Академический Документы

Профессиональный Документы

Культура Документы

Program Instructions

Загружено:

api-306226330Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Program Instructions

Загружено:

api-306226330Авторское право:

Доступные форматы

Program Instructions

Microsoft Excel

Please follow the instructions for each of the exercise to complete this section.

1. Visa Card Analysis

i.

Refer to the bank statement Prime IT Inc. Visa Card Statements June 25/10 May

25/11, create a visa card analysis for each of the month using Excel.

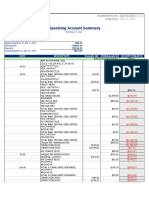

2. Bank Reconciliation

i.

Refer to the bank statement Prime IT Inc. Bank Reconciliation June 2011, perform a

bank reconciliation for June using Excel.

ii.

Refer to the bank statement Prime IT Inc. Bank Reconciliation July 2011, perform a

bank reconciliation for July using Excel.

3. Preparing Financial Statements

i.

Refer to Prime IT Inc. Sales Day Book January 2012, perform a sales analysis for the

month.

ii.

Refer to Prime IT Inc. Purchase Day Book January 2012, perform a purchase analysis

for the month.

iii.

Refer to Prime IT Inc. Bank and Cash Book January 2012, perform a bank and cash

analysis for the month.

iv.

Using the data generated, create an income statement for the month of January 2012.

v.

Refer to Prime IT Inc. December 2011, create a set of T-accounts with the data

generated in the month of January 2012.

vi.

Based on the T-accounts, create a new balance sheet for the month ended, January 31,

2012.

QuickBooks Premier

Please follow the QuickBooks Instructions to complete this section.

1. Case One (I.T. Consulting) Olympus I.T. Consulting Inc.

i.

Set up the company with their basic information: type of company, address, etc.

ii.

Using the provided balance sheet, and balances of accounts receivable, and accounts

payable, set up the chart of accounts, customer and vendor balances.

iii.

Enter the purchase invoices and sales invoices.

iv.

Using the receipts, receive customer payments and record deposits.

v.

Using the cheques made by the company, make payments to vendors.

vi.

Using the bank statement, perform bank reconciliation on Quickbooks.

vii.

Using the visa card statement, create a visa card analysis on Excel.

2. Case Two (Manufacturing) Regal Incorporated

i.

Set up the company with their basic information.

ii.

Set up the chart of accounts, customer and vendor balances.

iii.

Using the provided inventory list, set up the inventory of the company.

iv.

Enter the purchase invoices and sales invoices.

v.

Receive customer payments and record deposits.

vi.

Make payments to vendors.

vii.

Using the payroll information, set up the employees and their salaries.

viii.

Perform bank reconciliation.

ix.

Create and post adjusting entries.

3. Case Three (Retail) Maria Beauty Supplies Inc.

i.

Set up the company with their basic information.

ii.

Set up the chart of accounts, customer and vendor balances.

iii.

Set up the companys inventory.

iv.

Enter purchase invoices.

v.

Enter sales invoices.

vi.

Receive customer payments and record deposits.

vii.

Make payments to vendors.

viii.

Perform payroll.

ix.

Perform bank reconciliation.

x.

Create visa card analysis.

xi.

Enter credit notes.

xii.

Create and post adjusting entries.

Sage 50 Pro

Please follow the Sage Instructions and repeat the three cases from QuickBooks to complete this

section.

CaseWare

Please follow the CaseWare Instructions to complete this section.

1. Case One Regal Incorporated

i.

Using the provided trial balance, create a trial balance on CaseWare.

2. Case Two Managed Rite Construction

i.

Using the provided trial balance, create a trial balance on CaseWare.

ii.

Create and post adjusting entries.

Intuit ProFile Personal Tax (T1)

Please follow the ProFile T1 Instructions and create a personal tax return for each of the cases:

1.

2.

3.

4.

5.

6.

Basic Return

Business Income

HBP and LLP Withdrawal

HST Return

Pension Income

Foreign Income

Intuit ProFile Corporate Tax (T2)

Please follow the ProFile T2 Instructions and create a corporate tax return for each of the cases:

1. Brampton Car Inc.

2. Pallet Solutions

3. Reenpat Ltd.

Advaced Excel Functions

In this section, a Microsoft Excel work file will be provided. Please follow the Advanced Excel

Instruction to complete this section.

