Академический Документы

Профессиональный Документы

Культура Документы

Capital Gains and Losses: Schedule D (Form 1120)

Загружено:

IRSИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Capital Gains and Losses: Schedule D (Form 1120)

Загружено:

IRSАвторское право:

Доступные форматы

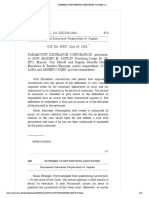

SCHEDULE D Capital Gains and Losses

(Form 1120) © Attach to Form 1120, 1120-A, 1120-C, 1120-F, 1120-FSC, 1120-H, 1120-IC-DISC, 1120-L, 1120-ND, OMB No. 1545-0123

1120-PC, 1120-POL, 1120-REIT, 1120-RIC, 1120-SF, or certain Forms 990-T.

Department of the Treasury

Internal Revenue Service

© See separate instructions. 2006

Name Employer identification number

Part I Short-Term Capital Gains and Losses—Assets Held One Year or Less

(e) Cost or other

(a) Description of property (b) Date acquired (c) Date sold (d) Sales price basis (see (f) Gain or (loss)

(Example: 100 shares of Z Co.) (mo., day, yr.) (mo., day, yr.) (see instructions) instructions) (Subtract (e) from (d))

2 Short-term capital gain from installment sales from Form 6252, line 26 or 37 2

3 Short-term gain or (loss) from like-kind exchanges from Form 8824 3

4 Unused capital loss carryover (attach computation) 4 ( )

5 Net short-term capital gain or (loss). Combine lines 1 through 4 5

Part II Long-Term Capital Gains and Losses—Assets Held More Than One Year

7 Enter gain from Form 4797, line 7 or 9 7

8 Long-term capital gain from installment sales from Form 6252, line 26 or 37 8

9 Long-term gain or (loss) from like-kind exchanges from Form 8824 9

10 Capital gain distributions (see instructions) 10

11 Net long-term capital gain or (loss). Combine lines 6 through 10 11

Part III Summary of Parts I and II

12 Enter excess of net short-term capital gain (line 5) over net long-term capital loss (line 11) 12

13 Net capital gain. Enter excess of net long-term capital gain (line 11) over net short-term capital

loss (line 5) 13

14 Add lines 12 and 13. Enter here and on Form 1120, page 1, line 8, or the proper line on other

returns 14

Note. If losses exceed gains, see Capital losses in the instructions.

For Privacy Act and Paperwork Reduction Act Notice, Cat. No. 11460M Schedule D (Form 1120) (2006)

see the Instructions for Forms 1120 and 1120-A.

Вам также может понравиться

- Equity Valuation: Models from Leading Investment BanksОт EverandEquity Valuation: Models from Leading Investment BanksJan ViebigОценок пока нет

- US Internal Revenue Service: f1120sd - 2004Документ4 страницыUS Internal Revenue Service: f1120sd - 2004IRSОценок пока нет

- US Internal Revenue Service: f1120sd - 2002Документ4 страницыUS Internal Revenue Service: f1120sd - 2002IRSОценок пока нет

- US Internal Revenue Service: f1120sd - 1998Документ2 страницыUS Internal Revenue Service: f1120sd - 1998IRSОценок пока нет

- US Internal Revenue Service: f2438 - 1999Документ2 страницыUS Internal Revenue Service: f2438 - 1999IRSОценок пока нет

- US Internal Revenue Service: f1120sd - 1994Документ2 страницыUS Internal Revenue Service: f1120sd - 1994IRSОценок пока нет

- US Internal Revenue Service: f1065sd - 2001Документ4 страницыUS Internal Revenue Service: f1065sd - 2001IRSОценок пока нет

- US Internal Revenue Service: f1120sd - 1999Документ2 страницыUS Internal Revenue Service: f1120sd - 1999IRSОценок пока нет

- US Internal Revenue Service: f2438 - 1998Документ2 страницыUS Internal Revenue Service: f2438 - 1998IRSОценок пока нет

- US Internal Revenue Service: f2438 - 2004Документ3 страницыUS Internal Revenue Service: f2438 - 2004IRSОценок пока нет

- US Internal Revenue Service: f2438 - 2001Документ3 страницыUS Internal Revenue Service: f2438 - 2001IRSОценок пока нет

