Академический Документы

Профессиональный Документы

Культура Документы

Output Tax V Input Tax

Загружено:

attyalan0 оценок0% нашли этот документ полезным (0 голосов)

200 просмотров1 страницаDistinctions between Output and Input Taxes

Оригинальное название

Output Tax v Input Tax

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документDistinctions between Output and Input Taxes

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

200 просмотров1 страницаOutput Tax V Input Tax

Загружено:

attyalanDistinctions between Output and Input Taxes

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

Output

Tax

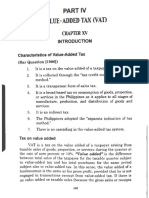

The VAT due on the sale or lease

of taxable goods/properties/

services by any person registered

or required to register under the

VAT system

What the taxpayer-seller passes

on to the purchaser

Input

Tax

The VAT due from or paid by a

VAT-registered person on

importation of goods or local

purchases of goods, properties,

or services, including lease or use

of properties, in the course of his

trade or business

It also includes: the transitional

input tax; the presumptive input

tax; input taxes which can be

directly attributed to transactions

subject to VAT plus a ratable

portion of any input tax which

cannot be directly attributed to

either the taxable or exempt

activity.

Вам также может понравиться

- Value-Added Tax PDFДокумент118 страницValue-Added Tax PDFRazel MhinОценок пока нет

- Value Added TaxДокумент9 страницValue Added TaxĴõ ĔĺОценок пока нет

- Case: Cir V PLDTДокумент29 страницCase: Cir V PLDTJaymee Andomang Os-agОценок пока нет

- Value Added TaxationДокумент76 страницValue Added Taxationxz wyОценок пока нет

- Input Taxes SummaryДокумент8 страницInput Taxes SummaryMichael AquinoОценок пока нет

- Lecture On VAT Output Vat PDFДокумент7 страницLecture On VAT Output Vat PDFCarl's Aeto DomingoОценок пока нет

- Module 3 - Value Added TaxДокумент113 страницModule 3 - Value Added TaxAllan C. MarquezОценок пока нет

- Unit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Документ23 страницыUnit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Bizu AtnafuОценок пока нет

- National Taxation System - RamosДокумент10 страницNational Taxation System - RamosAldrich RamosОценок пока нет

- National Taxation System - RamosДокумент10 страницNational Taxation System - RamosAldrich RamosОценок пока нет

- TAX ReviewerДокумент3 страницыTAX ReviewerCely jisonОценок пока нет

- Vat System and OptДокумент15 страницVat System and Optlyra21Оценок пока нет

- Vat PPT Icsb PDFДокумент66 страницVat PPT Icsb PDFsaiful2522Оценок пока нет

- Taxation Report2Документ22 страницыTaxation Report2Ritchelyn ArbonОценок пока нет

- Taxn03b Vat IntroДокумент20 страницTaxn03b Vat IntroTrishamae legaspiОценок пока нет

- Comprehensive VAT TAXATION (3!31!14)Документ166 страницComprehensive VAT TAXATION (3!31!14)dereckriveraОценок пока нет

- VatДокумент15 страницVatEller-JedManalacMendozaОценок пока нет

- VAT Input TaxesДокумент7 страницVAT Input TaxesJocelyn Verbo-AyubanОценок пока нет

- C9 Input VATДокумент18 страницC9 Input VATdraga pinasОценок пока нет

- Bustax Chapter 9Документ10 страницBustax Chapter 9Pineda, Paula MarieОценок пока нет

- 05 Input TaxesДокумент4 страницы05 Input TaxesJaneLayugCabacunganОценок пока нет

- Accounting For Indirect TaxesДокумент40 страницAccounting For Indirect TaxesSabaa if100% (1)

- Value Added TaxДокумент29 страницValue Added TaxRai MarasiganОценок пока нет

- A. VatДокумент5 страницA. VatKaye L. Dela CruzОценок пока нет

- Tax 303 - Input VatДокумент7 страницTax 303 - Input VatiBEAYОценок пока нет

- Lecture VAT With ExercisesДокумент82 страницыLecture VAT With ExercisesAko C JamzОценок пока нет

