Академический Документы

Профессиональный Документы

Культура Документы

1 46365tds-Exempt PDF

Загружено:

Sandeep Kumar0 оценок0% нашли этот документ полезным (0 голосов)

57 просмотров9 страницОригинальное название

1_46365tds-exempt.pdf

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

57 просмотров9 страниц1 46365tds-Exempt PDF

Загружено:

Sandeep KumarАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 9

Endad no. cay;

f

bape

4

‘CORPORATE OFFICE, TAXATION SECTION 3|

'S* FLOOR, BHARAT SANCHAR BHAWAN,

JANPATH, NEW DELHI - 110001

Ph No. 011-23037306 /23734087 |

Fax : 011-23718886 |

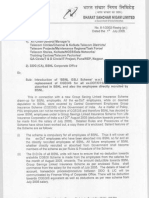

BHARAT SANCHAR NIGAM LIMITED

[A Government of tndia Enterprise]

Uefprinaction secamaday onchine born.

No.1001-02/2015-14/Taxation/BSNL/TDS Exempt./¢1° Dated:31.06.2013

To,

The Chief General Managers,

1. All Telecom Circles/ Metro Telephone Districts/ Maintenance Regions/ Project Circhs

2. Task Force/ Data Network/ NCES/ QA / T & D (Inspection)/ Telecom Stores/

Telecom Factories/ CPAO (ITI Bills)/ IT Circle, Pune

3. ALTTC/ BRBRAITT/ NATFM

4, All PGMs/Sr. GMs/GMs, BSNL C.O.

Subject: Certificate granted to BSNL under Section 197 (1) of the Income Tax Act,

1961 relating to Tax deduction at source (TDS) at lower rates ~ Reg.

Please find enclosed herewith certificate granted to BSNL by Income Tax

Department, u/s 197 (1) of Income Tax Act, 1961 relating to deduction of Tax

at Source for period from 14.06.2013 to 31.03.2014 (FY 2013-14), under their

ref. No. 197/AABCB5576G/2013-14/1-8 dated 14.06.2013 for information and

necessary action. The rate at which tax has to be deducted at source by the

parties covered by the Certificate(s) under various Sections of the Income Tax

Act is indicated in the said Certificates. It is also to be ensured that all the bills

received from other parties/Banks etc. named in said certificate have deducted

Tax at Source (TDS) at the rate mentioned in the certificate

Enel.: As Above (8 pages) \ vo

(.N. Singh)

General Manager (Taxation)

BSNL Corporate Office

Copy to: IFAs of All the Circles

Pb) SY In cime Tax] 2023 |Uy Dated BIH 228

byte, T The IFAs of al SS4s 1b Bin

2 Gm (Cmts) sec ua Chonct gent

BAW cvibleted an a, e

Binepe a7 7c Rajpusa,

5 C0 (ans) coule ofrin cndlyoul 7

Chief Accounts Officer (CA)

BSNL, ofo CGMT,

Pb, Circle, Chandigarh

CERTIF CATE UNDER SECTION 197(1) OF THE INCOME TAX ACT, “961

RELAT NG TO DEDUCTION OF TAX AT SOURCE

DCIT CR 49(1) (A TOG)

203-AAVKAR BHAWAN,

LAX NAGAR-DELHI

Ref No : 1ST/AABCSSS7EGI29°3-161 Dent Date : 13,

‘Subject : Certificate u/s 197 for PAN: AABCBSS76G

TAN (as per colume 2) are hereby 2uthorzed to make payment or crecit the amount of the nature (a5 per column 5) to ‘ne extert of Rs. (2s per column 8)

e rate (a5 72" coum ?, exclusing ecucation cess’sircrarge as ezzicable| ‘0. or 25 the cese may be to tne acccurt of BHARAT SANCHAR NIGAW

10001

Deousiors) wit

afar gecucting tex

[IWiTED, SHARAT SANCHAR NIGAM LIMITED. 8 148 “17 FLOOR, STATESMAN “OLSE, SARAKHAMBA ROAD, CONNAUGHT PLACE, NEW DELM!, DEL

