Академический Документы

Профессиональный Документы

Культура Документы

SC Tax Return

Загружено:

Celeste Katz0 оценок0% нашли этот документ полезным (0 голосов)

450 просмотров12 страницIf you are Married filing jointly (even if only one had income), enter spouse's SSN above and full name here. If you have a foreign address, see page 14. Check box below will no! presidential.BRONXVILLE NY 10708 change your tax or refund.

Исходное описание:

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документIf you are Married filing jointly (even if only one had income), enter spouse's SSN above and full name here. If you have a foreign address, see page 14. Check box below will no! presidential.BRONXVILLE NY 10708 change your tax or refund.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

450 просмотров12 страницSC Tax Return

Загружено:

Celeste KatzIf you are Married filing jointly (even if only one had income), enter spouse's SSN above and full name here. If you have a foreign address, see page 14. Check box below will no! presidential.BRONXVILLE NY 10708 change your tax or refund.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 12

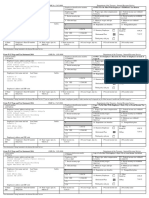

£1040 U's individual income Tax Return 2009] on nsvicos

Do not wee stale ints space

posta oc ie ose rates i ag er

Label | Vrewrtsinaneaceas— [lastrare Yours secory number

(See 8 | JOHN P. COFFEY

Scere, | © bipmeuncenstancanias care ee,

Use the IRS ANNE C. COFFEY

ody ase ere eer an me ee

Shewise |e r your $SNis) above.

Coie,

ee ee ee gia

Presidential BRONXVILLE NY_10708 ‘change your tax or refund,

Election Campaign Check here if you, or your spouse I fllng jomtly, want $3 to go to this fund (see page 14) > il You Bx Spouse

1] Srae 4 LJ Guamiroperson 9.6 chil Buel four cpencerk ner his”

Filing Status 2 |X! marries ting jointy (even t only one had income) ‘chid's name neve D>

3] Married ting separately. Enter spouse's SSN above 5 [] Quaitying widow(er) with dependent chid (eee page 16)

check only one

box

end ful ame ner

@ Pl Yousel sone canyon tae ee 3

Exemptions [K! spouse tegiguren

cae cece || ig een Pe cee 8

anna aed veatmermromn| nen Eon seat

\ioore han four“: KATHARINE C COFFEY. DAUGHTER "3

Gependerts,see CAMERON T_ COFFEY ‘SON x ae

poli CONOR S_COFFEY ey a ee

Total number of exemptions claimed trae" 5)

7 Voge, sos ts Ate Foi ez z

Income ta Tavabie crest Atach Schedule Bead ta 35,120

Atach Forms} Tax-exempt ners, Do notncloe on ine 88 » 171, 620]

‘W-2here. Also g_ Ordinary dividends. Attach Schedule B if required ga 134,875

auch Foams “Sater ce oe 23 oe 25,202]

W2G end 40. Taxable ehnds, es or fe at id ibcaincs tn fame page 23) 10

wacwnnel. 11 Almny receved 1

vain 12 Business income or oss), Atach Schedule C or EZ A

Fawn 13 congo fs, Mich See tt eco och D Gs =3,000

Seepege22. 14 Otvergans or(onees) tach Form 4797 “8

15a IRA distributions [15 'b Taxable amount (see page 24) [156]

162. Penclon and anes “(ea 1 Taxable amount (Sepa 25) [46D

Enclose, butdo 17 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 47 4,939,447

aot attach, ary 43 Farm income or (loss) Altach Schedule F 18

Bayment. AO 49 rrpqmetconpeaten ees 1820p i at 82 19

Porm 1000-V. 20a Sol soiy brs 2a Taxable amount (ve page 7) [20]

21 Obernime Lt ype ada (e507) 2 26

22__ Add the amount inh far ight column for ins 7 through 34 Ths i your total income | 22 8,110,568

28 Educalr expenses (see page 29) 2

Adjusted 24 Ceran business expenses of esenvsts, performing aris, and

Gross fee-basis government oficial tach Frm 2108 of 21062 | 24

Income 25 _Healn-savngs account ceducton. tach Form 6860 Fa

26 Mowing exponsos. tac Form 2003 3

27 One-half set-employment tax atch Scheie SE 2 72,187

26 Seftemployed SEP, SIMPLE, and quad plans 28 294,274

29 Seltemployed health Insurance deduction (see page 30) Fy 16,589|

30 Ponaly on ear wthraval of savings 20

31a Almony gad Recipients SSN b 3a

22" TRAdeducion (se page 31) 2

33. Studer an ierestdacuton (see page 38) 33

34 Tallon and feos deduction tach Form 8817 3

38. Domesteproducton actiaies deduction, Atach Fom 6608 [35

26. lines 23 Bough a0 32 rah 95 x 383,050

37 _Subiract ne 38 tom ine 2, Tis is ou aus gross income » [a 4,727; 518

Fy Disclonre, Privacy Ret and Paporwrk Reduction AGEN, S60 PODS. im 1040 cn

Fm 1040 000, JOHN BP. & ANNE C. COFFEY

998,

[Samsara __b tryna im ori s iesbatn pae So stn De 3B

Deduction oq. itemized deductions (from Schedule A) or your standard deduction (see leh margin) 4a] 1,222,226

