Академический Документы

Профессиональный Документы

Культура Документы

QUA06194 SalarySlipwithTaxDetails21 PDF

Загружено:

UtsabИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

QUA06194 SalarySlipwithTaxDetails21 PDF

Загружено:

UtsabАвторское право:

Доступные форматы

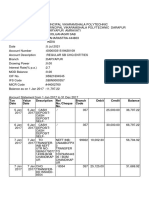

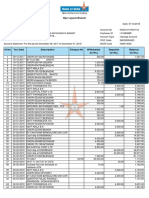

QUATRRO GLOBAL SERVICES PRIVATE LIMITED

Basement, 24, C- Block, Community Centre, Janak Puri, DELHI 110058

NEW DELHI

Pay Slip for the month of December 2015

All amounts in INR

Emp Code :

Emp Name :

Department:

Designation:

Grade

:

Gender

:

DOB

:

QUA06194

UTSAB DAS

Technical Solutions Group

SR. SOLUTION ENGINEER

1B

Male

21 Jan 1993

DOJ:06 May 2014

Location

:

Bank/MICR :

Bank A/c No.:

Cost Center :

PAN

:

PF No.

:

Payable Days:31.00 ESI No.

:

UAN

:

GURGAON

110234004

100028712850 (INDUSIND BANK LTD)

QBPO

BJLPD9135L

HR/GGN/29073/6109

100065673392

Earnings

Deductions

Description

Rate

Monthly

Arrear

Total

Description

BASIC

13570.00

13570.00

0.00

13570.00 PF

HRA

3917.00

3917.00

0.00

3917.00 LWF

CONV

1600.00

1600.00

0.00

1600.00

CBPB(Bonus)

2500.00

2500.00

0.00

2500.00

MED ALL

1250.00

1250.00

0.00

1250.00

GROSS EARNINGS

22837.00 22837.00

0.00 22837.00

GROSS DEDUCTIONS

Net Pay : 21199.00 (TWENTY ONE THOUSAND ONE HUNDRED NINETY NINE ONLY)

Amount

1628.00

10.00

1638.00

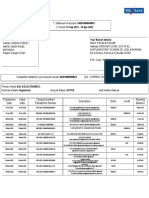

Income Tax Worksheet for the Period April 2015 - March 2016

Description

BASIC

HRA

CONV

CCA

CBPB(Bonus)

MED ALL

INCENTIVE

Gross

Exempt

Taxable

153222.00

0.00 153222.00

44308.00 32679.00 11629.00

16800.00 16800.00

0.00

2250.00

0.00

2250.00

21250.00

0.00 21250.00

13050.00 13050.00

0.00

2095.00

0.00

2095.00

Deduction Under Chapter VI-A

Investments u/s 80C

Provident Fund

18386.00

LIC DIRECT

25000.00

Taxable HRA Calculation(Metro)

Rent Paid

48000.00

From: 01/04/2015

To: 31/03/2016

1. Actual HRA

44308.00

2. 40% or 50% of Basic

76611.00

3. Rent > 10% Basic

32679.00

Least of above is exempt

32679.00

Taxable HRA

11629.00

Gross

252975.00 62529.00 190446.00

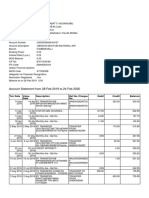

Tax Working

Previous Employer Taxable Income

0.00

Previous Employer Professional Tax

0.00

Professional Tax

0.00

Under Chapter VI-A

43386.00

Any Other Income

0.00

Taxable Income

147060.00

Total Tax

0.00

Tax Rebate u/s 87a

0.00

Surcharge

0.00

Tax Due

0.00

Educational Cess

0.00

Net Tax

0.00

Tax Deducted (Previous Employer)

0.00

Tax Deducted on Perq.

0.00

Tax Deducted on Any Other Income.

