Академический Документы

Профессиональный Документы

Культура Документы

IDBI India Top 100 Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 Y

Загружено:

Sandeep Borse0 оценок0% нашли этот документ полезным (0 голосов)

25 просмотров1 страницаidbi factsheet

Оригинальное название

Idbi Top 100

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документidbi factsheet

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

25 просмотров1 страницаIDBI India Top 100 Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 Y

Загружено:

Sandeep Borseidbi factsheet

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

InvestPlus Advisers

We help you multiply your investments

217, Swastik Plaza, Pokhran Road No.2, Near Voltas Ltd.,Thane (West) 400610

Tel: FaxNo: Email:

IDBI India Top 100 Equity Fund - Growth

Benchmark

: NIFTY 100

Scheme Type : Open-ended

Fund Manager : V Balasubramanian

Scheme Obj : Equity: Large Cap

Launch Date : May 15, 2012

Objective

Load

The investment universe of the scheme will be restricted to

equity stocks and equity related instruments of companies

that are constituents of the S&P CNX Nifty Index (Nifty 50)

and the CNX Nifty Junior Indices comprising a total of 100

stocks.

Composition (%)

Scheme Profile

Equity

Debt

Other

:

:

92.31

Top Holdings as on 30/11/2015

: 280.00

Corpus (Cr.)

7.85

-0.16

Entry Load : N.A.

Exit Load : 1% for redemption within 365 days

Holding

Cash & Cash

Equivalents

Maruti Suzuki India Ltd

Domestic Equities

Government

08.13 GS 22 JUN 2045

Securities

HDFC Bank Ltd

Domestic Equities

Bosch Ltd.

Domestic Equities

Mahindra & Mahindra Ltd

Domestic Equities

United Spirits Ltd

Domestic Equities

Sundaram Finance Ltd

Domestic Equities

IndusInd Bank Limited

Domestic Equities

Siemens Ltd

Domestic Equities

Housing Development Finance Corporation

Domestic

Limited

Equities

Glaxosmithkline Pharmaceuticals Ltd.Domestic Equities

HERO MOTOCORP LIMITED

Domestic Equities

Kotak Mahindra Bank Ltd

Domestic Equities

Bajaj Auto Ltd

Domestic Equities

Cummins India Ltd.

Domestic Equities

UltraTech Cement Ltd

Domestic Equities

Reliance Industries Ltd.

Domestic Equities

Apollo Hospitals Enterprises Ltd.

Domestic Equities

Infosys Ltd

Domestic Equities

Dr Reddys Laboratories Ltd

Domestic Equities

Yes Bank Ltd

Domestic Equities

Bharat Forge Ltd.

Domestic Equities

TATA CHEMICALS Ltd.

Domestic Equities

Eicher Motors Ltd

Domestic Equities

52 Week High : 20.67 (06/08/2015)

52 Week Low : 17.93 (12/01/2016)

Portfolio Stat.

Volatility Measures

R-Squared :

Mean

16.06

Alpha

5.31

Std. Deviation :

13.99

Beta

0.96

Sharpe Ratio :

0.67

Scheme Performance [ % ]

1M

3M

6M

-1.37

-5.76

-9.82

1Y

2Y

3Y

-2.33 18.55

14.20

5Y

10 Y

Instrument

CBLO - 01DEC2015

Sectoral Allocation (%)

17.0%

Others

Finance Development FIs

INDUSTRIAL

PRODUCTS

4.1%

5.0%

Cement

5.2%

AUTO

ANCILLARIES

5.3%

5.6%

Software

6.8%

Pharmaceuticals

Consumer Non

Durables

10.0%

Banks

13.0%

Finance

13.1%

14.9%

AUTO

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

Net Asset (%)

4.06

3.95

3.63

3.32

3.18

3.17

3.12

3.12

3.11

3.10

3.03

2.94

2.89

2.85

2.83

2.83

2.50

2.42

2.35

2.33

2.22

2.20

2.13

2.10

2.09

Вам также может понравиться

- Landmark Return Multiplier Fund: Capitalizing on Real Estate OpportunitiesДокумент37 страницLandmark Return Multiplier Fund: Capitalizing on Real Estate OpportunitiesSandeep BorseОценок пока нет

- Indiareit Apartment FundДокумент18 страницIndiareit Apartment FundSandeep BorseОценок пока нет

