Академический Документы

Профессиональный Документы

Культура Документы

Form No 16 in Excel With Formule

Загружено:

Sayal JiАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Form No 16 in Excel With Formule

Загружено:

Sayal JiАвторское право:

Доступные форматы

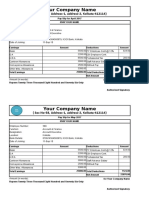

FORM NO.

16 See rule 31(1) (a)

Certificate under section 203 of the income-tax Act, 1961 for tax deducted at source from income chargeable under the head "salaries"

Name & Address of the Employer

Name & Designation of the Employee

PAN/GIR NO.

TAN

PAN/GIR NO. Period From To Assessment Year

Acknowledgement Nos. of all quarterly statements of TDS under sub- section(3) or section 200 as provided by TIN Facilitation Centre or NSDL website

Quarter

Acknowledgement No.

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED 1. GROSS SALARY (a) Salary as per provisions contained in section 17(1) Value of perquisites under section 17 (2) (b) (as per Form No. 12BA, where applicable) (c) Profits in lieu of salary under section 17(3) (as per Form No. 12BA, where applicable) (d) Total 0 2. Less: Allowance to the extent exempt under Section 10 Allowance Rs. 0 3. Balance(1-2) 0 4. Deductions : (a) Entertainment Allowance Rs. Nil (b) Tax on Employment Rs. Nil 5. Aggregate of 4(a) and (b) 6. Income Chargeable under the head 'Salaries' (3-5) 0 7. Add: any other income reported by the employee Rs. 8. Gross Total Income (6+7) 0 9. Deductions under Chapter VI-A 0 (A) Section 80C, 80CCC and 80CCD Deductible Gross Amount Amount (a) Section 80C (i) G.P.F./CPF (ii) G.I.S. (iii) L.I.C. (iv) PPF (v) NSC (vi)

Rs. Rs. Rs. Rs. Rs. Rs.

(b) Section 80 CCC (c) Section 80 CCD

Note:1. Aggregate amount deductible under section 80 C shall not exceed one lakh rupees 2. Aggregate amount deductible under the three sections i.e. 80 C,80 CCC and 80 CCD shall not exceed one lakh rupees

(B)Other sections (for e.g. 80 E, 80 G etc.) under Chapter VI-A Gross Amount (a) Section Rs. (b) Section Rs. (c) Section Rs. (d) Section Rs. (e) Section Rs. Total Rs.

10. Aggregate of deductible amount under Chapter VI-A

Qualifying Amount Rs. Rs. Rs. Rs. Rs. Rs.

11. 12. 13. 14.

Total Income (8-10) Tax on Total Income Surcharge (on tax computed at sr. no. 12) Education Cess (on tax computed at S. No.12 and surcharge at S.No.13) 15. Tax Payable (12+13+14) 16. Relief under section 89 (attach details) 17. Tax Payable (15-16) 18. Less:(a) Tax deducted at source u/s 192(1) (b) Tax paid by the employer on behalf of the employee u/s 192(1A) on prequisites u/s17(2) 19. Tax Payable/Refundable (17-18)

Deductible Amount Rs. Rs. Rs. Rs. Rs. Rs. Rs. 0 Rs. 0 Rs. Rs. Nil Rs. Rs. Rs. Rs. Rs. Rs. Rs.

0 0 0

Rs. Rs.

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT (The Employer is to provide transaction wise details of tax deducted and deposited) S. No. TDS Rs. Surcharge Rs. Education Cess Total tax Cheque/D BSR Code Date of Transfer Rs. deposited D No.(if of Bank depositin voucher/ any) branch g tax Challan Identification No.

