Академический Документы

Профессиональный Документы

Культура Документы

Avco Fifo

Загружено:

Muhammad TalhaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Avco Fifo

Загружено:

Muhammad TalhaАвторское право:

Доступные форматы

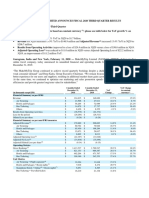

Example

Apply AVCO method of inventory valuation on the following information, first in periodic inventory system

and then in perpetual inventory system to determine the value of inventory on hand on Mar 31 and cost of

goods sold during March.

Mar 1

Beginning Inventory

60 units @ $15.00 per unit

Purchase

140 units @ $15.50 per unit

14

Sale

190 units @ $19.00 per unit

27

Purchase

70 units @ $16.00 per unit

29

Sale

30 units @ $19.50 per unit

Solution

AVCO Periodic

Units Available for Sale

= 60 + 140 + 70

= 270

Units Sold

= 190 + 30

= 220

Units in Ending Inventory

= 270 220

Weighted Average Unit Cost

Units

Unit Cost

Mar 1 Inventory

Mar 5 Purchase

= 50

Total

60

$15.00

$900

140

$15.50

$2,170

70

$16.00

$1,120

270

* $15.52

$4,190

220

$15.52

$3,414

50

$15.52

$776

27 Purchase

* $4,190 270

Cost of Goods Sold

Ending Inventory

AVCO Perpetual

Date

Purchases

Units

Unit Cost

Sales

Total

Units

Unit Cost

Balance

Total

Mar 1

5

140

$15.50

$2,170

14

27

29

31

190

70

$16.00

$15.35

$2,916

$1,190

30

$15.92

$478

Units

Unit Cost

Total

60

$15.00

$900

60

$15.00

$900

140

$15.50

$2,170

200

$15.35

$3,070

10

$15.35

$154

10

$15.35

$154

70

$16.00

$1,120

80

$15.92

$1,274

50

$15.92

$796

50

$15.92

$796

Вам также может понравиться

- Fifo MethodДокумент2 страницыFifo Methodwww_jeffersoncruz008Оценок пока нет

- Lecture Notes LIFO, FIFO Average CostДокумент11 страницLecture Notes LIFO, FIFO Average CostLegends FunanzaОценок пока нет

- Advanced Financial ManagementДокумент8 страницAdvanced Financial ManagementKRATOS GAMINGОценок пока нет

- Inventory ValuationДокумент26 страницInventory ValuationEricson ManceОценок пока нет

- Story of InventoryДокумент4 страницыStory of InventoryPrince AdyОценок пока нет

- FINMANДокумент4 страницыFINMANlaur33nОценок пока нет

- Inventory AccountingДокумент4 страницыInventory AccountingIndra ThamilarasanОценок пока нет

- Fifo Method and Debt Held As MaturityДокумент3 страницыFifo Method and Debt Held As MaturitysninaricaОценок пока нет

- SixДокумент6 страницSixHelplineОценок пока нет

- First-In First-Out (FIFO) Method - Example - Inventory ValuationДокумент2 страницыFirst-In First-Out (FIFO) Method - Example - Inventory Valuationmig007100% (1)

- Inventories and The Cost of Goods SoldДокумент27 страницInventories and The Cost of Goods SoldEzgi ÇebiОценок пока нет

- Inventory Method: FIFO (First In, First Out)Документ9 страницInventory Method: FIFO (First In, First Out)TEREОценок пока нет

- Chapter 6 Assignment Introductory Accounting Name: Nguyen Mai Phuong E6-5: (A) FIFO MethodДокумент4 страницыChapter 6 Assignment Introductory Accounting Name: Nguyen Mai Phuong E6-5: (A) FIFO MethodMai Phương NguyễnОценок пока нет

- Fifo PeriodДокумент24 страницыFifo PeriodlabasayungОценок пока нет

- Yasir Idrees Budget ModelДокумент22 страницыYasir Idrees Budget ModelkingyaseeОценок пока нет

- Chapter 9 Excel Budget AssignmentДокумент4 страницыChapter 9 Excel Budget Assignmentapi-261038165Оценок пока нет

- Accounting Study Guide PDFДокумент8 страницAccounting Study Guide PDFgetasewОценок пока нет

- Lifo FifoДокумент9 страницLifo FifoEprinthousespОценок пока нет

- Reporting and Analyzing InventoryДокумент48 страницReporting and Analyzing InventoryAlbert MorenoОценок пока нет

- CH 10 BudgetingДокумент83 страницыCH 10 BudgetingShannon BánañasОценок пока нет

- Accounting Exercise 7Документ2 страницыAccounting Exercise 7arshad mОценок пока нет

- ABC and FifoДокумент4 страницыABC and FifosninaricaОценок пока нет

- Cost of Goods Sold CogsДокумент29 страницCost of Goods Sold CogsArzan Ali0% (1)

