Академический Документы

Профессиональный Документы

Культура Документы

Personal Income Tax Rates in Nigeria

Загружено:

Sholola AjokeИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Personal Income Tax Rates in Nigeria

Загружено:

Sholola AjokeАвторское право:

Доступные форматы

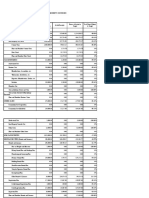

Personal Income Tax Rates

Chargeable Income Rates Tax on Cummulative Cummulative

Profit Band Charge Profit Tax

First 30,000.00 5.00% 1,500.00 30,000.00 1,500.00

Next 30,000.00 10.00% 3,000.00 60,000.00 4,500.00

Next 50,000.00 15.00% 7,500.00 110,000.00 12,000.00

Next 50,000.00 20.00% 10,000.00 160,000.00 22,000.00

Over 160,000.00 25.00% 0.00 0.00 0.00

Personal Relief's (S.33)

Title Description

Personal Allowance N5,000 plus 20% Earned income

Children Allowance N2,500 per child (Limited to 4 children)

Dependent Relative N2,000(max for 2)

Allowance

Life Assurance Relief Allowances are given in respect of premium paid by the taxpayer on policies taken out of

(LAR) the life taxpayer.

Corporate Withholding Tax

Description Rate

Dividend, Interest & Rent 10.00%

Royalties 10.00%

Commissions, Consultancy, Technical & Management 10.00%

Construction 5.00%

All types of contacts and agency arrangements, other than

Description Rate

Sales in the ordinary course of business 5.00%

Directors� Fees 10.00%

Company Income Tax Rates

Period Breakdown

1st April 1961 - 31st March 40% plus super tax. (Super tax was payable under certain circumstances)

1972

1st April 1972 - 31st March 40% on the first N10, 000 plus 45% on the excess Over N10, 000

1975

1st April 1975 - 31st March NIL on the first N6, 000 plus 40% on the excess over N6,000

1976

1st April 1976 - 31st March NIL on first N6, 000 plus 45% on the excess over N6,000

1978

1st April 1978 -31st March NIL on the first N6, 000 plus 50% on the excess 6,000 10% special levy payable on

1979 banks excess profit

1st April 1979 � 31st March 45% 10% Special levy payable by banks

1986

1st Jan 1987 � 31st Dec. 40% 20% Small business rate with effect from 1988 10% Special levy payable on banks

1988 excess Profit

1st Jan 1989 � 31st Dec. 40% 20% Small business rate with effect from 1988 10%Special levy payable on bank

1990 excess profit

1st Jan.1991 � 31st Dec. 40% 20% Small business rate. Special levy abolished by decree 63 of 1991

1991

1st Jan 1992 � 31st Dec. 35% (Decree changing rate from 40%- 35% was passed in 1993)

1992

1st Jan.1993 � 31st 35% 20% Small business rate 2%Educational Tax

Dec.1995

1st Jan 1996 � Date (2008) 30% 20% Small business rate 2%Educational Tax

Вам также может понравиться

- Taxes For JCДокумент2 страницыTaxes For JCstaticesОценок пока нет

- Withholding Tax For 2020-21Документ2 страницыWithholding Tax For 2020-21Rana InamОценок пока нет

- Income From Salary..adДокумент7 страницIncome From Salary..adduch mangОценок пока нет

- f6vnm 2007 Dec QДокумент9 страницf6vnm 2007 Dec QPhạm Hùng DũngОценок пока нет

- Dividend Tax CalculatorДокумент2 страницыDividend Tax Calculatornoonetwothreefour56Оценок пока нет

- Taxation (CHN) - Dec 2020 FinalДокумент3 страницыTaxation (CHN) - Dec 2020 FinalALEX TRANОценок пока нет

- QuestionsДокумент15 страницQuestionsSamuelNyaungaОценок пока нет

- Solution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryДокумент3 страницыSolution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryEmtiaz Ahmed AnikОценок пока нет

- Month Net Taxable Income Tax Slabs Tax RateДокумент2 страницыMonth Net Taxable Income Tax Slabs Tax RateBhargav ChintalapatiОценок пока нет

- Alison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateДокумент7 страницAlison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateNichole TumulakОценок пока нет

- Answer 1Документ5 страницAnswer 1mayetteОценок пока нет

- 115,200.00 Two 100,200.00 TwoДокумент19 страниц115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacОценок пока нет

- Taxation 2 (Maika Notes)Документ30 страницTaxation 2 (Maika Notes)Maria Acepcion DelfinОценок пока нет

- Tax Card 2021Документ1 страницаTax Card 2021MA AttariОценок пока нет

- Taxation 1-5Документ6 страницTaxation 1-5dimpy dОценок пока нет

- TX-UK Worked ExamplesДокумент5 страницTX-UK Worked ExamplesRich KishОценок пока нет

- Tax Changes You Need To Know Under RA 10963Документ20 страницTax Changes You Need To Know Under RA 10963Rosanno DavidОценок пока нет

