Академический Документы

Профессиональный Документы

Культура Документы

Finac 2010 Dec

Загружено:

Bavil Varghese0 оценок0% нашли этот документ полезным (0 голосов)

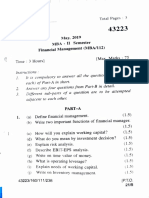

9 просмотров2 страницыThis document appears to be an exam for a Master's degree in Human Resource Management. The exam covers the topic of financial management and is divided into multiple sections. Section A asks the examinee to write short notes on 5 topics related to financial management. Section B asks the examinee to answer 3 out of 5 long-form questions. Section C asks the examinee to answer 1 out of 2 long-form questions. Finally, Section D contains 1 compulsory long-form question regarding the relationship between levered and unlevered firms.

Исходное описание:

Оригинальное название

FINAC 2010 DEC

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis document appears to be an exam for a Master's degree in Human Resource Management. The exam covers the topic of financial management and is divided into multiple sections. Section A asks the examinee to write short notes on 5 topics related to financial management. Section B asks the examinee to answer 3 out of 5 long-form questions. Section C asks the examinee to answer 1 out of 2 long-form questions. Finally, Section D contains 1 compulsory long-form question regarding the relationship between levered and unlevered firms.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

9 просмотров2 страницыFinac 2010 Dec

Загружено:

Bavil VargheseThis document appears to be an exam for a Master's degree in Human Resource Management. The exam covers the topic of financial management and is divided into multiple sections. Section A asks the examinee to write short notes on 5 topics related to financial management. Section B asks the examinee to answer 3 out of 5 long-form questions. Section C asks the examinee to answer 1 out of 2 long-form questions. Finally, Section D contains 1 compulsory long-form question regarding the relationship between levered and unlevered firms.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

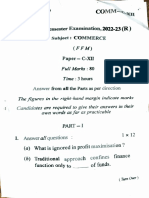

Register Number :

Name of the Candidate :

6382

M.B.A. ( Human Resource Management )

DEGREE EXAMINATION, 2010

( FIRST YEAR )

( PAPER - V )

150 / 120 / 140. FINANCIAL MANAGEMENT

[Common with M.B.A. (Marketing

Management) & M.B.A. ( Financial

Management )]

December ] [ Time : 3 Hours

Maximum : 75 Marks

SECTION - A (5 × 3= 15)

1. Write short notes on any FIVE :

(a) Activity budget.

(b) Capital budget.

(c) Sensititivy analysis.

(d) Proforma statements.

Turn Over

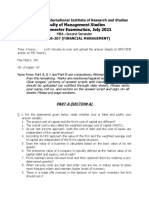

2 3

(e) Master budget. 8. Why do companies not employ very large

amount of debt in their capital structures ?

(f) Management by exception.

9. What is financial distress ? How does it

(g) Investment centre.

affect the value of the firm ?

(h) Forecasting.

SECTION - D (1 ×15= 15)

SECTION - B (3 ×10= 30)

( Compulsory)

Answer any THREE questions.

10. Consider two firms, L and U, that are

All questions carry equal marks.

identical except that L is levered whereas V

2. Explain the important steps in the capital is unlevered. Let V1 and Vu stand repsectively,

budgeting . for the market values of L and U. In a

perfect market, would one expect V u to be

3. Explain the concept of financial leverage.

less than, greater than or equal to V 1 ? Ex-

4. What is an EBIT -EPS analysis ? Illustrate. plain.

5. What do you think is appropriate combination

of financial and operating leverage ?

6. Briefly discuss the capital budgeting practices

of companies in India.

SECTION - C (1 ×15= 15)

Answer any ONE question.

7. What is financial risk ? How does it differ

from business risk ?

Вам также может понравиться

- Quest - 7922 FM May 2009Документ2 страницыQuest - 7922 FM May 2009babu2002Оценок пока нет

- M.B.A. (E-Business) Degree Examination, 2010: 210. Financial MangementДокумент2 страницыM.B.A. (E-Business) Degree Examination, 2010: 210. Financial MangementMahesh RОценок пока нет

- Quest 8555Документ2 страницыQuest 8555मोनू राउतОценок пока нет

- Answer Any TWO Questions. All Questions Carry Equal MarksДокумент3 страницыAnswer Any TWO Questions. All Questions Carry Equal MarksdinobalaОценок пока нет

- Financial ManagementДокумент5 страницFinancial ManagementHTB MoviesОценок пока нет

