Академический Документы

Профессиональный Документы

Культура Документы

Lincolns Mangerial Accounting Budgeting Project

Загружено:

api-285027299Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Lincolns Mangerial Accounting Budgeting Project

Загружено:

api-285027299Авторское право:

Доступные форматы

Introduction to Management Accounting

Solutions Manual

Problems: Set A

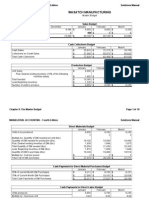

P9-59A Comprehensive budgeting problem (Learning Objectives 2 & 3)

Requirements

1. Prepare a schedule of cash collections for January, February, and March, and for the quarter

in total.

2. Prepare a production budget.

3. Prepare a direct materials budget.

4. Prepare a cash payments budget for the direct material purchases from Requirement 3.

5. Prepare a cash payments budget for conversion costs.

6. Prepare a cash payments budget for operating expenses.

7. Prepare a combined cash budget.

8. Calculate the budgeted manufacturing cost per unit.

9. Prepare a budgeted income statement for the quarter ending March 31.

Solution:

Given

Sales Budget

December

Unit sales

January

7,000

Unit selling price

Total sales Revenue

8,000

10 $

70,000

10

80,000

Req. 1

Cash Sales

Credit Sales

Total Cash Collections

Cash Collections

January

$24,000

$49,000

$73,000

February

$27,600

$56,000

$83,600

Production Budget

January

8,000

2,300

10,300

February

9,200

2,475

11,675

Req. 2

Unit Sales

Plus: Desired end inventory

Total Needed

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Less: Beginning inventory

Number of Units to produce

Solutions Manual

1,750

8,550

2,000

9,675

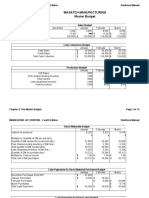

Req. 3

Direct Materials Budget

January

February

Units to be produced

8,000

9,200

Multiply by Pounds of DM needed per unit

2

2

Quantity (pounds) needed for production

16,000

18,400

Plus: Desired end inventory

1,840

1,980

Total quantity (pounds) needed

17,840

20,380

Less: Beginning inventory of DM

1,600

1,840

Quantity (pounds) to purchase

16,240

18,540

2

Multiply by: Cost per pound

2

Total cost of DM purchases

$32,480

$37,080

Units to be produced

Multiply by pounds of DM needed per unit

Quantity (pounds) needed for production

Plus: Desired end inventory

Total quantity (pounds) needed

Less: Beginning inventoy of DM

April

9,700

2

19,400

1,700

May

8,500

2

17000

1,700

Req. 4

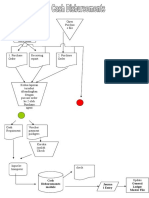

Schedule of Expected Cash DisbursementsMaterial Purchases

January

February

December purchases (from Accounts Payable)

$22,720

January purchases

$6,496

$25,984

February purchases

$7,416

March purchases

Total cash payments for direct material

purchases

$29,216

$33,400

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

Introduction to Management Accounting

Solutions Manual

Req. 5

Schedule of Expected Cash DisbursementsConversion Costs

January

February

Variable conversion costs

$9,600

$11,040

Rent (fixed)

$5,000

$5,000

Other fixed MOH

$3,000

$3,000

Total payments for conversion costs

$17,600

$19,040

Req. 6

Schedule of Expected Cash Disbursements -- Operating Expenses

January

February

Variable operating expenses

$9,600

$11,040

Fixed operating expenses

$10,600

$11,800

Total payments for operating expenses

$20,200

$22,840

Req. 7

Cash balance, beginning

Add cash collections

Total cash available

Less cash payments

Direct material purchases

Conversion costs

Operating expenses

Equipment purchases

Tax payment

Total cash payments

Ending cash balance before financing

Financing

Borrowings

Repayments

Interest payments

Ending cash balance

Total interest

Combined Cash Budget

January

February

$4,984

73,000

83,600

88,584

29,216

17,600

20,200

5,000

0

72,016

984

33,400

19,040

22,840

12,000

10,000

97,280

-8,696

4,000

0

0

4,984

13,000

0

0

4,304

$280

Req. 8

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Solutions Manual

Budgeted Manufacturing Cost per Unit

Direct materials cost per unit

Conversion costs per unit

Fixed manufacturing overhead per unit

Budgeted cost of manufacturing per unit

Req. 9

Silverman Manufacturing

Budgeted Income Statement

For the Quarter Ended March 31

Sales

Cost of goods sold

Gross profit

Operating expense

Depreciation

Operating income

Less interest expense

Less provision for income taxes

Net income

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Solutions Manual

(60 min.) P 9-59A

ves 2 & 3)

