Академический Документы

Профессиональный Документы

Культура Документы

Tax Ti On

Загружено:

munira sheraliИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tax Ti On

Загружено:

munira sheraliАвторское право:

Доступные форматы

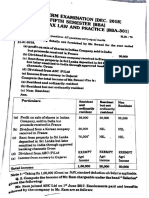

Q. 5 MI Baqar, MI Hadl, and Mr, Mlkdad a e members of an A SatiatIOn of PIons, (AOP) which Is doing bus nes- under!

e name 01 MIs BHM As ocia _ s As pe Ihelr agreement, Mr BaQar is entitled 10 ree Iva 5% In er s on his ca~llal e'1Iployed, besides his sna e (om profl Mr. Hadl IS nllUed to receive co Ission of 1% In recognition 0 his e rts 10 pro· mote s les Th prorl! is 10 be distributed qually amongs the members. DUring the year e dad June 30, 2004, he book of accoun of MIs BHM Assocla as so' ad ollowing resulls'

Sales Rs,

Gross pro Rs,

S III 9 & ad In expenses Rs

4,500,000 ,800.000 ,520,000

Further Notes re 8S under:

An asset. which had a wflhen down value of Rs, 100,000 on July 1, 2003 was disposed of for Rs, 1 0,000 0 May 30, 2004. N Ither d pr Clatlon nor gain on liS disposal was ree rded' the books 01 accoun s (Assets are depreciated al rates give In Ihe Ihird SChedule 10 Ihe Incom Tax Ordinance, 2001).

2, Inerest on capital employed and commlss 0 0 sales were p operly recorded i he books of accounls and paid 0 Mr BaQar and Mr Hadi

3 Provision ror bad debts charged 10 prom and loss account vas 6% of sales. During the year actual bad debts wnUen off a ounl d 0 R$ 1 0,000

4 Capital mployed by each member of AOP Is sunder

Mr 8aqar Mr Hadl Mr MI dad

1,000,000 200,000 300,000

5 Other I comes of embers were as under.

(A) Mr, Baqar received salary of Rs. 300,000 (Incluslv of house r nt allowance 0 Rs, 120,000) Irom another company dunng Ihe year The e . ployer deduc ed Rs 21,000 la at source from salary He also earned pro II of Rs. 20,000 on hiS bank depo I s on wh cl I 0 ~ lax was wi hheld by the bank

(8) Mr. Hadi In additron 10 h com Issie and share of AOP income has also receivedgncuH~ral income of Rs, 120,000 during I e year. HIS income from his own bus ness or the year end_d June 30,2004 was Rs. 100,000.

(C) Mr Mlkdad d ring Ihe year supplied goods 10 gover men! depa me s won Rs 1,500,000 on which Income Tax @ J 5% was Ithheld by t ose depart ents

Required:

Wor ou he foliowl g

(I) Taxable Income of Is BHM Associates (AOP). for the year, 2004

In) Taxable Income of each of Its members and theIr lax Ilabili les 101 12

the lalC year, 200

, :. Mr, M·usstldiqll;L; ,N,QOr"rS'~i eQT!s,U!'~~flt>lf'i o\:"9rll\JP Ql ~D/Ilp,;,1.~i:~s,; H~e . ~t~rt.~~(( rplloW.i!1.9 ::i~~ci.m:~ 9trri~ 9 ~~.si l~qom;e .,year ·Jul~i t, 209~'t~,' J'Lii~~ BO,~OO3 ':

. P,&r~fcid.ir;

• I ~~..._ ,. J,;

{i}. Sarillj!·'®Qme:

Bai=lit-·Silll,lirt ,

H;o~se Fi:en(PJICI'war.lce . l:Jtilit'!/ Arl~a;rnoo , . .

: M·6d~cal '. $!lOyZEIl1Ce,'

He·is,:",fs·rj prfJ,iJlde·ij viitl;~'8\1:~~0[) 'ti· Car.,.';;';~iI;t] '!$·n~~·lJsed 'lor uom:

P'ai1'i.s·I:l~~i!~~S5. j"l;~ha~ ~1~?p~,e8, g1a~!&f' ~h~. jI~Q~gQ~':J.o~n.pfR·:S: '000;000 Oil whiCh, ·110. profitfiPlt@f%tnas:·baen: tl'~fgelt .

. ". . .

~n.addUIM llQ. above; h~ al$o, r~ool~d:gmtJjlty:{jJ Hs. 75fOao h'oirl"lli"~ ·p:~.ilQ.~~ns.lnpl~;.e.~ ~u;n~:i the y~r: ,~~,g:rarl~,ily ·r~n~ l~·I~.Qt ~pp~.crjed b:y.lh.ft'CmnmtS:slol)"i:rF oJ; rnQ~m~ T~.or·C,El!;t