- Mutual Fund Top 5 Equity and DebtДокумент53 страницыMutual Fund Top 5 Equity and DebtAnirudh ShrivastavОценок пока нет

- BNP Paribas Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YДокумент1 страницаBNP Paribas Equity Fund - Growth: 1 M 3 M 6 M 1 Y 2 Y 3 Y 5 Y 10 YSandeep BorseОценок пока нет

- Uti Opportunities Fund: Speciality / Theme Based Equity FundДокумент2 страницыUti Opportunities Fund: Speciality / Theme Based Equity FundanandОценок пока нет

- SBI Mutual Funds PresentationДокумент21 страницаSBI Mutual Funds Presentationtoff1410Оценок пока нет

- Banking: Spike in Wholesale RatesДокумент6 страницBanking: Spike in Wholesale RatesnnsriniОценок пока нет

- Portfolio Review and RecommendationsДокумент11 страницPortfolio Review and RecommendationsPratik ShahОценок пока нет

- Ozone Propex BS 31.03.10Документ24 страницыOzone Propex BS 31.03.10Mohamed AnsariОценок пока нет

- Portfolio Details AMC Name: Scheme Name: Scheme Features Investment DetailsДокумент4 страницыPortfolio Details AMC Name: Scheme Name: Scheme Features Investment DetailsRobert AyalaОценок пока нет

- Factsheet August 2012 V10Документ13 страницFactsheet August 2012 V10Roshni BhatiaОценок пока нет

- PLTVF Factsheet October 2015Документ4 страницыPLTVF Factsheet October 2015gadiyaranandОценок пока нет

- Axis Factsheet February 2015Документ20 страницAxis Factsheet February 2015Sumit GuptaОценок пока нет

- Escorts Income Plan 10-10-2011Документ1 страницаEscorts Income Plan 10-10-2011cprabhashОценок пока нет

- SBI Securities Morning Update - 05-12-2022Документ6 страницSBI Securities Morning Update - 05-12-2022deepaksinghbishtОценок пока нет

- SBI Securities Morning Update - 29-11-2022Документ6 страницSBI Securities Morning Update - 29-11-2022deepaksinghbishtОценок пока нет

- DSP BlackrockДокумент82 страницыDSP BlackrockParulGuptaОценок пока нет

- Original Hard Copy of Mutual FundsДокумент26 страницOriginal Hard Copy of Mutual FundsjasmineebanОценок пока нет

- Risk Management Through Derivative in Indian Stock MarketДокумент29 страницRisk Management Through Derivative in Indian Stock MarketHimanshu RastogiОценок пока нет

- Portfolio Details AMC Name: Scheme Name: Investment DetailsДокумент8 страницPortfolio Details AMC Name: Scheme Name: Investment DetailsKrishna TiwariОценок пока нет

- Tata Mutual Fund-FINALДокумент8 страницTata Mutual Fund-FINALTamanna MulchandaniОценок пока нет

- Submitted By:-Shelza Gupta Roll No: - 500901509Документ29 страницSubmitted By:-Shelza Gupta Roll No: - 500901509digvijaygargОценок пока нет

- L&T Finance Holding Ltd. Ipo: Kumar Fanishwar Priyanka Nagpal Shruti SharmaДокумент22 страницыL&T Finance Holding Ltd. Ipo: Kumar Fanishwar Priyanka Nagpal Shruti Sharmashruds18Оценок пока нет

- 22mbr002-Sapm Mini ProjectДокумент23 страницы22mbr002-Sapm Mini ProjectABUBAKAR SIDIQ M 22MBR002Оценок пока нет

- HDFC SlicДокумент83 страницыHDFC Slicsidd4893Оценок пока нет

- Holi Comes Early For Fiis: Five Themes Light Up The Path For Tomorrow'S IndiaДокумент1 страницаHoli Comes Early For Fiis: Five Themes Light Up The Path For Tomorrow'S Indiasmdali05Оценок пока нет

- SBI Securities Morning Update - 12-01-2023Документ6 страницSBI Securities Morning Update - 12-01-2023deepaksinghbishtОценок пока нет

- HDFC Arbitrage Fund RatingДокумент6 страницHDFC Arbitrage Fund RatingagrawalshashiОценок пока нет

- 209652CIMB Islamic DALI Equity Growth FundДокумент2 страницы209652CIMB Islamic DALI Equity Growth FundazmimdaliОценок пока нет

