Академический Документы

Профессиональный Документы

Культура Документы

Domestic Debt

Загружено:

AbdulManan_uolccИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Domestic Debt

Загружено:

AbdulManan_uolccАвторское право:

Доступные форматы

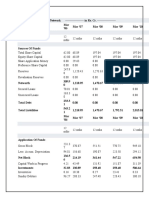

Domestic Debt (Outstanding)

(In Billions Rs.)

As on end period

Debt Instruments

Jun-09 Aug-09 Jun-10 Aug-10

A. Permanent Debt 678.0 682.3 794.3 786.9

Market Loans1 2.9 2.9 2.9 2.9

Federal Government Bonds 7.2 7.2 7.1 0.6

Income Tax Bonds 0.0 0.0 0.0 0.0

Government Bonds (L.R.-1977) 0.1 0.1 0.1 0.1

Special Government Bonds For SLIC (Capitalization) 0.6 0.6 0.6 0.6

GOP Ijara Sukuk 3 years 27.8 27.8 42.2 42.2

Government Bonds (issued to HBL for settlement of CBR Refund) 0.0 0.0 0.0 0.0

Bearer National Fund Bonds(BNFB) 0.0 0.0 0.0 0.0

BNFB Roll Over-II 0.0 0.0 0.0 0.0

Special National Fund Bonds 0.0 0.0 0.0 0.0

Federal Investment Bonds(Auction) 1.0 0.0 0.0 0.0

Federal Investment Bonds (TAP) 0.0 0.0 0.0 0.0

Pakistan Investment Bonds (PIBs) 441.0 440.8 505.3 500.1

Prize Bonds 197.4 202.9 236.0 240.2

B. Floating Debt 1,904.0 2,038.1 2,399.1 2,593.3

Treasury Bills(3 Months) 0.0 0.0 0.0 0.0

Market Treasury Bills(auction) 796.1 897.1 1,227.4 1,309.0

MTBs for Replenishment2 1,107.9 1,141.0 1,171.7 1,284.2

C. Unfunded Debt 1,270.5 1,321.4 1,456.2 1,479.8

Defense Savings Certificates 257.2 234.1 224.9 225.7

National Deposit Certificates 0.0 0.0 0.0 0.0

Khas Deposit Certificates 0.3 0.3 0.3 0.3

Special Savings Certificates (Reg) 288.8 317.9 350.8 357.0

Special Savings Certificates (Bearer) 0.3 0.3 0.3 0.3

Regular Income Certificates 91.1 102.4 135.6 143.5

Premium Saving Certificates 0.0 0.0 0.0 0.0

Bahbood Savings Certificates 307.5 320.1 366.8 376.6

Khas Deposit Accounts 0.3 0.3 0.3 0.3

National Deposit Accounts 0.0 0.0 0.0 0.0

Savings Accounts 16.8 14.7 17.1 12.9

Special Savings Accounts 88.6 107.8 119.6 119.2

Mahana Amdani Accounts 2.4 2.3 2.1 2.3

Pensioners' Benefit Accounts 109.9 113.7 128.0 130.8

National Savings Bonds 0.0 0.0 3.7 3.6

Postal Life Insurance 67.1 67.1 67.1 67.1

GP Fund 40.1 40.4 39.5 40.1

D. Foreign Currency Instruments3 8.1 8.2 3.1 3.1

Overall Domestic Debt (A+B+C+D) 3,860.7 4,050.0 4,652.7 4,863.0

1

Including Provincial Government Loans.

2

Inclusive of Outright Sale of MRTBs to Commercial Banks.

3

It includes FEBCs, FCBCs, DBCs and Special US Dollar Bonds held by the residents. Previously, these are the part of External Debt

Liabilities which are now shifted in Domestic Debt.