1 2 3 4 5 6 7 8 9 10 11 12 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Govt. Treasury Fatehgarh Sahib

I, _____________________working in the capacity of Principal (Designation) do hereby certify that a sum of Rs. _______ [Rupees _________________________ Only (in words) has been deducted at source and paid to the credit of the Center

Signature of the person responsible for deduction of tax Place: Full Name

Date ;

Desgination

Вам также может понравиться

- Salary SlipДокумент1 страницаSalary SlipJohn HallОценок пока нет

- Accenture Form 16Документ7 страницAccenture Form 16Srikrishna PadmannagariОценок пока нет

- Master CTC Calculator & Salary Hike CalculatorДокумент6 страницMaster CTC Calculator & Salary Hike Calculatorvirag_shahsОценок пока нет

- Form No. 16: Part AДокумент5 страницForm No. 16: Part APunitBeriОценок пока нет

- Salary Slip FormatДокумент2 страницыSalary Slip FormatManu SenОценок пока нет

- Christ in The Bible - Jude - A. B. SimpsonДокумент9 страницChrist in The Bible - Jude - A. B. Simpsonhttp://MoreOfJesus.RR.NUОценок пока нет

- CtsДокумент2 страницыCtsDineshОценок пока нет

- QUA05891 SepSalarySlipwithTaxDetailsДокумент1 страницаQUA05891 SepSalarySlipwithTaxDetailssrajput66Оценок пока нет

- CTC - Salary CalculatorДокумент4 страницыCTC - Salary Calculatorboopathi.nОценок пока нет

- PayslipДокумент1 страницаPayslipSanthosh ChОценок пока нет

- A356536Документ1 страницаA356536Er Ravi Kant MishraОценок пока нет

- Auto CTC Salary CalculatorДокумент1 страницаAuto CTC Salary CalculatorSathvika SaaraОценок пока нет

- Dua AdzkarДокумент5 страницDua AdzkarIrHam 45roriОценок пока нет

- Salary Breakup Calculator ExcelДокумент3 страницыSalary Breakup Calculator ExcelLaksHay JuggyОценок пока нет

- Salary SlipДокумент1 страницаSalary SlipJames Jones100% (1)

- Interview Letter Tata 2Документ3 страницыInterview Letter Tata 2Ghazala JamalОценок пока нет

- Form 16 FormatДокумент2 страницыForm 16 FormatParthVanjaraОценок пока нет

- E3 - Mock Exam Pack PDFДокумент154 страницыE3 - Mock Exam Pack PDFMuhammadUmarNazirChishtiОценок пока нет

- Pay Slip ModelДокумент1 страницаPay Slip ModelAryan ShashiОценок пока нет

- Appraisal Letter 2Документ1 страницаAppraisal Letter 2csreddyatsapbiОценок пока нет

- 556salary Slip Template V12Документ5 страниц556salary Slip Template V12Kathleen PascualОценок пока нет

- Employee Details Payment & Leave Details: Arrears Current AmountДокумент1 страницаEmployee Details Payment & Leave Details: Arrears Current AmountsakthivelОценок пока нет

- QUA05242 Form16Документ5 страницQUA05242 Form16saurabhОценок пока нет

- Salary Slip FebДокумент1 страницаSalary Slip FebDee JeyОценок пока нет

- Comviva Technologies Limited: Pay Slip For The Month of April 2012Документ1 страницаComviva Technologies Limited: Pay Slip For The Month of April 2012Prabhakar KumarОценок пока нет

- June SalaryДокумент1 страницаJune Salaryaruna nadagouniОценок пока нет

- Jitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Документ4 страницыJitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Sonam BhardwajОценок пока нет

- Salary SlipДокумент3 страницыSalary Slippankaj singhОценок пока нет

- SalarySlip 5876095Документ1 страницаSalarySlip 5876095Larry WackoffОценок пока нет

- Payslip For The Month of JUN-2011Документ1 страницаPayslip For The Month of JUN-2011Binay K SrivastawaОценок пока нет

- Manoj Singh ITRДокумент1 страницаManoj Singh ITRPANKAJ RAUTELAОценок пока нет

- (123066207) 24957413-Copy-of-Sample-of-Pay-SlipДокумент1 страница(123066207) 24957413-Copy-of-Sample-of-Pay-Slipabhimanbehera100% (1)

- Risk AssessmentДокумент11 страницRisk AssessmentRutha KidaneОценок пока нет

- Payslip For MarchДокумент1 страницаPayslip For Marchomkass100% (1)

