Академический Документы

Профессиональный Документы

Культура Документы

Assignment 3, Question 10: This Time Period Is Irrelevant!

Загружено:

greattrekОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Assignment 3, Question 10: This Time Period Is Irrelevant!

Загружено:

greattrekАвторское право:

Доступные форматы

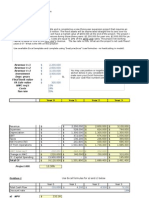

Assignment 3, Question 10

(15 points) Sairah purchased an investment property for $350,000, 3 years ago. The after-tax

cashfow of the property has been $35,000 per year to date, but market conditions have

improved and Sairah expects the cashflow to improve to $42,000 per year for the next 25 years

(assume these are year end cashflows). The annual cost of capital (or cap rate) for this area is

9%. What is the value of the property today?(Enter just the number without the $ sign or a

comma; round off decimals.)

This problem is quite straightforward to solve as long as you dont get caught up in some of the

extra information. As with all problems in finance, the past doesnt matter! Therefore, the value

of the property TODAY has nothing to do with what Sairah paid for it 3 years ago, nor the cash

flow she has been getting from it these past 3 years. What matters are her expectations of the

future cash flows it will bring in, valued in todays dollars. Therefore, the relevant numbers to

use from the problem are the $42,000 in annual cash flow going forwards, a 25 year time

horizon (since the 3 years up to today are in the past), and a 9% cap rate. Plug these into the PV

formula and you should come up with the right answer!

This time

period is

irrelevant!

Expected Annual Cash Flow=$42,000

T= -3

T=0

House

purchase

for $350K

TODAY!

T=25

Capitalization Rate=9%

End of

investment

Вам также может понравиться

- Assignment 3Документ3 страницыAssignment 3decofuОценок пока нет

- FinanceДокумент10 страницFinanceHaley Hamill100% (1)

- Chapter04 Xlssol-1Документ42 страницыChapter04 Xlssol-1Aaron NatarajaОценок пока нет

- Assignments of Corporate FinanceДокумент21 страницаAssignments of Corporate FinanceAli0% (2)

- Final RevisionДокумент9 страницFinal RevisionVo Phuc An (K17 HCM)Оценок пока нет

- Lab. MKI - Pertemuan 3 - Time Value of MoneyДокумент2 страницыLab. MKI - Pertemuan 3 - Time Value of Moneynova yulianiОценок пока нет

- Fundamentals of Financial PlanningДокумент6 страницFundamentals of Financial PlanningJulius NgaregaОценок пока нет

- Excel ProjectДокумент2 страницыExcel Projectapi-253067568Оценок пока нет

- Subjective Question of ACC501Документ9 страницSubjective Question of ACC501Devyansh GuptaОценок пока нет

- Final Exam Solutions 2012 1 SpringДокумент123 страницыFinal Exam Solutions 2012 1 SpringBenny KhorОценок пока нет

- 1030proj1-Buying A HouseДокумент5 страниц1030proj1-Buying A Houseapi-325431488Оценок пока нет

- Assignment 2Документ9 страницAssignment 2Sam VuppalОценок пока нет

- Karinagonzalez Fin3320Документ4 страницыKarinagonzalez Fin3320api-282831661Оценок пока нет

- Assignment 1Документ4 страницыAssignment 1Abhay PoddarОценок пока нет

- FINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Документ7 страницFINC 655 Summer 2012 Exam #1 - You Must Show All of Your Work To Receive Any Credit Problems (5pts Each)Sheikh HasanОценок пока нет

- Solve The Following Crossword Round Your Final Answers To TheДокумент3 страницыSolve The Following Crossword Round Your Final Answers To TheAmit PandeyОценок пока нет

- FeedbackДокумент8 страницFeedbackSarbartho MukherjeeОценок пока нет

- Finance Excel AssignmentДокумент2 страницыFinance Excel AssignmentKyleLippeОценок пока нет

- Assignment # 2: Course Title: Introduction To Mathematics Question No 01Документ2 страницыAssignment # 2: Course Title: Introduction To Mathematics Question No 01Quratulain Shafique QureshiОценок пока нет

- Buyingahouse 1Документ4 страницыBuyingahouse 1api-251852099100% (1)

- Chapter 2: The Present ValueДокумент4 страницыChapter 2: The Present ValueVân ĂnggОценок пока нет

- Quiz 1Документ3 страницыQuiz 1carlos9abrОценок пока нет

- TVM Additional QДокумент1 страницаTVM Additional Qwahida_halim0% (1)

- As 1Документ4 страницыAs 1Lê AnhОценок пока нет

- Chapter 2 - How To Calculate Present Value - Extra ExercisesДокумент2 страницыChapter 2 - How To Calculate Present Value - Extra ExercisesNhư Quỳnh Nguyễn NgọcОценок пока нет

- Chapter 2 - How To Calculate Present Value - Extra ExercisesДокумент2 страницыChapter 2 - How To Calculate Present Value - Extra ExercisesTrọng PhạmОценок пока нет

- Bs204 Frequently Asked QuestionsДокумент13 страницBs204 Frequently Asked QuestionsTakudzwa GwemeОценок пока нет

- Assignment Solution Weekend Nov18Документ6 страницAssignment Solution Weekend Nov18Lp SaiОценок пока нет

- PlanningДокумент3 страницыPlanningAhmed HusainОценок пока нет

- Practice Quiz 5Документ8 страницPractice Quiz 5Samantha SiauОценок пока нет

- Answers Exercises Chapter 4 and 5Документ10 страницAnswers Exercises Chapter 4 and 5Filipe FrancoОценок пока нет

