Академический Документы

Профессиональный Документы

Культура Документы

6 Copy of Tds Chart

Загружено:

Dhiraj RawatАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

6 Copy of Tds Chart

Загружено:

Dhiraj RawatАвторское право:

Доступные форматы

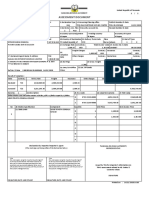

T.D.S. & T.C.S CHART W.E.F.

: 01/04/2008

TAX DEDUCTED AT SOURCE (TDS )

SR NATURE OF PAYMENT PAYMENT PAYMENT T.D.S E.C H.E.C. TOTAL SECTION CODE CHALLAN REMARK

NO (Rs.) MADE TO % 2% 1% T.D.S NO.

Surcharge

1 LABOUR CHARGES 20000 IND/HUF 2 0.04 0.02 2.06% 194C 94-C ITNS 281 @ 10% of

WORKS CONTRACT FIRM/CO. TDS 1)

JOB WORK If Payee is

TRANSPORT & FREIGHT Ind

/HUF and

2 ADVERTISEMENT 20000 IND/HUF 1 0.02 0.01 1.03% 194C 94-C ITNS 281 amount paid

FIRM/CO. exceeds

RS.10 lacs

3 INTEREST 5000 IND/HUF/FIRM 10 0.20 0.10 10.30% 194A 94-A ITNS 281 2) if payee is

COMPANY 20 0.40 0.20 20.60% Company

/firm and

4 TECHNICAL & PROF.SER. 20000 IND/HUF 10 0.20 0.10 10.30% 194J 94-J ITNS 281 amount paid

FIRM/CO. exceeds

Rs.1 Crore

5 COMMISSION 2500 IND/HUF 10 0.20 0.10 10.30% 194H 94-H ITNS 281

FIRM/CO.

6 RENT

A) P & M - Equipments 120000 IND/HUF 10 0.20 0.10 10.30% 194-I 94-I ITNS 281

Car Etc. FIRM/CO.

B) Land, Building, Furniture 120000 IND/HUF 15 0.30 0.15 15.45% 194-I 94-I ITNS 281

FIRM/CO. 20 0.40 0.20 20.60%

7 PAYMENT TO Non Residents 1 Non Residents 30 0.60 0.30 30.90% 195 195 ITNS 281

TAX COLLECTION AT SOURCE (TCS )

SR NATURE OF SALE SALE SOLD TO T.D.S E.C H.E.C. TOTAL SECTION CODE CHALLAN REMARK

NO BILL (%) 2% 1% T.C.S NO.

(RS.)

1 SCRAP 1 IND/HUF 1 0.02 0.01 1.03% 206 C 6 CE ITNS 281

FIRM/CO. 1 0.02 0.01 1.03%

Surcharge

2 MINING/QUARY 1 IND/HUF 2 0.04 0.02 2.06% 206 C 6 CH ITNS 281 As above

FIRM/CO. 2 0.04 0.02 2.06%

As above

Вам также может понравиться

- TDS Rates and ReturnsДокумент4 страницыTDS Rates and ReturnsMohanlal BishnoiОценок пока нет

- Contract Certificate CC1 & Part BillДокумент2 страницыContract Certificate CC1 & Part BillpushpaakarОценок пока нет

- Zoomlion Heavy Industry bill for partsДокумент1 страницаZoomlion Heavy Industry bill for partsfaruqОценок пока нет

- Silage Final DPR 2023Документ24 страницыSilage Final DPR 2023K N GUPTAОценок пока нет

- Tanzania Revenue Authority assesses used car importДокумент2 страницыTanzania Revenue Authority assesses used car importMwenda Mongwe0% (1)

- TPT2458Документ2 страницыTPT2458naresh marriОценок пока нет

- Tax Invoice: Grindrod Logistics Africa (Pty) LTDДокумент1 страницаTax Invoice: Grindrod Logistics Africa (Pty) LTDalsone07100% (1)

- Zoomlion Heavy Industry Science and Technology Co.,Ltd.: PCS/ NoДокумент1 страницаZoomlion Heavy Industry Science and Technology Co.,Ltd.: PCS/ NofaruqОценок пока нет

- TAX Invoice: SR Description Hour Rate Amount Tax Amount TAX Rate Total Amount (DHS)Документ1 страницаTAX Invoice: SR Description Hour Rate Amount Tax Amount TAX Rate Total Amount (DHS)MUJAHIDОценок пока нет

- Income Tax Department: Computerized Payment Receipt (CPR - It)Документ1 страницаIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990Оценок пока нет