- Estate TaxДокумент7 страницEstate TaxSirci RamОценок пока нет

- Income Tax Calculation SheetДокумент8 страницIncome Tax Calculation SheetArajrubanОценок пока нет

- Profit Tax ClassДокумент9 страницProfit Tax ClassAndreea MateiОценок пока нет

- (Train) : Taxchanges U Need To KnowДокумент27 страниц(Train) : Taxchanges U Need To KnowNoel DomingoОценок пока нет

- Finals Exam SolutionsДокумент6 страницFinals Exam SolutionsZhengzhou CalОценок пока нет

- OPT SolutionsДокумент3 страницыOPT SolutionsJane EstradaОценок пока нет

- 511skin Financial Projections - Sheet1Документ1 страница511skin Financial Projections - Sheet1skincareby511Оценок пока нет

- Mart Manalo Tax Calculator for 1M IncomeДокумент2 страницыMart Manalo Tax Calculator for 1M IncomeMart ManaloОценок пока нет

- WorkingДокумент4 страницыWorkingHaresh RajputОценок пока нет

- Tax DefinitionsДокумент4 страницыTax DefinitionsrajaОценок пока нет

- Anwar Group Manager Income Tax AssessmentДокумент1 страницаAnwar Group Manager Income Tax AssessmentMoment RevealersОценок пока нет

- Scale of Professional Fees NewДокумент9 страницScale of Professional Fees NewOwolabi Olusola RajiОценок пока нет

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsДокумент8 страницNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezОценок пока нет

- Calculate New Salary Tax by ShajarДокумент2 страницыCalculate New Salary Tax by Shajarshajar-abbasОценок пока нет

- Corporate Income TaxДокумент8 страницCorporate Income TaxClaire BarbaОценок пока нет

- Activity 13 May 2023 Key To CorrectionДокумент1 страницаActivity 13 May 2023 Key To CorrectionJohn Paul MagbitangОценок пока нет

- AK Mock MT ProbДокумент7 страницAK Mock MT ProbJJCookieОценок пока нет

- Calculate New Salary Tax by Ather SaleemДокумент2 страницыCalculate New Salary Tax by Ather Saleemabdul_348Оценок пока нет

- 2019 Tax Card PakistanДокумент9 страниц2019 Tax Card PakistanRaja Hamza rasgОценок пока нет

- COMPARISON OF PHILIPPINE TAX RATESДокумент3 страницыCOMPARISON OF PHILIPPINE TAX RATESKevin JugaoОценок пока нет

- Sales 3,000,000.00: Invoice Price 112,000.00Документ11 страницSales 3,000,000.00: Invoice Price 112,000.00Alicia FelicianoОценок пока нет

- 2020 Indian income tax slab ratesДокумент2 страницы2020 Indian income tax slab ratessarwar raziОценок пока нет

- Income Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionДокумент4 страницыIncome Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionEr Amit JambhulkarОценок пока нет

- 19040400095- Nguyễn Hữu Phú- Lab03 Model Design 21092020Документ5 страниц19040400095- Nguyễn Hữu Phú- Lab03 Model Design 21092020Viem AnhОценок пока нет

- TaxationДокумент5 страницTaxationPauline Jasmine Sta AnaОценок пока нет

- Bureau of Local Government Finance Department of FinanceДокумент5 страницBureau of Local Government Finance Department of FinanceMa. Zenia DetorioОценок пока нет

- ESTATEДокумент12 страницESTATEVangie AntonioОценок пока нет

- Untitled SpreadsheetДокумент9 страницUntitled SpreadsheetMiguel BautistaОценок пока нет

- Chartered Institute of Taxation of NigeriaДокумент8 страницChartered Institute of Taxation of NigeriaAfolabi OladunniОценок пока нет

- Notes - Help For BPДокумент21 страницаNotes - Help For BPmitemkt9683Оценок пока нет

- Calculate New Salary Tax by Ather SaleemДокумент2 страницыCalculate New Salary Tax by Ather SaleemMalikKamranAsifОценок пока нет

- November 6 - CorporationsДокумент2 страницыNovember 6 - CorporationsDarius DelacruzОценок пока нет

- Income Tax: Click HereДокумент3 страницыIncome Tax: Click HereRrrОценок пока нет

- (8) Financial Planning 2Документ7 страниц(8) Financial Planning 2atentoangiaОценок пока нет

- Income Tax Rates and Deductions for Tax Year 2015Документ3 страницыIncome Tax Rates and Deductions for Tax Year 2015Sardar Shahid KhanОценок пока нет

- Faq'S & Guidlines On Income TaxДокумент50 страницFaq'S & Guidlines On Income TaxRavikarthik GurumurthyОценок пока нет

- Tax Card 2020-21Документ2 страницыTax Card 2020-21Lahore TaxationsОценок пока нет

- Deductible Non-Deductible: PenaltiesДокумент6 страницDeductible Non-Deductible: PenaltiesFerl ElardoОценок пока нет

- Tax 2020Документ1 страницаTax 2020Afreen MasoodОценок пока нет

- Income Tax Sample ProblemsДокумент12 страницIncome Tax Sample ProblemsYellow BelleОценок пока нет

