Академический Документы

Профессиональный Документы

Культура Документы

Puneet Singh QAM

Загружено:

Puneet SinghАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Puneet Singh QAM

Загружено:

Puneet SinghАвторское право:

Доступные форматы

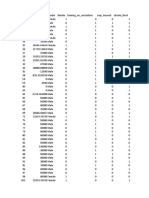

Puneet Singh

PGP26359

Prudent Provisions for Pension

Year MMF Bond 1 Bond 2 Bond 3 Bond 4 Total Investment

2003 0 44265.65 0 51359.3648 43550.62 124740357.5

2004 35342792.12

2005 25416450.45 Bond Price

2006 13993791.69 980 920 750 800

2007 0 Coupon Returns

2008 35665883.55 40 20 0 30

2009 18755696.45 Maturity Value

2010 0 1000 1000 1000 1000

2011 22857142.86

Req. Pension

2003 8000000 8000000

MMF return Bond ReturnMaturity Return

MMF investment

Total = Required Amount

2004 0 3077145 44265647 -35342792.1 12000000 = 12000000

2005 37109931.72 1306519 -25416450.4 13000000 = 13000000

2006 26687272.97 1306519 0 -13993791.7 14000000 = 14000000

2007 14693481.28 1306519 0 16000000 = 16000000

2008 0 1306519 51359365 -35665883.6 17000000 = 17000000

2009 37449177.73 1306519 -18755696.5 20000000 = 20000000

2010 19693481.28 1306519 0 21000000 = 21000000

2011 0 1306519 43550624 -22857142.9 22000000 = 22000000

2012 24000000 24000000 = 24000000

Question: The Everglade Golden years Company

LT Rate 0.07 Start Bal 1

ST Rate 0.1 Min Bal 0.5

Year Cash Flow LT Loan ST Loan LT interest ST interest LT Payable ST Payable Ending Bal >= Min. Bal

2003 -8 6.649459 0.850541 0.5 >= 0.5

2004 -2 3.401057 -0.46546213 -0.08505 -0.850540992 0.5 >= 0.5

2005 -4 8.206625 -0.46546213 -0.34011 -3.401057223 0.5 >= 0.5

2006 3 6.49275 -0.46546213 -0.82066 -8.206625077 0.5 >= 0.5

2007 6 1.607487 -0.46546213 -0.64927 -6.492749717 0.5 >= 0.5

2008 3 0 -0.46546213 -0.16075 -1.607486819 1.266302 >= 0.5

2009 -4 3.69916 -0.46546213 0 0 0.5 >= 0.5

2010 7 0 -0.46546213 -0.36992 -3.699159762 2.965462 >= 0.5

2011 -2 0 -0.46546213 0 0 0.5 >= 0.5

2012 10 0 -0.46546213 0 0 10.03454 >= 0.5

2013 -0.46546213 0 -6.64946 0 2.919617 >= 0.5

Вам также может понравиться

- TD Bank StatementДокумент1 страницаTD Bank StatementBaba d100% (2)

- Blank Cash Flow Template ExcelДокумент5 страницBlank Cash Flow Template ExcelPro ResourcesОценок пока нет

- Member Statements-04302021Документ2 страницыMember Statements-04302021bОценок пока нет

- Asset Classes and Financial Instruments: Bodie, Kane, and Marcus Eleventh EditionДокумент48 страницAsset Classes and Financial Instruments: Bodie, Kane, and Marcus Eleventh EditionFederico PortaleОценок пока нет

- Dominion Motors and Control LTDДокумент13 страницDominion Motors and Control LTDPiyushОценок пока нет

- CA Foundation Accounts Theory Question Bank Dec 2021 Attempt NotesДокумент142 страницыCA Foundation Accounts Theory Question Bank Dec 2021 Attempt NotesRakesh Roshan100% (1)

- 02 23-AtmДокумент19 страниц02 23-Atmmevrick_guyОценок пока нет

- Chapter 11 - The God CommitteeДокумент6 страницChapter 11 - The God CommitteeMahima SikdarОценок пока нет

- CRISIL Research - Ier Report Apollo Hospitals Enterprise LTD 2016Документ32 страницыCRISIL Research - Ier Report Apollo Hospitals Enterprise LTD 2016Vivek AnandanОценок пока нет

- 1 - Placefile - GIM Placement Report 2010Документ6 страниц1 - Placefile - GIM Placement Report 2010Akash RoyОценок пока нет