0.00

Tax Deducted Till Date

0.00

Tax to be Deducted

0.00

Tax per month

0.00

Tax on Non-Recurring Earnings

0.00

Tax Deduction for this month

0.00

Total Investments u/s 80C

43386.00

U/S 80C

43386.00

Total Ded Under Chapter VI-A43386.00

TDS Deducted Monthly

Month

April-2015

May-2015

June-2015

July-2015

August-2015

September-2015

October-2015

November-2015

December-2015

Tax Deducted on Perq.

Total

Total Any Other Income

0.00

Personal Note: This is a system generated payslip, does not require any signature.

Amount

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

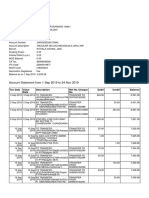

Вам также может понравиться

- Dec Salary SlipДокумент1 страницаDec Salary SlipPrayagОценок пока нет

- Feb2017Документ2 страницыFeb2017Kalai SelvanОценок пока нет

- Payslip Prakhar PRA745634 1635359400000Документ1 страницаPayslip Prakhar PRA745634 163535940000024hours service centerОценок пока нет

- Adecco India Pvt. LTD.: Payslip For The Month of May 2019Документ2 страницыAdecco India Pvt. LTD.: Payslip For The Month of May 2019Secret EarthОценок пока нет

- SalaryReport 0404701 201802Документ61 страницаSalaryReport 0404701 201802Abhay SinghОценок пока нет

- Acct Statement XX0012 25052023Документ5 страницAcct Statement XX0012 25052023JunoonОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент3 страницыStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancerashikaОценок пока нет

- 1571988702732Документ33 страницы1571988702732LS GUPTAОценок пока нет

- Bank statement summary for Rayudu PeyyalaДокумент12 страницBank statement summary for Rayudu PeyyalaDr V SaptagiriОценок пока нет

- Contact details for Singhhania University in RajasthanДокумент1 страницаContact details for Singhhania University in RajasthanNungcba DonerОценок пока нет

- SBI savings account statement summaryДокумент6 страницSBI savings account statement summaryKrishna rajaОценок пока нет

- RetailAccountStatement 638177701684443330Документ2 страницыRetailAccountStatement 638177701684443330ankiankita SounОценок пока нет

- Comviva Technologies Limited: Pay Slip For The Month of March 2012Документ1 страницаComviva Technologies Limited: Pay Slip For The Month of March 2012Prabhakar KumarОценок пока нет

- Account Statement PDFДокумент12 страницAccount Statement PDFLeo ClintonОценок пока нет

- HDFC Bank statement for Deepanshu GargДокумент5 страницHDFC Bank statement for Deepanshu GargDeepanshu GargОценок пока нет

- Salary Slip Report SpecimenДокумент1 страницаSalary Slip Report SpecimenMuhammad Zeeshan HaiderОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент5 страницStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancethiyaguОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент2 страницыStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRohan ChavanОценок пока нет

- Screenshot 2023-07-06 at 3.03.02 PMДокумент8 страницScreenshot 2023-07-06 at 3.03.02 PMShweta KothariОценок пока нет

- mPassBook 20221201 20230301 1617Документ6 страницmPassBook 20221201 20230301 1617Manojkumar PrajapatiОценок пока нет

- 1 Jan 2017 To 31 Dec 2017Документ19 страниц1 Jan 2017 To 31 Dec 2017DIPAK VINAYAK SHIRBHATEОценок пока нет

- eSewa Punjab Non Encumbrance Certificate ApplicationДокумент1 страницаeSewa Punjab Non Encumbrance Certificate ApplicationDiljan AliОценок пока нет

- Salry DecДокумент1 страницаSalry DecAnkush KumarОценок пока нет

- Ku XLR 4 Gls ZJ 2 YqqfДокумент5 страницKu XLR 4 Gls ZJ 2 YqqfdeepanshuОценок пока нет

- Account Statement: Non-TransferableДокумент2 страницыAccount Statement: Non-Transferablemaakabhawan26Оценок пока нет

- Current Ac DavinderДокумент8 страницCurrent Ac DavinderSonu F1Оценок пока нет

- SB Account Statement SummaryДокумент15 страницSB Account Statement SummaryMandalabatti noorasabuОценок пока нет