March, and for the quarter

from Requirement 3.

udget

February

March

9,200

April

9,900

May

9,700

8,500

10

10 $

10

10

92,000

99,000 $

97,000

85,000

March

$29,700

$64,400

$94,100

Quarter

$81,300

$169,400

$250,700

March

9,900

2425

12,325

Quarter

27,100

2,425

34,300

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

2,300

10,025

1,750

28,250

March

9,900

2

19,800

1940

21,740

1,980

19,760

2

$39,520

Quarter

27,100

2

54,200

1,940

54,200

1,600

52,600

2

$105,200

aterial Purchases

March

$29,664

$7,904

Quarter

$22,720

$32,480

$37,080

$7,904

$37,568

$100,184

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

Introduction to Management Accounting

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

Introduction to Management Accounting

onversion Costs

March

$11,880

$5,000

$3,000

$19,880

Quarter

$32,520

$15,000

$9,000

$56,520

erating Expenses

March

$11,880

$12,500

$24,380

Quarter

$32,520

$34,900

$67,420

March

$4,304

94,100

98,404

Solutions Manual

Quarter

250,700

37,568

19,880

24,380

16,000

0

97,828

576

100,184

56,520

67,420

33,000

4000

0

0

4,576

21,000

257,124

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

10

Вам также может понравиться

- Budget AssignmentДокумент10 страницBudget Assignmentapi-248058538Оценок пока нет

- Master Budget ProjectДокумент10 страницMaster Budget Projectapi-268950886Оценок пока нет

- Excel Budget Project Tanya MayДокумент10 страницExcel Budget Project Tanya Mayapi-316478827Оценок пока нет

- Budget Project LLДокумент10 страницBudget Project LLapi-220037346Оценок пока нет

- Managerial Accounting ProjectДокумент11 страницManagerial Accounting Projectapi-271746126Оценок пока нет

- Excel Project P9-59aДокумент3 страницыExcel Project P9-59aapi-272100463Оценок пока нет

- ProblemsДокумент4 страницыProblemsapi-316770820Оценок пока нет

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualДокумент10 страницWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-231890132100% (1)

- Budgetery Control & ABCДокумент41 страницаBudgetery Control & ABCanupams3Оценок пока нет

- Wasatch ManufacturingДокумент12 страницWasatch Manufacturingapi-301899907Оценок пока нет

- Budgetery Control & ABCДокумент41 страницаBudgetery Control & ABCRohit ChandakОценок пока нет

- TuyjДокумент51 страницаTuyjagnesОценок пока нет

- Accounting Chapter 9 Eportfolio ExcelДокумент12 страницAccounting Chapter 9 Eportfolio Excelapi-273030710Оценок пока нет

- Abigail Foss - Comprehensive Problem - Master BudgetДокумент15 страницAbigail Foss - Comprehensive Problem - Master Budgetapi-325954956Оценок пока нет

- p9-60 PsimasinghДокумент8 страницp9-60 Psimasinghapi-241811190Оценок пока нет

- Financial Forecasting: SIFE Lakehead 2009Документ7 страницFinancial Forecasting: SIFE Lakehead 2009Marius AngaraОценок пока нет

- Wasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions ManualДокумент12 страницWasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions Manualapi-247933607Оценок пока нет

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualДокумент12 страницWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-269073570Оценок пока нет

- Hailey Fernelius ch9 Excel ProjectДокумент4 страницыHailey Fernelius ch9 Excel Projectapi-242652884Оценок пока нет

- Characteristics of A Budget: Cash ReceiptsДокумент11 страницCharacteristics of A Budget: Cash ReceiptsMukesh ManwaniОценок пока нет

- EportfolioДокумент8 страницEportfolioapi-220792970Оценок пока нет

- Acct 2020 Excel Budget Problem Student TemplateДокумент12 страницAcct 2020 Excel Budget Problem Student Templateapi-242720692Оценок пока нет