(PAN: AABCBSS76G) ever whom | nave ursdicton to issue this cerca

Se Cerificate TAN TAN NAME NOPC Amount = Tax Vi

No, Number Rate trom Date

ft (2) I) i) 18} wer) 18

orscuzeer RrKBOREIEE BHARTI TED ee 2 sean

2 crisaweasc RTKEOB=RS= BHARTI ARTEL UMTED 90a

5 oscwecen 2e-coszeon CCANARA BANK. PARLIAMENT STREET 13a 6903800 SEMAR

© aisoncer peLconse:¢ CCORPCRATION BANKING oy 90378<00 SAR

5 IND/AN BANK NEW DELMINA'N BRANCH 26a 3099700 seavanera

8 cswasse INDUSING BANE TD reek 7582000

7 sreswesee oELPDosTEC PUNIAS NATIONAL BANKSE7E8 186, ece0008 sean

& muRt65500 VANCE COMMUNICATIONS 234720 ay carareeoo FAUNAS SHUARE

€ euvRoeasse ELANCE TELECOM LiT=D sooo 7 “AWAD “SeWAR-TE

2 cetsse227e S18 EM SHYAM TELESERV-CES LIMITED 3010997 “esuNAS STatARNE

3e.5258976 ‘STATE BAnxOF ROA WEES 2 UNS

2 3e.s2"1885 STATE BANKGF NDIANEW OELMI VAN BRANCH pooezesce 2

3 caronecie TATA TELESERVICES eerste

+ Decreases TATA TELESERVICES « aroenesce

3E.va228'c UO BAK OF NIA resosz00 2 SeMARete

‘ BLanars280 VODAFONE SOUTH UTED orm 3 ShvaRend

7 2008 SHESCSETIA sores 2

© araso3e25¢ ewoayizce > vasa

‘uvgoisere eartoo sve

DEL DOBTE7S, escnes00 Sevan

(es ver column 2) ¢ poc-ransteran.e ard valid for above PAN tolde: fev naymierts 0° cred cy wheteves name called vricneveis e272"

: Assessing Ofice

SEAN DCiT CIR £841} (AOS)

CERT FICATE UNDER SECTION 197(7) OF THE INCOME TAX ACT, 1964

RELATING TC DEDUCT.CN OF TAX A” SOURCE

DCIT CR 4911) (A 70S)

403-AAVKAR BHAWAN,

LAX NAGAR-DELH!

Dates “eJUNTS

Ref No : 127/ARBCBS576G!2013-14 /2

Subject : Certificate u/s 197 for PAN: AABCBSST6G

Decucior’s) wit TAN (as pe” column 3) are hevesy autho: zec to make pay nen: or credit Ine amoun: cf tne “ature (as per column §) tc the extert of Rs. (28 per column 6)

after cedcting tax a: the vate {as pe" cols? 7. excludg educetion cess/surcharge a8 aDzlicadle) co, or a the case may be to the acccurt ot SHARAT SANCHAR NIGAM,

LIM:TES BhARAT SANCHAR NIGA\ FLOOR, STATESVAN HOUSE, SARAKHAMBA ROAD, CONNAUGHT PLACE, NEW DELMI DELMI-t10007

IPAN: AABCS5576G) over whom | have jsissiction to issue ths certificate

Sr Cerificate TAN TAN NAME NOPS Amount Tax Valid Effective

No. Number (Rs) Rate _ trom Date ‘cance!

