Академический Документы

Профессиональный Документы

Культура Документы

Questions

Загружено:

divakar reddyАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Questions

Загружено:

divakar reddyАвторское право:

Доступные форматы

Answer the Answer the following question. Each question carries 5 marks.

following

questions. 6. State the steps for accounting in amalgamation in the books of

Each amalgamating firm? With journal entries?

question

Answer the following question. Each question carries 10 marks.

carries 2

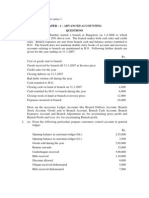

marks. The following were the balance sheets of the firms Anil and Akbar and Singh

and Dev on 31/3/2003 when they decided to amalgamate their business.

1. What is

Anil & Singh& Anil & Singh&D

Amalgamati Libalities Akbar Dev Assets Akbar ev

on of firms?

Creditors 42,000 54,000 cash at bank 24,000 12,000

2. Sate the Bills Payable 18,000 nil Debtors 33,000 36,000

objectives of

Reserves 24,000 nil Stock 27,000 37,500

Amalgamati

on of firms? Capitals nil nil Furniture nil 25,500

Anil 16,500 nil Motar Vans nil 15,000

3. Pass the

journal entry Akbar 19,500 nil Premises 36,000 nil

for transfer Sing 60,000 Goodwill nil 24,000

the

Dev 36,000

Revaluation

profit to 1 1,50,00

,20,000 0 1,20,000 1,50,000

partners?

The terms of amalgamation were as follows:

4. What is

Revaluation a) The new firm was to take over the assets and liabilities of both the firms

Account? subject to M/s Anil and Akbar meeting their bills payable out of their bank

balance.

5. State the

steps for b) The assets of Anil and Akbar were Valued as follows:

Accounting

in Debtors Rs 30,000: Premises Rs 54,000: Stock Rs 18,000: Goodwill Rs

Amalgamati 15,000.

on, in the

C) The assets of Singh and Dev were valued as follows

books of

amalgamate Debtors Rs 30,000: Furniture Rs 18,000: Stock Rs 28,500: Goodwill Rs 9,000.

d firm?

d) Singh took over the motor car

Вам также может понравиться

- 12th CbseДокумент4 страницы12th CbseDhroob MannaОценок пока нет

- 1bba FOA Prep QPДокумент2 страницы1bba FOA Prep QPSuhail AhmedОценок пока нет

- 12 Accountancy SQP 5Документ13 страниц12 Accountancy SQP 5KandaroliОценок пока нет

- Sample Paper Xi Acc 2022 23Документ7 страницSample Paper Xi Acc 2022 23rehankatyal05Оценок пока нет

- MAA AssignmentДокумент2 страницыMAA AssignmentVineela PathapatiОценок пока нет

- Attempt Any Four Questions. All Questions Carry Equal MarksДокумент47 страницAttempt Any Four Questions. All Questions Carry Equal MarksAbhishek GwalОценок пока нет

- Paper 1Документ19 страницPaper 1GianОценок пока нет

- Ent 2-2Документ4 страницыEnt 2-2danielzashleybobОценок пока нет

- 12 2006 Accountancy 1Документ5 страниц12 2006 Accountancy 1Akash TamuliОценок пока нет

- Institute of Business Management: Important AssignmentДокумент5 страницInstitute of Business Management: Important AssignmentShaheer KhurramОценок пока нет

- XI AccountancyДокумент5 страницXI Accountancytechnical hackerОценок пока нет

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceДокумент4 страницыLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorОценок пока нет

- Revision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolДокумент3 страницыRevision Test - I STD - Xii (Accountancy) : Seventh Day Adventist Higher Secondary SchoolStudy HelpОценок пока нет

- 11 Accountancy SP 2Документ17 страниц11 Accountancy SP 2Vikas Chandra BalodhiОценок пока нет

- 1.2 Managerial AccountingДокумент4 страницы1.2 Managerial AccountingAshik PaulОценок пока нет

- R-18 Befa Question BankДокумент4 страницыR-18 Befa Question Bankrachana gopisettyОценок пока нет

- BCA DEGREE EXAM ACCOUNTING EXAMДокумент11 страницBCA DEGREE EXAM ACCOUNTING EXAMStudents Xerox ChidambaramОценок пока нет

- October2022 B Com WithCredits RegularunderCBCSPatternF Y B Com 956AA1A3Документ3 страницыOctober2022 B Com WithCredits RegularunderCBCSPatternF Y B Com 956AA1A3All timeОценок пока нет

- Fundamentals of Accounting 2019Документ4 страницыFundamentals of Accounting 2019sreehari dineshОценок пока нет

- Gradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanДокумент4 страницыGradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanNaveen KumarОценок пока нет

- Modle Paper 1Документ7 страницModle Paper 1Yaseen MaalikОценок пока нет

- Class Xi SP 1Документ17 страницClass Xi SP 1Priya NasaОценок пока нет

- XI Accounts Case Based QuestionsДокумент10 страницXI Accounts Case Based QuestionsyuvisinghmankooОценок пока нет