Budgeting

Please complete the following budgeting exercise. For several exercises, you may use the provided

Microsoft Excel Template to assist you.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

Budgeting Exercise 2 - Estimating Income and Expenditure

Budgeting Exercise 3 - Working Out the Break-Even Point (template provided)

Budgeting Exercise 4 - Gross Profit Scenarios

Budgeting Exercise 5 - Estimating Charging Fees (template provided)

Budgeting Exercise 6 - Event Budget (template provided)

Budgeting Exercise 7 - Create a Simple Program Budget

Budgeting Exercise 8 - Employment Budgets (template provided)

Budgeting Exercise 9 - Cash flow Budgeting (template provided)

Budgeting Exercise 10 - Evaluating Capital Expenditure Proposals (template provided)

Budgeting Exercise 11 - Profit by Cost Centre (template provided)

Budgeting Exercise 13 - Create a Simple Financial Model (template provided)

Budgeting Exercise 15 - Monitoring Budget Performance (template provided)

Вам также может понравиться

- Acct 200 MidtermДокумент9 страницAcct 200 MidtermLương Thế CườngОценок пока нет

- Lab FinalsДокумент9 страницLab FinalsErika Jeanne CatulayОценок пока нет

- Magada, Ma. Louella OДокумент17 страницMagada, Ma. Louella OMaria Louella MagadaОценок пока нет

- MYOB Data Import ProcedureДокумент3 страницыMYOB Data Import ProcedureAnonymous 7mJIoO1bh4Оценок пока нет

- Assignment # 2 MBA Financial and Managerial AccountingДокумент7 страницAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenОценок пока нет

- Practice SessionsДокумент10 страницPractice Sessionsapps_yousufОценок пока нет

- Competencies: Company Accounting WorkbookДокумент6 страницCompetencies: Company Accounting WorkbookMeshack MateОценок пока нет

- Rift Valley University Geda Campus Post Graduate Program Masters of Business Administration (MBA) Accounting For Managers Individual AssignmentДокумент7 страницRift Valley University Geda Campus Post Graduate Program Masters of Business Administration (MBA) Accounting For Managers Individual Assignmentgenemu fejoОценок пока нет

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsДокумент7 страниц# 2 Assignment On Financial and Managerial Accounting For MBA Studentsobsa alemayehuОценок пока нет

- Assessment Two - Group CaseДокумент8 страницAssessment Two - Group CaseDalyaОценок пока нет

- BSBFIA412 - S1 (Tugas 1)Документ7 страницBSBFIA412 - S1 (Tugas 1)jessyflorenciaОценок пока нет

- Management Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orДокумент6 страницManagement Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDeselagn TefariОценок пока нет

- Microsoft Word - SLA Lab 05Документ4 страницыMicrosoft Word - SLA Lab 05Ur's RangaОценок пока нет

- Bank ConfigurationДокумент74 страницыBank Configurationdeep dcruzeОценок пока нет

- Chapter-Two: Financial Planning and ProjectionДокумент6 страницChapter-Two: Financial Planning and Projectionমেহেদী হাসানОценок пока нет

- Revisions-October 13-2023-1Документ2 страницыRevisions-October 13-2023-1Usman RaiОценок пока нет

- Kelly Pitney Began Her Consulting Busines 2Документ5 страницKelly Pitney Began Her Consulting Busines 2Ghadd MОценок пока нет

- Trial Balance: JAIIB / AFB / MODULE - C / UNIT 2 - Preparation of Final AccountsДокумент7 страницTrial Balance: JAIIB / AFB / MODULE - C / UNIT 2 - Preparation of Final Accountscpk200Оценок пока нет

- Exam 1z0-1054: IT Certification Guaranteed, The Easy Way!Документ21 страницаExam 1z0-1054: IT Certification Guaranteed, The Easy Way!Ahmed A. DawoodОценок пока нет

- FABM 1 - Contextualized LAS - Quarter 2 - Week 1bДокумент12 страницFABM 1 - Contextualized LAS - Quarter 2 - Week 1bSheila Marie Ann Magcalas-GaluraОценок пока нет

- Lab 4Документ3 страницыLab 4Bame TshiamoОценок пока нет

- FABM2 Module 04 (Q1-W5)Документ5 страницFABM2 Module 04 (Q1-W5)Christian Zebua100% (1)

- It Journal 2021-22Документ30 страницIt Journal 2021-22AadityaОценок пока нет

- Comprehensive Exam AДокумент12 страницComprehensive Exam Ajdiaz_646247100% (2)

- ACC 305 Complete Course FilesДокумент16 страницACC 305 Complete Course FileshomeworkbagsОценок пока нет

- Prepare Budgets: Performance ObjectiveДокумент25 страницPrepare Budgets: Performance ObjectiveTanushree JawariyaОценок пока нет

- Module 2 - The Accounting Equation and The Double-Entry SystemДокумент41 страницаModule 2 - The Accounting Equation and The Double-Entry SystemJenny Paculaba100% (1)

- AFN 132 Homework 1Документ3 страницыAFN 132 Homework 1devhan12Оценок пока нет

- Accounting Papers of Ibp Part TwoДокумент64 страницыAccounting Papers of Ibp Part TwoTehreem Ali50% (2)

