Академический Документы

Профессиональный Документы

Культура Документы

Ask For Receipt

Загружено:

Sy HimИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ask For Receipt

Загружено:

Sy HimАвторское право:

Доступные форматы

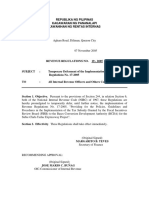

REPUBLIKA NG PILIPINAS

KAGAWARAN NG PANANALAPI

KAWANIHAN NG RENTAS INTERNAS

March 31, 2005

REVENUE REGULATIONS NO. 7 - 2005

SUBJECT : Amending

Pertinent Provision of Revenue

Regulations No. 4-2000, By Providing a new Format

for the Notice to the Public to be Exhibited at Place of

Business.

TO

: All Revenue Officials, Employees and Others Concerned

SECTION 1.

Scope Pursuant to the provisions of Section 244, in

relation to Sections 237, 238, 264 and 265 of the Tax Code of 1997,

this Regulation is hereby promulgated to provide a new BIR Notice to

be exhibited at place of business.

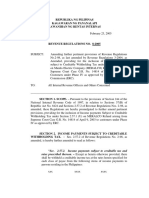

SECTION 2. Exhibition of Notice at Place of Business For the

purpose of enhancing accomplishment of the objectives of RR No. 42000, the NOTICE provided for under Section 3 is hereby changed to

conform strictly to the following:

ASK FOR

B I R

RECEIPT

This will ensure that the

taxes on your purchases

will be remitted to the

2 to 4 YEARS IMPRISONMENT

FOR NON ISSUANCE OF RECEIPT

REPORT VIOLATORS TO ANY OF FOLLOWING:

! BIR CONTACT CENTER (02)981-8888

! commissioner@bir.gov.ph

! BIR DISTRICT OFFICES

government. It will be

used for the development

of the Philippines

(Name of Business Establishment)

________________________________________

(TIN)

RR#____.This NOTICE shall cause to be posted in place of business, including branches and mobile stores in such area conspicuous to the

public view.

SECTION 3 Repealing Clause All regulations, rules, orders or

portions thereof contrary to the provisions of these Regulations are

hereby modified and/or repealed accordingly.

SECTION 5 Effectivity These regulations shall take effect fifteen

(15) days after publication in any newspaper of general circulation.

(Original Signed)

CESAR V. PURISIMA

Secretary of Finance

Recommending Approval:

(Original Signed)

GUILLERMO L. PARAYNO

Commissioner of Internal Revenue

Вам также может понравиться

- BIR Revenue Regulations Summary 2019-2021Документ87 страницBIR Revenue Regulations Summary 2019-2021Erica NicolasuraОценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- Ensuring Tax Compliance for Government ContractsДокумент4 страницыEnsuring Tax Compliance for Government ContractsCarla GrepoОценок пока нет

- Revenue Regulation No. 16-2005Документ0 страницRevenue Regulation No. 16-2005Kaye MendozaОценок пока нет

- Revenue Regulations No 2-2015Документ4 страницыRevenue Regulations No 2-2015Yaz Carloman0% (1)

- RR 2-98 - AmendmentsДокумент196 страницRR 2-98 - AmendmentsArchie Guevarra100% (1)

- K-12 Science Curriculum Guide promotes scientific literacyДокумент66 страницK-12 Science Curriculum Guide promotes scientific literacycatherinefernandezОценок пока нет

- K-12 Science Curriculum Guide promotes scientific literacyДокумент66 страницK-12 Science Curriculum Guide promotes scientific literacycatherinefernandezОценок пока нет

- RR 8-2007Документ2 страницыRR 8-2007naldsdomingoОценок пока нет

- 2000 BIR-RR ContentsДокумент5 страниц2000 BIR-RR ContentsMary Grace Caguioa AgasОценок пока нет

- 2001 BIR-RR ContentsДокумент5 страниц2001 BIR-RR ContentsMary Grace Caguioa AgasОценок пока нет

- Related Revenue Issuances For VATДокумент4 страницыRelated Revenue Issuances For VATKenneth DavidОценок пока нет

- "Section 3. - COVERAGE.-xxx XXX XXXДокумент2 страницы"Section 3. - COVERAGE.-xxx XXX XXXnaldsdomingoОценок пока нет

- Jllois: in ToДокумент2 страницыJllois: in ToA2 ZОценок пока нет

- RR 11 98Документ1 страницаRR 11 98Joanna AbañoОценок пока нет

- 2006 BIR-RMC ContentsДокумент22 страницы2006 BIR-RMC ContentsMary Grace Caguioa AgasОценок пока нет

- "XXX XXX XXX "XXX XXX XXXДокумент1 страница"XXX XXX XXX "XXX XXX XXXJaypee LegaspiОценок пока нет

- RMO 16-2017 amends VAT provisions for wheat importersДокумент2 страницыRMO 16-2017 amends VAT provisions for wheat importersYna YnaОценок пока нет

- rr01 01 PDFДокумент1 страницаrr01 01 PDFHarryОценок пока нет

- Subject: of To ToДокумент2 страницыSubject: of To ToAnonymous DCfjLP50Оценок пока нет

