Академический Документы

Профессиональный Документы

Культура Документы

Costing Answers

Загружено:

salman10280 оценок0% нашли этот документ полезным (0 голосов)

25 просмотров1 страницаАвторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

XLS, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

25 просмотров1 страницаCosting Answers

Загружено:

salman1028Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

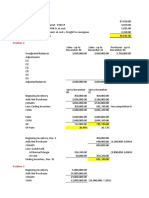

Answer Q no.

1

1. Absorption Costing

Particulars Amount (Rs.)

Sale Price (20000*30) 600,000.00

Less VCOGS

DM 80,000.00

DL 100,000.00

VFOH 120,000.00

FFOH 72,000.00

COGM 372,000.00

Less Closing Stock

(24000-20000=4000*15.5) 62,000.00

COGS 310,000.00

Gross Profit 290,000.00

Less: Admin & Marketing Expenses

Fixed Marketing & Admin 60,000.00 60,000.00

Net Profit under Absoption Costing 230,000.00

2. Direct Costing

Particulars Amount (Rs.)

Sale Price (20000*30) 600,000.00

Less VCOGS

DM 80,000.00

DL 100,000.00

VFOH 120,000.00

VCOGM 300,000.00

Less Closing Stock

(24000-20000=4000*12.5) 50,000.00

VCOGS 250,000.00

Contribution Margin 350,000.00

Less: Fixed Expenses

Fixed FOH 72,000.00

Fixed Marketing & Admin 60,000.00 132,000.00

Net Profit under Direct Costing 218,000.00

Difference due to stock

Units Produced - Units Sold * Fixed FOH Rate

(24000 - 20000) * 3 12,000.00

Absoption Costing - Direct Costing

230000 - 218000 12,000.00

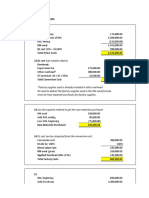

Answer Question # 2

Particulars Existing Plan New Plan

Sale price (100*100) 10,000.00 (110*90) 9,900.00

Less Variable Cost (100*70) 7,000.00 (110*70) 7,700.00

Contribution Margin 3,000.00 2,200.00

Less Fixed Cost 2,000.00 2,350.00

Net Profit 1,000.00 Net Loss -150.00

Note: Existing Plan is better as it gives profit

Вам также может понравиться

- 06 Incremental AnalysisДокумент11 страниц06 Incremental AnalysisannarheaОценок пока нет

- StratCost Quiz 2Документ6 страницStratCost Quiz 2ElleОценок пока нет

- CVP AnalysisДокумент10 страницCVP AnalysisHarold Beltran DramayoОценок пока нет

- Umipig AbbyMarileth Interim2Документ3 страницыUmipig AbbyMarileth Interim2abbyyyyy.mariОценок пока нет

- FPQ1 - Answer KeyДокумент6 страницFPQ1 - Answer KeyJi YuОценок пока нет

- AFAR 2 NotesДокумент157 страницAFAR 2 NotesAlexandria EvangelistaОценок пока нет

- Learning Activity 3 Sensitivity AnalysisДокумент3 страницыLearning Activity 3 Sensitivity AnalysisjessОценок пока нет

- AC - IntAcctg1 Quiz 2 Solution GuideДокумент6 страницAC - IntAcctg1 Quiz 2 Solution Guidejohn hellОценок пока нет

- Finals Quiz and ActivityДокумент4 страницыFinals Quiz and ActivityHello PMОценок пока нет

- Chapter 14Документ5 страницChapter 14Kiminosunoo LelОценок пока нет

- Homework SolutionsДокумент5 страницHomework SolutionsAnonymous CuUAaRSNОценок пока нет

- Chapter 6-ExamplesДокумент6 страницChapter 6-ExamplesNguyen Tan AnhОценок пока нет

- Joint Product & By-Product ExamplesДокумент15 страницJoint Product & By-Product ExamplesMuhammad azeemОценок пока нет

- Midterms MAДокумент10 страницMidterms MAJustz LimОценок пока нет

- TaxationДокумент5 страницTaxationPauline Jasmine Sta AnaОценок пока нет

- ExpensesДокумент3 страницыExpensesJezerie Kaye T. FerrerОценок пока нет

- Afar SolutionДокумент8 страницAfar SolutionAsnifah AlinorОценок пока нет

- Bacostmx-3tay2021-Quiz 1-SolutionДокумент7 страницBacostmx-3tay2021-Quiz 1-SolutionMarjorie NepomucenoОценок пока нет

- Akuntansi Biaya IiДокумент9 страницAkuntansi Biaya IiMa'rifatusSolikhahОценок пока нет

- DividendsДокумент13 страницDividendsTrixieОценок пока нет

- Joint Product & By-ProductДокумент14 страницJoint Product & By-ProductMuhammad azeem100% (1)