- Chapter5 HW QuestionsДокумент4 страницыChapter5 HW QuestionsAshish Bhalla0% (1)

- ProblemSet 1Документ2 страницыProblemSet 1Kasra Ladjevardi0% (1)

- Practice QuestionsДокумент2 страницыPractice QuestionsDaud BilalОценок пока нет

- TVM ChallengingДокумент5 страницTVM Challengingnabeelarao100% (1)

- Practice Test MidtermДокумент6 страницPractice Test Midtermrjhuff41Оценок пока нет

- Example: PMT (Rate, Nper, PV, FV, Type)Документ2 страницыExample: PMT (Rate, Nper, PV, FV, Type)chkhurramОценок пока нет

- Tutorial 40 Sem 2 20212022Документ6 страницTutorial 40 Sem 2 20212022Nishanthini 2998Оценок пока нет

- Investigating The Value of An MBA Education Using NPV Decision ModelДокумент72 страницыInvestigating The Value of An MBA Education Using NPV Decision ModelnabilquadriОценок пока нет

- Introduction To Finance University of Michigan Assignment Answers Week 2Документ6 страницIntroduction To Finance University of Michigan Assignment Answers Week 2Akshay100% (1)

- Wiley PLUS Assignment Week 5 Assignment Your Finance Text Book Sold 48,000 CopiesДокумент2 страницыWiley PLUS Assignment Week 5 Assignment Your Finance Text Book Sold 48,000 CopiesKathy ChuggОценок пока нет

- Final ExamДокумент6 страницFinal ExamOnat PОценок пока нет

- Ôn Tập Cuối Kỳ - Trắc NghiệmДокумент35 страницÔn Tập Cuối Kỳ - Trắc Nghiệmthaoluhan456Оценок пока нет

- Simple Interest and Compound InterestДокумент28 страницSimple Interest and Compound InterestVignesh AvirineniОценок пока нет

- Ps Na Bago Sa ECONДокумент10 страницPs Na Bago Sa ECONJonelou CusipagОценок пока нет

- Exercises - Corporate Finance 1Документ12 страницExercises - Corporate Finance 1Hông HoaОценок пока нет

- Fin 501Документ21 страницаFin 501AyeshaAkterОценок пока нет

- Homework PDFДокумент3 страницыHomework PDFSyed AliОценок пока нет

- Introduction To Corporate FinanceДокумент4 страницыIntroduction To Corporate FinanceDarshitОценок пока нет

- Assignment No 1 SFA&DДокумент6 страницAssignment No 1 SFA&DSyed Shabbir RizviОценок пока нет

- Aynur Efendiyeva - Maliye 1Документ7 страницAynur Efendiyeva - Maliye 1Sheen Carlo AgustinОценок пока нет

- Practice Questions On TVMДокумент5 страницPractice Questions On TVMANUP MUNDEОценок пока нет

- Buying A HouseДокумент4 страницыBuying A Houseapi-325824593Оценок пока нет

- Solution Sketches Test 2, Fall 2011Документ27 страницSolution Sketches Test 2, Fall 2011Den Mark GuizzaganОценок пока нет

- Lab 3 IndividualДокумент3 страницыLab 3 Individualeeman kОценок пока нет

- Ch. 2 Problems JoinedДокумент10 страницCh. 2 Problems JoinedNazmulAhsan50% (2)

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?От EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?Оценок пока нет

- Foundations of Finance Problem Set 9Документ2 страницыFoundations of Finance Problem Set 9Richard ZhangОценок пока нет

- A Private Developer's Roadmap for Affordable Housing: Profitable Rental Apartment Solutions in CanadaОт EverandA Private Developer's Roadmap for Affordable Housing: Profitable Rental Apartment Solutions in CanadaОценок пока нет

- The Young Entrepreneurs Financial Literacy Handbook Personal FinanceОт EverandThe Young Entrepreneurs Financial Literacy Handbook Personal FinanceОценок пока нет

- QuestionnaireДокумент2 страницыQuestionnairegreattrekОценок пока нет

- Ogundana's ModelДокумент3 страницыOgundana's ModelgreattrekОценок пока нет

- Nigerian Ports Authority: Operational StatisticsДокумент3 страницыNigerian Ports Authority: Operational StatisticsgreattrekОценок пока нет

- Advantages and Disadvantages of Different Modes of TransportДокумент7 страницAdvantages and Disadvantages of Different Modes of TransportgreattrekОценок пока нет

- Quoting and ParaphrasingДокумент2 страницыQuoting and ParaphrasinggreattrekОценок пока нет

- NASA Finds Message From God On MarsДокумент1 страницаNASA Finds Message From God On MarsgreattrekОценок пока нет

- Criticalmanagement-Week One Study QuestionsДокумент1 страницаCriticalmanagement-Week One Study QuestionsgreattrekОценок пока нет

- Lagos - Ibadan Expressway: FG Had To Intervene - JonathanДокумент2 страницыLagos - Ibadan Expressway: FG Had To Intervene - JonathangreattrekОценок пока нет

- What The Dime Is in A Name - Mwadimeh Wa'keshoДокумент3 страницыWhat The Dime Is in A Name - Mwadimeh Wa'keshogreattrek100% (1)

- One Planet Worth Keeping Zeer ParryДокумент2 страницыOne Planet Worth Keeping Zeer ParrygreattrekОценок пока нет