Академический Документы

Профессиональный Документы

Культура Документы

FCE EBTD Bridge 3rd Q 2010

Загружено:

Norman OderИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

FCE EBTD Bridge 3rd Q 2010

Загружено:

Norman OderАвторское право:

Доступные форматы

EBDT Bridge EBDT Increase

2010 3rd QTR vs. 2009 3rd QTR

Variances are pre-tax in millions with taxes shown separately EBDT Decrease

110.0

2.8

5.4

3.1

105.0

Corporate

4.0 was down

$1.4 million

100.0

4.3 Land

Segment 3.3

was up 4.7

95.0 $1.7

5.0 22.0 million

3.1

90.0

90 0 Combined Commercial and Residential 10.4

10 4

Segments were down $2.5 million

5.7

1.9 90.7

85.0 3.6

85.6

80.0

2009 Participation

Nets operations

New property openings

NOI on mature portfolio

Hedging Income/ Loss

extinguishment of debt

extinguishment of debt

Corporate interest

extinguishment of debt

Land operations

Other

2009 3rd QTR

Project write-offs

Taxes

2010 3rd QTR

Property sales

Gain on early

Gain on early

Gain on early

payment

.

This graph reflects earnings before depreciation, amortization and deferred taxes ("EBDT") a non‐GAAP measure. For a more thorough discussion of the Company's use of EBDT and a

reconciliation of EBDT to net earnings (loss), the most comparable financial measure calculated in accordance with GAAP, please see pages 22 ‐ 23 and 26 ‐ 27 of the Supplemental

Package for the Nine Months Ended October 31, 2010, located on the Company's website under SEC Filings.

Вам также может понравиться

- Pacific Park Conservancy BylawsДокумент21 страницаPacific Park Conservancy BylawsNorman OderОценок пока нет

- Categorical Data Analysis 3rd Edition Agresti Solutions ManualДокумент35 страницCategorical Data Analysis 3rd Edition Agresti Solutions Manualparellacullynftr0100% (20)

- Chapter 2 Audit of ReceivablesДокумент33 страницыChapter 2 Audit of ReceivablesDominique Anne BenozaОценок пока нет

- Revenue Regulations No. 2-40Документ3 страницыRevenue Regulations No. 2-40June Lester100% (1)

- 648 Pacific Street Firehouse Appraisal Atlantic YardsДокумент53 страницы648 Pacific Street Firehouse Appraisal Atlantic YardsNorman OderОценок пока нет

- Value Investors Club - AMAZONДокумент11 страницValue Investors Club - AMAZONMichael Lee100% (1)

- Cost of Modern HospitalДокумент9 страницCost of Modern Hospitalrajmb16Оценок пока нет

- Corporate Finance: Laurence Booth - W. Sean ClearyДокумент136 страницCorporate Finance: Laurence Booth - W. Sean Clearyatif41Оценок пока нет

- Single EntryДокумент18 страницSingle EntryFizzazubair rana50% (2)

- (l6) Corporate Financial Management2015Документ22 страницы(l6) Corporate Financial Management2015Moses Mvula100% (2)

- Alipio Vs CAДокумент1 страницаAlipio Vs CAgrego centillas0% (1)

- Electricl Model - pdf3Документ1 страницаElectricl Model - pdf3Noora KamalОценок пока нет

- Red Digsilent VPPДокумент1 страницаRed Digsilent VPPSANTIAGO ANDRES OSORIO HUERTASОценок пока нет

- Electricl Model - pdf1Документ1 страницаElectricl Model - pdf1Noora KamalОценок пока нет

- Pearson Coefficient 0.992 Pearson Coefficient 0.974 Pearson Coefficient 0.978 Pearson Coefficient 0.992Документ1 страницаPearson Coefficient 0.992 Pearson Coefficient 0.974 Pearson Coefficient 0.978 Pearson Coefficient 0.992Geetesh Gupta (B17CS024)Оценок пока нет

- Display Pc2404aДокумент1 страницаDisplay Pc2404aPedro MartinezОценок пока нет

- Hardscape Layout-ModelДокумент1 страницаHardscape Layout-ModelJannet RodriguezОценок пока нет