'Difyou are increasing your standard deduction by certain ea estate txes, new motor

sess ‘vehicle taxes, 2 net aster los, attach Schedule Land check hee (seepage 3% 400 []

Borentne | 41 Subtract ine 40a from line 38 at 3,505,292

32.82, | 42. Exemptions ne 38's $125,100 o ass and you dt not provide housing to 2 Migwestem

can be displaced individual, multiply $3,650 by the number on line 6d, Otherwise, see page 37 42 12,165

CTA ey serra eeepc ep iinet 3yaes 497

febhace 95 | 44 Taxper ne 9 iether L] Fea BL ] ror? [17187916

sAtobers | 45 Alternative minimum tx (see pape 40), Atach Form 6251 45

[oko M8 Adin ana as > [ae| 1, 187, 916

BRS) ay Foreign tax cro. tach Form 1176 requires a 6a4

Tenosting| 42 Stor hid and dependent cae expenses. tach Fom 2441 [a8

menestina| 49 Education ced fom Form 8863, kne 29 42

Sebvee | 50 Retirement savings contibutons ced. Atach Form 6890 50

HERGS" | 51 chia ax creat (see page «2) 1

vac | 52 Croats tromFom: aL] e505. b [7] 9830 © [1] sets 2

fests. | 53 Ober cess tom Fema [] 3e00 b [] aeot « s

54 Akd nes 47 trough 53. These re your total reds s 684

55 _ Subtract line 54 from line 46. If line 54 is more than line 46, enter -0- > | 55 1,187,232

86 Self-employment tax. Attach Schedule SE 56 144,373

Other 57 Umepened socal saunly and Medcaretaxtom Fora] 4137» [] 8519 al

158 Adatona tax on IRA, other qualifledretrement plans, ee Atach Form SS28itrequred (56

59 rattnstmes « [] a8 nro» DR House enpyrentines Mich St [301 6523

{60 _ Aad ines 55 trough $8. Ths is your total tax > [ool 1,338,128

(1 Federal nome tax wield rom Forme W2 and 1000 a

Payments 62 2009 estimated tax payments and amount appid from 2008 retum 62 1,279,253)

63 -Malrg nak py and goverment eles cedisAtac SoheddeM [63

Tyosrawa'—Bla Earned income credit 1c) os

austvng |b Nontaxable combat pay election [64D

SBiedlele] 6s —Adconal cic tax crt tach Fam 882_ es

————* 66 Refundable education credit from Form 8863, ine 16 66

67 _Fsttme homebuyer cred tach Form 5405,

68 Amount paid with request for extension to fle (see page 72) 68 60 , 000)

68 Excots soil socumty and ter 1 RRTA tx witha (eae pga 72| 68

ole clot tea Focea [-] sole] aaa 2 [1] oon] anon

74s 263485917 Tne 0 pymats e1n| 1,339,253

Refund 72 WWline 77 is more than line 60, subtract line 60 from line 71. This is the amount you overpaid 72 1,125

Srectdepet? 738. Amount line 72 you want refunded to you. Form 8880 is aached checkhere Pe [] [73a

Seesa9e73 pw Routing number be type [] checking [] savngs

Beets Pd Account rumber

orForm 58874 _ Amount of line 72 you want applied to your 2010 estimated tax 74 |

‘Amount 75 Amount you owe. Subiract ine 7 or ne 60. For deals on how io pay, seepage 7@ P| 75 o

You Owe _76 Estate ax penal (see pape 74) [76 | o

Thi Partjo0}O0 tN oto prone cs sem win Ree ope TOR] Toe, Coputo"Gws [] We

Designee (une b_LAWRENCE_TORELLA tone oo & 212-686-5900

5 ie paraee Toa TOSS aL ae ey RS TS SS ST TS gg aT Mg aT

Rig ey ee Save b ene: Boot cpr ct no eeu eaten at tarotn oA pope Tiny louie ane

Sep .TTORNEY

ferzacoos ¥Speoses soars Wa anion Both avn ate | Seuss ceasten

eee le R

Praswery| ate Tepe

paid SoaceD Bow O

Preparer's remsnaneio TORELLA & ASSOCIATES LLC rm . =

Use Only jorsitsrercioyos)p 303 FIFTH AVE SUITE 1605 Phone no

Sees occ” NEW YORK Ny 10016 212-686-5900

aa Form 1040 200%)

SCHEDULE A Itemized Deductions coo i. 5454

{Form 1040) 2009

Pigacramtelnecesin(..,| De Attach to Form 1040. See Instructions for Schedule A (Form 1040), ABET o. OF

Raets) shown cn Fa 1000 T Your sort sory nomber

JOHN P. & ANNE C. COFFEY

Medical ‘Caution. Dont nude expanses rambureed or pal by oer

and 1 Mesical and deta expenses (seepage A-1) 1

Dental 2. Enerancut tom Fem 108, e382

Expenses 3 wtpy ine 2 by 7.5% (075) 3

4 Subic ine 3 om ine ne Sis mare than ine 1 entero ‘

Taxes You 5 Sisto and ocl check only one box:

Paid a X Income taxes, or > 5 634,833)

(See b | Genera sales taxes

page A-2.) 6 Real estate taxes (see page A-5) 6 77,694!

