Академический Документы

Профессиональный Документы

Культура Документы

Class 6 Government Policy Odp

Загружено:

Lanphuong BuiИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Class 6 Government Policy Odp

Загружено:

Lanphuong BuiАвторское право:

Доступные форматы

Microeconomics. Chapter 6.

1. Lovers of classical music persuade Congress to impose a price ceiling of $40 per ticket. Does this policy get more or

fewer people to attend classical music concerts? If currently market prices are higher, then price ceiling will result in

shortage. Lowe price will reduce supply, so the number of people attending concerts will fall.

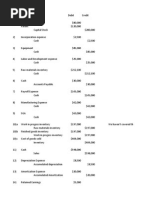

3. A recent study found that the demand and supply schedules for Frisbees are as follows:

PRICE PER QUANTITY QUANTITY

FRISBEE DEMANDED SUPPLIED

$11 1 million 15 million

10 2 12

9 4 9

8 6 6

7 8 3

6 10 1

a. What are the equilibrium price and quantity of Frisbees? $8, 6 million.

b. Frisbee manufacturers persuade the government that Frisbee production improves scientists’ understanding of

aerodynamics and thus is important for national security. A concerned Congress votes to impose a price floor $2 above

the equilibrium price. What is the new market price? $10. How many Frisbees are sold? 2 million

c. Irate college students march on Washington and demand a reduction in the price of Frisbees. An even more concerned

Congress votes to repeal the price floor and impose a price ceiling $1 below the former price floor. What is the new

market price? Price ceiling is not binding, market price is $8. How many Frisbees are sold? 6 million

5. Asenator wants to raise tax revenue and make workers better off. A staff member proposes raising the payroll

tax paid by firms and using part of the extra revenue to reduce the payroll tax paid by workers. Would this accomplish the

senator’s goal? No, employers will reduce the wage to pay the tax.

7. Congress and the president decide that the United States should reduce air pollution by reducing its use of

gasoline. They impose a $0.50 tax for each gallon of gasoline sold.

a. Should they impose this tax on producers or consumers? Explain carefully using a supply-and-demand diagram. It does

not matter.

b. If the demand for gasoline were more elastic, would this tax be more effective or less effective in reducing the quantity

of gasoline consumed? Effective. Explain with both words and a diagram.

c. Are consumers of gasoline helped or hurt by this tax? Why? Hurt – consumer surplus is reduced

d. Are workers in the oil industry helped or hurt by this tax? Why? Hurt – lower demand for gasoline implies lower

production and lower employment/wages

9. Consider the following policies, each of which is aimed at reducing violent crime by reducing the use of guns. Illustrate

each of these proposed policies in a supply- and-demand diagram of the gun market.

a. a tax on gun buyers D shifts downwards

b. a tax on gun sellers S shifts upwards

c. a price floor on guns Works only if it is binding

d. a tax on ammunition D shifts downward

11. A subsidy is the opposite of a tax. With a $0.50 tax on the buyers of ice-cream cones, the government collects $0.50

for each cone purchased; with a $0.50 subsidy for the buyers of ice-cream cones, the government pays buyers $0.50 for

each cone purchased.

a. Show the effect of a $0.50 per cone subsidy on the demand curve for ice-cream cones, the effective

price paid by consumers lower, the effective price received by sellers higher, and the quantity of cones sold. higher

b. Do consumers gain or lose from this policy? Gain Do producers gain or lose? Gain Does the government gain

or lose? Loses

Вам также может понравиться

- Green Investing: A Guide to Making Money through Environment Friendly StocksОт EverandGreen Investing: A Guide to Making Money through Environment Friendly StocksРейтинг: 3 из 5 звезд3/5 (2)

- Homework 3 - Part - II - AK PDFДокумент16 страницHomework 3 - Part - II - AK PDFShaina AragonОценок пока нет

- Chapter 6 - Prob & AppДокумент7 страницChapter 6 - Prob & AppĐỗ Minh100% (1)

- Homework #6 Economics For Business Creation: Ashmed Farid Porte Petit Hernández A01281338 Martha Eugenia GonzálezДокумент4 страницыHomework #6 Economics For Business Creation: Ashmed Farid Porte Petit Hernández A01281338 Martha Eugenia GonzálezFarid Porte Petit HernandezОценок пока нет

- KW Macro CH 03 End of Chapter ProblemsДокумент9 страницKW Macro CH 03 End of Chapter ProblemsVivek YadavОценок пока нет

- ECON 201 Midterm Practice Version 1Документ7 страницECON 201 Midterm Practice Version 1examkillerОценок пока нет

