Академический Документы

Профессиональный Документы

Культура Документы

Excel Project P9-59a

Загружено:

api-272100463Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Excel Project P9-59a

Загружено:

api-272100463Авторское право:

Доступные форматы

Introduction

to Management Accounting

Solutions Manual

Problems: Set A

Kathryn Buda

P9-59A

Comprehensive

budgeting

problem

(Learning

Objectives

2

&

3)

Requirements

1.

Prepare

a

schedule

of

cash

collections

for

January,

February,

and

March,

and

for

the

quarter

in

total.

2.

Prepare

a

production

budget.

3.

Prepare

a

direct

materials

budget.

4.

Prepare

a

cash

payments

budget

for

the

direct

material

purchases

from

Requirement

3.

5.

Prepare

a

cash

payments

budget

for

conversion

costs.

6.

Prepare

a

cash

payments

budget

for

operating

expenses.

7.

Prepare

a

combined

cash

budget.

8.

Calculate

the

budgeted

manufacturing

cost

per

unit.

9.

Prepare

a

budgeted

income

statement

for

the

quarter

ending

March

31.

Solution:

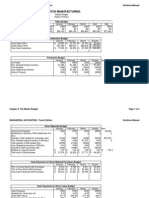

Given

Unit sales

Sales

Budget

December

January

February

March

April

May

7,000

8,000

9,200

9,900

9,700

8,500

Unit selling price

Total sales Revenue

$

10

$

10

$

10

$

10

$

10

$

10

$

70,000

$

80,000

$

92,000

$

99,000

$

97,000

$

85,000

Req. 1

Cash

Collections

January

$24,000

$49,000

$73,000

February

$27,600

$56,000

$83,600

March

$29,700

$64,400

$94,100

Quarter

$81,300

$169,400

$250,700

Production

Budget

January

$8,000

$2,300

$10,300

$800

$9,500

February

$9,200

$2,475

$11,675

$920

$10,755

March

$9,900

$2,425

$12,325

$990

$11,335

Quarter

$27,100

$2,425

$29,525

$800

$28,725

Direct Materials Budget

January

February

Units to be Produced

9,500

10,755

Multiply by: Quantity (pounds) of DM needed per Unit

2

2

Quantity (Pounds) of DM needed for production 19,000

21,510

Plus: Desired Ending Inventory of DM

2,151

2,267

Total Quantity (Pounds) needed

21,151

23,777

Less: Beginning Inventory of DM

1,900

2,151

Quantity (pounds) to purchase

19,251

21,626

Multiply by: Cost per Pound

$2.00

$2.00

Total Cost of DM Purchases

$38,502

$43,252

March

11,335

2

22,670

1880

24,550

2,267

22,283

$2.00

$44,566

Quarter

28,725

2

57,450

1,880

59,330

1,900

57,430

$2.00

$114,860

Schedule of Expected Cash DisbursementsMaterial Purchases

January

February

March

Quarter

Cash

Sales

Credit

Sales

Total

Cash

Collections

Req. 2

Unit

Sales

Plus:

Desired

ending

Inventory

Total

Needed

Less:

Beginning

Inventory

Units

to

Produce

Req. 3

Units

to

produce

Multiply

by:

Quantity(pounds)

of

DM

needed

per

unit

Quantity

(pounds)

needed

for

production

Plus:

Desired

Ending

Inventory

of

DM

Total

Quantity

(pounds)

needed

Less:

Beginning

Inventory

of

DM

Quantity

(pounds)

to

Purchase

Multiply

by:

Cost

per

pound

Total

Cost

of

DM

Purchases

April

9,700

May

8,500

2

19,400

1,700

21,100

1940

19160

2

38,320

2

17000

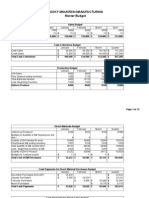

Req. 4

Chapter 9: The Master Budget and Responsibility Accounting

Introduction to Management Accounting

20% of Current Month DM Purchases

80% of Last Month's DM purchases

Total Cash Payments

Chapter 9: The Master Budget and Responsibility Accounting

Solutions Manual

$7,700

$56,000

$63,700

$8,913

$30,802

$39,452

$8,913

$34,602

$43,515

$22,972

$121,403

$144,375

Introduction to Management Accounting

Solutions Manual

Req. 5

Schedule of Expected Cash DisbursementsConversion Costs

January

February

March

Variable Manufacturing Overhead Costs

$11,400

$12,906

$13,602

Rent (Fixed)

