Академический Документы

Профессиональный Документы

Культура Документы

Coast Jewelers, Inc. Income Statement For The Year Ended: Student Name 12/09/2021 58542433

Загружено:

Amy NinhОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Coast Jewelers, Inc. Income Statement For The Year Ended: Student Name 12/09/2021 58542433

Загружено:

Amy NinhАвторское право:

Доступные форматы

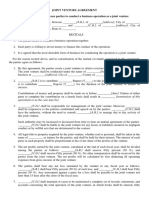

Coast Jewelers, Inc.

Income Statement

For the Year Ended

12/31/08 12/31/09 % Change

Sales Revenue $ 850,511.65 $ 825,974.15 -3%

Less: Cost of Goods Sold 442,619.87 489,547.25 11%

Gross Margin 407,891.78 336,426.90 -18%

Expenses:

Advertising 20,654.21 26,548.55 29%

Depreciation 22,000.00 22,000.00 0%

Interest 40,846.24 32,338.94 -21%

Payroll 115,365.11 129,547.97 12%

Utilities 23,541.25 27,546.16 17%

Net income before taxes 185,484.97 98,445.28 -47%

Income taxes 65,218.98 31,600.00 -52%

Net income $ 120,265.99 $ 66,845.28 -44%

Student Name 12/09/2021 58542433.xls

Coast Jewelers, Inc.

Balance Sheet

as of

Assets 12/31/08 12/31/09 %Change

Current Assets:

Cash $ 25,412.35 $ 20,182.15 -21%

Accounts Receivable 84,245.25 102,544.24 22%

Inventory 125,351.45 152,154.21 21%

Prepaid Expenses 15,625.26 15,241.75 -2%

Supplies 10,245.15 6,578.24 -36%

Property, Plant, and Equipment:

Land 120,000.00 120,000.00 0%

Building 300,000.00 315,000.00 5%

Equipment 65,000.00 70,000.00 8%

Less: Accumulated Depreciation (68,000.00) (90,000.00) 32%

Total $ 677,879.46 $ 711,700.59 5%

Liabilities and Stockholders' Equity

Liabilities

Current Liabilities:

Accounts Payable $ 75,182.10 $ 84,005.70 12%

Payroll Liabilities 8,152.25

Long-Term Debt 400,000.00 350,000.00 -13%

Stockholders' Equity

Common Stock 10,000.00 10,000.00 0%

Retained Earnings 192,697.36 259,542.64 35%

Total $ 677,879.46 $ 711,700.59 5%

Student Name 12/09/2021 58542433.xls

Coast Jewelers Inc.

Ratio Analysis

9-Dec

Profitability

Return on Owner's Investment 0.28309876

Return on Total Investment 0.14275424

Profit Margin

Gross Margin

Liquidity

Current Ratio

Quick Ratio

Receivable turnover

Inventory Turnover

Solvency

Debt-to-equity

Liability

Вам также может понравиться

- IFS - Simple Three Statement ModelДокумент1 страницаIFS - Simple Three Statement ModelThanh NguyenОценок пока нет

- LBO TITLEДокумент16 страницLBO TITLEsingh0001Оценок пока нет

- Additional Problem SubsequentДокумент4 страницыAdditional Problem SubsequentasdasdaОценок пока нет

- Valuation - CocacolaДокумент14 страницValuation - CocacolaLegends MomentsОценок пока нет

- Maynard Company Balance Sheet and Income StatementДокумент2 страницыMaynard Company Balance Sheet and Income StatementTating Bootan Kaayo YangОценок пока нет

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОценок пока нет

- Template 2 Task 3 Calculation Worksheet - BSBFIM601Документ17 страницTemplate 2 Task 3 Calculation Worksheet - BSBFIM601Writing Experts0% (1)

- Lecture - 5 - CFI-3-statement-model-completeДокумент37 страницLecture - 5 - CFI-3-statement-model-completeshreyasОценок пока нет

- Is Excel Participant - Simplified v2Документ9 страницIs Excel Participant - Simplified v2Yash JasaparaОценок пока нет

- IS Excel Participant - Simplified v2Документ9 страницIS Excel Participant - Simplified v2deepika0% (1)

- Financial Statement Analysis On APEX and Bata Shoe CompanyДокумент12 страницFinancial Statement Analysis On APEX and Bata Shoe CompanyLabiba Farah 190042118Оценок пока нет

- Task 1 AnswerДокумент9 страницTask 1 AnswerSiddhant Aggarwal0% (4)

- DCF Case Sample 1Документ4 страницыDCF Case Sample 1Gaurav SethiОценок пока нет

- P5-3a Pa1Документ10 страницP5-3a Pa1Agnes Eviyany50% (6)

- Professor Office Beach Cabana 2014-2013 Financial StatementsДокумент2 страницыProfessor Office Beach Cabana 2014-2013 Financial StatementsDave SallaoОценок пока нет

- Minicase 2Документ2 страницыMinicase 2TompelGEDE GTОценок пока нет

- Account Name Account No. BalanceДокумент9 страницAccount Name Account No. BalanceDreamer_ShopnoОценок пока нет