- US Internal Revenue Service: f1065sd - 2000Документ4 страницыUS Internal Revenue Service: f1065sd - 2000IRSОценок пока нет

- US Internal Revenue Service: f2438 - 2000Документ3 страницыUS Internal Revenue Service: f2438 - 2000IRSОценок пока нет

- US Internal Revenue Service: f1065sd - 1999Документ4 страницыUS Internal Revenue Service: f1065sd - 1999IRSОценок пока нет

- US Internal Revenue Service: f1065sd - 2003Документ4 страницыUS Internal Revenue Service: f1065sd - 2003IRSОценок пока нет

- US Internal Revenue Service: f2438 - 2002Документ3 страницыUS Internal Revenue Service: f2438 - 2002IRSОценок пока нет

- US Internal Revenue Service: f2438 - 1997Документ2 страницыUS Internal Revenue Service: f2438 - 1997IRSОценок пока нет

- US Internal Revenue Service: f1065sd - 1998Документ4 страницыUS Internal Revenue Service: f1065sd - 1998IRSОценок пока нет

- Capital Gains and Losses: Schedule D (Form 1120)Документ2 страницыCapital Gains and Losses: Schedule D (Form 1120)张泽亮Оценок пока нет

- US Internal Revenue Service: f1041sd - 1995Документ2 страницыUS Internal Revenue Service: f1041sd - 1995IRSОценок пока нет

- Capital Gains and Losses and Built-In Gains: Attach To Form 1120S. See Separate InstructionsДокумент1 страницаCapital Gains and Losses and Built-In Gains: Attach To Form 1120S. See Separate InstructionsIRSОценок пока нет

- US Internal Revenue Service: f1040sd - 1993Документ2 страницыUS Internal Revenue Service: f1040sd - 1993IRSОценок пока нет

- US Internal Revenue Service: f1065sd - 2004Документ4 страницыUS Internal Revenue Service: f1065sd - 2004IRSОценок пока нет

- US Internal Revenue Service: f1040sd - 2001Документ2 страницыUS Internal Revenue Service: f1040sd - 2001IRSОценок пока нет

- US Internal Revenue Service: f1065sd - 2005Документ4 страницыUS Internal Revenue Service: f1065sd - 2005IRSОценок пока нет

- Taxation For Decision Makers 2017 1st Edition Escoffier Solutions ManualДокумент5 страницTaxation For Decision Makers 2017 1st Edition Escoffier Solutions Manualamandabinh1j6100% (22)

- US Internal Revenue Service: f1040sd - 2003Документ2 страницыUS Internal Revenue Service: f1040sd - 2003IRSОценок пока нет

- US Internal Revenue Service: f5227 - 1999Документ4 страницыUS Internal Revenue Service: f5227 - 1999IRSОценок пока нет

- US Internal Revenue Service: f1040sd - 1997Документ2 страницыUS Internal Revenue Service: f1040sd - 1997IRSОценок пока нет

- U.S. Return of Income For Electing Large Partnerships: Taxable Income or Loss From Passive Loss Limitation ActivitiesДокумент5 страницU.S. Return of Income For Electing Large Partnerships: Taxable Income or Loss From Passive Loss Limitation ActivitiesIRSОценок пока нет

- US Internal Revenue Service: f1041sd - 1991Документ2 страницыUS Internal Revenue Service: f1041sd - 1991IRSОценок пока нет

- US Internal Revenue Service: f4797 - 2000Документ2 страницыUS Internal Revenue Service: f4797 - 2000IRSОценок пока нет

- Gains and Losses From Section 1256 Contracts and Straddles: A B C D (A) Identification of Account (B) (Loss) (C) GainДокумент4 страницыGains and Losses From Section 1256 Contracts and Straddles: A B C D (A) Identification of Account (B) (Loss) (C) GainGaro OhanogluОценок пока нет

- Capital Gains and Losses: Schedule D (Form 1040) 12Документ2 страницыCapital Gains and Losses: Schedule D (Form 1040) 12tinpenaОценок пока нет

- Capital Gains and Losses: Schedule DДокумент2 страницыCapital Gains and Losses: Schedule DJulie AustinОценок пока нет