- Practice MidtermДокумент4 страницыPractice MidtermLinda GeОценок пока нет

- Week 3 HomeworkДокумент4 страницыWeek 3 Homeworkapi-331018879Оценок пока нет

- Microeconomics Problem Set 3Документ10 страницMicroeconomics Problem Set 3Khánh HuyềnОценок пока нет

- Microeconomics Problem Set 3Документ10 страницMicroeconomics Problem Set 3Thăng Nguyễn BáОценок пока нет

- Supply and Demand College Problem SetsДокумент5 страницSupply and Demand College Problem Setsjesse jamesОценок пока нет

- Assignment 5Документ4 страницыAssignment 5Syeda Umyma FaizОценок пока нет

- Econ 201 Tutorial #3 Date: Week 5 Coverage: Chapter 4 Elasticity I. Multiple Choice QuestionsДокумент4 страницыEcon 201 Tutorial #3 Date: Week 5 Coverage: Chapter 4 Elasticity I. Multiple Choice QuestionsMtl BloggersОценок пока нет

- Answer For Homework #2 of Managerial EconomicsДокумент6 страницAnswer For Homework #2 of Managerial EconomicsMahmud MishuОценок пока нет

- ElasticityДокумент11 страницElasticityAyub AhmedОценок пока нет

- Fa 2Документ5 страницFa 2Amit SemwalОценок пока нет

- Individual & Market DemandДокумент12 страницIndividual & Market DemandAkshay ModakОценок пока нет

- Module 4 ActivitiesДокумент15 страницModule 4 ActivitiesDaisy Ann Cariaga SaccuanОценок пока нет

- Professor Elliott Parker Spring 2005 Midterm Exam 1 Name: ECON 102 - Principles of MicroeconomicsДокумент9 страницProfessor Elliott Parker Spring 2005 Midterm Exam 1 Name: ECON 102 - Principles of Microeconomicshyung_jipmОценок пока нет

- ME Problem Set-5Документ6 страницME Problem Set-5Akash DeepОценок пока нет

- GE Chapter 04 Solutions - FMTДокумент14 страницGE Chapter 04 Solutions - FMTAli RazaОценок пока нет

- HOME WORK #1 Discussed 12 Sept Durint Tutorial-1Документ2 страницыHOME WORK #1 Discussed 12 Sept Durint Tutorial-1Nevis SapphireОценок пока нет

- Micro Chapter 3 Study Guide Questions 14eДокумент6 страницMicro Chapter 3 Study Guide Questions 14eBeauponte Pouky MezonlinОценок пока нет

- Homework Supply and Demand Answer KeyДокумент2 страницыHomework Supply and Demand Answer KeyAllie Contreras67% (3)

- BECO110-Assignment1-2012 10 05Документ4 страницыBECO110-Assignment1-2012 10 05Price100% (2)

- 7759Документ11 страниц7759Rashid AyubiОценок пока нет

- f12 103h r1p PDFДокумент36 страницf12 103h r1p PDFvikas0% (1)

- AP Macro Economics Practice Exam 2Документ18 страницAP Macro Economics Practice Exam 2KayОценок пока нет

- Micro Final Practice ExamДокумент16 страницMicro Final Practice Examюрий локтионовОценок пока нет

- Pindyck Chapter 2Документ7 страницPindyck Chapter 2Nino KazОценок пока нет

- Econ204A2 F07 LeeG Fall05 Midterm1Документ7 страницEcon204A2 F07 LeeG Fall05 Midterm1bevinjОценок пока нет

- Z Eco Test 01 PPC & DemandДокумент5 страницZ Eco Test 01 PPC & DemandsmentorОценок пока нет

- Eco 1St Assignment Usiu-A: Joanna Veronique Nduwimana - 663066Документ5 страницEco 1St Assignment Usiu-A: Joanna Veronique Nduwimana - 663066JoОценок пока нет

- Sample Ex2Документ24 страницыSample Ex2JacobОценок пока нет

- Eco 2Документ10 страницEco 2mh2358502Оценок пока нет

- Internal Assessment #1Документ6 страницInternal Assessment #1Rakesh PatelОценок пока нет

- Practice 2 - ECON1010Документ6 страницPractice 2 - ECON1010veres.tankerОценок пока нет

- Httpshhadah Github iomicroSlidesMyPresentationsCh6Ch6 PDFДокумент37 страницHttpshhadah Github iomicroSlidesMyPresentationsCh6Ch6 PDF정서윤Оценок пока нет

- Written HW4Документ14 страницWritten HW4aplesgjskОценок пока нет

- Practice 4Документ13 страницPractice 4Nguyễn Quỳnh TrâmОценок пока нет

- Answer Keys Mankiw 7th 1Документ10 страницAnswer Keys Mankiw 7th 1Mii AnnОценок пока нет