- Group G Answer KeyДокумент5 страницGroup G Answer KeyMaichaОценок пока нет

- FCF 9th Edition Chapter 03Документ37 страницFCF 9th Edition Chapter 03tarekffОценок пока нет

- Financial Management (1) NewДокумент15 страницFinancial Management (1) NewEngineering Rotech PumpsОценок пока нет

- ENTI Ver 1Документ72 страницыENTI Ver 1krishna chaitanyaОценок пока нет

- Oka Corporation BHDДокумент3 страницыOka Corporation BHDFagbile TomiwaОценок пока нет

- Lincoln Electric Itw - Cost Management ProjectДокумент7 страницLincoln Electric Itw - Cost Management Projectapi-451188446Оценок пока нет

- Income Statement: Company NameДокумент9 страницIncome Statement: Company NameAkshay SinghОценок пока нет

- Quiz 1 Acco 204 - GonzagaДокумент17 страницQuiz 1 Acco 204 - GonzagaLalaine Keendra GonzagaОценок пока нет

- Fixed Assets Amount Depreciation (Years) Notes: You Are Fully Funded (Balanced)Документ4 страницыFixed Assets Amount Depreciation (Years) Notes: You Are Fully Funded (Balanced)Paulo TorresОценок пока нет

- Financial ManagementДокумент4 страницыFinancial ManagementHara KimОценок пока нет

- Panther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)Документ7 страницPanther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)HussainОценок пока нет

- The Citizen's Report: Ernie Lee MagahaДокумент39 страницThe Citizen's Report: Ernie Lee Magahalendyd7463Оценок пока нет

- (Financial Analysis) MANALO, Frances M. LM2-1Документ3 страницы(Financial Analysis) MANALO, Frances M. LM2-11900118Оценок пока нет

- Final Req VCMДокумент8 страницFinal Req VCMMaxine Lois PagaraganОценок пока нет

- Historical Financial Forecast ResultsДокумент10 страницHistorical Financial Forecast ResultsÄyušheë TŸagïОценок пока нет

- IFS Dividends IntroductionДокумент2 страницыIFS Dividends IntroductionMohamedОценок пока нет

- Income Statement, Balance Sheet, and Financial Ratios AnalysisДокумент8 страницIncome Statement, Balance Sheet, and Financial Ratios AnalysisAhsan FirdausОценок пока нет

- DCF ModelДокумент2 страницыDCF ModelKolariya DheerajОценок пока нет

- Casos FinanzasДокумент20 страницCasos FinanzasPepe La PagaОценок пока нет

- BSBFIM601 Manage FinancesДокумент34 страницыBSBFIM601 Manage Financesneha0% (1)

- Horizontal Analaysis GLOBEДокумент2 страницыHorizontal Analaysis GLOBEjerameelnacalaban1Оценок пока нет

- (Billions) : Q2 2012 Data, Except Where NotedДокумент17 страниц(Billions) : Q2 2012 Data, Except Where Notedchatterjee rikОценок пока нет

- Ratio Analysis - SeminarДокумент6 страницRatio Analysis - SeminarTariq KhanОценок пока нет

- Table Exercises for Sample DataДокумент14 страницTable Exercises for Sample DataNyasha MakoreОценок пока нет

- Common Size Income StatementДокумент7 страницCommon Size Income StatementUSD 654Оценок пока нет

- Financial AnalysisДокумент8 страницFinancial AnalysisMaxine Lois PagaraganОценок пока нет

- Key Financial Indicators of The Company (Projected) : Cost of The New Project & Means of FinanceДокумент15 страницKey Financial Indicators of The Company (Projected) : Cost of The New Project & Means of FinanceRashan Jida ReshanОценок пока нет

- Managerial Finance AssingmentДокумент9 страницManagerial Finance AssingmentEf AtОценок пока нет

- FM Model - Coffee ParlorДокумент11 страницFM Model - Coffee ParlorPRITESH PATILОценок пока нет

- Unitedhealth Care Income Statement & Balance Sheet & PE RatioДокумент8 страницUnitedhealth Care Income Statement & Balance Sheet & PE RatioEhab elhashmyОценок пока нет

- Base Case Equipment Costs, Sales, and Cash Flow AnalysisДокумент7 страницBase Case Equipment Costs, Sales, and Cash Flow AnalysisPaula AntonioОценок пока нет

- I. Assets: 2018 2019Документ7 страницI. Assets: 2018 2019Kean DeeОценок пока нет

- NPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Документ11 страницNPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Ali Hussain Al SalmawiОценок пока нет

- 03. DCF Model of a Venture , Exit ValueДокумент2 страницы03. DCF Model of a Venture , Exit Valueharshit.dwivedi320Оценок пока нет

- Firm Balance SheetДокумент5 страницFirm Balance SheetHimanshu YadavОценок пока нет

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Документ2 страницыAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuОценок пока нет

- PCEC - FLUENCE TSP - Billing Form - JMC - Feb 15Документ1 страницаPCEC - FLUENCE TSP - Billing Form - JMC - Feb 15GREGORIO RAMBAYONОценок пока нет