- Material BudgetДокумент37 страницMaterial BudgetRahul SardaОценок пока нет

- Anggaran Berdasarkan Fungsi Dan AktivitasДокумент42 страницыAnggaran Berdasarkan Fungsi Dan AktivitasAri SuryadiОценок пока нет

- Wasatch Manufacturing Master BudgetДокумент6 страницWasatch Manufacturing Master Budgetapi-255137286Оценок пока нет

- Handout: Course Code and Name: Unit Code: Unit TitleДокумент10 страницHandout: Course Code and Name: Unit Code: Unit TitleGabriel ZuanettiОценок пока нет

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualДокумент12 страницWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-239130031Оценок пока нет

- CASH BUDGET PREPARATIONS Lesson Material and Activity SheetsДокумент8 страницCASH BUDGET PREPARATIONS Lesson Material and Activity SheetsLee Arne BarayugaОценок пока нет

- ACCA MA - Fma Study School Budgeting Part B SolutionsДокумент16 страницACCA MA - Fma Study School Budgeting Part B Solutionsmaharajabby81Оценок пока нет

- Chapter 04 - 12thДокумент16 страницChapter 04 - 12thSarah JamesОценок пока нет

- CH 6Документ16 страницCH 6Miftahudin Miftahudin100% (3)

- Lecture-7 Overhead (Part 1)Документ22 страницыLecture-7 Overhead (Part 1)Nazmul-Hassan Sumon100% (2)

- A 201 Chapter 12Документ14 страницA 201 Chapter 12blackprОценок пока нет

- Cash Budgets 2Документ9 страницCash Budgets 2Kopanang LeokanaОценок пока нет

- Assignment BriefДокумент10 страницAssignment BriefNguyen Dac ThichОценок пока нет

- Financial PlanДокумент54 страницыFinancial PlanTeku ThwalaОценок пока нет

- Acct 2020 Excel Budget Problem Student TemplateДокумент12 страницAcct 2020 Excel Budget Problem Student Templateapi-249190933Оценок пока нет

- ACCT504 Case Study 1 The Complete Accounting Cycle-13Документ12 страницACCT504 Case Study 1 The Complete Accounting Cycle-13Mohammad Islam100% (1)

- Tori Kallerud Chapter 9 HWДокумент12 страницTori Kallerud Chapter 9 HWapi-325347697Оценок пока нет

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualДокумент5 страницWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-284934265Оценок пока нет

- Ac102 ch7Документ22 страницыAc102 ch7Mohammed OsmanОценок пока нет

- Required: Using The Data Above, Complete The Following Statements and Schedules For The First QuarterДокумент6 страницRequired: Using The Data Above, Complete The Following Statements and Schedules For The First QuarterteferiОценок пока нет

- Danielle Nelson Final Essay QuestionsДокумент5 страницDanielle Nelson Final Essay Questionsapi-408647155100% (1)

- Week 4 Financial Planning Part 2Документ26 страницWeek 4 Financial Planning Part 2VENICE MARIE ARROYOОценок пока нет

- Required: Using The Data Above, Complete The Following Statements and Schedules For The First QuarterДокумент6 страницRequired: Using The Data Above, Complete The Following Statements and Schedules For The First QuarterNomunzul GanpurevОценок пока нет

- FinMgt Lecture 5 - Preparing BudgetssvДокумент23 страницыFinMgt Lecture 5 - Preparing BudgetssvMd. Sumon Chowdhury 152-11-4644Оценок пока нет

- Master BudgetДокумент20 страницMaster BudgetYsabelle Sacriz100% (1)

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualДокумент12 страницWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-242429455Оценок пока нет

- Week 5 - Sept 26-30 - AcctgДокумент13 страницWeek 5 - Sept 26-30 - Acctgmaria teresa aparreОценок пока нет

- Case Study The Complete AccounДокумент16 страницCase Study The Complete Accoundeepak.agarwal.caОценок пока нет

- Problem 1 Variable Cost Per UnitДокумент7 страницProblem 1 Variable Cost Per UnitŠĥỳ ÄñïlОценок пока нет

- Seminar 11answer Group 11Документ115 страницSeminar 11answer Group 11Shweta SridharОценок пока нет

- Accounting Excel Budget ProjectДокумент8 страницAccounting Excel Budget Projectapi-242531880Оценок пока нет

- Chapter+3 the+Adjusting+ProcessДокумент61 страницаChapter+3 the+Adjusting+ProcessOrkun Kızılırmak100% (1)

