Академический Документы

Профессиональный Документы

Культура Документы

Table of Contents Alfa

Загружено:

farhan375Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

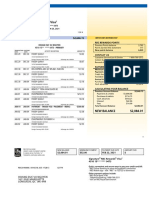

Table of Contents Alfa

Загружено:

farhan375Авторское право:

Доступные форматы

TABLE OF CONTENTS

Chapter 1

Introduction

1-1 Bank………………………………………………………………………………..1

1-2 Evolution of banking………………………………………………………………2

1-3 Banking history in Pakistan………………………………………………………..3

1-4 Historical overview of Bank Alfalah Limited……………………………………..4

1-5 Objective of Bank Alfalah Limited………………………………………………..6

1-6 Vision Of Bank Alfalah Limited…………………………………………………..6

1-7 Management of Bank and Organizational Charts…………………………………10

1-8 Board of Directors…………………………………………………………………15

1-9 Branch Network……………………………………………………………………20

1-10 Purpose of Study………………………………………………………………….25

1-11 Objective of Study………………………………………………………………..26

1-12 Methodology……………………………………………………………………..26

1-13 Limitations……………………………………………………………………….27

Chapter 2

Automation at Bank Alfalah

2-1 Introduction……………………………………………………………………….28

2-2 Computer………………………………………………………………………….29

2-3 Computer Department at Bank Alfalah……………………………………………29

2-4 ATM(Auto teller Machine)/Debit Card……………………………………………32

2-5 Internet banking security…………………………………………………………..32

2-6 E Banking at Bank Alfalah………………………………………………………...33

Chapter 3

Different Functional Division of BAL

3-1 Audit and Inspection Division…………………………………………………..35

3-2 Business Promotion Division……………………………………………………35

3-3 Credit Division…………………………………………………………………..36

3-4 Establishment Division…………………………………………………………..36

3-5 Finance Division…………………………………………………………………36

3-6 Human Resource Division……………………………………………………….36

3-7 Information technology Division………………………………………………...36

3-8 International Division……………………………………………………………37

3-9 Treasury Division……………………………………………………..………….37

Chapter 4

General Banking

4-1 Cash Department………………………………………………………………..38

4-2 Accounts…………………………………………………………………………38

4-3 Remittance Department………………………………………………………….41

4-4 Clearing and Collection………………………………………………………….43

4-5 BAL Account Opening Procedure………………………………………………43

4-6 Lockers…………………………………………………………………………..49

Chapter 5

Forms of Advances

5-1 Categories/Types Of Advances………………………………………………….50

5-2 Finance/Types of Finance………………………………………………………..53

5-3 Modes Of Securing Advances…………………………………………………. 55

Chapter 6

Foreign Exchange Department

6-1 Foreign Exchange……………………………………………………………….57

6-2 Import……………………………………………………………………………57

6-3 Export……………………………………………………………………………62

6-4 Foreign Currency Accounts……………………………………………………...63

6-5 Inward And Outward Foreign Remittances……………………………………...64

Chapter 7

Products of Bank Alfalah Limited

7-1 Deposit Product…………………………………………………………………..65

7-2 Remittance Products……………………………………………………………...66

7-3 Credit Product……………………………………………………………………71

Chapter 8

Conclusions and Suggestions

8-1 Conclusions………………………………………………………………………78

8-2 Suggestions………………………………………………………………………79

Bibliography………………………………………………………………………….80

Appendix A-Auditor Report………………………………………………………….81

Appendix B-Board of Directors Report………………………………………………81

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- JH EcampusUpload SubjectNote GRADE 12 - ENG 1 - OCT 2022 - INTERNAL ASSESSMENT 2 ASSIGNMENTДокумент2 страницыJH EcampusUpload SubjectNote GRADE 12 - ENG 1 - OCT 2022 - INTERNAL ASSESSMENT 2 ASSIGNMENTDheer PanjwaniОценок пока нет

- Questions about your Spark billДокумент3 страницыQuestions about your Spark billAilton FrancoОценок пока нет

