Академический Документы

Профессиональный Документы

Культура Документы

Accounting for mutual fund investments

Загружено:

Manoj JainИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Accounting for mutual fund investments

Загружено:

Manoj JainАвторское право:

Доступные форматы

Investments in the financial statements of mutual funds are to be accounted as per AS -

30

Revised solutions of illustrations of Mutual funds

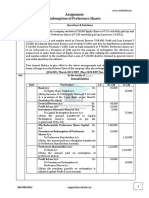

Illustration 2

The investment portfolio for a mutual fund scheme includes 10,000 shares of A Ltd. and 8,000 shares of B

Ltd. acquired on 30/10/2005. The cost of A Ltd. shares is Rs. 20 while that of B Ltd. shares is Rs. 30. The

market values of these shares at the end of 2005-06 were Rs. 19 and Rs. 32 respectively. Show important

accounting entries in books of the fund in the accounting year 2005-06. Investments are FVTPL assets

Solution

Rs. 000 Rs. 000

Investment in A Ltd. shares Dr. 200

Investment in B Ltd. shares 240

To Bank 440

Revenue A/c Dr. 10

To Investment in A Ltd. shares 10

Investment in B Ltd. shares Dr. 16

To Revenue A/c 16

Illustration 3

In the previous example, suppose that shares of both of the companies were disposed off on 31/05/06

realizing Rs. 18.50 per A Ltd. shares and Rs. 33.50 per B Ltd. shares. Show important accounting entries in

books of the fund in the accounting year 2006-07

Solution:

Rs. 000 Rs. 000

Bank Dr. 185

Revenue A/c Dr. 5

To Investment in A Ltd. shares 190

Bank Dr. 268

To Investment in B Ltd. shares 256

To Revenue A/c 12

Illustration 7

The details of a MF for an open ended scheme given below:

10.5.2008 500 units sold at par & the money is invested in

securities.

11.5.2008 The securities appreciated by 20%

12.5.2008 The securities appreciated by another 25%

13.5.2008 Sold 10% of the portfolio at existing prices.

14.5.2008 Sold 100 new units at NAV

14.5.2008 Repurchase 20 new units at NAV

Pass the journal entries and prepare the balance sheet on 14.5.2008

Investments are available for sale investments

Solution

10.5.2008 Bank Dr. 5000

To Unit Capital 5000

Investments Dr. 5000

To Bank 5000

11.5.2008 Investments Dr. 1000

To IRR 1000

12.5.2008 Investments Dr. 1500

To IRR 1500

13.5.2008 Bank Dr. 750

To Investments 750

IRR Dr. 250

To Realised Gain 250

14.5.2008 Bank Dr. 1500

To Unit Capital 1000

To Unit Premium Reserve (IRR) 450

To Equalisation Reserve (Realised gain) 50

Unit Capital Dr. 200

Unit Premium Reserve Dr. 90

Equalisation Resrve Dr. 10

To Bank 300

Balance Sheet

Unit Capital 5800 Investments 6750

IRR 2250 Bank 1950

Realised gain 250

Unit Premium Reserve 360

Equalisation Reserve 40 ____

8700 8700

Вам также может понравиться

- Ap RmycДокумент16 страницAp RmycJoseph Bayo BasanОценок пока нет

- Statement of Account: Summary of Charges and CreditsДокумент3 страницыStatement of Account: Summary of Charges and CreditsRye LozadaОценок пока нет

- EnglishIVWriting SLO Preassessment-1Документ4 страницыEnglishIVWriting SLO Preassessment-1Peyton GallowayОценок пока нет

- Pe2 Acc Nov05Документ19 страницPe2 Acc Nov05api-3825774Оценок пока нет

- Consolidation Q30Документ5 страницConsolidation Q30johny SahaОценок пока нет

- Business & Financial RiskДокумент26 страницBusiness & Financial RiskPrabhuvardhan ReddyОценок пока нет

- Accounting-Bonus Issue and Right-Issue-1653399117076303Документ17 страницAccounting-Bonus Issue and Right-Issue-1653399117076303Badhrinath ShanmugamОценок пока нет

