Академический Документы

Профессиональный Документы

Культура Документы

CAPE - Relative Valuation US vs. Europe and Developed Markets

Загружено:

ritholtz10 оценок0% нашли этот документ полезным (0 голосов)

45 просмотров1 страницаCAPE - Relative Valuation US vs. Europe and Developed Markets

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCAPE - Relative Valuation US vs. Europe and Developed Markets

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

45 просмотров1 страницаCAPE - Relative Valuation US vs. Europe and Developed Markets

Загружено:

ritholtz1CAPE - Relative Valuation US vs. Europe and Developed Markets

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

08/2015

CAPE: Relative Valuation US vs. Europe and Developed Markets

250%

US Valuation vs. Regions

US vs. Europe: 25.7 vs. 16.4 (Overvaluation 57%)

(Avg. Overvaluation vs. Europe since 1979: 34%)

US vs. DevMkts: 25.7 vs. 21.7 (Overvalutation 19%)

(Avg. Overvaluation vs. DevMrkts since 1979: 8%)

US CAPE relative to Europe CAPE

225%

Avg. Overvaluation US vs. Europe (34%)

US CAPE relative to Developed Markets CAPE

Avg. Overvaluation US vs. Developed Markets (8%)

US Valuation vs. local History

CAPE: 25.7 vs. 16.5 (Overvaluation 56%)

Price-Book: 2.9 vs. 2.1 (Overvaluation 38%)

TobinsQ: 1.1 vs. 0.7 (Overvaluation 60%)

200%

175%

Relative

Overvaluation of

57% near ATH

150%

CAPE US / Europe

Avg. 34% since 79

125%

CAPE US / DevMkts

also near ATH

100%

75%

Dez. 79

Dez. 83

Dez. 87

Dez. 91

Dez. 95

Dez. 99

Dez. 03

Dez. 07

Sources: StarCapital as of 31/07/2015.

Contact:

Norbert Keimling

Head of Research

Dez. 11

Dez. 15

Dez. 19

Вам также может понравиться

- The Role of Headhunters in Wage Inequality It's All About MatchingДокумент43 страницыThe Role of Headhunters in Wage Inequality It's All About Matchingritholtz1Оценок пока нет

- United States Bankruptcy Court Southern District of New YorkДокумент19 страницUnited States Bankruptcy Court Southern District of New YorkTBP_Think_TankОценок пока нет

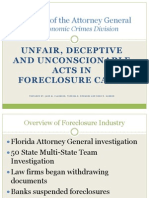

- Florida Attorney General Fraudclosure Report - Unfair, Deceptive and Unconscionable Acts in Foreclosure CasesДокумент98 страницFlorida Attorney General Fraudclosure Report - Unfair, Deceptive and Unconscionable Acts in Foreclosure CasesForeclosure Fraud100% (12)

- Evidence Based Investor Conference InterviewsДокумент15 страницEvidence Based Investor Conference Interviewsritholtz1100% (1)

- Fed (Atlanta) : Affine Term Structure Pricing With Bond Supply As FactorsДокумент19 страницFed (Atlanta) : Affine Term Structure Pricing With Bond Supply As Factorsritholtz1Оценок пока нет

- Is Momentum Really MomentumДокумент64 страницыIs Momentum Really Momentumritholtz1Оценок пока нет

- Turnover Liquidity and The Transmission of Monetary PolicyДокумент94 страницыTurnover Liquidity and The Transmission of Monetary Policyritholtz1Оценок пока нет

- Fooled by ConvictionДокумент11 страницFooled by Convictionritholtz1Оценок пока нет

- Fed (San Francisco) : Measuring The Effect of The Zero Lower Bound On Monetary PolicyДокумент29 страницFed (San Francisco) : Measuring The Effect of The Zero Lower Bound On Monetary Policyritholtz1Оценок пока нет

- IMF Financial Stability and Interest-Rate Policy A Quantitative Assessment of Costs and BenefitsДокумент29 страницIMF Financial Stability and Interest-Rate Policy A Quantitative Assessment of Costs and Benefitsritholtz1Оценок пока нет

- Fed (Board) What Are The Perceived Barriers To Homeownership For Young AdultsДокумент33 страницыFed (Board) What Are The Perceived Barriers To Homeownership For Young Adultsritholtz1Оценок пока нет

- GDP Forecast SummaryДокумент6 страницGDP Forecast Summaryritholtz1Оценок пока нет

- BIS When The Walk Is Not Random Commodity Prices and Exchange RatesДокумент54 страницыBIS When The Walk Is Not Random Commodity Prices and Exchange Ratesritholtz1Оценок пока нет

- Monetary Policy When Households Have Debt New Evidence On The Transmission MechanismДокумент70 страницMonetary Policy When Households Have Debt New Evidence On The Transmission Mechanismritholtz1Оценок пока нет

- 2014 Bailout Barometer Current EstimateДокумент10 страниц2014 Bailout Barometer Current Estimateritholtz1Оценок пока нет

- Mapers MO July2016Документ48 страницMapers MO July2016TBP_Think_TankОценок пока нет

- Credit Risk Spillover Between Financials and Sovereigns in The Euro Area During 2007-2015Документ52 страницыCredit Risk Spillover Between Financials and Sovereigns in The Euro Area During 2007-2015ritholtz1Оценок пока нет

- Minimum Wage ReportДокумент31 страницаMinimum Wage Reportritholtz1Оценок пока нет

- Increased Credit Availability, Rising Asset Prices Help Boost Consumer SpendingДокумент4 страницыIncreased Credit Availability, Rising Asset Prices Help Boost Consumer Spendingritholtz1Оценок пока нет

- A New Dimension To Currency Mismatches in The Emerging MarketsДокумент47 страницA New Dimension To Currency Mismatches in The Emerging Marketsritholtz1Оценок пока нет