Contact Person: Mr. Abdul Hamid Akhter

Senior Joint Director

email: abdul.hamid@sbp.org.pk

Contact Number: 021-32453662

Feedback: http://www.sbp.org.pk/stats/survey/

Вам также может понравиться

- Ce Ngo DebtДокумент1 страницаCe Ngo Debtjalees23Оценок пока нет

- Domestic Debt & LiabДокумент10 страницDomestic Debt & LiabKhizar Khan JiskaniОценок пока нет

- D Debt LiabilitiesДокумент1 страницаD Debt Liabilitiessherman ullahОценок пока нет

- Agricultural Bank of China Limited SEHK 1288 Financials Industry SpecificДокумент3 страницыAgricultural Bank of China Limited SEHK 1288 Financials Industry SpecificJaime Vara De ReyОценок пока нет

- Financial Statements - GOOD LEATHER SHOES PRIVATE LIMITEDДокумент3 страницыFinancial Statements - GOOD LEATHER SHOES PRIVATE LIMITEDJas AyyapakkamОценок пока нет

- SddsДокумент1 страницаSddssherman ullahОценок пока нет

- SIF Oltenia Net Asset ValueДокумент3 страницыSIF Oltenia Net Asset ValueMihai RusОценок пока нет

- Coca Cola Balance Sheet Analysis 2009-2005Документ2 страницыCoca Cola Balance Sheet Analysis 2009-2005Devender SinghОценок пока нет

- Beyond Meat Inc NasdaqGS BYND FinancialsДокумент6 страницBeyond Meat Inc NasdaqGS BYND FinancialsFabricio Arturo Olalde MacedoОценок пока нет

- Laporan Operasional: Pemerintah Kabupaten PelalawanДокумент4 страницыLaporan Operasional: Pemerintah Kabupaten PelalawanBiyta BatubaraОценок пока нет

- COCA COLA CO Balance Sheet: Period Ending FY2010 FY2009 FY2008 FY2007 FY2006Документ5 страницCOCA COLA CO Balance Sheet: Period Ending FY2010 FY2009 FY2008 FY2007 FY2006Sudeep PatneОценок пока нет

- Pakistan's External Debt Servicing - Principal: (Million US $)Документ2 страницыPakistan's External Debt Servicing - Principal: (Million US $)sanaОценок пока нет

- Chappan Bhog 26.11.2018Документ6 страницChappan Bhog 26.11.2018PRAHARSHITAОценок пока нет

- AdvaClasi SecBorДокумент2 страницыAdvaClasi SecBorSana SaeedОценок пока нет

- Management Accounting: Assignment 1Документ8 страницManagement Accounting: Assignment 1franky_pawanОценок пока нет

- Private Company Financials Balance Sheet: Xchanging Software Europe LimitedДокумент1 страницаPrivate Company Financials Balance Sheet: Xchanging Software Europe Limitedprabhav2050Оценок пока нет

- Numbers Sheet Name Numbers Table Name Excel Worksheet NameДокумент15 страницNumbers Sheet Name Numbers Table Name Excel Worksheet NameSridhar KatnamОценок пока нет

- Annexure P 1finalДокумент2 страницыAnnexure P 1finalgkbantiОценок пока нет

- DB Renews Private Limited: Provisionalbalance Sheet As at 31stmarch, 2019Документ8 страницDB Renews Private Limited: Provisionalbalance Sheet As at 31stmarch, 2019Anonymous btsj64wRОценок пока нет

- Georgian Yogurt Business Case AnalysisДокумент7 страницGeorgian Yogurt Business Case AnalysisChichinadze TakoОценок пока нет

- SDP Stone Term Laon MarbleДокумент72 страницыSDP Stone Term Laon MarbleSURANA1973Оценок пока нет

- Tesco PLC LSE TSCO Financials Balance SheetДокумент6 страницTesco PLC LSE TSCO Financials Balance SheetYA JiaoОценок пока нет

- Titan Balance-SheetДокумент2 страницыTitan Balance-SheetDt.vijaya ShethОценок пока нет

- Balance Sheet of Sun TV NetworkДокумент2 страницыBalance Sheet of Sun TV NetworkMehadi NawazОценок пока нет

- Balance Sheet of B and AДокумент6 страницBalance Sheet of B and Aleo EmmaОценок пока нет

- Shree Shyam Granite Cma Data - Xls FINALДокумент45 страницShree Shyam Granite Cma Data - Xls FINALSURANA1973100% (1)

- BDOДокумент6 страницBDOVince Raphael MirandaОценок пока нет

- Balance SheetДокумент2 страницыBalance Sheetkrishnasinghal866Оценок пока нет

- Adani Green Balance SheetДокумент2 страницыAdani Green Balance SheetTaksh DhamiОценок пока нет

- ECG Canara Bank Term Loan - 5 LakhsДокумент11 страницECG Canara Bank Term Loan - 5 Lakhsanil kumar thota AssociatesОценок пока нет

- CMA DATA (Bhargav Roadways)Документ7 страницCMA DATA (Bhargav Roadways)Mahim DangiОценок пока нет