[2} 131 14) 15) t eit) Oate(s0),

oN78E9 CHEDEZIOSS DiS-NET WIRELESS LMNTED ose proear 2

2 OvsG61265A MUMFOR"730 1A. EXPRESS CORPORATION es vse; 13 i

3 tisooass sRocmErZ6 ‘CU-ARAT URUA ViCAS NIGAN LINTED 38 aosscsee 2 3

4 siawes7s avesore2e DEA CELLULAR LNTEC cee: 3

5 prtowasse memriooeses DEA CELLAR L 2 13

8 oraewesee PTANMose90 2 1s

cHNerss6 2 13

snicas72® wr 2 3

BiaMo-9826 vosen 2 2

vo c00%56 (SEA CEUUGAR L soto 2 2

7 TEA CELLULAR 7 oa BET “2 -

cHEwstetD ER CELLULAR U isa zoe 2 13

cauaenes 2 CELLULAR ve wecoe 2 “3

KMS TF {DEA CELLULAR LITE ee awe 2 13

smugnass DEA CELLULAR ee sere 2 3

RT4001238 1LAN2 #8 TECHNOLOG! * S570 2 ELUN

Tve008s66 WATE se M702 EUS

DeLnoa72ac MAT OM. NFORMATICS CENTRE SERVICES INC se 2asee00 2 “eUNs

wwuners \SCLEAR POWER CORPORATION 3 nese 2 eu

Devonscsea cence 61 saesereo 2 tenes

icneveris carter between she period

ae

Assessing Ovicer

DGIT oR 48(") ATO)

+ above DAN holder fer payrerts

on fe "osaeciive TANI} aetore

ecit 3y whetever name called w

fas pe: columa 21is tonterstevabie

CERTIFICATE UNDER SECTION 197(1) OF THE INCOME TAX ACT, *964

RELATING TO DEDUCTION OF TAX AT SOURCE

DCI CIR 49(1) (A 70S}

403-AAYKAR BHAWAN

LAXMI NAGAR-DELHI

Ret No : “QT/AASCBSS76GI2013-16 13, Print Date: 12JUNS13

Subject : Certificate wis 197 for PAN: AABCBSS7EG

er column 7, exclucing education cessisurcha’ge as appl

(17ED, SHARAT SANCHAR NIGAM LIMITED, 8 148 “1TH =LOOR, STATESVAN HOUSE, BARAKMAMBA ROAD. CONNAUGHT PLACE, NEW DELHI, DELH

PAN, AABCBSS78G) over whom | have jurisdictos to issue this cerificace

9° 8s tre case may De fo the accourt of BHARAT SANCHAR NIGAM

10001

St Certificate TAN TAN NAME Nope Effective

Cancel

131 14 Date(t0)

wuvRiessoc {NCE COMMUN CATIONS Li ooas0s7c0|

2 unoazes RELIANCE TELECOM LIMITED see 58520000

2 S282872 2h SHVAM TELESERVICES LMATED 230900

‘ UASTBAOA, TATA COMMUNICATIONS LnMTED 381 383000

5 aLTo2S208 TATATELESERV CES LIMITED, se: sn23i200

. pscross26 TATA TELESERV-CES UnnTED ae ‘ce5r700

, uonssi¢ ‘TATA TELESERV.CES VAHARASHTRALMITED sae 2878400

: wuvucsee LUVION BANK OF IND'A 20) 18 12608200

De.ro2s2e \VBzOCON “ELECOVMUNICATIONS LMTEC we enagsi00

coussoanese 3 sren279e

er eee8800

2 DEL HOS"68 me 5:3600

7 SUR+9"508D se e2s6ssce :

cALMERIEEC va 13652120

caeececaz? VODAFONE SOUTH LMTED

~vonucesz LYCEAONE SOUTH LNETED

BENEDORE

2103500,

s1asse0

5:9600

ee 79:0700

exotosoe

vorsaseos 7 tein

1d whichever’ earlier cetween the oericd

The sesifcate {as cer colume 2} 's rar-transtecable ar valid ‘or above PAN nolde: fc: payre:

se corenlinin Bars © unigss tis sascalen ay me unset ° ve TANS) before inal da:e

: Assessing Officer

(SEAL: OC'T CIR 49/15 (70 3;

by whatever name cal

CERTIFICATE UNDER SECTION 197(1) OF THE INCOME TAX ACT, 1967

RELATING TO DEDUCTION OF TAX AT SCURCE

DCIT CIR 49(1) (A TO G)

203-AAVKAR BHAWAN.