$5,000

$5,000

$5,000

Other Fixed MOH

$3,000

$3,000

$3,000

Cash Payments for Manufacturing Overhead

$19,400

$20,906

$21,602

Quarter

$37,908

$15,000

$9,000

$61,908

Req. 6

Schedule of Expected Cash Disbursements -- Operating Expenses

January

February

March

Variable Operating Expenses

$8,000

$9,200

$9,900

Fixed Operating Expenses

$1,000

$1,000

$1,000

Cash Payments for Operating Expenses

$9,000

$10,200

$10,900

Quarter

$27,100

$3,000

$30,100

Req. 7

Beginning Cash Balance

Plus: Cash Collections

Total Cash Available

Less Cash Payments:

Direct Materials Purchases

Conversion Costs

Operating Expenses

Equipment Purchases

Tax Payment

Total Disbursements

Ending Cash Balance Before Financing

Plus: New Borrowings

Less: Debt Repayments

Less: Interest Payments

Combined Cash Budget

January

February

$4,500

$5,598

$73,000

$83,600

$77,500

$89,198

$38,502

$19,400

$9,000

$5,000

$71,902

$5,598

Ending Cash Balance

$5,598

Interest Owed

$0

Total interest

$280

$43,252

$20,906

$10,200

$12,000

$10,000

$96,358

-$7,160

$12,000

$4,840

$120

March

$4,840

$94,100

$98,940

Quarter

$4,500

$250,700

$255,200

$44,566

$21,602

$10,900

$16,000

$93,068

$5,872

$126,320

$61,908

$30,100

$33,000

$10,000

$261,328

-$6,128

-$1,000

-$1,000

$4,642

$4,642

$110

$230

Req. 8

Budgeted Manufacturing Cost per Unit

Direct Materials cost per unit

Conversion costs per unit

fixed manufacturing overhead per unit

budgeted cost of manufacturing each unit

$5

$6

$1

$4

Req. 9

Silverman

Manufacturing

Budgeted

Income

Statement

For

the

Quarter

Ended

March

31

Sales

Revenue

Less:

Cost

of

Goods

Sold

Gross

Profit

Operating

Expenses

Less:

Depreciation

Expense

Operating

Income

Less:

Interest

Expense

Less:

Income

Tax

Expense

Net

Income

Chapter 9: The Master Budget and Responsibility Accounting

$271,000

($162,600)

$108,400

($30,100)

($4,800)

$73,500

($230)

($21,981)

$51,289

Вам также может понравиться

- Accounting E-Portfolio FinalДокумент8 страницAccounting E-Portfolio Finalapi-310911560Оценок пока нет

- Managerial Accounting ProjectДокумент11 страницManagerial Accounting Projectapi-271746126Оценок пока нет

- Budget AssignmentДокумент10 страницBudget Assignmentapi-248058538Оценок пока нет

- ProblemsДокумент4 страницыProblemsapi-316770820Оценок пока нет

- Master Budget ProjectДокумент10 страницMaster Budget Projectapi-268950886Оценок пока нет

- Excel Budget Project Tanya MayДокумент10 страницExcel Budget Project Tanya Mayapi-316478827Оценок пока нет

- Budget Project LLДокумент10 страницBudget Project LLapi-220037346Оценок пока нет

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualДокумент10 страницWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-231890132100% (1)

- Excel Budget ProjectДокумент6 страницExcel Budget Projectapi-314303195Оценок пока нет

- Wasatch ManufacturingДокумент12 страницWasatch Manufacturingapi-301899907Оценок пока нет

- Wasatch Manufacturing Master BudgetДокумент6 страницWasatch Manufacturing Master Budgetapi-255137286Оценок пока нет

- Accounting Chapter 9 Eportfolio ExcelДокумент12 страницAccounting Chapter 9 Eportfolio Excelapi-273030710Оценок пока нет

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualДокумент12 страницWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-269073570Оценок пока нет

- Comprehensive BudgetДокумент5 страницComprehensive Budgetapi-317125310Оценок пока нет

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualДокумент5 страницWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-284934265Оценок пока нет

- Budget Assignment Norma GДокумент5 страницBudget Assignment Norma Gapi-242614310Оценок пока нет

- Answer Key To Test #2 - ACCT-312 - Fall 2019Документ6 страницAnswer Key To Test #2 - ACCT-312 - Fall 2019Amir ContrerasОценок пока нет

- Brewer8e GEs PPT Chapter 8 UpdДокумент22 страницыBrewer8e GEs PPT Chapter 8 UpdNguyễn Ngọc Quỳnh TiênОценок пока нет

