Академический Документы

Профессиональный Документы

Культура Документы

Rose Bowl - IRS Form 990 - FYE 2010

Загружено:

Playoff PACИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Rose Bowl - IRS Form 990 - FYE 2010

Загружено:

Playoff PACАвторское право:

Доступные форматы

---- -~- .. -.- .. ~.

--

THIS IS A COpy OF A LIVE RETURN FROM SMIPS. OFFICIAL USE ONLY.

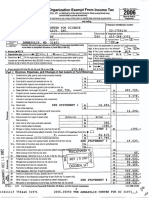

F~rm 990

OMS NO 1545·0047

Return of Organization Exempt From Income Tax

2009

Department ortne: T~eastlry

Int~mal Revenue ServIce .... The orqarazauon may have to use a copy of th IS return to satisfy state reporting requirements

Under section 501 (c). 527. or 4947(a)(1) of the Internal Revenue Code (except black lung . benefit trust or private foundation)

Open to PubliC Inspection

A For the 2009 calendar year or tax year beginning MAY 1 2009 and ending APR 30 2010

,

B Che<;k,1 Please C Name of orgamzatton D Employer identification number

applocibl. use IRS

OAddr-eSS label or PASADENA TOURNAMENT OF ROSES ASSOCIATION

change prrnt or

OName type Domq Business As 95-1725190

change-

Olnlljal See Number and street (or P.O.bo~ If mau s not deuvered to street address) I Hoom/suue Telephone number

return E

OTermfn. Speafic 391 SOUTH ORANGE GROVE BLVD. (626) 449-4100

ated tnsuuc-

OAmended none ClIy or town, state or country, and ZIP + 4 G Gross recepts s 107 781,265.

return

OAPPI'ca. PASADENA CA 91184 H(a) Is thrs a group return

non

pend'ng F Name and address of pnncipal officer P • SCOTT MCKIBBEN for affiliates? Dves WNo

391 S. ORANGE GROVE BLVD. , PASADENA CA 91105 H(b) Are all affiliates rncluded?DVes D No

I Tax-exempt status [XJ 501 (c) { 3 } .... (Insert no) D 4947!a)(1} or 0527 If "No, H attach a hst (see instructions)

J Website: .... WWW • TOURNAMENTOFROSES. COM H(c) Group exemption number ....

K Form 01 organization: [XJ Corporation o Trust o Assocanon o Other .... <: [L Year of formation: 18951 M State of leQaJ dormcae: CA

I Part II Summary

G> 1 Bnefly descnbe the organization's mission or most sigmflcant activmes: AS A VOLUNTEER - DRIVEN NONPROFIT

0 ORGANIZATIONi THE TOURNAMENT OF ROSES ASSOCIATION BRINGS PEOPLE

c

w Check trns box ... D If the orgamzauon discontinued lis operations or disposed of more than 25% of its net assets

c 2

~

G>

> 3 Number of voting members of the govermng body (Part VI, hne 1 a) 3 55

0

(!) 4 Number of Independent voting members of the governing body (Part VI, hne 1 b) C() 4 55

olI

1/1 5 Total number of employees (Part V, hne 2a) . C() 5 44

dO

.. 6 Total number of volunteers (estimate rf necessary) :) 6 935

s

;;:; 7a Total gross unrelated business revenue from Part VIII, column (C), lme 1&, 7a O.

0

-c O.

b Net unrelated business taxable Income from Form 990·T, hne 34 7b

\J- PriorVear Current Year

dO 8 Contributions and grants (Part VIII, line 1 h) . (() 99 365. 99 180.

:::I Pro "" ce revenue (Part VIII, hne 2g) ~ SO 470 626. 107 636 151-

t:: 9

dO InV{~tmenft~~mn\lP' hnes 3, 4, ~

> 10 40 387 .• 27,403.

(11

0:: <700. <3 521-

11 Oth ~~[ ''' .. ~. A. hn~s 5, BeA: ,1 c, and 11e) >

12 Tot I~ ~enul'l· add unes 8 thrOugh' hi must e u Part VIII, column {A), una 12) 50 609 678. 107 759 213.

13 Gr ~ and S1~lrar &n9u~t91ild ( 15ft X, column (A), lines 1·3) 135 962. 62 140.

14 Be efl .!Lald to or for members (F f x, column (A), line 4)

Sa ~ne~e~Ja(lrY:r: 0lj e benefits (part IX, column (A), hnes 5-10) 2,496 575. 3 402 176.

III 15

dO

III 16a ProTesmonaf,,;w III 'column (A), hne 11 e)

t::

dO b Total fund raIsing expenses (Part lx:7'olumn (D). line 25) ~

CL

><

w 17 Other expenses (Part IX, column (A), lines 11 a·11 d. 11 f-24f) 48,307 80l. 97 150 665.

18 Total expenses. Add hnes 13·17 (must equal Part IX, column (A), hne 25) 50 940 338. 100 614 98l.

19 Revenue less expenses. Subtract hne 18 from hne 12 ... <330,660. > 7 144 232.

~'" Beginning of Current Year

o~ End of Year

">I::::

Q;.!2 20 Total assets (Part X, hne 16} 19 554,832. 24 499 471-

"''''

~ 21 Total habilmes (Part X, tme 26} . r 7 536 188. S 336 496.

zJ' 22 Net assets or fund balances Subtract hne 21 from ne 20 12 018 644. 19 162 975.

I Part II I Sigpaftf(,_e Block 1ll

Und.. on~~fttury. I d~~ Ih ~.v ~t ;"., ~mpanYmg sc!1edulos and statements, and to Ihe best 01 my knowledge and belJel, II IS lrUe, correct,

and co piela 0 la'I Ion 01 ~ t h .. tv° t'J "J matoon 01 wnlcn prepat ... has any knowledge

Sign ~ .f __ I'~ r\ ru VI /lJ;j~.P/k 1£;f)'Dl111

Here Slol\llure ol\illlcer'" "' J 11 ' Dare

~ P. SCOTT MCKIBBENt EXECUTIVE DIRECTOR

Type or PIlOt name and ntle

Preparer's ~ __.--c:::::::-.- t I~~o Check If I I P,eparer's Idenblyon9 numb.,.

Paid ~ self· (see 'fl5trucbons)

Preparers signature - employed ... 0

Furn's name (or MARTIN WERBELOW LLP EIN iii-

Use Only YOUts If

solr·..-nployed), ~3 00 N. LAKE AVE. I SUITE 930

addr~and PASADENA CA 91101-4106 Phone no .... {6 26} 577-1440

ZIP+4 >

o w z

,z

t3

C/)

May the IRS diSCUSS thiS return with the preparer Shown above? (see Instrucllons) [XJ Ves 0 No

93200' 02..(l4·10 LHA For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Form 990 (2009)

SEE SCHED1£LES CA R.:CORYcmGmLzw.r~~NSte6TEMEN'JlCItWTJWU~N

THIS IS A COPY OF A LIVE RETURN FROM SMIPS. OFFICIAL USE ONLY.

Form990 2009 PASADENA TOURNAMENT OF ROSES ASSOCIATION 95-1725190 Pa e 2

Part III Statement of Program Service Accomplishments

1 Briefly dsscnbe the orqarnzanon's mission. SEE SCHEDULE 0 FOR CONTINUATION

AS A VOLUNTEER-DRIVEN NONPROFIT ORGANIZATION, THE TOURNAMENT OF ROSES ASSOCIATION BRINGS PEOPLE TOGETHER TO CREATE PREMIERE EVENTS AND

ENTERTAINMENT CELEBRATING THE NEW YEAR. THE TOURNAMENT OF ROSES

ENRICHES THE LIVES OF THE MANY PEOPLE AND ORGANIZATIONS IT TOUCHES BY

2 Did the organization undertake any Significant program services dunng the year which were not listed on the prior Form 990 or 99()'EZ?

If "Yes," descnbe these new services on Schedule 0

3 Old the orqaruzanon cease conducting, or make slgmficant changes In how It conducts, any program services?

If "Yes,"descnhe these chances on Schedule 0

4 Descnbe the exempt purpose achievements for each of the organization's three largest program services by expenses Section 501 (c){3) and 501(c)(4) orpanzancns and section 4947(a)(1) trusts are required to report the amount of grants and allocations 10 others, the total expenses, and revenue, If any, for each program service reported

SEE SCHEDULE 0 FOR CONTlNUATION{S)

[XJYes DNo

DYes[XJNo

4a {Code, } (Expenses $ 85 , 413 , 98 6. mcludmq grants of $ ) (Revenue $ 9 5 , 9 8 2 , 3 50. )

ROSE BOWL GAME- THE ASSOCIATION, WITH ITS VOLUNTEER MEMBERSHIP,

ORGANIZES AND CONDUCTS THE ANNUAL COLLEGIATE POSTSEASON FOOTBALL ROSE BOWL GAME ON NEW YEAR'S DAY. THE ROSE BOWL GAME SHOWCASES TWO OF THE COUNTRY'S TOP COLLEGIATE TEAMS IN A POST-SEASON MATCH UP IN FRONT OF

APPROXIMATELY 94,000 LIVE VIEWERS. THE GAME IS ALSO TELEVISED LIVE ON ESPN AND ON ABC TO OVER 24 MILLION VIEWERS NATIONWIDE AND REACHES OVER 70 MILLION HOUSEHOLDS IN 163 COUNTRIES THROU UT LATIN AMERICA THE

4b (Code ) {Expenses $ 8 I 531, 420. In 9 nts of $ 62 I 140. ){Revenue $ 7, 993 , 798. }

ROSE PARADE AND RELATED EVENTS ASSOCIATION WITH ITS VOLUNTEER

ASSOCIATION HAS STAGED PR E E EVENTS THAT SHOWCASE MARCHING BANDS AND EQUESTRIAN UNITS FROM ARO THE WORLD IN ADDITION TO THE TRADITION·AND PAGEANTRY OF ITS MAGNIFICENT FLORAL FLOATS. OVER 700,000 SPECTATORS

LINE THE STREETS OF PASADENA TO VIEW THE PARADE LIVE IN ADDITION TO THE LIVE TELEVISION BROADCAST TO OVER 51 MILLION VIEWERS NATIONWIDE AND

