Академический Документы

Профессиональный Документы

Культура Документы

Ifrs 13 Fair Value Measurement

Загружено:

api-292644739Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ifrs 13 Fair Value Measurement

Загружено:

api-292644739Авторское право:

Доступные форматы

Address:

Phoenix Accounting Solutions

Chartered Accountants (SA)

Contact No.

Practice Number 30680497

4 Edmund Road

Constantia Kloof

Florida

1709

079 878 5903

072 477 2945

www.phoenixaccounting.co.za

IFRS 13: Fair Value Measurement

IFRS 13 is the first comprehensive standard to deal

with the concept of measuring fair value.

The objectives of IFRS 13 are to establish principles for fair value measurement of

assets and liabilities, and set out required disclosures about fair value

measurement.

This standard determines HOW to apply fair value if required or

permitted by other standards.

NOTE:

IFRS 13 does NOT apply to:

Transactions accounted for under either IFRS 2: Share Based Payments or

IAS 17: Leases;

Net Realisable Value (IAS 2: Inventory) and Value In Use for impairments

(IAS 36: Impairment) which have similar characteristics to fair value, but are

not fair value;

The disclosure requirements of Plan Assets (IAS 19: Employee Benefits &

IAS 26: Accounting and Reporting by Retirement Benefit Plans) and Assets

measured at Fair Value less Costs to Sell (IAS 36: Impairment).

Partners: Michelle Beukes (CA) SA & Hartmann Beukes (CA) SA

Page 1

Address:

Phoenix Accounting Solutions

Chartered Accountants (SA)

Contact No.

Practice Number 30680497

4 Edmund Road

Constantia Kloof

Florida

1709

079 878 5903

072 477 2945

www.phoenixaccounting.co.za

FAIR VALUE is defined as:

1. the price that would be

2. received to sell an asset or paid to

transfer a liability

3. in an orderly transaction

4. between market participants

5. at the measurement date.

In essence this is an EXIT PRICE that would

be achieved in a hypothetical transaction

between market participants.

Partners: Michelle Beukes (CA) SA & Hartmann Beukes (CA) SA

Page 2

Address:

Phoenix Accounting Solutions

Chartered Accountants (SA)

Contact No.

Practice Number 30680497

4 Edmund Road

Constantia Kloof

Florida

1709

079 878 5903

072 477 2945

www.phoenixaccounting.co.za

The key elements to consider:

Assumes that:

Orderly

Transaction

The asset/liability has been

exposed to the market for a

reasonable amount of time to

allow for marketing activities

that are customary for

transactions involving these

assets/liabilities.

The transaction is NOT a forced

transaction (ie not a fire sale).

Assumes that:

Principal

Market

This is the market in which the

entity NORMALLY transacts.

Can also be the most

advantageous market to which

that entity has access.

Assumes that:

Market

Participants

These participants are

independent.

These participants are

knowledgeable (ie have a

reasonable understanding of the

asset/liability).

The participants are willing and

able to transact.

Partners: Michelle Beukes (CA) SA & Hartmann Beukes (CA) SA

Page 3

Address:

Phoenix Accounting Solutions

Chartered Accountants (SA)

Contact No.

Practice Number 30680497

4 Edmund Road

Constantia Kloof

Florida

1709

079 878 5903

072 477 2945

www.phoenixaccounting.co.za

Special Considerations when dealing with non-financial

assets:

Highest and Best Use:

-

The fair value of a non-financial asset is the price that would be paid by a

market participant given the best use that can be made of an asset,

irrespective of its current use.

However, highest and best use must be:

-

A use that is physically possible

Legally permissible

Financially feasible

This concept requires that the fair value of a non-financial asset be considered

from the perspective of a market participant and NOT based on the entitys

plans/current use!

Fair Value of Liabilities:

IFRS 13 does NOT require liabilities to be measured at fair value, but does provide

guidance where an entity chooses to measure a liability at fair value.