LAXMI NAGAR-DELHI

Rel Ne | 1SIAABCBSS7EG201S- 16/4 Print Date : 1€-JUNGB

Subject : Certificate uls 197 for PAN: AABCBSS76G

tn TAN (es ger column 3} ace nereby auitonzed to make payment or erent zne arrount of he Hatets 125 Bt selumn 5} to the extent of Rs. (28 per coiumn 6)

ry sine ate (as per colume 7 exclsding education cessisurcharge oe aopcable) of 8 Se nay be fo the account of BHARAT SANCHAR NIGAM

Se ANGHAR NIGAM LIMITED, 3 168 17H FLOOR, STATESMAN HOUSE, BARAKTAMEA SOAD. CONNAUGHT PLACE, NEW DELHI, DELHi-11000"

TAN. AABCBSS76G} over whom I have jursciction to issue this certficate,

TAN TAN NAME, NoPC Amount «Tax ‘Valid Valid’ EMectve

Rate from Date tillDate Canc

mtr] £8) (8) Datelt0)

2 tedUNts BARE

Deductor

131 4 (81

22 ro

cHesosarta NRCG

° nvonnee785 [ANDH3A SANK CORE BANKING SOLUTIONS DEPARTMENT 194) 2 veduNet3 [S1aMAR-te

orragwizeec eN=8008220 SANK OF MAHARASHTRA ae sregera 2 YUUNES

£ SHSGwGIPA DELETIBN8 2ARAT BROADBAND NETWORK LINITED 198 sezizeo 2 HEIN

5 prrgawans! MUYBIE7"7S -SUARAT BUS NESS CHANNEL LIMITED s90 peteeaco 2 TEJUNSS

sQ3CUG | RTKBO3E2EE 138s psrggezeoo «2 M4uUNS

DecB0RessC g2cseoo 2 1M

-PRHCORIIE BrARTI HEXACOWLN siiziereo 2 YUUNSS

a oF S4.5507508 BHART! HEXACOM A yprariag 2 TE WUNGS. SHMARTE

> orrsaws"s! DeLB0N8T7A BeagT TELEVEDIAL ezwgecco 2 1EJUNSS SMARTS

p1TsQwaiee WANGIEEETF ~ “3 goa: COWMUNCATIONS INDIA PRIVATE UMFED ~ pps "2 TEDUNS “She

gerscwarsp BLRCEI30= NASA BANA, HEAD OFFICE ANNEXE, aaoesran? «2 MUNG BiMARTE

Tesguatee RLRCOSs25> ‘CENTRE 708 E GOVERNAN. roupericd 2 HUW WARE

2 guiagwsi7s JPRC002568 COMMERCIAL TAKES COMWISSIONER, eezosoe 2 SoNaR.

crvseware€.2367C28 GENERAL OF SYSTEMS AND DATA MANAGEMENT aeoseece 2 anwaare

fe prtsenSt9F CHEDCDIOEE 1p SeNET WIRELESS LIMITED syorzsox00 2 FeMAR

saGnaZ0D CHEECODOA “RON 0S CORFORAT CN OF TAM, NADU LIVITED vs7eresco 2 suvaante

Be3218 AnteGOEREE GUJARAT NFORMATICS LTC s70s200 2 ssARve

Loyssouaa) Ovar2sss PARMA pesegend 2 pevarie

2558 ce susrios 2 srvaae

orsGas7am SPUDIESSS EACELLUMA

ne yeriTuate {as por solurr* 2) 5 nanctranstareb'e ard valid for above PAN 7) by wherever name celled whichever is earier betwee :he perod

seerupe 9 and ®, unless t's carce.ed by 76 "ser THimation to resnec

re =

Assess 0g Offer

DeIT SIR 481} ATSC,

CERTIFICATE UNDER SECTION 197(1} OF THE INCOME TAX ACT, 1951

RELATING TO DEDUCTION OF TAX AT SOURCE

DCIT CIR 49(1) (A 70 G}

403-AAVKAR BHAWAN

LAXM! NAGAR-DELH!

