Академический Документы

Профессиональный Документы

Культура Документы

Despatch NPV Question

Загружено:

ANADILBhuttoИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Despatch NPV Question

Загружено:

ANADILBhuttoАвторское право:

Доступные форматы

A person is looking for investment opportunities.

He has about

Rs.50 million. Presently, he is concentrating on TWO PROJECTS:

(1) Weaving Mills & (2) Oil Plant.

Both projects require an investment of Rs.10 million each.

Preliminary information indicates that while Oil Plant would give a

constant return of Rs.3,300,000 per annum for the next four years,

the income from weaving Plant would be as follows:

Rs. Weaving

1 1,000,000

2 1,500,000

3 3,000,000

4 9,000,000

Supposing no other information is available, except that the normal

return on Investment from industrial projects are 12% per annum

and both projects have same life, which project would be accepted.

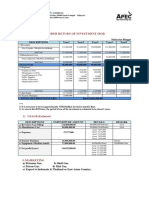

12%

PVIF PVIFA Present Value Interest Factor Annuity

1 0.893 0.893

2 0.797 1.690

3 0.712 2.402

4 0.636 3.038

5 0.567 3.605

Weaving Oil Plant

0 (10,000,000) 1.0000000 (10,000,000) (10,000,000) 1.0000000 (10,000,000)

1 1,000,000 0.89300 893,000 3,300,000 -

2 1,500,000 0.79700 1,195,500 3,300,000 -

3 3,000,000 0.71200 2,136,000 3,300,000 -

4 9,000,000 0.63600 5,724,000 3,300,000 -

14,500,000 9,948,500 - 10,025,400

4,500,000 (51,500) 25,400

NPV - EXEL (56,349) 23,253 NPV - EXEL 23,253

3,300,000 3.0380 10,025,400

pvifa, 12%. 4 year

Differene of (2,147) due round-off

Вам также может понравиться

- Mini Case Capital Budgeting ProcessДокумент6 страницMini Case Capital Budgeting Process032179253460% (1)

- Concepts and Techniques: Capital BudgetingДокумент66 страницConcepts and Techniques: Capital BudgetingAMJAD ALIОценок пока нет

- Girum Tsega PerfectДокумент13 страницGirum Tsega PerfectMesi YE GIОценок пока нет

- Solved Answers For Payback PeriodДокумент9 страницSolved Answers For Payback Periodwihanga100% (2)

- Sujata 5lakhДокумент9 страницSujata 5lakhpradeep reddyОценок пока нет

- Capital Budgeting: Ravi Kanth MiriyalaДокумент20 страницCapital Budgeting: Ravi Kanth MiriyalaBonkyОценок пока нет

- Q No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyДокумент3 страницыQ No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyMuneeb Qureshi0% (1)

- Financial Management-Coursework 2Документ11 страницFinancial Management-Coursework 2Tariq KhanОценок пока нет

- Same Questions - F303 - 1st MidДокумент5 страницSame Questions - F303 - 1st MidRafid Al Abid SpondonОценок пока нет

- FM09-CH 11Документ5 страницFM09-CH 11Mukul KadyanОценок пока нет

- Session 8 & 9 HWДокумент9 страницSession 8 & 9 HWElisten DabreoОценок пока нет

- Solutions For Capital Budgeting QuestionsДокумент7 страницSolutions For Capital Budgeting QuestionscaroОценок пока нет

- Final Practrice (Unit 4 and 5)Документ9 страницFinal Practrice (Unit 4 and 5)mjlОценок пока нет

- 2.11Lpg Gas-Cylinder ROIДокумент1 страница2.11Lpg Gas-Cylinder ROIKeroz NazriОценок пока нет

- Me 5.4 RMДокумент12 страницMe 5.4 RMPawan NayakОценок пока нет

- Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Документ10 страницCapital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Aditya Anshuman DashОценок пока нет

- A-3 Capital BudgetingДокумент4 страницыA-3 Capital BudgetingUTkarsh DOgraОценок пока нет

- Project Report On General StoreДокумент10 страницProject Report On General StoreApplication's ManagerОценок пока нет

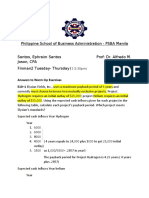

- Philippine School of Business Administration - PSBA ManilaДокумент12 страницPhilippine School of Business Administration - PSBA ManilaephraimОценок пока нет

- Financial Management Session 10Документ20 страницFinancial Management Session 10vaidehirajput03Оценок пока нет

- Case Study 1: Casflow Statements Assignment 2Документ6 страницCase Study 1: Casflow Statements Assignment 2albertОценок пока нет

- NPV and Irr (English)Документ13 страницNPV and Irr (English)RobertKimtaiОценок пока нет

- FINANCE Case Study NoДокумент15 страницFINANCE Case Study Nofalina100% (1)

- Executive Summary Tripplesea Soya ProjectДокумент3 страницыExecutive Summary Tripplesea Soya ProjectebubecОценок пока нет

- Fin304 (Mid-Sem Answers 2021)Документ9 страницFin304 (Mid-Sem Answers 2021)sha ve3Оценок пока нет