- Gimenez Jose Mari CДокумент14 страницGimenez Jose Mari CMari Calica GimenezОценок пока нет

- Vat TaxДокумент6 страницVat TaxJunivenReyUmadhayОценок пока нет

- Value Added Tax (Cap 476)Документ15 страницValue Added Tax (Cap 476)Triila manillaОценок пока нет

- Tax Ii - Value Added Tax: APRIL 27, 2018Документ82 страницыTax Ii - Value Added Tax: APRIL 27, 2018Ronald VillanuevaОценок пока нет

- 07 Chap 15 16 Mamalateo 2019 Tax BookДокумент19 страниц07 Chap 15 16 Mamalateo 2019 Tax BookJeremias CusayОценок пока нет

- Tax 2 Notes Finals 4Документ36 страницTax 2 Notes Finals 4Boom ManuelОценок пока нет

- CONTEX CORPORATION, Petitioner, Vs - HON. Commissioner of Internal Revenue, RespondentДокумент13 страницCONTEX CORPORATION, Petitioner, Vs - HON. Commissioner of Internal Revenue, RespondentJhudith De Julio BuhayОценок пока нет

- Tax 2 - BanggawanДокумент175 страницTax 2 - BanggawanJessica IslaОценок пока нет

- Chapter 1 Tax 2Документ5 страницChapter 1 Tax 2Hazel Jane EsclamadaОценок пока нет

- Value Added Tax: Output Tax Less Input Tax VAT PayableДокумент26 страницValue Added Tax: Output Tax Less Input Tax VAT PayableRon RamosОценок пока нет

- VAT ReportДокумент32 страницыVAT ReportNoel Christopher G. BellezaОценок пока нет

- VATДокумент11 страницVATSaurav KumarОценок пока нет

- The Internal Revenue TaxesДокумент3 страницыThe Internal Revenue Taxesedadkoay14Оценок пока нет

- Vat PDFДокумент81 страницаVat PDFAudrey DeguzmanОценок пока нет

- Tax InformationДокумент2 страницыTax InformationAlvin WatinОценок пока нет

- SALES TAX NotesДокумент3 страницыSALES TAX NotesMuhammad AhmadОценок пока нет

- Chapter 9 Input VatДокумент10 страницChapter 9 Input VatHazel Jane EsclamadaОценок пока нет

- Introduction To TheДокумент11 страницIntroduction To The9211420420Оценок пока нет

- CIR Vs Seagate, GR 153866Документ3 страницыCIR Vs Seagate, GR 153866Mar Develos100% (1)

- Notes in Value Added TaxДокумент52 страницыNotes in Value Added Taxedelyn roncalesОценок пока нет

- Combine PDFДокумент198 страницCombine PDFliamdrlnОценок пока нет

- Business Tax - VATДокумент165 страницBusiness Tax - VATAlgen Lyn MendozaОценок пока нет

- CIR v. Seagate Technology PhilsДокумент6 страницCIR v. Seagate Technology PhilsL.A. ManlangitОценок пока нет

- Value Added TaxДокумент15 страницValue Added TaxJoshua PeraltaОценок пока нет

- Business Tax: Value Added Tax Percentage Tax Excise Tax Documentary Stamp TaxДокумент7 страницBusiness Tax: Value Added Tax Percentage Tax Excise Tax Documentary Stamp TaxJessaОценок пока нет

- Vat Training ModuleДокумент59 страницVat Training Modulebandajobanda100% (3)

- Business Tax: Value Added Tax Percentage Tax Excise Tax Documentary Stamp TaxДокумент7 страницBusiness Tax: Value Added Tax Percentage Tax Excise Tax Documentary Stamp TaxJessaОценок пока нет

- Notes On VATДокумент15 страницNotes On VATErnest Benz Sabella DavilaОценок пока нет