'.....~. .. '.

~~~. p·~i';I.~~;~·d ,'a! .~~iJl~d ·frOl!l·'Splapt .am?urn[~ .. t9· R¥. ,15:qOQ,'

(Ii) ·ProplirtY I~oo~j~ . Rs~

,f-l.ei~l~ ~Qtn;~ ·~Olis.e· 'I.~i.o~t, iQ,!Qqp nlj!r;·~:Orlth 8,e~~nrifirre(t .fDllo~~ fig. ·(l!):;pens.e.s . on ..this

I ~ I I ,1;,-. i I ........ .' ".

~Rr.op~rW diLtcling,,!he.year·:

R:~~3jr~,: . ._.

·.CoHe~ton q~a~.es .:~ .. 9ff r~I~I·

:G~hrrcl: r:e~( ,. "' . , 'I Oi.t1DCF

'~~~!le.r,¥:Y~, .... " ~ .,. ,.ts·,obci'

',~~i'iIl21~dnn.~.}·f~!h·.h9l1~! ng !FrR3![l,e:e ..,. . .

" tmnRaJ1Y· . Jlj.p00 p<eF month

. . .. '(" "

I' I';hneeeived .tI d~pooH ,of :Ri- 200"OQO, not ·adjL.ls,table, ,ags!iwt ffifl't., ,OLlt' ,01' .wlii~h ;hs r~ttlilde€rl{5:1 'OIJ,Gtia Japreiji.D.tJS ,ter'l~~t."~'lho' 'vaCate~ tltaln:itlse hMi ~lY2ar~."1€Yn~nh¥; .

;.:,;.~ ". \ . . _.. \' ,.. ~. .

(iii], QJUer l'nCDm~' '

:'pr~ !Il~Qn' PL~ ,&~nk,~eCOp~1 (n0\'ot· 'I'~%,l~~

,Wil,M1&'.O)..., ~~~OO

Gallll~lssrOIl frO~l. :Insuranoe G.run[lam~;aila

~~[b~~i'al,~:.bl~}QI~ (nel nt~I~.:I,~X~ Itl'l1rl{0,1~1 j ~,OO~ ..

tec~rdrlg a·n9 :~a ni~.alidn ·S~MCB,s . .!e~5: \tol1l. ~

p;o'[e~!on~Hnstilllt6S,(ri'gt al,b%: ta~'wilI1~elal I g,OOO'

I '

~.

,

A~ ~Jat C~Il,SU!I~11~t ~qu, arY~I:~ired' 1~"GQmrU\~,Mr; ,iV!~5ad~t~ue:s lo\al~1) I i o~in6:ai~J'1l1s. ~iicmne tat Ijaojlizy'19rJ~e l~x"year·2~~3.

I I ,:" • I ,

'Q~ t . ~1~e91"~QS'p.ita! ,is ~IHln~~lsi8~,O ~a~~i,~~nip':I!II~<OW~~.,~.~r, ~~£:~S ~Ii~ '~'[ly, MctM MI~~ R~~i~,: YQU b~il~ a l~t:~ro~Utloll@~ ~a~:e .~~ell a~~lUaGnM\o w~~~is.,nie.l~eon)e,~~ Relu,Wol the 11!m linm:!oIIQwln~ ~v0n~h~tou'nt allti o\M'~18\1anr~uja 8~.~rOlii~ed:tO',~ou r~r' tllS'lax

. '('t,A,

ve~r, 2 Ju~'"

'.

8

, Ii) Dijrire,ci~ti~~ IIWluQOS -As:.. 2P,COO ,on i,car COll1p~erlJ:Jv In OO'so~fit U,'I1l

~,~ p~~n.e~:s.' . .

00 Salides,lodlide dramflgs.,01 Fl~. 1oti,hll ~nd1 m~:e i1J' end! ~! 11l~

p~MefS,

(iii) A :1)l1namh!!Opi~1 ~o,nMffif R~, 1,0 mllii¢n illrli ,ctmq~~Ja.r ~crISIlUcttoi" 01'

, , s~eQI!l1 Cl,l;l:ll,ler WtlFC!. "

(Iv) 11 es ,'.IInfineld by oorpcn1e ellen!:; ~~regaloo ils. 200,000<.

lvlr. Naqar"g I!land, ,~BilOOd an tIlt8rest ' lee 10IIn 01 Rs. 100,000 10 IDe

HOS~llll dYrin~ 019 year.' ,

(vii A 'lorelgn,p8Ne~1, ,~e[ng salls.~ed 1'(1lIl1'O$pllll"G beslq~i!llfy CAre gtl~ii !\:O~8~ Qlt~1 Fls:iSO.~O·~~ hHjher btipiMilU Ihl! Hoopll~I's ~NI(!e~, T~I~ amoul1t h'as nol teel'f,MCOU~lillJ1l~t S~fIU, ' , .

{villh.J'i)itill ,equ1fMllelll" ~~~Q As, i OO,@ WilH '" 'f:II~ bllfl'll, ou~ i'ihlill. daOOl!s looll awa,y Bs,.5MOO fuiin I~e ~le;J~ I~ "OO1l1 ilems IlrQ rUllyl~,~\I1ed and ~he QI~im Ims beertfulJy ~dr]1itleP py l~~ ln~urll~Ce

,Colnpany, '" .. '

(viii} ih ,H{)'~~~al Ms iid~e,d, \0 ref10\~n~d cQI1]pal1!ls io !he PIlOel, ,'iiiJl ll!XiltOIed increas~ of fu: 2,000,000 In iulum rr.renue~

(~ Salnrles In' Ill!ii !lI!CE~ pertpJlsTIlffi a Rs. 80,000

,&'1~M~~ HQs~)iiali(ippll~~:

E'leclr~iIY;.' '1

Cb~rl"lif;i~~~ici~; . Insu~~;~~, W,rlur.

liep~IIS'& '4ail1!~F\311Gec.:' OefJ'l~iat'ioll Q'n'fued' ass~s I~xdu~in~ ,hun£ O! II ~qut~ln[ri)', ", P!dR~rl~,tB~~'. ", ' ~.8dio!o~'y~L~~ t!~~nS~~i Proles'~iDMI'j~~ p~i~" E~p~\f1~S, !)~ II~O:Wee~l~ dil"idDr'~I1;n~t)ir~.

1I n1ilipp~ttl)d 'payments, p~(1~ll!es ~Dr n6Mbw.

,( ,I, \ .: "

\'Mct 01 rp:)~ en\~r6n' ,

1118h!al ,rIJ~l!la~i.Qtl~,

Ne! Pmfll, .

O!her 1IlllWllalkmtdalU :

Akwl Ho'spil~1 ' ReVenue AQQO,UIII Year200i" ,',

Bt.,

-',-,-

,3,WO,OQQ

~

0,,5. MI. Q8~, 'lallSOOIls Cre-r,CtlmiCcmDll~ St(tela~ 01' t Sal Salam & Co. Lld'i s neD' the year! 900 •.

,

lOO,Q~O 5~;O~: 100,000

> ~ c .

50,000

G,08s'II\~~\1~n! ~,~P.l~

~elors tn£~~dllcliolm) 1.,~oo\Qao

Q"P . .D,.CD~I~tio115

(o~IQ~a l~td~j~11~nsl ,500~M'

S~e cl'59is p. 100;000'

Rs.

-

IBa5~ S~ary 2~~'

HOUS& Renl )i1~wID1ee B.33~

Utltl~ AltOWMCB 2.000

MDdloel AlID\Van~ 2.000

H~ '\'fIlS ~ _ m!iJi\enance ces! 01 ~ Pfrf e ca ~i&!l \~~~I 1'0' he s~mwan1 ~u~ne!S on aduaJ bas~ aOOIlJ~allr'9 fis. 20,000, He ~ece~ved banu~as e~I~~olDnIIOI IhrB,~ bll51c ,~a~i&; plus IW~ basl~ sal~ne& BS speCial mBllI f&WS!tJS a~d~gllha ~Yr.

100',000

, i.

50,000

~O;~~, 1C~:,Oa.o

TIle camJHlfiV hes also prtNlded him IMlhi lrea Ilumlshed m:£t1rnnIDda· IIQn OOSI~lg ~t ~QOI,OOO pelf IllUIUI1\' Tllel C(Jrlipa~ also, p~lcl hl~ la~ I!ae ij~ Q R$, 20,000,

. B _ d *I'ting amouni e- n,w IJ\! rec!!P1S bu~ng j)Q\' ees; .• Ns. w~ .. ev!r. a .• ~_btG:

I! SclfOal ~!Qs I Rs, ~OOO ", monl~ Igr ~8e~ o~ nls h'tIJ dallY llers, :~. ~G _ Q personal so~dl~~ l lax ad\'lser As. 20,000,

:1, Pnor ~&a ·IJiMe aM p&lalm As, 50,000,

,4, ConaI~ooMO~ - ovee In$~ ~~ _ _ As 500,00).

5. Pu. diL~ of am car !vI R~, . ,OCO;COO Q lanmy us

RequIred:

As DIIlX. C¢!!sullan! }'OU ar~ !eQulwed'lo C{llcu'n~e' lo-!allnCDnI .! nd lax 20

~aij~~ol ~~r. 0$1& Manst-:lr l~llaX yUJ ~OOl

u' ~ [j~in~'1 I't'i [(\I1IIIIILlI1I YOli kl\,~ beell rfl)\,ided will~ 111~ ~i1110\\,jl1g illfUll11:1' lilill illl"~lrecl ~f Mr. A, D, CllIIglltai, 3 s~l1i~r l1lall~ger or a loc~1 COmpnl)Y for ili~ p~l"il1d lsi jill)" ~Il02 ta )0111 ApI'!!. ~003 (T~~ Y~ar, 200q):

U:lsic pa)'.Iwa~c) H()llS~ 1"~lIt ~'~edbll ,lltli\~Lmre

eml III" liV'~lIgallow~llc~ lIti lilies

OrderlylSelVl1l11 alk1l\'nllc~ 8oll1lliex'W'Uliu

Company car DOO cc

(Jlal1ly used i(lr cOl1lr~ny's business) I.e a v'e~1re assi )I~ 11;; C

~Inpll\)'cr·s conll·iblilion [0 providelll flmd EllirlrI]'N\ ~ontl'i~lItion to pension flll]J

InC\llll c w~ ded II ctelj uis 149.

Rupee1 ~IO,OOO II )500

4,300 7,~60 J 1500 JO,OOO m,OOQ

17,500 21.786 mOO

60,000

'In ildditkll~ [0 the ~Do\'l' you Ilavr OCl;n provid~d wil~ th~ foHowii1g J~I~;

i I ])i I' ide lid i IICume 17.500

(wtltllioldillgtax deducl~d Rs, 1,7,0, ZlIkM (Icducted Rs, 250)

ii) PI'Gfil nil PLS Ac~o~nt 20,000

(w~tIIIIOldillg tal deducted Rs, 2,000: 7:,a~ai !'Iedilctcd Rs, 1.520)

iii}1 Pmfessiollal fe~recei\led IIl,nOO

[\\'[lhholding t~~ dedllcted Rs, 500)

IV) Sch(){li Fe~ paid for two children EOIIO

(Rcc~ipt) ~IIOIV NaliGllal TID: Number}

~'l LegJI ex~ellses (collsuitmlt fee} I ~,500

(I~e~irtl ,11!ow Nali~llal Ta~ NUI!lbtr)

vi) Tllert is 110 lillie scek for rllis pllsitilin.

Ih'q ~Iircd :

WI!i'k (il([ tllc taxable illtlllllt alia lax liahility or Mr. A. D, Chllght~i fill' !~e Tax 20

Y~ar, 200t

0, S Dr. A. A. Q Ute sh i ~ medi~~ I pille! i I~ncl'; fll rn iihe ~ bi j Re.reip t an ~ Paynleill

'~;l;~CCOlilli tor lill'" period lSI htlyl2002 to JO!~ April, 20~} (Ta) year, 2004),

,,' ; r Alii/jiM

~1!\'I1I!'!I!.l ~lIIilllllj ,?t't'~ii!Li

{t. &,

RIll[ Ilr clink 24,O~~ C~!l~ul1aiiQlI f!~~ 450.0~~

Hllu~~I\nld (')i.~~l1m %,~~~ Vhlillg feel iO~,OOO

~ :,

l'iII t I\~S(' of m010r I ~l JOO,~~Q Rem u ~eralion fmm articlCl

]lufei1J:j1,' of nll~icul e'luirm~'ii I MJ,OOO pliniiSlIOO in m agllincs I~,OOD

!\d\'M\c1 inrom~ tn~ 60,~OO Rental income nOI)!)

Silia[v to [IS;islanr )fi,~OO Om~ from rlti:ntl . j~JlD[i

C il r [\11111 illg exr.~n~s l~,~OO ---_ ..

jlmpC[I~ in,1 1~,Owll

~r~cialil)n Df motor '~r ~~,Ol)~

~\\lti~II~~ 3,O~~

Ulilities hOM

------

i{elluiNd: ('l)m~lIlc tile illcom~ fGr t~e rel~ti~~ tiP: y~ ~I~ rtL'L '!fIereon arl~r I~king inl!) 16

