Академический Документы

Профессиональный Документы

Культура Документы

GST 101 A

Загружено:

chriswoonИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

GST 101 A

Загружено:

chriswoonАвторское право:

Доступные форматы

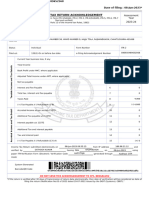

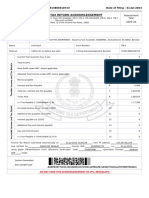

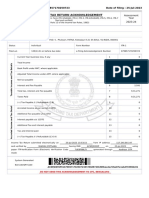

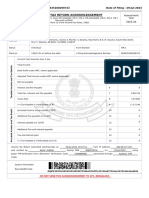

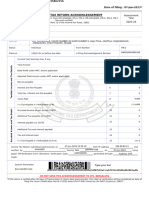

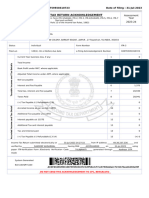

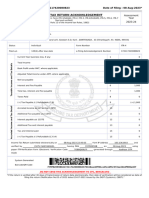

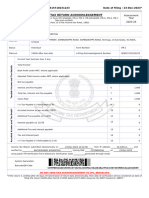

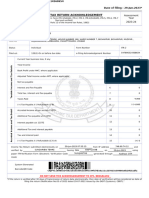

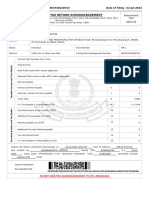

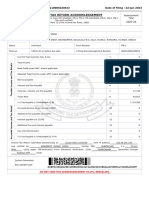

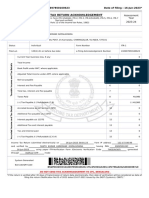

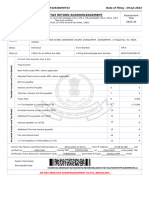

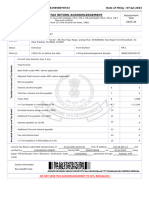

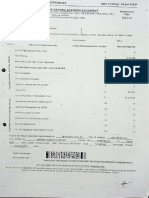

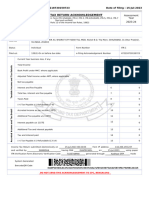

*00001*

¨321321323301S1;«

321321323301S1

Goods and Services Tax Act 1985

Goods and services tax return ¨GST101A*0707D«

You can use the GST guide (IR 375) to help you complete this return, which you ll find at GST 101A

www.ird.govt.nz or call us on 0800 377 776. July 2007

MR 15 - LOC 2 INDIVIDUAL

69 ORANGI KAUPAPA ROAD Registration number 1 10- 000- 181

NORTHLAND WELLINGTON 6005

Period covered by the return MONTHLY

from 01 02 2008 2 to 29 02 2008

This return and any payment are due 28 March 2008

If your correct postal address for

GST is not shown above, print it 3

in Box˚3.

Payments Basis If your correct daytime phone number

is not shown here, print it in Box 4 4

Area code Phone number

Total sales and income for the period

(including GST and any zero-rated supplies) 5

Goods and services Zero-rated supplies included in Box 5 6

tax on your sales

Subtract Box 6 from Box 5 and enter the

and income difference here 7

OFFICE USE ONLY

Divide the amount in Box 7 by nine (9) 8

Operator Corresp.

code indicator Adjustments from your calculation sheet 9

Payment Return

Add Box 8 and Box 9. This is your total GST

10

attached cat.

collected on sales and income

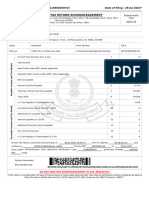

Goods and services Total purchases and expenses (including GST)

tax on your purchases for which tax invoicing requirements have been 11

met excluding any imported goods

and expenses

Divide the amount in Box 11 by nine (9) 12

Declaration

The information in this return

Credit adjustments from your calculation sheet 13

is true and correct and Add Box 12 and Box 13. This is your total GST

represents my assessment credit for purchases and expenses 14

as required under the

Tax Administration Act 1994. Print the difference between Box 10 and

Box 14 here 15

Signature

If Box 14 is larger than Box 10 the difference is your GST refund (Tick one)

If Box 10 is larger than Box 14 the difference is GST to pay Refund

Has payment been made electronically? Yes No GST to pay

Date

GST 700

Payment slip

Registration number 10- 000- 181

MR 15 - LOC 2 INDIVIDUAL Return for the period ending 29 02 2008

Amount of payment

This return and any payment are due 28 MAR 2008

Use the envelope provided to post your return, payment Copy your total from Box 15 and enter it here. Include any late

slip and any cheque payment. payment penalties for this period only.