- Test Questions in Fabm2 4th Qtr333Документ3 страницыTest Questions in Fabm2 4th Qtr333Rosanno DavidОценок пока нет

- How BJP Used WhatsApp to Create a Successful WOM CampaignДокумент5 страницHow BJP Used WhatsApp to Create a Successful WOM Campaignmushq2004 AccountОценок пока нет

- Standard Bank - Payment ProofДокумент1 страницаStandard Bank - Payment ProofChequeОценок пока нет

- Marketing Management Case Study on Tag Taste's Online Sensory PlatformДокумент10 страницMarketing Management Case Study on Tag Taste's Online Sensory PlatformRajaОценок пока нет

- Fra Madhumita Quiz 1 To 4Документ12 страницFra Madhumita Quiz 1 To 4Kushagra VarshneyОценок пока нет

- ICICI Global Expansion StrategyДокумент15 страницICICI Global Expansion StrategyAmit DeyОценок пока нет

- Cipla P&L ExcelДокумент9 страницCipla P&L ExcelNeha LalОценок пока нет

- Official Finocontrol Brochure 2020Документ23 страницыOfficial Finocontrol Brochure 2020pavan kalyan50% (2)

- Ranbaxy Energy CandyДокумент10 страницRanbaxy Energy CandyMuhammad Nb100% (2)

- ITC Case Study - Group 10Документ15 страницITC Case Study - Group 10shardulОценок пока нет

- Young Tax Professional of The Year 2020Документ5 страницYoung Tax Professional of The Year 2020Dishant KhanejaОценок пока нет

- Grp-10 Assignment Akshaya PatraДокумент16 страницGrp-10 Assignment Akshaya Patrasanray9Оценок пока нет

- Target Niche Market for Clean Edge Razor LaunchДокумент7 страницTarget Niche Market for Clean Edge Razor LaunchRyan SheikhОценок пока нет

- Jayalaxmi Agro TechДокумент92 страницыJayalaxmi Agro TechYavnish GargОценок пока нет

- 1 Sampling DistДокумент35 страниц1 Sampling DistYogeshОценок пока нет

- Asian PaintsДокумент13 страницAsian PaintsGOPS000Оценок пока нет

- Group 6 Vora-and-CompanyДокумент9 страницGroup 6 Vora-and-CompanyAkanksha SinhaОценок пока нет

- Apex Oil Spill - GRP Learning PaperДокумент2 страницыApex Oil Spill - GRP Learning PaperShivam GargОценок пока нет

- MAXGXL Compensation PlanДокумент13 страницMAXGXL Compensation PlanaprildelacuraОценок пока нет

- QMДокумент87 страницQMjyotisagar talukdarОценок пока нет

- Managing Sales Force EffectivenessДокумент52 страницыManaging Sales Force EffectivenessHarsh Vardhan100% (1)

- Study of TQM Framework Implementation IN Gujarat Co-Operative Milk Marketing Federation Limited (AMUL)Документ2 страницыStudy of TQM Framework Implementation IN Gujarat Co-Operative Milk Marketing Federation Limited (AMUL)Sandipan Samuel DasОценок пока нет

- Rs. RS.: Compass Company Balance Sheet, March 31Документ2 страницыRs. RS.: Compass Company Balance Sheet, March 31aditi4garg-10% (1)

- Marico R1 - Over The Wall Season 9Документ2 страницыMarico R1 - Over The Wall Season 9Aniket DograОценок пока нет

- Group 9 - SDMДокумент50 страницGroup 9 - SDMPRASHANT KUMARОценок пока нет

- WILLS LIFESTYLE: ITC'S PREMIUM RETAIL CHAINДокумент25 страницWILLS LIFESTYLE: ITC'S PREMIUM RETAIL CHAINsangram960% (1)

- Morte inДокумент45 страницMorte inAshish Kumar PaniОценок пока нет

- Apo - 1 Aishwarya Mundada 210101139 Vamika Shah 210101121 Somnath Banerjee 210101109 Siddhant Goyal 210101166 Navneet Fatehpuria 210101182 Vissapragada Ananth 210101151 Victor D 21FRN-612Документ3 страницыApo - 1 Aishwarya Mundada 210101139 Vamika Shah 210101121 Somnath Banerjee 210101109 Siddhant Goyal 210101166 Navneet Fatehpuria 210101182 Vissapragada Ananth 210101151 Victor D 21FRN-612Siddhant Goyal100% (1)