- Abigail Foss - Comprehensive Problem - Master BudgetДокумент15 страницAbigail Foss - Comprehensive Problem - Master Budgetapi-325954956Оценок пока нет

- p9-60 PsimasinghДокумент8 страницp9-60 Psimasinghapi-241811190Оценок пока нет

- Accounting 202 Chapter 9 NotesДокумент15 страницAccounting 202 Chapter 9 NotesnitinОценок пока нет

- Ac102 ch7Документ22 страницыAc102 ch7Mohammed OsmanОценок пока нет

- Hailey Fernelius ch9 Excel ProjectДокумент4 страницыHailey Fernelius ch9 Excel Projectapi-242652884Оценок пока нет

- Seminar 11answer Group 11Документ115 страницSeminar 11answer Group 11Shweta SridharОценок пока нет

- Functional Budget - SolutionДокумент11 страницFunctional Budget - SolutionLance Jewel RamosОценок пока нет

- Acct 2020 Excel Budget Problem Student TemplateДокумент12 страницAcct 2020 Excel Budget Problem Student Templateapi-242720692Оценок пока нет

- Wasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions ManualДокумент12 страницWasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions Manualapi-247933607Оценок пока нет

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualДокумент12 страницWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-239130031Оценок пока нет

- MACP.L II Question April 2019Документ5 страницMACP.L II Question April 2019Taslima AktarОценок пока нет

- Cost II - Assignment & WorksheetДокумент7 страницCost II - Assignment & WorksheetBeamlak WegayehuОценок пока нет

- CH 09Документ3 страницыCH 09ghsoub77750% (2)

- Multiple ChoiceДокумент5 страницMultiple ChoicejaneОценок пока нет

- Carolyn Trowbridge Acct 2020 Excel Budget Problem Student Template 1Документ8 страницCarolyn Trowbridge Acct 2020 Excel Budget Problem Student Template 1api-284502690Оценок пока нет

- Portfolio Acct123Документ6 страницPortfolio Acct123api-284834569Оценок пока нет

- Problem 1 Variable Cost Per UnitДокумент7 страницProblem 1 Variable Cost Per UnitŠĥỳ ÄñïlОценок пока нет

- EportfolioДокумент8 страницEportfolioapi-220792970Оценок пока нет

- 202E06Документ21 страница202E06foxstupidfoxОценок пока нет

- Cost II (Chapter-Two)Документ48 страницCost II (Chapter-Two)SemiraОценок пока нет

- VANDERBECKCh7 - Multiple Choice (Theory and Problem)Документ8 страницVANDERBECKCh7 - Multiple Choice (Theory and Problem)Saeym SegoviaОценок пока нет

- Acct 2020 Excel Budget Problem Student TemplateДокумент12 страницAcct 2020 Excel Budget Problem Student Templateapi-249190933Оценок пока нет

- Acct 2020 Excel Budget Problem Student TemplateДокумент12 страницAcct 2020 Excel Budget Problem Student Templateapi-278341046Оценок пока нет

- Seminar 11answer Group 10Документ75 страницSeminar 11answer Group 10Shweta Sridhar40% (5)

- Chap07 Rev. FI5 Ex PR 1Документ10 страницChap07 Rev. FI5 Ex PR 1Beyond ThatОценок пока нет

- Lecture-7 Overhead (Part 1)Документ22 страницыLecture-7 Overhead (Part 1)Nazmul-Hassan Sumon100% (2)

- Cost Accounting: Level 3Документ18 страницCost Accounting: Level 3Hein Linn KyawОценок пока нет

- Hillyard CompanyДокумент3 страницыHillyard CompanyJea BalagtasОценок пока нет

- Management Accounting Level 3: LCCI International QualificationsДокумент17 страницManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (2)

- ACC102 Chapter7newДокумент26 страницACC102 Chapter7newSuryadinata SamuelОценок пока нет

- L3 - Operating BudgetДокумент44 страницыL3 - Operating BudgetFrOzen HeArtОценок пока нет

- Comp. ExamДокумент11 страницComp. ExamProf. Nisaif JasimОценок пока нет

- Tori Kallerud Chapter 9 HWДокумент12 страницTori Kallerud Chapter 9 HWapi-325347697Оценок пока нет

- Final Managerial AccountingДокумент8 страницFinal Managerial Accountingdangthaibinh0312Оценок пока нет