- Installment MethodДокумент4 страницыInstallment Methodjessica amorosoОценок пока нет

- AFA IIP.L III SolutionJune 2016Документ4 страницыAFA IIP.L III SolutionJune 2016HossainОценок пока нет

- TAX Final Preboard Examination - Solutions PDFДокумент15 страницTAX Final Preboard Examination - Solutions PDF813 cafeОценок пока нет

- Problem 3: Multiple Choice - COMPUTATIONAL 1. BДокумент10 страницProblem 3: Multiple Choice - COMPUTATIONAL 1. BCharizza Amor TejadaОценок пока нет

- Activity 1 Man. Acct.Документ2 страницыActivity 1 Man. Acct.Aia Sophia SindacОценок пока нет

- Variable CostingДокумент4 страницыVariable CostingKhairul Ikhwan DalimuntheОценок пока нет

- Sogradiel - CVP Independent LearningДокумент4 страницыSogradiel - CVP Independent LearningRIZLE SOGRADIELОценок пока нет

- Ia Forcadela Part IIIДокумент5 страницIa Forcadela Part IIIMary Joanne forcadelaОценок пока нет

- Ecsy Cola Question2Документ8 страницEcsy Cola Question2Dhagash SanghaviОценок пока нет

- Cañas Alexia V Pa1Документ4 страницыCañas Alexia V Pa1Joshua BangiОценок пока нет

- Consignment Sales SolutionДокумент15 страницConsignment Sales SolutionJessie KimОценок пока нет

- 04 FAR04-answersДокумент12 страниц04 FAR04-answersBea GarciaОценок пока нет

- CH 13Документ6 страницCH 13Agung PrabowoОценок пока нет

- AssignmentДокумент40 страницAssignmentnoeljrpajaresОценок пока нет

- Management Accounting 1Документ4 страницыManagement Accounting 1Tax TrainingОценок пока нет

- Proforma StatmentsДокумент4 страницыProforma StatmentsMehar AttaullahОценок пока нет

- MC Solution Pages 2 61 To 2 66Документ8 страницMC Solution Pages 2 61 To 2 66sumagpangkeannecleinОценок пока нет

- Pasicolan, Mark Joshua BSA 3206: Absorption CostingДокумент6 страницPasicolan, Mark Joshua BSA 3206: Absorption CostingMark Joshua PasicolanОценок пока нет

- Full Absorption & Variable Costing Methods (Answers)Документ3 страницыFull Absorption & Variable Costing Methods (Answers)Juan FrivaldoОценок пока нет

- Answer To Prelim QuizzerДокумент4 страницыAnswer To Prelim QuizzerLouina YnciertoОценок пока нет

- Quali Review Interim Reporting Complete SolutionДокумент7 страницQuali Review Interim Reporting Complete SolutionPaul Ivan CabanatanОценок пока нет

- Sol. Man. Chapter 10 Installment Sales Method 2020 EditionДокумент13 страницSol. Man. Chapter 10 Installment Sales Method 2020 EditionJam Surdivilla100% (1)

- FAR05 - First Pre-Board SolutionsДокумент7 страницFAR05 - First Pre-Board SolutionsMellaniОценок пока нет

- CHEER UP Chapter 14 Retail Inventory MethodДокумент5 страницCHEER UP Chapter 14 Retail Inventory MethodaprilОценок пока нет

- BT Chapter 1Документ10 страницBT Chapter 1Thanh Tâm Lê ThịОценок пока нет

- Via BIR Form 1706Документ1 страницаVia BIR Form 1706YnnaОценок пока нет

- Assignment 2 - CVP AnalysisДокумент1 страницаAssignment 2 - CVP AnalysisInke RentandatuОценок пока нет

- Variable Absorption Costing Formula NewДокумент23 страницыVariable Absorption Costing Formula NewKenneth PimentelОценок пока нет

- VARAIBLE COSTING (Solutions)Документ8 страницVARAIBLE COSTING (Solutions)Mohammad UmairОценок пока нет

- Whitney CompanyДокумент4 страницыWhitney CompanyRIZA JOY CAÑETE DELARAGAОценок пока нет

- SCM TableДокумент5 страницSCM TableRed VelvetОценок пока нет

- Non-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model AnswersДокумент8 страницNon-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model Answersrwl s.r.lОценок пока нет

- Allowable DeductionsДокумент9 страницAllowable DeductionsLyka RoguelОценок пока нет

- Key To Correction - Intermediate Accounting - Midterm - 2019-2020Документ10 страницKey To Correction - Intermediate Accounting - Midterm - 2019-2020Renalyn ParasОценок пока нет

