Академический Документы

Профессиональный Документы

Культура Документы

SAP SD Sales and Distribution Accounting Entries

Загружено:

Raghuchandran RevanurИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

SAP SD Sales and Distribution Accounting Entries

Загружено:

Raghuchandran RevanurАвторское право:

Доступные форматы

SAP SD Sales and Distribution Accounting Entries INVOICE GENERATION IN SAP Invoices will be generated at the same time.

SAP accounting entries for the sale of goods despatched will flow from the SAP Sales invoice generated in SAP Sales and Distribution module -SD. Following SAP accounting entries shall be posted / passed:

Customer Account Debit Revenue (Sales) Account Credit Excise Duty Payable Credit ( in case of India) Sales Tax Payable (local or central) Credit ( Tax in any country )

FI financial accounting document, will be generated automatically in the background, the SD invoice number shall be captured. However as per the current accounting procedure the accounting entry posted is as below :-

Customer Account Debit Revenue Credit Excise Duty Billed Credit Sales Tax Payable (local or central) Credit

EXPORT SALES

You may configure SAP to deal with export business. SAP system will be designed to handle export business. The accounting entry is posted as below:

Export Customer Account Debit Revenue (Exports) -Sales Credit

The realisation of funds from export sales will be directly Credit to the respective bank. The SAP accounting entries will be posted as below: Bank Debit Export Customer Credit Exchange Fluctuation Debit/ Credit

Exchange fluctuation will arise due to difference in foreign exchange rate at the time of invoicing and at the time of amount realised from bank.

If there is any rebate/ discount or Credit note to be given to customer, following accounting entries to be posted.

Rebates/Discounts account Debit Customer account Credit

DEBIT MEMOS

If there is any situation when Debit Memos shall be issued in case of price difference, sale tax difference and interest on period and overdue payments. Accounting entries for two possible scenarios are as follows:

Price Under charged: Customer Account Debit. Revenue Account Credit. Sales tax payable Account Credit.

If Sales tax undercharged

Customer Account Debit. Sales tax adjustment Account Credit.

If Interest on delayed payments period and other charges

Customer Account Account Debit. Interest Others Account Credit.

SALE OF SCRAP in SAP

The sale of scrap (non-stock) shall be mapped as a direct manual FI entry. The customer will be debited as a FI customer. No Logistics module will be involved in the process. A FI Invoice will be prepared for the sale of scrap with the following entries:

Customer account Debit Sale of Scrap account Credit Excise Duty Payable account Credit

Вам также может понравиться

- European Price List Firebrand TrainingДокумент2 страницыEuropean Price List Firebrand Trainingaqua2376Оценок пока нет

- 2778a 05Документ28 страниц2778a 05gise8Оценок пока нет

- 6234A-En Implementing Maintaining MS SQLServer2008 Analysis Services-TrainerManualДокумент370 страниц6234A-En Implementing Maintaining MS SQLServer2008 Analysis Services-TrainerManualRandall V LiОценок пока нет

- Course 2778A: Writing Queries Using Microsoft® SQL Server® 2008 Transact-SQLДокумент11 страницCourse 2778A: Writing Queries Using Microsoft® SQL Server® 2008 Transact-SQLMansi ThakurОценок пока нет

- BEx Tools 2nd Edition SAP PRESS Sample ChapterДокумент31 страницаBEx Tools 2nd Edition SAP PRESS Sample Chapterbharadwaj037Оценок пока нет

- MCBC TCodesДокумент2 страницыMCBC TCodesshaankaleemОценок пока нет

- 13 14 15 16Документ123 страницы13 14 15 16chelemopОценок пока нет

- Accounting EntriesДокумент5 страницAccounting Entriesshreya9962Оценок пока нет

- SAP Ebook - EWM120 Config - Overview PDFДокумент1 страницаSAP Ebook - EWM120 Config - Overview PDFSanil Guda0% (3)

- Export Document Printing InterfaceДокумент12 страницExport Document Printing InterfaceMatthew SpraderОценок пока нет

- SQLДокумент4 страницыSQLvracleОценок пока нет

- SQL PerfMon Counters ReadyRef Ver 11Документ32 страницыSQL PerfMon Counters ReadyRef Ver 11srikanth_33Оценок пока нет

- MOC.6231B.enu - Beta.maintaining.a.sql - Server.2008.R2.Databaes - Trainer.handbook - Volume1.ebook LMSДокумент528 страницMOC.6231B.enu - Beta.maintaining.a.sql - Server.2008.R2.Databaes - Trainer.handbook - Volume1.ebook LMSasmodian2Оценок пока нет

- 2778A-En Writing Queries Using MS SQL Server Trans SQL-TrainerManualДокумент501 страница2778A-En Writing Queries Using MS SQL Server Trans SQL-TrainerManualsoricutyaОценок пока нет