- Andrea Smith 5915 San Pablo Ave Oakland Ca 94608: Thanks For Saving With Capital One 360®Документ5 страницAndrea Smith 5915 San Pablo Ave Oakland Ca 94608: Thanks For Saving With Capital One 360®Usm amОценок пока нет

- Flowchart Account Payable & Cash DisbursementsДокумент4 страницыFlowchart Account Payable & Cash DisbursementsAlif Nur IrvanОценок пока нет

- PM Reyes Notes On Taxation Ii: Local Taxation: 1. General Principles, Definitions, and LimitationsДокумент9 страницPM Reyes Notes On Taxation Ii: Local Taxation: 1. General Principles, Definitions, and LimitationsMich FelloneОценок пока нет

- The Evolution, Function and Characteristics of Money (1) - 1Документ15 страницThe Evolution, Function and Characteristics of Money (1) - 1Emily GudinoОценок пока нет

- 1450 BTДокумент1 страница1450 BTShahjada ShekhОценок пока нет

- No 3, Simpang 370-81, Kelas C Jalan Muara, Kampong Sungai Tilong Brunei Muara BC3315 Brunei DarussalamДокумент2 страницыNo 3, Simpang 370-81, Kelas C Jalan Muara, Kampong Sungai Tilong Brunei Muara BC3315 Brunei DarussalamEddy MisuariОценок пока нет

- Illustration - 2022-11-03T115112.732Документ3 страницыIllustration - 2022-11-03T115112.732BLOODY ASHHERОценок пока нет

- Anupama DevДокумент10 страницAnupama DevANUPAMA GOKULОценок пока нет

- MITC CCДокумент12 страницMITC CCDeepak SinghОценок пока нет

- Fee Structure PDFДокумент2 страницыFee Structure PDFNarinderОценок пока нет

- Tuition Fee Policy 202122Документ20 страницTuition Fee Policy 202122Osama SharafОценок пока нет

- Income Tax Refund ChartДокумент2 страницыIncome Tax Refund ChartKelly Phillips ErbОценок пока нет

- Emp July To SepДокумент3 страницыEmp July To SepsivagamipalaniОценок пока нет

- PB TaxДокумент15 страницPB TaxNabuteОценок пока нет

- Chapter 16 Problem SolutionsДокумент6 страницChapter 16 Problem SolutionsAnila AОценок пока нет

- Coinify Inwallet Buy - SellДокумент2 страницыCoinify Inwallet Buy - SellmehocayОценок пока нет

- Allama Iqbal Open University: Assignment # 2Документ13 страницAllama Iqbal Open University: Assignment # 2Irfan AslamОценок пока нет

- TDS, TCS & Advance Payment of TaxДокумент54 страницыTDS, TCS & Advance Payment of TaxFalak GoyalОценок пока нет

- JdndneДокумент2 страницыJdndneArpit AggarwalОценок пока нет

- Percentage Tax Return: BIR Form NoДокумент2 страницыPercentage Tax Return: BIR Form NoLele CaparasОценок пока нет

- Receipt: Transfer OverviewДокумент3 страницыReceipt: Transfer Overviewdargo75% (4)

- A-Level Programme: Universal College LahoreДокумент4 страницыA-Level Programme: Universal College LahoreZeeshanОценок пока нет

- GAD X-9 Fillable 7-17 PDFДокумент1 страницаGAD X-9 Fillable 7-17 PDFPatricio LarrouletОценок пока нет

- NusukДокумент2 страницыNusukJib RanОценок пока нет

- Encasa BrochureДокумент12 страницEncasa Brochuremanoj_dalalОценок пока нет

- Ap202105 - 076 PT Daenjo Tasima Indo 19016-085Документ11 страницAp202105 - 076 PT Daenjo Tasima Indo 19016-085Ari TriwibisonoОценок пока нет

- Topic 14 - Income and Business TaxationДокумент71 страницаTopic 14 - Income and Business TaxationFrancez Anne Guanzon100% (1)

- RTGS FormДокумент2 страницыRTGS FormravilotusОценок пока нет

- Taxation: DFA 2104YДокумент16 страницTaxation: DFA 2104YFhawez KodoruthОценок пока нет

- Kepco Philippines Corporation v. CIRДокумент17 страницKepco Philippines Corporation v. CIRAronJamesОценок пока нет