- Advance Sales Invoice-SI - 28128-27-Jan-2023 15 - 27 - 06 - 230128 - 103459Документ3 страницыAdvance Sales Invoice-SI - 28128-27-Jan-2023 15 - 27 - 06 - 230128 - 103459Vidyanti AnggraeniОценок пока нет

- Tax Deducted at Source (T.D.S.) : IND, HUF, EtcДокумент1 страницаTax Deducted at Source (T.D.S.) : IND, HUF, Etchit2011Оценок пока нет

- EPFO PF Contribution SummaryДокумент1 страницаEPFO PF Contribution SummarysudhirОценок пока нет

- TDS TRS GST (2) 20211228151919Документ38 страницTDS TRS GST (2) 20211228151919Rishi PriyadarshiОценок пока нет

- Weather Conditions and Report Cargo WT: 48992.00 LCF (A or F)Документ11 страницWeather Conditions and Report Cargo WT: 48992.00 LCF (A or F)kolcth x-rayОценок пока нет

- Tdsrateschart2008 09Документ2 страницыTdsrateschart2008 09Libins SebastianОценок пока нет

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Документ13 страницTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11av_meshramОценок пока нет

- LSGD Section Kanjikuzhy Kanjikuzhy GP 2018-2019: Churuli SNDP Padi Attikalam Road Culvert (273/19)Документ5 страницLSGD Section Kanjikuzhy Kanjikuzhy GP 2018-2019: Churuli SNDP Padi Attikalam Road Culvert (273/19)Assistant EngineerОценок пока нет

- ServiceInvoice FOCGA83488Документ1 страницаServiceInvoice FOCGA83488Anonymous FKn0IvPОценок пока нет

- BTДокумент1 страницаBTWikum MadushankaОценок пока нет

- TDS - Rates - 07 - 08Документ3 страницыTDS - Rates - 07 - 08KRISHNAKUMARОценок пока нет

- Form 26AS Annual Tax StatementДокумент4 страницыForm 26AS Annual Tax StatementFiroz AminОценок пока нет

- File Save Ref Date Draught SurveyДокумент11 страницFile Save Ref Date Draught Surveykolcth x-rayОценок пока нет

- Defense Finance and Accounting Service Military Leave and Earnings Statement IDДокумент1 страницаDefense Finance and Accounting Service Military Leave and Earnings Statement IDAmaryОценок пока нет

- Receipt of Import Declaration 1 / 2Документ2 страницыReceipt of Import Declaration 1 / 2Thant ZinОценок пока нет

- House No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidДокумент4 страницыHouse No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidIkramОценок пока нет

- Tender For DEOs 2019 20 Instructions To Bidders - ITB PDFДокумент29 страницTender For DEOs 2019 20 Instructions To Bidders - ITB PDFVarun ThallamОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Parthiban BaskaranОценок пока нет

- Tds Income Tax Rates Fy 2010-11Документ13 страницTds Income Tax Rates Fy 2010-11Surender KumarОценок пока нет

- G4S SECURE SOLUTIONS CANADA PAY STUBДокумент1 страницаG4S SECURE SOLUTIONS CANADA PAY STUBfaresОценок пока нет

- Declaration 4005106Документ2 страницыDeclaration 4005106Muhammad AbdullahОценок пока нет

- MSEDCL - Bill Info - PDF 788Документ4 страницыMSEDCL - Bill Info - PDF 788Mahesh MirajkarОценок пока нет

- Ganraj ConstructionДокумент2 страницыGanraj ConstructionSUNIL GAIKWADОценок пока нет

- Salary AdviceДокумент1 страницаSalary AdviceVee-kay Vicky KatekaniОценок пока нет

- CHECKLIST1Документ14 страницCHECKLIST1Rudro KumarОценок пока нет

- Declaration 3520274918639Документ5 страницDeclaration 3520274918639Muhammad Ahmad Nadeem MughalОценок пока нет

- Invoice - 202400114325 - Sonu KumarДокумент1 страницаInvoice - 202400114325 - Sonu KumarservicedeogharОценок пока нет

- Airlogix PiДокумент1 страницаAirlogix PiAmit KumarОценок пока нет

- Bartronics Update 16 Oct. 2009Документ7 страницBartronics Update 16 Oct. 2009achopra14Оценок пока нет

- Import ChecklistДокумент1 страницаImport ChecklistGolden RosesОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Vipin SaxenaОценок пока нет

- BG121436Документ2 страницыBG121436Eng Venance MasanjaОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961bhavdeepsinhОценок пока нет

- Tax Invoice: Delhi International Cargo Terminal PVT LTDДокумент1 страницаTax Invoice: Delhi International Cargo Terminal PVT LTDyogesh nagarОценок пока нет