- 12TH Acc QPДокумент9 страниц12TH Acc QPLOHITHОценок пока нет

- Aditya Degree College::Bhimavaram: Accounting For ManagersДокумент3 страницыAditya Degree College::Bhimavaram: Accounting For Managersrealguy556789Оценок пока нет

- AccountsДокумент5 страницAccountssunil kumar100% (2)

- P6 June 2023 SY23Документ5 страницP6 June 2023 SY23Shivam GuptaОценок пока нет

- Acc Ws Dissolution of Part - FirmДокумент12 страницAcc Ws Dissolution of Part - FirmDhivegaОценок пока нет

- Retire Death Dissolution SheetДокумент6 страницRetire Death Dissolution SheetTanvi SisodiaОценок пока нет

- PaperДокумент4 страницыPaperamirОценок пока нет

- Accounts Parntership TestДокумент6 страницAccounts Parntership TestdhruvОценок пока нет

- 51938bos41633 p1qДокумент5 страниц51938bos41633 p1qAman GuptaОценок пока нет

- Dissolution Practice Questions. PDFДокумент8 страницDissolution Practice Questions. PDFUmesh JaiswalОценок пока нет

- Mozammil 029Документ4 страницыMozammil 029Iqbal Shan LifestyleОценок пока нет

- Tutorial 9-1: Ratio AnalysisДокумент16 страницTutorial 9-1: Ratio AnalysisShivati Singh KahlonОценок пока нет

- Screenshot 2020-10-04 at 4.01.11 PMДокумент3 страницыScreenshot 2020-10-04 at 4.01.11 PMAghna AbbasiОценок пока нет

- Accounting for Company Transactions and AmalgamationsДокумент68 страницAccounting for Company Transactions and AmalgamationsOsamaОценок пока нет

- BCA & BSC (CS) Bussines Accounting I Internal QuestionДокумент3 страницыBCA & BSC (CS) Bussines Accounting I Internal QuestionVignesh GopalОценок пока нет

- Partnership QsДокумент3 страницыPartnership QsJAYARAJALAKSHMI IlangoОценок пока нет

- Suggested Answer CAP II Dec 2011Документ98 страницSuggested Answer CAP II Dec 2011Sankalpa NeupaneОценок пока нет

- ACCOUNTANCY CLASS NOTESДокумент8 страницACCOUNTANCY CLASS NOTESpraveenpv7Оценок пока нет

- Individual Assignment OneДокумент3 страницыIndividual Assignment OnefeyselОценок пока нет

- Subject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100Документ5 страницSubject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100darla85nagarajuОценок пока нет

- Management Accounting and Analysis Assignment Term - 1Документ9 страницManagement Accounting and Analysis Assignment Term - 1gayathri saranОценок пока нет

- Test PaperДокумент27 страницTest PaperAnand BandhuОценок пока нет

- Xi Accountancy 80 Marks General InstructionsДокумент5 страницXi Accountancy 80 Marks General InstructionsJash ShahОценок пока нет

- Ratio Analysis-1Документ4 страницыRatio Analysis-1Aakash RamakrishnanОценок пока нет

- ACCOUNTANCY+2 B0ardДокумент12 страницACCOUNTANCY+2 B0ardlakshmanan2838Оценок пока нет

- 11 AccДокумент6 страниц11 AccPushpinder KumarОценок пока нет

- Sanskriti School Dr. S. Radhakrishnan Marg New DelhiДокумент7 страницSanskriti School Dr. S. Radhakrishnan Marg New DelhiAVNEET XII-CОценок пока нет

- Retirement and Dissolution of Firm Class TestДокумент2 страницыRetirement and Dissolution of Firm Class TestHarish RajputОценок пока нет

- 12 2006 Accountancy 2Документ5 страниц12 2006 Accountancy 2Akash TamuliОценок пока нет

- Fundamentals of Accounting 2020Документ4 страницыFundamentals of Accounting 2020sreehari dineshОценок пока нет

- Kendriya Vidyalaya Sangathan, Mumbai Region Term-II Examination 2021-22 Accountancy (055) Set-Ii XIДокумент4 страницыKendriya Vidyalaya Sangathan, Mumbai Region Term-II Examination 2021-22 Accountancy (055) Set-Ii XIRidhima SharmaОценок пока нет

- CALCULATING PURCHASE CONSIDERATIONДокумент11 страницCALCULATING PURCHASE CONSIDERATIONJoel VargheseОценок пока нет

- 1 Accounting Equation UniqueДокумент3 страницы1 Accounting Equation UniqueSohan AgrawalОценок пока нет

- Corporate Accounting - I Semester ExaminationДокумент7 страницCorporate Accounting - I Semester ExaminationVijay KumarОценок пока нет