Ret. No | 197/AABCSSETEGI201G-"4 /5 Print Date : 14-JuN-'3

‘Subject : Certificate ws 197 for PAN: AABCASS76G

Secuctor(s) wih TAN (as ger column 3) are nereby 2uthorzed to make cayment oF credit the amcunt cline nature {95 08” column 8) tc the extert of RS. (as oer colunin 6)

afte deg.ciing tax at he rete (as pe column 7. excluding ecuce:ion cessisutcharge as aricacie) tc, 0 as the case “vay be fa the account of SHARAT SANCHAR NIGAN-

UNITED. BARAT SANCHAR NIGAW; LIMITED. 8 148 “17H FLOOR, STATESVAN HOUSE, BARAKHAMBA AOAC. CONNALGH™ PLACE, NEW DEL™ Deve

PAN: AABCBSS76G) over whom ‘ have ;."'scictior {2 issue this cevifcate

TaN TAN NAME, NoPC Amount

Re)

13 i 18]

exesoresoe enere 30, essecssn0 2 a

wwRTioose8e IDEA CELLULAR 198, so7seseco 2

srwonsese 284 es7esens 2

cHoarses te: soserseco 2

paw a0879F ‘02 capsscace 2

aLawres26 Be cmeroee 2

svoaoates 96 eoiezreo—z eUNS2 Iatwance

ee ae zoesaezeo 2 “JUNG'S

JPsTESSE. ongseoe 2

cue a631D SEACELLULARLCTED seaoesac’ «2 sauna at

nore DrACECU.AR NitED arsine”

erett97" SEACELLULARLMKTED cresseoc 2

A 22883 DEA SEL YAR MITES 6. arsanrco 2

>euieaote EA CELLAR LMITED vssseot 2 “eu

ewoeaece DER CELLULAR c¥"ED 2

8c DEA CER 35 2

‘vonmings288 DER CELULAR virED 2

ecg IND AW BAN 2REW’ S35 ESTATE AND ENTENO TURE DEDARTMENT 2 seuunerd iawaRe

INDIAN FARYENS FERTIUSER COUPERATVE SWWTED 3 2 reuKed at

ND AN SVERSEAS SANK ANNA 5 oe mazeisea tau "3

ve PAN older for saymets ¢° ces! by whatever same call

lier Detween tre povoe

be

Assessing OMicer

SEAL Com iz agit AOS

Ret No. : SST/AABC3SS76Gi

Decuctor(s) wit TA

1g per eolurnr 3) are nereby 2u!

14) OF THE INCOME TAX ACT, 1961

CERTIFICATE UNDER SECTION “9

‘SOURCE

RELATING TO DEDUCTION OF TAX

DCIT CIR 49(7} (A TOG)

403-AAYKAR BHAWAN

LAXMI NAGAR-DELHI

2013-16 16 Print Date

Subject Certificate uls 197 for PAN: AABCBSS766

tne extent of Rs. {2s per column 8)

Of BHARAT SANCHAR NIGAN.

nn 8) 10

we account

cf the nature (28 per co's

viged te maxe payment or crecit ine amou’

fos per our 7, excluding education cessisircherge 6 AP ole) c. or as the case May 96

after deducting tax at the rate

aise, BHARAT SANC™AR NIGAM LIMITED. 6 148 7°78) Book STATESWAN HOUSE, BARAKHAMBA ROAD. SONNAUGHT PLACE, NEW DELHI, DELH!-11000"

AN wABCSSS7EG) over whom have jussdicion fe SUES certificate,

Sc. Certificate TAN TAN NAME, NoPc Amount = Tex Valid

No, Number Rate from Date

cy (2) 131 ro (51 cai7y 18)

prisewaeed -v2007#20 INFORWATION TECHNOLOGY AND CONINUN'CATION OEPAATME wwe 2 tun 3

2 orssgwaesn JPRI0TEBD [RCON INTERNATIONAL LIWITED 98s 752863002 14UUNHI3 STNARIE

2 swumsnseaeC LOOP MOBILE {INDIA LIVITED cars 2 1EWUNNS (GT-MAR TE

2 NATIONAL BANK FOR AGRICULTURE AND RURAL DEVELO! sesggtod 2 SEWN

5 peLNocTsEe "NATIONAL INFORMATICS CENTRE SERVICES INC racssag0 2 4UUNA3 (SIMARI

6 BLAPUERISE DRAGATH GRAM N BANK HEAD OFFICE ageremee 2 1EJUNSD STNARSTE

r TUR 3528 ENTURES LINITED sogergod 2 1EWUNSS. STARE

8 reo reaets 3 |gvMARne

* RELIANCE COMMUNICATORS LINED soaeser7ac 2?