In addition to the fair value requirements above:

-

The fair value for liabilities should assume the liability remains

outstanding after transfer and the transferee will fulfil the obligations;

The fair value should take into consideration non-performance risk

including the entitys own credit risk.

Partners: Michelle Beukes (CA) SA & Hartmann Beukes (CA) SA

Page 4

Address:

Phoenix Accounting Solutions

Chartered Accountants (SA)

Contact No.

Practice Number 30680497

4 Edmund Road

Constantia Kloof

Florida

1709

079 878 5903

072 477 2945

www.phoenixaccounting.co.za

Liabilities

held by

others

Liabilities

NOT held

by others

Where liabilities of an entity are

held by others (investors/other

counter-parties) the fair value of

those liabilities should be

determined from the perspective

of the ASSET-HOLDER (ie the fair

value of the investors/counterpartys asset)

Where liabilities of an entity do

not represent assets of a

counter-party, fair value should

be determined from the

perspective of the market

participant required to fulfil the

obligation.

(Normally measured by using the

present value of expected cash flows,

taking into account a risk premium

that actual cash flows will differ from

those expected, and an expected

return on investment.)

Partners: Michelle Beukes (CA) SA & Hartmann Beukes (CA) SA

Page 5

Address:

Phoenix Accounting Solutions

Chartered Accountants (SA)

Contact No.

Practice Number 30680497

4 Edmund Road

Constantia Kloof

Florida

1709

079 878 5903

072 477 2945

www.phoenixaccounting.co.za

Initial recognition:

On initial recognition the transaction price is GENERALLY equal to the fair value, but

the entity will still need to apply the definition of fair value to ensure accuracy (ie is

the value equal to an exit price?).

In certain instances an item requires measurement at fair value upon initial

measurement, for example the fair value of net assets acquired in a business

combination in terms of IFRS3.

This is therefore an entry price and not an exit price.

It is therefore sometimes necessary to adjust the actual transaction

price (being and entry price) on initial recognition to an exit price (fair

value).

This may result in the immediate recognition of a gain or loss in profit

or loss or other comprehensive income.

Short-term items:

The fair value of short-term receivables and payables with no stated interest rate

may be measured at the invoice amount without discounting when the effect of not

discounting is IMMATERIAL.

Partners: Michelle Beukes (CA) SA & Hartmann Beukes (CA) SA

Page 6

Address:

Phoenix Accounting Solutions

Chartered Accountants (SA)

Contact No.

Practice Number 30680497

4 Edmund Road

Constantia Kloof

Florida

1709

079 878 5903

072 477 2945

www.phoenixaccounting.co.za

Valuation approaches that may be applied:

MARKET

APPROACH

Uses prices and other relevant

information generated by market

transactions involving similar

assets/liabilities

INCOME

APPROACH

Converts future cash flows/income

& expenses to a discounted current

amount. Fair value measurement is

determined on the basis of current

market expectations about those

future amounts.

COST

APPROACH

Reflects the amount that would

currently be required to replace the

service capacity of an asset (ie

current replacement cost).

Each of these approaches make use of OBSERVABLE and

UNOBSERVABLE inputs.

IFRS 13 proposes a bias towards the use of OBSERVABLE inputs

whenever possible and appropriate.

Partners: Michelle Beukes (CA) SA & Hartmann Beukes (CA) SA

Page 7

Address:

Phoenix Accounting Solutions

Chartered Accountants (SA)

Contact No.

Practice Number 30680497

4 Edmund Road

Constantia Kloof

Florida

1709

079 878 5903

072 477 2945

www.phoenixaccounting.co.za

A change in valuation technique is treated as a CHANGE IN ESTIMATE in

terms of IAS 8: Accounting Policies, Changes in Estimates & Errors.

Such a change will only lead to PROSPECTIVE ADJUSTMENTS, with no

restatement of previously reported amounts.