n~COIIIII rile fnl!awing ract.1:

!) ']'1\'IHllirJ of em' mnn il)~ ~,~pelt!eS'~I~ in ~onil~ction 1'1 ith persan~llllse, ii) 1)~i)r;('~1IiDn on m shoulc oe cllIIrgccl a~cor~illg 10 t~e Tulel.

iii) 11I\'['jtIllCnl ill Ddtlice Sa~ill£s CeltitkM~! Ilt R~ )O,OO~,

Q.5. Following are the details of income cf Mr, A. Rehman for the fir1anc~al year ended June 30,2004, who Is employed with a company as SeniOr

Manager. .

Sli./aIYJn&,OLtlt

Pay : Rs. 60.000 per month

House rent allowance : Rs., 27;000 per mont~

UUlilies : R&, 8,000 per monln

He was prov,ioed with a eOmpiilrlY melntalned ear of BOO ee, part.

. Iy ror busiMSS and pa~Jy for his personal use. The (lost of the car to tMe c-ompany was Rs 500.000,

Binra/ joc;Qme:

Annual letting value

ot property : Rs.372.0oo

(including Rs. 120,000 for furniture and fixtures), Durinllhe year property remained vaecanl (or 4 monthS.

GrOlJn~ rent paid : Rs. 8,000

Business InCOme : Rs, 200,,000

~!algains;

Cost of snares of unUs!e~

coOmpanies (bought in 1986) : RS.500,000

Sale proceeds of shares : Rs, 600,000

l!1KeslaJ,ems.:

I Investment in share ~ listed companies

- Premium paid rQr life annuity eligIble LInder Seclion 63

: Rs. 1BO,000

Requlrtd:

: Rs, 45,000

Compute taxable Inc-Qme and lax liabUity of Mr. A, Rehman for the: year. 20

Prepare aM present all necessary worKings, .

Q 5 Following are the details of Mr. Shakeel for the financial year ended June 30, 2005, who is employed with the Institute of Computer Sciences as Professor. He joined the Institute on July 1, 2004. Previously he worked with Institute of computer studies. He was required to give 3 months' notice to his previous employer to terminate his employment. He served notice period for 1 month and his current employer paid the notice pay equivalent to 2 months' salary to the previous employer amounting to Rs. 150,000. Other details for the year are as follows.

Salary Income:

Pay

House rent allowance Utilities

Rs. 90,000 per month. Rs. 40,500 per month. . Rs. 9,000 per month.

No company maintained car was provided 10 him. However, 1751itres petrol per month was given to him @ Rs. 50 per li!re.

Investmen~ :

Investment in share of Isited Rs, 175,000

companies

House Loan:

Payment of interest 10 Com- Rs. 250,000

mercial Bank on house loan

Charitable Donation: He paid Rs, 50,000 to non-prom organization, 2/3

Required:

Compule taxable income and tax liabilily of Mr. ShaKeel for lax year 20

2005, Prepare and presen! all necessar~ workings.

Marks Q, 5 D~fine the followings in terms ollhe Income Tax Ordinance, 2001:

(il Tax on taxable incorM 2

(Ii) Capi!algains 2

(iii) As social i on 01,- -- '2,

, , _perllons

(Iv) Tax year 2

Q, 6 Zahid is working in a localorganizallon as civil engineer. Further, he ,is pern1itled by, his,employers to operate in a limiled way, as an independ· ent consultant to other companies ,and projects, He pays 25%. o,llhe grGSS ,consulling fees collecled to his employers, He rendered you the following account of his estimated income and taxes for the financial yeal ending June 3D, 2006:,

(1) lOOiRl Irom emoloyer:

Amollnf(Rsl,

(a) Basksala~ 144;000

(b) CqnveyanCe's.llowance 12,0,00

(el House re'nt allowance 60.000

(d) Entertainment expenses reimbursed 18,000

(Actual expenditure incurred on

compan~,'s business wasR~, 20,500)

(2) COlls.u1ljng_ business;

,Constllla~cy fees (Nel amount) 54,000

(3) Tax paidJdeducted at sOU[C§:,

Under S,ection 149 Under Section 153

1:~OO MOO

Required:

Compuletaxable income and tax payable for tax year20D6.

, " .

Q.4. Colonel (Retired) Ahmed Ali is'the Managing Director of a listed public

company and has provided the following details of his expected income and expenses for the year ending June 30, 2007:

Salary Income

1. BasicSala~

Rs, 1,800,000 per ~ear

2, Dearness allowance 10% 01 basic sala~

3 Medical Allowance Rs, 25,000 per month

Managing Director is not entitled for,

an~ reimbursemenl of actual

expenses of hospitalization or med·

ical treatment

4. The company disbursed on July 1, 2006 to Colonel Ahmed Ali, Rs,. 3 million Interest free loan to be recovered from the final dues on retire· ment The bench mark rate for the year 2007 is 7% as notified by Federal Government.

5. Company has. paid Rs. 850,000 as annual rent for the accommod~tion provided to Managing Director.

12

6, He has been provided with a compa·

, ny hlaintained car for business and personal use, The purchase price of the car is Rs, 1.2 million, The company also pays sala~ to driver @ Rs, 8,000 per month,

7 Colonel Ahmed Ali is also receiving pension from the Army @ Rs, 10,000 per month,

Property Income

Colonel Ahmed Ali owns a flat, which has been let out @ Rs. 45,000 per month. He has incurred following expenses todate on flat during the year.

Marks

a) b) c)

Repair .& maintenance Property tax Insurance of flat

Rs. 30,0001= Rs. 20,0001= Rs. 15,0001=

Other Income

1. Colonel Ahmed Ali has also received Rs. 500,000 as his share under Section 92(1) of Income Tax Ordinance, 2001 being the member of an Association of Persons, where the Association has paid the tax.

2. Colonel Ahmed Ali has won a cash prize of Rs , 200,OOO'from a company which· offered the prize for promotion .of sale under Section 156 of Income Tax Ordinance. 2001.

Required

Compute the expected total income taxable income, and income tax thereon for the tax year 2007. .,

20

Q.2 (a) Mis. Z. Attari Ltd., has a tax year ending on 30th June, is feeling difficulty in filing the return in time. You are required to advice the management on the following issues:

(i) Who is responsible to file return on behalf of the company and what conditions

shall be applicable to the return? 6

(ii) What procedure the company has to follow if extension in filing is required? 5

(iii) What penalties shall be applicable in respect of the following contraventions of

the law:

(a) Failure in furnishing a return;

(b) Non-payment of tax or failure in payment of tax; and (c) Concealment of Income.

(b) Mr. Nasir has received a notice from the tax authorities declaring him a 'legal representative' of his deceased uncle, Dr. Yawer. Mr. Nasir has approached you and sought your expert advice on the following issues:

(i) What does the term 'legal representative' mean? 1

1

1

1

(ii) Taxation of income earned by Dr. Yawar prior to his death and the extent of tax

liability of Mr. Nasir in respect of such income. 2

(iii) Legality of the tax assessment proceeding pending against Dr. Yawar at the time

of his death. 3

Q. 3 (a) Explain the provisions of section 29 of the Income Tax Ordinance, 2001 with regard to

recovery of bad debts in subsequent years. 5

(b) Discuss the provision of sections 170 & 171 for claiming "refund" under the Income Tax

Ordinance, 2001. Also narrate that who is entitled to a refund and how it becomes due. 6

(c) Enumerate "the prescribed qualification for registration as an income tax practitioner"

as provided under Rules 86 of the Income Tax Rules, 2002. 6

