Академический Документы

Профессиональный Документы

Культура Документы

US Internal Revenue Service: p4589

Загружено:

IRS0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров1 страницаThe Telephone Excise Tax Refund (TETR) is a one-time refund for 2006 tax year. Tax-exempt organizations that are not normally required to File Form 990-T, but are eligible to request the refund, can use the following basic steps.

Исходное описание:

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe Telephone Excise Tax Refund (TETR) is a one-time refund for 2006 tax year. Tax-exempt organizations that are not normally required to File Form 990-T, but are eligible to request the refund, can use the following basic steps.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров1 страницаUS Internal Revenue Service: p4589

Загружено:

IRSThe Telephone Excise Tax Refund (TETR) is a one-time refund for 2006 tax year. Tax-exempt organizations that are not normally required to File Form 990-T, but are eligible to request the refund, can use the following basic steps.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

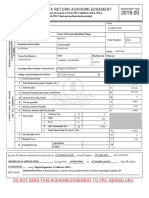

Attention

Tax-Exempt

Organizations

Including churches and charities

You can request a telephone excise

tax refund on your 2006 Form 990-T.*

The Telephone Excise Tax Refund (TETR) is a one-time

refund for 2006 tax year, designed to refund previously

collected long distance telephone taxes.

Tax-exempt organizations that are not normally required

to file Form 990-T, but are eligible to request the refund,

can use the following basic steps:

a. Compute your refund amount in one of two ways:

(1) determine actual excise taxes paid with March 2003-

July 2006 telephone bills; or (2) estimate with April and

September 2006 telephone bills. Record either of these

computations on Form 8913, Credit for Federal Excise Tax

Paid. Follow form instructions.

b. Complete top section (above Part 1) of IRS Form 990-T,

Exempt Organization Business Income Tax Return (and

proxy tax under section 6033(e)), and complete line 44f

using your calculations from Form 8913.

c. File Form 990-T with Form 8913 attached in accord-

ance with form instructions.

Download these IRS forms with their instructions

and the complete details on the telephone excise tax

at www.irs.gov.

Department of the Treasury Publication 4589 (3-2007)

*Different procedures apply to exempt political organizations that file

Internal Revenue Service Catalog Number 49719U

Form 1120POL.

Вам также может понравиться

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiДокумент71 страницаTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryДокумент260 страниц2008 Data DictionaryIRSОценок пока нет

- US Internal Revenue Service: 2290rulesty2007v4 0Документ6 страницUS Internal Revenue Service: 2290rulesty2007v4 0IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsДокумент112 страниц2008 Credit Card Bulk Provider RequirementsIRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Документ153 страницы2008 Objectives Report To Congress v2IRSОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- 3 Piece Men SuitДокумент1 страница3 Piece Men Suitmdasifkhan2013Оценок пока нет

- Bir Ruling Da 052 98Документ2 страницыBir Ruling Da 052 98Nash Ortiz LuisОценок пока нет

- 1 15 2022.PayStubSJ99Документ1 страница1 15 2022.PayStubSJ99troymc101Оценок пока нет

- Quiz 001 - Attempt Review 1Документ6 страницQuiz 001 - Attempt Review 1christoper laurenteОценок пока нет

- Module 1 - Cherry Alfuerte - Train LawДокумент41 страницаModule 1 - Cherry Alfuerte - Train Lawgerry dacerОценок пока нет

- OdunДокумент3 страницыOdunLoco CocoОценок пока нет

- Singapore Airlines v. CIR CTA No. 7500Документ15 страницSingapore Airlines v. CIR CTA No. 7500bianca.denise.dawisОценок пока нет

- Direct Taxes Semester 3 Roll No: 19P0310307: Filing Your Income Tax ReturnДокумент5 страницDirect Taxes Semester 3 Roll No: 19P0310307: Filing Your Income Tax ReturnPriya KudnekarОценок пока нет

- Chapter-1 Introduction To Finance.: Vidyavahini Post Graduate College, TumkurДокумент19 страницChapter-1 Introduction To Finance.: Vidyavahini Post Graduate College, TumkurBOJJAPPA IBОценок пока нет

- Madaum Resource Labor Service CooperativeДокумент1 страницаMadaum Resource Labor Service CooperativeProbinsyana KoОценок пока нет

- ARVIND PRESS Tax InvoiceДокумент1 страницаARVIND PRESS Tax InvoiceSrishti GaurОценок пока нет

- Project On Capital GainsДокумент14 страницProject On Capital Gainsanuragsingh55Оценок пока нет

- Taxation of Cross Border ActivitiesДокумент5 страницTaxation of Cross Border ActivitiesTriila manillaОценок пока нет

- A Guide To Income Tax Benefits For Senior CitizensДокумент18 страницA Guide To Income Tax Benefits For Senior CitizensAshutosh JaiswalОценок пока нет

- RMC 23Документ1 страницаRMC 23Jhenny Ann P. SalemОценок пока нет

- Economics - JAMB 2020 SYLLABUSДокумент9 страницEconomics - JAMB 2020 SYLLABUSOLUWANIFEMI ABIFARINОценок пока нет

- Income Tax: Full PFRS, Prfs For Smes & Pfrs For SesДокумент15 страницIncome Tax: Full PFRS, Prfs For Smes & Pfrs For SesChara etangОценок пока нет

- CBDTДокумент11 страницCBDTNidhi GowdaОценок пока нет

- Basic Concepts MCQs by CA Pranav ChandakДокумент11 страницBasic Concepts MCQs by CA Pranav ChandakJoginder shahОценок пока нет

- Notification No. 16/2021 - Central Tax (Rate)Документ2 страницыNotification No. 16/2021 - Central Tax (Rate)santanu sanyalОценок пока нет

- Taxes in Canada-Final 2010-4-07 Recovered)Документ112 страницTaxes in Canada-Final 2010-4-07 Recovered)DayarayanCanadaОценок пока нет

- Itr 2018-19 PDFДокумент1 страницаItr 2018-19 PDFMalik MuzafferОценок пока нет

- Week 1 Principles of Taxation True or FalseДокумент4 страницыWeek 1 Principles of Taxation True or FalsekemeeОценок пока нет

- 2022 FinalsДокумент49 страниц2022 FinalsJane GaliciaОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ9 страницForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961taxolegalОценок пока нет

- Vision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Документ1 страницаVision RX Lab Private Limited P-4, Kasba Industrial Estate, Phase - 1, Kolkata - 107Pravin KhopadeОценок пока нет

- 8% Income Tax OptionДокумент14 страниц8% Income Tax OptionZaaavnn VannnnnОценок пока нет

- NMT04212 - ENTREPRENEURSHIP Ii-1-1Документ47 страницNMT04212 - ENTREPRENEURSHIP Ii-1-1emmanuelmkibuniОценок пока нет

- Pay Stub Template 03 PDFДокумент1 страницаPay Stub Template 03 PDFchairgraveyardОценок пока нет

- Assignment Public Finance and Taxation - 2022-ExtensionДокумент3 страницыAssignment Public Finance and Taxation - 2022-ExtensionMesfin YohannesОценок пока нет