- US Internal Revenue Service: f1065sd - 1996Документ2 страницыUS Internal Revenue Service: f1065sd - 1996IRSОценок пока нет

- US Internal Revenue Service: F1120ric - 2001Документ4 страницыUS Internal Revenue Service: F1120ric - 2001IRSОценок пока нет

- US Internal Revenue Service: f6781 - 2003Документ4 страницыUS Internal Revenue Service: f6781 - 2003IRSОценок пока нет

- US Internal Revenue Service: f1120l - 1994Документ8 страницUS Internal Revenue Service: f1120l - 1994IRSОценок пока нет

- US Internal Revenue Service: f5227 - 1995Документ4 страницыUS Internal Revenue Service: f5227 - 1995IRSОценок пока нет

- Formulario D Federal Tax 2015Документ2 страницыFormulario D Federal Tax 2015Johanies M. Cortés RiveraОценок пока нет

- US Internal Revenue Service: f1040sd - 2004Документ2 страницыUS Internal Revenue Service: f1040sd - 2004IRSОценок пока нет

- f4797VENTA DE PROPIEDADДокумент2 страницыf4797VENTA DE PROPIEDADGriselda DavadiОценок пока нет

- US Internal Revenue Service: f8830 - 1995Документ2 страницыUS Internal Revenue Service: f8830 - 1995IRSОценок пока нет

- US Internal Revenue Service: f8830 - 1996Документ2 страницыUS Internal Revenue Service: f8830 - 1996IRSОценок пока нет

- US Internal Revenue Service: f6781 - 2001Документ3 страницыUS Internal Revenue Service: f6781 - 2001IRSОценок пока нет

- Form 6781Документ4 страницыForm 6781MarkОценок пока нет

- US Internal Revenue Service: f6781 - 2002Документ3 страницыUS Internal Revenue Service: f6781 - 2002IRSОценок пока нет

- US Internal Revenue Service: f4797 - 1998Документ2 страницыUS Internal Revenue Service: f4797 - 1998IRSОценок пока нет

- US Internal Revenue Service: f1041sd - 1993Документ2 страницыUS Internal Revenue Service: f1041sd - 1993IRSОценок пока нет

- Full Income Tax Fundamentals 2018 36Th Edition Whittenburg Solutions Manual PDFДокумент54 страницыFull Income Tax Fundamentals 2018 36Th Edition Whittenburg Solutions Manual PDFstephen.crawford258100% (15)

- US Internal Revenue Service: f8844 - 1994Документ3 страницыUS Internal Revenue Service: f8844 - 1994IRSОценок пока нет

- US Internal Revenue Service: f8830 - 1994Документ2 страницыUS Internal Revenue Service: f8830 - 1994IRSОценок пока нет

- US Internal Revenue Service: f4797 - 2003Документ2 страницыUS Internal Revenue Service: f4797 - 2003IRSОценок пока нет

- US Internal Revenue Service: f8830 - 2002Документ2 страницыUS Internal Revenue Service: f8830 - 2002IRSОценок пока нет

- US Internal Revenue Service: f8830 - 1998Документ2 страницыUS Internal Revenue Service: f8830 - 1998IRSОценок пока нет

- US Internal Revenue Service: F1120rei - 2005Документ4 страницыUS Internal Revenue Service: F1120rei - 2005IRSОценок пока нет

- US Internal Revenue Service: f1120l - 1999Документ8 страницUS Internal Revenue Service: f1120l - 1999IRSОценок пока нет

- US Internal Revenue Service: I8895Документ4 страницыUS Internal Revenue Service: I8895IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Документ6 страницUS Internal Revenue Service: 2290rulesty2007v4 0IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Документ153 страницы2008 Objectives Report To Congress v2IRSОценок пока нет

- 2008 Data DictionaryДокумент260 страниц2008 Data DictionaryIRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsДокумент112 страниц2008 Credit Card Bulk Provider RequirementsIRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Child Protection ActДокумент19 страницChild Protection ActSahil GargОценок пока нет

- Insular Bank V IAC (DADO)Документ1 страницаInsular Bank V IAC (DADO)Kylie Kaur Manalon DadoОценок пока нет

- Paramount Ins. Corp. vs. Judge Japzon, Et AlДокумент10 страницParamount Ins. Corp. vs. Judge Japzon, Et AlBeltran KathОценок пока нет