1 New rato’ ven gcc tom ne 1 of he workshest on

Dace Sap ine Py Cheetos co a8 7

8 Ofertas. List ype and amount

8

9 Add lines § through & 2 712,527

Interest 10 Home mortgage interest and points reported to you on Form 1094 _10 62 , 292!

You Paid 11 Hone motyape interes ot epare oyouon Fon 1088. pita the

(see pon em Duh ane, se ape 7 nd sho ta

poge M6) pes’ name, iri no, an ares.

Note. “

Perscal 12 ais no eporedio you on xm 108. See page A for

serest Special ies 2

BR scible 13 Cuaiied mongage insurance pramiums (se page A7) 1

14 investment intrest tach Form 4952 required. (See

page AS) “

415 Add lines 10 through 14 45 62,292

Gifts to ‘16 Gifts by cash or check. If you made any gift of $250 or

‘Charity more, see page A-8 16 483,414!

ityou made a 17 Othe then by cash or check i ny if of $260 or moe, sew

Qikand gate page A-8 You must tach Form 8283 if over $500, ” 9,600)

enefitfor i, 48 Carryover from prior year 18

SeRSeDO BR yg els nes 16 MMOH 1 says uia

Casualty and

Theft Losses 20 Casvaty o htt ss(es). Atach Form 4684. (S00 page A-10.) 2

job Expenses 21 Unreinbursed enployeeexpenses—job reel. ion dues job

soe earn’ seston sc Atak Fes S15 or F0SE? fees ee

age £10) >

Miscellaneous Hf

Deductions 22 tax preparation fees 22 6,700)

See 23 Other expenses—investmen, safe depos box. List ype

page A-10.) ‘and amount P

PORTFOLIO INC DED (K-18) 23 8,397

24 ines 21 trough 23 28 15,097

25 Enter amount from Form 1040, line 38 [25 4,727,518)

26 Mulply ine 25 by 2% (02) 2 94,550

277 Subtract ine 26 rom in 24 ine 2's moc than ine 24, eter 2 o

Ber 2B Other—fom ist on page A-H. List ype and amount B

Migceaneous

Deductions 2

Total 28 1s Form 1040, ne 38, ovr $165 80 (over 885400 merried fing separate? ¥

Itemized No. Your deduction not mtg, Ac the amount in he fa ight column

Deductions lines trough 28 Ais, ere this amount on Form 1040, Ine dda >|20| : 1,222,296

X Yes. Your dosucton may be ites. See 9999-11 forthe anounto ent

30 you elec to temize deductions eventhough they ar ess than your standards

deduction, check here * LIMITED BY AGD

ade R Farm TOADY BOS

Fox Papanwark Reduction Act Note, see Form TOAD instructions

New York Sate Department of Taxation and Finance

Resident Income Tax Return (iong form) 209 + «IT-201

New York State @ New York City @ Yonkers

For the full ear January 1, 2009, through December 21,2009, or fiscal year beginning

rn cron yn, se hes ein ons tenting

Years ie nal Yann rata aon no) W You Sa

oan p CorrEY

Spins tntraeané niente ne Seuss a set te

5 Rane c CorrEy

Frases ecco ngs) (rr sntreniy) mtn Ne acre

i oes

BRONXVILLE

NY 10708

manent home address (see instructions, page 61) unter and shee ot rao.) Aparmen umbe

$) BRONXVILLE

soa senetcsemimber 069

Cy. wiloe, orpst oe swe tone Teopaers te ofaeon Sets chen

Ny Piel © 3

() Filing) Shoe (D) Choose direct deposit o avo paper check eins delays

status — (©) 01401 07 you spouse maintain ving

mark an (2) X Mate ing jit rtm Guavters nV Gung 2000 we renneaves No. X

Xin (ocr apices unbraboe) (Ey enue ena NYC purtyen

fone box: (2) Maced fing separate tun Tesidonts only xe.

(tar seus’ sal sec rumbe bv (0) Manterot ments you he NY Cyn 2008

(4) Head ofneusehol th autivng person

(2 urea ot nets your spouse ben

(8) Quativing widower with dependent cid vin

(8) Did you itemize your deductons on (G) Enteryour2-gt special condition code

You2008ederalincome trav"? Yas Xo (8) ippteati et are

(©) can you be claimed a8 a dopandont Wappicable, sso ener your second 2a

Snanohertapayersfederlreimm™ Yes No X {peal condition code

/income and adjustments

‘iy uk year New Vek State resides may fle th farm. For ines 1 cugh 1 below evar

your income tems atl astnent a ty appear on your fea en eee pas 83).

[No see naga 4 insets fr enowing aoa

s, salaries, tins, ate 1

Se intrest income 2 39,120.

ay dividends, 3 134,875.

le refunds, credits, o offsets of state and local income taxes ao mente 4

ny received 5.

