Академический Документы

Профессиональный Документы

Культура Документы

TDS TCS Tax Challan

Загружено:

jagdish412301Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

TDS TCS Tax Challan

Загружено:

jagdish412301Авторское право:

Доступные форматы

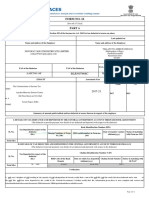

* Important : Please see notes overleaf

before filling up the challan. T.D.S. / T.C.S. TAX CHALLAN Single Copy (to be sent to the ZAO)

Tax Applicable (Tick One) *

CHALLAN NO./ Assessment

ITNS TAX DEDUCTED/ COLLECTED AT SOURCE FROM Year

(0020) COMPANY (0021) NON-COMPANY

281 DEDUCTEES DEDUCTEES

Tax Deduction Account No. (T.A.N.)

Full Name

Complete Address with City & State

Tel. No. Pin

Type of Payment Code * FOR USE IN RECEIVING BANK

Debit to A/c / Cheque credited on

TDS/TCS Payable by Taxpayer (200)

TDS/TCS Regular Assessment (Raised by I.T. Deptt.) (400)

DETAILS OF PAYMENTS Amount (in Rs. Only) DD MM YY

SPACE FOR BANK SEAL

Income Tax

Surcharge

Education Cess

Interest

Penalty

Others

Total

Total (in words)

CRORES LACS THOUSANDS HUNDREDS TENS UNITS

Paid in Cash/Debit to A/c / Cheque No. Dated

Drawn on

(Name of the Bank and Branch)

Rs.

Date : Signature of person making payment

Tear Off

Taxpayers Counterfoil (To be filled up by tax payer)

SPACE FOR BANK SEAL

TAN

Received from

(Name)

Cash/Debit to A/c /Cheque No. for Rs.

Rs. (in Words)

Drawn on

(Name of the Bank and Branch)

Company / Non-Company Deductees

on account of Tax Deducted at Source (TDS)/Tax Collected at source(TCS) (Fill up Code

from (Strike out whichever is not applicable)

for the Assessment Year Rs.

Вам также может понравиться

- TDS ChallanДокумент1 страницаTDS ChallanJainsanjaykumarОценок пока нет

- Itns-281 TDS ChallanДокумент1 страницаItns-281 TDS Challanvirendra36999100% (2)

- For Payment From July 2005 OnwardsДокумент1 страницаFor Payment From July 2005 Onwardsvijay123*75% (4)

- TDS ChallanДокумент1 страницаTDS ChallanJayОценок пока нет

- Income Tax - Bank Remittance CHALLANДокумент1 страницаIncome Tax - Bank Remittance CHALLANvivek anandanОценок пока нет

- ITNS 280: Challan No. Challan No. ITNS 281Документ1 страницаITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticОценок пока нет

- Income Tax Challan - 280Документ1 страницаIncome Tax Challan - 280Subrata SarkarОценок пока нет

- Zentds KDK SoftwareДокумент1 страницаZentds KDK Softwarear8ku9sh0aОценок пока нет

- Challan No. ITNS 280Документ2 страницыChallan No. ITNS 280RAHUL AGARWALОценок пока нет

- Challanitns 280Документ1 страницаChallanitns 280saritabh05Оценок пока нет

- ImportantДокумент1 страницаImportantWilliam SureshОценок пока нет

- Challan 280Документ1 страницаChallan 280Jayesh BajpaiОценок пока нет

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearДокумент1 страницаChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaОценок пока нет

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankДокумент3 страницыChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaОценок пока нет

- T.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseДокумент10 страницT.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseHARDEEPTHAPARОценок пока нет

- (0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanДокумент3 страницы(0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanRambabuОценок пока нет

- Challan No./ ITNS 282: Tax Applicable (Tick One)Документ2 страницыChallan No./ ITNS 282: Tax Applicable (Tick One)satishkumar.mandora.smОценок пока нет

- Form 281 Candeur Constructions - 92bДокумент1 страницаForm 281 Candeur Constructions - 92bReddeppa Reddy BisaigariОценок пока нет

- TCS TenduДокумент1 страницаTCS TenduSwetha KarthickОценок пока нет

- TDS-ChallanFormatДокумент1 страницаTDS-ChallanFormatAnand_Gupta_6499Оценок пока нет