° RELIANCE TELECON LICTEC sroseseao 2

y nanegcne38F s ia NARRADANIGAMTTS. frogeico 2

2 wsees7e TU MAHARASHTRA GOVESNMENT OF "AAT ARASHTRA SETU SOC! sore?

2 griggiisess cHESCHHD0S FV TECHNOLOGIES LIVED wraoe 2 SeMAa.te

4 grngwasr® De806%") SiS TEWA S»YAW TELESERVICES ~ soazessoc 2 TEVUNNTS“BTANARTE

15 orrsgwaseo UNS TI2508 rock FOLENG CORPORATION OF INDIA LI 1 Sreget0n 2 TEUNAS.STMAR TE

6 auwwa7eeta TATA COMMUNICATIONS | M\TED 2) sraroigig 2 MENUNEDBHMARIE

7 pyar! TATA CONSL-TRNCY SERVICES UTED eee peocree 2 NS

e en.cuDaztE “RTA TELESERVICES AIVITEC. sees yso7ac 2 NEMUNMD

lg yirngwaan® DEL 0088F ‘aNis TELESERY 184, 2 TeyOND BeMAR

2 noea31e ugh TELESERV.CES MAMARASHTRA UMITED. su 2 TUNE SHMAR TE

2s por soume

highever's eavier between the 22°00

ShA—

Assessing Olticet

CIT CIR 49)

2) ig nerversteracie ore ver name called W!

scanceiler by MELTS

CERTIFICATE UNDER SECTION 197(1) OF THE INCOME TAX ACT. “98!

RELATING TO DEDUCTION OF TAX AT SOLRCE

DCIT CiR 49/1) (A 70 G)

403-AAVKAR BHAWAN

LAXMI NAGAR-DELHI

Ref, No : 197/AABCBSS78G:2013-14 (7 Print Date + 14-JUN-13,

Subject : Certificate uis 197 for PAN: AABCSSS76G

fn TAN (28 per colurra 3) are hereby authorized to ake payrrert or credit the amourt ol the nature (es per column $} te the exlent of RS. (as per coluras 6!

aiter deducing tax at the sete {28 per column 7. exclucing educator cessisurcharge as applicable) to, of as tne case ~ey 2e te tre account of BHARAT SANCUAR Ricatt

MINED, BRARAT SANCHAR NIGAM LIMITED, 8 148 117+ FLOOR, STATESMAN HOUSE, SARAK™ANBA ROAD CONNAUGHT PLACE, NEW DEL=i, DELHI¢t 1090

PAN: AABCBSS78G) over whom | diction fo issue "is cenicate,

St Coriieate TAN TAN NAME NoPC Amount Tax Valid_——Valid——Ettectve

No. Number (Rs) Rate fromDate ill Date Cancel

aca (6) 151 1 wiry 18} 9] atelt0

20Ns82 TONE INS AET LITE say rosse7s9g 2 teyUNNS IoriaRee

2 crows, UNITEGH WRSLESS (EAST) PRNVATE La TED 194s 388185002 -16JUN-IS BARE

3 so 204328002 NeJUNNTD /2tAAR.TE

a re or3"300 2 *

5 sa; ssccere 2 fanacarte

a winzocen 1 UNEATIONS 16: SBE5e7O0 2 TELA SAMAR

7 JAVA BANK ~EAD OFF CE 263 eres 2

a NBCIESA VODAFONE €: oe

6 weaEnI0ESE vosarone cau, eenessnc

2 VODAFONE CE. ssseseaco

: - VonaF ove os. ni - serssac> 2

1" VoDsFoNe 3 GiINK 4s smsortee oz

3 VODAFONE persaasoc 2 “enn 21

2 VODAFCME ecesosco 2 eUNWa (2Taaa.te

* VODATONE NOMA 186257002 *EJUNIDS-MAR.YE

6 VODA-ONE VOBRE SERVICES LED vem 2

7 YODAFONE 8 peroresoo 2 ¥

a ea 3

9 002 Swan ie

e veacewees 2 s1asaa

ty payments cr cred: * Betweer the pericd

CERTIFICATE UNDER SECTION *97(1) OF THE INCOME TAX ACT 1967

RELATING 70 DEDUCTION OF TAX AT SOLRCE

DCIT CIR 43(1} (A OS)

403-AAVKAR BHAWAN

LAXW! NAGAR-DELHI

Print Date: 16-JUN13

QT/AABCRSS7EG:2013-14 8

Ret. No.