- Hsslive Xii Acc 3 Admission of A Partner KeyДокумент8 страницHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadОценок пока нет

- Business Combination Answers (Manav)Документ58 страницBusiness Combination Answers (Manav)Harshit ChauhanОценок пока нет

- Dividend Journal Entries and CalculationsДокумент4 страницыDividend Journal Entries and CalculationsLorence Patrick LapidezОценок пока нет

- AC3102 Jan2018 Seminar 3 Three Consolidation Post Acquisition LKW 13jan2018Документ27 страницAC3102 Jan2018 Seminar 3 Three Consolidation Post Acquisition LKW 13jan2018Shawn TayОценок пока нет

- Calculation of PC and preparation of balance sheet on amalgamationДокумент4 страницыCalculation of PC and preparation of balance sheet on amalgamationJagriti SharmaОценок пока нет

- Sample QSДокумент12 страницSample QSIsha KatiyarОценок пока нет

- Internal Reconstruction PQ SolДокумент17 страницInternal Reconstruction PQ SolKaran MokhaОценок пока нет

- CA Inter Accounts A MTP 1 Nov 2022Документ13 страницCA Inter Accounts A MTP 1 Nov 2022smartshivenduОценок пока нет

- Introduction To Group Statements - FASSET Class - 15 May 2021Документ22 страницыIntroduction To Group Statements - FASSET Class - 15 May 2021Mike NdunaОценок пока нет

- ELOHIM Company bond amortizationДокумент6 страницELOHIM Company bond amortizationReginald ValenciaОценок пока нет

- Co Operative HSG Soc. 2Документ48 страницCo Operative HSG Soc. 2ishan.patel.310Оценок пока нет

- Chap 014Документ25 страницChap 014Rizal YusanОценок пока нет

- 5 Amalgamation, Absorption and External Reconstruction - HomeworkДокумент21 страница5 Amalgamation, Absorption and External Reconstruction - HomeworkYash ShewaleОценок пока нет

- Financial Accounting and Reporting Assignment 1 - Lesson 16 ExercisesДокумент5 страницFinancial Accounting and Reporting Assignment 1 - Lesson 16 ExercisesShilla Mae BalanceОценок пока нет

- Chapter 9 ExercisesДокумент14 страницChapter 9 Exercisesshiroe raabuОценок пока нет

- Chapter: Common Size, Comparative and Trend AnalysisДокумент6 страницChapter: Common Size, Comparative and Trend Analysiseldridatech pvt ltdОценок пока нет

- M&M Capital Structure WACC & Value CreationДокумент15 страницM&M Capital Structure WACC & Value CreationsdsdvdgОценок пока нет

- BB QuestionsДокумент2 страницыBB QuestionsHari NaamОценок пока нет

- Mcgraw-Hill/Irwin Corporate Finance, 7/E: © 2005 The Mcgraw-Hill Companies, Inc. All Rights ReservedДокумент26 страницMcgraw-Hill/Irwin Corporate Finance, 7/E: © 2005 The Mcgraw-Hill Companies, Inc. All Rights ReservedMohammad Ilham FawwazОценок пока нет

- Excel For Accounting CycleДокумент15 страницExcel For Accounting CycleLois RazonОценок пока нет

- 1044 FR Old Compiler 10 YrsДокумент369 страниц1044 FR Old Compiler 10 YrsCA OFFICEОценок пока нет

- The Stupidity of Using MultiplesДокумент2 страницыThe Stupidity of Using MultiplesHesham TabarОценок пока нет

- Patnership TwoДокумент8 страницPatnership TwoTapz IbrahimОценок пока нет

- Control and Significant InfluenceДокумент11 страницControl and Significant InfluencePatrick ArazoОценок пока нет

- 616806cf0cf2b988fbcdbd97 OriginalДокумент20 страниц616806cf0cf2b988fbcdbd97 OriginalTM GamingОценок пока нет

- Case study on determining optimal capital structure and debt capacity of Zip Zap Zoom Car CompanyДокумент17 страницCase study on determining optimal capital structure and debt capacity of Zip Zap Zoom Car CompanyRaghav Agarwal100% (3)