Disclosure:

IFRS 13 requires the fair value ASSUMPTIONS and RELATED INFORMATION to

be disclosed were applicable.

The disclosure requirements are largely a copy of the fair value disclosures

required by IFRS 7: Disclosure of Financial Instruments.

IFRS 13 requires the same 3-level fair value disclosures!

The level in the fair value hierarchy within which the fair value measurement is

categorised in its entirety is determined on the basis of the lowest level input

that is significant to the fair value measurement in its entirety.

Partners: Michelle Beukes (CA) SA & Hartmann Beukes (CA) SA

Page 8

Address:

Phoenix Accounting Solutions

Chartered Accountants (SA)

Contact No.

Practice Number 30680497

4 Edmund Road

Constantia Kloof

Florida

1709

079 878 5903

072 477 2945

www.phoenixaccounting.co.za

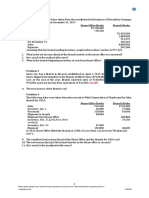

Level 1

Hierarchy

Fair value is determined with reference to a

QUOTED PRICE in an active market.

Level 2

Hierarchy

Fair value is determined using INPUT-DERIVED

market information, but not directly from a

quoted price in an active market.

Level 3

Hierarchy

Fair value is determined primarily from inputs

reflective of MANAGEMENTS EXPECTATIONS.

In addition, for LEVEL 3, a reconciliation is required disclosing:

Total gains/losses for the period recognised in profit or

loss , and a description of where they are disclosed;

Total gains/losses recognised in Other Comprehensive

Income;

Purchases, sales, settlements issues; and

Transfers into and out of Level 3, and reasons for the

transfers.

Partners: Michelle Beukes (CA) SA & Hartmann Beukes (CA) SA

Page 9

Вам также может понравиться

- Chapter 15-Financial Planning: Multiple ChoiceДокумент22 страницыChapter 15-Financial Planning: Multiple ChoiceadssdasdsadОценок пока нет

- Special Topics in Income TaxationДокумент78 страницSpecial Topics in Income TaxationPantas DiwaОценок пока нет

- RADS Summit Highlights Accountancy Competition and Career PathsДокумент4 страницыRADS Summit Highlights Accountancy Competition and Career PathsDaniella CustodioОценок пока нет

- Module 8 LIABILITIESДокумент5 страницModule 8 LIABILITIESNiño Mendoza MabatoОценок пока нет

- Global 6000 SystemsДокумент157 страницGlobal 6000 SystemsJosé Rezende100% (1)

- Notes On The Life and Works of Jose Rizal - IncompleteДокумент15 страницNotes On The Life and Works of Jose Rizal - Incompleteblock_me_please50% (2)

- Assignment 3 Part 3 PDFДокумент6 страницAssignment 3 Part 3 PDFStudent555Оценок пока нет

- Korba - BAH Online Temp MonitoringДокумент7 страницKorba - BAH Online Temp Monitoringrama jenaОценок пока нет

- G.M4 HW GWДокумент3 страницыG.M4 HW GWClint Agustin M. RoblesОценок пока нет

- Testing Internal Controls for Revenue CycleДокумент4 страницыTesting Internal Controls for Revenue CyclestillwinmsОценок пока нет

- Karkits Corporation PDFДокумент4 страницыKarkits Corporation PDFRachel LeachonОценок пока нет

- Translation of Foreign FSДокумент7 страницTranslation of Foreign FSLloyd SonicaОценок пока нет

- Risk-Based Internal Auditing and Identifying Operational RisksДокумент5 страницRisk-Based Internal Auditing and Identifying Operational RisksMaricar PinedaОценок пока нет

- Pre Week NewДокумент30 страницPre Week NewAnonymous wDganZОценок пока нет

- Business Combination-Acquisition of Net AssetsДокумент2 страницыBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanОценок пока нет

- Assignment - Aduit of CashДокумент5 страницAssignment - Aduit of CashEdemson NavalesОценок пока нет