- QUIEZON NATIONAL HIGH SCHOOL 1ST QUARTER EXAM REVIEWДокумент7 страницQUIEZON NATIONAL HIGH SCHOOL 1ST QUARTER EXAM REVIEWMAYCAROL TUMALIUANОценок пока нет

- Project Report On ICICI BankДокумент106 страницProject Report On ICICI BankRohan MishraОценок пока нет

- TCS - First Interim Dividend 2011-12Документ605 страницTCS - First Interim Dividend 2011-12Pavan KumarОценок пока нет

- PDF BankДокумент9 страницPDF BankRAJAVANI GОценок пока нет

- Fee Information Document: General Account ServicesДокумент7 страницFee Information Document: General Account Servicesdaryl30011996Оценок пока нет

- New AgainДокумент6 страницNew AgainRahmatОценок пока нет

- Nepalese Banks and Their Role in Economic DevelopmentДокумент5 страницNepalese Banks and Their Role in Economic DevelopmentnirajsaruОценок пока нет

- World Bank GroupДокумент8 страницWorld Bank GroupkarthickОценок пока нет

- Lap 13 - Simple InterestДокумент20 страницLap 13 - Simple InterestJILIANNEYSABELLE MONTONОценок пока нет

- RBC Rewards Visa statement summaryДокумент5 страницRBC Rewards Visa statement summaryHoang DucОценок пока нет

- Tink - The Future of Payments Is OpenДокумент46 страницTink - The Future of Payments Is OpenDavid HelmanОценок пока нет

- 0.1 Course Outline - Regulatory Framework and Legal Issues in BusinessДокумент2 страницы0.1 Course Outline - Regulatory Framework and Legal Issues in BusinessIm NayeonОценок пока нет

- What Is A Treasury BondДокумент12 страницWhat Is A Treasury Bondmorris yenenehОценок пока нет

- Monthly Collection Summary - 10-2022Документ11 страницMonthly Collection Summary - 10-2022Anonymous iTzCnMОценок пока нет

- Axix Bank & Its Financial ServicesДокумент82 страницыAxix Bank & Its Financial ServicesShobhit GoswamiОценок пока нет

- Bangladesh's Financial System OverviewДокумент15 страницBangladesh's Financial System OverviewTanjin keyaОценок пока нет

- Accounting Materials Multiple Choice QuestionsДокумент11 страницAccounting Materials Multiple Choice QuestionsJanine LerumОценок пока нет

- PUSHPALATA M'S SALARY ACCOUNT STATEMENTДокумент2 страницыPUSHPALATA M'S SALARY ACCOUNT STATEMENTPushpalataОценок пока нет

- Statement 20200901 20200910Документ15 страницStatement 20200901 20200910Dika MongkolОценок пока нет

- The DifferenceДокумент13 страницThe Differencekefale birhanОценок пока нет

- Share Market Guide: Basics, Types, Trading & MoreДокумент45 страницShare Market Guide: Basics, Types, Trading & Moretn63 villanОценок пока нет

- 015 Allied Bank Vs Sps MacamДокумент3 страницы015 Allied Bank Vs Sps MacamJanelle ManzanoОценок пока нет

- Licensing and Supervision of Banking Business Minimum Capital Requirement For Banks Directives No. SBB/50/2011Документ3 страницыLicensing and Supervision of Banking Business Minimum Capital Requirement For Banks Directives No. SBB/50/2011FeteneОценок пока нет

- Akanksha Bharti ReportДокумент41 страницаAkanksha Bharti ReportPrashant MishraОценок пока нет

- A Study On Profitability Position OF Nepal Bangladesh Bank LimitedДокумент9 страницA Study On Profitability Position OF Nepal Bangladesh Bank LimitedArati Shin Za LeeОценок пока нет

- AA in Specialized Industries - FINALSДокумент10 страницAA in Specialized Industries - FINALSMiraflor Sanchez BiñasОценок пока нет

- Winter ProjectДокумент25 страницWinter ProjectKishan gotiОценок пока нет

- SAP FI Interview Questions PDFДокумент102 страницыSAP FI Interview Questions PDFDeepak SОценок пока нет