- Module 4 Inclass QuestionsДокумент3 страницыModule 4 Inclass QuestionsPhát GamingОценок пока нет

- AccountingДокумент22 страницыAccountingTia1977Оценок пока нет

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsОт EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsОценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОт Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОценок пока нет

- AEON - AR2021 (Part 4)Документ66 страницAEON - AR2021 (Part 4)SITI NAJIBAH BINTI MOHD NORОценок пока нет

- Adjustments To Final Account Format1Документ2 страницыAdjustments To Final Account Format1KANGOMA FODIE MansarayОценок пока нет

- Providence Creek Academy Charter School Inspection (Signed)Документ18 страницProvidence Creek Academy Charter School Inspection (Signed)KevinOhlandtОценок пока нет

- Excel Workings ITE ValuationДокумент19 страницExcel Workings ITE Valuationalka murarka100% (1)

- Syllabus: Join Us On Telegram For More: "Law College Notes & Stuffs"Документ25 страницSyllabus: Join Us On Telegram For More: "Law College Notes & Stuffs"Aishwarya B.AОценок пока нет

- Financial Statement Analysis 11th Edition Subramanyam Solutions Manual DownloadДокумент60 страницFinancial Statement Analysis 11th Edition Subramanyam Solutions Manual DownloadDavid Williams100% (21)

- Statutory Text Tax Reform Act of 2014 Discussion DraftДокумент979 страницStatutory Text Tax Reform Act of 2014 Discussion DraftBrett LoGiuratoОценок пока нет

- Accoting Process AssignmentДокумент8 страницAccoting Process Assignmentpramod Kumar0% (4)

- Grounds of Appeal N161Документ34 страницыGrounds of Appeal N161LGOComplaintОценок пока нет

- Pepper Food Delivery Assignment : 4. Wrap Text Within CellsДокумент2 страницыPepper Food Delivery Assignment : 4. Wrap Text Within CellsLaura E. VargasОценок пока нет

- The Accounting Process-A ReviewДокумент11 страницThe Accounting Process-A ReviewLeoreyn Faye MedinaОценок пока нет

- Projected Cash Flow StatementДокумент6 страницProjected Cash Flow StatementIqtadar AliОценок пока нет

- Business Plan For Plastic in Ethiopia DoДокумент39 страницBusiness Plan For Plastic in Ethiopia DoTesfaye Degefa100% (3)

- Insaf Pharmaceu-Wps OfficeДокумент23 страницыInsaf Pharmaceu-Wps OfficeHasnain KhanОценок пока нет

- CH 6Документ6 страницCH 6Natsu DragneelОценок пока нет

- DOCJT KLEFPF Report and FindingsДокумент58 страницDOCJT KLEFPF Report and FindingsMary LyonsОценок пока нет

- Horngren Ima16 stppt16Документ66 страницHorngren Ima16 stppt16SumitasОценок пока нет

- BBA 27 Batch (Section A & C) Advanced Financial Accounting - II (2201)Документ4 страницыBBA 27 Batch (Section A & C) Advanced Financial Accounting - II (2201)ahmedxisan179Оценок пока нет

- Subsidiary BooksДокумент16 страницSubsidiary BooksAnindya NandiОценок пока нет

- BSAMERCHANDISING2021Документ5 страницBSAMERCHANDISING2021Jean MaeОценок пока нет

- Computation of Income Tax Due and PayableДокумент14 страницComputation of Income Tax Due and Payablealia fauniОценок пока нет

- Far 1 - Accounting Cycle Exercise ProblemsДокумент8 страницFar 1 - Accounting Cycle Exercise ProblemsCha Eun WooОценок пока нет

- Review of Accounting ProcessДокумент8 страницReview of Accounting ProcessVenn Bacus RabadonОценок пока нет

- BA 99.2 Current Liabilities Additional ExercisesДокумент1 страницаBA 99.2 Current Liabilities Additional ExercisesAlison BlackОценок пока нет

- KLBFДокумент3 страницыKLBFM Khoirun NasihОценок пока нет

- NTC ProposalДокумент29 страницNTC ProposalSantosh Chhetri100% (1)

- Financial PlanДокумент16 страницFinancial PlanSenpai Kun0% (1)

- 12 PensionДокумент4 страницы12 PensionMichael BongalontaОценок пока нет

- Midterm ManaccДокумент13 страницMidterm ManaccTheodora YenneferОценок пока нет

- Modibbo Adama University of Technology, YolaДокумент1 страницаModibbo Adama University of Technology, YolaBabatunde BambiОценок пока нет