- Adani Green Energy Limited: PrintДокумент3 страницыAdani Green Energy Limited: PrintBijal DanichaОценок пока нет

- Adresseavisen Group: ND NDДокумент6 страницAdresseavisen Group: ND NDaptureincОценок пока нет

- PVR LTD (PVRL IN) - StandardizedДокумент18 страницPVR LTD (PVRL IN) - StandardizedSrinidhi SrinathОценок пока нет

- Raj Packaging Industries Standalone Balance SheetДокумент2 страницыRaj Packaging Industries Standalone Balance SheetRAKESH VARMAОценок пока нет

- Magelang City Government Financial ReportДокумент8 страницMagelang City Government Financial ReportGamiyu AhjussiОценок пока нет

- Monmouth Inc Solution 5 PDF FreeДокумент12 страницMonmouth Inc Solution 5 PDF FreePedro José ZapataОценок пока нет

- Monmouth Inc Solution 5 PDF FreeДокумент12 страницMonmouth Inc Solution 5 PDF FreePedro José ZapataОценок пока нет

- Brazil Balance of Payments Analysis 1991-2004Документ4 страницыBrazil Balance of Payments Analysis 1991-2004tjarnob13Оценок пока нет

- Annual Report 2020 Balance SheetДокумент1 страницаAnnual Report 2020 Balance Sheetghayur khanОценок пока нет

- Data On Central Government Debt For The Quarter Ended December 2021 (Q4)Документ1 страницаData On Central Government Debt For The Quarter Ended December 2021 (Q4)Dhanesk KAОценок пока нет

- S.A. 667Документ4 страницыS.A. 667Celeste KatzОценок пока нет

- VIE-Balance of Payments Analytic PresenДокумент9 страницVIE-Balance of Payments Analytic PresenHùng Nguyễn LệnhОценок пока нет

- Assessing Working Capital RequirementsДокумент24 страницыAssessing Working Capital Requirementsbharat khandelwalОценок пока нет

- NDDB AR 2016-17 Eng 0 Part44Документ2 страницыNDDB AR 2016-17 Eng 0 Part44siva kumarОценок пока нет

- KMC Balance Sheet Stand Alone NewДокумент2 страницыKMC Balance Sheet Stand Alone NewOmkar GadeОценок пока нет

- Balance Sheet: StandaloneДокумент9 страницBalance Sheet: StandaloneKabita BuragohainОценок пока нет

- Osian'sДокумент12 страницOsian'sDiksha SharmaОценок пока нет

- Balance Sheet of Hero Honda MotorsДокумент2 страницыBalance Sheet of Hero Honda MotorsMehul ShuklaОценок пока нет

- International Granimarmo CMA DTA 115 LACS CC - FinalДокумент63 страницыInternational Granimarmo CMA DTA 115 LACS CC - FinalSURANA1973Оценок пока нет

- The Strategic Management Process at Harley DavidsonДокумент11 страницThe Strategic Management Process at Harley DavidsonLarry LimОценок пока нет

- Eicher Motors: PrintДокумент3 страницыEicher Motors: PrintAryan BagdekarОценок пока нет

- Marico BSДокумент2 страницыMarico BSAbhay Kumar SinghОценок пока нет

- Cma DataДокумент9 страницCma Datapk9079885245Оценок пока нет

- Nishat Mills Limited 1Документ10 страницNishat Mills Limited 1Abdul MoizОценок пока нет

- Money ControlДокумент2 страницыMoney ControljigarОценок пока нет

- Statement of Assets and Liabilities of Sif Moldova Date of Calculation 30/06/2014 - Recalculated Monthly, Balanta FinalaДокумент4 страницыStatement of Assets and Liabilities of Sif Moldova Date of Calculation 30/06/2014 - Recalculated Monthly, Balanta FinalaMihai RusОценок пока нет

- Definition of Money and its FunctionsДокумент38 страницDefinition of Money and its FunctionsAsif HussainОценок пока нет

- 2018 BS 1 - Merged PDFДокумент16 страниц2018 BS 1 - Merged PDFSakthivel GounderОценок пока нет

- INSURANCE - AND - RISK - MANAGEMENT - (BBA631) Enterprise and Individual Risk Management - 1573707308592 PDFДокумент1 242 страницыINSURANCE - AND - RISK - MANAGEMENT - (BBA631) Enterprise and Individual Risk Management - 1573707308592 PDFAGRITI MEHROTRA 1720641100% (1)