(d.) What is the duration of registration for income tax practitioner as per Rule 88 of the

Income Tax Rules, 2002? 3

Marks

Q.4 The following is the Profit & Loss Account of MIs Fast Track Company (Pvt) Limited for the year ended on 30th June.

Sundry expenses Office salaries Rent, rates & taxes Income tax

Legal charges Advertisement Auditor's fees

Cost of issue of debentures Loss on sales of furniture

P F contribution

Bad debts

Vehicle expenses

Fire insurance premium Communication Provision for taxes Provision for bad debts Liquidated damages Depreciation

Net Profit

Required:

Rs.

8,000 104,000 32,000 10,400

7,200 20,000 24,000 20,000

8,000 28,000 16,000 32,000 28,000

3,600 36,000 16,000 12,000

160,000 326,400 891,600

Rs.

G,ross Profit Casual income

Premium on issue of debentures Recovered bad debts

(allowed in the past)

Dividend

840,000 2,000 40,000

1,600 8,000

891. ,600

Compute the net taxable income of the company for the tax year 2010 from the

above data after keeping in view the following notes: 20

(i) Sundry expenses include Rs 1,600 paid to an institution not recognized under

section 61

(il) Office salaries include Rs.20,000 paid to one of the directors. (iii) Provident Fund is recognized by the Income Tax Department.

(iv) Vehicle expenses are not vouched and verifiable to the extent of Rs.6,000. (v) Actual depreciation works out to Rs.136,000 only.

Q. 5 (a) Describe the records required to be maintained by registered persons under

section 22 of the Sales Tax Act, 1990 5

(b) An officer of Sales Tax obtains authority under section 38 of the Sales Tax Act, 1990

for access to premises, stocks and records Explain the legal provisions in this regard. 5

Q.2 (a)

Define the following terms under the Income Tax Ordinance, 2001: (i) Fee for technical services

(ii) Employment

(iii) Small company

02 02 02

(b) Explain the section 113 of the Income Tax Ordinance, 2001 relating to 'minimum tax on

the income of certain persons'. 09

(c) What does section 102 of the Income Tax Ordinance,. 2001 say about 'foreign source

salary of resident individuals'? 03

(d) Ust the methods that shall apply for the purposes of determining an arm's length result 02 under Rule 23(3) of the Income Tax Rules,. 2002.

Q,3 (a)

As per Rule 10 of the Income Tax Rules, 2002: (i) Define the term entertainment expenditure.

(ii) What is the condition of admissibility of entertainment expenditure?

(iii) What are the limitations on the deduction of entertainment expenditure?

(b)

02 01 05

(i) According to sub-section (1) of section 114 of the Income Tax Ordinance, 2001, name the persons who are required to furnish a 'return of income'

06

(ii) What is agricultural income as per the Income Tax Ordinance,. 2001?

06

Marks

Q.5 The Trading and Profit and Loss Account of Mis Arshad Limited for the year ended on so= June,. 2009 IS as under:

Sales

Less cost of sales G ross profit

Less expenses:

Salaries and wages

Office rent

Telephone expense Traveling and conveyance Forwarding

E ntertai n ment Miscellaneous Office stationery Depreciation

Income tax for last year Bad debts

Rs.'OOO'

Rs.'OOO' 2,300,000 1.571.000 729,000

Doubtful debts

170,000 55,000 39,500 41,500 61,000

2,500 9,000 9,000

58,000 54,000 9,000 5,000 900

500 6,000 79.000

599.900 129.100

Donations Liquidated damages Insurance

Provision for taxation Net Profit

Notes and additional information:

(i) A sum of Rs.900,000 written off last year and allowed by the Income Tax Department, has been recovered and credited to bad debt reserve

(ii) Un-vouched and un-ciet aileri expenses Included in the entertainment amounted to Rs.350,000.

(iii) Depreciation allowable as per the Income Tax Law is Rs.55,000,000.

(iv) Salanes and wages include payment of Rs.250,000 without deducting tax at

source

(v) Salary paid amounting to Rs.240,000 In cash.

(vi) Donation amounting to Rs .500,000 paid to an approved institution as specified in Clause (51) of Part-I of Second Schedule.

(vii) Donation amounting to Rs 400,000 paid to an approved institution but not specified in Clause (51) of Part-I of Second Schedule.

(viii) Pre-paid insurance Rs.250,.oOO

Required:

Compute the taxable income and the tax liability of the company for the tax year 2009.

20

Q.6 (a)

Define the following under Sales Tax Act, 1990: (i) Distributor

(ii) Documents

02 02

(b)

What is meant by 'return' under the Sales Tax Act, 19907 List out different types of returns that sales tax department may require to file.

03

(e)

Explain the provisions of Sales Tax Return under Section 25 of the Sales Tax Act,1990.

03

Q.2 DISCUSS the fol1ow.lng under the Income Tax Ordinance 2'001:

(a)

Provisions for additional payments far dielayed refunds under Section 171

7

(b)

Penalty for failure tofur!1isil, a return or statement under Section 182

8

03.

Exp.j.sln the following in the light of the Income Tax Ordinance. 2001,

ta.) Foreign source salary of resident IndiVidual under Se·c~lioh 102. 5

(b) The provisions for e.xteridlng time for furnis;hing returns and other 10

documents under- Sectio.n 11119

Marks

Q.4 Explain the following under the Income Tax Ordinance, 2001_ (a) "Ttrrrrov e r" under Section 113 (3}_

(b) "Best Judgement Assessment" under Section 121_ (c), "Evidence of Assessment" under Section 126

5 5 5

a.5.

You are engaged in the InC::"GIme Tax cons.ultancy services_ One of your cl.ients Mr. A.B. Malik". an employee of M1s. Excellent Airlines, Pes/;1awar. asks you to determine his total income, taxable income and income tax payable by him for tax year. 2007 on the basis of the following information:

Salary Income (per month)

o Basic Salary Rs_ 22,5001- (in pay scale of Rs. 15,000-750-26.250).

o Dearness allowance Rs'_ 1,500/-.

<> Special relief allowance @ Rs. 150/0 of the basic salary. o Flying allowance Rs. 15,0001-

<> Entertainmen1 allowance Rs. 500/-

o Medical allowance @ Rs. 5,0001-. No free medical facility or hospitalization or re--'imbursernent of medical charg.es is prOVided by the employer.

o Accommodation is provided by the employer. Mr. A. B. MaJlk IS entitled to house rent allowance @ 60% of the minimum of pay scale, had the accommodation not been provided.

<> A BOOce vehicle Is prOVided by the employer partly for official and partly for private use. The cost of the vehicle to the employer is Rs. 450,000/-

Property Inco1T1e

o Mr A. :8. Malik. owns a house which IS On rent @ Rs_16,OOO/- per month,

Investment/contribution du~ing the year

o Investment in shares

RS.50,000 Rs_100,OOO

o Contribution to an approved pension fund

!\!Ir. A. B Malik also obtained the concessional loan amounting to Rs 1,500,000/- from the BITlployer, rn ark-rrp rate of which is 4% per annum (Assume that the benchmark rate for the tax year, 2007 is go/a per annum).

- 214

Requir,ed:

You, beIng a tax consultant are required to compute ·tofal Income ax- 20

able mcorne and Income ax payable by Mr A B. Malik.

Q.7

(a