- Important SAP MM TcodesДокумент4 страницыImportant SAP MM TcodesSrinu KakolluОценок пока нет

- The Complete Web Assistant: Provide in-application help and training using the SAP Enable Now EPSSОт EverandThe Complete Web Assistant: Provide in-application help and training using the SAP Enable Now EPSSОценок пока нет

- 6232A-ENU LabManualДокумент188 страниц6232A-ENU LabManualWaldo Martinez P.Оценок пока нет

- SQL Server 2019 Installation Guide PDFДокумент20 страницSQL Server 2019 Installation Guide PDFHM Moin SiddiquiОценок пока нет

- SAP NetWeaver Business Warehouse A Complete Guide - 2021 EditionОт EverandSAP NetWeaver Business Warehouse A Complete Guide - 2021 EditionОценок пока нет

- Applied Microsoft Analysis Services 2005Документ713 страницApplied Microsoft Analysis Services 2005reidc810100% (1)

- Sap Fico Accounting EntryДокумент18 страницSap Fico Accounting EntryKrishna KumarОценок пока нет

- What Is SAP Plant MaintenanceДокумент5 страницWhat Is SAP Plant MaintenancekkОценок пока нет

- SAPMM ProcurementДокумент2 страницыSAPMM ProcurementTareq ShehadehОценок пока нет

- SAP BI Analysis Authorization (Customer Exit Variables)Документ11 страницSAP BI Analysis Authorization (Customer Exit Variables)rbutacaОценок пока нет

- SAP Accounting EntriesДокумент7 страницSAP Accounting EntriesJessica AlvarezОценок пока нет

- Book3SQLArchitecture WebSampleДокумент90 страницBook3SQLArchitecture WebSamplequirpa88Оценок пока нет

- Sap MMДокумент9 страницSap MMBala KasireddyОценок пока нет

- Procure To Pay Cycle Covers The Following StepДокумент24 страницыProcure To Pay Cycle Covers The Following Stepravi3936Оценок пока нет

- Warehouse Management Systems A Complete Guide - 2019 EditionОт EverandWarehouse Management Systems A Complete Guide - 2019 EditionОценок пока нет

- BPI - I ExercisesДокумент241 страницаBPI - I Exercisesdivyajeevan89Оценок пока нет

- 2 MMДокумент20 страниц2 MMarunОценок пока нет

- Extracting Pricing ConditionsДокумент18 страницExtracting Pricing ConditionsKoos GossОценок пока нет

- BW305-02 Query DesignerДокумент23 страницыBW305-02 Query DesignerAmelia SimónОценок пока нет

- Idoc Extension & ProcessingДокумент28 страницIdoc Extension & Processingesameer7837Оценок пока нет

- TCS SD ConfigurationsДокумент12 страницTCS SD Configurationssekhar dattaОценок пока нет

- SAP MM Tables Link and FlowДокумент1 страницаSAP MM Tables Link and Flowmallikarjun_kОценок пока нет

- BPI-O (Version ECC 6.0 (US) Release January 2008) ExercisesДокумент210 страницBPI-O (Version ECC 6.0 (US) Release January 2008) ExercisesProfe Mónica AnichОценок пока нет

- HU Print For ISU Stock UploadДокумент4 страницыHU Print For ISU Stock UploadshyamsateeshОценок пока нет

- User Manual: "GST - Order To Cash Cycle" GST ImplementationДокумент32 страницыUser Manual: "GST - Order To Cash Cycle" GST ImplementationSamarjit JenaОценок пока нет

- Pricing Configuration Guide With Used CasesДокумент39 страницPricing Configuration Guide With Used CasesGulliver Traveller100% (1)

- Sap SD Configuration 1675701258Документ43 страницыSap SD Configuration 1675701258Abhishek AserkarОценок пока нет

- Accounting Entries in SAP: S No Transaction T Code Other Info GL Account Accounting Entry RemarksДокумент8 страницAccounting Entries in SAP: S No Transaction T Code Other Info GL Account Accounting Entry Remarksnanduri.aparna161Оценок пока нет

- Base Tables in APДокумент6 страницBase Tables in APdevender143Оценок пока нет

- Gross Invoice Posting (RE) V - S Net Invoice Posting (RN) - SAP BlogsДокумент24 страницыGross Invoice Posting (RE) V - S Net Invoice Posting (RN) - SAP BlogsAnanthakumar A100% (1)

- SQL Server 2012 Performance White Paper FINALДокумент10 страницSQL Server 2012 Performance White Paper FINALamos_evaОценок пока нет

- Z Reports - SCNДокумент3 страницыZ Reports - SCNAnkit GargОценок пока нет

- SAP SD Course SyllabusДокумент7 страницSAP SD Course SyllabusRAGHU BALAKRISHNANОценок пока нет

- Idocs in Sap StepsДокумент46 страницIdocs in Sap StepsSyamal Babu N100% (1)