- CW The Year Ahead 2015-2016Документ32 страницыCW The Year Ahead 2015-2016vdmaraОценок пока нет

- Is Modern Capitalism Sustainable? RogoffДокумент107 страницIs Modern Capitalism Sustainable? RogoffAriane Vaz Dinis100% (1)

- Toyota Case StudyДокумент18 страницToyota Case StudySanjidaОценок пока нет

- The Oil Dividend Staying Power Negative Thoughts: Fed Frets Over Growing Risks To US Economy Amid Market TurmoilДокумент24 страницыThe Oil Dividend Staying Power Negative Thoughts: Fed Frets Over Growing Risks To US Economy Amid Market TurmoilstefanoОценок пока нет

- Project in Philippine History on Presidents Elpidio Quirino and Ramon MagsaysayДокумент21 страницаProject in Philippine History on Presidents Elpidio Quirino and Ramon MagsaysayRandy GasalaoОценок пока нет

- Case DescriptionДокумент6 страницCase DescriptionNamra ZaheerОценок пока нет

- Marx and Financial LiteracyДокумент24 страницыMarx and Financial LiteracyChris ArthurОценок пока нет

- Erikson Developmental Theory PDFДокумент2 страницыErikson Developmental Theory PDFPatriciaОценок пока нет

- Lavoie 14Документ659 страницLavoie 14xp2015to100% (1)

- Barclays Equity Gilt Study 2011Документ144 страницыBarclays Equity Gilt Study 2011parthacfaОценок пока нет

- Long Term Capital ManagementДокумент13 страницLong Term Capital ManagementDeepak BadlaniОценок пока нет

- 2017 List of Global Systemically Important Banks (G-Sibs)Документ3 страницы2017 List of Global Systemically Important Banks (G-Sibs)AFTAB U M CHOWDHURYОценок пока нет

- The Rise of Curated Crisis Content - Sophia B. LiuДокумент46 страницThe Rise of Curated Crisis Content - Sophia B. LiuSophia B. LiuОценок пока нет

- Davis Langdon Middle East Handbook 2012Документ132 страницыDavis Langdon Middle East Handbook 2012Angelo Sanghoon HAN100% (1)

- 2019 03 13 EEP Modern Monetary TheoryДокумент2 страницы2019 03 13 EEP Modern Monetary TheoryPevita PearceОценок пока нет

- Paragraph Completion QuestionsДокумент20 страницParagraph Completion QuestionsअभिनवОценок пока нет

- SyllabusДокумент6 страницSyllabusJames LarsonОценок пока нет

- Paul McCulley - Learning From The Bank of Dad May10Документ8 страницPaul McCulley - Learning From The Bank of Dad May10Fanny ChanОценок пока нет

- Crisis management case study Mumbai attacksДокумент2 страницыCrisis management case study Mumbai attacksIvan chester QuejadaОценок пока нет

- College Students Drowning in DebtДокумент2 страницыCollege Students Drowning in Debtapi-297792884Оценок пока нет

- 10 Professional Practices - Prepare BCM CertificationДокумент60 страниц10 Professional Practices - Prepare BCM CertificationAdneya AudhiОценок пока нет

- Regional Currency Trends AnalysisДокумент26 страницRegional Currency Trends AnalysisTrương Quang Huân100% (1)

- Crisis Communication Key to Protect ReputationДокумент2 страницыCrisis Communication Key to Protect ReputationYsabel Juachon0% (1)

- 05-01-13 Taibbi: Secret and Lies of The BailoutДокумент17 страниц05-01-13 Taibbi: Secret and Lies of The BailoutWilliam J GreenbergОценок пока нет

- Notes in Contemporary WorldДокумент4 страницыNotes in Contemporary WorldJuan paoloОценок пока нет

- Impact of Global Finacial Crises On EconomyДокумент2 страницыImpact of Global Finacial Crises On EconomyHabiba FouadОценок пока нет

- 1973 Oil Crisis - Wikipedia, The Free EncyclopediaДокумент17 страниц1973 Oil Crisis - Wikipedia, The Free EncyclopediaCarl CordОценок пока нет

- Icis Chemical Business 2013Документ77 страницIcis Chemical Business 2013mich0pОценок пока нет

- Insulation HandbookДокумент8 страницInsulation HandbookSanket PujariОценок пока нет