- 3-The Accounting Information SystemДокумент98 страниц3-The Accounting Information Systemtibip12345100% (1)

- 10 March AssignmnetДокумент4 страницы10 March Assignmnetkevin kipkemoiОценок пока нет

- SAP FI-Conf Bank Reconciliation BRSДокумент11 страницSAP FI-Conf Bank Reconciliation BRSSUKANT CHAKRABORTHYОценок пока нет

- Final Exam All Problem Solving Revision 2 1Документ28 страницFinal Exam All Problem Solving Revision 2 131231023949Оценок пока нет

- Financial Accounting Workbook Version 2Документ90 страницFinancial Accounting Workbook Version 2Honey Crisostomo EborlasОценок пока нет

- Ch3 Application 1-10Документ4 страницыCh3 Application 1-10MUSTAFAОценок пока нет

- Chapter 4 NotesДокумент8 страницChapter 4 NotesLex XuОценок пока нет

- Task-2 Financial Modeling and AnalysisДокумент3 страницыTask-2 Financial Modeling and AnalysisPampana Bala Sai Saroj RamОценок пока нет

- GuideДокумент8 страницGuideYenifer MG'Оценок пока нет

- BPACTG Fundamentals of AccountingДокумент27 страницBPACTG Fundamentals of Accountingqueenoroyo8Оценок пока нет

- CH 04Документ10 страницCH 04api-274120622Оценок пока нет

- Computer Accounting Essentials With Quickbooks 2014 7th Edition Yacht Solutions ManualДокумент11 страницComputer Accounting Essentials With Quickbooks 2014 7th Edition Yacht Solutions Manualboredomake0ahb100% (25)

- Accountancy and Auditing Papers 2017 - CSS Forums PDFДокумент7 страницAccountancy and Auditing Papers 2017 - CSS Forums PDFFawad ShahОценок пока нет

- Buffalo Accounting Go-Live ChecklistДокумент16 страницBuffalo Accounting Go-Live ChecklistThach DoanОценок пока нет

- Accounting Exam GuideДокумент3 страницыAccounting Exam GuideJUNE CARLO CATULONGОценок пока нет

- Accounting Equation, Transaction Analysis and Preparation of Financial StatementДокумент10 страницAccounting Equation, Transaction Analysis and Preparation of Financial Statementশুভ MitraОценок пока нет

- PT 1 Transaction AnalysisДокумент3 страницыPT 1 Transaction AnalysisJanela Venice SantosОценок пока нет

- SAP FICO BanK ConfigurationДокумент46 страницSAP FICO BanK ConfigurationSriram RangarajanОценок пока нет

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОт EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОценок пока нет

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesОт EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesОценок пока нет

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyОт EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyОценок пока нет

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)От EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Рейтинг: 3 из 5 звезд3/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОт Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОценок пока нет

- QuickBooks Online for Beginners: The Step by Step Guide to Bookkeeping and Financial Accounting for Small Businesses and FreelancersОт EverandQuickBooks Online for Beginners: The Step by Step Guide to Bookkeeping and Financial Accounting for Small Businesses and FreelancersОценок пока нет

- Small Business Accounting Guide to QuickBooks Online: A QuickBooks Online Cheat Sheet for Small Businesses, Churches, and NonprofitsОт EverandSmall Business Accounting Guide to QuickBooks Online: A QuickBooks Online Cheat Sheet for Small Businesses, Churches, and NonprofitsОценок пока нет

- Quickbooks Instructions 2017Документ5 страницQuickbooks Instructions 2017api-306226330Оценок пока нет

- Maria 2018Документ88 страницMaria 2018api-306226330Оценок пока нет

- Financial Statement Excel InstructionsДокумент2 страницыFinancial Statement Excel Instructionsapi-306226330Оценок пока нет

- Profile t1 InstructionsДокумент4 страницыProfile t1 Instructionsapi-306226330Оценок пока нет

- Prime It Bank Statement - June 2019Документ4 страницыPrime It Bank Statement - June 2019api-306226330Оценок пока нет

- Prime It Bank Statement - July 2019Документ4 страницыPrime It Bank Statement - July 2019api-306226330Оценок пока нет

- Corporate Tax Instructions - FinalДокумент15 страницCorporate Tax Instructions - Finalapi-306226330Оценок пока нет

- Corporate Tax Instructions - FinalДокумент15 страницCorporate Tax Instructions - Finalapi-306226330Оценок пока нет

- Caseware InstructionsДокумент1 страницаCaseware Instructionsapi-306226330Оценок пока нет

- Case 3 - Andy 2015Документ14 страницCase 3 - Andy 2015api-306226330Оценок пока нет

- Any Company Inc - Final 2016Документ4 страницыAny Company Inc - Final 2016api-306226330Оценок пока нет