- BBA II Chapter 2 Sale of Partnership ProblemsДокумент14 страницBBA II Chapter 2 Sale of Partnership ProblemsSiddharth SalgaonkarОценок пока нет

- Assigment BBM Finacial AccountingДокумент6 страницAssigment BBM Finacial Accountingtripathi_indramani5185Оценок пока нет

- A Comparison of Mean-Variance and Mean-Semivariance Optimisation On The JseДокумент10 страницA Comparison of Mean-Variance and Mean-Semivariance Optimisation On The JseRodolpho Cammarosano de LimaОценок пока нет

- RBL Bank Ltd. BUYДокумент7 страницRBL Bank Ltd. BUYpajadhavОценок пока нет

- Binary OptionsДокумент10 страницBinary Optionsmimimi_88100% (1)

- South African Airways v. Commissioner of Internal Revenue: The CorrectДокумент2 страницыSouth African Airways v. Commissioner of Internal Revenue: The CorrectJeliSantosОценок пока нет

- Audit procedures and evidenceДокумент7 страницAudit procedures and evidenceJun Ladrillo100% (1)

- MR Ranjit SinghДокумент77 страницMR Ranjit SinghMonu MehanОценок пока нет

- City of London LSE David KynastonДокумент2 страницыCity of London LSE David Kynastonmary engОценок пока нет

- History of Credit Rating AgenciesДокумент3 страницыHistory of Credit Rating AgenciesAzhar KhanОценок пока нет

- SBI-SME-Checklist SME Smart ScoreДокумент2 страницыSBI-SME-Checklist SME Smart ScorebiaravankОценок пока нет

- Principles of Options and Option PricingДокумент76 страницPrinciples of Options and Option PricingSakshi SachdevaОценок пока нет

- (Principle of Commerce) T, C & B MCQS: Rade Ommerce UsinessДокумент18 страниц(Principle of Commerce) T, C & B MCQS: Rade Ommerce UsinessGhalib HussainОценок пока нет

- By Otmar, B.A: Leasing PreparedДокумент53 страницыBy Otmar, B.A: Leasing PreparedAnna Mwita100% (1)

- Due - Diligence ChecklistДокумент4 страницыDue - Diligence ChecklistAndrew D. WalcottОценок пока нет

- Iowa Committee On Political Education - AFL-CIO - 6060 - DR2 - SummaryДокумент1 страницаIowa Committee On Political Education - AFL-CIO - 6060 - DR2 - SummaryZach EdwardsОценок пока нет

- QUANTITATIVE STRATEGIES RESEARCH NOTES GADGETSДокумент43 страницыQUANTITATIVE STRATEGIES RESEARCH NOTES GADGETSHongchul HaОценок пока нет

- Australian School of BusinessДокумент12 страницAustralian School of BusinessMaria Luisa Laniado IllingworthОценок пока нет

- Statutory Registers Under Companies ActДокумент16 страницStatutory Registers Under Companies ActAmey PatwardhanОценок пока нет

- Final ThesisДокумент67 страницFinal Thesisshoaib_hafeez50% (2)

- Committee # 1. CII Code of Desirable Corporate Governance (1998)Документ11 страницCommittee # 1. CII Code of Desirable Corporate Governance (1998)Vaidehi ShuklaОценок пока нет

- Keith Brown ResumeДокумент2 страницыKeith Brown ResumekeithbrownfinanceОценок пока нет

- Invoice Template TitleДокумент2 страницыInvoice Template Titlejaya prameswariОценок пока нет

- Rivera V FlorendoДокумент2 страницыRivera V FlorendoRegion 6 MTCC Branch 3 Roxas City, CapizОценок пока нет

- Forgery Defenses; Bank LiabilitiesДокумент24 страницыForgery Defenses; Bank LiabilitiesbrendamanganaanОценок пока нет

- Accounting TransactionsДокумент28 страницAccounting TransactionsPaolo100% (1)

- Annual Report 2015 16Документ193 страницыAnnual Report 2015 16Rahul KumarОценок пока нет

- A Comparative Analysis On Public and Private Mutual FundsДокумент72 страницыA Comparative Analysis On Public and Private Mutual FundsMadhuri Tripathi80% (5)

- Nifty Weightage Understanding Its Significance in The Indian Stock MarketДокумент23 страницыNifty Weightage Understanding Its Significance in The Indian Stock Marketmahedihasan141997Оценок пока нет

- Advanced Corporate Finance Module-Student EditionДокумент60 страницAdvanced Corporate Finance Module-Student EditionDavid Mavodo100% (2)

- Factors Determining Capital StructureДокумент2 страницыFactors Determining Capital StructureMostafizul HaqueОценок пока нет

- The 21St-Century Covered Call Does History Repeat Itself? Trading The Fakeout Interview Breakaway GapsДокумент64 страницыThe 21St-Century Covered Call Does History Repeat Itself? Trading The Fakeout Interview Breakaway GapsEdgar Santiesteban Collado100% (2)