- United States v. James E. Jackson, Sidney Stein, Fred Fine, Alexander Trachtenberg, William Norman and George Blake Charney, 257 F.2d 830, 2d Cir. (1958)Документ5 страницUnited States v. James E. Jackson, Sidney Stein, Fred Fine, Alexander Trachtenberg, William Norman and George Blake Charney, 257 F.2d 830, 2d Cir. (1958)Scribd Government DocsОценок пока нет

- Republic of The Philippines, Petitioner, vs. MARTIN T. NG, RespondentДокумент13 страницRepublic of The Philippines, Petitioner, vs. MARTIN T. NG, RespondentMirzi Olga Breech SilangОценок пока нет

- Definition of Large TaxpayerДокумент29 страницDefinition of Large TaxpayerakidnarОценок пока нет

- SNY1019 CrosstabsДокумент8 страницSNY1019 CrosstabsNick ReismanОценок пока нет

- Ssa 827Документ2 страницыSsa 827joshud7264100% (2)

- All Constitution Q&AДокумент57 страницAll Constitution Q&APranjal PragyaОценок пока нет

- Indicatifs RadioamateursДокумент14 страницIndicatifs RadioamateursSidBenОценок пока нет

- Obligations and Contracts SeatworkДокумент3 страницыObligations and Contracts SeatworkShaneeeeyОценок пока нет

- Shoening v. Seton Hall UniversityДокумент15 страницShoening v. Seton Hall UniversityNicholas KerrОценок пока нет

- Pmap & EcopДокумент27 страницPmap & EcopRoseNTolentinoОценок пока нет

- Legal SeparationДокумент12 страницLegal SeparationBenitez Gherold100% (1)

- Constitutional Bodies - National IAS AcademyДокумент18 страницConstitutional Bodies - National IAS AcademyVenkatesh MallelaОценок пока нет

- #17-013 Rush - Arbitration Opinion & Award - Redacted DecisionДокумент80 страниц#17-013 Rush - Arbitration Opinion & Award - Redacted Decisionjckc107l100% (2)

- 20.03.2020 Order of NCLAT Regarding Appointment of IRP For Two UP ProjectsДокумент3 страницы20.03.2020 Order of NCLAT Regarding Appointment of IRP For Two UP Projectspraveensingh77Оценок пока нет

- Kim v. North Korea - Findings of Fact SubmittedДокумент92 страницыKim v. North Korea - Findings of Fact SubmittedShurat HaDin - Israel Law CenterОценок пока нет

- City of Iriga V CASURECO IIIДокумент3 страницыCity of Iriga V CASURECO IIIJerico GodoyОценок пока нет

- Joseph Siegelman LawsuitДокумент9 страницJoseph Siegelman LawsuitMike CasonОценок пока нет

- Theories of PunishmentДокумент19 страницTheories of PunishmentNikhil JainОценок пока нет

- Woodland Township OPRA Request FormДокумент3 страницыWoodland Township OPRA Request FormThe Citizens CampaignОценок пока нет

- Chapter 32Документ6 страницChapter 32softplay12Оценок пока нет

- Case Stated Freedom of Information RedactДокумент35 страницCase Stated Freedom of Information RedactGotnitОценок пока нет

- Civ 3Документ4 страницыCiv 3Len Sor LuОценок пока нет

- People V Mabansag, GR L-46293Документ14 страницPeople V Mabansag, GR L-46293Jae MontoyaОценок пока нет

- Rule 45 Vs Rule 65Документ4 страницыRule 45 Vs Rule 65Diane SamОценок пока нет

- G.R. No. 133036 Recuerdo Vs PeopleДокумент4 страницыG.R. No. 133036 Recuerdo Vs PeopleKristin C. Peña-San FernandoОценок пока нет

- U.S. v. Rajaratnam - No "Gain" WithoutДокумент18 страницU.S. v. Rajaratnam - No "Gain" WithoutNEJCCCОценок пока нет

- 0 - Vicarious Liability and Liability of State Doctrine of Sovereign ImmunityДокумент6 страниц0 - Vicarious Liability and Liability of State Doctrine of Sovereign ImmunityAYUSH BARDHAN 20213213Оценок пока нет