- Latest Revenue Issuances Related To AuditДокумент4 страницыLatest Revenue Issuances Related To Auditapplemae.mostalesОценок пока нет

- Department of Finance: Bureau of Internal RevenueДокумент1 страницаDepartment of Finance: Bureau of Internal RevenuePeggy SalazarОценок пока нет

- 2009 BIR-RMC ContentsДокумент56 страниц2009 BIR-RMC ContentsMary Grace Caguioa AgasОценок пока нет

- RTCo - Ease of Paying Taxes ActДокумент76 страницRTCo - Ease of Paying Taxes ActSamantha AlejandroОценок пока нет

- Tax Alert (Jurisprudence)Документ6 страницTax Alert (Jurisprudence)Cherilyn NgoОценок пока нет

- (VAT) in To: Clarifying (RR) No. The The Tax of (TaxДокумент13 страниц(VAT) in To: Clarifying (RR) No. The The Tax of (TaxShiela Marie Maraon100% (1)

- RMC No. 24-2022Документ13 страницRMC No. 24-2022arnulfojr hicoОценок пока нет

- REVENUE REGULATIONS Issued On The 1st Semester of 2021Документ71 страницаREVENUE REGULATIONS Issued On The 1st Semester of 2021HC LawОценок пока нет

- 2014 BIR-RMC ContentsДокумент13 страниц2014 BIR-RMC ContentsMary Grace Caguioa AgasОценок пока нет

- ACCOUNTING PERIODS AND TAX ACCOUNTING METHODS 2020 Printed Edition (iBOOK Version)Документ31 страницаACCOUNTING PERIODS AND TAX ACCOUNTING METHODS 2020 Printed Edition (iBOOK Version)Quinciano MorilloОценок пока нет

- BIR Revenue Regulations 4-2014Документ2 страницыBIR Revenue Regulations 4-2014Tonyo CruzОценок пока нет

- Revenue Code of Liberia With 2011 Amendments Included 011212 PDFДокумент263 страницыRevenue Code of Liberia With 2011 Amendments Included 011212 PDFHassan NewlandОценок пока нет

- RR 10-2019Документ2 страницыRR 10-2019Jackie PadasasОценок пока нет

- Bir Tax Updates 2022 WebinarДокумент1 страницаBir Tax Updates 2022 Webinarsheina asuncionОценок пока нет

- BIR RMC No. 84-2022 - Sworn Declaration Template For RBEsДокумент1 страницаBIR RMC No. 84-2022 - Sworn Declaration Template For RBEsMaricris MendozaОценок пока нет

- 1998 BIR-RR ContentsДокумент5 страниц1998 BIR-RR ContentsMary Grace Caguioa AgasОценок пока нет

- Phrases Shall Be Defined As Follows: XXX XXX XXXДокумент12 страницPhrases Shall Be Defined As Follows: XXX XXX XXXWilfred MartinezОценок пока нет

- RR 10 2004 PDFДокумент2 страницыRR 10 2004 PDFJio LabitiganОценок пока нет

- RR 10-2004 GRT On FI Including Pawnshop PDFДокумент2 страницыRR 10-2004 GRT On FI Including Pawnshop PDFMarc Myer De AsisОценок пока нет

- BIR RegulationsДокумент13 страницBIR RegulationsDaphne Dione BelderolОценок пока нет

- 2005 BIR-RR ContentsДокумент7 страниц2005 BIR-RR ContentsMary Grace Caguioa AgasОценок пока нет

- RR No. 1-2024Документ2 страницыRR No. 1-2024Anostasia NemusОценок пока нет

- Sanggunian Provincial, City and Municipal Treasurers and AllДокумент4 страницыSanggunian Provincial, City and Municipal Treasurers and AllCarlos RabagoОценок пока нет

- 1999 BIR-RR ContentsДокумент5 страниц1999 BIR-RR ContentsMary Grace Caguioa AgasОценок пока нет

- VAT IssuancesДокумент26 страницVAT IssuancesjoshuaОценок пока нет

- 2009 Revenue Regulations Table of ContentsДокумент2 страницы2009 Revenue Regulations Table of ContentsRamon Augusto Melad LacambraОценок пока нет

- Commissioner of Internal Revenue vs. San Miguel CorporationДокумент7 страницCommissioner of Internal Revenue vs. San Miguel CorporationBethany MangahasОценок пока нет

- AFF's Tax Memorandum - Changes in Finance Bill, 2023 (Pakistan)Документ14 страницAFF's Tax Memorandum - Changes in Finance Bill, 2023 (Pakistan)salahuddin ahmedОценок пока нет

- Internal Revenue Regulations on Electronic Invoicing SystemДокумент4 страницыInternal Revenue Regulations on Electronic Invoicing SystemrodrigoОценок пока нет

- General Provisions and Tax Procedures: Arie Pratama, Se, Cpsak, Cpma, CertifrДокумент64 страницыGeneral Provisions and Tax Procedures: Arie Pratama, Se, Cpsak, Cpma, CertifrKucing HitamОценок пока нет