OVER 25.5 MILLION VIEWERS WORLDWIDE IN 220 TERRITORIES. IT.IS THE

INTENT OF THE ASSOCIATION, FOR EDUCATIONAL PURPOSES, TO PROVIDE AN

ENVIRONMENT IN WHICH THE BENEFITS FROM .THE PARTICIPATION AND

CONTRIBUTION OF A SOCIALLY, CULTURALLY DIVERSE MEMBERSHIP, THAT IS

4c (Code: ) (Expenses $ 85 8 , 61 7. Including grants of $ ) (Revenue $ 1, 207 , 67 2. )

OFFICIAL TOUR- THE ASSOCIATION, .IN ITS EFFORTS TO PROMOTE THE CITY OF PASADENA, ITS SURROUNDING COMMUNITIES AND ITS CULTURE, ORGANIZES A TOUR SHOWCASING THE ANNUAL TOURNAMENT OF ROSES PARADE AND ROSE BOWL GAME FOR THOSE LIVING OUTSIDE THE PASADENA AREA WHO WISH TO ATTEND THE

TOURNAMENT EVENTS. THE OFFICIAL TOUR ARRANGES FOR LOCAL ACCOMMODATIONS FOR OUT-OF-AREA AND OUT-OF-STATE VISITORS. EXCURSIONS TO LOCAL AREA

LIBRARIES AND ART MUSEUMS, IN ADDITION TO ATTENDANCE AT TOURNAMENT

EVENTS. THE TOUR PROVIDES A TRULY UNIQUE, ONE-OF-A-KIND EXPERIENCE OF "AMERICA'S NEW YEAR CELEBRATION". IT IS THE INTENT OF THE ASSOCIATION TO PROVIDE AN ENVIRONMENT IN WHICH THE BENEFITS FROM THE PARTICIPATION AND CONTRIBUTION OF A SOCIALLY, CULTURALLY DIVERSE MEMBERSHIP, THAT IS

REPRESENTATIVE OF THE GREATER COMMUNITY, ARE REFLECTED IN IT~. _

4d Other programservices (Descnbe In Schedule 0.) (Expenses $ 2 , 2 61 , 25 8. Including grants of $

)(Revenue s 2, 4 4 8 , 81 0 .

4e Total program service expenses ... $ 97 « 0 6 5 • 2 81.

932002 02..(l4·IO

Form 990 {2009}

THIS IS A COPY OF A LIVE RETURN F1loM SMIPS.

OFFICIAL USE ONLY.

1h?40QOA 7~Qq7~ h7Rh-7

_______ c c • c_.

THIS IS A COPY OF A LIVE RETURN FROM SMIPS.

OFFICIAL USE ONLY.

Form 990 (2009) PASADENA TOURNAMENT OF ROSES ASSOCIATION

95-1725190

Page 3

I Part IV I Checklist of Required Schedules

1 Is the organization described In section 501 (c)(3) or 4947(a)(1) (other than a pnvate foundation)?

If 'Yes," complete Schedule A

:2 Is the orqamzation required to complete Schedule B, Schedule of Contnbutors?

3 Did the orqaruzanon engage In dnect or Indirect pclmcal carnpaiqn actrvmes on behalf of or In opposition to candidates for public office? If 'Yes, ' complete Schedule C, Part I

4 Section 501(c)(3) organizations. Old the organization engage In lobbying activities? If • Yes, • comptete Schedule C, Part 1/

5 Section 501(c)(4), 5(1 1 (c)(5). and 501(c)(6) organizations_ Is the organization subject to the section 6033(e) notice and reporting requirement and proxy tax? If 'Yes,· complete Schedule C, Part J/I

6 Old the orparuzauon rnamtain any donor advised funds or any Similar funds or accounts where donors have the nght to provide advrce on the distnbunon or Investment of amounts In such funds or accounts? If "Yes," complete Schedule D, Part I 7 Old the orgaruzatron receive or hold a conservation easement, Including easements to preserve open space,

the environment. histone land areas, or lustonc structures? If 'Yes,' complete Schedule 0, Part II

8 Old the organization maintain collections of works of art, historical treasures, or other Similar assets? If 'Yes, • complete Schedule 0, Part III

9 Old the organization report an amou nt In Part X, line 21; serve as a custodian for amounts not listed In Part X, or provid e

credit counseling, deb-t management, credit repair, Or debt negotiation services? If "Yes, ' complete SChedule D, Part IV 10 Old the orqamzatron, directly or through a related orgaruzauon. hold assets In term, permanent, or quasi-endowrnants?

If 'Yes, • complete Schedule D, Part V

11 Is the organization's answer to any ofthe following questions "Yes"? If so, complete Schedule D, Parts VI, VII, VlII, IX, or X

as applicable _

• Old the organization report an amount for land, builomqs. and equipment In Part X,line l~YeS," complete Schedule D,

Part VI ()...__ -u

• Old the organlzahon report an amount for Investments - other securrties In Part ~ ~at IS 5%. or more of rts lotal assets reported In Part X, hne 16? If "Yes,' complete Schedule 0, Part VII f -.. - _)

• Old the orqarnzation report an amount for Investments - program related In ~, hne 13 that IS 5% or more of ItS total assets reported In Part X, IIne16? If 'Yes, • complete Schedufe D, PartCiii\.

• Old the organization report an amount for other assets In Part X, II{e.;1.5 ~ IS 5% or more of Its total assets reported In

Part X, hne 16? If 'Yes, • complete Schedule D, Pert tx. ~ 'l)

• Old the organization report an amount for other lIablhtlesf"'\.~line 25? If "res, ' complete Schedule 0, Part X

• Old the organization's separate or consolidated financlal~ments for the tax year Include a footnote that addresses the orqaruzauon's liability for uncertain tax posllion~der FIN 48? If "Yes, • complete Schedule D, Part X

Old the organization obtain separate, Independent auc¥ed tmancsal statements for the tax year? If 'Yes. " complete Schedule 0, Parts XI, XIf, and XIII

12

x

1

x

Yes No

2

3 X

4 X

5 N/ ~

6 X

7 X

8 X

9 X

10 X

11 X r Yesl No

12

x

12A Was the organization Included In consolidated, independent audited fmancial statements for the tax year?

If 'Yes, • completmg Schedule 0, Parts XI, XII, and Xli/IS optIOnal

13 - Is the organization a school described 10 section 170(b)(1)(A)(IQ? If • Yes, • complete Schedule E 143 Old the orqamzabon maintain an office, employees, or agents outside of the Urnted States?

b Did the organization have aggregate revenues or expenses of more than $10,000 from grantmaklng, fundraismq, business. and program service acnvmes outside the United States? If 'Yes, • complete Scheilu/e F, Part J

15 Old the organization report on Part IX, column (A), line 3, more than $5,000 of grants or assistance to any orqarnzanon or entrty located outsrde the United States? If ·Yes. ' complete Schedule F, Part II

16 Did the orqaruzation report on Part IX, column (A), [me 3, more than $5,OOD of aggregate grants or assistance to mdrviduals

located outside the United States? If 'Yes,' complete Schedule F, Part 11/

17 Old the orqaruzatron report a total of more than $15,000 of expenses for professional fund raising services on Part IX,

column (A), hnes 6 and 11 e? If 'Yes, • complete Schedule G, Part I

18 Did the organization report more than $15,000 lotal of fundraismq event gross Income and contnbunons on Part VIII, hnes 1 c and Ba? ff 'Yes, • complete Schedule G, Part /I

19 Old the orqamzanon report more than $15,000 of gross Income from gaming acuvrties on Part VIII, hne 9a? II ·Yes,·

complete Schedule G, Part /If _

20 Old the oroaruzanon operate one or more hosoitals? If 'Yes • comotete Schedule H

13

x

14a

x

14b

x

15

x

16

x

17

x

18

x

19

x

20

x

932003 02·04-10

THIS IS A COPY OF A LIVE RETURN F1!OM SMIPS,

OFFICIAL USE ONLY.

Form 990 (2009)

THIS IS A COpy OF A LIVE RETURN FROM SMIPS.

OFFICIAL USE ONLY.

Form 990 (2009) PASADENA TOURNAMENT OF ROSES ASSOCIATION

95-1725190

Page 4

b Old the organization Invest any proceeds of tax-exempt bonds beyond a temporary penod exception? ...,2",4b=-+-_-+- __

C Old the orqaruzanon maintain an escrow account other than a refunding escrow at any time dunng the year to defease

any tax-exempt bonds? r==2.;.4c=-t----1r--

d Old the orqarnzatron act as an "on behalf of" Issuer for bonds outstanding at any time dunng the year? !-'2.,,4_,_d=-t_---1r-_

25a Section 501(c){3) and 501(c)(4) organizations, Old the orqamzanon engage In an excess benefit transaction with a

I Part IV I Checklistof Required $chedules(contmued)

21 Old the organization report more than $5,000 of grants and other assistance to governments and organizatIons In the United States on Part IX, column tAl, line 1? If ·Yes, " complete Schedule I, Parts I and It

22 Old the orgamzatton report more than $5,000 of grants and other assrstance to mdivrduals In the Unrted States on Part IX, column (Al, Irne 2? If 'Yes, • complete Schedule I, Parts I and 1/1

23 Old the organization answer "Yes' to Part VII, Section A, hna 3, 4, or5 about compensation of the organization's current and former Officers, dnectors, trustees, key employees, and highest compensated employees? If • Yes, • complete Schedule J

248 Did theorgamzation have a tax-exempt bond Issue with an outstanding pnnopal amount of more than $100,000 as of the last day of the year, that was Issued after December 31, 20D2? If • Yes •• answer Imes 24b through 24d and complete Schedule K If 'No', go to Ime 25

disqualified person dunng the year? If • Yes: complete Schedule L, Part I

21 X

22 X

23 X

248

Yes No

x

X

25a

b Is the orqamzanon aware that rt engaged In an excess benetrt transaction WIth a disqualified person In a prior year, and that the transaction has not been reported on any of the orgamzation's pnor Forms 990 or 990·EZ? " 'Yes, " complete

Schedule L, Part I 25b X

2ti Was a loan to or by a current or former officer, director, trustee, key employee, highly compensated employee, or disqualified

person outstanding as of the end of the orparuzatron's tax year? If 'Yes,' complete Schec@\k.. Part 1/ 26 X

27 Did the orqanrzanon provide a grant or other assistance to an officer, director, trustef1t!' '"iaJloyee, substantial contributor, or a grant selection comrruttee member, or to a person related to .s3.~ldUal? If 'Yes, • complete