- Cases (Cabrera)Документ5 страницCases (Cabrera)Queenie100% (1)

- RAPPLER HOLDINGS CORPORATION'S Accounts Receivable Subsidiary Ledger Shows The FollowingДокумент2 страницыRAPPLER HOLDINGS CORPORATION'S Accounts Receivable Subsidiary Ledger Shows The FollowingAlvinDumanggasОценок пока нет

- Auditing fraud risk factors and responsibilitiesДокумент2 страницыAuditing fraud risk factors and responsibilitiesnhbОценок пока нет

- Top 5 Accounting Firms in The PhilippinesДокумент8 страницTop 5 Accounting Firms in The PhilippinesRoselle Hernandez100% (3)

- Intermediate Accounting - Final Output ReceivablesДокумент56 страницIntermediate Accounting - Final Output ReceivablesAnitas LimmaumОценок пока нет

- Far - Pre BoardДокумент17 страницFar - Pre BoardClene DoconteОценок пока нет

- Partnership Formation and OperationДокумент12 страницPartnership Formation and OperationDevine Grace A. MaghinayОценок пока нет

- 10.28.2017 MT (Audit of Receivables)Документ7 страниц10.28.2017 MT (Audit of Receivables)PatOcampo100% (1)

- Psa 510Документ9 страницPsa 510Rico Jon Hilario GarciaОценок пока нет

- 1.2 Assignment Audit of Cash and Cash Equivalents 2Документ3 страницы1.2 Assignment Audit of Cash and Cash Equivalents 2ORIEL RICKY IGNACIO GALLARDOОценок пока нет

- Direct Method or Cost of Goods Sold MethodДокумент2 страницыDirect Method or Cost of Goods Sold MethodNa Dem DolotallasОценок пока нет

- Module QuizsДокумент24 страницыModule QuizswsviviОценок пока нет

- AssignmentДокумент6 страницAssignmentIryne Kim PalatanОценок пока нет

- Quiz 2Документ19 страницQuiz 2Quendrick SurbanОценок пока нет

- Learning Objective 11-1: Chapter 11 Considering The Risk of FraudДокумент25 страницLearning Objective 11-1: Chapter 11 Considering The Risk of Fraudlo0302100% (1)

- Theories: Basic ConceptsДокумент20 страницTheories: Basic ConceptsJude VeanОценок пока нет

- Contemporary Strategy Analysis Ch1Документ3 страницыContemporary Strategy Analysis Ch1Beta AccОценок пока нет

- BS Accountancy Sample ThesisДокумент8 страницBS Accountancy Sample ThesisBUENA SANGELОценок пока нет

- Midterm Examination: Financial Management IДокумент3 страницыMidterm Examination: Financial Management IROB101512Оценок пока нет

- Dayag Notes Partnership DissolutionДокумент3 страницыDayag Notes Partnership DissolutionGirl Lang AkoОценок пока нет

- Unit 1 Erica Abegonia Sec Code 416 Exercise 1Документ2 страницыUnit 1 Erica Abegonia Sec Code 416 Exercise 1Ivan AnaboОценок пока нет

- Audit of LiabsДокумент2 страницыAudit of LiabsRommel Royce CadapanОценок пока нет

- PDF Chapter 9 Audit of Liabilities Roque CompressДокумент77 страницPDF Chapter 9 Audit of Liabilities Roque CompressLovely Dela Cruz GanoanОценок пока нет

- CFR-40C Financial Reporting StandardsДокумент6 страницCFR-40C Financial Reporting StandardsedrianclydeОценок пока нет

- An Information Systems FrameworkДокумент30 страницAn Information Systems FrameworkDr. Mohammad Noor AlamОценок пока нет

- Chapter 7 - Conversion Cycle P4Документ26 страницChapter 7 - Conversion Cycle P4Joana TrinidadОценок пока нет