- ExercisesComparative and Trend AnalysisДокумент3 страницыExercisesComparative and Trend AnalysisJoody CatacutanОценок пока нет

- ACLEDA AnnRept2005Документ84 страницыACLEDA AnnRept2005henglayОценок пока нет

- Finance Quiz 3Документ43 страницыFinance Quiz 3Peak ChindapolОценок пока нет

- poa_2012_Jan_p.2.q.1_1Документ4 страницыpoa_2012_Jan_p.2.q.1_1RealGenius (Carl)Оценок пока нет

- Title Names University'S IdsДокумент10 страницTitle Names University'S IdsUzma SiddiquiОценок пока нет

- Manaal - Commercial Banking W J.P MorganДокумент9 страницManaal - Commercial Banking W J.P Morganmanaal.murtaza1Оценок пока нет

- Exam 1 Masan GroupДокумент4 страницыExam 1 Masan GroupQuynh NguyenОценок пока нет

- W3Extra Question AuditДокумент1 страницаW3Extra Question AuditChiran AdhikariОценок пока нет

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineОценок пока нет

- Management Accounting and Procedures For Quantity Surveying PracticeДокумент14 страницManagement Accounting and Procedures For Quantity Surveying PracticeDasun MahabadugeОценок пока нет

- NVIDIAAnДокумент9 страницNVIDIAAnDinheirama.comОценок пока нет

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualДокумент35 страницFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDrMichelleHutchinsonegniq100% (15)

- Barton Co. Balance Sheet For Branch December 31, 20x4Документ27 страницBarton Co. Balance Sheet For Branch December 31, 20x4Love FreddyОценок пока нет

- This Study Resource WasДокумент4 страницыThis Study Resource WasTegar NurfitriantoОценок пока нет

- A. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalanceДокумент5 страницA. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalancevaldaОценок пока нет

- Joint Venture AgreementДокумент2 страницыJoint Venture Agreementpan RegisterОценок пока нет

- Financial Data Analysis of Ferozsons LaboratoryДокумент36 страницFinancial Data Analysis of Ferozsons Laboratorymartain maxОценок пока нет

- FR Smart BLPL PDFДокумент32 страницыFR Smart BLPL PDFShreelekha PradeepОценок пока нет

- Lehman BrothersДокумент38 страницLehman Brothersapi-370084550% (6)

- CAHPTER 3. Analisis Keuangan (Analysis of Financial Statements) MankeuДокумент12 страницCAHPTER 3. Analisis Keuangan (Analysis of Financial Statements) MankeuKezia NatashaОценок пока нет

- Edexcel Level 5Документ6 страницEdexcel Level 5Raja NarenОценок пока нет

- Manual Operation Profitability 1 TPD SystemДокумент8 страницManual Operation Profitability 1 TPD SystemAnkit AgrawalОценок пока нет

- Financial Statement AnalysisДокумент18 страницFinancial Statement Analysis223001006Оценок пока нет

- Challenges and Problems Faced by FMCG Companies: A Project OnДокумент51 страницаChallenges and Problems Faced by FMCG Companies: A Project OnvinodkatariaОценок пока нет

- Chapter 3 Homework Template 7.6 21Документ27 страницChapter 3 Homework Template 7.6 21Ahmed Mahmoud100% (1)

- Finman 244 SummaryДокумент144 страницыFinman 244 Summaryhermanschreiber47Оценок пока нет

- CH05Документ47 страницCH05carlosortizfelixОценок пока нет

- Model Question For Account409792809472943360Документ8 страницModel Question For Account409792809472943360yugeshОценок пока нет

- Ratio Analysis of APLДокумент15 страницRatio Analysis of APLTusarkant BeheraОценок пока нет

- Why Engineers Need To Understand The Financial Statements?: Contemporary Engineering Economics, 5th Edition. ©2010Документ8 страницWhy Engineers Need To Understand The Financial Statements?: Contemporary Engineering Economics, 5th Edition. ©2010GhostОценок пока нет

- Ch-4 Ratios TheoryДокумент3 страницыCh-4 Ratios TheoryShubham PhophaliaОценок пока нет

- Final Thesis Daniel Tsegaye Accounting and FinanceДокумент48 страницFinal Thesis Daniel Tsegaye Accounting and FinanceBee TadeleОценок пока нет

- Ratio Analysis Pankaj 180000502015Документ64 страницыRatio Analysis Pankaj 180000502015PankajОценок пока нет

- Performance Evaluation Through Financial Ratios: Comparative Analysis of Pfizer, Inc. and Novartis AgДокумент41 страницаPerformance Evaluation Through Financial Ratios: Comparative Analysis of Pfizer, Inc. and Novartis AgKanak MishraОценок пока нет

- Chapter 08 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Документ133 страницыChapter 08 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi100% (2)

- Royal Ceramics Lanka PLC: Interim Financial Statements For The Period Ended 30Th September 2022Документ12 страницRoyal Ceramics Lanka PLC: Interim Financial Statements For The Period Ended 30Th September 2022kasun witharanaОценок пока нет