Schedule L, Part fII 27 X

28 Was the organization a party to a busmess transacnon wrth one of the fOIlO~ ies, (see Schedul~ L, Part IV

instructions for applicable filing thresholds, conomons, and exceptlon~ .

a A current or former officer, director, trustee, or key employee? If '{e~ ~Iete Schedule L, Part IV

b A family member of a current or former officer, director, trust~ ~mployee? If 'Yes, • compiete Schedule L, Part IV

c An entrty of which a current or former officer, duector. t~te~ey employee of the orqamzanon (or a family member) was an officer, director, trustee, or direct or mdirect owner? ')'1 " complete SChedule L, Part IV

29 Old the organization receive mora than $25,000 In ~cas ontnbunons? If 'Yes,' complete Schedule M

30 Did the orqamzahon receive contnbuuons of art, hlsto~1 treasures, Or other smutar assets, or qualified conservation contnbutrons? If 'Yes, • complete Schedule M

31 Did the orgamzanon hquidate, terminate, or dissolve and cease operations?

If 'Yes, ' complete Schedule N, Part I

32 Did the orgamzatron sell, exchange, dispose of, or transfer more than 25% of rts net assetS? If 'Yes, ' complete SChedule N, Part II

33 Old the crqaruzatron own 100"/0 of an .entlty disregarded as separate from the organization under Regulations sections 301 7701·2 and 301.7701,3? If • Yes, • complete Schedule R, Part I

34 Was the orgamzation related to any tax-exempt or taxable entJty?

If 'Yes, • complete Schedule R, Parts fI, III, IV, and V, fine 1

35 Is any related orqaruzauon a controlled entity Within the meamng of section 512(b}(13)?

If 'Yes, • complete Schedule R, Part V, hne 2

36 Section 501(c){3) organizations. Old the orgamzahon make any transfers to an exempt non-chantabla related orqaruzanon?

If 'Yes, • complete Schedule R, Part V, Ime 2 .,", c.c.

37 Did the orqaruzauon conduct more than 5% of ns activmes through an entrty that IS not a related orqamzanon and that is treated as a partnership for federal mcorne tax purposes? If 'Yes, • complete Schedule R, Part VI

as Did the orgamzatJon complete Schedule 0 and p rovid e explanatIOns In Schedule 0 for Part VI; lines 11 and 19?

Note. All Form 990 filers are renuired to complete Schedule O. .. ..

28a X

28b X

28c X

29 X

30 X

31 X

32 X

33 X

34 X

35 X

36 X

37 X

38 X

Form 990 (2009) 932004 02·04-10

16240908 75997)lI~nr6~7COPY OF Azmyg:.MifW d~KSTOa.RN~UO~ W~E: 6786-7 1

THIS IS A COPY OF A LIVE RETURN FROM SMIPS.

OFFICIAL USE ONLY.

Statements Regarding other IRS Filings and Tax Compliance

95-1725190

Pa -s

- 1a Enter the number reported In Box 3 of Form 1096, Annual Summary and Transmittal of US lntormation Returns Enter -0- rf not applicable

b Enter the number of Forms W-2G Included in hne 1 a Enter -0- If not applicable

1b

1a

c Old the organization comply With backup Withholding rules for reportable payments to vendors and reportable gaming

(gambling) wmrnnqs to pnze winners?

2a Enter the number of employees reported on Form W-3, Transmittal of Wage and Tax Statements, filed for the calendar year ending With or within the year covered by trus return

b It at least one IS reported on hne 2a, did theorqaruzatron file all required federal employment lax returns?

Note_It the sum of hnes ta and 2a IS greater than 250, you may be required to e-flle this return (see Instructions)

3a Did the organization have unrelated busmsss gross Income of $1,000 or more dunng the year covered by trus return? b If "Yes," has It flied a Form 990T forth IS year? If "No, • prOVide an explanatIOn In Schedule 0

4a At any time dunng the calendar year. did the organization have an Interest In, or a signature or other authorrty over. a financial account In a foreign country (such as a bank account, secunties account. or other financial account)?

b If "Yes," enter the name of the foreign country ...

-----------------------------------------------------

See the Instructions for exceptions and fihng requirements for Form TO F 90-22 1, Report of Foreign Bank and

Financial Accounts

5a Was the organization a party to a prohibrted tax shelter transaction at any time dUring the tax year?

b Old any taxable party notify the organization that It was or IS a party to a prohibrted tax shelter transaction?

c If "Yes," to line 5a or 5b, did the orqamzanon file Form 8886·T, Disclosure by Tax-Exempt Entity Regarding Prohibited Tax Shelter Transaction?

6a Does the organization have annual gross receipts that are normally greater than $100.0~d did the organization sohcrt

any corrtnbunons thai were not tax deductible? ()_ -u

b If "Y. as," did the organrzatlon Include With every sohcitanon an express stateme~~h contnbutions or gifts

were nol tax deductible? ( _..J

7 Organizations that may receive deductible contributions under section~c).

<I Old the organization receive a payment In excess of $75 made partly ~ontnbutlon and partly for goods and services

provided to the payor? (-__' _

b If "Yes," did the orqanrzatron notify the donor of the value Of~~ or services provided?

c Did the organization sell, exchange, or otherwise dISPO~ ~re personal property for which It was required

to file Form 8282? '-.)

d If "Yes, ,. Indicate the number of Forms 8282 flied cfu'lx,g the year 1,-,-,.7-=d:....-,- 1 -1

e Did the organization, dunng the year, receive any fun£dlrectly or Indirectly, to pay premiums on a personal

benefit contract?

f Old the orqamzatron, dunnq the year, pay prermums, directly or Indirectly. on a personal benefrt contract? 9 For all contnbutrons of qualified Intellectual property. did the organization file Form 8899 as reqUIred?

Yes No

85

0

1c X

44

2b X

3a X

3b

4a X Sa

x

5b

x

5c

6a

x

6b

7a

x

7b

7c

x

7e

X

7f

x

79

h For contnbunons of cars, boats, airplanes, and other vehicles, dId the orqaruzanon file a Form 1098-C as rsquired? r7,-,h~I-_+ __

8 Sponsoring organizations maintaining donor advised funds and section 509{a)(3) supporting organizations. DId the

supportmq orgamzahon, or a donor advised fund rnamtamed by a sponsonng orqamzation, have excess business holdings

at any time dunng the year? _n. __ N / ~ 1--'8"'---1f------1f----

9

Sponsoring organizations maintaining donor advised funds.

a Did the organization make any taxable distnbutions under section 49667

b Old the organization make a distnbution to a donor, donor advisor, or related person?

Section 501(c){7) organizations. Enter.

N/A N/A

10

1 lOa I

<I lnmatron fees and capital contributions Included on Part VIII, line 12

N/A

b Gross receipts, Included on Form 990, Part VlII,hne 12, for pubhc use of club faCilities 11 Section 501(c)(12) organizations. Enler:

lOb

a Gross Income from members or shareholders __

N/A

11a

b Gross Income from other sources (Do not net amounts due or paid to other sources against

amounts due or received from them.) __ L_'1~1b'-__< -l

123 Section 4947Ia)(1) non-exempt charitable trusts. Is the organization filing Form 990 In lieu of Form 1041?

b If "Yes • enter the amount of tax-exempt Interest received or accrued dunnq the year 112b I

9a

9b

120

g32005 02-04-10

Form 990 (2009)

THIS IS A COpy OF A LIVE RETURN FROM SHIPS. OFFICIAL USE ONLY.

1h?dOqOA 7~qq7~ h7A~-7 ?OOQ ndO?n paQ~n~M~ ~nTmM~M~M~ n~ Dn~~ ~7a~~7 1

THIS IS A COPY OF A LIVE RETURN FROM SMIPS.

OFFICIAL USE ONLY.

Form 990 (2009 PASADENA TOURNAMENT OF ROSES ASSOCIATION 95~1725190 Pa e6

Part VI Governance, Management, and Disclosure For each "Yes· response to Imes 2 through 7b below, and for a "No" response

to kne 8a, 8b, Of 1 Db below, descnbe the circumstances, processes, Of changes In Schedule O. See mstrucuons

Section A Governing Body and Management

1a Enter the number of voting members of the governing body b Enter the number of voting members that are Independent

I 1b I

2 Did any officer, director. trustee, or key employee have a family relationship or a business relationship with any other officer, director, trustee, Of key employee?

3 Old the organization delegate control over management duties customanly performed by or under the direct supervision

of officers, dtrectors or trustees, or key employees to a management company or other person?

4 Old the organization make any slgmficant changes to Its organizational documents since the prior Form 990 was filed? 5 Old the organization become aware dunnq the year of a matenal drversion of the organization's assets?

6 Does the orqamzanon have members or stockholders?

7a Does the organization have members, stockholders, or other persons who may elect one or more members of the governrng body?

. b Are any decisions of the governing body subject to approval by members, stockholders, or other persons?

8 Old the orqaruzation contemporaneously document the meetings held or wntten actrons undertaken dunng the year by the followrng

a The governrng body?

b Each committee With authonty to act on behalf of the governIng body?

9 Is there any officer, director, trustee, or key employee listed In Part VII, Section A, who cannot be reached at the orqaruzanon's rnaihnq address? If 'Yes • proVide the names and addresses In Schedule 0

Yes No

55

55

2 X

3 X

4 X

5 X

6 X

7a X

7b X

Sa X

8b X

9 X

Yes No

10a X

lOb

11 X

128 X

l2b X

12c X

13 X

14 X

153 X

15b X

16a X

16b Section B. Po licies (ThIS Section B requests mtotmetsor: about poliCies not reqUired by thfiatemal Revenue Gode )

lOa Does the organization have local chapters, branches, or affiliates? n..... C() V

b If 'Yes," does the organrzatlon have wntten concies and procedures governr~he_,.trvrtles of such chapters, affiliates,

and branches to ensure their operations are consistent With those of the or~tlon? .