- Report 1277718Документ81 страницаReport 1277718Ranjan KumarОценок пока нет

- 0104sdsr41a PДокумент6 страниц0104sdsr41a PPatricio SilvaОценок пока нет

- FasbruyerДокумент2 страницыFasbruyerFelipe SepulvedaОценок пока нет

- CPT 205488 Rep01Документ2 страницыCPT 205488 Rep01rupalss1235Оценок пока нет

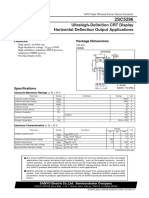

- Ultrahigh-Definition Color Display Horizontal Deflection Output ApplicationsДокумент4 страницыUltrahigh-Definition Color Display Horizontal Deflection Output ApplicationsManuel MartinezОценок пока нет

- School BuildingДокумент11 страницSchool BuildingJohn Jay Opeña SolsoloyОценок пока нет

- 2SC5296Документ4 страницы2SC5296Alex GonzalezОценок пока нет

- Malaysia-Saudi Arabia Cooperation On Trade and InvestmentДокумент19 страницMalaysia-Saudi Arabia Cooperation On Trade and InvestmentAaron AlibiОценок пока нет

- Integrated Report en 2022Документ166 страницIntegrated Report en 2022Omar BenaichaОценок пока нет

- Central Banks - Banlance Sheets - 10oct2022Документ9 страницCentral Banks - Banlance Sheets - 10oct2022scribbugОценок пока нет

- GHope-Contents-Directors Profile-Letter To Shareholders-CEO ReviewДокумент98 страницGHope-Contents-Directors Profile-Letter To Shareholders-CEO ReviewGerald ChowОценок пока нет

- Idea 2Документ1 страницаIdea 2elio flavio quispe vasquezОценок пока нет

- ACNielsen ConsumptioReport2017 InvДокумент26 страницACNielsen ConsumptioReport2017 InvIbrahim AjieОценок пока нет

- Electricl Model - pdf2Документ1 страницаElectricl Model - pdf2Noora KamalОценок пока нет

- Tarea AreasДокумент3 страницыTarea Areasdiegomontero23Оценок пока нет

- Dong Energy Q4 - 2011 - Presentation - March - 2012Документ34 страницыDong Energy Q4 - 2011 - Presentation - March - 2012Justyna LipskaОценок пока нет

- VP - 5409 DATE - 15 10 2022: Section A-A Section A-AДокумент1 страницаVP - 5409 DATE - 15 10 2022: Section A-A Section A-APRIAMCON PMCОценок пока нет

- IBCS Chart Template 01 2018-01-24 RHДокумент12 страницIBCS Chart Template 01 2018-01-24 RHlegion17Оценок пока нет

- Layout Genset SecondaryДокумент1 страницаLayout Genset SecondarySri RahayuОценок пока нет

- Floor PatternДокумент1 страницаFloor Pattern21-07164Оценок пока нет

- 01 VillaДокумент16 страниц01 VillaFabio OliveiraОценок пока нет

- The Largest Automobile Scandal in The History !Документ21 страницаThe Largest Automobile Scandal in The History !rohitОценок пока нет

- CPT Static Liquefaction Analysis PlotsДокумент1 страницаCPT Static Liquefaction Analysis PlotsmyplaxisОценок пока нет

- En Special Series On Covid 19 Digital Financial Services and The PandemicДокумент13 страницEn Special Series On Covid 19 Digital Financial Services and The Pandemicaabishkar gyawaliОценок пока нет

- Primer Piso Segundo Piso Azotea Piso: Esc. 1/50 Esc. 1/50Документ1 страницаPrimer Piso Segundo Piso Azotea Piso: Esc. 1/50 Esc. 1/50antony_3_31Оценок пока нет

- A2 PDFДокумент1 страницаA2 PDFantony_3_31Оценок пока нет

- A2 PDFДокумент1 страницаA2 PDFantonyОценок пока нет

- 14 Infographics 02Документ1 страница14 Infographics 02Michitha BandaraОценок пока нет

- Working Drawings of Proposed Residence at Amritsar: Demarcation PlanДокумент1 страницаWorking Drawings of Proposed Residence at Amritsar: Demarcation PlanSaurish ChopraОценок пока нет