- Beginning Inventory Cost of Goods SoldДокумент8 страницBeginning Inventory Cost of Goods SoldAndres BorreroОценок пока нет

- P6-2A Cost of Goods Available For SaleДокумент3 страницыP6-2A Cost of Goods Available For Saleandie dewantoОценок пока нет

- Advanced Finance Applied PowerPoint ChapterДокумент47 страницAdvanced Finance Applied PowerPoint ChapterasdfasfasdfasdfasdfsdafОценок пока нет

- CH 09Документ63 страницыCH 09Yustamar RamatsuyОценок пока нет

- F2 một số dạng BTДокумент15 страницF2 một số dạng BTdohanh0512Оценок пока нет

- MA Session 6Документ46 страницMA Session 6Sameer FaisalОценок пока нет

- Financial Management - Merchandise InventoryДокумент45 страницFinancial Management - Merchandise InventoryWaqas Ul HaqueОценок пока нет

- Week 8 Homework - Part 2 - Financial AccountingДокумент5 страницWeek 8 Homework - Part 2 - Financial Accountinglamvolamvo0912Оценок пока нет

- BreakevenanalysisДокумент10 страницBreakevenanalysisrraj09102002Оценок пока нет

- Break Even AnalysisДокумент6 страницBreak Even AnalysishmarcalОценок пока нет

- Name: Rahma Dewi Class: 2AD NPM: 061930500105 Group 1: ST TH TH TH THДокумент5 страницName: Rahma Dewi Class: 2AD NPM: 061930500105 Group 1: ST TH TH TH THRahma DewiОценок пока нет

- Accounting,: 21 Edition Warren Reeve FessДокумент63 страницыAccounting,: 21 Edition Warren Reeve FessimadОценок пока нет

- Description Units Unit Cost Total Cost Computation Total CostДокумент4 страницыDescription Units Unit Cost Total Cost Computation Total CostJoshua Capa FrondaОценок пока нет

- Lls 5e Chapter 07Документ58 страницLls 5e Chapter 07Gabrielle TanОценок пока нет

- FIFO LIFOegДокумент4 страницыFIFO LIFOegDayana MasturaОценок пока нет

- Inventory ValuationДокумент23 страницыInventory Valuationvkvivekkm163Оценок пока нет

- Income StatementДокумент2 страницыIncome StatementHiền PhạmОценок пока нет

- Hours and PayДокумент1 страницаHours and PaySara CarlsonОценок пока нет

- Workings:: Computing Cost of Sales and Ending InventoryДокумент2 страницыWorkings:: Computing Cost of Sales and Ending InventoryKia PottsОценок пока нет

- Schedule of COGSДокумент4 страницыSchedule of COGSSmithОценок пока нет

- Exam 1 Part 4 q1Документ3 страницыExam 1 Part 4 q1api-312583408Оценок пока нет

- Manufacturing Cost Accounting PPT at MBA FINANCEДокумент10 страницManufacturing Cost Accounting PPT at MBA FINANCEBabasab Patil (Karrisatte)Оценок пока нет

- CH 6: Budgets Budget Types: Why Budget? Planning Communication Control:Performance Evaluation MotivatingДокумент6 страницCH 6: Budgets Budget Types: Why Budget? Planning Communication Control:Performance Evaluation MotivatingUfuk ErdenОценок пока нет

- Vakho Tako SalomeДокумент27 страницVakho Tako SalomerbegalashviliОценок пока нет

- Funamentals of Acct - II - Chapter 1 InventoriesДокумент47 страницFunamentals of Acct - II - Chapter 1 InventoriesibsaashekaОценок пока нет

- Inventory Formula Excel TemplateДокумент4 страницыInventory Formula Excel TemplateMustafa Ricky Pramana SeОценок пока нет

- Chapter 6Документ17 страницChapter 6RB100% (1)

- Accounting Group ProjectДокумент5 страницAccounting Group ProjectParul ShahidОценок пока нет

- Chapter 4 Inventorie Ifa 4Документ38 страницChapter 4 Inventorie Ifa 4Nigussie BerhanuОценок пока нет

- Periodic Inventory-LIFOДокумент6 страницPeriodic Inventory-LIFOHassleBustОценок пока нет

- Schedule of Expected Cash Collections: Master BudgetingДокумент14 страницSchedule of Expected Cash Collections: Master BudgetingAniruddha RantuОценок пока нет

- Problem Sheet 3Документ4 страницыProblem Sheet 3Samyuktha KОценок пока нет

- Account & AuditДокумент40 страницAccount & AuditKalavathi KalyanaramanОценок пока нет

- Chap 3 - CVPДокумент19 страницChap 3 - CVPAhmad SayutiОценок пока нет

- Inventory Valuation-ProblemsДокумент3 страницыInventory Valuation-ProblemsKaran100% (1)

- Robinson Lawn Chair CompanyДокумент3 страницыRobinson Lawn Chair CompanymmmmmmmmmmmmmmmОценок пока нет