- SIVARAJA G Account StatementДокумент3 страницыSIVARAJA G Account StatementSivaraja GopinathanОценок пока нет

- Aman Verma Bank StatementДокумент4 страницыAman Verma Bank StatementAman VermaОценок пока нет

- Salary Slip (31692031 April, 2019) PDFДокумент1 страницаSalary Slip (31692031 April, 2019) PDFMuhammad AdnanОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент5 страницStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAmit GodaraОценок пока нет

- 1453875621523E19p2rGrQ4tFxCDj PDFДокумент6 страниц1453875621523E19p2rGrQ4tFxCDj PDFAditya ParabОценок пока нет

- 914010004015551 (5)Документ3 страницы914010004015551 (5)Eureka KashyapОценок пока нет

- Archana V Offfer LetterДокумент10 страницArchana V Offfer LetterKetsyОценок пока нет

- AccountДокумент10 страницAccountDeepak GautamОценок пока нет

- Review your bank statement onlineДокумент3 страницыReview your bank statement onlineSam BabuОценок пока нет

- PNBONE Mpassbook 124831 1-11-2022 1-11-2023 6781XXXXXXXX4385 UnlockedДокумент13 страницPNBONE Mpassbook 124831 1-11-2022 1-11-2023 6781XXXXXXXX4385 Unlockedmrrobotmod15Оценок пока нет

- Customer No.: 22855256 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressДокумент12 страницCustomer No.: 22855256 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressBalakrishna SОценок пока нет

- 1563270990991Документ11 страниц1563270990991JohnОценок пока нет

- DrLipika1Документ4 страницыDrLipika1Jr AkongaОценок пока нет

- StatementOfAccount 225476905 Jan06 133048 PDFДокумент7 страницStatementOfAccount 225476905 Jan06 133048 PDFmannarmannanОценок пока нет

- PDFДокумент6 страницPDFAjit RaoОценок пока нет

- Income From Salaries: Rs. Rs. Rs. SCH - NoДокумент2 страницыIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriОценок пока нет

- SasssДокумент1 страницаSasssAdil SyedОценок пока нет

- Bhanu Pay SlipДокумент1 страницаBhanu Pay SlipShyam ChouhanОценок пока нет

- March 2019 Payslip for Vijay RahiДокумент1 страницаMarch 2019 Payslip for Vijay RahiVijay RahiОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент57 страницStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNagendrababu VasaОценок пока нет

- Telangana State Board of Intermediate Education: Hyderabad: Online Memorandum of MarksДокумент1 страницаTelangana State Board of Intermediate Education: Hyderabad: Online Memorandum of MarksSaikishore Naidu100% (1)

- Account Statement SummaryRTGS INB:CR02646079TRANSFER TO99827044308 /RTGS INB:CR02653891TRANSFER TO99827044308 /99922999224,99,976.004,99,976.00Документ4 страницыAccount Statement SummaryRTGS INB:CR02646079TRANSFER TO99827044308 /RTGS INB:CR02653891TRANSFER TO99827044308 /99922999224,99,976.004,99,976.00Mufaddal RashidОценок пока нет

- Rpc Layout Branch Account StatementДокумент3 страницыRpc Layout Branch Account StatementmohmmedОценок пока нет

- Salary Slip SriwatiДокумент2 страницыSalary Slip SriwatiFauziliza JayaОценок пока нет

- Statement of Account 201003072715: Eljos 40/1 GF Muktidham Estate Opp Danav Park Nikol AHMEDABAD 382350 Gujarat IndiaДокумент6 страницStatement of Account 201003072715: Eljos 40/1 GF Muktidham Estate Opp Danav Park Nikol AHMEDABAD 382350 Gujarat IndiaAnonymous n30qTRQPoIОценок пока нет

- Gaurav Joshi Payslip Nov 2021Документ1 страницаGaurav Joshi Payslip Nov 2021Gaurav Jay JoshiОценок пока нет

- Government of Telangana: PAYSLIP:-DEC-2020Документ2 страницыGovernment of Telangana: PAYSLIP:-DEC-2020Raghavendra BiduruОценок пока нет