- Ci Latam q4 2018 ReportДокумент8 страницCi Latam q4 2018 ReportHarold Zuñiga NatividadОценок пока нет

- 04 Por 3-1 3-28.p2Документ1 страница04 Por 3-1 3-28.p2HspetrocrusosОценок пока нет

- Spending On Private Health insurance-OECD-2022Документ6 страницSpending On Private Health insurance-OECD-2022Swapna NixonОценок пока нет

- PeacockfedecbassetsДокумент9 страницPeacockfedecbassetsJeetguptaОценок пока нет

- Option 1: Finance Room Admin Room PaintryДокумент1 страницаOption 1: Finance Room Admin Room PaintrySanjay JangirОценок пока нет

- Bby 2008Документ1 страницаBby 2008londonmorganОценок пока нет

- Site Plan New Revisi-1Документ1 страницаSite Plan New Revisi-1ovan triwinarkoОценок пока нет

- Laboratorio - Ypfb Final 2Документ1 страницаLaboratorio - Ypfb Final 2Cris TianОценок пока нет

- CPT Interpretation and Seismic Analysis SummaryДокумент1 страницаCPT Interpretation and Seismic Analysis SummaryTran Vu QuocОценок пока нет

- PLANO TERMICAS-ModeloДокумент1 страницаPLANO TERMICAS-ModeloJonyОценок пока нет

- Building Material Store (G+M) : (Smoke Vents: 1.5m Fixed LOUVER Openings, Max. 300mm Below Slab Soffit)Документ1 страницаBuilding Material Store (G+M) : (Smoke Vents: 1.5m Fixed LOUVER Openings, Max. 300mm Below Slab Soffit)Abid AyubОценок пока нет

- Cabana 02 Scheme 4 PДокумент2 страницыCabana 02 Scheme 4 PJun NarvaezОценок пока нет

- Ras Laffan Model AppliedДокумент105 страницRas Laffan Model AppliedhanswuytsОценок пока нет

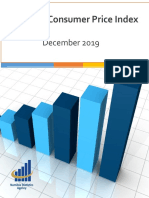

- 2020-01-22-064434 NCPI December 2019 PDFДокумент22 страницы2020-01-22-064434 NCPI December 2019 PDFMathiasОценок пока нет

- IndianOil AR 2022-23 - 1Документ9 страницIndianOil AR 2022-23 - 1pgpm2024.asafОценок пока нет

- Color TV Horizontal Deflection Output ApplicationsДокумент3 страницыColor TV Horizontal Deflection Output ApplicationsJose M PeresОценок пока нет

- LOIIIIДокумент1 страницаLOIIIIMARCOS PAQUIYAURI CCANTOОценок пока нет

- Papel de Probabilidade - WeibullДокумент1 страницаPapel de Probabilidade - WeibullAnaPaulaFranceschettoОценок пока нет

- +8.10 F.F.L +8.10 F.F.LДокумент1 страница+8.10 F.F.L +8.10 F.F.LMahmoud AhmedОценок пока нет

- 1:3 1:3 Extended Retracted: Cvl1000 / Cvl1500 (No Manual Override) - Specification SheetДокумент1 страница1:3 1:3 Extended Retracted: Cvl1000 / Cvl1500 (No Manual Override) - Specification SheetDaniel Camargo PérezОценок пока нет

- PLANITO TERMICAS-ModeloДокумент1 страницаPLANITO TERMICAS-ModeloJonyОценок пока нет

- P TERMICAS-ModeloДокумент1 страницаP TERMICAS-ModeloJonyОценок пока нет

- Winstar Wh2004 20x4 LCDДокумент1 страницаWinstar Wh2004 20x4 LCDGeorge PapadoОценок пока нет

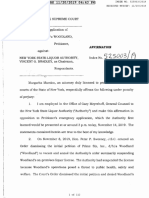

- NYC Commission On Property Tax Reform Preliminary ReportДокумент72 страницыNYC Commission On Property Tax Reform Preliminary ReportNorman OderОценок пока нет