- Does The US Have A Productivity Slowdown or A Measurement ProblemДокумент75 страницDoes The US Have A Productivity Slowdown or A Measurement Problemritholtz1Оценок пока нет

- A Size Cap For The Largest US Banks - Simon JohnsonДокумент8 страницA Size Cap For The Largest US Banks - Simon Johnsonritholtz1Оценок пока нет

- SR 768Документ46 страницSR 768TBP_Think_TankОценок пока нет

- Financial Fragility and Over-The-Counter MarketsДокумент33 страницыFinancial Fragility and Over-The-Counter Marketsritholtz1Оценок пока нет

- Financial FourДокумент1 страницаFinancial Fourritholtz1Оценок пока нет

- Financial FourДокумент1 страницаFinancial Fourritholtz1Оценок пока нет

- The Big Picture Conf Schedule 10-3-1013Документ1 страницаThe Big Picture Conf Schedule 10-3-1013ritholtz1Оценок пока нет

- AAII Brain On Stocks Presentsation NYC 2014Документ53 страницыAAII Brain On Stocks Presentsation NYC 2014ritholtz1Оценок пока нет

- Taxing TimesДокумент107 страницTaxing Timesritholtz1Оценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- G.R. No. 92735 Monarch V CA - DigestДокумент2 страницыG.R. No. 92735 Monarch V CA - DigestOjie Santillan100% (1)

- John Zink - Flare - Upstream - ProductionДокумент20 страницJohn Zink - Flare - Upstream - ProductionJose Bijoy100% (2)

- Celex 02003L0109-20110520 en TXTДокумент22 страницыCelex 02003L0109-20110520 en TXTertanОценок пока нет

- Extreme Sports TestДокумент3 страницыExtreme Sports TesttrigtrigОценок пока нет

- QM PB 4 2Документ23 страницыQM PB 4 2mariiaОценок пока нет

- Kerala University PHD Course Work Exam SyllabusДокумент4 страницыKerala University PHD Course Work Exam Syllabuslozuzimobow3100% (2)

- 2008-12-16Документ32 страницы2008-12-16CoolerAdsОценок пока нет

- A Beginner Guide To Website Speed OptimazationДокумент56 страницA Beginner Guide To Website Speed OptimazationVijay KumarОценок пока нет

- Factors Influencing The PerceptionДокумент1 страницаFactors Influencing The PerceptionTinesh Kumar100% (1)

- Additional Mathematics Project Work Kelantan 2/2012Документ29 страницAdditional Mathematics Project Work Kelantan 2/2012Muhammad Afif44% (9)

- Pain Assessment AND Management: Mr. Swapnil Wanjari Clinical InstructorДокумент27 страницPain Assessment AND Management: Mr. Swapnil Wanjari Clinical InstructorSWAPNIL WANJARIОценок пока нет

- Prose: Jooprencess E. PonoДокумент11 страницProse: Jooprencess E. Ponoaye plazaОценок пока нет

- Complete Wedding With DJ Worksheets.4pgsДокумент4 страницыComplete Wedding With DJ Worksheets.4pgsDanniОценок пока нет

- WC 500029819Документ23 страницыWC 500029819nsk79in@gmail.comОценок пока нет

- State MottosДокумент3 страницыState MottosFrancisco MedinaОценок пока нет

- Tony Robbins ResultДокумент11 страницTony Robbins ResultSalee BuiserОценок пока нет

- (JPN) - E-Hand Book UpdatedДокумент31 страница(JPN) - E-Hand Book UpdatedjainvaibhiОценок пока нет

- Theri GathaДокумент26 страницTheri GathaLalit MishraОценок пока нет

- 11 Rabino v. Cruz 222 SCRA 493Документ4 страницы11 Rabino v. Cruz 222 SCRA 493Joshua Janine LugtuОценок пока нет

- Scanner Hardware Stopped Scan - Replace Collimator CAM (A - B) Motor and Coupling AssemblyДокумент5 страницScanner Hardware Stopped Scan - Replace Collimator CAM (A - B) Motor and Coupling AssemblyLuis BattaОценок пока нет

- MIS ProjectДокумент12 страницMIS ProjectDuc Anh67% (3)

- Cold Calls Excerpt by Charles BenoitДокумент25 страницCold Calls Excerpt by Charles BenoitHoughton Mifflin HarcourtОценок пока нет

- Ansari Ibnarabdoctrine 1999Документ45 страницAnsari Ibnarabdoctrine 1999JYOTI PALОценок пока нет

- Preliminary Basic Definitions Definition: 1 GraphДокумент27 страницPreliminary Basic Definitions Definition: 1 GraphramОценок пока нет

- Mock Test 3Документ15 страницMock Test 3MadhuОценок пока нет

- School of Construction 2010-2011 Program OutcomesДокумент34 страницыSchool of Construction 2010-2011 Program OutcomesAnonymous fYHyRa2XОценок пока нет

- Mosaic TRD4 Tests EOY 1Документ4 страницыMosaic TRD4 Tests EOY 1MarcoCesОценок пока нет

- Choral Speaking - Our School LifeДокумент4 страницыChoral Speaking - Our School LifeAINA AZMINA BINTI ANUAR KPM-GuruОценок пока нет

- Intussusception in Children - UpToDate PDFДокумент38 страницIntussusception in Children - UpToDate PDFwisdom loverОценок пока нет

- Abnormal or Exceptional Mental Health Literacy For Child and Youth Care Canadian 1St Edition Gural Test Bank Full Chapter PDFДокумент20 страницAbnormal or Exceptional Mental Health Literacy For Child and Youth Care Canadian 1St Edition Gural Test Bank Full Chapter PDFdustin.washington425100% (22)