288 income o loss (aac copy of federal Schedule Cx C-EZ, Ferm 1040), 6

| gan oF loss (requea,atach a cap tte Schedule O, Form 1040) 2 -3,000.

gains or losses (atch a copy of federal Fe 4797) 8

le amount of RA distibutons. If received as a beneficiary, mark an X in the box 8

le amount of pensions and annuities, W received as a beneficiary, mark an X inthe box 10.

real estate, royalties, partnerships, S corporations, trusts, etc (tn sryfeaeal Senta fom so) 11 4,939,447,

income oF 18s tach a copy of ederal Saneule F, Form 1040) 12.

ployment compensation in excess of $2,400 per recipient 13.

le amount of socal securty benefits (ls anion ine 27) 14

income seepage Identity, MISCELLANEOUS 1. 126.

pes 1 through 15 16. 5,110,568.

federal adjustments to income mepaets Mdentify: SEE STATEMENT 1 17 383,050.

adjusted gross income (subtract ine £7 from line 16) 18 4,727,518.

zor1091022

{our pages of this original scannable return with the Tax Department.

nn

Federa

1 Wag

2 Teal

3 Ordin

4 Taxal

5 Almo

6 Busin

7 Capt

8 othe

9 Taxa

10 Taxa

11 Rent

12 Farm

13 Unen

14 Taxa

18 Other

16 Ada i

17 Total

18 Fede

You m

Page 2 of 417-201 (2009)

1 or your socal sceuty number

18 Federal adjusted gross income trom ine 18 onthe front page) 19. 4,727,518.

New York additions (sce page 63)

20 Interest income on state and local bonds and obligations (bt ot hose of NY Slate ris oc govermens) 20. 22,680.

21 Pubic employee 414(h) retirement contributions tom your wage and tax statements (ene pape ea) 2

22 New York's 529 colege savings program distributions (see nage 64) 2

23 Other seesouess|Mentfy. PARTNERSHIP ADDITIONS THRU BERNSTEIN 23, 208,304.

24 Add ines 19 though 23, 2, 4,958,502.

New York subtractions (see page 6=)

25 arable tnd, ces, of ft of alan lcalincame axes fronton) 25,

26 Pensions of NYS ad loca govermens andthe federal government ee Dag8 6828,

27 Taxable amount of socal security benefits (rom ne 4) 27

28 Interest income on US. government bonds 28.

28 Pension and annuity income excision (ee page 68) 29.

30 New York's 528 college savings program deducton/eamings 90. 10,000.

31 Othercesexem Klentiy, SEE STATEMENT 2 a 47,694.

132 Ad tines 25 through 31 22, 57,694.

‘89. New York adjusted gross income (subtract line 32 rom tne 24) 33, 4,900,808.

Standard deduction or itemized deduction (see page 73)

‘4 Enter your standard deduction (tom abe below or your itemized deduction rom wartenest

Yow, Mark an Xin the appropriate box ® ‘Standard. or «BOX ‘Remized ag, 246,507.

‘35 Subtract line 34 from tne 33 (tine 94s more than ne 33, leave bln) 35, 4,654,301.

36 Dependent exemptions (rot he sea tl deta exerts, ee rope 7) 3. 3,000.

37 Taxable income (subirac line 36 om line 35) ar. 4,651,301.

< or

New York State New York State itemized deductinn.waskehan.

Servtarel deouction table: ‘4 Mecical and dental expenses tedeaiSen Ames) a,

Fring status Standard deduction Taxes you pak geal Sch. tre), ». 712,527.

(fommetomsaas) (enerenlne ate) yy Stat, local and foreign income taxes inchuded

imine b above bt 634,833.

(1) Single and you marked © Interest you paid sed ne 9 ‘. 62,292.

tome Yes $3,000 Gist charity eas. 510 18 4 493,014.

© Casuaty and thet losses season 20) .

(1) Single and you marked {Job expensesimise. deductions uwaseh.Almea7)—t,

item C No 7.600 g Other mise. deductions reso. A tet o

hy Enter amount from federal Schedule Aine 29. 1,222,226.

(2) Married fing jin return 15,000. State focal, and foreign income taxes and

ther subtraction adjustments 66 page 73 i 611,979.

(3) Martie fing separate J Subiract ine ftom tine ® i 610,247.

retum 7.500 Addition adjustments ae) kK

1 Ada ines jand k \ 610,247.

(6) Head of household (with im temized deduction adjustment sepae75 m. 363,740.

s0 Joo

59 Enter cect name code no ang amount bso 100

{60 To claim more than two credits (ee page 19) ooo 100,

61 Nonrefundabe renters cred (262 page 57) eet {oo

{62 Add line 55 and line 67 through line 61. These are your total credits 62 Too.

{63 Subtract ine 62 rom ne. tes than zero, enter 0. 6 TIT, 845 [00

4g 71 Aternative minimum tax, Attach Schedule P (S40NR) on Joo,

E72 Mental Heath Services Tax (see nage 20) on 1, 835_[00

55 79 Other taxes andere recapture (see page 20) on Too

© 74 Add ine 63, ne 71, ine 72, ad ine 73. This your total tx ov 113,680 00

81 Calfomia income tax withheld (see page 20) oan, I.

{82 Realestate or other wthhokiing (see page 20) oe [oo

83 2008 CA estimated tax and other payments (see page 20) 983 109,263 [00

{84 Excess SDI (or POI) withheld. To ee If you quality 88 page 21) oo Too.

