Академический Документы

Профессиональный Документы

Культура Документы

Capital Alert - 6/20/2008

Загружено:

Russell KlusasИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Capital Alert - 6/20/2008

Загружено:

Russell KlusasАвторское право:

Доступные форматы

6/20/2008

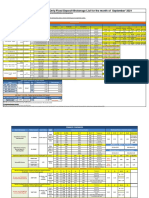

Multi-Family Loan Programs > $3 Million

Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

5 Yr. 80% 6.16% to 6.31% 75% 6.05% to 6.28%

7 Yr. 80% 6.14% to 6.29% 75% 6.40% to 6.65%

10 Yr. 80% 6.25% to 6.46% 75% 6.55% to 6.85%

15 Yr. 80% 6.67% to 7.27% 75% 6.85% to 7.35%

*Rates based on Act/360

Multi-Family Loan Programs < $3 Million

Fixed Rate Agency Lenders Portfolio Lenders*

Term Leverage Max. Interest Rates Leverage Max. Interest Rates

3 Yr. 80% 6.12% to 6.56% 75% 5.90% to 6.25%

5 Yr. 80% 6.08% to 6.46% 75% 6.05% to 6.35%

7 Yr. 80% 6.07% to 6.37% 75% 6.40% to 6.65%

10 Yr. 80% 6.18% to 6.48% 75% 6.55% to 6.85%

15 Yr. 80% 6.74% to 7.65% 75%0 6.85% to 7.35%

*Rates based on Act/360

Commercial Loan Programs

Fixed Rate Portfolio Lenders* Index Rate as of 6/6/20

5- Year Treasury: 3.59%

Term Leverage Max. Interest Rates

10-Year Treasury: 4.17%

5 Yr. 75% 6.25% to 6.55%

5-Year Swap: 4.49%

7 Yr. 75% 6.45% to 6.65%

10-Year Swap: 4.87%

10 Yr. 75% 6.65% to 6.90%

Prime: 5.00%

15 Yr. 75% 6.95% to 7.45%

Libor: 3.18%

Bridge Floating Leverage Max. Spread Over Libor

Stabilized 75% 225 to 300

Re-Position 90% 275 to 350

(*Portfolio Lenders include Banks, Life Insurance Companies and Credit Unions)

Economic Commentary

Rates offered a slight reprieve from the

increases realized over the last three-weeks.

10-year Treasuries closed the week at 4.16

percent and 10-year Swaps at 4.85 percent,

both a .10 percent reduction from a week ago.

However, while agency lenders tracked these

indexes with similar reductions, portfolio

lenders held firm at the rate increases

instituted recently. Concerns over the record

levels of oil prices continue to be the overriding

issue in trying to project the length and breadth

of the current economic slump.

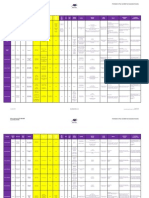

Recent Transactions

11045 La Maida Auto Zone Logan's Roadhouse 8 San Marcos Lane

Multi-Family STNL STNL Retail Center

North Hollywood, CA Corpus Christi, TX Columbus, OH Chandler, AZ

$2,912,000 $2,100,000 $2,250,000 $2,530,000

Adjustable Interest Rate 6.03% Interest Rate 6.7% Interest Rate 7- 6.05% Interest Rate

36-mos. Term/Purchase 10-yr. Term/30-yr. Amort. mos. Term/30-yr. Amortiz. 10-yr. Term/30-yr. Amort.

For more information, contact:

William E. Hughes

Senior Vice President/ Managing Director

Newport Beach, CA

Office: (949) 851-3030

whughes@marcusmillichap.com

Terms, rates and conditions subject to change. www.MMCapCorp.com

Вам также может понравиться

- Wells Fargo Everyday CheckingДокумент3 страницыWells Fargo Everyday CheckingKarapet MerganyanОценок пока нет

- Sample Navy FederalДокумент3 страницыSample Navy Federalhitta100% (1)

- Landbank Cash Card/Prepaid Card Enrollment Form: Jomar Soriano MendrosДокумент2 страницыLandbank Cash Card/Prepaid Card Enrollment Form: Jomar Soriano MendrosJomar Mendros100% (1)

- Answers of Cash and Cash Equivalents AssignmentДокумент4 страницыAnswers of Cash and Cash Equivalents AssignmentGee Lysa Pascua Vilbar50% (2)

- Assignment On Negotiable Instruments ActДокумент6 страницAssignment On Negotiable Instruments ActBitthal Sharma0% (1)

- Capital Markets - 8/15/2008Документ2 страницыCapital Markets - 8/15/2008Russell KlusasОценок пока нет