- Accounting For Special Transactions:: Corporate LiquidationДокумент28 страницAccounting For Special Transactions:: Corporate LiquidationKim EllaОценок пока нет

- Auditing Problems Intangibles Impairment and Revaluation PDFДокумент44 страницыAuditing Problems Intangibles Impairment and Revaluation PDFMark Domingo MendozaОценок пока нет

- AC 3101 Discussion ProblemДокумент1 страницаAC 3101 Discussion ProblemYohann Leonard HuanОценок пока нет

- QuizДокумент13 страницQuizPearl Morni AlbanoОценок пока нет

- Final 2 2Документ3 страницыFinal 2 2RonieOlarteОценок пока нет

- Accountants Embracing Changing Times in AcademeДокумент12 страницAccountants Embracing Changing Times in AcademeLorie Anne ValleОценок пока нет

- Libyae Lustare - Audit Cash & Equivalents Under 40 CharactersДокумент1 страницаLibyae Lustare - Audit Cash & Equivalents Under 40 CharactersAna Mae HernandezОценок пока нет

- PESTELДокумент14 страницPESTELAmy LlunarОценок пока нет

- Seatwork - Advacc1Документ2 страницыSeatwork - Advacc1David DavidОценок пока нет

- 03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Документ5 страниц03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Ma Jessa Kathryl Alar IIОценок пока нет

- Why Is Planning An Audit Important?Документ5 страницWhy Is Planning An Audit Important?panda 1Оценок пока нет

- MiniscribeДокумент14 страницMiniscribeImadОценок пока нет

- Accounting Research EssayДокумент4 страницыAccounting Research EssayInsatiable LifeОценок пока нет

- The New Code of Ethics For CPA S by Atty Eranio Punsalan PDFДокумент9 страницThe New Code of Ethics For CPA S by Atty Eranio Punsalan PDFsamuel debebeОценок пока нет

- This Study Resource Was: Pre-QE ExaminationДокумент8 страницThis Study Resource Was: Pre-QE ExaminationMarcus MonocayОценок пока нет

- Quiz 2 Case StudyДокумент3 страницыQuiz 2 Case StudyChristian Mark ParasОценок пока нет

- Intercompany Plant Asset TransactionsДокумент11 страницIntercompany Plant Asset TransactionsRo-Anne LozadaОценок пока нет

- InventoriesДокумент3 страницыInventoriesJane TuazonОценок пока нет

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Документ20 страницPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Pdf FilesОценок пока нет

- Nfjpia Nmbe Far 2017 Ans-1Документ10 страницNfjpia Nmbe Far 2017 Ans-1Stephen ChuaОценок пока нет

- Audprob Final Exam 1Документ26 страницAudprob Final Exam 1Joody CatacutanОценок пока нет

- Individuals Tax Guide 2016-2017Документ1 страницаIndividuals Tax Guide 2016-2017api-292644739Оценок пока нет

- Corporate Tax Guide 2016-2017Документ1 страницаCorporate Tax Guide 2016-2017api-292644739Оценок пока нет

- Ias 7 Statement of Cash FlowsДокумент8 страницIas 7 Statement of Cash Flowsapi-292644739Оценок пока нет

- Eme B-Bbee Status LevelsДокумент3 страницыEme B-Bbee Status Levelsapi-292644739Оценок пока нет

- Deductions From Travel AllowancesДокумент9 страницDeductions From Travel Allowancesapi-292644739Оценок пока нет

- Brief Summary - Ifrs 9 Financial InstrumentsДокумент9 страницBrief Summary - Ifrs 9 Financial Instrumentsapi-292644739Оценок пока нет

- Ifrs For Smes AmendmentsДокумент9 страницIfrs For Smes Amendmentsapi-292644739Оценок пока нет

- Applying Ifrs For SmesДокумент5 страницApplying Ifrs For Smesapi-292644739Оценок пока нет

- Individuals Tax Guide 2015-2016Документ1 страницаIndividuals Tax Guide 2015-2016api-292644739Оценок пока нет