Child and Dependent Care Expenses Credit (see page 21). Atach form FT 3506,

Payments

85 Qualifying person's socal securty number on,

186 Qualifying person's socal securty numer o0s,

{87 Enter the amount from form FTB 3506, Pat il ine @ oor

‘88 Crild and Dependent Care Expenses Crecit from form FTB 3505, Par

89 Aid line 8, ine 6 ie 63, ne 64, ard ine 88. These are you tal payments 2 109,263 |00

+g 3 101 Overpaid tax. ie 8 is more than ne 74 subtract ne 74am ne 68 sot

5 102 Amountofine 101 you wat appt o your 2010 estimated tax e102

5 108 Overpaid tox aval this year, Subsract ine 102 rom ne 101 e103.

104 Tax due. Iline 89 is less than ine 74, subiract ine 89 from line 74

ror 4, 417 Too

‘Side 2 Long Form S40NR C7 2008 034 3132094

Yoursane JOHN P. COFFEY Your s¥ ot TIN

Calforia Seniors Special Fund, See instructions (see page 21)

‘Avheimer’s Dsease/Related Disorders Fund

California Fun for Senior Citizens

Rare and Endangered Species Preservation Program

‘State Chilaren's Trust Fund forthe Prevention of Child Abuse

Cafornia Breast Cancer Research Fund

Calfornia Firefighters! Memorial Fund

Emergency Food for Families Fund

Calfomia Peace Officer Memorial Foundation Fung

Catfornia Miltary Famly Reliet Fund

Callrna Sea Otter Fund

California Ovarian Cancer Research Fund

Municipal Shelter Spay-Neuter Fund

California Cancer Research Fund

ALSiLou Gehrig Disease Research Fund

Contributions

105 Add code 400 through code 414. This is your total contribution

5 sarawounrYou owe. As ine 04 ar 105 (ee page 2) 0 nat ond cash

£3 Mall FRANCHISE TAX BOARD, PO BOX 942867, SACRANENTO CA 942670001

ES saz interest, late return penalties, and late payment penalties 122 90)

TE 129 Underpayment of estimated tar Check thobox. [X] FTB S805 attached {) FTB S8OSF atached @ 123 |

EE 126 Total amount cue (see page 23). Enclose, but do not staple, any payment 24 4,507

¥25 REFUND OR NO AMOUNT DUE. Subtraci line 105 rom ine 102

‘Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0002 ons 00

% inte eromatonte authorize direct depos of your eur it oe or wo accounts. Dano tah vole nec ra poet ip

20009073) Hove you varied te rutin and account numbers? Use vole dlrs oy

De

é Checking

: Sovge 22

2 eRoamgnmiw Tye @Accontnmber 126 Drea depost avout

3 Thereraning aroun’ of ywtnd ne 125) 8 auored fe ret depos ino te scout shown blow

z Crecang

H sos 7

Reaigninber”_e Type @ Accominanber 227 Disc pont omen

Important: Atach a copy a your complete federal income tox run

Uncerpenaties of peay, | deca that have examined th etm, inciding accompanying schedules and statements andi the best of

fronledgo anc ble ue creck and conplee

You eortve Spouse sROPaaoraoe Cyne pan br eh

Sign (tape ena 9)

Here x x oe

is nawsl_Paawoprers sare (rcs of pep sed onal afomaioncl whch papa hv eyed) [@ Pal papow™s SONPTIN

bioges

space Ror

Frame eryons Tearanptyed Ti aoe @ Fen

ee, TORELLA & ASSOCIATES LLC

Gash) 303 FIFTH AVE SUITE 1605

NEW YORK, NY 10016

Do you want alow anche person odesas Ts Tetum wu oe pape ZV?

LAWRENCE TORELLA

rt Td Paty Designee’ Nore Talephone Naber

TO7I5 INT 30

034 3133094 Tang Form S40NR C7 2009 Side 3

“wasicree California Adjustments — SoHo

2009 _ Nonresidents or Part-Year Residents CA (540NR)

important: tach is schedule behind Long Form S4ONR, Side 3 asa supporing

Names 8 shown ann SaaTW

JOHN P. COFFEY

ANNE_C. COFFEY

Part | Residency Information, Complete all lines that apply to you and your spouse RDP.

During 2000:

1. Iwas domiciled in (enter state or country)

1b Iwas inthe itary and stoned in (enter state county)

2 mean Carat (na Ba tf rere a i

8. scae anova ter aw tester an dono),

Yourself

SHHSEREEEY Sou aie HEPES

4s arenes Caton er yer tater cunts)

'5 The number of day | spent in Calfomia or any purposes

6 owned a homeproperty in Calf (enter "¥es*cr"No")

Before 2008:

7 | was aCaltoia resent forte period of ent cats) z

8 entered Calforna on enter date)

9 Le Catfornia on (enter date

NEW_YORK

NO

NEW YORK

NO

Part ll_income Adjustment Schedule A @ c

D E

apes

SectonA Income Sees,

"ene iccera our

cas

RE erate

ee ee

Ani Vouwer a | (ccencser sex’

elever* | cree,

7 ape, ats. eS tnt

betvemaingznertyncairm orc 7

8 Taxable interest s___39,120 171,620

210,740 #043

Oran Suede. Sette

25,202 9@)__134,875

134,875

10 Toe ids cs cis ie

Endbzl name ie br Festne

Raninsouentsnoarma 10

11 aieyreaied See enters 11

12 Business income or (loss) 12

13 capltgancr (es) Sasanutons 19___(3, 000)

(000)

14 hereon) 4

15 IRAdisveutens, See nsiuctons

® 1500.