- Technical Report 22nd March 2012Документ5 страницTechnical Report 22nd March 2012Angel BrokingОценок пока нет

- Equity MF NavigatorДокумент57 страницEquity MF NavigatorSavio Institute of science and Technology , TJОценок пока нет

- ValueResearchFundcard DSPBRTop100EquityReg 2011jun22Документ6 страницValueResearchFundcard DSPBRTop100EquityReg 2011jun22Aditya TipleОценок пока нет

- Profit Margin, Net Margin, Net Profit MarginДокумент5 страницProfit Margin, Net Margin, Net Profit MarginsnehaОценок пока нет

- MS-42 Capital Investment and Financing Decisions AssignmentДокумент3 страницыMS-42 Capital Investment and Financing Decisions AssignmentbabumstechОценок пока нет

- "ULIPS V/s Mutual Fund" As An Investment Option Among The Investors of LudhianaДокумент58 страниц"ULIPS V/s Mutual Fund" As An Investment Option Among The Investors of Ludhianaads110Оценок пока нет

- Canara Robeco Liquid Plus Retail Liquid Plus: June 2008Документ2 страницыCanara Robeco Liquid Plus Retail Liquid Plus: June 2008Sushant SaxenaОценок пока нет

- Axis Equity Fund: Investment Growth Trailing Returns Investment ObjectiveДокумент1 страницаAxis Equity Fund: Investment Growth Trailing Returns Investment Objectiveway2iimaОценок пока нет

- CIMB Islamic Sukuk Fund PerformanceДокумент2 страницыCIMB Islamic Sukuk Fund PerformanceAbdul-Wahab Abdul-HamidОценок пока нет

- MOSt Shares M50 ETF RatingДокумент4 страницыMOSt Shares M50 ETF RatingYogi173Оценок пока нет

- Birla Sun Life Frontline Equity Fund: Investment ObjectiveДокумент1 страницаBirla Sun Life Frontline Equity Fund: Investment ObjectivehnarwalОценок пока нет

- Total Number of AccountsДокумент11 страницTotal Number of AccountsJohnathan RiceОценок пока нет

- Axis Equity Fund FactsheetДокумент16 страницAxis Equity Fund Factsheetsrgupta99Оценок пока нет

- CHAPTER III Findings and AnalysisДокумент28 страницCHAPTER III Findings and AnalysisshirinОценок пока нет

- MUTUALFUNDANALYSISATLKPSecurities MDMASIUDDIN3 LA16 MBA10Документ79 страницMUTUALFUNDANALYSISATLKPSecurities MDMASIUDDIN3 LA16 MBA10Prakash KumarОценок пока нет

- Sharekhan's Top Equity Mutual Fund Picks: August 23, 2011Документ6 страницSharekhan's Top Equity Mutual Fund Picks: August 23, 2011ravipottiОценок пока нет

- Reliance Mutual Fund-FinalДокумент7 страницReliance Mutual Fund-FinalTamanna Mulchandani100% (1)

- Dewan Housing Finance Corporation Limited (DHFL) : High Safety RatingsДокумент6 страницDewan Housing Finance Corporation Limited (DHFL) : High Safety RatingsheyramzzОценок пока нет

- Comparison of Home Loan & FD RatesДокумент1 страницаComparison of Home Loan & FD RatesSukhdeep Singh BrarОценок пока нет

- HDFC Mutual FundДокумент9 страницHDFC Mutual Fundshailendra8085Оценок пока нет

- Presented By: Anoop Periwal. Avishek Mehta. C VarunДокумент16 страницPresented By: Anoop Periwal. Avishek Mehta. C VarunVarun CheruvuОценок пока нет

- CIMB-Principal Australian Equity Fund (Ex)Документ2 страницыCIMB-Principal Australian Equity Fund (Ex)Pei ChinОценок пока нет

- Premarket MorningGlance SPA 23.11.16Документ3 страницыPremarket MorningGlance SPA 23.11.16Rajasekhar Reddy AnekalluОценок пока нет

- R R R Research Esearch Esearch Esearch D D D Desk Esk Esk EskДокумент10 страницR R R Research Esearch Esearch Esearch D D D Desk Esk Esk EskTirthankar DasОценок пока нет

- SFM May 2015Документ25 страницSFM May 2015Prasanna SharmaОценок пока нет

- Short Term Call: Company Name: HG Infra Engineering LTDДокумент4 страницыShort Term Call: Company Name: HG Infra Engineering LTDVishnu RaoОценок пока нет