Write short notes on the followlril9 in terms of the Sales Tax Ad. 1990. (1) Arrears - Section 2(2A)

(ri) E-Intermediary - Section 2(9A) 1111) Retail Price - Section 2(27)

DeSCribe he proceoure for recovery of tax not leVied or sho levied or erroneously refunded under Section 3-6.

2 2

3

(b)

8

Q 2 (a) How are following defined under the income Tax: OFdinance. 2001? (i) Cash-basis accounting

(II) Accrual-basIs accountln9

11

(b)

State the expenses. whIch are not aHowed as deductIon while c alc-olating the InCOf"'('le under- the head ~lncon"1e from e.usiness- underInceme Tax Ordinance. 2001_

What are the conditions for imposJtton of penalty as given in Sectlon'90 part X of Chapter X 0 Income Tax Ordinan,ee 2001?

10

Q 3 (a)

(b) VVhat are the penalties under Income Tax Ordinance 2001 for faIlure. 10'-

(.) Mainta.n records.

(il) Give notice for discontinuance ef business.

3 2

Mark

Q .. 4 <a) Describe thespeculat'on business and merrtlon the businesses 7

whlGh are not mctuded in speculation busmess under the Income

Tax Ordinance. 2001

(b) ExpJai' the foWowing terms as defined In lnceme Tax Ordinance. 8

20tH

li) Resident aasoclanon of persons (ii) Finsoce society

(IIi) Trust

(ill) Royally

0.5 M AsgHar Abbas is ~ssistant manager ln an engiheermg orgamzation He has engaged you as his tax consult a I'll and provlded you with the following Information of his estimaled incomes ano expenses for the year ending 301h June. 200Q'-

• Sala.f',;( Income lper month)

(1 ) Ba SIC salary 18.000

(2) House rent allowance 10.000

(3) UtiUty allowance 6.000

(4) Mediea aJlow:ance 3.()OO'

(5) Conveyance a[Jowance 5,000

Mr. Asghar owns and mai,ntains a car, Which he uses partly for hiS personal and part~y fOf busineas use of his employer In January, 2006 he remained admitted in 'ne hospital for 10 days and the employer: reimbursed hospitallza ion charges of Rs 25 000/-

• Property Income

Ii) He owns 5 shops~ which a e rented out. His income and expenses In this behalf are as under:

(1) A-nnual rent of A shops

~s_ 96.000

Shop Nu 5' remained cccuoreo

for 1 months at a rent of Rs.1.200

per month. rt was vacated througli court order fOT which Mr. Asgha·r incurred Rs 6000'/-. as Jegal expenses

(3) Ground rent paid

(2)

2.000 8,000 10,000

(4) CoHec1ion charges paid (5) Propert')l' tax

(This amount includes Rs, 5.000/- of last year's tax not paid in 2005 )

Marks

• AgirlCu'ltural lincome 60.000

• Oiv,idend received on inve5tment in shares 20,000

of'co pub1i¢ ,I'jmited c'ompany. ('gross)

The ernp'IQyer has ded:ucted, tax at source from salary arnounting to :Rs 12.000/-.

Requir,ed~

Y'oubem;g a tax consuttant of MI:'. Asg.har Abbas. calculat,e his taxable 20

,nco:me and tax payable a.lon9 Vlfith his lax return. (TAX YEAR 2006)..

Q 6 (a) What are the provisions for filing an a,ppeal: 10 the Supreme Court 12

under trroorrie Tax Qrdinanoe2001?

(b) When as,sessm,ent or amended assessn1ent in relation to disputed ,3

property is made?

0.2 (a) Define amendment of assessment as provided in section 12.2 of the Income 8

Tax Ordinance" 2001.

(b) How additional payment for delayed refunds becomes payable to a tax payer 7

unde r th e provisio ns of section - 171 of the Income Tax Ord in ance, 2001 ?

(c) What is the definition of "Small Company" under section 2 (59A) of the Income 5

Tax Ordinance" 2001?

0.3 (a) What do you understand from the concept of "loss carried forward" under the Income Tax Ordinance, 2001, with regard to each of the following heads of income?

(i) Income from business.

(ii) Speculation business losses. (iii) Capital losses.

5 5 4

(b) Four partners firm comprising Mr. JS, KK, TT, RR, are sharing profit and losses equally. The unadjusted loss of "AOP" stands at Rs. 444,000. Mr. RR submits resignation and retires from business.

Required:

(i) State the set-off and carry forward of losses of AOPs.

(ii) Compute the amount of loss to be carried forward by the firm.

Q.4 Mr. Shahbaz is an officer in a Pakistani Airline. He provided the following particulars of his sources of income pertaining to the tax year 2009:

Salary Bonus

Reward on passing an examination required by the terms of his employment

House allowance (per month) Conveyance allowance (per month)

Medical allowance (Actual expenses Rs, 17,000) Entertainment allowance

Rupees 210,000

10,000 35,000

10,000 1,500 20,000 12,000

4 2

Flying allowance

Property income (including Rs. 2,000 per month for rent of furniture & fittings)

Expenditures claimed:

• Legal expenses

• P rope rty tax

• Insurance premium

• Water charges paid (current Rs. 10,000 + arrears Rs. 2,000) Dividend (Zakat deduction Rs. 250 & tax ded uction Rs. 1,000) Leave encashment

Birthday present

I.nsurance money received on maturity of policy Capital gain on sale of shares of a private Itd., co. (Shares were retained for 18 months)

Expenses on children education (receipts are available) Professional books purchased (receipts are available) Zakat paid

Tax deducted at source

Required:

Compute total income and tax liability of Mr. Shahbaz for the tax year 2009.

(The tax slabs are given on page # 4.)

60,000 120,000

7,500 5,000 3,000

12,000 10,000 25,000 10,000

100,000 25,000

40,000 5,000 10,000 10,000

20

0.5 (a) Karsaz Limited is engaged simultaneously in manufacturing and supply of taxable as well as exempted goods. Summary of Its transactions for the month of October is given below'

Purchase of goods to be used for taxable supplies Purchase of goods to be used for exempt supplies Purchase of goods to be used for both taxable and exempt supplies

Total input tax on all purchases Supply of wholly taxable goods Supply of wholly exempt goods

Supply of partly taxable and partly exempted goods:

Taxable supplies Exempt supplies

Rupees 3,750,000 750,.000

Required:

Compute the sales tax liability of the company for the tax period.

Note: (show proper workings)

Rupees 600,000 900,000

3,000,000 675,000

1,500,000 1,800,000

4,500,000

10

0.2 (a) What is the prescribed time limit for payment to the Commissioner of Income 5

Tax on account of ta,x collected or deducted by the \Nithholding' agent?

(b) Mr. N aseer is an em p loye e of Mis. ABC (Pvt) Li mited, the terms of employment provide that the tax vvll I be paid by the company. The company paid a total of Rs. 1.535,0001= to Mr. Naseer and the Income Tax Department. The rate of tax is 14%.

Required:

Calculate the amount of tax paid by ABC (Pvt) Limited u/s '149 of the Income Tax Ordinance. 2001 on account of salary and the amount of salary paid to rvu-, Naseer.

5

(c) Describe the provisions of the Income Tax Ordinance. 2001 for foreign 3

source salary of resident individuals.

(d) What a forei gn loss is as descri bed in the I n come Tax Ordi nance 2001? HO\N 7

these fore.ign losses are treated under the Income Tax Ordinance. 2001?

Q.3 (a) What shall be the treatment of a depreciable asset under Section 22 of the 5

Income Tax Ordinance, 2001, if it is disposed of in a tax year?