11 Has the orqarnzatron provrded a copy of thrs Form 990 to all members~· governtng body before filing the form?

11A Descnbe In Schedule 0 the process, If any, used by the organlzat6'!J..4> ~ew ttus Form 990

123 Does the orqarnzatron have a wntten conflict of Interest pOhc("'\ ~ go to tme 13

b Are officers, drrectors or trustees, and key employees re~~):"sclose annually Interests that could give nse

·to conflicts? '->

e Does the organization regu·larly and consistently m~or and enforce cornpnance wnn the policy? If ·Yes, • descnbe

In Schedule 0 how thIS IS done . Y

13 Does the orqaruzation have a wntten whistle blower polrcy?

14 Does the orqaruzanon have a wntten document retention and destruction pohcy?

15 Did the process for determining compensation of the follOWing persons Include a review and approval by Independent persons, comparabllrty data, and contemporaneous substantration of the deliberation and decrsron?

a The orqaruzatron's GEO, Executive DIrector, or top management official

b Other officers or key employees of the orqarnzatton

If 'Yes" to line 15a or 15b, descnbe the process In Schedule 0, (See Instructions)

16a Old the organization Invest in, contribute assets 10, or particrpate In a JOint venture or Similar arrangement wrth a taxable entrty dunng the year?

b If "Yes," has the crqaruzanon adopted a wntten policy or procedure reqUlnng the organlzatron to evaluate Its parncipanon rn jOint venture arrangements under applicable federal tax law, and taken steps to safeguard the orqaneanon's

exelllp.t status wrth respect to such arrangements?

Section C. Disclosure

17 Ust the states wrth which a copy of trns Form 990 IS required to be filed ~.!:C==A~ ___;

18 Section 6104 requires an organization to make Its Forms 1023 (or 1024 If applicable). 990, and 99(H (501(c)(3)s only) available for

pubhc Inspection Indicate how you make these available Check all that apply

o Ow~ websrte 00 Another's website [XJ Upon request

19 Descnbe In Schedule ° whether (and If so, how), the organization makes Its governing documents, conflict of Interest POliCY, and flnancial statements available to the public

20 State the name, physical address, and telephone number of the person who possesses the books and records of the organrzatlOn: ~ ~

P. SCOTT MCKIBBEN, EXECUTIVE DIRECTOR ~ 626-449-4100

391 SOUTH ORANGE GROVE BLVD. PASADENA, CA 91184

Form 990 (2009)

THIS IS A COPY OF A LIVE RETURN ~M SMIPS. OFFICIAL USE ONLY.

1 f\?4nQOR 7"QQ7~ h'7R;;'~7 .,onQ n4n·.,n t:lhQlLn~Nll 'l'f'lTmNllMRl>J''l' ("1'1;' Pf'lC:::W F;'7P.';'~'7 1

THIS IS A COPY OF A LIVE RETURN FROM SMIPS. OFFICIAL USE ONLY.

f;>art VII Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors

Pa e 7

Form 990 (2009 PASADENA TOURNAMENT OF ROSES ASSOCIATION 95-1725190

Section A: Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

1a Complete this table for all persons required to be hsted Report compensation for the calendar year ending With or Within the orqaruzanon's tax year Use Schedule J 2 If additional space IS needed

- list all of the orgamzanon's current officers, directors, trustees (whether mdrvrduals or organrzatlons), regardless of amount of compensation Enter·(} In columns (0), (E), and (F) If no compensation was paid

- list all of the organization's current key employees See instructions for definrtron of "key employee."

-List the orgamzallon's five current h!ghest compensated employees (other than an officer, director, trustee, or key employee) who received reportable

cormensanon (Box 5 of Form W·'l and/or Box 7 of Form 1099·MISC) of more than $100,000 from the organization and any related oruanzanons

- list all ofthe oroamzanon's former officers, key employees, and highest compensated employees who received more than $100,000 of reportable compensation from the orqaruzation and any related organizations.

- List all of the orqarnzauon's former directors or trustees that received, In the capacity as a former director or trustee ot the organization, more than $10;000 of reportable compensation from the organization and any related organizations.

list persons In the follOWing order mdividual trustees or directors; Institutional trustees, officers, key employees, highest compensated employees, and former such persons

Oeh k h b f h dd I ffi d

ec I IS ox J t e organization I no compensate any curren 0 Icer, irector, or trus ee.

(A) (B) (e) (0) (E) {F}

Name and Tille Average Position Reportable Reportable Estimated

hours (check all that apply) compensation compensation amount of

per ~ from from related other

week the organizations compensation

'i5 ~

0 ~ I organization (W·2J1099·MISC) from the

! I: f:N-2I1099-M1SC) organization

S ]! ~ E

1:i ~ t ~~ n.C6 and related

i ~ ~Q § organizations

~ 5' s-~

co :I:_ s:

JEFFREY THROOP ,. I ~U

PRESIDENT X X O. O. O.

RICHARD JACKSON \~ J -:

EXECUTIVE VICE PRESIDENT X x r o. o. O.

SALLY M. BIXBY .~ D' J

TREASURER X .......... O. O. O.

R. SCOTT JENKINS ('} ~ )

SECRETARY X O. O. O.

RICHARD L. CHINEN ''> -

EXECUTIVE COMMITTEE VP X x O. O. O.

IRA C. MATTHIES SEN III

EXECUTIVE COMMITTEE VP X x O. O. O.

BRAD RATLIFF

EXECUTIVE COMMITTEE VP X x O. O. O.

LANCE M. TIBBET

EXECUTIVE COMMITTEE VP X x O. O. O.

RONALD H. CONZONIRE

EXECUTIVE COMMITTEE PAST X X o • O. O.

ERNESTO CARDENAS

EXECUTIVE COMMITTEE X o. O. O.

KAREN JONG

EXECUTIVE COMMITTEE X o. O. o.

AMIT R. PATEL

EXECUTIVE COMMITTEE X o. O. O.

KATHRYN PERINI

EXECUTIVE COMMITTEE X O. O. O.

CRAIG WASHINGTON

EXECUTIVE COMMITTEE X O. O. o.

CYNTHIA AMERIO

EXECUTIVE COMMITTEE X O. O. o.

JOCELYN MANILAY~YAN

EXECUTIVE COMMITTEE X O. O. O.

DENNIS WONG

EXECUTIVE COMMITTEE X O. O. O. ~32007 02-04-10 Fonn 990 (2009)

THIS IS A COPY OF A LIVE RETURN FJOM SMIPS. OFFICIAL USE ONLY.

THIS IS A COPY OF A LIVE RETURN FROM SMIPS. OFFICIAL USE ONLY.

Form 990 (2009) PASADENA TOURNAMENT OF ROSES ASSOCIATION 95-1725190 PageS

I Part VIII Section A. Officers Directors Trustees Kev Emolovees and H'Qhest Compensated Emolo ees (contmued)

IA) (8) (C) ID) (E) (F)

Name and trtle Average Posrnon Reportable Reportable Estimated

, hours (check all that apply) compensation compensation amount of

per B from from related other

week ~ the organizations compensation

'<i

Q i I organization 0/'I2/1099-MISe} from the

! (W-2/1099-MISC) orgaruzation

~ ~ E

jjj -2 e~ and related

~ 1,; ~ ~~ E orparnzanons

~ ~ g ~a

'" "''' of:

"'~

JOHN M DORGER

CEO 40.00 X 254.718. O. 27.477.

WILLIAM B FLINN

COO 40.00 X 142 180. O. 13.972.

KEVIN ASH

CAO - ROSE BOWL GAME 40.00 X 188 793. o. 25,917.

JEFFREY J ALLEN

CFO 40.00 X 133 658. O. 14 143.

P. SCOTT MCKIBBEN

EXECUTIVE DIRECTOR 40.00 X 34 672. O. O.

AMY WISCHNIA

DIR OF GAME. OPS 40.00 X 153 810. O. 19.766.

GINA CHAPPIN rLiG

DIRECTOR-MEDIA ROSE BOWL 40.00 X 655. O. 16,690.

EDWARD M AFSHARIAN r p,lJ

DIRECTOR X /' O. O. O.

ALEX AGHAJANIAN ~~ D I ....

DIRECTOR X (" o . O. O.

STACY AMAR-HOUSER ICc )' f.J

DIRECTOR X <, o . o. O •

1b Total ......... \. ~ 1 046 486. o. 117.965.

2 Total number of mdlv;duals (Inctu~lng but not hrnned to ~frs~ed above) who received more than $100,000 In reportable 6

3 DId Ihe. organization hst any former officer, director or trustee, key employee, or highest compensated employee on line 1 a? If Tes, • complete Schedule J for such indIVIdual

4 For any individual listed on hne 1 a, IS the sum of reportable compensation and other compensation from the organization and related organizations greater than $150,00D? If ·Yes,· complete Schedule J for such mdlvldual

5 Did any person nsred on line 1 a receive or accrue compensation from any Unrelated orqaruzanon for services rendered to the or amzanon? If 'Yes • com lete Schedule J for such arson

3

x

Yes No

x

4 X

5

Section B. Independent Contractors

1 Complete this table for your five highest compensated JOdependent contractors that received more than $1 00,000 of compensation from

the orqarnzanon.

(A) {B} (C)

Name and business address Descnpnon of services Compensation

ROSE BOWL OPERATING CO. IUICENSE FEES. TICKET

117 E. COLORADO BLVD. PASADENA. CA 91105 TAXES SUITES RENTA 1 783,825.

CITY OF PASADENA ~ICENSEFEES FOR

100 N GARFIELD AVE PASADENA CA 91109 ~OFR SITES 1 290.499.

CONTEMPORARY SERVICES CORPORATION !PARKING, SECURITY,

17101 SUPERIOR ST. NORTHRIDGE CA 91325 ~ CROWD MANAGEMENT 1 024,379.

SITELINE PRODUCTIONS INC. ~BG

3366 VIA LIDO NEWPORT BEACH CA 92663 DESIGN/COORDINATION 671,511.

GOLD COAST TOURS PARTICIPATING TEAMS

1613 CHELSEA ROAD SAN MARINO. CA 91108 IT-RANSPORTATION 657 380.

2 Total number of Independent contractors (Indudlng but not limited to those listed above) who received more than

$100 000 In comoensauon from the ornaruzatron .... 24 SEE SCHEDULE J-2 FOR PART VII, SECTION A CONTINUATION

Form 990 (2009)

932008: 02-04- 10

THIS IS A COPY OF A LIVE RETURN F&oM SMIPS. OFFICIAL USE ONLY_

- _ .. --- - ---~-

THIS IS A COPY OF A LIVE RETURN FROM SMIPS. OFFICIAL USE ONLY.

Form 990 (20D9) PASADENA TOURNAMENT OF ROSES ASSOCIATION 95-1725190 Page 9

I Part VIII I Statement of Revenue

-

, (A) (S) (e) (0)

Total revenue Relatedor Unrelated Revenue

excluded from

. exempt function business tax under

revenue revenue sections 512.