- Seat No.: All Questions Are CompulsoryДокумент19 страницSeat No.: All Questions Are CompulsoryNishant PatilОценок пока нет

- K20u 1035Документ2 страницыK20u 1035muneermkd1234Оценок пока нет

- FM QP 2008-20Документ18 страницFM QP 2008-20Jubin JacobОценок пока нет

- Answer Any ONE Question.: Section - CДокумент2 страницыAnswer Any ONE Question.: Section - CRavi KrishnanОценок пока нет

- Anu Mba 3 Years Final Year Question Paper June 2010Документ41 страницаAnu Mba 3 Years Final Year Question Paper June 2010gauravОценок пока нет

- Documents - Pub - Basics in Finance 10 Questions Homework Warmups Inclanswers PDFДокумент15 страницDocuments - Pub - Basics in Finance 10 Questions Homework Warmups Inclanswers PDFJona FranciscoОценок пока нет

- Time: 3 Hours Total Marks: 100Документ81 страницаTime: 3 Hours Total Marks: 100geetanjali vermaОценок пока нет

- Sample Question Paper Level 5 Effective Financial ManagementДокумент4 страницыSample Question Paper Level 5 Effective Financial ManagementTheocryte SergeotОценок пока нет

- IPMNew Dec2012Документ1 страницаIPMNew Dec2012Umang ModiОценок пока нет

- MTTM 005 Previous Year Question Papers by IgnouassignmentguruДокумент45 страницMTTM 005 Previous Year Question Papers by IgnouassignmentguruReshma RОценок пока нет

- Examination,: Degree MAYДокумент2 страницыExamination,: Degree MAYSiva Chandran SОценок пока нет

- TutorialsДокумент28 страницTutorialsmupiwamasimbaОценок пока нет

- Adobe Scan 03 Feb 2023 PDFДокумент7 страницAdobe Scan 03 Feb 2023 PDFShraddhanjali NayakОценок пока нет

- Viewdocument PDFДокумент2 страницыViewdocument PDFWenlang SwerОценок пока нет

- FN3092 - Corporate Finance - 2015 Exam - Zone-AДокумент9 страницFN3092 - Corporate Finance - 2015 Exam - Zone-AAishwarya PotdarОценок пока нет

- Paper14 SolutionДокумент21 страницаPaper14 SolutionJabir AghadiОценок пока нет

- QP CODE: 18103380: Third SemesterДокумент2 страницыQP CODE: 18103380: Third SemesterOnline Class, CAS KPLYОценок пока нет

- MBA (International Business)Документ52 страницыMBA (International Business)Nazhia KhanОценок пока нет

- 2021 ZB PaperДокумент11 страниц2021 ZB Papermandy YiuОценок пока нет

- (Affiliated To DAPJAK Technical University, Lucknow) : Rakshpal Bahadur Management Institute, BareillyДокумент1 страница(Affiliated To DAPJAK Technical University, Lucknow) : Rakshpal Bahadur Management Institute, BareillyHimanshu DarganОценок пока нет

- Question Paper Code:: Reg. No.Документ11 страницQuestion Paper Code:: Reg. No.Livin TОценок пока нет

- MJ17 Hybrids F9 Clean ProofДокумент6 страницMJ17 Hybrids F9 Clean ProofVinny Lu VLОценок пока нет

- Total Pages3: (1.5) How Will You Explain Working Capital? (1.5) (1.5) byДокумент2 страницыTotal Pages3: (1.5) How Will You Explain Working Capital? (1.5) (1.5) bytrendy FashionОценок пока нет

- Paper 5 - Financial Accounting: Answer To MTP - Intermediate - Syllabus 2008 - June 2015 - Set 2Документ16 страницPaper 5 - Financial Accounting: Answer To MTP - Intermediate - Syllabus 2008 - June 2015 - Set 2Aleena Clare ThomasОценок пока нет

- 2012 Ii PDFДокумент23 страницы2012 Ii PDFMurari NayuduОценок пока нет

- M.B.A. Degree Examination, May 2015 (International Business)Документ1 страницаM.B.A. Degree Examination, May 2015 (International Business)Shaik TousifОценок пока нет

- MBA108CДокумент2 страницыMBA108CRohit TushirОценок пока нет

- Instruction: Answers Should Written in English OnlyДокумент2 страницыInstruction: Answers Should Written in English OnlyLishanthОценок пока нет

- Mba 1 Year - 201Документ2 страницыMba 1 Year - 201Prasanth EmmanuvalОценок пока нет