- Tax Calculator AY 2021-22Документ1 страницаTax Calculator AY 2021-22mehedi hasanОценок пока нет

- Income TAX: Particular Case 1 Case 2Документ15 страницIncome TAX: Particular Case 1 Case 2Shekh SalmanОценок пока нет

- (Lecture 10 & 11) - Gearing & Capital StructureДокумент18 страниц(Lecture 10 & 11) - Gearing & Capital StructureAjay Kumar TakiarОценок пока нет

- Machine Dynamics and Vibration-Forced Vibration AssignmentДокумент4 страницыMachine Dynamics and Vibration-Forced Vibration AssignmentVijay ReddyОценок пока нет

- Pakistan Relations With EnglandДокумент4 страницыPakistan Relations With Englandpoma7218Оценок пока нет

- Container Stowage Plans ExplainedДокумент24 страницыContainer Stowage Plans ExplainedMohd akifОценок пока нет

- Nca Lahore Nca Lahore Nca LahoreДокумент1 страницаNca Lahore Nca Lahore Nca LahoreSalman QaiserОценок пока нет

- Estimate For New College BuildingДокумент8 страницEstimate For New College BuildingslummdogОценок пока нет

- VR Headset QR CodesДокумент35 страницVR Headset QR CodesAbdelsabour Ahmed100% (1)

- Vissim 11 - ManualДокумент1 219 страницVissim 11 - Manualmauricionsantos60% (5)

- Service Level ManagementДокумент8 страницService Level Managementrashmib1980Оценок пока нет

- Hofa Iq Limiter Manual enДокумент8 страницHofa Iq Limiter Manual enDrixОценок пока нет

- Ecovadis Survey Full 3 07 2019Документ31 страницаEcovadis Survey Full 3 07 2019ruthvikОценок пока нет

- Intangible Capital: Key Factor of Sustainable Development in MoroccoДокумент8 страницIntangible Capital: Key Factor of Sustainable Development in MoroccojournalОценок пока нет

- This Study Resource Was: Artur Vartanyan Supply Chain and Operations Management MGMT25000D Tesla Motors, IncДокумент9 страницThis Study Resource Was: Artur Vartanyan Supply Chain and Operations Management MGMT25000D Tesla Motors, IncNguyễn Như QuỳnhОценок пока нет

- CAT Álogo de Peças de Reposi ÇÃO: Trator 6125JДокумент636 страницCAT Álogo de Peças de Reposi ÇÃO: Trator 6125Jmussi oficinaОценок пока нет

- BS Iec 61643-32-2017 - (2020-05-04 - 04-32-37 Am)Документ46 страницBS Iec 61643-32-2017 - (2020-05-04 - 04-32-37 Am)Shaiful ShazwanОценок пока нет

- Innovative Uses of Housing Lifting Techniques-JIARMДокумент16 страницInnovative Uses of Housing Lifting Techniques-JIARMPOOJA VОценок пока нет

- Carino v. Insular Govt 212 U.S. 449 (1909)Документ3 страницыCarino v. Insular Govt 212 U.S. 449 (1909)Wendy PeñafielОценок пока нет

- DamaДокумент21 страницаDamaLive Law67% (3)

- @airbus: Component Maintenance Manual With Illustrated Part ListДокумент458 страниц@airbus: Component Maintenance Manual With Illustrated Part Listjoker hotОценок пока нет

- Final Slip2Документ30 страницFinal Slip2rohan pawarОценок пока нет

- Market ResearchДокумент89 страницMarket ResearchSankeitha SinhaОценок пока нет

- InkscapePDFLaTeX PDFДокумент3 страницыInkscapePDFLaTeX PDFFrancesco ReaОценок пока нет

- Gram-Charlier para Aproximar DensidadesДокумент10 страницGram-Charlier para Aproximar DensidadesAlejandro LopezОценок пока нет

- CIT-Vs-NCR-Corporation-Pvt.-Ltd.-Karnataka-High-Court - ATMs Are ComputerДокумент15 страницCIT-Vs-NCR-Corporation-Pvt.-Ltd.-Karnataka-High-Court - ATMs Are ComputerSoftdynamiteОценок пока нет

- Valuing Common and Preferred SharesДокумент31 страницаValuing Common and Preferred SharesAdam Mo AliОценок пока нет

- Opentbs Demo: Merge Data With A ChartДокумент4 страницыOpentbs Demo: Merge Data With A Charteduarditom1Оценок пока нет

- Development Approach PlanДокумент15 страницDevelopment Approach PlanGaurav UpretiОценок пока нет

- Postal-BSNL Meeting MinutesДокумент5 страницPostal-BSNL Meeting MinutesP Karan JainОценок пока нет

- Career As A Pharmacist in South AfricaДокумент2 страницыCareer As A Pharmacist in South AfricaPaul WasikeОценок пока нет

- Pulau Besar Island Off Malacca CoastДокумент5 страницPulau Besar Island Off Malacca CoastLucy TyasОценок пока нет