RESET form

290208< 700< 001: 010000181<

Вам также может понравиться

- GST 101 AДокумент2 страницыGST 101 AsingularpointyОценок пока нет

- Business Activity Statement: Summary of AmountsДокумент2 страницыBusiness Activity Statement: Summary of AmountsSimona StratulatОценок пока нет

- SWG02-Kuljot Walia Income Tax Full Set Assessment Year 2022-23Документ13 страницSWG02-Kuljot Walia Income Tax Full Set Assessment Year 2022-23xqggtxyzhfОценок пока нет

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearДокумент1 страницаIndian Income Tax Return Acknowledgement 2022-23: Assessment YearGaming CavesОценок пока нет

- Rajesh Bora Itr PLBS 2022Документ5 страницRajesh Bora Itr PLBS 2022ABDUL KHALIKОценок пока нет

- Group 8 Project 2 - Preparation of Quarterly Percentage Tax ReturnДокумент4 страницыGroup 8 Project 2 - Preparation of Quarterly Percentage Tax ReturnVan Joshua NunezОценок пока нет

- PDF 438429930210822Документ1 страницаPDF 438429930210822peetamber agarwalОценок пока нет

- Santhos KumarДокумент1 страницаSanthos KumarnandsavghОценок пока нет

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearДокумент1 страницаIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRajagopal ArunachalamОценок пока нет

- Financial AY 21 22Документ23 страницыFinancial AY 21 22NAHID AFSARОценок пока нет

- BAS Form TemplateДокумент2 страницыBAS Form TemplateEricKangОценок пока нет

- Ack Aadhn6348f 2022-23 220799250290722Документ1 страницаAck Aadhn6348f 2022-23 220799250290722Akansha JainОценок пока нет

- PDF 115914800310723Документ1 страницаPDF 115914800310723jayanto chowdhuryОценок пока нет

- MAC Jan-2022 Pending InvДокумент1 страницаMAC Jan-2022 Pending InvSree ganapathy Facilitation servicesОценок пока нет

- ACK679857170250723Документ1 страницаACK679857170250723Pritam KumarОценок пока нет

- Adobe Scan 15 Dec 2023Документ1 страницаAdobe Scan 15 Dec 2023gandhipl74Оценок пока нет

- PDF 829435100290723Документ1 страницаPDF 829435100290723Nilay KumarОценок пока нет

- PDF 554248680190723Документ1 страницаPDF 554248680190723Deepika SОценок пока нет

- 22-23 All PagesДокумент5 страниц22-23 All PagesBulbuli DasОценок пока нет

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:611395890220723 Date of Filing: 22-Jul-2023Документ1 страницаIndian Income Tax Return Acknowledgement: Acknowledgement Number:611395890220723 Date of Filing: 22-Jul-2023Respect InfinityОценок пока нет

- Itr Acknowledgement FormatДокумент1 страницаItr Acknowledgement FormatDinesh RajputОценок пока нет

- Indian Income Tax Return Acknowledgement: Assessment YearДокумент1 страницаIndian Income Tax Return Acknowledgement: Assessment Yearbhaseen photostateОценок пока нет

- PDF 879885330190722Документ1 страницаPDF 879885330190722Sumit MurumkarОценок пока нет

- Itr 23-24 AnubhavДокумент1 страницаItr 23-24 AnubhavAnubhav MishraОценок пока нет

- Indian Income Tax Return Acknowledgement: Date of Filing: 10-Jun-2023 Acknowledgement Number:218792930100692Документ1 страницаIndian Income Tax Return Acknowledgement: Date of Filing: 10-Jun-2023 Acknowledgement Number:218792930100692shreemultistateservice23Оценок пока нет