(b) Describe the rules for registration of Income Tax Practitioner as per the 5

Income Tax Rules, 2002.

(c) Define the following terms with reference to the Income Tax Ordinance, 2001 :

i) Fee for technical services ii) Non-profit organization

3 3

(d) Define the types of tax credits available under Section 61 to Section 64 of the 4

Income Tax Ordinance, 2001.

Q.4 Company "Zaighm Chemicals (Pvt) Ltd " was incorporated on 1 st January, 2006 and started its production and services activities from 15th January 2006. Company has total 150 employees. Its paid-up capital and reserves as on 30-06- 2006 were as under:-

Paid-up capital

Losses carried forward (taxable loss) General reserves

(Rupees) 21,000,000 (155,000)

20,845,000

During the financial year ended 30-06-2007, its books of accounts show the following balances:

i) Raw Material

• Imported value (before custom duty and taxes)

• Local purchases

ii) Other manufacturing I trading expenses iii) Selling and admin expenses

(Rupees) 55,000,000 4,500,000 6,500,000 12,600,000

78,600,000

Marks

Additional information:

1) To sell its products, the company's value addition is 30% of the cost of goods sold.

2) Both the raw material and finished goods are subject to following levies:

i) SalesTax@15%.

ii) Additional Sales Tax @ 2 % on imports.

iii) Special Federal Excise Duty @ 1 % on imports and goods sold.

iv) Customs duty on import value @ 25%.

v) Income Tax @ 6% on import vaule plus customs duty and Sales Tax.

3) Manufacturing expense includes Rs. 5,000,000 on account of depreciation charged on plant and machinery and Rs. 80,000 charged on computers in selling and administration expenses. The rate of depreciation charged by company on both types of assets is 25%.

4) A laptop purchased for Rs. 80,000 for use by the Chief Executive was charged to profit and loss expenses.

5) Utilites bills amounting to RS.760,000 charged to profit and loss expense include Rs. 86,000 of withholding income tax and Rs. 134,000 sales tax.

6) No opening and closing stocks.

7) Applicable tax depreciation: @15% on machinery and @ 30% on computer and laptop respectively (ignore initial tax depreciation)

Required:

a) Under what category this company falls for Income Tax purposes? 1

b) Workout company's sales. 3

c) Workout its net profit chargeable to income tax for the tax year 6

2007 (ignore initial depreciation).

d) What are company's tax and duties liabilities under the:

i) Customs Act, 1969 1

i i) Sales Tax Act, 1990 3

ii i) Federal Excise Act, 2005 2

iv) Income Tax Ordinance, 2001. 4 a.5 (a) Define the following terms with reference to the Sales Tax Act, 1990:

i) Cottage industry

ii) Manufacture or Produce

2 2

(b) What are the rules for de-registration of a registered person under the Sales 6

Tax Law?

Q.2

(a) An employer may provide medical facility to its employees in any of the following manners:

i)· Free medical treatment or hospitalization.

ii) Re-imbursement of medicat expenses incurred by an employee, and

iii) Payment of medical allowance instead of providing medical facility.

Discuss legal provrsions under the Income Tax Ordinance, 5

2001 for each of the above stated situations.

(b) "X" Limited. has granted an option to all of its employees for purchase of Its 1,000 shares at a price of Rs. 25/- per share. Habib, one of the employees has exercised the option available to him.

PTO

1/C,

·'he. marke.t value. c>~the. sharesr' at thE> timE> .o~ e.xe.rcisE> C>~ c>ption vvas R.s. 4-0/- pe.r share. Later c>n during the year. Ha·bib dispc>sed ·01' the

total shares ~ R.s. 4-S/- per share. .

Compute the income. if any, ct'largeable under the. ~ollovving heads ·o~ income :

i)

Salary income.; and

3 2

ii)

Capital gain.

(c) In the light of the Income ,ax C>rdi .... ance.. 2001 vvhat do you 2

understand ~rc>m the te.rm "Trust- ?

(d) De~ine ~c>lIovving terms as used in the ·Income .Tax C>rdinance. 2001 :

i) ··Pre.-commencernent expe.nditure'· (S·oac>ti~n 25). 3

ii) "R"",nt", under Section· 1 S. chargeable. under the head, incC>l"Tloa 5

~rc>rn prc>perty. -

)0.3

(a) VVhat are the provisions for exemptic>n ~r~m tax ~n "profit ~n debt". recoaivE9d by a non-reside"t person under Secti~ .... 4-15 ~~ the Inc~rne.

Tax C>rdinance, .2001 ? .

(b) Explain the ~oll~vving under the Inc~me 'ax Ordinance, 2001 :

(i) VVhy a .... d vVh~ can pre~er an appeal too Income. 'ax Appellate. 2

Tribunal?

(ii) VVhat are. the requirements of· an appeal t~ Income Tax 4-

A.ppellate. Tribunal?

(iii)

VVhat is the. time lirnitati~n t~ give. e.ffE>c>t t~ an appeal on 'an appe.llate~rcter LJnde~ Section 129. vvhoare. diroact re.lioaf has bee.n provide<;i in such order?

(IV)

VVhat are. the. circumstances under vVhich Commlssione.r ~~ Inc~me 'ax sha.1I n~t Te.vise any ordoar of a taxation officer?

(C) VVhat are the provisions· ~f Secti~n 162 of the .Incoorne 'ax 4-

C:>rdinance. 2001 re>garding re.cC)vEtry 001' tax ~rC>rTI the perse>n fr~m vvh~rTI tax vvas root colle.cte.d ~r deducted?

/\1:

Q. 4 Mr. Arif, Baqar and umEir are members of an Association of Persons (AOP) "FRIENOSCOn and share th-e profit and loss in the ratio of 1 :2:3 respectively. They wanted to know their tax liability for the tax year, 2008. Accountant of MIs FRIENOSCO.,- has prepared the following proft and loss account:'

Rupees

Sales

Cost of sales Gross profit

Selling and admin expenses Net profit before tax

6,400,000 3,200,000 3,200,000

. 2,400,000 800,000

=======~=:::;::

Additional Information:

• It is a wholesale business and sales include supplies of Rs. 800,000 to govet:nment departments subject to withholding tax.

• Expenses include:

(i) Accounting depreciation of Rs.75,000 on vehicle with W.OV, of Rs. 500,000.

(ii) Provision forbad debts of Rs.50,000 has been made, whereas actual bad debts are Rs. 80,000.

(iii) Commission of Rs.120,000 has been paid to Mr. Arif for promotion of sales.

(iv) Utility bills amounting to Rs.80,000 charged to expenses include Rs. 15,000 income tax withheld on these bills.

• Mr. Baqa-r is a sleeping partner. He. is working as full time teacher in a university and receives monthly pay and allowances asunder:

(i) Pay Rs. 60,000.

(ii) House rent allowance Rs. 30,000.

Marks

• Mr. Umer is in receipt of income from property of Rs. 50,000 per month.

• The accounting depreciation on vehicle is also charged @ 15% of W.oV, which coincides with the statutory rate of depreciation.

Required:

You being a tax consultant of Mis FRIENDSCO., work out tax 20

liability of the AOP and its members for Tax Year, 2008 ..

MarKS

Q 2 (a) Discuss the provisions of Section 29 of the Income Tax Ordinance, 6

2001. regarding deduction of bad debts.

(b) Define the following terms as per the provisions of Section 35 of 4

the Income Tax Ordinance, 2001:

- Prime-cast-method

- Stock-in-trade

(c) How residential status of an individual is determined under Rule 14 5

of the Income Tax Rules, 2002?

(d) What are the provisions of Rule 29 of the Income Tax Rules, 2002, 5