- MG8091 Entrepreneurship Development CT 1 QPДокумент1 страницаMG8091 Entrepreneurship Development CT 1 QPparandaman.mechОценок пока нет

- P15 Syl2012 Set2Документ12 страницP15 Syl2012 Set2Christine Joy LeonardoОценок пока нет

- CLASS TEST - II (2018-19) Bachelor of Business Administration - VI Sem Fundamentals of E-Commerce (BBA-N-606) Time: 1.5Hrs. M.M.: 30Документ2 страницыCLASS TEST - II (2018-19) Bachelor of Business Administration - VI Sem Fundamentals of E-Commerce (BBA-N-606) Time: 1.5Hrs. M.M.: 30Himanshu DarganОценок пока нет

- Suggested Answer - Syl12 - June2017 - Paper - 12 Intermediate ExaminationДокумент16 страницSuggested Answer - Syl12 - June2017 - Paper - 12 Intermediate ExaminationDevendra AryaОценок пока нет

- Sec-B2 2022Документ3 страницыSec-B2 2022Sanchari DasОценок пока нет

- Common Course - Perspectives and Methodology of Business Studies Nov 2009Документ3 страницыCommon Course - Perspectives and Methodology of Business Studies Nov 2009PRIYA CHARLESОценок пока нет

- B.Tech III Year I Semester (R15) Regular Examinations November/December 2017Документ1 страницаB.Tech III Year I Semester (R15) Regular Examinations November/December 2017Sandeep BadinehalОценок пока нет

- Final Examination: Suggested Answers To QuestionsДокумент18 страницFinal Examination: Suggested Answers To QuestionsSmit JariwalaОценок пока нет

- WWW - Manaresults.co - In: (Common To Ce, Eee, Me, Ece, Cse, Eie, It, MCT, Etm, MMT, Ae Mie, PTM, Cee, MSNT)Документ2 страницыWWW - Manaresults.co - In: (Common To Ce, Eee, Me, Ece, Cse, Eie, It, MCT, Etm, MMT, Ae Mie, PTM, Cee, MSNT)NIMMANAGANTI RAMAKRISHNAОценок пока нет

- FM End Sem QP July 2021Документ3 страницыFM End Sem QP July 2021Pratham SharmaОценок пока нет

- B. Com. (Hons.) (Second Semester) Examination, 2015 Commerce (Public Finance) (BCH-202)Документ2 страницыB. Com. (Hons.) (Second Semester) Examination, 2015 Commerce (Public Finance) (BCH-202)AbhishekОценок пока нет

- Financial Management May 2019Документ2 страницыFinancial Management May 2019Thomas RajuОценок пока нет

- Master of Commerce Term-End Examination / 1:3 1-June, 2019Документ4 страницыMaster of Commerce Term-End Examination / 1:3 1-June, 2019Tushar SharmaОценок пока нет

- 2nd Year EnglishДокумент8 страниц2nd Year EnglishKAJAL YADAVОценок пока нет

- 3 Set Q-Papaer FormatДокумент6 страниц3 Set Q-Papaer FormatPalash BairagiОценок пока нет

- Bachelor of Business Administration (BBA) in Retailing II YearДокумент8 страницBachelor of Business Administration (BBA) in Retailing II YearManpreet KaurОценок пока нет

- Mei623b May 2018Документ2 страницыMei623b May 2018Bharat PahujaОценок пока нет

- B.B.A (2013 Pattern)Документ142 страницыB.B.A (2013 Pattern)Priyanka PriyaОценок пока нет

- 0452 m15 QP 12 PDFДокумент16 страниц0452 m15 QP 12 PDFKrish PatelОценок пока нет

- Mba 516Документ2 страницыMba 516api-3782519Оценок пока нет

- Financial Risk Online 2Документ16 страницFinancial Risk Online 2wilson garzonОценок пока нет

- CBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Документ4 страницыCBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill75% (4)

- P. G. D. B. M. (Semester-I) Examination, 2012 101: Principles and Practices of Management and Organisational Behavior (2008 Pattern)Документ54 страницыP. G. D. B. M. (Semester-I) Examination, 2012 101: Principles and Practices of Management and Organisational Behavior (2008 Pattern)Muhamad AdibОценок пока нет

- Data Interpretation Guide For All Competitive and Admission ExamsОт EverandData Interpretation Guide For All Competitive and Admission ExamsРейтинг: 2.5 из 5 звезд2.5/5 (6)