- ACK160159480020823Документ1 страницаACK160159480020823SanthoshRajОценок пока нет

- PDF 923744260220722Документ1 страницаPDF 923744260220722Ashish SinghОценок пока нет

- PDF 387693400310722Документ1 страницаPDF 387693400310722kumar kishanОценок пока нет

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:500402890170723 Date of Filing: 17-Jul-2023Документ1 страницаIndian Income Tax Return Acknowledgement: Acknowledgement Number:500402890170723 Date of Filing: 17-Jul-2023tdsbolluОценок пока нет

- Ack 155284530310723Документ1 страницаAck 155284530310723sankarpradhan354Оценок пока нет

- $RX7B05VДокумент1 страница$RX7B05Vakxerox47Оценок пока нет

- PDF 169223670270722Документ1 страницаPDF 169223670270722adhya100% (1)

- MAHADEVДокумент1 страницаMAHADEVnandsavghОценок пока нет

- Ack Aacar1829b 2022-23 290901450300722Документ1 страницаAck Aacar1829b 2022-23 290901450300722Amma FoundationОценок пока нет

- Itr Ay 22-23Документ1 страницаItr Ay 22-23Bandari GoverdhanОценок пока нет

- ITRVДокумент1 страницаITRVyashbaislaa1234Оценок пока нет

- Ghana Revenue Authority: Monthly Vat & Nhil ReturnДокумент2 страницыGhana Revenue Authority: Monthly Vat & Nhil Returnokatakyie1990Оценок пока нет

- ACK172117420080823Документ1 страницаACK172117420080823thakurravindra197071Оценок пока нет

- PDF 877874540190722Документ1 страницаPDF 877874540190722SiddharthОценок пока нет

- Acknowledgement Fy 2020-21Документ1 страницаAcknowledgement Fy 2020-21Prajwal ShettyОценок пока нет

- PDF 233195180290722Документ1 страницаPDF 233195180290722B KОценок пока нет

- PDF 387774570310722Документ1 страницаPDF 387774570310722dassantana831Оценок пока нет

- BAS Template PDFДокумент2 страницыBAS Template PDFrajkrishna03Оценок пока нет

- Itr 2020-21Документ6 страницItr 2020-21KpAb OfficeОценок пока нет

- PDF 569515710231223Документ1 страницаPDF 569515710231223sushmithasaptharshiofficialОценок пока нет

- Sundaribai TemreДокумент1 страницаSundaribai TemrenandsavghОценок пока нет

- PDF 601503740220723Документ1 страницаPDF 601503740220723Preetha ChelladuraiОценок пока нет

- PDF 280110080220623Документ1 страницаPDF 280110080220623AKS SONG SAN SINGHОценок пока нет

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearДокумент1 страницаIndian Income Tax Return Acknowledgement 2022-23: Assessment Yeartanish gargОценок пока нет

- PDF 242697850160623Документ1 страницаPDF 242697850160623Sujith GowdaОценок пока нет

- PDF 820742540290723Документ1 страницаPDF 820742540290723CYNICALОценок пока нет

- Ack Fnups3286n 2022-23 338831280310722Документ1 страницаAck Fnups3286n 2022-23 338831280310722Sumit SainiОценок пока нет

- PDF 386615950070723Документ1 страницаPDF 386615950070723Sudhanshu PandeyОценок пока нет

- E-Return 22-23 GauravДокумент1 страницаE-Return 22-23 Gauravchaudharigaurav96Оценок пока нет

- PDF 224006290290722Документ1 страницаPDF 224006290290722Just a Random Guy On the InternetОценок пока нет

- Ranjit ItrrДокумент1 страницаRanjit ItrrRadha SureshОценок пока нет

- PDF 337886890310722Документ1 страницаPDF 337886890310722pankajОценок пока нет

- Pandge 2022-23 - CompressedДокумент6 страницPandge 2022-23 - Compressedjoshikrishnakumar19Оценок пока нет

- PDF 472218730150723Документ1 страницаPDF 472218730150723pankajОценок пока нет

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОт EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesОценок пока нет