- Tata Motors Dupont and Altman Z-Score AnalysisДокумент4 страницыTata Motors Dupont and Altman Z-Score AnalysisLAKHAN TRIVEDIОценок пока нет

- Sasan Power Project Handouts 2020Документ16 страницSasan Power Project Handouts 2020Asawari JoshiОценок пока нет

- VC Problem Set SolutionsДокумент3 страницыVC Problem Set SolutionsJerry Chang0% (1)

- Team Accio's operating plan for delivering benefitsДокумент7 страницTeam Accio's operating plan for delivering benefitsSohini Dey0% (1)

- RHCF: Reaching Primary Healthcare To The Base of The PyramidДокумент31 страницаRHCF: Reaching Primary Healthcare To The Base of The PyramidHensi ShethОценок пока нет

- Dabur IndiaДокумент16 страницDabur IndiaAshwini SalianОценок пока нет

- Decision Making Report On Managing Diversity at Spencer Owens and Co. CaseДокумент5 страницDecision Making Report On Managing Diversity at Spencer Owens and Co. Casebada donОценок пока нет

- Changing Mindsets in Consumption Pattern of SOFT DRINK in Rural MarketДокумент36 страницChanging Mindsets in Consumption Pattern of SOFT DRINK in Rural MarketgouravawanishraviОценок пока нет

- Boots Hair Care Sales Promotion Case Study AnalysisДокумент11 страницBoots Hair Care Sales Promotion Case Study Analysispritish chadhaОценок пока нет

- WinZO BOSS Season 2 Case Study (24264)Документ3 страницыWinZO BOSS Season 2 Case Study (24264)Sarthak mishraОценок пока нет

- Oyo - PresentationДокумент27 страницOyo - PresentationNaveen AlluОценок пока нет

- Mountain ManДокумент9 страницMountain Manvish_b_soni100% (1)

- TrueEarth CaseДокумент11 страницTrueEarth Caseliving.to.the.hilt6707Оценок пока нет

- Unicity India Compensation PlanДокумент16 страницUnicity India Compensation PlanPREMKUMAR YUMLEMBAMОценок пока нет

- Tinplate Company of IndiaДокумент19 страницTinplate Company of IndiaariefakbarОценок пока нет

- Seminar Applications of Management Accounting and Control: Cottle-Taylor: Expanding The Oral Care Group in IndiaДокумент22 страницыSeminar Applications of Management Accounting and Control: Cottle-Taylor: Expanding The Oral Care Group in IndiaLukasОценок пока нет

- Atomberg MG1 Mixer Grinder Case StudyДокумент4 страницыAtomberg MG1 Mixer Grinder Case StudyPrivate AccountОценок пока нет

- Final Reduced Cell Name Value CostДокумент36 страницFinal Reduced Cell Name Value CostK Navneeth RaoОценок пока нет

- Swosti FoodsДокумент6 страницSwosti FoodsAdarshОценок пока нет

- Final PPT On Vijay MallayaДокумент24 страницыFinal PPT On Vijay MallayaBhawna DhamijaОценок пока нет

- Tetley Most Updated PPT 1Документ32 страницыTetley Most Updated PPT 1api-247080646Оценок пока нет

- Wal-Mart Stores, IncДокумент40 страницWal-Mart Stores, IncJason Huang50% (2)

- New Ways to Engage Existing and New CustomersДокумент5 страницNew Ways to Engage Existing and New CustomersBhavya BansalОценок пока нет

- Group 8 - Global MarketingДокумент10 страницGroup 8 - Global MarketingKautilya ParmarОценок пока нет

- Gemini Electronics Template and Raw DataДокумент9 страницGemini Electronics Template and Raw Datapierre balentineОценок пока нет

- Case Analysis Topic - Working Capital Management & ROI Case - An Irate Distributor Submitted by - Srishti Joshi (PGFC1934)Документ5 страницCase Analysis Topic - Working Capital Management & ROI Case - An Irate Distributor Submitted by - Srishti Joshi (PGFC1934)Surbhi SabharwalОценок пока нет

- Cristina 22200016 Tugas Latihan 6Документ5 страницCristina 22200016 Tugas Latihan 6CHARLES CHARITY SCORPIONOОценок пока нет

- PoissonДокумент447 страницPoissonStefania Stoica100% (1)

