthcare District ReportДокумент44 страницыLos MeDanos Community Healthcare District ReportBayAreaNewsGroupОценок пока нет

- Memo From Outgoing Interim SJSU President Sue Martin To Incoming President Papazian in 2016Документ5 страницMemo From Outgoing Interim SJSU President Sue Martin To Incoming President Papazian in 2016BayAreaNewsGroupОценок пока нет

- San Jose State Investigation of Former Gymnastics CoachДокумент40 страницSan Jose State Investigation of Former Gymnastics CoachBayAreaNewsGroupОценок пока нет

- Federal Analysis of The BART's San Jose ExtensionДокумент145 страницFederal Analysis of The BART's San Jose ExtensionBayAreaNewsGroupОценок пока нет

- California Energy Commission Chair David Hochschild's Letter To Major Oil CompaniesДокумент4 страницыCalifornia Energy Commission Chair David Hochschild's Letter To Major Oil CompaniesBayAreaNewsGroupОценок пока нет

- Santa Clara Valley Water District Poll 1Документ5 страницSanta Clara Valley Water District Poll 1BayAreaNewsGroupОценок пока нет

- Water District Term Limits PollДокумент10 страницWater District Term Limits PollBayAreaNewsGroupОценок пока нет

- Antioch Redistricting Draft Map AДокумент5 страницAntioch Redistricting Draft Map ABayAreaNewsGroupОценок пока нет

- Personnel Complaint Opa 2018-012 Investigator: Sergeant Josh ClarkДокумент25 страницPersonnel Complaint Opa 2018-012 Investigator: Sergeant Josh ClarkBayAreaNewsGroupОценок пока нет

- Marie Tuite Response 02.04.22Документ3 страницыMarie Tuite Response 02.04.22BayAreaNewsGroupОценок пока нет

- Sent Via Electronic Mail Only To:: O S S E D Deborah ScrogginДокумент3 страницыSent Via Electronic Mail Only To:: O S S E D Deborah ScrogginBayAreaNewsGroupОценок пока нет

- Richmond Police Department: MemorandumДокумент11 страницRichmond Police Department: MemorandumBayAreaNewsGroupОценок пока нет

- March 9, 2019 - KhalfanДокумент24 страницыMarch 9, 2019 - KhalfanBayAreaNewsGroupОценок пока нет

- Richmond PD Use of Force Report: Nathan Tanner MyersДокумент32 страницыRichmond PD Use of Force Report: Nathan Tanner MyersBayAreaNewsGroupОценок пока нет

- Case # 2019-00014491 - Supplement - 2 Report: NarrativeДокумент4 страницыCase # 2019-00014491 - Supplement - 2 Report: NarrativeBayAreaNewsGroupОценок пока нет

- April 9, 2019Документ42 страницыApril 9, 2019BayAreaNewsGroupОценок пока нет

- SodaPDF-converted-maina - 6 Months Bank StatementДокумент5 страницSodaPDF-converted-maina - 6 Months Bank StatementShashikant JoshiОценок пока нет

- WdmlistДокумент267 страницWdmlistHarshitОценок пока нет

- Investment - Charles P Jones - Chapter 3Документ19 страницInvestment - Charles P Jones - Chapter 3RakaAninditaPradanaОценок пока нет

- Banks in Country United KingdomДокумент9 страницBanks in Country United KingdomGill ParamОценок пока нет

- Wilful Defaulters As On 30.06.2013 (Suit Filed) (Rs. in Lacs)Документ16 страницWilful Defaulters As On 30.06.2013 (Suit Filed) (Rs. in Lacs)amandeepОценок пока нет

- Nodal OfficersДокумент6 страницNodal OfficersManish SrivastavaОценок пока нет

- Insurance CompaniesДокумент5 страницInsurance CompaniesdarshangoshОценок пока нет

- Srilanka TandcДокумент4 страницыSrilanka Tandcnthusanth thusanthОценок пока нет

- S No. Name of Bank User Id Remarks: (7 Characters)Документ4 страницыS No. Name of Bank User Id Remarks: (7 Characters)Sudeepa SudeepaОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент7 страницStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancemathur1995Оценок пока нет

- Mutual Funds Vs Gold Saving FundsДокумент19 страницMutual Funds Vs Gold Saving Fundschaluvadiin100% (1)

- Central Banks of Different CountriesДокумент9 страницCentral Banks of Different CountriesHimanshu KumarОценок пока нет

- Three-Fund Portfolio - BoogleheadsДокумент11 страницThree-Fund Portfolio - BoogleheadsMRT10100% (4)

- Domestic Bank ListДокумент14 страницDomestic Bank Listfadli_zulОценок пока нет

- 49 2Документ14 страниц49 2Ali RaziОценок пока нет

- Sbi StatementДокумент5 страницSbi Statement321910303040 gitamОценок пока нет

- CB Insights - Tech IPO Pipeline 2024Документ72 страницыCB Insights - Tech IPO Pipeline 2024Razvan CosmaОценок пока нет

- Statement of Axis Account No:916010066252060 For The Period (From: 01-04-2021 To: 31-03-2022)Документ13 страницStatement of Axis Account No:916010066252060 For The Period (From: 01-04-2021 To: 31-03-2022)ma.shehlaintОценок пока нет

- Introduction To Public and Private Sector BanksДокумент21 страницаIntroduction To Public and Private Sector Bankspriyanka shedge100% (1)

- Kenya Bank Codes PDFДокумент1 страницаKenya Bank Codes PDFJohn Maundu NdambukiОценок пока нет

- Guide As A Shopee SellerДокумент2 страницыGuide As A Shopee SellerManuel MarcelОценок пока нет

- Ishares US ETFs - Dividends and Implied Volatility Surfaces ParametersДокумент2 страницыIshares US ETFs - Dividends and Implied Volatility Surfaces ParametersQ.M.S Advisors LLCОценок пока нет

- Backup - GJ Januari 2024Документ24 страницыBackup - GJ Januari 2024Rosmina. S MagribОценок пока нет

- The Biggest Fund Investors in Private EquityДокумент7 страницThe Biggest Fund Investors in Private EquityDavid KeresztesОценок пока нет

- Ifsc Code List-1501-2000 PDFДокумент500 страницIfsc Code List-1501-2000 PDFMaheshОценок пока нет

- Oferta Ulei VerilaДокумент4 страницыOferta Ulei VerilaSava SergiuОценок пока нет

- Insurance Case ListДокумент4 страницыInsurance Case ListFai MeileОценок пока нет

- A ON Mutual Fund Industry-Analysis & Recent TrendsДокумент107 страницA ON Mutual Fund Industry-Analysis & Recent TrendsjohnyramnaniОценок пока нет

- Financial Analysis of Sbi Pratul Karki NewestДокумент69 страницFinancial Analysis of Sbi Pratul Karki NewestHimanshu Dhami50% (2)

- My Watchlist - Value ResearchДокумент1 страницаMy Watchlist - Value ResearchpksОценок пока нет