- Strategy for the Corporate Level: Where to Invest, What to Cut Back and How to Grow Organisations with Multiple DivisionsОт EverandStrategy for the Corporate Level: Where to Invest, What to Cut Back and How to Grow Organisations with Multiple DivisionsРейтинг: 5 из 5 звезд5/5 (1)

- 7 Steps to professional project leadership: A practical guide to delivering projects professionally using easy-to-remember steps and tools.От Everand7 Steps to professional project leadership: A practical guide to delivering projects professionally using easy-to-remember steps and tools.Оценок пока нет

- Waterfall Project PlanningДокумент19 страницWaterfall Project PlanningAhmed ShakilОценок пока нет

- TAFA Profit SharingДокумент5 страницTAFA Profit SharingRiza D. SiocoОценок пока нет

- Corporate ReputationДокумент337 страницCorporate Reputationmohitkbr100% (4)

- 55888bos45300 PDFДокумент18 страниц55888bos45300 PDFSourav ChamoliОценок пока нет

- Tax Quick Reviewer - Edward Arriba PDFДокумент70 страницTax Quick Reviewer - Edward Arriba PDFDanpatz GarciaОценок пока нет

- GV - Subex Digital - HY1 - FY - 22-23 - v01 - 10oct2022 - Draft - Report - AS 15 (R)Документ20 страницGV - Subex Digital - HY1 - FY - 22-23 - v01 - 10oct2022 - Draft - Report - AS 15 (R)Ajay GoelОценок пока нет

- Self Evaluation QuestionsДокумент4 страницыSelf Evaluation QuestionsNeeraj KhatriОценок пока нет

- 3 Sem EcoДокумент10 страниц3 Sem EcoKushagra SrivastavaОценок пока нет

- Innovation and Design Thinking PDFДокумент20 страницInnovation and Design Thinking PDFEnjoy ShesheОценок пока нет

- Brand and Branding: Jean - Noel KapfererДокумент19 страницBrand and Branding: Jean - Noel Kapferersun girlОценок пока нет

- Wrigley's Eclipse Case Study - IIMKДокумент2 страницыWrigley's Eclipse Case Study - IIMKDeepu SОценок пока нет

- Union BankДокумент4 страницыUnion Bankanandsingh1783Оценок пока нет

- Best Practices For Deploying Microsoft Dynamics AX Opening BalancesДокумент4 страницыBest Practices For Deploying Microsoft Dynamics AX Opening Balancesearnestgoh3635Оценок пока нет

- Black ListДокумент5 страницBlack ListnaveenОценок пока нет

- Group Asssignment CHAP11Документ5 страницGroup Asssignment CHAP11Lê Trọng Nhân67% (3)

- Multiple Choice Questions Distrubution Logistic PDFДокумент14 страницMultiple Choice Questions Distrubution Logistic PDFYogesh Bantanur50% (2)

- MKT318m SyllabusДокумент54 страницыMKT318m SyllabusBích DânОценок пока нет

- Black BookДокумент50 страницBlack BookRaj PatelОценок пока нет

- SME and SE ParagraphДокумент2 страницыSME and SE ParagraphAimee CuteОценок пока нет

- Peloton Case Study Assignment InstructionsДокумент5 страницPeloton Case Study Assignment Instructionsdineshupadhyay213Оценок пока нет

- OfferLetter PDFДокумент7 страницOfferLetter PDFDanjei SanchezОценок пока нет

- Financial Statement Analysis On BEXIMCO and SQUAREДокумент33 страницыFinancial Statement Analysis On BEXIMCO and SQUAREYolowii XanaОценок пока нет

- A 12 Wage and SalaryДокумент28 страницA 12 Wage and SalaryNeeru SharmaОценок пока нет

- 62 SBD PDFДокумент51 страница62 SBD PDFaneeshp_4Оценок пока нет

- COA Segments 10-31-16Документ108 страницCOA Segments 10-31-16Miguel FelicioОценок пока нет

- English To ArabicДокумент10 страницEnglish To ArabicAyyoob ThayyilОценок пока нет

- Smart Investment Gujarati Issue (H)Документ82 страницыSmart Investment Gujarati Issue (H)Mukesh GuptaОценок пока нет

- Lecture Notes: Auditing Theory AT.0107-Understanding The Entity's Internal Control MAY 2020Документ6 страницLecture Notes: Auditing Theory AT.0107-Understanding The Entity's Internal Control MAY 2020MaeОценок пока нет

- CBM ReportДокумент11 страницCBM ReportBen ChongОценок пока нет

- Customer Satisfaction Research ProposalДокумент16 страницCustomer Satisfaction Research ProposalRichard Lewis71% (7)