- Paid Up Capital +reserves Surplus No .Of Outstnading Equity Shares B.V.1 B .V - 2Документ5 страницPaid Up Capital +reserves Surplus No .Of Outstnading Equity Shares B.V.1 B .V - 2Harmeet kapoorОценок пока нет

- Top 100 Fund PerformanceДокумент4 страницыTop 100 Fund PerformanceGulshan VanjaniОценок пока нет

- Future DRДокумент34 страницыFuture DRarpitimsrОценок пока нет

- Fundcard L&TCashДокумент4 страницыFundcard L&TCashYogi173Оценок пока нет

- Gilt Funds Trailing Returns From 2019Документ2 страницыGilt Funds Trailing Returns From 2019Sandeep BorseОценок пока нет

- Eastings and NorthingsДокумент1 страницаEastings and NorthingsSandeep BorseОценок пока нет

- Gilt Funds Traling Returns From 2015Документ2 страницыGilt Funds Traling Returns From 2015Sandeep BorseОценок пока нет

- CCP - One PagerДокумент1 страницаCCP - One PagerSandeep BorseОценок пока нет

- 7th ScienceДокумент22 страницы7th ScienceSandeep BorseОценок пока нет

- Representing Geographical FeaturesДокумент1 страницаRepresenting Geographical FeaturesSandeep BorseОценок пока нет

- Cover Page PicsДокумент3 страницыCover Page PicsSandeep BorseОценок пока нет

- Debt Fund Portfolio June 2017Документ10 страницDebt Fund Portfolio June 2017Sandeep BorseОценок пока нет

- PolicySchedule PDFДокумент1 страницаPolicySchedule PDFSandeep Borse100% (1)

- REC Capital Gain Bond-10200083Документ4 страницыREC Capital Gain Bond-10200083viralshukla4290Оценок пока нет

- ARN Circular No. 17 Dt. 26-Sep-14 - Revised Self Declaration FormatsДокумент5 страницARN Circular No. 17 Dt. 26-Sep-14 - Revised Self Declaration FormatsSandeep BorseОценок пока нет

- Large Funds Performance Jan 2016Документ1 страницаLarge Funds Performance Jan 2016Sandeep BorseОценок пока нет

- Nhai54ecapr16 21705523Документ2 страницыNhai54ecapr16 21705523Sandeep BorseОценок пока нет

- Crisil Composite Bond Debt: Credit Opportunities Open-Ended Oct 31, 2011Документ1 страницаCrisil Composite Bond Debt: Credit Opportunities Open-Ended Oct 31, 2011Sandeep BorseОценок пока нет

- DSP Focus 25Документ1 страницаDSP Focus 25Sandeep BorseОценок пока нет

- Mahalaxmi Presentation InvestorsДокумент29 страницMahalaxmi Presentation InvestorsSandeep BorseОценок пока нет

- There'S Life Beyond Bank FdsДокумент20 страницThere'S Life Beyond Bank FdsSandeep BorseОценок пока нет

- Melvin Jones FellowДокумент4 страницыMelvin Jones FellowSandeep BorseОценок пока нет

- Basics of Asset Allocation Paradigm for Wealth CreationДокумент29 страницBasics of Asset Allocation Paradigm for Wealth CreationSandeep BorseОценок пока нет

- Magicbricks OfferДокумент14 страницMagicbricks OfferSandeep BorseОценок пока нет

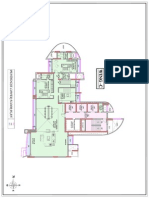

- Atlantis C Wing Lower FLRДокумент1 страницаAtlantis C Wing Lower FLRSandeep BorseОценок пока нет

- Transactions - Apartment FundДокумент5 страницTransactions - Apartment FundSandeep BorseОценок пока нет

- Sunita RuiaДокумент3 страницыSunita RuiaSandeep BorseОценок пока нет

- Project Sunrise Grande Floor PlanДокумент6 страницProject Sunrise Grande Floor PlanSandeep BorseОценок пока нет

- Non-Resident Home Loan ApplicationДокумент2 страницыNon-Resident Home Loan ApplicationSharath BhavanasiОценок пока нет

- Khar PropertyДокумент7 страницKhar PropertySandeep BorseОценок пока нет