513,or514

OJ", 1 a Federated campaigns 1a

......

Cc 64 680.

111:1 b Membership dues 1b

"'0

~E c Fundralslng events 1c

~III

._ .. d Related orgamzatrons 1d

tn~

c6"-e e Government grants (contributions) 1e 34.500.

1:0-

0'" f All other contnbunons, giftS, grants. and

~+= ~

_5.s: sirnrlar amounts not Included above 1.

'j;o Nerrcasx conmbutrons Included In lines 1a-1t S

1:" 9

01: .... 99 180.

0111 h Total, Add hnes 1a-1f

BUSIness Code

41 2a NATIONAL CHAMPIONSHIP 711210 54169326. 54169326.

0

's b ROSE BOWL GAME 711210 43702107. 43702107.

'-ill

41;:, c SPONSORSHIP 900099 2.385 186.2 385.186.

Cl)c

E~ d COMMITTEES - TICKETS 900099 2.013.019.2 013 019.

III ill

~ e LICENSING REVENUE 900099 1.358.725.1 358 725.

0

~ f All other program service revenue 561520 4.007.788.4 007 788.

o Total, Add hnas 2a-2f ..... 107636151.

3 Investment Income (Including dividends, Interest, and Fa

other SImilar amounts) ... 27.4M\_ 27 403 •

4 Income from Investment of tax-exempt bond proceeds ... r"\ l If

5 Royalties ..... r ..,

-m Real (In Personal \G-

6a Gross Rents D\J

b Less rental expenses (

c Rental Income or (loss) r--..'l

d Net rental Income or (loss) -.. \..

7 a Gross amount from sales of (i) Secunbes 'N)d!her

assets other than Inventory r t\. ""

b less cost or other baSIS r

and sales expenses

c Gain or (Joss)

d Net gain or (loss) ...

CII 8a Gross Income from fund raisIng events (not

::;, Including $ of

c::

CII

> contnbunons reported on line 1 c) See

CII

c: Part IV, hne 18

._ a

CII

.s: b Less direct expenses b

s

c Net Income or (loss) from tundra Ising events ...

9a Gross Income from gaming activities See

Part IV, hne 1 9 a

b t.ess direct expenses b

c Net income or (loss) from gaming acuvmes ....

10 a Gross sales of Inventory. less returns

and allowances a 18.531.

b Less- cost of goods sold b 22.·052.

c Net Income or floss) from sales of Inventory lit> <3 521.b- <3 521.t:>

Miscellaneous Revenue BUSIness Code

11 a

b

c

d AU other revenue _.

e Total. Add lines 11 a-11d .....

12 Total revenue. See mstrucnons, ... 107759213. 107632630 . o. 27 403. ~~~~1D Form 990 (2009)

THIS IS A COPY OF A LIVE RETURN FttoM SMIPS. OFFICIAL USE ONLY.

?flnQ nAO?n 'D2I.C!lI.TYI ....... T2I. 'T'r'ITna.T2I.Mt:;'1I.T'I' {"It;' D{"IC't;' &:'''7Q&:._''7 1

THIS IS A COPY OF A LIVE RETURN FROM SMIPS. OFFICIAL USE ONLY.

95 -1 72519 0 Pa e 10

, ,

Do not include amounts reported on lines 6b, (A) (8) Ic) JD)

7b, 8b, 9b, and 10b of Part VIII. Total expenses Program service Management and Fun ralsmg

expenses qeneralexpenses expenses

1 Grants and other assrstance to governments and

orqaruzanons In the U.S. See Part IV, hne 21 44 640. 44,640.

2 Grants and other assistance to individuals In

the U.S See Part IV. line 22 17 500. 17 500.

3 Grants and other assistance to govemments,

organizations, and Individuals outside the U S

See Part IV, lines 15 and 16

4 Benefits paid to or for members

5 Compensation of current officers, directors,

trustees, and key employees 648 390. 648 390.

6 Compensation nol mdud ad above, to dlsQuahfle d

persons (as defmed under section 4958(f)(1)) and

persons described In section 4958(C)[3)(B)

7 Other salaries and wages 2 423 492. 886 684. 1 536 808.

8 Pension plan comnbunons (Include section 401(k)

and section 403(b) employer contnounons) 120 506. 60 862. 59 644.

9 Other employee benefits 20 937. 10 574. 10 363.

10 Payroll taxes 188 851. 95 @.Q. 93 471.

11 Fees for services (non-employees)' /""\COU

a Management

b Legal 159 726. / 5)9 812. 99 914.

c Accounnnq 36 000. \.r) '13 800. 22 200.

d t.obbymq l r\--

e Protessronal fundraismq services. See Part IV, line 17 (_ f-I

f Investment management fees r-; '\...J

9 Other Nk }78. 27 278.

12 Advertismq and promotion \Q1'6 274. 515 274.

13 Office expenses ''\. 5~4 446. 554 446.

14 Information technology r 35 949. 35 949.

15 Royalties

16 Occupancy. 575 045. 515 036. 60 009.

H Travel 1 311 060. 1 311 060.

18 Payments of travel or entertainment expenses

for any federal, state, or local public offlcials

19 Conferences, conventions, and meetings 103 493. 103 493.

20 Interest 220 369. 220 369.

21 Payments to affiliates

22 Depreciatron, depletion, and arnortzation 467 367. 291 544. 175 823.

23 Insurance 905 389. 406 834. 498 555.

24 Other expenses. Itemize expenses no! covered

above. [Expenses grouped together and labeled

miscellaneous may not exceed 5% 01 total

expenses shown on Ime 25 below.)

a CONFERENCE DISTRIBUTION 70.770 615. 70 770 615.

b OTHER OUTSIDE SERVICES 6 518 879. 6 518 879.

c EQUIPMENT RENTAL & MAIN 3,681 139. 3 552 849. 128 290.

d FOOD SERVICES 2,770 699. 2 770 699.

B CAPITAL IMPROVEMENTS GA 2 000 000. 2 000 000.

f All other expenses 6 497 937. 5 889 632. 608 305.

25 Total lunctional exoenses. Add lmes 1 throuoh 241 100 614 98l. 97 065 28l. 3 549 700. O.

26 Join! costs. Check here .... D Jffollowmg

SOP 98-2. Complete ttns line only If the oruaneanon

reported mcolumn (B) lomt costs from a combined

educational camnaion and tundraismo sohenanon Section 50 1 (c}(3) and 501(c}(4) orqanizations must complete all columns.

All other organizations must complete cotumn (A) but are not required to complete columns (8) (e) and (0)

93201O 02-04-10 Form 990 (2009)

THIS IS A COPY OF A LIVE RETURN Flt<&l SMIPS. OFFICIAL USE ONLY.

THIS IS A COPY OF A LIVE RETURN FROM SMIPS. OFFICIAL USE ONLY.

Form 990 (2009) PASADENA TOURNAMENT OF ROSES ASSOCIATION

9 5 -1 72519 0 Page 11

jPart X I Balance Sheet

(A) Beginning of year

3

24 499 471.

600798.1

4 311 025. 2

{Bl End of year

l' Cash - non-mterest-beannq

2 Savings and temporary cash Investments 3 Pledges and grants receivable, net

4 Accounts receivable, net

5 Receivables from current and former officers, directors, trustees, key

employees, and highest compensated employees Complete Part II

of Schedule L 6 Receivables from other disqualified persons (as defined under section

49S8(f){1}} and persons described In section 4958(c}(3)(8} Complete

Part II of Schedule L

7 Notes and loans receivable, net

8 Inventones for sale or use

9 Prepaid expenses and deferred charges 10a Land, buildmqs, and equipment cost or other

baSIS Complete Part VI of Schedule 0 ~10a=-1--_;1~8:..L.:8=4:..::3~~2~8~O~.

b Less accumulated depreciation L.!!10~bc..t.__.:.5~9::o._::4-=1:__r_:_8::_3=1_".+-_1=3~3~4~4...L;:3:..:3~4~. ~10~c,-+-~1~2~'L:9~0~1:.L4=-=4:!.9~.

11 Investments - publicly traded secunties 11 825 213.

12 Investments - other secunnes See Part IV, hne 11 12

13 Investments - program-related See Part IV, line 11 13

6 035,234.

3,156 416.

484 129. 4

992 829.

5

6

7

291 084. 8

519 962. 9

262 841.

277 574.

14 15 16

Intangible assets _ (J.... 14

Other assets_ See Part IV, line 11 . (rt U 3 . 500. 15

Total assets. Add lines 1 throuqh 15 (must equal hne 34) /""\ ~ J 19 554 832. 16

47 915. 24 499 471.

Accounts payable and accrued expenses ( -.. 'J. 9 9 7 0 3 9. 17

Grants payable 'l) 18

Deferred revenue <::J - 6 4 7 • 2 5 O. 19

Tax-exempt bond habilmes ( _' 20

Escrow or custodial account liability Complete Part IV ~~e 0 21

Payables to current and former officers, dlrector5,~~ey employees,

highest compensated employees, and dlsqua1tfle~ns Complete Part II

of Schedule L " . 22

Secured mortgages and notes payable to unrela~ third parties 4 4 0 0 0 0 O. 23

17 18 19 20 21 22

23

24 Unsecured notes and loans payable to unrelated third parties

25 Other habsrnes Complete Part X of Schedule D

26 Total liabilities. Add hnes 17 tnrouon 25

24

1 725 013.

464 679.

1491899.25

7 536 188. 26

3 146 804.

5 336 496.

Organizations that follow SFAS 117, check here..... [XJ and complete lines 27 through 29, and lines 33 and 34.

Unrestricted net assets Temporanly restncted net assets

27 28 29

Permanently restncted nel assets

Organizations that do not follow SF AS 117. check here ..... 0 ~~~

:s complete lines 30 through 34_

932011 02-04-10

Caprtal stock or trust pnncipal, or current funds

30 31 32 33 34

Paid-in or capita! surplus, or land, bUilding. or equipment fund Retained earnings, endowment, accumulated Income, or other funds Total net assets or fund balances

Tolal liabilities and net assets/fund balances

12.018 644. 27

19,162 975.

28

29

30

31

32

12 018 644. 33

19 162 975.

19 554 832. 34

Form 990 (2009)

THIS IS A COPY OF A LIVE RETURN F~~ SMIPS. OFFICIAL USE ONLY.

THIS IS A COPY. OF A LIVE RETURN FROM SMIPS.

OFFICIAL USE ONLY.