- Companies Tax Guide 2015-2016Документ1 страницаCompanies Tax Guide 2015-2016api-292644739Оценок пока нет

- Differences Between An Audit and Independent ReviewДокумент2 страницыDifferences Between An Audit and Independent Reviewapi-292644739Оценок пока нет

- Prof. Michael Murray - Some Differential Geometry ExercisesДокумент4 страницыProf. Michael Murray - Some Differential Geometry ExercisesAnonymous 9rJe2lOskxОценок пока нет

- EQ - Module - Cantilever MethodДокумент17 страницEQ - Module - Cantilever MethodAndrea MalateОценок пока нет

- HU675FE ManualДокумент44 страницыHU675FE ManualMar VeroОценок пока нет

- Chapter 9-10 (PPE) Reinzo GallegoДокумент48 страницChapter 9-10 (PPE) Reinzo GallegoReinzo GallegoОценок пока нет

- Motivations for Leaving Public Accounting FirmsДокумент33 страницыMotivations for Leaving Public Accounting Firmsran0786Оценок пока нет

- Fda PDFДокумент2 страницыFda PDFVictorОценок пока нет

- Quality CircleДокумент33 страницыQuality CircleSudeesh SudevanОценок пока нет

- Aircraft ChecksДокумент10 страницAircraft ChecksAshirbad RathaОценок пока нет

- Wsi PSDДокумент18 страницWsi PSDДрагиша Небитни ТрифуновићОценок пока нет

- StsДокумент10 страницStsSamonte, KimОценок пока нет

- Biomechanics of Advanced Tennis: January 2003Документ7 страницBiomechanics of Advanced Tennis: January 2003Katrien BalОценок пока нет

- BSC6900 UMTS V900R011C00SPC700 Parameter ReferenceДокумент1 010 страницBSC6900 UMTS V900R011C00SPC700 Parameter Referenceronnie_smgОценок пока нет

- Brochure - Truemax Concrete Pump Truck Mounted TP25M4Документ16 страницBrochure - Truemax Concrete Pump Truck Mounted TP25M4RizkiRamadhanОценок пока нет

- Nature and Scope of Marketing Marketing ManagementДокумент51 страницаNature and Scope of Marketing Marketing ManagementFeker H. MariamОценок пока нет

- Java MCQ QuestionsДокумент11 страницJava MCQ QuestionsPineappleОценок пока нет

- E PortfolioДокумент76 страницE PortfolioMAGALLON ANDREWОценок пока нет

- EMECH 2 MarksДокумент18 страницEMECH 2 MarkspavanraneОценок пока нет

- Donaldson 004117 PDFДокумент6 страницDonaldson 004117 PDFNSОценок пока нет

- Useful Coaching Questions: Questions To Create A State Change Questions To Ask When Something Goes WrongДокумент2 страницыUseful Coaching Questions: Questions To Create A State Change Questions To Ask When Something Goes WrongAntonioОценок пока нет

- E-banking and transaction conceptsДокумент17 страницE-banking and transaction conceptssumedh narwadeОценок пока нет

- DMS-2017A Engine Room Simulator Part 1Документ22 страницыDMS-2017A Engine Room Simulator Part 1ammarОценок пока нет

- STEM Spring 2023 SyllabusДокумент5 страницSTEM Spring 2023 SyllabusRollins MAKUWAОценок пока нет

- The Invisible Hero Final TNДокумент8 страницThe Invisible Hero Final TNKatherine ShenОценок пока нет

- 9 - NCP Computer Science PGДокумент19 страниц9 - NCP Computer Science PGM AmbreenОценок пока нет

- Aquafine Optivenn Series Data SheetДокумент8 страницAquafine Optivenn Series Data SheetKenz ZhouОценок пока нет

- Osora Nzeribe ResumeДокумент5 страницOsora Nzeribe ResumeHARSHAОценок пока нет