regarding maintenance of books of account, documents and

. records by every taxpayer?

0.3

(a) Define the term 'amalgamation' as per Section 2(1A) of the Income Tax Ordinance. 2001.

(b) Define the term 'Industrial Undertaking' as per Section 2(29C) of 5

the Income Tax Ordinance, 2001.

5

MarKS

(c) Define the term 'profit on debt' as per Section 2 (46) of the Income 3

Tax Ordinance, 2001.

(d) Describe in detail:

(i) Disposal and acquisition of assets as per Section 75 of the 3

lncome Tax Ordinance, 2001.

(ji) Business and personal assets as per Section 75 (7) of Income 4

Tax Ordinance. 2001.

Q.5

(a) Explain the term "Short-paid amount recoverable without notice" as per Section 11A of Saies Tax Act, 1990.

5

(b) Describe the records, which are required to be maintained by a 5

registered person under Section 22 of Sales Tax Act, 1990.

Q.2 (a) What do you understand by the concept of "Income splitting" as provided under section 07

90 and 91 of the Income Tax Ordinance, 2001?

(b) Mr. Aslam has transferred a vehicle to his wife Mrs. Sabila who has derived a rental income during the tax year 2009. You are required to explain the taxability of the above income under the following cases:

(i) If the transfer has been made for inadequate consideration.

01

(ii) If the transfer has been made for adequate consideration.

01

(iii) If the transfer has been made for adequate consideration and the consideration 01

has been paid by Mrs. Sabila from a loan acquired from her husband Mr. Aslam.

(c) In each of the following cases, you are req uired to identify the income as Pa kistan- 10

source income or foreign-source income, and provide the relevant provision of the section(s) used as the basis for identification:

(i) Mr. Walter Vincent, is the employee of United Nations, who is employed in Pakistan. H is salary is paid by United Nations th roug h direct credit to his foreign bank account.

MARK!

(li) Mr. Jonty Rhodes has been hired for one month as coach of national cricket team for training in Dubai. He has been paid US $100,000 as fee for professional service by the Federal Government of Pakistan.

(iii) Mr. Hammad Ali is a resident person for tax purpose. He has earned an income of Rs.500,000 from the disposal of shares of a company incorporated outside Pakistan.

(iv) M. Clifford, a resident of United Kingdom, has made a gain of UK £1000 from the sale of the shares of a company listed in London Stock Exchange. The principal activity of the company is to explore for the natural resources of Pakistan.

tv) Mr. Kareem, a resident of Pakistan, has been paid an amount of US $100,000 on account of secret formula for making a chemical, by a company incorporated outside Pakistan.

0.3 (a) What records are required to be maintained under Rule 29 of the Income Tax Rules, 10

2002 to determine "Income from business"?

(b) Mr. Ali Hassan a professor and Irani citizen entered into an employment contract with a government university in Pakistan for teaching and research work. The university is incorporated under section 42 of the Companies Ordinance, 1984 as a non-profit organization.

The employment contract was effective from November 01, 2007. However, Mr. Ali Hassan arrived in Pakistan on November 02, 2007. Since November 03, 2007 was Sunday therefore he could not join his office. On Monday November 04, 2007 he became ill and had to be hospitalized for the next five days and joined office on November 09, 2007. Due to his continuous illness he took sick leave and went back to Iran on November 10,2007.

Mr. Ali Hassan came back to Pakistan on January 03,2008 and remained in Pakistan for the purpose of his employment till June 30, 2008.

Required:

0) State the provrsrons applicable to "Resident Individual" under Rule 14 of the 06

Income Tax Rules, 2002, to determine the number of days an individual is present

in Pakistan.

(ii) Determine the residential status of Mr. Ali Hassan with reasons in accordance with 04

Rule 14 of the Income Tax Rules, 2002.

0.4 Mr. Jamshaid is an executive in a group of companies. He derived following incomes during the tax year ended June 30, 2008:

Particulars

(i) Salary Income (per month):

• Basic Salary

• House rent allowance

• Utility allowance

• Medical allowance

• Expenses on children books

Rs.

20,000 8,000 1,000 1,000

400

He is also provided with a 1 OOOcc car, wh lch is partly used for company's business. As per books of accounts, the cost of the car is Rs.650,000. He has also been granted with a housing loan of Rs.SOO,OOO on which no profit! interest has been charged.

MAKK!::I

In addition to above, he also received gratuity of Rs.70,000 from his previous employer during the year. The gratuity fund is not approved by the Commissioner of Income Tax or Federal Board of Revenue.

Tax deducted at source from salary amounted to Rs.15,000.

(ii) Property Income:

• Rent from a house let out

• He incurred following expenses on this property during

the year Repairs

Collection charges Ground rent Property tax

Rent-sharing with housing finance company

Rs.

10,000 per month

30,000

7% of rent

10,000

15,000

3,000 per month He received a deposit of RS.200,000, not adjustable against rent, out of which he refunded Rs.1 00,000 to previous tenant who vacated the house after 3 years' tenancy.

(iii) Other Income:

• Profit on PLS bank account (net of 10% tax withheld)

• Commission from insurance company and from sale of plots (net of 10% taxes withheld)

• Lecturing and examination services fees from professional institutes (net of 6% tax withheld)

• Birthday present - cash bonds

(iv) Gain on sale of shares of KayToo Ltd., a public listed company

iquired:

Rs. 9,000

18,000

18,800 50,000

55,000

As a tax consultant you are required to compute Mr. Jamshaid's total income and his 20

income tax liability for the tax year 2008.

(The Tax Slabs are attached as per Finance Act, 2008)

1.5 (a) What are the provisions of the Sales Tax Law regarding refund of input tax? 05

(b) Differentiate between zero rates supply and exempt supply, showing major distinctions. 05

Вам также может понравиться

- Fractional Differential Equations: An Introduction to Fractional Derivatives, Fractional Differential Equations, to Methods of Their Solution and Some of Their ApplicationsОт EverandFractional Differential Equations: An Introduction to Fractional Derivatives, Fractional Differential Equations, to Methods of Their Solution and Some of Their ApplicationsОценок пока нет

- 'Finance 'LTD: AnrajДокумент18 страниц'Finance 'LTD: AnrajContra Value BetsОценок пока нет

- Anything Goes: An Advanced Reader of Modern Chinese - Revised EditionОт EverandAnything Goes: An Advanced Reader of Modern Chinese - Revised EditionРейтинг: 5 из 5 звезд5/5 (1)

- Catalogo Polipastos A Cadena Hyundai IngevalДокумент12 страницCatalogo Polipastos A Cadena Hyundai IngevalOscar ValderramaОценок пока нет

- Coca Cola Case StudyДокумент5 страницCoca Cola Case StudyGajendra Rathi0% (1)

