Академический Документы

Профессиональный Документы

Культура Документы

IncomeTax Calculator

Загружено:

murarirahul100%(3)100% нашли этот документ полезным (3 голоса)

4K просмотров2 страницыIts calculate your tax just 10 second

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

XLS, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документIts calculate your tax just 10 second

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

100%(3)100% нашли этот документ полезным (3 голоса)

4K просмотров2 страницыIncomeTax Calculator

Загружено:

murarirahulIts calculate your tax just 10 second

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

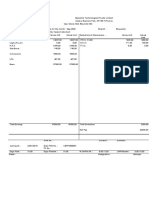

SENIOR CITIZEN 2007-08

Name of The Assessee :

Father's Name :

Date of Birth : 13/04/1979

Address of The Assessee :

:

:

Status : INDIVIDUAL

Sex (Select) : MALE

Assessment Year : 2007-08

PAN No. :

Ward/Circle :

Name of Bank :

Address of Bank Branch :

Type of Account :

MICR Code :

Bank Account No. :

COMPUTATION OF TOTAL INCOME

Income From Salary 150,000.00

Income From House Property 0.00

Income From Business & Profession 0.00

Income From Capital Gain 0.00

Income From Other Sources 0.00

Gross Total Income 150,000.00

Less : Deduction U/s 80C, 80CCC & 80CCD 0.00

Less : Deduction U/s 80D

Less : Deduction U/s 80E

Less : Deduction U/s 80G

Less : Deduction U/s 80GG

Less : Deduction U/s 80U

Gross Total Deductions 0.00

Net Taxable Income 150,000.00

Net Taxable Income Round Off U/s 288A 150,000.00

Income Tax On Rs. 150000/- -

Surcharge On Tax 10%

Education Cess 2% 0.00 0.00

Total Tax. Surcharge and Education Cess Payable 0.00

Balance Tax Payable 0.00

Add : Interest U/s 234 A 31/07/2008

Add : Interest U/s 234 B 31/03/2008

Add : Interest U/s 234 C 0.00 0.00

Interest u/s 234A

Total Tax and Interest Payable 0.00

U/s 234 C

Taxes Paid 15 Sep = 30%

Advance Tax 0.00 15 Dec = 60%

TDS 0.00 15 Mar =100%

Self Assessment Tax 0.00 0.00 Amount of Advance Tax

15 Sep = 30%

Balance Income Tax Nil 0.00 15 Dec = 60%

15 Mar =100%

For Calculation Select here.

#NAME?

Please fisrt enter the month and date and year

e.g. 01/10/2001

Select Status

Select Sex

In case of refund this is mandatory.

A.Y TAX SUR CESS TOTAL

2006-07 0.00 0.00 0.00 0.00

2007-08 0.00 0.00 0.00 0.00

2008-09 0.00 0.00 0.00 0.00

2009-10 0.00 0.00 0.00 0.00

mm/dd/yyyy

U/s 234 A Date of Return filing

U/s 234 B Date of Tax deposit 140A

Interest u/s 234A Interest u/s 234B

Tax Deposit ShortFall Rate Interest

0.00 1%

0.00 1%

0.00 1%

Amount of Advance Tax 0.00 Total -

-

-

-

Вам также может понравиться

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Документ3 страницыComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARОценок пока нет

- Corona Remedies PVT LTD: Pay Slip For The Month of Apr - 2019Документ1 страницаCorona Remedies PVT LTD: Pay Slip For The Month of Apr - 2019Emmanuel melvinОценок пока нет

- HCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Документ1 страницаHCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Kittu SinghОценок пока нет

- Earnings Deductions: Eicher Motors LimitedДокумент1 страницаEarnings Deductions: Eicher Motors LimitedR SEETHARAMANОценок пока нет

- Luminous Power Technologies Private Limited: Earnings DeductionsДокумент1 страницаLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kОценок пока нет

- Payslip 147988 202312-27Документ1 страницаPayslip 147988 202312-27SUNKARA ISОценок пока нет

- Form Template Format Slip Gaji Karyawan Swasta Sederhana Dalam ExcelДокумент1 страницаForm Template Format Slip Gaji Karyawan Swasta Sederhana Dalam ExcelGita RahmayaniОценок пока нет

- New Tax Certi PDFДокумент1 страницаNew Tax Certi PDFAli Azhar KhanОценок пока нет

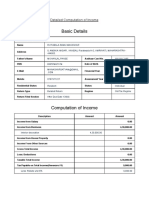

- Basic Details: Detailed Computation As Per OLD Tax RegimeДокумент2 страницыBasic Details: Detailed Computation As Per OLD Tax RegimeVishal SharmaОценок пока нет

- Arunachala Logistics PVT - Ltd. Pay Slip For The Month of APR - 2019Документ1 страницаArunachala Logistics PVT - Ltd. Pay Slip For The Month of APR - 2019Ganesh KumarОценок пока нет

- 97Документ2 страницы97rusingh932Оценок пока нет

- Earning Rate Amount (RS.) Deductions Amount (RS.)Документ2 страницыEarning Rate Amount (RS.) Deductions Amount (RS.)Ajay KharwarОценок пока нет