- TDS Challan for Shree Raghuvanshi Lohana MahajanДокумент2 страницыTDS Challan for Shree Raghuvanshi Lohana Mahajannilesh vithalaniОценок пока нет

- PrintTDSChallan (281) 2020-2021 PDFДокумент1 страницаPrintTDSChallan (281) 2020-2021 PDFAmeyОценок пока нет

- Self Assessment Tax Challan NiДокумент1 страницаSelf Assessment Tax Challan NiNitin KarwaОценок пока нет

- Ganraj ConstructionДокумент2 страницыGanraj ConstructionSUNIL GAIKWADОценок пока нет

- TDS TCS Tax Challan PaymentДокумент5 страницTDS TCS Tax Challan PaymentSachin KumarОценок пока нет

- ITNS 281 TDS/TCS ChallanДокумент3 страницыITNS 281 TDS/TCS ChallanC.A. Ankit JainОценок пока нет

- Itns 285Документ2 страницыItns 285Anurag SharmaОценок пока нет

- Tax Payment Challan 280Документ2 страницыTax Payment Challan 280analystbankОценок пока нет

- Tds Challan 281 Nov'2021Документ6 страницTds Challan 281 Nov'2021tojendra laltenОценок пока нет

- TDS Challan FormДокумент1 страницаTDS Challan FormVipin Kumar ChandelОценок пока нет

- Single (Copy To Be Sent The ZAO)Документ1 страницаSingle (Copy To Be Sent The ZAO)James GonzalezОценок пока нет

- Challan 280Документ2 страницыChallan 280Rahul SinglaОценок пока нет

- Ashima Kalra 194 CДокумент1 страницаAshima Kalra 194 CSudhanshu JaiswalОценок пока нет

- (0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FДокумент1 страница(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FAngad MundraОценок пока нет

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Документ3 страницыD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarОценок пока нет

- GST FormatДокумент3 страницыGST FormatAnmol GoyalОценок пока нет

- Draft Challan IchhaДокумент1 страницаDraft Challan IchhaSneha SharmaОценок пока нет

- Zero Zero Three Zero Two Zero: DD MM YyДокумент1 страницаZero Zero Three Zero Two Zero: DD MM YyShubham Pandey WatsonОценок пока нет

- Sri Ram SilksДокумент1 страницаSri Ram SilksMathanagopal KОценок пока нет

- Itax Form 2006Документ4 страницыItax Form 2006AliMuzaffarОценок пока нет

- Challan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsДокумент2 страницыChallan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDharmeshОценок пока нет

- TDS Challan2009-2010Документ18 страницTDS Challan2009-2010ANJAIAHCHARYОценок пока нет

- Form 16B TDS CertificateДокумент1 страницаForm 16B TDS CertificateSurendra Kumar BaaniyaОценок пока нет

- Challan - 281Документ1 страницаChallan - 281Kelly WilliamsОценок пока нет

- Tds Challan 281 Excel FormatДокумент459 страницTds Challan 281 Excel FormatSaravana Kumar0% (1)

- Form 16 AДокумент2 страницыForm 16 AParminderSinghОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ2 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ViJaY HaLdErОценок пока нет

- Challan No. ITNS 280: Tax Applicable Assessment YearДокумент1 страницаChallan No. ITNS 280: Tax Applicable Assessment YearNalini SenthilkumarОценок пока нет

- It 000130629196 2021 00Документ1 страницаIt 000130629196 2021 00muhammad faiqОценок пока нет

- Return 2008Документ73 страницыReturn 2008sahil-ujОценок пока нет

- Ganapati TDS ChalanДокумент3 страницыGanapati TDS ChalanPruthiv RajОценок пока нет

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersДокумент1 страницаAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaОценок пока нет

- ChallanFormДокумент1 страницаChallanFormmanpreet singhОценок пока нет

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Документ1 страницаAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanОценок пока нет

- 1form 16 Novopay PDFДокумент2 страницы1form 16 Novopay PDFTirupathi Rao TellaputtaОценок пока нет

- Form No. 16A: From ToДокумент2 страницыForm No. 16A: From ToRajesh AntonyОценок пока нет

- Form No. 16: Part BДокумент4 страницыForm No. 16: Part BSAURABH GOELОценок пока нет

- FatturaNotaCredito 54035 2021 BZ PEДокумент1 страницаFatturaNotaCredito 54035 2021 BZ PEAdnan KotorićОценок пока нет