Subject : Certificate u/s 197 for PAN: AABCBSS76G.

i> TAN [as ger come 3) are heresy authorizes to 7iake payrvent or crecit the amount of Ine nature (a8 Der column 5) to "Ne extent of RS. (a8 per column 6)

ing tex at the fate (a8 pes column 7, exciucing education cessisursharge 3s explicate) tc. as ine case may be :c Te account of BARAT SANCHAR NIGAV

LIMITED, SHARAT SANCHAR NIGAM LIMITED, 8 148 11TH FLOOR, STATESMAN HOUSE. BARACTAMBA ROAD, CONNAUG-T PLACE, NEW DELI, DELHI-17000"

(PAN, AABCBSS76¢

“igdition to issue this cer cate

Sr. Certificate TAN NAME NoPC Amount. Tex Valid Valid tective

Mo. Number (Rs) Rate “fremDate til Date Cane!

ui (1 1 (3 m1 (8)

a svorccssi2 VODAFONE SOUTH LE 263 e272“ EUNS

2 >ru7se3 VODAFONE SOU" 98s gese7io0 «2 HMUNAS

3 BENEDESESE VOSAFONE SPACETEL 196, seeneasee 2 aun

‘ asse0n: 108 VODAFONE WEST rae sreascte 2 tu

's nonirenste-e0 e enc vals ‘or azove PAN nc'ce” ‘cr payrrents or crecil by whatever rame calles Ww" chever's earlier between the period

Li

Assessing Officer

DGIT CIR 49/1) (A TOG)

‘The certicate (as per columns 7

28 29° columns 8 and 9 unless cancels by Me une” intimal

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Axis Bank Bank Faults: S.No. SSA Branch Address Reason For Fault ATR (Action Taken Report)Документ1 страницаAxis Bank Bank Faults: S.No. SSA Branch Address Reason For Fault ATR (Action Taken Report)Sandeep KumarОценок пока нет

- 1 - 51712scan0053 Tds PDFДокумент2 страницы1 - 51712scan0053 Tds PDFSandeep KumarОценок пока нет

- FTTH Number LocalityДокумент10 страницFTTH Number LocalitySandeep KumarОценок пока нет

- Query 2Документ20 страницQuery 2Sandeep KumarОценок пока нет

- 1 46365tds-Exempt PDFДокумент9 страниц1 46365tds-Exempt PDFSandeep KumarОценок пока нет

- BillДокумент1 страницаBillSandeep KumarОценок пока нет

- Orders - Not - Created - With Current CDR Due To Another Service Order Pending - WestZone - 05032016Документ23 страницыOrders - Not - Created - With Current CDR Due To Another Service Order Pending - WestZone - 05032016Sandeep KumarОценок пока нет

- Letter Reg. Women Help Line 1091 PDFДокумент1 страницаLetter Reg. Women Help Line 1091 PDFSandeep KumarОценок пока нет

- 1 49484centrrex TariffДокумент7 страниц1 49484centrrex TariffSandeep KumarОценок пока нет

- 1 65417SuspendedcollagesNov15Документ12 страниц1 65417SuspendedcollagesNov15Sandeep KumarОценок пока нет

- Recovery of IwftДокумент1 страницаRecovery of IwftSandeep KumarОценок пока нет

- 2 SSFДокумент130 страниц2 SSFSandeep KumarОценок пока нет

- AntennaДокумент1 страницаAntennaSandeep KumarОценок пока нет

- BB 56 122011Документ1 страницаBB 56 122011Sandeep KumarОценок пока нет

- Isdn Bri Back UpДокумент47 страницIsdn Bri Back UpSandeep KumarОценок пока нет

- From:: Varun KohliДокумент63 страницыFrom:: Varun KohliSandeep KumarОценок пока нет

- GSLISchemeДокумент22 страницыGSLISchemeSandeep Kumar100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)