Академический Документы

Профессиональный Документы

Культура Документы

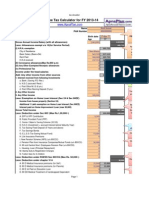

Income Tax Calculator F.Y. 2016-17 (AY 2017-18

Загружено:

Pankaj BatraИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Income Tax Calculator F.Y. 2016-17 (AY 2017-18

Загружено:

Pankaj BatraАвторское право:

Доступные форматы

http://www.PankajBatra.

com

Income Tax Calculator F.Y. 2016-17 (AY 2017-18)

Gender

Male

Name

Your Name

Age

Have a Question? Ask it here: http://www.SocialFinance.in

30

Number of children

Salary Breakup

April

May

Basic Salary

House Rent Allowance (HRA)

Dearness allowance (DA)

Transport/Conveyence Allowance

Child Education Allowance

Grade/Special/Management/Supplemementary All

City Compensatory Allowance (CCA)

Arrears

Gratuity

Leave Travel Allowance (LTA)

Leave Encashment

Performance Incentive/Bonus

Medical Reimbursement

Food Coupons

Periodical Journals

Uniform/Dress Allowance

Telephone Reimbursements

Professional Development Allowance

Car Reimbursement

Internet Expense

Driver Salary

Gifts From Non-Relatives

Gifts From Relatives

Agricultural Income

House Rent Income/Notional rent (income from ho

Saving bank account interest

Other income (Fixed deposit /NSC/SCSS Interest)

Income from Lottery, Crossword Puzzles, prizes etc

STCG from listed equity products/equity MFs

STCG not from listed equity products/equity MFs

LTCG from listed equity products/equity MFs

June

July

August

September

October

November

December

January

February

March

Total

LTCG not from listed equity product/equity MFs s w/o indexation

LTCG not from listed equity products/equity MFs with indexation benefits

TOTAL INCOME

Exemptions

Actual Rent paid as per rent receipts

Place of residence

HRA Exemption

Metro City Metro City Metro City Metro City Metro City Metro City Metro City Metro City Metro City Metro City Metro City Metro City

Availing

both HRA

and Home

loan

exemption

Non-Taxable Allowances

Investment/Bills Details

Child Education Allowance

Medical Reimbursement receipts sub

Transport/Conv. Allowance

LTA receipt submitted

Food Coupons

Periodical Journals

Uniform/Dress Allowance

Telephone Reimbursement receipts su

Prof. Development receipts submitted

Car Expenses Reimbursement receipts

Internet expense receipts submitted

Driver Reimbursement

Salary receipts submitted

Other

receipts

submitted

Non taxable Gratuity

Non taxable

Non

taxable leave

Houseencashment

rent income-30%

ded.

Balance Salary

Professional Tax

Net Taxable Salary

Total Home loan amount

During Service

Self occup. Home Loan Interest Component

Letout property Home Loan Interest

Municipal taxes paid on letout proper

Gross Total Income

Deductions under chapter VIA

Life Insurance Premium payment

Employee's contribution to PF

PPF (Public Provident Fund) or SSAS

Equity Tax saver Mutual Funds - ELSS

National Savings Certificate (NSC) de

National Savings Scheme (NSS) depos

Senior Citizen Savings Scheme (SCSS)

Post Office/Tax saving Bonds investm

Children Tution Fees paid

Housing Loan Principal repayment

Tax saving Fixed Deposit for 5 yrs. or

Stamp Duty/Registration charges for

Other Eligible Investments

Total of Section 80C

Pension Fund (80 CCC)

NPS/APY Deposit 80CCD

Total Deductions u/s 80C, 80CCC, 80

80D (Medical insurance premium

for Self and/or Family)

80D (Medical insurance premium

for Parents)

80DD (Maintainence of depandant

disabled)

80DDB (Medical treatment for

specific diseases)

80E (Interest paid on Higher

Education Loan)

80U (Handicapped person/Perm.