- RR No. 3-2021Документ2 страницыRR No. 3-2021zelayneОценок пока нет

- 1998 RR DigestДокумент16 страниц1998 RR DigestJeremeh PenarejoОценок пока нет

- S. B. NO-12&2: Iyrtn (OДокумент8 страницS. B. NO-12&2: Iyrtn (OAli GuyaminОценок пока нет

- Digest of 1998 Revenue Memorandum OrdersДокумент15 страницDigest of 1998 Revenue Memorandum OrdersTenten ConanОценок пока нет

- Income Tax Explainatory NotesДокумент42 страницыIncome Tax Explainatory NotesSunny RajeevОценок пока нет

- Audit Project TAX AUDITДокумент34 страницыAudit Project TAX AUDITkhairejoОценок пока нет

- E - Newsletter - 21st October 2023.Документ4 страницыE - Newsletter - 21st October 2023.Dinesh kumarОценок пока нет

- RMC No. 92-102-2020Документ5 страницRMC No. 92-102-2020nathalie velasquezОценок пока нет

- Revenue Regulations No. 6 ' 9.0 2 2: Muauc Ofthe Philippines Department or FinanceДокумент3 страницыRevenue Regulations No. 6 ' 9.0 2 2: Muauc Ofthe Philippines Department or FinancerodrigoОценок пока нет

- G.R. No. 184428 November 23, 2011 VILLARAMA, JR., J.Документ3 страницыG.R. No. 184428 November 23, 2011 VILLARAMA, JR., J.Maribel Nicole LopezОценок пока нет

- Revenue Regulations No. 7 - 2006: Quezon City May 18, 2006Документ2 страницыRevenue Regulations No. 7 - 2006: Quezon City May 18, 2006Sy HimОценок пока нет

- RR 19-02Документ1 страницаRR 19-02saintkarriОценок пока нет

- Amending MCIT Payment DatesДокумент6 страницAmending MCIT Payment DatesIrish BalabaОценок пока нет

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОт EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОценок пока нет

- Chapter 1Документ8 страницChapter 1Rafael GarciaОценок пока нет

- Ping Pong AnyoneДокумент5 страницPing Pong AnyoneSy HimОценок пока нет

- 29411rr No. 06-2006Документ7 страниц29411rr No. 06-2006Sy HimОценок пока нет

- 27695rr No. 01-2006Документ4 страницы27695rr No. 01-2006Sy HimОценок пока нет

- 28495rr No. 04-2006Документ11 страниц28495rr No. 04-2006Jas MineОценок пока нет

- 29083rr No. 05-2006Документ1 страница29083rr No. 05-2006Sy HimОценок пока нет

- 26814rr No. 19-2005Документ1 страница26814rr No. 19-2005Sy HimОценок пока нет

- Revenue Regulations No. 7 - 2006: Quezon City May 18, 2006Документ2 страницыRevenue Regulations No. 7 - 2006: Quezon City May 18, 2006Sy HimОценок пока нет

- 27697rr No. 02-2006Документ10 страниц27697rr No. 02-2006Sy HimОценок пока нет

- Implementing Guidelines on Revised Tax Rates for Alcohol and TobaccoДокумент44 страницыImplementing Guidelines on Revised Tax Rates for Alcohol and TobaccoSy HimОценок пока нет

- 26715rr No. 18-2005Документ9 страниц26715rr No. 18-2005Sy HimОценок пока нет

- 21429RR15 2005Документ3 страницы21429RR15 2005Sy HimОценок пока нет

- 21171rr05 14Документ54 страницы21171rr05 14Sy HimОценок пока нет

- 15711rr04 11Документ16 страниц15711rr04 11Sy HimОценок пока нет

- Philippine Tax Subsidy Regulations for Subic-Clark-Tarlac Expressway ProjectДокумент10 страницPhilippine Tax Subsidy Regulations for Subic-Clark-Tarlac Expressway ProjectSy HimОценок пока нет

- 17541rr05 06Документ6 страниц17541rr05 06Sy HimОценок пока нет

- 21103RR 11-2005Документ2 страницы21103RR 11-2005Sy HimОценок пока нет

- Republika NG Pilipinas Kagawaran NG Pananalapi Kawanihan NG Rentas InternasДокумент2 страницыRepublika NG Pilipinas Kagawaran NG Pananalapi Kawanihan NG Rentas InternasSy HimОценок пока нет

- 16723RR 1-2005Документ4 страницы16723RR 1-2005Sy HimОценок пока нет

- 15441rr04 13Документ14 страниц15441rr04 13Sy HimОценок пока нет

- 20286RR 8-2005Документ3 страницы20286RR 8-2005Sy HimОценок пока нет

- 16771rr05 05Документ8 страниц16771rr05 05Sy HimОценок пока нет

- 16769rr05 04Документ4 страницы16769rr05 04Sy HimОценок пока нет

- 15439rr04 12Документ16 страниц15439rr04 12Sy HimОценок пока нет

- 14592rr04 10Документ2 страницы14592rr04 10Sy HimОценок пока нет