- NCLT Referred Listed Cases Equity Valuation FrameworkДокумент8 страницNCLT Referred Listed Cases Equity Valuation FrameworkNiveditaОценок пока нет

- Accounting for Business Combinations and Internal ReconstructionsДокумент27 страницAccounting for Business Combinations and Internal ReconstructionsbinuОценок пока нет

- ISC Solved Accounts Paper 2017Документ25 страницISC Solved Accounts Paper 2017PANKAJ's ACCOUNTANCY PATHSHALAОценок пока нет

- 5 6084915055709651012Документ8 страниц5 6084915055709651012Ajit Yadav100% (1)

- UntitledДокумент3 страницыUntitledTINOTENDA MUCHEMWAОценок пока нет

- Week 9 QuizДокумент8 страницWeek 9 QuizWang ChoiОценок пока нет

- WN - 1 Resource Test WN-2 Shares Outstanding TestДокумент8 страницWN - 1 Resource Test WN-2 Shares Outstanding TestSimran KhandujaОценок пока нет

- 2 NBFC-1Документ6 страниц2 NBFC-1Hariom PatidarОценок пока нет

- CBSE Class 12 Accountancy Question Paper 2015 Foreign Set 1Документ42 страницыCBSE Class 12 Accountancy Question Paper 2015 Foreign Set 1Ashish GangwalОценок пока нет

- Issue of ShareДокумент3 страницыIssue of ShareSayeed AnwarОценок пока нет

- AnswersДокумент5 страницAnswersPawan TalrejaОценок пока нет

- CMA Volume 2 MergedДокумент153 страницыCMA Volume 2 MergedShyaambhavi NsОценок пока нет

- Case Study 3: Alok Industries: Business ValuationДокумент6 страницCase Study 3: Alok Industries: Business Valuationsairad1999Оценок пока нет

- Npo Comprehensive QuestionДокумент4 страницыNpo Comprehensive Questionanurags pageОценок пока нет

- Cash Flow StatementsДокумент21 страницаCash Flow StatementsAnaya KaleОценок пока нет

- 07 Financial LeverageДокумент28 страниц07 Financial LeverageAbdullah matenОценок пока нет

- Question 2: Ifrs 9 - Financial InstrumentsДокумент2 страницыQuestion 2: Ifrs 9 - Financial InstrumentsamitsinghslideshareОценок пока нет

- Marking Scheme: PRE - BOARD-2 (2023 - 2024)Документ11 страницMarking Scheme: PRE - BOARD-2 (2023 - 2024)Kaustav DasОценок пока нет

- B326 MTA Fall 2017-2018 MGLДокумент7 страницB326 MTA Fall 2017-2018 MGLmjlОценок пока нет

- Semester V (Finance) 2018-19Документ51 страницаSemester V (Finance) 2018-19anurag chaurasiaОценок пока нет

- Ultimate Accountancy Class 12 Sample Paper SolutionsДокумент8 страницUltimate Accountancy Class 12 Sample Paper SolutionsBeena ShibuОценок пока нет

- 5 Internal ReconstructionДокумент31 страница5 Internal ReconstructionHariom PatidarОценок пока нет

- CH 2 in ClassДокумент2 страницыCH 2 in ClassMAINY RYANОценок пока нет

- BA2088 - Tut4 - Financial Statement AnalysisДокумент5 страницBA2088 - Tut4 - Financial Statement AnalysisAprilОценок пока нет

- C.S. Executive - Answers For CC Test Paper - IДокумент7 страницC.S. Executive - Answers For CC Test Paper - Isekhar_gantiОценок пока нет

- Amalgamation WKДокумент12 страницAmalgamation WKBashu GuragainОценок пока нет

- H077 Chp.5 Q.2Документ10 страницH077 Chp.5 Q.2Isha KatiyarОценок пока нет

- Corporations: Retained Earnings and The Income StatementДокумент40 страницCorporations: Retained Earnings and The Income Statementmustafa_33Оценок пока нет