Disability)

Donations - 80G (100 % deductions)

Donations - 80G (50 % deductions)

80CCG - RGESS

Employer NPS deduction u/s 80CCD(2

Saving account Interest section 80TT

Parents above 60 years

With Severe Disability

Patient Below 65 years

With Severe Disability

Total Taxable Income

Taxable Income rounded off

Income Tax on Total Income

Tax credit u/s 87A

Income tax after Tax credit

Surcharge

Income tax including surcharge

Education Cess @ 3%

Income tax including education cess

TDS (Tax deducted at source)

Pending Tax Payable

Monthly Deductions from salary

April

TDS (Tax deducted at source)

Professional Tax

Employee's PF Contribution

Self/Employee's NPS/APY Contribution

VPF (Voluntarily Provident Fund) contribution

Deduction for company provided transport

Deduction towards State Labour welfare Fund (LWF)

Deduction towards company provided Group Term insurance

Deduction towards Leave availed

Deduction towards company provided medical insurance

Other Deductions from Employer

Employer's NPS Contribution

Employer's PF Contribution

May

June

July

August

September

October

November

December

January

February

March

In Hand Salary

In Hand Salary without reimbursments

Total Income in this year

ADVANCE TAX SCHEDULE - NOT APPLICABLE FOR SENIOR CITIZENS

Total Tax as per Consolidation Sheet:

PARTICULARS

Payable upto 15th September

Payable upto 15th December

Payable upto 15th March

%

30%

60%

Payable

-

100%

Paid

-

Difference

-

Success

Savings for Tax

PPF Investments

April

May

June

July

August

September

October

November

December

January

February

March

Total

Long Term infra bonds investment

April

May

June

July

August

September

October

November

December

January

February

March

Total

Post Office/Tax saving Bonds investments

April

May

June

July

August

September

October

November

December

January

February

March

Total

Pension Fund (80 CCC) investments

April

May

June

July

August

September

October

November

December

January

February

March

Total

GROSS TOTAL

Children Tution Fees paid

Вам также может понравиться

- Income Tax Calculator 2012-13Документ2 страницыIncome Tax Calculator 2012-13Cool Friend GksОценок пока нет

- Declaration For Income TaxДокумент1 страницаDeclaration For Income TaxjameerahmadОценок пока нет

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherДокумент6 страницMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yОценок пока нет

- Income Tax Sheet Bmoi 2012 13Документ2 страницыIncome Tax Sheet Bmoi 2012 13rincepОценок пока нет

- Income Tax Calculator FY 2013 14Документ4 страницыIncome Tax Calculator FY 2013 14faiza17Оценок пока нет

- Personal Tax Heads of Income and DeductionsДокумент3 страницыPersonal Tax Heads of Income and DeductionsHimanshu AroraОценок пока нет

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Документ28 страницModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyОценок пока нет

- Individual Financial Plan: Complete The Gray Shaded CellsДокумент6 страницIndividual Financial Plan: Complete The Gray Shaded Cellsraven505Оценок пока нет

- Genpact Vs InfosysДокумент3 страницыGenpact Vs InfosysNidhi MishraОценок пока нет

- MG Pricing For 2015Документ1 страницаMG Pricing For 2015api-191645396Оценок пока нет

- Individual Income Tax Formula ExplainedДокумент2 страницыIndividual Income Tax Formula ExplainedHenry ZhuОценок пока нет

- Income tax filing deadline reminderДокумент2 страницыIncome tax filing deadline remindermakamkkumarОценок пока нет

- Calculate your income tax with this online tax calculatorДокумент4 страницыCalculate your income tax with this online tax calculatorraattaiОценок пока нет

- Click Here To Check Take Home Salary-Once You Have Filled Input Sheet CompletelyДокумент24 страницыClick Here To Check Take Home Salary-Once You Have Filled Input Sheet CompletelyHARSHITA JOSHIОценок пока нет

- Latest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsДокумент90 страницLatest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsTambi ThambiОценок пока нет

- Subcategory Category Group CategoryДокумент4 страницыSubcategory Category Group CategoryHolly M. Barrios DiNardoОценок пока нет

- Cost To The CompanyДокумент15 страницCost To The CompanyrockОценок пока нет

- Whichever Is Lower Is Exempt From Tax. For ExampleДокумент13 страницWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedОценок пока нет

- Maulana Azad National Urdu University: CircularДокумент4 страницыMaulana Azad National Urdu University: CircularDebasish BiswalОценок пока нет

- Tax Deductions Under Sections 80C, 80D, 80EE, 80G and MoreДокумент5 страницTax Deductions Under Sections 80C, 80D, 80EE, 80G and MoreAjay MagarОценок пока нет

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsДокумент4 страницыFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiОценок пока нет