- Salary PDFДокумент2 страницыSalary PDFAjay KharwarОценок пока нет

- OE0036Документ1 страницаOE0036kumud kalaОценок пока нет

- Metro Telworks September Salary SlipДокумент1 страницаMetro Telworks September Salary SlipDheer SinghОценок пока нет

- PW37196 34541005Документ2 страницыPW37196 34541005rajan singhОценок пока нет

- Balance B/F - 1.00Документ1 страницаBalance B/F - 1.00kumbirai john chiparaОценок пока нет

- FPU WorksheetsДокумент11 страницFPU WorksheetsJean Marc LouisОценок пока нет

- Manthan Aug NewДокумент1 страницаManthan Aug NewManthan ShahОценок пока нет

- Sentsho, Johannes Zebediela STAND 2796 Refilwe 1003 7000149846Документ2 страницыSentsho, Johannes Zebediela STAND 2796 Refilwe 1003 7000149846Sanmaria Swart Black50% (2)

- EW17593 NovДокумент2 страницыEW17593 Novfaraz.ahmad.roseОценок пока нет

- July Stub 001Документ1 страницаJuly Stub 00176xzv4kk5vОценок пока нет

- Payslip - May - 2020 PDFДокумент1 страницаPayslip - May - 2020 PDFchanduОценок пока нет

- PaySlip Jan 2024Документ2 страницыPaySlip Jan 2024sanchitnayak21Оценок пока нет

- I888 Food Catering Payslip & AttendanceДокумент8 страницI888 Food Catering Payslip & AttendanceMark LopezОценок пока нет

- Kotak Mahindra Bank LTD: Full and Final SettlementДокумент2 страницыKotak Mahindra Bank LTD: Full and Final SettlementvasssssssSОценок пока нет

- Letters p1 Individual and Company Nil Estimate 3Документ3 страницыLetters p1 Individual and Company Nil Estimate 3Mark SilbermanОценок пока нет

- BusinessPlan 2022 01 31Документ13 страницBusinessPlan 2022 01 31Komal GuptaОценок пока нет

- Tasleem MayДокумент2 страницыTasleem MayManthan ShahОценок пока нет

- Cashflow Book TemplatesДокумент33 страницыCashflow Book TemplatesSantiago RestrepoОценок пока нет

- Payslip 147988 202311-10Документ1 страницаPayslip 147988 202311-10SUNKARA ISОценок пока нет

- The GameДокумент1 страницаThe Gamechhabram137Оценок пока нет

- Concentrix payslip titleДокумент5 страницConcentrix payslip titlebijender singh100% (1)

- Tuv Sud Employee Tax ComputationДокумент2 страницыTuv Sud Employee Tax Computationprashanth kumarОценок пока нет

- Pay Slip of Feb-2020Документ1 страницаPay Slip of Feb-2020jawedaman123Оценок пока нет

- HCL Income Tax SheetДокумент2 страницыHCL Income Tax Sheetkumar praweenОценок пока нет

- Salary Slip OctДокумент1 страницаSalary Slip OctRahul RajawatОценок пока нет

- Salary Slip NovДокумент1 страницаSalary Slip NovRahul RajawatОценок пока нет

- 883997_0_GPIND_TMCGOFFOCT2022_V2_gpinit01 (1)Документ2 страницы883997_0_GPIND_TMCGOFFOCT2022_V2_gpinit01 (1)lakb5304Оценок пока нет

- SATTUCOM21Документ2 страницыSATTUCOM21Alok G ShindeОценок пока нет

- C001 SP RMC3720 202106Документ1 страницаC001 SP RMC3720 202106suprakash samantaОценок пока нет

- Pay slip Of Mar-2020Документ1 страницаPay slip Of Mar-2020jawedaman123Оценок пока нет

- Trading Account FormatДокумент4 страницыTrading Account FormatCommerce Adda ConsultancyОценок пока нет

- FNP00765Документ1 страницаFNP00765Rajaram RayОценок пока нет

- Bijurappai PDFДокумент1 страницаBijurappai PDFTAV CreditОценок пока нет

- Chola Business Services Pay SlipДокумент3 страницыChola Business Services Pay SlipsathyaОценок пока нет

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationДокумент2 страницыDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairОценок пока нет

- Sep2022 STFC PayslipДокумент1 страницаSep2022 STFC PayslipAjith NandhaОценок пока нет

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Документ1 страницаRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Ridwan YoyoiОценок пока нет

- E010072 Payslip 01-JanДокумент1 страницаE010072 Payslip 01-JanhariprasadhpОценок пока нет

- Bruce Proof of ResidenceДокумент1 страницаBruce Proof of ResidencePaul Shenjere MutiswaОценок пока нет

- Tax Invoice: Bill Amount: 3300.00Документ1 страницаTax Invoice: Bill Amount: 3300.00Akshay SaneparaОценок пока нет