- Salary Slip January 2023Документ1 страницаSalary Slip January 2023SYAHRIL 25071991Оценок пока нет

- StatementOfAccount 244682927 Dec10 173649Документ16 страницStatementOfAccount 244682927 Dec10 173649vsguru15Оценок пока нет

- Pay Slip January 2019Документ1 страницаPay Slip January 2019Ajay KumarОценок пока нет

- Udyam Registration Certificate Details for Mushroom Plant in HaridwarДокумент1 страницаUdyam Registration Certificate Details for Mushroom Plant in HaridwarDeepanshu Singh PanwarОценок пока нет

- QUA06194 SalarySlipwithTaxDetails22 PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails22 PDFUtsabОценок пока нет

- Quatrro Global Services Private LimitedДокумент1 страницаQuatrro Global Services Private LimitedZubairsaeedОценок пока нет

- QUA06194 SalarySlipwithTaxDetails23 PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails23 PDFUtsabОценок пока нет

- MQUA06189 - SalarySlipwithTaxDetails May2015Документ1 страницаMQUA06189 - SalarySlipwithTaxDetails May2015UtsabОценок пока нет

- Server QuestionsДокумент4 страницыServer QuestionsUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails24 PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails24 PDFUtsabОценок пока нет

- MQUA06189 SalarySlipwithTaxDetails JulyДокумент1 страницаMQUA06189 SalarySlipwithTaxDetails JulyUtsabОценок пока нет

- QuesДокумент2 страницыQuesUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails3Документ1 страницаQUA06194 SalarySlipwithTaxDetails3UtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails22 PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails22 PDFUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails20 PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails20 PDFUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetailsДокумент1 страницаQUA06194 SalarySlipwithTaxDetailsUtsabОценок пока нет

- Also Prepare Well With The Topics Given BelowДокумент2 страницыAlso Prepare Well With The Topics Given BelowUtsabОценок пока нет

- MQUA06189 SalarySlipwithTaxDetails JulyДокумент1 страницаMQUA06189 SalarySlipwithTaxDetails JulyUtsabОценок пока нет

- Office 365Документ1 страницаOffice 365UtsabОценок пока нет

- 4 Office365Документ6 страниц4 Office365UtsabОценок пока нет

- QUA06271 SalarySlipwithTaxDetailsДокумент1 страницаQUA06271 SalarySlipwithTaxDetailsUtsabОценок пока нет

- June SalaryДокумент1 страницаJune SalaryVivek KumarОценок пока нет

- QUA06194 SalarySlipwithTaxDetails14Документ1 страницаQUA06194 SalarySlipwithTaxDetails14UtsabОценок пока нет

- MQUA06189 SalarySlipwithTaxDetails AugustДокумент1 страницаMQUA06189 SalarySlipwithTaxDetails AugustUtsabОценок пока нет

- June SalaryДокумент1 страницаJune SalaryVivek KumarОценок пока нет

- MQUA06189 - SalarySlipwithTaxDetails June15Документ1 страницаMQUA06189 - SalarySlipwithTaxDetails June15UtsabОценок пока нет

- MQUA06189 - SalarySlipwithTaxDetails April 2015 PDFДокумент1 страницаMQUA06189 - SalarySlipwithTaxDetails April 2015 PDFUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails PDFДокумент1 страницаQUA06194 SalarySlipwithTaxDetails PDFUtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails3Документ1 страницаQUA06194 SalarySlipwithTaxDetails3UtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails9Документ1 страницаQUA06194 SalarySlipwithTaxDetails9UtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails3Документ1 страницаQUA06194 SalarySlipwithTaxDetails3UtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails3Документ1 страницаQUA06194 SalarySlipwithTaxDetails3UtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails4Документ1 страницаQUA06194 SalarySlipwithTaxDetails4UtsabОценок пока нет

- QUA06194 SalarySlipwithTaxDetails3Документ1 страницаQUA06194 SalarySlipwithTaxDetails3UtsabОценок пока нет