- Monserrat2D Activity6 AE9Документ5 страницMonserrat2D Activity6 AE9Jerome MonserratОценок пока нет

- HW01 Proy 003Документ18 страницHW01 Proy 003Juan Diego Medina MedinaОценок пока нет

- Passport Application NOCДокумент2 страницыPassport Application NOCmyxplorerОценок пока нет

- Group Presentation Topics on Labor Laws in IndiaДокумент1 страницаGroup Presentation Topics on Labor Laws in IndiaPuneet SinghОценок пока нет

- Diagram 1Документ2 страницыDiagram 1Puneet SinghОценок пока нет

- Nihit/Kaustab: 1) Case Name (Details) :: Satyanarayana Vs Narayan Rao 1999 (Quasi Contract)Документ9 страницNihit/Kaustab: 1) Case Name (Details) :: Satyanarayana Vs Narayan Rao 1999 (Quasi Contract)Puneet SinghОценок пока нет

- Money Supply in India from 1950-2010Документ5 страницMoney Supply in India from 1950-2010Puneet SinghОценок пока нет

- Common Payment Methods in International TradeДокумент14 страницCommon Payment Methods in International TradePuneet SinghОценок пока нет

- Investment and Portoflio MGT QuestionsДокумент6 страницInvestment and Portoflio MGT QuestionsnathnaelОценок пока нет

- Brochure-NSE-CFAP - Certified Stock Market Forensic AccountantДокумент10 страницBrochure-NSE-CFAP - Certified Stock Market Forensic AccountantvinothdeviОценок пока нет

- New Bank of Baroda New Commission Chart 28.11.2020Документ1 страницаNew Bank of Baroda New Commission Chart 28.11.2020kaleeswaran MОценок пока нет

- HE Ntegrated Eview: Far Eastern Uni Ersity - ManilaДокумент11 страницHE Ntegrated Eview: Far Eastern Uni Ersity - ManilaChanelОценок пока нет

- Icici Bk-Customergrievance-Redressal-PolicyДокумент12 страницIcici Bk-Customergrievance-Redressal-Policyprassna_kamat1573Оценок пока нет

- Estatement 2023.01Документ11 страницEstatement 2023.01pese022Оценок пока нет

- AE 212 01 Accounting For Investment Property Part 1 PDFДокумент12 страницAE 212 01 Accounting For Investment Property Part 1 PDFEula EalenaОценок пока нет

- Cariboo Case StudyДокумент6 страницCariboo Case Studyzahraa aabedОценок пока нет

- FDC Tax InvoiceДокумент12 страницFDC Tax InvoiceAnura PiyatissaОценок пока нет

- Ratio Analysis FormulasДокумент1 страницаRatio Analysis FormulasJessa Sabrina AvilaОценок пока нет

- Business Aircraft AnalystДокумент2 страницыBusiness Aircraft AnalystjamesbrentsmithОценок пока нет

- Fa1 Day One ACCA Introduction ClassДокумент11 страницFa1 Day One ACCA Introduction Classasad khanОценок пока нет

- Cpa Sample TestДокумент10 страницCpa Sample TestAnuj Harshwardhan SharmaОценок пока нет

- Series A TFCs of Bank Alfalah Limited Shelf ProspectusДокумент144 страницыSeries A TFCs of Bank Alfalah Limited Shelf Prospectusshahnawaz aliОценок пока нет

- Shifting BranchДокумент39 страницShifting Branchaniket_kulal29Оценок пока нет

- Audit ReviewerДокумент32 страницыAudit ReviewerDianna Rose VicoОценок пока нет

- 806840749Документ10 страниц806840749Henry Sicelo NabelaОценок пока нет

- N5 Financial Accounting June 2018Документ18 страницN5 Financial Accounting June 2018Anil HarichandreОценок пока нет

- Digital-Banking-Presentation-Sept-2021 - Axis BankДокумент91 страницаDigital-Banking-Presentation-Sept-2021 - Axis Bankv1997inОценок пока нет

- Work Sheet 1 PDFДокумент9 страницWork Sheet 1 PDFProtik SarkarОценок пока нет

- Bank ReconciliationДокумент20 страницBank ReconciliationJalieca Lumbria GadongОценок пока нет

- Karely Ordaz SEI 2012-2013Документ3 страницыKarely Ordaz SEI 2012-2013RecordTrac - City of OaklandОценок пока нет