- VatДокумент70 страницVatPETERWILLE CHUAОценок пока нет

- Mamalateo Part 1 VATДокумент12 страницMamalateo Part 1 VATPeterОценок пока нет

- Contex Corp. vs. CIRДокумент1 страницаContex Corp. vs. CIRiwamawiОценок пока нет

- I. Introduction To Consumption TaxesДокумент18 страницI. Introduction To Consumption TaxescarlaОценок пока нет

- Income Tax: Individual CorporateДокумент1 страницаIncome Tax: Individual CorporateolafedОценок пока нет

- Monday Tuesday Wednesday Thursday Friday Saturday 27 28 1 2 3 4Документ2 страницыMonday Tuesday Wednesday Thursday Friday Saturday 27 28 1 2 3 4attyalanОценок пока нет

- Elements of InsuranceДокумент1 страницаElements of InsuranceattyalanОценок пока нет

- Wage V SalaryДокумент1 страницаWage V SalaryattyalanОценок пока нет

- Double Insurance V ReinsuranceДокумент1 страницаDouble Insurance V ReinsuranceattyalanОценок пока нет

- Elements of InsuranceДокумент1 страницаElements of InsuranceattyalanОценок пока нет

- Surety V GuarantyДокумент1 страницаSurety V GuarantyattyalanОценок пока нет

- Requisites of Double InsuranceДокумент1 страницаRequisites of Double InsuranceattyalanОценок пока нет

- Zero-Rated, Effectively Zero-Rated, VAT ExemptДокумент1 страницаZero-Rated, Effectively Zero-Rated, VAT ExemptattyalanОценок пока нет

- Deed of Chattel Mortgage: WitnessethДокумент3 страницыDeed of Chattel Mortgage: WitnessethattyalanОценок пока нет

- Ferrer v. Mayor Herbert Bautista (2015) - Case DigestДокумент3 страницыFerrer v. Mayor Herbert Bautista (2015) - Case Digestattyalan88% (8)

- Corporators V IncorporatorsДокумент1 страницаCorporators V Incorporatorsattyalan100% (1)

- Kinds of CorporationДокумент1 страницаKinds of Corporationattyalan50% (2)

- 02 - Deed of Sale of Personal PropertyДокумент2 страницы02 - Deed of Sale of Personal Propertyattyalan100% (3)

- 02 - Deed of Sale of Personal Property - Motor VehicleДокумент2 страницы02 - Deed of Sale of Personal Property - Motor Vehicleattyalan100% (2)

- Mendoza V ComelecДокумент3 страницыMendoza V Comelecattyalan100% (1)

- VFP V ReyesДокумент3 страницыVFP V ReyesattyalanОценок пока нет

- Boy Scouts V COAДокумент3 страницыBoy Scouts V COAattyalanОценок пока нет

- 03 - Deed of Sale Immovable PropertyДокумент2 страницы03 - Deed of Sale Immovable PropertyattyalanОценок пока нет

- VFP V ReyesДокумент3 страницыVFP V ReyesattyalanОценок пока нет

- One-Page Summary of The Remaining TopicsДокумент2 страницыOne-Page Summary of The Remaining TopicsattyalanОценок пока нет

- VFP V ReyesДокумент3 страницыVFP V ReyesattyalanОценок пока нет

- Boy Scouts V COAДокумент3 страницыBoy Scouts V COAattyalanОценок пока нет

- MIAA V PasayДокумент3 страницыMIAA V PasayattyalanОценок пока нет

- Aratea V ComelecДокумент4 страницыAratea V Comelecattyalan80% (5)

- Quisumbing V GarciaДокумент3 страницыQuisumbing V Garciaattyalan100% (1)

- Cebu V IACДокумент3 страницыCebu V IACattyalanОценок пока нет

- Boy Scouts V COAДокумент3 страницыBoy Scouts V COAattyalanОценок пока нет

- D-01 - Machetti V Hospicio de San JoseДокумент2 страницыD-01 - Machetti V Hospicio de San JoseattyalanОценок пока нет

- C-10 - Serrano V Central BankДокумент1 страницаC-10 - Serrano V Central BankattyalanОценок пока нет