Form 990 (2009) PASADENA TOURNAMENT OF ROSES ASSOCIATION 95-1725190 Page 12

I Part XII Financial Statements and Reporting

. Yes No

1 Accounting method used to prepare the Form 990 DCash [XJ Accrual D Other

If the organization changed Its method of accounting from a prior year or checked "Other." explam In Schedule O.

2a Were the organization's financral statements compiled or reviewed by an Independent accountant? 2a X

b Were the organization's financial statements audited by an Independent accountant? 2b X

c If "Yes" to hne 2a or 2b, does the orqaruzaticn have a committee that assumes responsibility for oversight of the audrt,

review, or compilation of rts fmancral statements and selection of an Independent accountant? 2c X

If the organization changed erther Its oversight process or selecnon process dunng the tax year, explain In Schedule O.

d If "Yes" to line 2a or 2b, check a box below to indicate whether the financial statements for the year were Issued on a

consohdated baSIS, separate baSIS, or both'

D Separate baSIS [Xl Consolidated baSIS D Both consolidated and separate baSIS

3a As a result of a federal award, was the organization required to undergo an audrt or audits as set forth In the Single Audit

Act and OMS Circular A·133? 3a X

b If "Yes," did the orqamzanon undergo the requred audit or audits? 11 the organization did not undergo the requtred audit

or audits explain why In Schedule 0 and descnbe any steps taken to underao such audits 3b Form 990 (2009)

g32012 02.04-10

THIS IS A COPY OF A LIVE RETURN FaaM SMIPS.

OFFICIAL USE ONLY.

') n nonA n') n D l\. C' lI. T\lO" .... tll. <T!f"ITTO ... tbll,n;· ... TITI f"I'C' l:)f'\CO'C' Cry 0 c _., 1

THIS IS A COPY OF A LIVE RETURN FROM SMIPS.

OFFICIAL USE ONLY.

SCHEDULE A (Form 990 or 99O·EZ)

OMB t.Jo 1545-0047

Public Charity Status and Public Support

Open to Public Inspection

2009

Department of the- Treasury ~ntES'nal Rev~ue Service

Complete if the organization is a section 501 (c)(3) organization or a section 4947(a)(1) nonexempt charitable trust.

.... Attach to Form 990 or Form 99O·EZ ..... See separate instructions.

Name of the organization

Employer identification number

PASADENA TOURNAMENT OF ROSES ASSOCIATION

95-1725190

Reason for Public Charity StatuS(A11 orgarnzatsons must complete this part) See Instructions

The orqaruzanon 15 not a private foundation because It 15_ (For hnes 1 through 11, check only one box)

1. 0 A church, convention of churches, or association of churches descnbed In section 170{b)[1)(A)(i).

2 0 A school descnbed In section 170(b)(1)(A)(ii). (Attach Schedule E) .

3 0 A hospital or a cooperative hospital service orpamzanon descnbed In Section 170(b)(1)(A)(iUl_

4 0 A medical research organization operated In conjunction WIth a hosprtal descnbed fnsection170(b}(1)(A)(iii)_ Enter the hospital's name,

60 7 D

sO 9 [Xl

City, and state ~ _

An orqanzatron operated for the benefit of a college or uruversity owned or operated by a governmental unit descnbed In

section 170Ih){1)(A}(iv). (Complete Part II)

A federal, state, or local government orgovemmental unit dsscnbad In section 17O(b)(l){A){v)_

An organization that normally receives a substantral part of Its support from a governmental unn or from the general public descnbed In section 17O{b)(1){A)(vi). (Complete Part II )

A community trust described In section 170(b)(1)(A)(vi). (Complete Part II)

5 D

eO

An organization that normally receives. (1) more than 33 1/3% of Its support from contnbutrons, membership fees, and gross receipts from activities related to ItS exempt functions - subject to certain exceptions, and (2) no more than 331/3% of Its support from gross Investment Income and unrelated business taxable Income (less section 511 tax) from busmesses acnuired by the organization after June 3D, 1975

See section 509(a)l2)_ (Complete Part 111 ) 0....

An orparuzanon organized and operated eXClUSIVely to test for pubhc safety S~"JeJ509{aIl4).

An organization organized and operated exclusively for the benefit of, to p~ ~funCtionS of, or to carry out the purposes of one or more publicly supported orqamzanons descnbed In section 509(a)(1) '(::.:.ctl~09(a)(2) See section 509(a)(3). Check the box that descnbes the type of supporting orgamzahon and complete hnes~e ~h 11 h

a D Type I b D Type II c ~ e I - Functionally Integrated d D Type 111- Other

By checking this box, I certify that the organization IS not co rectlv or mdlrectly by one or more d Isquahfled persons other than

foundation managers and other than one or more publi~p ad organizations descnbed In section 509(a)(1) or section 509(a)(2}.

If the organization reo ceived a wntten determlnatlon~~RS that It IS a Type I, Type II, or Type !II

supporting orqaruzanon, check trus box '-' .

Since August 17, 2006. has the organization ~Dted any gift or contnbution from any of the follOWing persons?

(i) A person who directly or Indirectly contr;I~~ ~er alone or together with persons descnbed In (tij and (II~ below,

D

10 D 11 D

9

Yes No

the governing body of the supported oroarnzanon? (ii) A family member of a person descnbed In (ij above?

{iii} A 35% controlled entity of a person descnbed m {ij or (Iij above? Provide the follOWing information about the supported orqamzanonts).

11

11

h

(i) Name of supported (ii) EIN (iii) Type of IV) Is the organeanon (v) Old you notlly Ihe (vi) Is the (VII) Amount of

ot(Ja mzation n col. (i) listed In your organIZation In cot organization In col.

organization (described on hnes 1-9 (I) organrzed In the support

above Or IRe section govermng document? ti) of your support? US?

(see lnstruetionsj) Yes No Yes No Yes No

Total LHA For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 990 or 99O-EZ_

Schedule A (Fonm 990 or 99O--EZ) 2009

9321121 02-118-10

THIS IS A COPY OF A LIVE RETURN FaQN SMIPS.

OFFICIAL USE ONLY.

THIS IS A COPY OF A LIVE RETURN FROM SMIPS.

OFFICIAL USE ONLY.

Fonn 990 or 99D- 2009

Pa e z

Support Schedule for Organizations Described in Sections 170{b)(1)(A)(iv) and 170(b)(1)(A)(vi) (Cpmplele only If you checked the box on line 5, 7, or 8 of Part I.)

Section A Public Support

- .

Calendar year (or fiscal year beginning In)~ (a) 2005 Ibi 2006 Ie} 2007 Id\ 2008 Ie} 2009 If} Total

1 Grfts, grants, contnbuttcns, and

membership fees received (Do not

Include any "unusual grants.")

2 Tax revenues levied for the organ·

izanon's benefrt and erther paid to

or expended on Its behalf

3 The value of services or facilities

furnished by a governmental Unit to

the orqanaanon wrthout charge

4 Total. Add hnes 1 through 3

5 The portion of total contributions

by each person (other than a

governmental Unit or publicly

supported organization) Included

on hne 1 that exceeds 2% of the

amount shown on hne 11,

column (f)

6 PubliC SUODort. Sublraci line S ~om nne 4

Section B. Total Support 71:

Calendar year (or nscal year beglnmng m)~ (a) 2005 (b) 2006 1c)20qf)_ U (d}2008. (e) 2009 (f) Total

7 Amounts from hne 4 "l.J

8 Gross Income from Interest, Co')

dividends, payments received on r_'

sscunnes loans, rents, royalties D

and Income from similar sources

9 Net Income from unrelated business \j"-J

acnvmes, whether or not the

busmsss IS regularly earned on (\'

10 Other Income Do not Include gam '"\ -

or loss from the sale of caprtal y

assets (Explain In Part IV.)

11 Total support. Add lines 7 through 10

12 Gross receipts from related activities, etc. (see instructions) 121 13 First five years. If the Form 990 IS for the orqaruzanon's first, second, third, fourth, or fifth tax year as a section 501 (c}(3) organiZation, check tlns box and stop here

14 Public support percentage for 2009 (line 6, column (I) drvided by line 11, column (f}) 15 Pubhc support percentage from 2008 Schedule A, Part II, line 14

16a 33 1/3% support test - 2009.1f the orqanizanon did not check the box on hne 13, and line 14 IS 33 1/3% or more, check th IS box and stop here. The orqaruzation qualifies as a publicly supported organization

%

Section C. Computation of Public Support Percentage

b 331/3% support test - 2008.1fthe orgamzatron did not check a box on hne 13 or 16a, and hne 15 IS 33113% or more, check this box

and stop here. The organlzalfon qualifies as a publicly supported organization ... D

17a 10"10 -facts-and-circumstances test - 2009. If the orqarnzanon did not check a box on hne 13, 16a, or 16b, and hne 14 IS 10% or more,

and If the organizatIon meets the ·facts·and-(:lrcumstancE)S" test, check this box and stop here. Explain In Part IV how the orqamzanon

meets the "tacts-and-cucumstances" test The organization quahfies as a publicly supported organization ... D

b 10% -facts-and-circumstances test - 2008..lf lhe organization dld not checka box on hne 13, 16a, 16b, or 17a, and hne 15is 10"/0 or

more, and If the orqaruzatron meets the "Iacts-and-cncumstances" test, check tms box and stop here. Explain In Part IV how the

organization meets the "facts-and-cucumstances" test. The crqaruzanon qualifies as a publicly supported organization ~ D

18 Private foundation. If the organization did not check a box on line 13, 16a, 16b, 17a, or 17b, check thiS box and see instructions ... D

Schedule A (Form 990 or 99()..EZ) 2009

THIS IS A COPY OF A LIVE RETURN FAQ1M SMIPS.

OFFICIAL USE ONLY.

THIS IS A COPY OF A LIVE RETURN FROM SMIPS. OFFICIAL USE ONLY.

Calendar year (or fiscal year beginning m)~ Cal 2005 (b} 2006 [c) 2007 Idl2008 te\ 2009 CO Total

1 GiftS, grants, contnbutrons, and

membership fees received {Do not

Include any "unusual grants "} 63 935. 89 609. 96 360. 99 365. 99 180. 448 449.