- CCI GuidelinesДокумент7 страницCCI GuidelinesJarchit28Оценок пока нет

- Cosmic Accessories 1966Документ10 страницCosmic Accessories 1966triumph_friendОценок пока нет

- Income Tax 2018Документ9 страницIncome Tax 2018Devyank SinghОценок пока нет

- Carisma-99 ZubehoerkatalogДокумент11 страницCarisma-99 ZubehoerkatalogBrankoОценок пока нет

- Century Paradise BrochureДокумент14 страницCentury Paradise BrochureArghya BhattacharyaОценок пока нет

- Business Week June 11 2007Документ122 страницыBusiness Week June 11 2007Mai Hòa100% (1)

- Santera Catalog Legrand BTICINO 2010Документ7 страницSantera Catalog Legrand BTICINO 2010Santera SRLОценок пока нет

- A Multi Tubular Reactor For Obtention of Acetaldehyde by Oxidation of Ethyl AlcoholДокумент7 страницA Multi Tubular Reactor For Obtention of Acetaldehyde by Oxidation of Ethyl AlcoholDelong88Оценок пока нет

- Advanced Control of Chemical Processes 1994От EverandAdvanced Control of Chemical Processes 1994D. BonvinОценок пока нет

- Product Catalogue 10Документ44 страницыProduct Catalogue 10ripma_entОценок пока нет

- A Trip to China: An Intermediate Reader of Modern Chinese - Revised EditionОт EverandA Trip to China: An Intermediate Reader of Modern Chinese - Revised EditionРейтинг: 3.5 из 5 звезд3.5/5 (8)

- Marcom Dlms SolutionsДокумент18 страницMarcom Dlms SolutionsMARCOM SRLОценок пока нет

- JetДокумент32 страницыJetManbir Singh100% (5)

- Pollution Free Environment ( from Fuels and Oils ) for the GenerationsОт EverandPollution Free Environment ( from Fuels and Oils ) for the GenerationsОценок пока нет

- UJ1ln.: T/i.e' .1 (6 11-DudДокумент31 страницаUJ1ln.: T/i.e' .1 (6 11-DudjrodОценок пока нет

- Environmental Scenario in Indian Mining Industry - an OverviewОт EverandEnvironmental Scenario in Indian Mining Industry - an OverviewОценок пока нет

- Hardanger - Burda No 15Документ82 страницыHardanger - Burda No 15staurovelonia100% (1)

- Physics F4 C2 Pelangi Workbook-AnswersДокумент5 страницPhysics F4 C2 Pelangi Workbook-AnswersRebecca Choong Xin HuiОценок пока нет

- RX 100 Workshop ManualДокумент92 страницыRX 100 Workshop ManualS.N.RajasekaranОценок пока нет

- Price ListДокумент25 страницPrice ListVijay BarreyОценок пока нет

- Sant Sipahi (Dec 1986)Документ68 страницSant Sipahi (Dec 1986)Sant Sipahi MagazineОценок пока нет

- The Cambridge Modern History AtlasДокумент264 страницыThe Cambridge Modern History AtlaskryzanderОценок пока нет

- Practice Test For First CertificateДокумент60 страницPractice Test For First CertificateThao LuongОценок пока нет

- What Is CholestrolДокумент10 страницWhat Is Cholestrolbajiraojadhav100% (1)

- TouchДокумент57 страницTouchSyafaat Tisya Tidak Pelank100% (2)

- Victor MorelliДокумент18 страницVictor MorellibibliotecalandraОценок пока нет

- LG 2800mah ICR18650 C1Документ8 страницLG 2800mah ICR18650 C1Street_skОценок пока нет

- Fletcher 1989 BrochureДокумент12 страницFletcher 1989 Brochurechriswilkinsonuk100% (1)

- Helical Tension and Suspension Set Fiber Optic ADSS OPGW LesatelДокумент23 страницыHelical Tension and Suspension Set Fiber Optic ADSS OPGW LesatelLesatelОценок пока нет

- Computer Power User (CPU) November 2008Документ112 страницComputer Power User (CPU) November 2008tttruxpinОценок пока нет

- Inimigo Da Cultura Popular: " Fuels.OДокумент4 страницыInimigo Da Cultura Popular: " Fuels.OAntónio TorresОценок пока нет

- PIC Microcontroller Project BookДокумент220 страницPIC Microcontroller Project Bookkalidas_29586% (7)

- Prospekt Wal-MartДокумент12 страницProspekt Wal-MarteoicoОценок пока нет

- Air Forces International 013Документ32 страницыAir Forces International 013José Fernandes Dos SantosОценок пока нет

- Alvin Greene Military RecordДокумент17 страницAlvin Greene Military RecordAmy WoodОценок пока нет

- BMW R80 G-S Workshop ManualДокумент249 страницBMW R80 G-S Workshop ManualPhilip Griffiths100% (8)

- Megaflex CatalogДокумент33 страницыMegaflex CatalogMikeReyОценок пока нет

- Architecture Now - Vol 1Документ532 страницыArchitecture Now - Vol 1davperezm80% (5)

- Vafc WiringДокумент42 страницыVafc WiringextremedecayОценок пока нет

- Business-To-business Marketing by Ross Brennan - Louise Canning - Raymond McDowellДокумент76 страницBusiness-To-business Marketing by Ross Brennan - Louise Canning - Raymond McDowellwabz340% (5)

- G.O. NO. 440 JD L Dated 08 July 2010Документ8 страницG.O. NO. 440 JD L Dated 08 July 2010Binod MahatoОценок пока нет

- Patchwork Labores Hogar Extra 68Документ37 страницPatchwork Labores Hogar Extra 68maria547100% (3)

- President Obama's 2005 Tax ReturnДокумент28 страницPresident Obama's 2005 Tax ReturnBarack ObamaОценок пока нет

- PTC2 2010Документ26 страницPTC2 2010douamiiОценок пока нет

- Ms Office QuestionsДокумент10 страницMs Office Questionsmunira sherali33% (3)

- Q5 Costing Autumn 2012Документ5 страницQ5 Costing Autumn 2012munira sheraliОценок пока нет

- Power PointДокумент61 страницаPower Pointmunira sheraliОценок пока нет

- Ms Access Practice Quiz 01Документ5 страницMs Access Practice Quiz 01specialityОценок пока нет

- Ow To Achieve Success in Examinations 1. Planning Course MaterialДокумент5 страницOw To Achieve Success in Examinations 1. Planning Course Materialmunira sheraliОценок пока нет

- Advance Taxation Refresher CourseДокумент92 страницыAdvance Taxation Refresher Coursemunira sheraliОценок пока нет

- Concepts and Definitions of LawДокумент220 страницConcepts and Definitions of Lawmunira sheraliОценок пока нет

- Financial MathematicsДокумент4 страницыFinancial Mathematicsmunira sheraliОценок пока нет

- B3-Spring 2010Документ6 страницB3-Spring 2010munira sheraliОценок пока нет

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProОт EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProРейтинг: 4.5 из 5 звезд4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОт EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОценок пока нет

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesОт EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesРейтинг: 4 из 5 звезд4/5 (9)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideОт EverandTax Savvy for Small Business: A Complete Tax Strategy GuideРейтинг: 5 из 5 звезд5/5 (1)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthОт EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthОценок пока нет

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyОт EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyРейтинг: 4 из 5 звезд4/5 (52)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCОт EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCРейтинг: 4 из 5 звезд4/5 (5)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessОт EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessРейтинг: 5 из 5 звезд5/5 (5)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessОт EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessОценок пока нет

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОт EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОценок пока нет