- Woodland Case ALJ Decision, Part of SLA Defense To Second SuitДокумент112 страницWoodland Case ALJ Decision, Part of SLA Defense To Second SuitNorman OderОценок пока нет

- Atlantic Yards/Pacific Park Construction Alert 2.3.2020 and 2.10.2020Документ2 страницыAtlantic Yards/Pacific Park Construction Alert 2.3.2020 and 2.10.2020Norman OderОценок пока нет

- Atlantic Yards Final SEIS Chapter 4D - Operational - TransportationДокумент144 страницыAtlantic Yards Final SEIS Chapter 4D - Operational - TransportationNorman OderОценок пока нет

- Atlantic Yards/Pacific Park Construction Alert 12.23.19 and 12.30.19Документ2 страницыAtlantic Yards/Pacific Park Construction Alert 12.23.19 and 12.30.19Norman OderОценок пока нет

- SLA Cancellation Order WoodlandДокумент2 страницыSLA Cancellation Order WoodlandNorman OderОценок пока нет

- Atlantic Yards FEIS Chapter 12 Traffic ParkingДокумент94 страницыAtlantic Yards FEIS Chapter 12 Traffic ParkingNorman OderОценок пока нет

- Atlantic Yards/Pacific Park Brooklyn Construction Alert 1.20.2020 and 1.27.20Документ2 страницыAtlantic Yards/Pacific Park Brooklyn Construction Alert 1.20.2020 and 1.27.20Norman OderОценок пока нет

- Pacific Park Owners Association (Minus Exhibit K, Design Guidelines)Документ93 страницыPacific Park Owners Association (Minus Exhibit K, Design Guidelines)Norman OderОценок пока нет

- Atlantic Yards Pacific Park Quality of Life Meeting Notes 11/19/19 From ESDДокумент4 страницыAtlantic Yards Pacific Park Quality of Life Meeting Notes 11/19/19 From ESDNorman OderОценок пока нет

- Greenland Metropolis Press Release 12.17.19Документ1 страницаGreenland Metropolis Press Release 12.17.19Norman OderОценок пока нет

- Atlantic Yards/Pacific Park Construction Alert 12.23.19 and 12.30.19Документ2 страницыAtlantic Yards/Pacific Park Construction Alert 12.23.19 and 12.30.19Norman OderОценок пока нет

- Pacific Park Conservancy IRS FilingДокумент40 страницPacific Park Conservancy IRS FilingNorman OderОценок пока нет

- Atlantic Yards/Pacific Park Brooklyn Construction Alert Weeks of 9/2/19 + 9/9/19Документ2 страницыAtlantic Yards/Pacific Park Brooklyn Construction Alert Weeks of 9/2/19 + 9/9/19Norman OderОценок пока нет

- MTA Appraisal Vanderbilt YardДокумент3 страницыMTA Appraisal Vanderbilt YardNorman OderОценок пока нет

- Fifth Avenue Between Atlantic and Pacific Appraisal Atlantic YardsДокумент24 страницыFifth Avenue Between Atlantic and Pacific Appraisal Atlantic YardsNorman OderОценок пока нет

- Pacific Park Owners Association (Minus Exhibit K, Design Guidelines)Документ93 страницыPacific Park Owners Association (Minus Exhibit K, Design Guidelines)Norman OderОценок пока нет

- Pacific Park Conservancy Registration and Board MembersДокумент6 страницPacific Park Conservancy Registration and Board MembersNorman OderОценок пока нет

- Pacific Street Fifth To Sixth Avenue AppraisalДокумент24 страницыPacific Street Fifth To Sixth Avenue AppraisalNorman OderОценок пока нет

- Site 5 Amazon FOIL ResponseДокумент4 страницыSite 5 Amazon FOIL ResponseNorman OderОценок пока нет

- Block 1118 Lot 6 Appraisal Atlantic YardsДокумент14 страницBlock 1118 Lot 6 Appraisal Atlantic YardsNorman OderОценок пока нет

- Forest City Block 927, Severance of Lot 1 Into Lots 1 and 16, 1998Документ3 страницыForest City Block 927, Severance of Lot 1 Into Lots 1 and 16, 1998Norman OderОценок пока нет