- Basic Income Tax StructureДокумент69 страницBasic Income Tax StructureAditya AnandОценок пока нет

- Latest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Документ6 страницLatest Income Tax Slabs and Rates For FY 2013-14 and AS 2014-15Michaelben MichaelbenОценок пока нет

- 2009 Tax Calculator-1Документ2 страницы2009 Tax Calculator-1Sandip S NagareОценок пока нет

- Income Tax Calculation StatementДокумент106 страницIncome Tax Calculation Statementnarayanan630% (1)

- Wealth Managemen T Project: Submitted by Talluri PrasanthДокумент7 страницWealth Managemen T Project: Submitted by Talluri PrasanthPrasanth TalluriОценок пока нет

- Please Complete All Answers in U.S. Dollars: Check All That ApplyДокумент1 страницаPlease Complete All Answers in U.S. Dollars: Check All That ApplyMihai MîţuОценок пока нет

- Auto Income Tax Calculator Version 5.1 2010-11Документ19 страницAuto Income Tax Calculator Version 5.1 2010-11Bijender Pal ChoudharyОценок пока нет

- Easy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - TaxworryДокумент2 страницыEasy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - Taxworrytiata777Оценок пока нет

- Income Tax Exemptions For The Year 2010Документ4 страницыIncome Tax Exemptions For The Year 2010Homework PingОценок пока нет

- Whichever Is Lower Is Exempt From Tax. For ExampleДокумент13 страницWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarОценок пока нет

- Tax Deductions under Sections 80C to 80U from Gross Total IncomeДокумент19 страницTax Deductions under Sections 80C to 80U from Gross Total IncomeShamrao GhodakeОценок пока нет

- IT Calculator 14 15 Taxguru - inДокумент16 страницIT Calculator 14 15 Taxguru - inanirbanpwd76Оценок пока нет

- 56 Incom Tax CalculatorДокумент6 страниц56 Incom Tax Calculatorspecky123Оценок пока нет

- Sample - Comprehensive Personal Financial Plan - Created in ExcelДокумент147 страницSample - Comprehensive Personal Financial Plan - Created in ExcelSatish Mistry100% (1)

- DonationS UNDE INCOME TAX ACTДокумент2 страницыDonationS UNDE INCOME TAX ACTManjeet KaurОценок пока нет

- Budget PlannerДокумент202 страницыBudget PlannerHarry Warren BrownОценок пока нет

- Financial QuestionnaireДокумент8 страницFinancial QuestionnaireNishant PokleОценок пока нет

- Cashflow Planner - Panduan Aliran Tunai: ArahanДокумент7 страницCashflow Planner - Panduan Aliran Tunai: ArahanWeesswee Binti KusainiОценок пока нет

- Income Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxДокумент16 страницIncome Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxshikhaxohebkhanОценок пока нет

- Income Tax Calculator 2013-14Документ2 страницыIncome Tax Calculator 2013-14kirang gandhiОценок пока нет

- Income Tax Deductions FY 2016Документ13 страницIncome Tax Deductions FY 2016Nishant JhaОценок пока нет

- How To Save Tax For FY 2013 14Документ42 страницыHow To Save Tax For FY 2013 14duderamОценок пока нет

- Nsfas Finassist FormДокумент11 страницNsfas Finassist FormnephembaniОценок пока нет

- Bifurcation of Salary ArrearsДокумент3 страницыBifurcation of Salary ArrearsSrikant SheelОценок пока нет

- Guideline On ITДокумент19 страницGuideline On ITmikekikОценок пока нет

- Enter Necessary Data For Income Tax CalculationДокумент15 страницEnter Necessary Data For Income Tax Calculationsa_mishraОценок пока нет

- Til Debt Do Us Part Budget SheetДокумент1 страницаTil Debt Do Us Part Budget SheetLauren Kelin33% (3)

- Traditional College StudentДокумент20 страницTraditional College Studentapi-253951251Оценок пока нет

- Employee Investment Declaration Form For The Financial Year 2019-2020Документ2 страницыEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghОценок пока нет

- Some of The Tax Saving SavingsДокумент3 страницыSome of The Tax Saving SavingsNira SinhaОценок пока нет

- Buckner 2 Family BudgetДокумент1 774 страницыBuckner 2 Family BudgetEmily Jones BucknerОценок пока нет