- Capital Markets - 6/30/2008Документ1 страницаCapital Markets - 6/30/2008Russell KlusasОценок пока нет

- Capital Alert - 8/29/2008Документ1 страницаCapital Alert - 8/29/2008Russell KlusasОценок пока нет

- Capital Alert 6/13/2008Документ1 страницаCapital Alert 6/13/2008Russell KlusasОценок пока нет

- CapAlertPDF 072508Документ1 страницаCapAlertPDF 072508Russell KlusasОценок пока нет

- Capital Alert - 8/22/2008Документ1 страницаCapital Alert - 8/22/2008Russell KlusasОценок пока нет

- Capital Alert - 7/3/2008Документ1 страницаCapital Alert - 7/3/2008Russell KlusasОценок пока нет

- Capital Alert - 5/30/2008Документ1 страницаCapital Alert - 5/30/2008Russell KlusasОценок пока нет

- Capital Markets - 4/18/2008Документ1 страницаCapital Markets - 4/18/2008Russell KlusasОценок пока нет

- Capital Markets - 4/25/2008Документ1 страницаCapital Markets - 4/25/2008Russell KlusasОценок пока нет

- Capital Markets - 5/16/2008Документ1 страницаCapital Markets - 5/16/2008Russell KlusasОценок пока нет

- Multi-Family Loan Programs $3 MillionДокумент1 страницаMulti-Family Loan Programs $3 MillionRussell KlusasОценок пока нет

- Capital Alert - 7/12/2008Документ1 страницаCapital Alert - 7/12/2008Russell KlusasОценок пока нет

- Website Disclosure Effective 05 Apr 2024Документ4 страницыWebsite Disclosure Effective 05 Apr 2024Ab CdОценок пока нет

- Bank A: Housing Loan Property Equity LoanДокумент6 страницBank A: Housing Loan Property Equity LoanRaesa BadelОценок пока нет

- Website Disclosure Effective 02nd May 2023Документ3 страницыWebsite Disclosure Effective 02nd May 2023Prathamesh PatikОценок пока нет

- Bank A: Housing Loan Property Equity LoanДокумент5 страницBank A: Housing Loan Property Equity LoanRaesa BadelОценок пока нет

- HDFC RatesДокумент4 страницыHDFC RatesdesikanttОценок пока нет

- BankingДокумент4 страницыBankingBhavin GhoniyaОценок пока нет

- Yield CurveДокумент3 страницыYield CurveRochelle Anne OpinaldoОценок пока нет

- Interest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankДокумент1 страницаInterest Rates On Domestic Recurring Deposit: WWW - Utkarsh.bankSusovan DasОценок пока нет

- Tel No: 022-4215 9068Документ3 страницыTel No: 022-4215 9068mamatha niranjanОценок пока нет

- Website Disclosure Effective 03 Feb 2024Документ3 страницыWebsite Disclosure Effective 03 Feb 2024abhishek sharmaОценок пока нет

- Capital Alert - 2/1/2008Документ1 страницаCapital Alert - 2/1/2008Russell KlusasОценок пока нет

- HDFC Deposit FormДокумент4 страницыHDFC Deposit FormnaguficoОценок пока нет

- Website Disclosure Effective 30 Nov 2023Документ3 страницыWebsite Disclosure Effective 30 Nov 2023bggbggОценок пока нет

- Interest Rates For Fixed DepositsДокумент2 страницыInterest Rates For Fixed Depositssaurav katarukaОценок пока нет

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Документ3 страницыAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakОценок пока нет

- Interest Rates For Fixed DepositsДокумент2 страницыInterest Rates For Fixed Depositssasi 'sОценок пока нет

- Effective Annualized Rate of Return - Resident-NRO TD 1-09-2023Документ1 страницаEffective Annualized Rate of Return - Resident-NRO TD 1-09-2023Arun sharmaОценок пока нет

- Rates of Return On PLSDeposits OtherDepositsДокумент2 страницыRates of Return On PLSDeposits OtherDepositsranamkhan553Оценок пока нет

- Website Disclosure EffectiveДокумент3 страницыWebsite Disclosure EffectiveHimanshu MilanОценок пока нет

- Capital Markets - 3/07/2008Документ1 страницаCapital Markets - 3/07/2008Russell KlusasОценок пока нет

- Interest Rates For Fixed DepositsДокумент2 страницыInterest Rates For Fixed DepositsY_AZОценок пока нет

- Capital Markets - 2/29/2008Документ1 страницаCapital Markets - 2/29/2008Russell KlusasОценок пока нет