- 12A (Ground Floor), Prakash Deep Building, 7 Tolstoy Marg, New Delhi, INДокумент1 страница12A (Ground Floor), Prakash Deep Building, 7 Tolstoy Marg, New Delhi, INwdwdwОценок пока нет

- Offer Letter Personal & Confidential: Asish Kumar JДокумент3 страницыOffer Letter Personal & Confidential: Asish Kumar JSecret EarthОценок пока нет

- Employee Details Payment & Leave Details: Arrears Current AmountДокумент1 страницаEmployee Details Payment & Leave Details: Arrears Current Amountvarunk8275Оценок пока нет

- FORM16: Signature Not VerifiedДокумент5 страницFORM16: Signature Not Verifiedmath_mallikarjun_sapОценок пока нет

- Payslip 103323 092013Документ1 страницаPayslip 103323 092013vishu_mmmec0% (1)

- Cebu BRT Feasibility StudyДокумент35 страницCebu BRT Feasibility StudyCebuDailyNews100% (3)

- FORM16Документ5 страницFORM16sunnyjain19900% (1)

- Salary StructureДокумент4 страницыSalary StructureniranjanaОценок пока нет

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryДокумент2 страницыSalary Calculation Yearly & Monthly Break Up of Gross Salarymoh300Оценок пока нет

- Salary Slip FinalДокумент1 страницаSalary Slip FinalSarita NayakОценок пока нет

- 1 1000 Form16Документ5 страниц1 1000 Form16Rakshit SharmaОценок пока нет

- Emp Code Emp Name Department Cost Center PF No. Location Designation Esi No. Date of Birth Bank A/c No Pan No. Date of Joining Gender Eps No. UANДокумент1 страницаEmp Code Emp Name Department Cost Center PF No. Location Designation Esi No. Date of Birth Bank A/c No Pan No. Date of Joining Gender Eps No. UANVBОценок пока нет

- Mar 2021Документ1 страницаMar 2021Srinivas HkОценок пока нет

- Revenue LipcksДокумент1 страницаRevenue LipcksArPit GuptaОценок пока нет

- Walmart Global Tech India - Software Engineer LLДокумент3 страницыWalmart Global Tech India - Software Engineer LLShbОценок пока нет

- Leave Letter SalmanДокумент1 страницаLeave Letter SalmanSALMAN JEETОценок пока нет

- Salary Slip Format For HCLДокумент1 страницаSalary Slip Format For HCLrajkannamdu100% (1)

- Salary Slip NovДокумент1 страницаSalary Slip NovRahul RajawatОценок пока нет

- Matrimony - Offer LetterДокумент6 страницMatrimony - Offer LettersperoОценок пока нет

- EPF CalenderДокумент1 страницаEPF CalenderAmitav TalukdarОценок пока нет

- IBM Salary CalculatorДокумент11 страницIBM Salary Calculatorapi-3817239100% (7)

- Pay SlipДокумент1 страницаPay SlipKumar AshuОценок пока нет

- Cubist ResumeДокумент1 страницаCubist ResumeOtabek SadiridinovОценок пока нет

- HRA Exemption CalculatorДокумент10 страницHRA Exemption CalculatorBala Balaji MОценок пока нет

- Salary Structure: Please Put The Gross Salry in Red Column in Any Slab, U Will Find StructureДокумент6 страницSalary Structure: Please Put The Gross Salry in Red Column in Any Slab, U Will Find StructureSagar ShindeОценок пока нет

- Form 16Документ6 страницForm 16Ravi DesaiОценок пока нет

- Form 16Документ2 страницыForm 16Hari Krishnan ElangovanОценок пока нет

- Form 16Документ2 страницыForm 16jwadje1Оценок пока нет

- Form 16Документ3 страницыForm 16tid_scribdОценок пока нет

- 1 Form 16 16a LatestДокумент25 страниц1 Form 16 16a LatestNishant GhaseОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОценок пока нет