2 Gross receipts from adrmssions,

merchandise sold or services per-

formed, or tacmnss turrushed In

any activity that IS related to the 51751304. 47121725. 48720978. 45880362. 89920036. 283394405

orqamzanon's tax-exempt purpose

3 Gross receipts from acuvmes that

are not an unrelated trade or bus-

mass under section 513

4 Tax revenues levied for the organ-

izatson's benefit and either paid to

or expended on Its behalf

5 The value of services or facilities

furrusned by a governmental umt to

the organization wrthout charge

6 Total. Add hnest through 5 51815239. 47211334. 48817338. 45979727. 90019216. 283842854

7a Amounts Included on hnes 1 , 2, and

3 received from disqualified persons O.

b J'vnounts II1duded on lines 2 and 3 received ~i p

trom other than disqualified pe scns that

exceeo the greater of $5,000 or 1% of the

amount on nne 13 tor the yea O.

c Add hnes 7a and 7b /' ') O.

8 Public support jSublJilctime 7c Iromlln! 61 V'\ ... 283842854

Section B. Total Support t '\ -

Calendar year- (or tscat year beglnmng tn)~ la12005 (b)201~ i-' Ic}2007 Idl2008 (e) 2009 In Total

9 Amounts from hne 6 51815239. ~72~W. 48817338. 45979727. 90019216. 283842854

10a Gross income from Interest, ~~27.

drvrdends, payments received on

securmes loans, rents, royalties 215 981\ 183 595. 40.387. 27 403.

and Income from Similar sources 770 299.

b Unrelated business taxable Income y

(less section 511 taxes) from businesses

acconed after June 30, 1975

c Add lines 10a and lOb 215.987. 302 927. 183 595. 40.387. 27.403. 770,299.

11 Net Income from unrelated business

acnvmes not Included In hne 1 Db,

whether or not the business IS

regularly camed on

12 Other Income Do not Include gain

or loss from the sale of capital

assets (Explain In Part IV}

13 Total SUllllort(Add I'nes Q, 10<;, 11, and 12) 52031226. 47514261. 49000933. 46020114. 90046619. 284613153 14 First five years. If the Form 990 1$ for the organization's first, second, third, fourth, or fifth tax year as a sacnon 501 (c)(3) organization, check this box and stop her-e

Section C. Computation of Public Support Percentage

99.73 %

15 Public support percentage for 2009 (!tne B, column (f) drvided by hne 13, column (f)) 16 Pubuc su art ercenta e from 200B Schedule A, Part III, line 15

99.64 %

17 Investment Income percentage for 2009 (hne 1 Oc, column (f) divided by line 13, column (f))

18 Investment Income percentage from 2008 Schedule A, Part III, hne 17 _

.27 %

.36 %

19a331/3% support tests - 2009. If the organrzatton did not check the box on hne 14, and hne 151$ more than 33113%, and hne 17 IS not more than 33 1/3%, check thrs box and :stop here. The organization qualifies as a publicly supported orqaruzanon

b 33 1/3% support testa- 2008. If the organlzatron did not check a box on line 14 or line 19a, and hne 16 IS more than 33 1/3%, and.

hne 18 IS not more than 33113%, check thiS box and stop here. The orqaruzenon qualifies as a pubhcly supported orqaruzanon _ ~D

20 Private foundation_ If the organization did not check a box on hne 14, 19a, or 19b, check thiS box and see InstructionS ~D

Schedule A (For-m 990 or 99O-EZ) 2009

932023 OZ.Q8·10

THIS IS A COPY OF A LIVE RETURN Fa~ SMIPS. OFFICIAL USE ONLY.

THIS IS A COPY OF A LIVE RETURN FROM SMIPS.

OFFICIAL USE ONLY.

Schedule 0

IForm 990)

Supplemental Financial Statements

.... Complete if the organization answered ·Y es, " to Form 990, Part IV,line 6,7,8,9, 10, 11, or 12.

.... Attach to Form 990 ..... See separate instructions.

2009

OMS No 1545·0047

Departmera of Ihe "Treasury Internal Revenue Service

Open to Public Inspection

Name·of1he organization Employer identification number

PASADENA TOURNAMENT OF ROSES ASSOCIATION 95-1725190

Organizations Maintaining Donor Advised Funds or Other Similar Funds or Accounts. Complete If the orqaneanon answered "Yes" to Form 990 Part IV line 6

,

(a) Donor advised funds (b) Funds and other accounts

1 Total number at end of year

2 Aggregate contnbunons to (during year)

3 Aggregate grants from (dunng year)

4 Aggregate value at end of year 5 Did the orqaruzatron Inform an donors and donor advisors In wnling that the assets held In donor advised funds are the organization's property, subject to the organization's exclusive legal control?

6 Old the organization inform all grantees, donors, and donor advisors In writing that grant funds can be used only for chantable purposes and not for the benefit of the donor or donor advisor, or for any other purpose confemng

Dyes

DNo

Dves

ONo

1 Purpose(s) of conservation easements held by the organization (chec k all that apply)

D Preservation of land for pubhc use (e g , recreation or pleasure) 0 Preservation of an historically Important land area

D Protection of natural habitat 0 Preservation of a certified histone structure

D Preservation of open space .

2 Complete hnes 2a through 2d If the orqaruzanon held a qualified conservation contnbutl~he form of a conservation .easernent on the last

day of the tax year Cf:J I...J

a Total number of conservation easements ( _ ~

b Total acreage restricted by conservation easements 'l)

c Number of conservation easements on a certified histone structure In~d In (a) d Number of conservation easements Included In (c) acquired after 'W'W

3 Number of conservation easements modified, transferred, r~~lnguished, or terminated by the organization dunng the tax

year.... ~ ~

4 Number of states where property subject to conservatl~ement IS located ....

5 Does the orqarnzanon have a wrrtten policy regard~he penodic rnorutonnq, Inspection, handling of

Violations. and enforcement of the conservation eas;~ts rt holds? D Ves 0 No

6 Staff and volunteer hours devoted to monltonng, Inspecting, and enforCing conservation easements dunng the year ....

7 Amount of expenses Incurred In morutonnq, Inspectmg, and enforcmq conservation easements dunng the year .... $ _

8 Does each conservation easement reported on hne 2(d} above satisfy the requuernents of section 170(h)(4}(8)(j} and section 170(h){4){B}(I~?

Held atthe End of the TaxYear

2a

2b

2c

2d DYes

ONo

9 In Part XIV, describe how the organization reports conservation easements In rts revenue and expense statement, and balance sheet, and Include. If applicable, the text of the footnote to the orgamzatlon's financsal statements that descnbes the orqamzaton's accounting for conservation easements

I Part 1111 Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets.

Complete If the orqamzation answered 'Yes' to Form 990, Part IV, hne 8

1a If the organization elected, as permitted under SF AS 116, not to report In Its revenue statement and balance sheet works of art, rustoncal treasures, or other Similar assets held for public axrubmon, educanon, or research In furtherance of public service, provide, In Part XIV, the text of the footnote to Its flnancial statements that descnbes these !Iems,

b If the orqaruzation elected, as permitted under SFAS 116. to report In Its revenue statement and balance sheet works of art, lustoncal treasures, or other Similar assets held for public exhibrtion, education, or research In furtherance of pubhc service, provide the follOWing amounts relating to these !lems

Ii) Revenues Included in Form 990, Part VIII. line 1 (ii) Assets included In Form 990, Part X

.... $_-------

.... $_-------

2 . II the organization received or held works of art, rustorcal treasures, or other Similar assets for financial gain, provide

the followmg amounts required to be reported under SFAS 116 relating to these nerns a Revenues Included In Form 990, Part VIIl, hne 1

b Assets Included In Form 990, Part X

.... $_------.... $_------

LHA For Privacy Act and Paperwor1l Reduction Act Notice, see the Instructions fOl' FOI'm 990. 932051

02,01·10

Schedule D (Form 990) 2009

THIS IS A COPY OF A LIVE RETURN ~ SMIPS.

OFFICIAL USE ONLY.

THIS IS A COPY OF A LIVE RETURN FROM SMIPS.

OFFICIAL USE ONLY.

3 USing tho orqamzanon's accursmon, accession, and other records, check any of the follOWing that are a sl{Imficant use of ItS collection rterns

(check all that apply)

a [J Public exhibmon b 0 Scholarly research

c 0 Preservation for future generations

4 ProVide a descnpnon of the organization's collections and explain how they further the orcaruzation's exempt purpose In Part XIV

5 DUnl'lg the year, did the organization sohcrt or receive donations of art, histoncal treasures, or other similar assets to be sold to raise funds rather than to be maintained as art of the or amzanon's collection?

d D Loan or exchange programs

e D Other -r-r- _

DYes

DNa

Part IV Escrow and Custodial Arrangements. Complete If organization answered "Yes" to Form 990, Part IV, hne 9, or reported an amount on Form 990, Part X, line 21

1 a Is the organization an agent, trustee, custodian or other mtermsd lary for contnbutions or other assets not Included on Form 990, Part X?

b If "Yes," explam the arrangement In Part XIV and complete the follOWIng table.

DYes

DNa

c Beginning balance

d Additions dunng the year

e DistributIons dunng the year f EndH'lg balance

2a Old the orgamzatlon Include an amount on Form 990, Part X, line 217

Amount

1e

1d

1e

1f DYes

DNa

b If "YEl'S n explain the arranqernent In Part XIV

l Part V I Endowment Funds. Complete If the organization answered 'Yes" to Fcirm 990, Part IV, line 10

(a} Current year (bl Pnor year lc)~ears back . (d) Three years back (e) Four years back

1a Beginning of year balance h_ U

b Contnbuuons 1'""\ rlJ

c Net Investment earrunqs, gains, and losses r ,.

d Grants or scholarships \.r\-

e Other expendrtures for facllrtles r_\J _,

and programs

f Administrative expenses r- 'U

9 End of year balance ,.....,\. ,)

2 Provide the estimated percentage of the year end balan~d as: a Board desiqnated or quasi-enoowment ..... b Permanent endowment ....

C Term eooowrnent js- %

3a Are there endowment funds not In the possession of the organization thai are held and administered for the orqanrzauon

-----"'--~r------% %7

--------

Yes No

3a(i)

3a(it)

3b

4 Descnbe In Part XIV the Intended uses of the orqaruzation's endowment funds

I Part VI I Investments - land, Buildings, and Equipment. See Form 990, Part X, line 10.