- Interest Rates On FDR: Monthly Benefit PlanДокумент2 страницыInterest Rates On FDR: Monthly Benefit Planmushfik arafatОценок пока нет

- FD Leaflet - A5 - 13 Dec 23Документ2 страницыFD Leaflet - A5 - 13 Dec 23Shaily SinhaОценок пока нет

- Recurring Deposit Rates W e F August 21 2023Документ1 страницаRecurring Deposit Rates W e F August 21 2023kushboog019Оценок пока нет

- Loan RatesДокумент1 страницаLoan RatesAndrew ChambersОценок пока нет

- Interest Rates For Fixed DepositsДокумент2 страницыInterest Rates For Fixed DepositsV NaveenОценок пока нет

- Rights of BusinessДокумент2 страницыRights of BusinessHimanshu MilanОценок пока нет

- Interest Rates For Fixed DepositsДокумент2 страницыInterest Rates For Fixed DepositsIndranil Roy ChoudhuriОценок пока нет

- Interest Rates For Fixed DepositsДокумент2 страницыInterest Rates For Fixed DepositsspshekarОценок пока нет

- Term Deposit Rate Sheet: ShajarДокумент1 страницаTerm Deposit Rate Sheet: ShajarchqaiserОценок пока нет

- Cho RM 73 2020-21Документ1 страницаCho RM 73 2020-21Steve WozniakОценок пока нет

- Yes Bank Interest ChargesДокумент3 страницыYes Bank Interest ChargessaiaviОценок пока нет

- Interest Rates For Fixed DepositsДокумент2 страницыInterest Rates For Fixed DepositsD SunilОценок пока нет

- Interest Rate RetailДокумент6 страницInterest Rate RetailRavie S DhamaОценок пока нет

- Interest Rates On Deposits Above Rs 2 Crs Wef 15092022Документ5 страницInterest Rates On Deposits Above Rs 2 Crs Wef 15092022Manish bishnoiОценок пока нет

- Capital Markets - 3/14/2008Документ2 страницыCapital Markets - 3/14/2008Russell KlusasОценок пока нет

- Slabs Profit Rate: Deposit and Prematurity RatesДокумент1 страницаSlabs Profit Rate: Deposit and Prematurity RatesJay KhanОценок пока нет

- IIFL Associate FD List September'2021Документ4 страницыIIFL Associate FD List September'2021BHARAT SОценок пока нет

- Interest Rates On Deposits Above Rs 2 Crs Wef 09082023Документ5 страницInterest Rates On Deposits Above Rs 2 Crs Wef 09082023Mohammed Eidrees RazaОценок пока нет

- Capital Markets - 4/11/2008Документ1 страницаCapital Markets - 4/11/2008Russell KlusasОценок пока нет

- Excel FormatДокумент38 страницExcel FormatSaad QureshiОценок пока нет

- Group Members:: Comparison Between Bank AL Habib & Habib Metro BankДокумент13 страницGroup Members:: Comparison Between Bank AL Habib & Habib Metro BankAbbas AliОценок пока нет

- Interest Rates For Fixed DepositsДокумент2 страницыInterest Rates For Fixed DepositsRaghav sharmaОценок пока нет

- FD RatesДокумент3 страницыFD Rates22satendraОценок пока нет

- 08 - Term Structure of Interest Rate and Yield Curve - AnnotatedДокумент6 страниц08 - Term Structure of Interest Rate and Yield Curve - AnnotatedFindri Palias BokyОценок пока нет

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeОт EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeОценок пока нет

- Capital Alert - 8/22/2008Документ1 страницаCapital Alert - 8/22/2008Russell KlusasОценок пока нет

- Milwaukee - Office - 8/7/08Документ4 страницыMilwaukee - Office - 8/7/08Russell KlusasОценок пока нет

- Capital Alert - 7/12/2008Документ1 страницаCapital Alert - 7/12/2008Russell KlusasОценок пока нет

- Chicago - Industrial - 1/1/2008Документ1 страницаChicago - Industrial - 1/1/2008Russell KlusasОценок пока нет

- Milwaukee - Retail - 4/1/2008Документ4 страницыMilwaukee - Retail - 4/1/2008Russell KlusasОценок пока нет

- Milwaukee - Retail Construction - 4/1/2008Документ3 страницыMilwaukee - Retail Construction - 4/1/2008Russell Klusas100% (1)

- DesMoines Submarket - Retail - 10/1/2007Документ2 страницыDesMoines Submarket - Retail - 10/1/2007Russell KlusasОценок пока нет

- Indianapolis - Apartment - Construction - 4/1/2008Документ3 страницыIndianapolis - Apartment - Construction - 4/1/2008Russell Klusas100% (1)