- SAP MM - Inventory Management - Tutorialspoint PDFДокумент15 страницSAP MM - Inventory Management - Tutorialspoint PDFdiwaОценок пока нет

- The Ultimate C - P - TSEC10 - 75 - SAP Certified Technology Professional - System Security ArchitectДокумент3 страницыThe Ultimate C - P - TSEC10 - 75 - SAP Certified Technology Professional - System Security ArchitectKirstingОценок пока нет

- WM Printing SettingsДокумент4 страницыWM Printing SettingsWaaKaaWОценок пока нет

- About Workflow - Release StrategyДокумент11 страницAbout Workflow - Release StrategyShyam ChinthalapudiОценок пока нет

- 1FSales and Distribution Accounting EntriesДокумент4 страницы1FSales and Distribution Accounting EntriesKunjunni MashОценок пока нет

- Regions Bank StatementДокумент1 страницаRegions Bank Statementdudu adulОценок пока нет

- Treasury Rules TR STRДокумент407 страницTreasury Rules TR STREngr Rameez PatoliОценок пока нет

- For ClosureДокумент18 страницFor Closuremau_cajipeОценок пока нет

- Maria Theresia ThalerДокумент5 страницMaria Theresia ThalerZoltan NagyОценок пока нет

- Discussion 4 FinanceДокумент5 страницDiscussion 4 Financepeter njovuОценок пока нет

- GunsДокумент2 страницыGunsDaniela StoianОценок пока нет

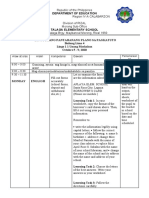

- BM Q2Wk1DLPДокумент10 страницBM Q2Wk1DLPJade MasiragОценок пока нет

- Chap 011Документ14 страницChap 011dbjnОценок пока нет

- Task 1Документ1 страницаTask 1Robin ScherbatskyОценок пока нет

- IDEX 2022 Q4 Interim ReportДокумент26 страницIDEX 2022 Q4 Interim ReportMaria PolyuhanychОценок пока нет

- 180 Words 4th GradeДокумент80 страниц180 Words 4th GradeMrityunjay Kumar Rai100% (16)

- Case Study 4.. Mariam Sharaf Al-Deen-MIS505Документ3 страницыCase Study 4.. Mariam Sharaf Al-Deen-MIS505AbduОценок пока нет

- Prelim NotesДокумент164 страницыPrelim NotesShaina Monique RangasanОценок пока нет

- Lec 1 After Mid TermДокумент9 страницLec 1 After Mid TermsherygafaarОценок пока нет

- Summary of The General Provisions Law and Tax ProceduresДокумент7 страницSummary of The General Provisions Law and Tax ProceduresAndhika Bella PrawitasariОценок пока нет

- Topics Covered: Does Debt Policy Matter ?Документ11 страницTopics Covered: Does Debt Policy Matter ?Tam DoОценок пока нет

- Running Head: Case Study: Pan-Europa Foods 1Документ6 страницRunning Head: Case Study: Pan-Europa Foods 1Prathibha VemulapalliОценок пока нет

- A Assume That Carbondale Co Expects To Receive S 500 000 inДокумент1 страницаA Assume That Carbondale Co Expects To Receive S 500 000 inAmit PandeyОценок пока нет

- DSE ClearingДокумент6 страницDSE ClearingMohammed Anwaruzzaman100% (1)

- Chart 10 Discounting and Compounding TablesДокумент6 страницChart 10 Discounting and Compounding TablesDhandhi PratamaОценок пока нет

- Investment Center and Transfer PricingДокумент10 страницInvestment Center and Transfer Pricingrakib_0011Оценок пока нет

- Cape Economics Past Paper Solutions June 2008Документ11 страницCape Economics Past Paper Solutions June 2008Akeemjoseph50% (2)

- GBP Statement: TransactionsДокумент2 страницыGBP Statement: Transactions13KARATОценок пока нет

- FM 1 CH 4 (Lti) My MLC ExtДокумент19 страницFM 1 CH 4 (Lti) My MLC ExtMELAT ROBELОценок пока нет

- Mancosa Mid Year Undergraduate Fee 2023Документ2 страницыMancosa Mid Year Undergraduate Fee 2023John-ray HendricksОценок пока нет

- These Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NoДокумент2 страницыThese Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NocykenОценок пока нет

- MODULE-3A AND 3B - OUTPUT - de Castro Ana CarlaДокумент10 страницMODULE-3A AND 3B - OUTPUT - de Castro Ana CarlaAna Carla de CastroОценок пока нет

- CV Format For A BankerДокумент2 страницыCV Format For A BankerNurun Nobi100% (1)

- Vat Liability Guide - 2012Документ29 страницVat Liability Guide - 2012Dobu KolobingoОценок пока нет

- Tax DemarirДокумент2 страницыTax DemarirJack SonОценок пока нет