- Final Costing CalculationsДокумент33 страницыFinal Costing CalculationsErrist YuanJinОценок пока нет

- F.M Rev 2019Документ17 страницF.M Rev 2019AA BB MMОценок пока нет

- End of Chapter 11 SolutionДокумент19 страницEnd of Chapter 11 SolutionsaniyahОценок пока нет

- Project MGT AssgnmntДокумент13 страницProject MGT AssgnmntIsuu JobsОценок пока нет

- WACC & PaybackДокумент9 страницWACC & PaybackBelle Dela CruzОценок пока нет

- Capital Budgeting PДокумент14 страницCapital Budgeting PAjayОценок пока нет

- Excercise 1 AnswersДокумент3 страницыExcercise 1 AnswersfaisalОценок пока нет

- Discounted Cash Flow of ReturnДокумент12 страницDiscounted Cash Flow of ReturnTHE TERMINATORОценок пока нет

- KotureshwaraДокумент9 страницKotureshwaraVeerabhadreshwar Online CenterОценок пока нет

- Franchise - CarДокумент14 страницFranchise - Carshrish guptaОценок пока нет

- A1. Fm-2018-Sepdec-Sample-AДокумент4 страницыA1. Fm-2018-Sepdec-Sample-ANirmal ShresthaОценок пока нет

- Project Report On General StoreДокумент10 страницProject Report On General StoredigitaltechnolifeОценок пока нет

- Chapter 11Документ11 страницChapter 11PeterGomesОценок пока нет

- Financial Management Tutorial 2 AnswersДокумент6 страницFinancial Management Tutorial 2 AnswersDelfPDF100% (2)

- Topic 8 - Inv App 1 Ans 2019-20Документ4 страницыTopic 8 - Inv App 1 Ans 2019-20Gaba RieleОценок пока нет

- Assigment IiДокумент18 страницAssigment IiIsuu JobsОценок пока нет

- Pulic Sector AssignmentДокумент11 страницPulic Sector AssignmentAlex Nkole MulengaОценок пока нет

- R21 Capital Budgeting Q Bank PDFДокумент10 страницR21 Capital Budgeting Q Bank PDFZidane KhanОценок пока нет

- CF 2Документ26 страницCF 2PUSHKAL AGGARWALОценок пока нет

- Practice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Документ3 страницыPractice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Sumit Kumar SahooОценок пока нет

- Profitability AnalysisДокумент12 страницProfitability AnalysisTHE TERMINATORОценок пока нет

- CH 10Документ74 страницыCH 10Chi NguyễnОценок пока нет

- Chapter 3.2. Economic Evaluation - Future W - PBAДокумент13 страницChapter 3.2. Economic Evaluation - Future W - PBATran HuyenОценок пока нет

- 29116520Документ6 страниц29116520Rendy Setiadi MangunsongОценок пока нет

- Com 203 (FM) - Capital Budgeting TechniquesДокумент10 страницCom 203 (FM) - Capital Budgeting TechniquesYash GangwaniОценок пока нет

- Net Present ValueДокумент21 страницаNet Present ValueMatthew LgkaroОценок пока нет

- Capital Investment AnalysisДокумент7 страницCapital Investment AnalysisAIDYОценок пока нет

- Financial Management Session 10Документ11 страницFinancial Management Session 10Shivangi MohpalОценок пока нет

- Revision: GDB 3023 Engineering Economics and EntrepreneurshipДокумент25 страницRevision: GDB 3023 Engineering Economics and Entrepreneurshipfaris yusofОценок пока нет

- A. B. C. D. E.: Capital Costs, Operating Costs, Revenue, Depreciation, and Residual ValueДокумент30 страницA. B. C. D. E.: Capital Costs, Operating Costs, Revenue, Depreciation, and Residual ValueAfroz AlamОценок пока нет

- Answers To Warm-Up Exercises: AnswerДокумент21 страницаAnswers To Warm-Up Exercises: AnswerMeyzla Ativa HuslikОценок пока нет

- Week 3 Capital Budgeting Cash Flows 2 - Replacement Project (Group 2, Slot 1)Документ40 страницWeek 3 Capital Budgeting Cash Flows 2 - Replacement Project (Group 2, Slot 1)XianFa WongОценок пока нет

- NPV Is Present Value of The Present Values of All Cash Inflows and Outflows From Particular ProjectДокумент3 страницыNPV Is Present Value of The Present Values of All Cash Inflows and Outflows From Particular ProjectHumair UddinОценок пока нет

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryОт EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryОценок пока нет

- Unilever: PresentersДокумент2 страницыUnilever: PresentersANADILBhuttoОценок пока нет

- What Does Balance Transfer Mean?: Features and BenefitsДокумент4 страницыWhat Does Balance Transfer Mean?: Features and BenefitsANADILBhuttoОценок пока нет

- R & S Strategy and PlaningДокумент10 страницR & S Strategy and PlaningANADILBhuttoОценок пока нет

- Greetings and Salutations: Presented byДокумент23 страницыGreetings and Salutations: Presented byANADILBhuttoОценок пока нет