- Chicago - Southwest Submarket - Retail - 1/1/2008Документ2 страницыChicago - Southwest Submarket - Retail - 1/1/2008Russell KlusasОценок пока нет

- Chicago - South Submarket - Retail - 7/1/2007Документ2 страницыChicago - South Submarket - Retail - 7/1/2007Russell KlusasОценок пока нет

- Indianapolis - Retail - 4/1/2008Документ4 страницыIndianapolis - Retail - 4/1/2008Russell Klusas100% (1)

- Milwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Документ2 страницыMilwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Russell KlusasОценок пока нет

- Chicago - Near West Submarket - Retail - 7/1/2007Документ2 страницыChicago - Near West Submarket - Retail - 7/1/2007Russell KlusasОценок пока нет

- Chicago - Retail - 4/1/2008Документ4 страницыChicago - Retail - 4/1/2008Russell KlusasОценок пока нет

- Evansville - Apartment - 1/1/2008Документ2 страницыEvansville - Apartment - 1/1/2008Russell KlusasОценок пока нет

- JJPTR Presentation English 2016Документ25 страницJJPTR Presentation English 2016api-329633478Оценок пока нет

- BankingДокумент7 страницBankingCatalina PinzariОценок пока нет

- DME NEET UG 2022 Institute Fee Paymet User ManualДокумент9 страницDME NEET UG 2022 Institute Fee Paymet User ManualYash AdhauliaОценок пока нет

- Dishonour of Negotiable InstrumentДокумент10 страницDishonour of Negotiable InstrumentHyderОценок пока нет

- Nishan SinghДокумент4 страницыNishan SinghNikhil Visa ServicesОценок пока нет

- A Note On Interest Rates in An EconomyДокумент1 страницаA Note On Interest Rates in An EconomyAmit Kumar MandalОценок пока нет

- Summary of Account As On 31-03-2018 I. Operative Account in INRДокумент1 страницаSummary of Account As On 31-03-2018 I. Operative Account in INRjayakrishna joshiОценок пока нет

- A Guide To Your Account: Monthly Service FeeДокумент4 страницыA Guide To Your Account: Monthly Service FeeUtibeima UbomОценок пока нет

- Topic 1 BankДокумент6 страницTopic 1 Banktai JtОценок пока нет

- Real Estate AcronymsДокумент2 страницыReal Estate Acronymselkeb89100% (1)

- Secondary Securities, While The Financial Claims of CommercialДокумент3 страницыSecondary Securities, While The Financial Claims of CommercialĐặng Thanh ThảoОценок пока нет

- A Final Project For The Course Title "Monetary Policy and Central Banking"Документ11 страницA Final Project For The Course Title "Monetary Policy and Central Banking"Elle SanchezОценок пока нет

- Differencite Simple and Compound InterestДокумент12 страницDifferencite Simple and Compound InterestSagal AbdirahmanОценок пока нет

- ICICI Bank - Case Study AnalysisДокумент10 страницICICI Bank - Case Study AnalysisThe Cultural CommitteeОценок пока нет

- 1Документ15 страниц1alicewilliams83nОценок пока нет

- Chapter 20 - Audit of NBFC PDFДокумент4 страницыChapter 20 - Audit of NBFC PDFRakhi SinghalОценок пока нет

- Specifications For An Image Replacement Document - IRD: American National Standard For Financial ServicesДокумент59 страницSpecifications For An Image Replacement Document - IRD: American National Standard For Financial ServicesctapyxaОценок пока нет

- Duration: 1 Hour Max. Marks: 20Документ2 страницыDuration: 1 Hour Max. Marks: 20Khushi TanejaОценок пока нет

- PDF DocumentДокумент2 страницыPDF DocumentLinh Trang DamОценок пока нет

- MCB Annual Report 2014 PDFДокумент344 страницыMCB Annual Report 2014 PDFArham khan0% (1)

- Canadian Mortgage CalculatorДокумент3 страницыCanadian Mortgage CalculatorYousef MohammadrezaeeОценок пока нет

- Deposit Slip CertificateДокумент1 страницаDeposit Slip CertificateMalou AblazaОценок пока нет

- Maven 1 Bedroom Sample ComputationДокумент1 страницаMaven 1 Bedroom Sample ComputationJonathan LeciasОценок пока нет

- Fiscal and Monetary Policy of IndiaДокумент62 страницыFiscal and Monetary Policy of IndiaNIKHIL GIRME100% (1)

- Axis BankДокумент20 страницAxis BankXYZ909Оценок пока нет