- Chapter 5Документ6 страницChapter 5moiz aliОценок пока нет

- Homework 2 AKДокумент10 страницHomework 2 AKTrang NguyễnОценок пока нет

- Intro Micro UTS EssayДокумент3 страницыIntro Micro UTS EssaynaylaОценок пока нет

- Econ 101, Sections 4 and 5, S09 Schroeter Exam #3, BlueДокумент7 страницEcon 101, Sections 4 and 5, S09 Schroeter Exam #3, BlueexamkillerОценок пока нет

- Individual and Market Demand: Review QuestionsДокумент14 страницIndividual and Market Demand: Review Questionsbuzz20090Оценок пока нет

- Practice 2 - Demand and Supply - HSB1010Документ6 страницPractice 2 - Demand and Supply - HSB1010hgiang2308Оценок пока нет

- Econ2113 PS2Документ5 страницEcon2113 PS2jacky114aaОценок пока нет

- Questions - Lecture - 6 - Supply, Demand and Government PoliciesДокумент13 страницQuestions - Lecture - 6 - Supply, Demand and Government PoliciesElvince DushajОценок пока нет

- Assignment 01Документ4 страницыAssignment 01Javed AhmedОценок пока нет

- Assignment From Lecture 3Документ5 страницAssignment From Lecture 3J. NawreenОценок пока нет

- Assignment 2Документ7 страницAssignment 2IlhamMinda0% (1)

- MOCK TEST Without AnswersДокумент5 страницMOCK TEST Without AnswersSolovastru MihaelaОценок пока нет

- Econ202 Tt1 2012f HellmanДокумент12 страницEcon202 Tt1 2012f HellmanexamkillerОценок пока нет

- Microeconomics: The Basic of Supply and DemandДокумент9 страницMicroeconomics: The Basic of Supply and DemandRidwan MuhammadОценок пока нет

- Ch10solution ManualДокумент31 страницаCh10solution ManualJyunde WuОценок пока нет

- GiẠI Quiz VI MãДокумент25 страницGiẠI Quiz VI MãhaОценок пока нет

- Market Force of Supply and DemandДокумент1 страницаMarket Force of Supply and DemandFarizzah 21Оценок пока нет

- Sp15 Micro Exam 2 Chs 5-10 Study Questions-5Документ40 страницSp15 Micro Exam 2 Chs 5-10 Study Questions-5Ahmed MahmoudОценок пока нет

- Stages of Economic IntegrationДокумент2 страницыStages of Economic IntegrationLanphuong BuiОценок пока нет

- What Entrepreneurs and Small Business Owners Can Do To Increase Their Chances of Success in The Global EconomyДокумент6 страницWhat Entrepreneurs and Small Business Owners Can Do To Increase Their Chances of Success in The Global EconomyLanphuong BuiОценок пока нет

- 04 Money Creation and Central BanksДокумент4 страницы04 Money Creation and Central BanksLanphuong BuiОценок пока нет

- WeberДокумент21 страницаWeberLanphuong BuiОценок пока нет

- Class 8 Cost of Taxation OdpДокумент2 страницыClass 8 Cost of Taxation OdpLanphuong Bui100% (2)

- Quiz ch8 OdpДокумент1 страницаQuiz ch8 OdpLanphuong BuiОценок пока нет

- Career Portfolio ReflectionДокумент2 страницыCareer Portfolio Reflectionapi-282908432Оценок пока нет

- Union BudgetДокумент9 страницUnion BudgetsameeraОценок пока нет

- History APECДокумент12 страницHistory APECWan Harith Wan AzmiОценок пока нет

- International Economics: Exchange-Rate SystemsДокумент23 страницыInternational Economics: Exchange-Rate SystemsKaranPatilОценок пока нет

- International FinanceДокумент10 страницInternational FinancelabelllavistaaОценок пока нет

- Chapter 17 Solutions BKM Investments 9eДокумент11 страницChapter 17 Solutions BKM Investments 9enpiper29100% (1)

- Full Download Macroeconomics Williamson 5th Edition Test Bank PDF Full ChapterДокумент36 страницFull Download Macroeconomics Williamson 5th Edition Test Bank PDF Full Chapterythrowemisavize.blfs2100% (19)

- Public Policy Course Outline Prof. Tarun DasДокумент32 страницыPublic Policy Course Outline Prof. Tarun DasProfessor Tarun DasОценок пока нет

- Exercise Set 5Документ2 страницыExercise Set 5Floreline Fae TabuzoОценок пока нет