- Income Tax Department: Computerized Payment Receipt (CPR - It)Документ1 страницаIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990Оценок пока нет

- Si No Item Gross Amt PDP Dis% Rebate Rate Qty GST Hsn/Sac: Date: 9-Mar-23 Salesman: BTMДокумент1 страницаSi No Item Gross Amt PDP Dis% Rebate Rate Qty GST Hsn/Sac: Date: 9-Mar-23 Salesman: BTMVishnu VОценок пока нет

- Tax Invoice: Transportation - PackagesДокумент1 страницаTax Invoice: Transportation - PackagesBala Praveen0% (1)

- Market Update 13th March 2018Документ1 страницаMarket Update 13th March 2018Anonymous iFZbkNwОценок пока нет

- Kadar Alir Gerik - (A) (Rev)Документ7 страницKadar Alir Gerik - (A) (Rev)Mohammad Hafiz MahadzirОценок пока нет

- E-26, Asad Street # 1, Mohallah Firdous Park, Ghazi Road, Lahore, Cantonement. Sadaat Naseem KhanДокумент3 страницыE-26, Asad Street # 1, Mohallah Firdous Park, Ghazi Road, Lahore, Cantonement. Sadaat Naseem KhanZeeshanОценок пока нет

- Qi0243 - Amnpn5168p - 2022-23 - Fy 2022 - 2023Документ9 страницQi0243 - Amnpn5168p - 2022-23 - Fy 2022 - 2023Dharma kurraОценок пока нет

- BCL 025 Inv 9677Документ2 страницыBCL 025 Inv 9677Sanjay LoyalkaОценок пока нет

- Income Tax Department: Computerized Payment Receipt (CPR - It)Документ1 страницаIncome Tax Department: Computerized Payment Receipt (CPR - It)muhammad kamranОценок пока нет

- Ce 01264659Документ1 страницаCe 01264659Zakhele MpofuОценок пока нет

- ABSA Bank BRANCH: 632005 ACCOUNT: 4099689566Документ1 страницаABSA Bank BRANCH: 632005 ACCOUNT: 4099689566Zakhele MpofuОценок пока нет

- Free Downloads by Moneypati: Telegram Twitter Linkedin Youtube FacebookДокумент3 страницыFree Downloads by Moneypati: Telegram Twitter Linkedin Youtube FacebookDhiraj RawatОценок пока нет

- Candlestick Patterns Analysis ToolboxДокумент21 страницаCandlestick Patterns Analysis Toolboxpaolo100% (1)

- Ewpclubtcc 2Документ5 страницEwpclubtcc 2Mukesh PandeОценок пока нет

- How To Use Tradingview Thread by MR Chartist Jan 16, 21 From RattibhaДокумент51 страницаHow To Use Tradingview Thread by MR Chartist Jan 16, 21 From RattibhaDhiraj RawatОценок пока нет

- ICAS - Initial Capacity Assessment Sheet - 2010-12-09Документ15 страницICAS - Initial Capacity Assessment Sheet - 2010-12-09pchakkrapaniОценок пока нет

- Welcome To Module 2 of The Elliott Wave Vertical. This Is On Impulsive PatternsДокумент33 страницыWelcome To Module 2 of The Elliott Wave Vertical. This Is On Impulsive PatternsediОценок пока нет

- ReadmeДокумент1 страницаReadmeDhiraj RawatОценок пока нет

- Gladiator Indicator: IntroducingДокумент5 страницGladiator Indicator: IntroducingDhiraj RawatОценок пока нет

- M2O2 NotesДокумент36 страницM2O2 Noteseric5woon5kim5thak100% (2)

- Liquitex Basics Color ChartДокумент2 страницыLiquitex Basics Color ChartJ_Iscariot100% (1)

- M1 NotesДокумент86 страницM1 NotesediОценок пока нет

- 0 Cma Format BlankДокумент32 страницы0 Cma Format BlankDhiraj RawatОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- MCExample SalesForecastДокумент298 страницMCExample SalesForecastDiego RiañoОценок пока нет

- EOQДокумент9 страницEOQJojoPANGОценок пока нет

- 33 - Balance Sheet Ion Check ListДокумент2 страницы33 - Balance Sheet Ion Check ListsampathkumarliveОценок пока нет

- XYZ Private Limited Financial Projections 2010-11Документ8 страницXYZ Private Limited Financial Projections 2010-11Dhiraj RawatОценок пока нет