- Application For 16-18 Study Programme Award 2020-21 - Updated v1 InteractiveДокумент2 страницыApplication For 16-18 Study Programme Award 2020-21 - Updated v1 InteractiveFaizan AliОценок пока нет

- J.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleОт EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleРейтинг: 3 из 5 звезд3/5 (1)

- J.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything DeductibleОт EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything DeductibleОценок пока нет

- Setting up, operating and maintaining Self-Managed Superannuation FundsОт EverandSetting up, operating and maintaining Self-Managed Superannuation FundsОценок пока нет

- Sports & Recreation Instruction Revenues World Summary: Market Values & Financials by CountryОт EverandSports & Recreation Instruction Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Snapdeal Has Some Good NewsДокумент4 страницыSnapdeal Has Some Good NewsPankaj BatraОценок пока нет

- Little Book of LegacyДокумент20 страницLittle Book of Legacyrhythems84Оценок пока нет

- Night Safari MapДокумент1 страницаNight Safari MapPankaj BatraОценок пока нет

- Singapore Visa Travel Agent List IndiaДокумент2 страницыSingapore Visa Travel Agent List IndiaPankaj Batra100% (7)

- KYC - New Individual FormДокумент2 страницыKYC - New Individual FormRoshan MalhotraОценок пока нет

- India Income Tax CalculatorДокумент1 страницаIndia Income Tax CalculatorPankaj Batra100% (24)

- Singapore Metro RoutemapДокумент1 страницаSingapore Metro RoutemapPankaj Batra100% (1)

- NPS Subscriber Registration FormДокумент6 страницNPS Subscriber Registration FormPankaj Batra100% (1)

- India Income Tax CalculatorДокумент1 страницаIndia Income Tax CalculatorPankaj Batra100% (24)

- Singapore City MapДокумент1 страницаSingapore City MapPankaj Batra100% (1)

- Map of SingaporeДокумент1 страницаMap of SingaporePankaj Batra100% (2)

- UTI Mutual Fund PIN Generation FormДокумент2 страницыUTI Mutual Fund PIN Generation FormPankaj Batra100% (2)

- Kotak Securities Address Update FormДокумент2 страницыKotak Securities Address Update FormPankaj Batra100% (1)

- Epfo Social Security NumberДокумент2 страницыEpfo Social Security Numberrana1979100% (8)

- HDFC Mutual Fund PIN Generation FormДокумент2 страницыHDFC Mutual Fund PIN Generation FormPankaj Batra100% (2)

- Kotak Securities Nomination Update FormДокумент1 страницаKotak Securities Nomination Update FormPankaj BatraОценок пока нет

- IFSC India Bank Codes For NEFT RGTSДокумент146 страницIFSC India Bank Codes For NEFT RGTSPankaj Batra100% (2)

- Kotak Mutual Fund PIN Generation FormДокумент2 страницыKotak Mutual Fund PIN Generation FormPankaj Batra100% (1)

- IFSC India Bank Codes For NEFT RGTSДокумент1 436 страницIFSC India Bank Codes For NEFT RGTSPankaj Batra100% (2)

- Sundaram Mutual Fund PIN Generation FormДокумент4 страницыSundaram Mutual Fund PIN Generation FormPankaj BatraОценок пока нет

- State Bank Mutual Fund PIN Generation FormДокумент4 страницыState Bank Mutual Fund PIN Generation FormPankaj BatraОценок пока нет

- ICICI MF Update Details FormДокумент2 страницыICICI MF Update Details FormPankaj Batra100% (1)

- Reliance Mutual Fund PIN Generation Form India Personal FinanceДокумент2 страницыReliance Mutual Fund PIN Generation Form India Personal FinancePankaj Batra100% (2)

- Franklin Mutual Fund PIN Generation FormДокумент1 страницаFranklin Mutual Fund PIN Generation FormPankaj BatraОценок пока нет

- Principal PNB Mutual Fund PIN Generation FormДокумент1 страницаPrincipal PNB Mutual Fund PIN Generation FormPankaj BatraОценок пока нет

- DSP ML Mutual Fund PIN Generation FormДокумент1 страницаDSP ML Mutual Fund PIN Generation FormPankaj Batra100% (2)

- Birla MF Update Details FormДокумент1 страницаBirla MF Update Details FormPankaj BatraОценок пока нет