- Results of 2008 Financial CrisisДокумент12 страницResults of 2008 Financial CrisislukkysreeОценок пока нет

- Aifta Asean - India Fta: Arguing Against The MotionДокумент15 страницAifta Asean - India Fta: Arguing Against The Motiontyros212Оценок пока нет

- Banking and Economics MCqs PDFДокумент103 страницыBanking and Economics MCqs PDFqazi k100% (1)

- Evolution of Exchange Rate Regime Impact On Macro Economy of BangladeshДокумент37 страницEvolution of Exchange Rate Regime Impact On Macro Economy of BangladeshAftab UddinОценок пока нет

- Discretionary Spending 4Документ7 страницDiscretionary Spending 4Committee For a Responsible Federal BudgetОценок пока нет

- Econ 2HH3 (Outline14)Документ4 страницыEcon 2HH3 (Outline14)MayОценок пока нет

- Questions Asked in IBPS Exam On 19th October Morning ShiftДокумент2 страницыQuestions Asked in IBPS Exam On 19th October Morning ShiftPramodMeenaОценок пока нет

- Dispensers of California (Jeff)Документ9 страницDispensers of California (Jeff)Jeffery KaoОценок пока нет

- ECON 201 12/9/2003 Prof. Gordon: Final ExamДокумент23 страницыECON 201 12/9/2003 Prof. Gordon: Final ExamManicks VelanОценок пока нет

- ECON 101+b-SyllabusДокумент3 страницыECON 101+b-SyllabusSteven MackeyОценок пока нет

- Public Economics LecturesДокумент884 страницыPublic Economics LectureslquerovОценок пока нет

- Sdnnew 16Документ306 страницSdnnew 16monster_newinОценок пока нет

- FinalДокумент41 страницаFinalLoveleen SinghОценок пока нет

- Indian EconomyДокумент1 страницаIndian EconomyDusmanta BeheraОценок пока нет

- List of Special Economic Zones in India - WikipediaДокумент17 страницList of Special Economic Zones in India - WikipediaVijay RamaniОценок пока нет

- BachoДокумент2 страницыBachoAramae BachoОценок пока нет

- MacroeconДокумент502 страницыMacroeconOrhun Ersoy100% (1)

- Public Finance & Accounting Take Home AssignmentДокумент20 страницPublic Finance & Accounting Take Home AssignmentJude Raj AsanteОценок пока нет

- ECON 312 Entire Course Principles of EconomicsДокумент4 страницыECON 312 Entire Course Principles of EconomicsdavidslewisОценок пока нет

- VAT ReportДокумент32 страницыVAT ReportNoel Christopher G. BellezaОценок пока нет

- ME Unit-5Документ20 страницME Unit-5Mitika MahajanОценок пока нет

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesОт EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyОт EverandChip War: The Quest to Dominate the World's Most Critical TechnologyРейтинг: 4.5 из 5 звезд4.5/5 (227)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumОт EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumРейтинг: 3 из 5 звезд3/5 (12)

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationОт EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationРейтинг: 4 из 5 звезд4/5 (11)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaОт EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaОценок пока нет

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingОт EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingРейтинг: 4.5 из 5 звезд4.5/5 (97)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsОт EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsРейтинг: 4.5 из 5 звезд4.5/5 (94)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistОт EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistРейтинг: 4.5 из 5 звезд4.5/5 (37)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationОт EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationРейтинг: 4.5 из 5 звезд4.5/5 (46)

- The Meth Lunches: Food and Longing in an American CityОт EverandThe Meth Lunches: Food and Longing in an American CityРейтинг: 5 из 5 звезд5/5 (5)

- The New Elite: Inside the Minds of the Truly WealthyОт EverandThe New Elite: Inside the Minds of the Truly WealthyРейтинг: 4 из 5 звезд4/5 (10)

- Look Again: The Power of Noticing What Was Always ThereОт EverandLook Again: The Power of Noticing What Was Always ThereРейтинг: 5 из 5 звезд5/5 (3)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetОт EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetОценок пока нет

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailОт EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailРейтинг: 4.5 из 5 звезд4.5/5 (237)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentОт EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentРейтинг: 4.5 из 5 звезд4.5/5 (92)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОт EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОценок пока нет

- Alchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningОт EverandAlchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningРейтинг: 5 из 5 звезд5/5 (4)

- This Changes Everything: Capitalism vs. The ClimateОт EverandThis Changes Everything: Capitalism vs. The ClimateРейтинг: 4 из 5 звезд4/5 (349)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyОт EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyРейтинг: 4.5 из 5 звезд4.5/5 (263)