- Islamic Finance - Ethics, Concepts, Practice PDFДокумент130 страницIslamic Finance - Ethics, Concepts, Practice PDFMuhammad TalhaОценок пока нет

- CH 3 Culture PDFДокумент31 страницаCH 3 Culture PDFMuhammad TalhaОценок пока нет

- Audit FirmsДокумент1 страницаAudit FirmsMuhammad TalhaОценок пока нет

- CHB 2 StructureДокумент49 страницCHB 2 StructureMuhammad TalhaОценок пока нет

- TeamworkДокумент11 страницTeamworkMuhammad TalhaОценок пока нет

- Business Studies Revision Guide O LevelДокумент145 страницBusiness Studies Revision Guide O LevelMuhammad Talha89% (90)

- Corporation LawsДокумент113 страницCorporation LawsemmanvillafuerteОценок пока нет

- First Quarter 2022 Earnings Presentation May 5, 2022Документ30 страницFirst Quarter 2022 Earnings Presentation May 5, 2022ignaciaОценок пока нет

- Create LawДокумент47 страницCreate LawRen Mar CruzОценок пока нет

- BFD Test 1 With Solution Jun 2023 ST AcademyДокумент10 страницBFD Test 1 With Solution Jun 2023 ST AcademyHassan AzamОценок пока нет

- AFAR Finals With SolutionsДокумент16 страницAFAR Finals With SolutionsJr TanОценок пока нет

- 5419 Advance AccountingДокумент5 страниц5419 Advance AccountingmansoorОценок пока нет

- IAS 16 PPE and IAS 40Документ81 страницаIAS 16 PPE and IAS 40esulawyer2001Оценок пока нет

- 2010 SampleEntranceExamДокумент76 страниц2010 SampleEntranceExamPavan KumarОценок пока нет

- ACCT1101 - Questions - Chapter 06Документ5 страницACCT1101 - Questions - Chapter 06Zong Zheng SunОценок пока нет

- 6-ch 18Документ38 страниц6-ch 18herueuxОценок пока нет

- Far450 Fac450Документ8 страницFar450 Fac450aielОценок пока нет

- FAR 2 Weekly Quiz 1 Incomplete DraftДокумент5 страницFAR 2 Weekly Quiz 1 Incomplete DraftAhmed Raza Tanveer50% (2)

- F3ffa Examreport j13Документ4 страницыF3ffa Examreport j13onyeonwuОценок пока нет

- Olam Brokers' ReportДокумент9 страницOlam Brokers' Reportsananth60100% (1)

- Course Pack For AgBus 174 Investment Management Module 1Документ31 страницаCourse Pack For AgBus 174 Investment Management Module 1Mark Ramon MatugasОценок пока нет

- Ap8501, Ap8502, Ap8503 Audit of ShareholdersДокумент21 страницаAp8501, Ap8502, Ap8503 Audit of ShareholdersRits Monte100% (1)

- What Broke Paytm? - FrontlineДокумент9 страницWhat Broke Paytm? - Frontlinebaapuu5695Оценок пока нет

- Name of Business Projected Income Statement For The Years Ended December 31,2017-2021Документ10 страницName of Business Projected Income Statement For The Years Ended December 31,2017-2021Aries Gonzales CaraganОценок пока нет

- MakeMyTrip-Quarterly Report (Q3-2019)Документ14 страницMakeMyTrip-Quarterly Report (Q3-2019)AlbertОценок пока нет

- Wrigley Case GRP 5Документ13 страницWrigley Case GRP 5Kobi Garbrah0% (1)

- CAPE Accounting 2010 U1 P2Документ8 страницCAPE Accounting 2010 U1 P2leah hostenОценок пока нет

- b2-c1 Grande Finale Solving 2023 May (Set 2)Документ17 страницb2-c1 Grande Finale Solving 2023 May (Set 2)charlesmicky82Оценок пока нет

- Topic: Explain CAPM With Assumptions. IntroductionДокумент3 страницыTopic: Explain CAPM With Assumptions. Introductiondeepti sharmaОценок пока нет

- Financial Engineering Class Sesi 1 Ver 2.0Документ16 страницFinancial Engineering Class Sesi 1 Ver 2.0Davis FojemОценок пока нет

- Kotak Security Intenship ReportДокумент34 страницыKotak Security Intenship ReportEk Deewana RajОценок пока нет

- Chapter 2 - Statement of Cash FlowsДокумент23 страницыChapter 2 - Statement of Cash FlowsCholophrex SamilinОценок пока нет

- ICBMFinal Jayantha Dewasiriand ProfДокумент15 страницICBMFinal Jayantha Dewasiriand ProfRobbyShougaraОценок пока нет

- Cost Accounting 1 8 FinalДокумент16 страницCost Accounting 1 8 FinalAsdfghjkl LkjhgfdsaОценок пока нет

- API Training SheetДокумент21 страницаAPI Training SheetAnirban KunduОценок пока нет

- RamSync BriefДокумент5 страницRamSync Briefjoshua arnettОценок пока нет