- Visa Card Analysis Excel InstructionsДокумент1 страницаVisa Card Analysis Excel Instructionsapi-306226330Оценок пока нет

- Case 2 - Edwin 2015Документ15 страницCase 2 - Edwin 2015api-306226330Оценок пока нет

- 2015 t1 - Vince SimmonsДокумент9 страниц2015 t1 - Vince Simmonsapi-306226330100% (1)

- Costing NotebookДокумент123 страницыCosting NotebookremarkuОценок пока нет

- Contents:: Introduction To Invoice VerificationДокумент13 страницContents:: Introduction To Invoice VerificationpravanthbabuОценок пока нет

- Airline Industry: Customer Relationship ManagementДокумент28 страницAirline Industry: Customer Relationship ManagementapurvanarangОценок пока нет

- Group10 OperationsДокумент12 страницGroup10 OperationsKumar SaurabhОценок пока нет

- 4305 IGCSE Accounting MSC 200907171Документ18 страниц4305 IGCSE Accounting MSC 200907171Simra RiyazОценок пока нет

- National Foods EditДокумент23 страницыNational Foods EditMisbah Nawab33% (3)

- Case Study 6 - Social Media and Customer Engagement atДокумент15 страницCase Study 6 - Social Media and Customer Engagement atYsaiah John GallegoОценок пока нет

- The LEGO Group - Group12Документ5 страницThe LEGO Group - Group12Vimal JephОценок пока нет

- Breakeven in Units Contribuiton Margin RatioДокумент11 страницBreakeven in Units Contribuiton Margin RatioCookies And CreamОценок пока нет

- Chap11 11e MicroДокумент45 страницChap11 11e Microromeo626laОценок пока нет

- Rippling Metrics RedactedДокумент17 страницRippling Metrics RedactedScott GalvinОценок пока нет

- Global Credit Policy 2021 and Further Modifications KEDAR - 21.04.2022Документ9 страницGlobal Credit Policy 2021 and Further Modifications KEDAR - 21.04.2022Rajkot academyОценок пока нет

- Quiz Test Marketing Management Ii (KMB-208) : MBA (SEM 2) (All Groups)Документ1 страницаQuiz Test Marketing Management Ii (KMB-208) : MBA (SEM 2) (All Groups)Vivek Singh Rana0% (1)

- MCQДокумент6 страницMCQTariq Hussain Khan100% (1)

- Study Plan For CFAP 1Документ3 страницыStudy Plan For CFAP 1cauzairismailОценок пока нет

- Government Securities MarketДокумент11 страницGovernment Securities MarketVikasDalal100% (2)

- Senior Buyer Purchasing in Boston MA Resume Anthony BarrassoДокумент2 страницыSenior Buyer Purchasing in Boston MA Resume Anthony BarrassoAnthonyBarrassoОценок пока нет

- 06 AnsДокумент4 страницы06 AnsAnonymous 8ooQmMoNs1Оценок пока нет

- Sip Dissertation - Final - Final For CollegeДокумент17 страницSip Dissertation - Final - Final For Collegevikashirulkar922Оценок пока нет

- IBC Notes by Y&A Legal PDFДокумент87 страницIBC Notes by Y&A Legal PDFbhioОценок пока нет

- Financial Management in A Global ContextДокумент18 страницFinancial Management in A Global ContextauroraincyberspaceОценок пока нет

- AssignmentДокумент5 страницAssignmentpeter chadaОценок пока нет

- BMO Capital Markets - Treasury Locks, Caps and CollarsДокумент3 страницыBMO Capital Markets - Treasury Locks, Caps and CollarsjgravisОценок пока нет

- Periodic and PerpetualДокумент2 страницыPeriodic and PerpetualLayОценок пока нет

- Strategic Social Media MarketingДокумент21 страницаStrategic Social Media MarketingTahir SaeedОценок пока нет

- The Oxford Handbook of Pricing ManagementДокумент1 194 страницыThe Oxford Handbook of Pricing ManagementAdeola Adeoye100% (4)

- Business Strategy of The E-Type Company PDFДокумент2 страницыBusiness Strategy of The E-Type Company PDFHadeer KamelОценок пока нет

- AFAR-04: PFRS 15 - Revenue From Contracts With Customers & Other TopicsДокумент14 страницAFAR-04: PFRS 15 - Revenue From Contracts With Customers & Other TopicsJenver BuenaventuraОценок пока нет

- G1NTI - ITC1 - BS04 - SI POC - JBO - CT - v0.1Документ26 страницG1NTI - ITC1 - BS04 - SI POC - JBO - CT - v0.1Burzes BatliwallaОценок пока нет

- 2020 Inspection Grant Thornton LLP: (Headquartered in Chicago, Illinois)Документ24 страницы2020 Inspection Grant Thornton LLP: (Headquartered in Chicago, Illinois)Jason BramwellОценок пока нет