- Materi Untuk Tugas Topik 2Документ11 страницMateri Untuk Tugas Topik 2Violen AmeliaОценок пока нет

- Product Sales Value (') P / V Ratio (%) Contribution (') : Less: Fixed OverheadsДокумент17 страницProduct Sales Value (') P / V Ratio (%) Contribution (') : Less: Fixed OverheadsHarshawardhan GuptaОценок пока нет

- Problem 14-7Документ2 страницыProblem 14-7Angelita Dela cruzОценок пока нет

- Firms in Perfectly Competitive MarketsДокумент51 страницаFirms in Perfectly Competitive MarketsYAKKALA VENKATA SANDEEPОценок пока нет

- Soal Job Application LetterДокумент4 страницыSoal Job Application LetterDzakiy AchmadhaniОценок пока нет

- Guest Speaker Report 4 - WORK 5570Документ4 страницыGuest Speaker Report 4 - WORK 5570Pratik ShahОценок пока нет

- Comparative Study OF Bajaj V/S Hero Honda: Project Report of Research Methodology OnДокумент44 страницыComparative Study OF Bajaj V/S Hero Honda: Project Report of Research Methodology OnMayankJainОценок пока нет

- Verka Research PaperДокумент14 страницVerka Research PaperSoneОценок пока нет

- Innovation ManagementДокумент15 страницInnovation ManagementJustin Abad FernandezОценок пока нет

- AnswersДокумент4 страницыAnswersChetan SaxenaОценок пока нет

- Pricing PoliciesДокумент24 страницыPricing PoliciesKritika VermaОценок пока нет

- Course Material of BBA 304 - Digital MarketingДокумент133 страницыCourse Material of BBA 304 - Digital MarketingVarun mendirattaОценок пока нет

- Case Study Free Cash FlowДокумент5 страницCase Study Free Cash FlowShayan ZafarОценок пока нет

- Lecturenote - 1745723012accounting - Mathematics For Finance PDFДокумент126 страницLecturenote - 1745723012accounting - Mathematics For Finance PDFAmanuel Amanuel67% (3)

- Assignment-1: PC MustafaДокумент6 страницAssignment-1: PC MustafanikhilОценок пока нет

- Business Model CanvasДокумент1 страницаBusiness Model CanvasFlores García ValeriaОценок пока нет

- Diff BW Industrial and Consumer MarketsДокумент3 страницыDiff BW Industrial and Consumer Marketstalon smithОценок пока нет

- Company Analysis ProjectДокумент48 страницCompany Analysis ProjectDalton PaternostroОценок пока нет

- Individual Assignment Analyzing Marketing Environment ofДокумент25 страницIndividual Assignment Analyzing Marketing Environment ofhei86% (7)

- Module 03 Supply Chain ManagementДокумент26 страницModule 03 Supply Chain ManagementAce RuizОценок пока нет

- Aman Singh MKT SurveyДокумент9 страницAman Singh MKT SurveypriyalОценок пока нет

- Supply Chain Performance Model of The Rail Freight Business in ThailandДокумент10 страницSupply Chain Performance Model of The Rail Freight Business in ThailandInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- 423430-1 - 11 Campbell-S-Ar WR SpreadДокумент52 страницы423430-1 - 11 Campbell-S-Ar WR SpreadPrakhar SinghaniaОценок пока нет

- Finance Manager Business Development in Chicago IL Resume Thomas KellyДокумент2 страницыFinance Manager Business Development in Chicago IL Resume Thomas KellyThomasKelly2100% (1)

- Cheetos Export - Google SearchДокумент1 страницаCheetos Export - Google Searchyusrayassin2011Оценок пока нет

- HTC6 Prelim Exam 2nd Sem 2022Документ7 страницHTC6 Prelim Exam 2nd Sem 2022Nicko DalisayОценок пока нет

- Amit Wagh F&O Functional Resume-23-03-23Документ4 страницыAmit Wagh F&O Functional Resume-23-03-23atush.rohanОценок пока нет

- Strategic Change Process: SyllabusДокумент32 страницыStrategic Change Process: Syllabussamreen workОценок пока нет

- 4-Fake Ads The Influence of Counterfeit Native Ads On Brands and ConsumersДокумент25 страниц4-Fake Ads The Influence of Counterfeit Native Ads On Brands and ConsumersMr. Saqib UbaidОценок пока нет

- Activ 10 de La 6 Steps To ExportДокумент7 страницActiv 10 de La 6 Steps To ExportRicardo Andres Barrios Vargas100% (1)

- Solution Ch18Документ118 страницSolution Ch18BONОценок пока нет

- CV Marina OДокумент1 страницаCV Marina OVladyslav HavrylovОценок пока нет

- Samsung 4P and STPДокумент5 страницSamsung 4P and STPHrishi KeshОценок пока нет