16 Fensrs atoms Soins

©,

16(0)

17 ad RTaaRR pen rete Ve a9 35 AAT

164, 395}

5,103,846 |1, 272,432

48 Farm income oF (oss) 18

18 Yeriprmtargesain ness: 9

20 Social securty benefits.

© 20)

2

‘otnar income:

California lotery winnings

Disaster loss carryover from FTB 3805V

Federal NOL (Form 1040, ine 21)

NOL canyover tom FTB 3805 21 126 4

NOL ftom FTB 38050, FTB 38082,

FT 2806, FTE 3807, or FTE 3809

Other (describe)

>

a

8

126

22 a Total Conbire ine’ trough

line 21 in each cot,

Continue te Sie 2 220|_5,110,568 o| 336,019)

5,446,587 1,276,475

For Privacy Notice, get form FTB 1104 034 71741094

‘Schedule GA (40NR) 2008 Side 1

FEY

FEY, -

a 2 c_ D. E

dara Amunia| — Subtraction tions plat Arpounis mounts

ile arourts fem] Searncnssons seainsrues Using Gataw | income estate

urfederalretuny | (aera between | (frence between | AsHYouWore a | ‘aoeved anaca

CAB teserliow | “Ch tederalan) ‘Aaa ® | Sderot scare

‘fomeotmnA” | “tom Ca seurces"

‘Seale | seanoweaden

eres)

110,568 336,019 |5, 446,587 |1,276,475

72,187 72,187

294,274 294,274

16,589 16,589

383,050 383,050

127,518 Q 336,019 5,063,537 11,276,475)

zed Deductions:

@ amounts on federal Schedule A (Form 1040) ines 4, 15

m 1040NR), lines 3, 7,8, 15, and 16), me __L,2A7. AV

m 1040), line 5 (State Disabily Insurance, snd state an local income

y motor vehicle tax), and line 8 (foreign taxes only). See instuctions 99 634,833

2 ‘000

lottery losses, See instructions

a

2 633,000

NR, ine 18) more than the amount shown below for your filing status?

‘separately $160,759

s2ei.119

qualifying widew‘er) $321,483

line 43,

ns Worksheet inthe instructions for Schedule CA (540NR), line 43,

ne 43 or your standard deduction listed below

separately $3,697

a0 of household, or quaiying widower) $7274 4 368,638

AGI fom ine 37, cum E as 1,276,475

46, 368,638

521

a 368,638

mn by tne 3. clu D. Cary the deci

000, ete 10000 Iss than ao, ete 0 a o

tions. Multiply ine 46 by the percentage on ine 47

line 48 from line 45. Transfer this amount to Long Form S40NR, ine 35,

92,934

49__1, 183,541

means 7742094

JOHN P.. cor

ANNE C. COF

Section B — Adjustments to income —

22 birt om Sresie ca

(et Se on a

SumAtghesume... 2265

23 Educator expenses 2a.

24 Caran wats pone

‘esr pany ass

feebaegowrmertateds 24

25 Heathers mroridotuten 25

26 Moving expenses. 26

27 Oretattsdtensoymet ian 27

28 Selremployed SEP, SIMPLE,

ans quali plans 20

29 Selt-employed neath

insurance deduction 29,

90 Peray oeaty wtcnalatsebes 30

31 8 Alimony paid.

Enter recipients:

ae sa

32 IRA deduction 2

3 Suerte iaretaiston 98

34 Tuilonandtees deacon 34

‘38 donate poduson shite deen 35

236 Ad ine 23 trough ine 35

ineach column, AtoughE 36

37 Toa Seren en 70 0h

coun Ata Sentra 97/4

Part ll_Aaustmonts to Federal em

58 Federal Remized Deductions. Ad t

18,20, 27. and 28 (or Schedule A (Fo

38 Enter otal of federal Schedule A (Fo

tax, General Sales Ta), ine 7 (ne

40 Subtract ine 28 fom tne 38

4 Oter ajustmentsineuding Calf

specty

42 Combine ine #Dand Ine #1

43 Is your federal AGI (Long Farm S40

Single of maried ROP tin

Head of nousenod

Maries/ROP fg joint ox

No. Transfer the amount one 42

Yes. Complete the Hemized Deduct

44 Enter the larger of the amount on i

‘Single or martediROP fling

Part IV _ California Taxable income.