Descnption of Investment (a) Cost or other (b) Cost or other (e) Accumulated (d) Book value

baSIS (mvestment) baSIS (other) depreciauon

1a Land S 028 106. S 028 #106.

b BUildings 6 129 144. 1 371 334. 4 757,810.

c Leasehold Improvements 718 242. 718,242. o.

d EqUipment 154 208. 48 542. 105 666.

e Other .. 6 813 580. 3 803 713. 3 009 867.

Total. Add hnes 1 a throuoh 1 e (Column (d) must equal Form 990 Part X. column (8), fine tOre)) .... 12 901 449. by. (i) unrelated orqaruzanons (ii} related organizations b If 'Yes" to 3a(lij, are the related organizations listed as required on Schedule R?

Schedule 0 (Form 990) 2009

932052 Q2Alt.1O

THIS IS A COPY OF A LIVE RETURN FJ:1cSM SMIPS.

OFFICIAL USE ONLY.

THIS IS A COPY OF A LIVE RETURN FROM SMIPS. OFFICIAL USE ONLY.

Schedule D (Form 990) 2009 PASADENA TOURNAMENT OF ROSES ASSOCIATION 95-1725190 Page 3

I Part VIII Investments - Other Securities. See Form 990, Part X, line 12,

(a) Description of security or category (b) Book value (e) Method of valuation

{mcludlng name of secunty} Cost or and-of-year market value

Financial denvauves

Closely-held equity Interests

Other

Tolal (COl (b) must equal Form 990 Part X cof_(_B_llme 12,)'"

I Part Villi Investments • Program Related. See Form 990, Part X, line 13

la) Descnption of Investment type (b) Book value (c) Method of valuanon

Cost Or end-of-year market value

C)....

flU

I J'""\ "1.)

/' 'J

V "'\-

('\

l »: <:»

Total. (Col (b) must ~al Form 990 Part X col (B) lme 13.1'" r»: "-J

I Part IX I Other Assets. See Form 990. Part X, line 15.,-... " )

la) Des\[lplpn (b) Book value

~ -

T

Total. (Column (b) must eauai Form 990 Part X col (8) Ime 15 ) ...

I Part X I Other Liabilities. See Form 990. Part X, hne 25.

1 (a) Descnpnon of liability (b) Amount

Federal Income taxes

RESTRICTED GAME FUNDS 664.

CAPITAL IMPROVEMENTS TRUST FUND 3,146 140.

Total. (Column (b) must equal Form 990, Part X. col (B) Ime 25.) ..,. 3 146 804. 2. FIN 48 Footnote" In Part XIV. provide the text of the footnote to the orqaruzanon's financial statements that reports the orqaruzatlon's liabllrty for uncertain tax posmons under FIN 48_

932053 02-01-10

Schedule 0 (Form 990) 2009 THIS IS A COpy OF A LIVE RETURN Fa~ SMIPS. OFFICIAL USE .ONLY.

THIS IS A COPY OF A LIVE RETUBN FROM SMIPS. OFFICIAL USE ONLY.

Schedule D (Form 990)_2009 PASADENA TOURNAMENT OF ROSES ASSOCIATION 95-1725190 pag_e4

I Part XI I Reconclliation of Change in Net Assets from Form 990 to Audited Financial Statements

1 Total revenue (Form 990, Part VI!I, column (Al, hne 12) 1 107 759 213.

2 Total expenses (Form 990, Part IX, column (Al, hne 25) 2 100 614 s. 981 .

3 Excess or (deftcu) for the year Subtract line 2 from hne 1 3 7 14 4 232.

99.

4 Net unrealized gaIns (losses) on Investments 4

5 Donated services and use of facilities 5

6 Investment expenses 6

7 Pnor penod adnrsfments 7

8 Other [Descnbe In Part XIV) - - 8 I Part XII I Reconciliation of Revenue per Audited Financial Statements With Revenue per Return

9 Total adjustments {net} Add lines 4 through 8 1----"9'----! --=----::----:--c-------'9~9_::_.

10 Excess or (d eficrtHor the year oer auorted fmancsal statements. Comb me hnes 3 and 9 10 7 14 4 3 3 1 •

2a

99.

1 Total revenue, gams, and other support per audrted financral statements 1---1-'----F1~0:;_7"_L_=9'-4=__:8'-'--'8=5-=1::__o_.

2 Amounts Included on line 1 but not on Form 990, Part VIII, Ime 12

bOther (Descnbe In Part XIV) 4tC ).... < 2 2 052. >

c Add hnes 4a and 4b ()_ U 4c < 22 052. >

5 Total revenue Add hnes 3 and 4c. (ThIS must eQual Form 990 Part lIme 12) r'\ V 5 1 0 7 7 5 9 2 13 .

I Part Xliii Reconciliation of Expenses per Audited Financial. S~tE!l11e)lts With Expenses per Return

a Net unreahzed gains on Investments b Donated services and use of tacihnes c Recoveries of prior year grants

d Other (Descnbe In Part XIV )

e Add hnes 2a through 2d

3 Subtract line 2e from line 1

2d

2c

167 487.

2b

4 Amounts mcluded on Form 990, Part VIII. line 12, but not on bne 1 3 Investment expenses not Included on Form 990, Part VIII, bne 7b

14a

2e 167 586. 3 107 '781 265.

1 Total expenses and losses per audited fmancral statements . \Q - 1 100. 804. 520 .

2 Amounts Included on line 1 but not on Form 990. Part IX. hne 25. <0

a Donated services and use of faCilities ( ---'

b Pnor year adjustments C"'\. 'lJ

c Other losses C"'\. '-.)

d Other (Desc nbe In Part XIV) "y"-J

e Add hnes 2a through 2d

3 Subtract hne 2e from hne 1 4 Amounts Included on Form 990, Part IX, hne 25. but not on line 1 a Investment expenses not Included on Form 990, Part VIII, hne 7b. bOther (Descnbe In Part XIV) c Add hnes 4a and 4b

5 Total expenses Add lines 3 and 4e.IIllls must eoual Form 990 Part lime 18}

2b

167 487.

23

2c

2d

I 4a I

4b

<22 052.>

2e 167 487. 3 100 637 033.

<22,052.> 5 100 614 981.

4c

I Part Xlvi Supplemental Information

Complete tlus part to provide the descnpttons required for Part II, hnes 3,5, and 9. Part lit, hnes 1 a and 4; Part IV, lInes 1 band 2b; Part V, line 4, Part X, hne 2; Part XI, hne S, Part XII, lines 2d and 4b, and Part XIII, hnes 2d and 4b Also complete thrs part to provide any additional mtormanon.

PART XII, LINE 4B - OTHER ADJUSTMENTS:

COSTS OF GOODS SOLD - 22,052 AS REPORTED ON FORM 990, PART VIII.

LINE lOB

PART XIII, LINE 4B - OTHER ADJUSTMENTS:

COSTS OF GOODS SOLD - 22,052 AS REPORTED ON FORM 990. PART VIII.

LINE lOB

Schedule D (Form 990) 2009

932054 02-Q1-10

THIS IS A COPY OF A LIVE RETURN FUf SMIPS. OFFICIAL USE ONLY.

~

:g ,~

C1.. - 00

- 8.

c U)

CII c 0.-

o

s

CII

a. E o o

w~

S~

0'" wE ::r: ... 00 (/)~

....

~ 8

~l

'f m

- "

'0 ~

- > " .. "'([ E _

i5~

nb

"'-

oJ;

THIS IS A COPY OF A LIVE RETURN FROM SMIPS.

OFFICIAL USE ONLY.

[

o z

o

"'~ cr,~

o~ E-I

C~-g~; gJ

"oU) 0.

~ * e. rJ Po.

.2c~o ~

~ ~ -

{\J ¢J: :S Orl

m u ~

_§ 9 ~

~ ~r-~----t--------~~~~--------~----------+---------~--------~---------t:: C <II 0

0. :6 g)6

ell "=

e6 .£ 8l

S E

o

-~ !:!: ~ ~r-------r---------~---------+----------~--------~---------+--------~

~ o

c o

g

to! c

""

~

o

<D

£;

"0

Q>

E

"" z

THIS IS

A COpy OF A LIVE RETURN FROM SMIPS.

OFFICIAL USE ONLY.

THIS IS A COPY OF A LIVE RETURN FROM SMIPS.

d>

U

I:

2·

'"

<ii

rJ)

ell

s:

'"

ell

U

i:

0

c;

'0

I:

0

g

<:

0

<I)

Q)

0

E

-c-

en

c.c

0-

_0

'(U-=-

::Jell I:

-rJ)

<'11- 0

>~ ~

- a.

00. §

1:J<'II

i?:> .£

-:E ~

~~ [ij

I:

.-..:.!: 0

410 :r: ;::

~o '0

,£ tJ)

~ 1::J

III

i: en 0 a; ( 0

°u 1:

1:1: a ~

-ell ~

0_

-~ --;

I: rJ)

:::><1) ~fc

o ell

E..c ~

<!rJ)

_ell (\J

EO e

~

0 KJ"-' ....:

"- 0 t

0 ..... IJ"i <::J<::J CIl

..... c a.

1:<'11 r- s

::J~ .....

00 "0

E-£ i!l

«<'II " i

~o y

I:

r- 0

'0 .;::;

CIl

~<I) E

<1>-

.01: >-

E91 .E

::JQ. S

ZO III

Ql -5

e- o.

'0

s

0

C

B

t

;g

!!l

:5

'"

Q) iii

0 tJ)

I: I>: 9

CIl r.J E

'ii) ~ 0

ii) ;.; o

tJ) r.J

co :t: C

0 E-< 0

:;:::

C I>: W

D E

e a

01 tJ ~

'0 ...l ...

<C .E

a> ~ ~

a.

>-

~ ~ c

III

s ~ E

a CIl

.... ~

til

p., ::J

H (f1

:r:

til -

~ ;::

..:

..., t:

a

:r: Ie

u D.

til '- N N

'" t;

;i

t

e d CD CD

E l5

u,

II

THIS IS A COpy OF A LIVE RETURN FROM SMIPS.

OFFICIAL USE ONLY.

OFFICIAL USE ONLY.

C""l N

THIS IS A COpy OF A LIVE RETURN FROM SMIPS. OFFICIAL USE ONLY.

SCHEDULE J (Form 990)

Compensation Information

For certain Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

~ Complete jf the organization answered "YesD to Form 990, Part IV, tine 23.

~ Attach to Form 990, ~ See separate instructions.

Department of the Treasury Internal Revenue Se"Y~ce

OM9 Polo 1545-0047

2009

Open to Public Inspection