- Atestat Pagau Maria XII-E CNPCB CorectatДокумент5 страницAtestat Pagau Maria XII-E CNPCB CorectatMaria ItuОценок пока нет

- PriceListHirePurchase Normal6thNov2019Документ56 страницPriceListHirePurchase Normal6thNov2019Jamil AhmedОценок пока нет

- JollibeeДокумент3 страницыJollibeeArgel Linard Francisco Mabaga100% (1)

- Management Theory and Practice - Chapter 1 - Session 1 PPT Dwtv9Ymol5Документ35 страницManagement Theory and Practice - Chapter 1 - Session 1 PPT Dwtv9Ymol5DHAVAL ABDAGIRI83% (6)

- Od-2017 Ed.1.7Документ28 страницOd-2017 Ed.1.7Tung Nguyen AnhОценок пока нет

- Cross TAB in Crystal ReportsДокумент15 страницCross TAB in Crystal ReportsMarcelo Damasceno ValeОценок пока нет

- Niraj-LSB CatalogueДокумент8 страницNiraj-LSB CataloguenirajОценок пока нет

- Aplicatie Practica Catapulta TUVДокумент26 страницAplicatie Practica Catapulta TUVwalaОценок пока нет

- Lessons 1 and 2 Review IBM Coursera TestДокумент6 страницLessons 1 and 2 Review IBM Coursera TestNueОценок пока нет

- Anubrat ProjectДокумент80 страницAnubrat ProjectManpreet S BhownОценок пока нет

- President Uhuru Kenyatta's Madaraka Day SpeechДокумент8 страницPresident Uhuru Kenyatta's Madaraka Day SpeechState House Kenya100% (1)

- Section 114-118Документ8 страницSection 114-118ReiZen UelmanОценок пока нет

- Oil and Gas Industry Overview SsДокумент2 страницыOil and Gas Industry Overview SsVidhu PrabhakarОценок пока нет

- Executive Summary:: Advanced & Applied Business Research Pillsbury Cookie Challenge Due Date: 4 March 2013Документ6 страницExecutive Summary:: Advanced & Applied Business Research Pillsbury Cookie Challenge Due Date: 4 March 2013chacha_420100% (1)

- ACCT1501 MC Bank QuestionsДокумент33 страницыACCT1501 MC Bank QuestionsHad0% (2)

- Leonardo Roth, FLДокумент2 страницыLeonardo Roth, FLleonardorotharothОценок пока нет

- Project On Max Life InsuranseДокумент48 страницProject On Max Life InsuranseSumit PatelОценок пока нет

- 73 220 Lecture07Документ10 страниц73 220 Lecture07api-26315128Оценок пока нет

- Venture Pulse Q1 16Документ101 страницаVenture Pulse Q1 16BusolaОценок пока нет

- CH3Документ4 страницыCH3Chang Chun-MinОценок пока нет

- Organization Chart UpdatedДокумент1 страницаOrganization Chart UpdatedganrashОценок пока нет

- SCAДокумент14 страницSCANITIN rajputОценок пока нет

- Terminal Operators LiabilityДокумент30 страницTerminal Operators LiabilityMurat YilmazОценок пока нет

- Management Accounting Perspective: © Mcgraw-Hill EducationДокумент12 страницManagement Accounting Perspective: © Mcgraw-Hill Educationabeer alfalehОценок пока нет

- International Business Management or Business EnviormentДокумент141 страницаInternational Business Management or Business Enviormentkvl rtdОценок пока нет

- Six Sigma Control PDFДокумент74 страницыSix Sigma Control PDFnaacha457Оценок пока нет

- Top Multinational Medical Devices CompaniesДокумент3 страницыTop Multinational Medical Devices CompaniesakashОценок пока нет

- MKT 566 Quiz 2Документ16 страницMKT 566 Quiz 2kaz92Оценок пока нет

- PARCOR-SIMILARITIESДокумент2 страницыPARCOR-SIMILARITIESHoney Lizette SunthornОценок пока нет

- BD 20231126Документ58 страницBD 20231126amit mathurОценок пока нет