45 California AGI. Ener yout Calfomia

46 Emer your deacon rom tne 44

47 Deduction Perconage. Orde ine 7,

‘efor ples th sat sgt

California hemized/Standard Deduc

California Taxable Income. Subtract

Ifless than 2er0, enter -0-

8

0

Side 2 Schedule CA (G40NR) 2008

Вам также может понравиться

- Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)Документ2 страницыFiling Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)eddie waites100% (2)

- Steven Booth 261-25-7668 Louise Booth 571-27-5430 5717 Roundup Bakersfield, 93306Документ21 страницаSteven Booth 261-25-7668 Louise Booth 571-27-5430 5717 Roundup Bakersfield, 93306Thomas Horne100% (1)

- F 1040Документ2 страницыF 1040Kevin RowanОценок пока нет

- W-2 Preview ADPДокумент4 страницыW-2 Preview ADPRyan AllenОценок пока нет

- 2019 Louisiana Resident - 2DДокумент4 страницы2019 Louisiana Resident - 2Djamo christine100% (1)

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramДокумент10 страницFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramBrittany LyОценок пока нет

- Fasfa DocsДокумент10 страницFasfa DocsKira Rivera100% (1)

- U.S. Individual Income Tax Return 1040A: Filing StatusДокумент3 страницыU.S. Individual Income Tax Return 1040A: Filing StatusYosbanyОценок пока нет

- I Pay Statements ServncoДокумент2 страницыI Pay Statements ServncoPablito Padilla100% (2)

- Income Tax Return For Single and Joint Filers With No DependentsДокумент3 страницыIncome Tax Return For Single and Joint Filers With No Dependentsラジャゴバラン サンカラナラヤナンОценок пока нет

- Unknown PDFДокумент4 страницыUnknown PDFomar hernandezОценок пока нет

- 2014 TaxReturnДокумент25 страниц2014 TaxReturnNguyen Vu CongОценок пока нет

- Marie Aladin 2019 Tax PDFДокумент60 страницMarie Aladin 2019 Tax PDFPrint Copy100% (1)

- Week 2 Form 1040Документ2 страницыWeek 2 Form 1040Linda100% (2)

- Eddie Salazar PDFДокумент11 страницEddie Salazar PDFsloweddie salazar0% (1)

- 2019 W2 2020120235817 PDFДокумент3 страницы2019 W2 2020120235817 PDFJamyia Nowlin Kirts100% (3)

- Dawn Income Tax 2019-07-21 - 1563756758720 PDFДокумент6 страницDawn Income Tax 2019-07-21 - 1563756758720 PDFDawn Smith100% (1)

- US Tax ReturnДокумент13 страницUS Tax Returnjamo christineОценок пока нет

- W2INTRV112312011Документ4 страницыW2INTRV112312011Scott Harrison0% (1)

- TAXES w2 REGAL HospitalityДокумент2 страницыTAXES w2 REGAL Hospitalityoskar_herrera2012Оценок пока нет

- Paycheck Protection Program ApplicationДокумент4 страницыPaycheck Protection Program ApplicationJay Mike100% (1)

- 2018 TaxReturn PDFДокумент6 страниц2018 TaxReturn PDFDavid LeeОценок пока нет

- 120s Az FormДокумент19 страниц120s Az FormStacey CanaleОценок пока нет

- 2019 Tax Return Documents (Mollah Ruisul I and Arm)Документ8 страниц2019 Tax Return Documents (Mollah Ruisul I and Arm)Barney The DinosaurОценок пока нет

- 2021 Tax Return: Prepared ByДокумент4 страницы2021 Tax Return: Prepared ByDennis0% (1)

- W2 2010Документ2 страницыW2 2010Rick Nunns100% (2)

- F 1040Документ2 страницыF 1040Sue BosleyОценок пока нет

- 2014 Federal 1040 (Esther)Документ2 страницы2014 Federal 1040 (Esther)Abdirahman Abdullahi Omar43% (7)

- W21225760934 0 PDFДокумент2 страницыW21225760934 0 PDFAnonymous czHLQeLPB4Оценок пока нет

- 2018 Turbo Tax ReturnДокумент5 страниц2018 Turbo Tax ReturnAnfacОценок пока нет

- FTF1299519215531Документ3 страницыFTF1299519215531Leslie Washington100% (1)

- Taxes Amy PDFДокумент7 страницTaxes Amy PDFJsjs JsjsjjshshОценок пока нет

- Downloadfile 30 PDFДокумент114 страницDownloadfile 30 PDFYianniAnd Sophia0% (1)

- Resume of Msnetty42Документ2 страницыResume of Msnetty42api-25122959Оценок пока нет

- Tax ReturnДокумент2 страницыTax ReturnJack.A1100% (1)

- 2015 Sams C Form 1040 Individual Tax Return - FilingДокумент8 страниц2015 Sams C Form 1040 Individual Tax Return - FilingNguyen Hien LuongОценок пока нет

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnДокумент6 страницElectronic Filing Instructions For Your 2019 Federal Tax ReturnSindy Cruz100% (1)

- TGДокумент2 страницыTGpr995Оценок пока нет

- Dan Simon 2016 W2 PDFДокумент2 страницыDan Simon 2016 W2 PDFAnonymous ndTTXL80MnОценок пока нет