- Forest City Modell's Block 927 First Mortgage Oct. 14, 1997Документ57 страницForest City Modell's Block 927 First Mortgage Oct. 14, 1997Norman OderОценок пока нет

- Pacific Street Between Carlton and Vanderbilt Appraisal Atlantic YardsДокумент26 страницPacific Street Between Carlton and Vanderbilt Appraisal Atlantic YardsNorman OderОценок пока нет

- P.C. Richard Mortgage Site 5 Block 927Документ20 страницP.C. Richard Mortgage Site 5 Block 927Norman OderОценок пока нет

- Block 927, Forest City Sale of Parcel To P.C. Richard 1998Документ5 страницBlock 927, Forest City Sale of Parcel To P.C. Richard 1998Norman OderОценок пока нет

- Forest City Modell's Block 927 Second Mortgage Oct. 14, 1997Документ56 страницForest City Modell's Block 927 Second Mortgage Oct. 14, 1997Norman OderОценок пока нет

- Atlantic Yards/Pacific Park Brooklyn Construction Alert Weeks of 9/2/19 + 9/9/19Документ2 страницыAtlantic Yards/Pacific Park Brooklyn Construction Alert Weeks of 9/2/19 + 9/9/19Norman OderОценок пока нет

- Credit Card Questions Sample and AnswerДокумент2 страницыCredit Card Questions Sample and AnswerNikki BaekОценок пока нет

- GenmathДокумент9 страницGenmathJuliet RoseОценок пока нет

- AssignmentДокумент12 страницAssignmentMeera JoshyОценок пока нет

- Laporan Keuangan Nasi LiwetДокумент116 страницLaporan Keuangan Nasi Liwetnirmaya esthiОценок пока нет

- A Discussion About What We Can Do To Become People of Generosity Like Our Father in HeavenДокумент4 страницыA Discussion About What We Can Do To Become People of Generosity Like Our Father in HeavenChristian ConsignaОценок пока нет

- RatioДокумент20 страницRatioAkashdeep MarwahaОценок пока нет

- CHP 19 FIN302 19Документ5 страницCHP 19 FIN302 19Sekhar aОценок пока нет

- Bank Confirmation Audit Request Treasury Operations Current Version 1.9Документ5 страницBank Confirmation Audit Request Treasury Operations Current Version 1.9davidooОценок пока нет

- ACPress HESAA MazzeoДокумент3 страницыACPress HESAA MazzeoAsmVinceMazzeoОценок пока нет

- API IDN DS2 en Excel v2 103862Документ480 страницAPI IDN DS2 en Excel v2 103862AntoОценок пока нет

- Module 5 - Strategic Evaluation and ControlДокумент13 страницModule 5 - Strategic Evaluation and ControlRonald Reagan AlonzoОценок пока нет

- A Study On A Financial Performance Analysis of Private Banks in IndiaДокумент26 страницA Study On A Financial Performance Analysis of Private Banks in Indiashrisha sharma100% (1)

- Complete C7Документ15 страницComplete C7tai nguyenОценок пока нет

- A Report On Financial Ratios and Dupont Analysis of Itc LTDДокумент32 страницыA Report On Financial Ratios and Dupont Analysis of Itc LTDdamandhinsaОценок пока нет

- MASДокумент45 страницMASAngel YbanezОценок пока нет

- INTRODUCTIONДокумент41 страницаINTRODUCTIONSatyajeet SinghОценок пока нет

- Ch.8 Creating Successful Fin. PlanДокумент16 страницCh.8 Creating Successful Fin. PlanRose Anne RecañaОценок пока нет

- Fundamental Analysis:: Shareholding PatternДокумент7 страницFundamental Analysis:: Shareholding PatternVikas SharmaОценок пока нет

- Msi Owner Occupancy AffidavitДокумент1 страницаMsi Owner Occupancy AffidavitbatinatorОценок пока нет

- Credit Transactions Reviewer FinalДокумент23 страницыCredit Transactions Reviewer Finalpit1xОценок пока нет

- The 800 Credit Score What It Means and How To Get This Score - Creidt TriangleДокумент4 страницыThe 800 Credit Score What It Means and How To Get This Score - Creidt TriangleCredit TriangleОценок пока нет