- Form I-129F - BRANDON - NATALIAДокумент13 страницForm I-129F - BRANDON - NATALIAFelipe AmorosoОценок пока нет

- War and Peace NTДокумент2 882 страницыWar and Peace NTAMBОценок пока нет

- Lesson 9 Government Programs and Suggestions in Addressing Social InequalitiesДокумент25 страницLesson 9 Government Programs and Suggestions in Addressing Social InequalitiesLeah Joy Valeriano-QuiñosОценок пока нет

- Basavaraju Reservation Under The Constitution of India Issues and PerspectivesДокумент9 страницBasavaraju Reservation Under The Constitution of India Issues and PerspectivesK ThirunavukkarasuОценок пока нет

- Running Head: Problem Set # 2Документ4 страницыRunning Head: Problem Set # 2aksОценок пока нет

- Itinerary KigaliДокумент2 страницыItinerary KigaliDaniel Kyeyune Muwanga100% (1)

- Weavers, Iron Smelters and Factory Owners NewДокумент0 страницWeavers, Iron Smelters and Factory Owners NewWilliam CookОценок пока нет

- Campaign Period: Terms and Conditions "CIMB 4.7% FD/FRIA-i Bundle With CASA/-i"Документ6 страницCampaign Period: Terms and Conditions "CIMB 4.7% FD/FRIA-i Bundle With CASA/-i"Tan Ah LiannОценок пока нет

- 304 1 ET V1 S1 - File1Документ10 страниц304 1 ET V1 S1 - File1Frances Gallano Guzman AplanОценок пока нет

- Employee Shift ScheduleДокумент32 страницыEmployee Shift ScheduleRishane RajapakseОценок пока нет

- From "Politics, Governance and The Philippine Constitution" of Rivas and NaelДокумент2 страницыFrom "Politics, Governance and The Philippine Constitution" of Rivas and NaelKESHОценок пока нет

- Unit 7:: Intellectual PropertyДокумент52 страницыUnit 7:: Intellectual Propertyمحمد فائزОценок пока нет

- OD2e L4 Reading Comprehension WS Unit 3Документ2 страницыOD2e L4 Reading Comprehension WS Unit 3Nadeen NabilОценок пока нет

- Security Incidents and Event Management With Qradar (Foundation)Документ4 страницыSecurity Incidents and Event Management With Qradar (Foundation)igrowrajeshОценок пока нет

- Folio BiologiДокумент5 страницFolio BiologiPrincipessa FarhanaОценок пока нет

- 4 Secrets Behind Disney's Captivating Marketing StrategyДокумент10 страниц4 Secrets Behind Disney's Captivating Marketing StrategyJuan Camilo Giorgi MartinezОценок пока нет

- 2020 Macquarie University Grading and Credit Point System PDFДокумент2 страницы2020 Macquarie University Grading and Credit Point System PDFRania RennoОценок пока нет

- Albert EinsteinДокумент3 страницыAlbert EinsteinAgus GLОценок пока нет

- BibliographyДокумент6 страницBibliographyJpWeimОценок пока нет

- VoterListweb2016-2017 81Документ1 страницаVoterListweb2016-2017 81ShahzadОценок пока нет

- CCC Guideline - General Requirements - Feb-2022Документ8 страницCCC Guideline - General Requirements - Feb-2022Saudi MindОценок пока нет

- Business Finance: Quarter 2 - Module 6: Philosophy and Practices in Personal FinanceДокумент2 страницыBusiness Finance: Quarter 2 - Module 6: Philosophy and Practices in Personal FinanceClemente AbinesОценок пока нет

- Final Project Report - Keiretsu: Topic Page NoДокумент10 страницFinal Project Report - Keiretsu: Topic Page NoRevatiОценок пока нет

- Gifts Under Islamic Law 2Документ24 страницыGifts Under Islamic Law 2Utkarsh SinghОценок пока нет

- Questionnaires in Two-Way Video and TeleconferencingДокумент3 страницыQuestionnaires in Two-Way Video and TeleconferencingRichel Grace PeraltaОценок пока нет