- Banana BBQ CPA Dentist Partnership Tax QuestionsДокумент4 страницыBanana BBQ CPA Dentist Partnership Tax QuestionsBarbara IgnacioОценок пока нет

- Rise of AccountancyДокумент1 страницаRise of AccountancyiamneonkingОценок пока нет

- Vertical Analysis of Income Statement 0F Blessed TextileДокумент208 страницVertical Analysis of Income Statement 0F Blessed TextileB SОценок пока нет

- Income Tax CalculatorДокумент2 страницыIncome Tax CalculatorVINOD KAОценок пока нет

- Request IRS Tax Transcript OnlineДокумент3 страницыRequest IRS Tax Transcript OnlineAsjsjsjsОценок пока нет

- Budget vs Actual Financial StatementДокумент1 страницаBudget vs Actual Financial StatementMonena G. Acar-CiñoОценок пока нет

- SSS Contribution Table As of January 2007Документ3 страницыSSS Contribution Table As of January 2007ahnzlove100% (3)

- MEPCO Online Consumer BillДокумент2 страницыMEPCO Online Consumer BillKhalil Ahmad59% (17)

- Exclusions From Gross Income: Atty. Richard M. Fulleros, Cpa, MbaДокумент10 страницExclusions From Gross Income: Atty. Richard M. Fulleros, Cpa, MbaLuntian Amour JustoОценок пока нет

- Taxing Situations Two Cases On Income Taxes - An Accounting Case StudyДокумент5 страницTaxing Situations Two Cases On Income Taxes - An Accounting Case Studyfossaceca80% (5)

- Guidelines For TDS Deduction On Purchase of Immovable PropertyДокумент4 страницыGuidelines For TDS Deduction On Purchase of Immovable Propertymib_santoshОценок пока нет

- Od127356569563402000 1Документ2 страницыOd127356569563402000 1M AFTAB SAJIОценок пока нет

- E-Trade Marketing Private Limited: Party DetailsДокумент1 страницаE-Trade Marketing Private Limited: Party DetailsSandeepОценок пока нет

- PDF CropДокумент4 страницыPDF Crop04vijilОценок пока нет

- Business Taxation Guide: Community Tax Rules & CalculationsДокумент3 страницыBusiness Taxation Guide: Community Tax Rules & CalculationsSuzette VillalinoОценок пока нет

- Case Digest For GR 184823Документ1 страницаCase Digest For GR 184823Ren PiñonОценок пока нет

- Bharat Sanchar Nigam Limited: Telephone Bill Name and Address of The CustomerДокумент1 страницаBharat Sanchar Nigam Limited: Telephone Bill Name and Address of The CustomerVijaya ChandОценок пока нет

- Invoice VF 364 Mr. SwamiDurai Train TicketДокумент1 страницаInvoice VF 364 Mr. SwamiDurai Train TicketBalaji dОценок пока нет

- Annex F RR 11-2018Документ1 страницаAnnex F RR 11-2018Kisu ShuteОценок пока нет

- Module 2 Transcript Federal Taxation I Individuals Employees and Sole ProprietorsДокумент66 страницModule 2 Transcript Federal Taxation I Individuals Employees and Sole ProprietorsFreddy MolinaОценок пока нет

- 2021 PTR and ITR filingДокумент2 страницы2021 PTR and ITR filingCelmer Charles Q. VillarealОценок пока нет

- Chapter 22Документ61 страницаChapter 22Tim LeeОценок пока нет

- Invoice OD211629772102222000Документ1 страницаInvoice OD211629772102222000Faruk PatelОценок пока нет

- RMC 78-2022Документ3 страницыRMC 78-2022Ian PalmaОценок пока нет

- Part 01 - CH 03-Computing The TaxДокумент51 страницаPart 01 - CH 03-Computing The TaxwdlzfrzОценок пока нет

- Pacific Airlines Operated Both An Airline and Several Rental CarДокумент1 страницаPacific Airlines Operated Both An Airline and Several Rental CarAmit PandeyОценок пока нет

- Cir v. Central Luzon Drug CorpДокумент2 страницыCir v. Central Luzon Drug CorpLadyfirst SMОценок пока нет

- House No. 43, Ghous Ul Azam Colony, Gulberg 2, Lahore Humna ShabirДокумент5 страницHouse No. 43, Ghous Ul Azam Colony, Gulberg 2, Lahore Humna ShabirAngrry BurdОценок пока нет