- 1 - 0 - 29032010investment Idea - SpiceJet (STRONG BUY)Документ5 страниц1 - 0 - 29032010investment Idea - SpiceJet (STRONG BUY)Dhiraj RawatОценок пока нет

- DEEMED INCOMES (Aggregation of Income)Документ3 страницыDEEMED INCOMES (Aggregation of Income)Dr. Mustafa KozhikkalОценок пока нет

- Special Accounting Issues For Specific OrganizationsДокумент45 страницSpecial Accounting Issues For Specific OrganizationsLyka WeeОценок пока нет

- Fairtrading - Nsw.gov - Au-Levies and Capital Works Funds PDFДокумент4 страницыFairtrading - Nsw.gov - Au-Levies and Capital Works Funds PDFKris VenkatОценок пока нет

- Szarowsk ProcediaEconomicsFinanceДокумент9 страницSzarowsk ProcediaEconomicsFinanceian opondoОценок пока нет

- Obillos v. CIR (G.R. No. L-68118. October 29, 1985.)Документ1 страницаObillos v. CIR (G.R. No. L-68118. October 29, 1985.)Nezte Virtudazo100% (1)

- Shoaib StatementДокумент88 страницShoaib StatementshaikhОценок пока нет

- Tax InterviewДокумент1 страницаTax InterviewGhayur HaiderОценок пока нет

- NY CA 01-01-1953 9984 TXPRДокумент98 страницNY CA 01-01-1953 9984 TXPRAdmin OfficeОценок пока нет

- Tax Planning and Managerial DecisionДокумент188 страницTax Planning and Managerial Decisionkomal_nath2375% (4)

- Solved Peter Jones Has Owned All 100 Shares of Trenton CorporationДокумент1 страницаSolved Peter Jones Has Owned All 100 Shares of Trenton CorporationAnbu jaromia0% (1)

- CIR vs. Procter and Gamble - BrinezДокумент2 страницыCIR vs. Procter and Gamble - BrinezMichelleОценок пока нет

- Renewal Premium Receipt: Invoice Number: A150048237100041Документ1 страницаRenewal Premium Receipt: Invoice Number: A150048237100041Aasiya shadab KhanОценок пока нет

- Caltex Vs Commission On Audit 1992Документ1 страницаCaltex Vs Commission On Audit 1992Praisah Marjorey PicotОценок пока нет

- ITR 4 SUGAM for Individuals with Income from Business/Profession up to Rs. 50 LakhДокумент8 страницITR 4 SUGAM for Individuals with Income from Business/Profession up to Rs. 50 LakhHitesh VishalОценок пока нет

- Appeal Tax Procedure (Malaysia)Документ2 страницыAppeal Tax Procedure (Malaysia)Zati TyОценок пока нет

- Camille Realty Journal To FSДокумент9 страницCamille Realty Journal To FSVenus AriateОценок пока нет

- Income Payee'S Sworn Declaration of Gross Receipts/SalesДокумент2 страницыIncome Payee'S Sworn Declaration of Gross Receipts/SalesHanabishi RekkaОценок пока нет

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyДокумент1 страницаSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Quiz - M2.5G POST-TEST May SagotДокумент17 страницQuiz - M2.5G POST-TEST May SagotJimbo ManalastasОценок пока нет

- Chapter 06 Donor's TaxДокумент16 страницChapter 06 Donor's TaxNikki Bucatcat0% (2)

- Since 1977: Philippine TaxationДокумент6 страницSince 1977: Philippine TaxationXyza JabiliОценок пока нет

- Hours & EarningsДокумент1 страницаHours & EarningsAmmara AhmedОценок пока нет

- Fringe Benefit Tax Dealings in PropertiesДокумент13 страницFringe Benefit Tax Dealings in PropertiesBea Marie BernardoОценок пока нет

- Publication Jan 2023Документ15 страницPublication Jan 2023JSОценок пока нет

- Tax Free Exchange v3Документ2 страницыTax Free Exchange v3Lara YuloОценок пока нет

- The Following Information Is Available For Bott Company Additional Information ForДокумент1 страницаThe Following Information Is Available For Bott Company Additional Information ForTaimur TechnologistОценок пока нет

- VALUATION PROFESSIONAL FEES of Various BanksДокумент12 страницVALUATION PROFESSIONAL FEES of Various BanksArunKumarVerma100% (2)

- A History of Tax and Taxation in Colonial ZambiaДокумент3 страницыA History of Tax and Taxation in Colonial Zambiamuna moono100% (1)

- MPDFДокумент1 страницаMPDFakshay takОценок пока нет

- Adjusting Entries HomeworkДокумент3 страницыAdjusting Entries HomeworkNaeem HussainОценок пока нет