- IGA69636 SalSlipWithTaxDetailsMiscДокумент1 страницаIGA69636 SalSlipWithTaxDetailsMiscHrithik ghoshОценок пока нет

- Rincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Документ1 страницаRincian Saldo Jaminan Hari Tua & Informasi Jaminan Pensiun Tahun 2016Dede DetianaОценок пока нет

- Aug2023 38349 SalarySlipwithTaxDetailsДокумент1 страницаAug2023 38349 SalarySlipwithTaxDetailsshyam kumarОценок пока нет

- Non-Employee Expense ReportДокумент3 страницыNon-Employee Expense ReportMthunzi MthunziОценок пока нет

- Statement of Account BBVAДокумент7 страницStatement of Account BBVAchistopher freundОценок пока нет

- Shrey Payslip Apr 2023Документ4 страницыShrey Payslip Apr 2023Shrey EducationОценок пока нет

- Economic & Budget Forecast Workbook: Economic workbook with worksheetОт EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetОценок пока нет

- CS Harley - May 2013Документ16 страницCS Harley - May 2013Neil CalvinОценок пока нет

- Why Students Choose ABM CoursesДокумент6 страницWhy Students Choose ABM CoursesJhas MinОценок пока нет

- MC 0920Документ16 страницMC 0920mcchronicleОценок пока нет

- Allied Banking Corporation VsДокумент3 страницыAllied Banking Corporation VsSheilaОценок пока нет

- iSocialWatch Inc. Delaware Articles of IncorporationДокумент3 страницыiSocialWatch Inc. Delaware Articles of IncorporationiSocialWatch.com50% (2)

- Mock Exam 2Документ9 страницMock Exam 2Katinaa PrasannaaОценок пока нет

- Duties and liabilities of withholding agentsДокумент2 страницыDuties and liabilities of withholding agentsAnselmo Rodiel IVОценок пока нет

- 10 TAX Tips: For Real Estate ProfessionalsДокумент14 страниц10 TAX Tips: For Real Estate ProfessionalsnnauthooОценок пока нет

- Accounting Standards Full INCLUSING ANSWERSДокумент235 страницAccounting Standards Full INCLUSING ANSWERSAnsari Salman100% (1)

- EMBA Strategic Marketing Case StudyДокумент11 страницEMBA Strategic Marketing Case StudySoham Pradhan100% (1)

- Presentation 1 - Cash Flow StatementДокумент35 страницPresentation 1 - Cash Flow StatementHans IbrahimОценок пока нет

- Tax Deductions and DDT for CompaniesДокумент23 страницыTax Deductions and DDT for Companieskarishmapatel93Оценок пока нет

- Slip Accomodation Dan TransportationДокумент5 страницSlip Accomodation Dan Transportationbovan28Оценок пока нет

- Bus 215 NotesДокумент18 страницBus 215 Notesctyre34Оценок пока нет

- Financial Analysis Reveals Asian Paints' Strong GrowthДокумент7 страницFinancial Analysis Reveals Asian Paints' Strong GrowthRohit SinghОценок пока нет

- Conceptual Framework Purpose Assist Standards Developed IFRSДокумент6 страницConceptual Framework Purpose Assist Standards Developed IFRSKyleZapantaОценок пока нет

- CPA Income Tax QuizДокумент15 страницCPA Income Tax QuizApolinar Alvarez Jr.100% (4)

- UntitledДокумент4 страницыUntitledrodelyn waclinОценок пока нет

- Classification of AccountsДокумент6 страницClassification of AccountsdddОценок пока нет

- Customer Culture PDFДокумент8 страницCustomer Culture PDFRahilHakimОценок пока нет

- Tax Planning for Business and IndividualsДокумент109 страницTax Planning for Business and IndividualsrahulОценок пока нет

- 4 Remuneration FormДокумент2 страницы4 Remuneration FormRDC SPUОценок пока нет

- Philippine Income Tax Classification GuideДокумент5 страницPhilippine Income Tax Classification GuideLouОценок пока нет

- Detailed Analysis of Tds For Contractor 194c by KC Singhal AdvocateДокумент27 страницDetailed Analysis of Tds For Contractor 194c by KC Singhal AdvocateAnkit SainiОценок пока нет

- Financial Analysis of Paint BusinessДокумент9 страницFinancial Analysis of Paint BusinessDianna Tercino IIОценок пока нет

- Sample Document - For Information Only: Name, Address and Telephone Number of Person Without AttorneyДокумент9 страницSample Document - For Information Only: Name, Address and Telephone Number of Person Without AttorneyRyan SteburgОценок пока нет

- Question Paper of MBA Second YearДокумент5 страницQuestion Paper of MBA Second YearKaran Veer SinghОценок пока нет

- The Banker-Customer RelationshipДокумент31 страницаThe Banker-Customer RelationshipStefan Adrian VanceaОценок пока нет

- Quiz NoДокумент12 страницQuiz NoEdith MartinОценок пока нет

- BIR Ruling 25-2002 June 25, 2002Документ4 страницыBIR Ruling 25-2002 June 25, 2002Raiya Angela0% (1)