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsДокумент2 страницыW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- 2016 Algeri C Form 1040 Individual Tax Return - RecordsДокумент10 страниц2016 Algeri C Form 1040 Individual Tax Return - RecordsbrynsteinОценок пока нет

- W2Документ1 страницаW2Flavia BegazoОценок пока нет

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramДокумент10 страницFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramRhaxma ConspiracyОценок пока нет

- AutoPay Output Documents PDFДокумент2 страницыAutoPay Output Documents PDFAnonymous QZuBG2IzsОценок пока нет

- U.S. Individual Income Tax Return: Filing StatusДокумент2 страницыU.S. Individual Income Tax Return: Filing Statusjakelong82100% (1)

- FTF1302745105156Документ5 страницFTF13027451051562sly4youОценок пока нет

- Consent To Disclose Your Information For The Credit Karma OfferДокумент4 страницыConsent To Disclose Your Information For The Credit Karma OfferDonald PetersonОценок пока нет

- Tax InfoДокумент5 страницTax InfoAdoumbia100% (1)

- FTF1327867575806Документ3 страницыFTF1327867575806erzahler0% (1)

- Psav Encore Global W-2Документ5 страницPsav Encore Global W-2Vincent NewsonОценок пока нет

- Evans W-2sДокумент2 страницыEvans W-2sAlmaОценок пока нет

- Edgar JДокумент2 страницыEdgar Japi-585014034Оценок пока нет

- File by Mail Instructions For Your 2009 Federal Tax ReturnДокумент11 страницFile by Mail Instructions For Your 2009 Federal Tax ReturnjakeОценок пока нет

- Client Copy Return 2020 For AT PRODUCTS & SERVICES LLCДокумент18 страницClient Copy Return 2020 For AT PRODUCTS & SERVICES LLCEdwin Altamiranda100% (2)

- Federal Electronic Filing Instructions: Tax Year 2018Документ13 страницFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielОценок пока нет

- Amara Enyia's 2017 Tax ReturnДокумент4 страницыAmara Enyia's 2017 Tax ReturnMark Konkol100% (1)

- Profit or Loss From Business: Schedule C (Form 1040) 09Документ2 страницыProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- Santos Return PDFДокумент14 страницSantos Return PDFMark Long75% (4)

- President Barack Obama Income Tax Return - Form 1040 - April 2011Документ59 страницPresident Barack Obama Income Tax Return - Form 1040 - April 2011Zim VicomОценок пока нет

- Chapter 4Документ6 страницChapter 4Ashanti T Swan0% (1)

- Sec. Dunlap Files Lawsuit Seeking Access To Elections Commission Correspondence, InformationДокумент1 страницаSec. Dunlap Files Lawsuit Seeking Access To Elections Commission Correspondence, InformationCeleste KatzОценок пока нет

- S.A. 667Документ4 страницыS.A. 667Celeste KatzОценок пока нет

- Summary of Physical Exam For President Trump 12 Jan 2018Документ3 страницыSummary of Physical Exam For President Trump 12 Jan 2018blc88100% (1)

- Celeste Katz 2017 ResumeДокумент1 страницаCeleste Katz 2017 ResumeCeleste KatzОценок пока нет

- ACLU v. Donald TrumpДокумент31 страницаACLU v. Donald TrumpCeleste KatzОценок пока нет

- OGE Letter With Exhibits 7-3-17Документ49 страницOGE Letter With Exhibits 7-3-17Celeste KatzОценок пока нет

- Joint Letter From Secretaries To PACEI-7/10/17Документ1 страницаJoint Letter From Secretaries To PACEI-7/10/17Celeste KatzОценок пока нет

- FoxvPaterson DecДокумент21 страницаFoxvPaterson DecElizabeth BenjaminОценок пока нет

- Hatch Act Letter With Exhibits 7-3-17Документ49 страницHatch Act Letter With Exhibits 7-3-17Celeste Katz100% (1)

- Kobach Letter To States On Election IntegrityДокумент2 страницыKobach Letter To States On Election Integritysam levine100% (1)

- US V Sheldon Silver ComplaintДокумент35 страницUS V Sheldon Silver ComplaintNick ReismanОценок пока нет

- Financial SecurityДокумент23 страницыFinancial SecurityCeleste KatzОценок пока нет

- Exhibit A Summary of Inventory Counts by SchoolДокумент5 страницExhibit A Summary of Inventory Counts by SchoolCeleste KatzОценок пока нет

- Needles AuditДокумент19 страницNeedles AuditCeleste KatzОценок пока нет

- Ny Dem +BPДокумент14 страницNy Dem +BPCeleste KatzОценок пока нет

- Siena College Poll: December 2014 CrosstabsДокумент9 страницSiena College Poll: December 2014 Crosstabsrobertharding22Оценок пока нет

- New York State Department of Health Completes Review of High-Volume Hydraulic FracturingДокумент2 страницыNew York State Department of Health Completes Review of High-Volume Hydraulic FracturingCeleste KatzОценок пока нет

- Labor Committee LetterДокумент2 страницыLabor Committee LetterCeleste KatzОценок пока нет

- Gosr Report Letter Full HighДокумент44 страницыGosr Report Letter Full HighCeleste KatzОценок пока нет