- ms4 2017 IIДокумент4 страницыms4 2017 IIsachin gehlawatОценок пока нет

- Winning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinОт EverandWinning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinОценок пока нет

- 2 Quick Success Series BPRДокумент8 страниц2 Quick Success Series BPRvvivek22Оценок пока нет

- Rockview University Computer Science Department: February, 2022Документ5 страницRockview University Computer Science Department: February, 2022mwanzadmОценок пока нет

- In The Debt Recovery Tribunal, PatnaДокумент10 страницIn The Debt Recovery Tribunal, PatnaAshar AkhtarОценок пока нет

- THE ESSENCE OF THE FRAUDДокумент30 страницTHE ESSENCE OF THE FRAUDsumthintado100% (1)

- Financial Instrument: What Are Financial Instruments?Документ8 страницFinancial Instrument: What Are Financial Instruments?Sarvan KumarОценок пока нет

- Jaisalmer 384Документ299 страницJaisalmer 384sakar guptaОценок пока нет

- AIS Complete Testbank QuizДокумент74 страницыAIS Complete Testbank QuizRomiline Umayam100% (5)

- SLJ-Global Bilingual 31 Des 2017 ReleasedДокумент97 страницSLJ-Global Bilingual 31 Des 2017 ReleasedIswan AditiyaОценок пока нет

- BPI vs. Fernandez, GR. No. 173134, September 2, 2015Документ3 страницыBPI vs. Fernandez, GR. No. 173134, September 2, 2015Charmaine Valientes CayabanОценок пока нет

- Fatimat STMTДокумент53 страницыFatimat STMTayo.adegokeОценок пока нет

- Topic - :: Employee Engagemet in Canara BankДокумент9 страницTopic - :: Employee Engagemet in Canara BankSweta PandeyОценок пока нет

- RS Cashless India Projuct PDFДокумент90 страницRS Cashless India Projuct PDFRAJE100% (1)

- Terms C Depmob Easy Access Savings CustomersДокумент3 страницыTerms C Depmob Easy Access Savings CustomersHemlataОценок пока нет

- The Role of Material Management On Organizational Performance: A Case Study in Commercial Bank of EthiopiaДокумент7 страницThe Role of Material Management On Organizational Performance: A Case Study in Commercial Bank of EthiopiaAlriyaanОценок пока нет

- Five Keys To Investing SuccessДокумент12 страницFive Keys To Investing Successr.jeyashankar9550Оценок пока нет

- Rogoff (1985) ConservativeДокумент5 страницRogoff (1985) Conservative92_883755689Оценок пока нет

- Country BriefingДокумент23 страницыCountry BriefingSabrina YuОценок пока нет

- The Philippines Financial SystemДокумент21 страницаThe Philippines Financial SystemZenedel De JesusОценок пока нет

- ICICI Bank Service Marketing Project ReportДокумент15 страницICICI Bank Service Marketing Project ReportShaloo MinzОценок пока нет

- Report On Financial Market Review by The Hong Kong SAR Government in April 1998Документ223 страницыReport On Financial Market Review by The Hong Kong SAR Government in April 1998Tsang Shu-kiОценок пока нет

- Sample Audit ProgramДокумент119 страницSample Audit ProgramEcyojEiramMarapaoОценок пока нет

- UCC BasicsДокумент17 страницUCC BasicsJay Eternity100% (11)

- Screenshot 2023-10-31 at 10.18.30 PMДокумент28 страницScreenshot 2023-10-31 at 10.18.30 PMmariakylie99Оценок пока нет

- Banks Asset Liability ManagementДокумент5 страницBanks Asset Liability ManagementRuben CollinsОценок пока нет

- Lesson 6 Forms and Functions of State and Non-State InstitutionДокумент24 страницыLesson 6 Forms and Functions of State and Non-State InstitutionLeah Joy Valeriano-QuiñosОценок пока нет

- Project Report On Islamic BankingДокумент26 страницProject Report On Islamic BankingMichael EdwardsОценок пока нет

- Corporate InvestmentДокумент20 страницCorporate InvestmentJuan Manuel FigueroaОценок пока нет