Академический Документы

Профессиональный Документы

Культура Документы

Ghmc-Fee Charges 08

Загружено:

kgannapureddyИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ghmc-Fee Charges 08

Загружено:

kgannapureddyАвторское право:

Доступные форматы

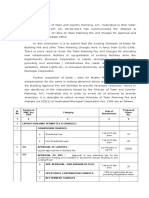

GREATER HYDERABAD MUNICIPAL CORPORATION

SCHEDULE OF TOWN PLANNING CHARGES & FEES Item No.16 of Agenda No.21

Resolution No.416, Dated:30.6.2008 of the Standing Committee, GHMC Town Planning Section (HO) Building Permit Fee & others Charges Schedule of Rates Rationalization of rates (Town Planning Charges & Fees) in the entire GHMC Area Proposals submitted for Revision Approval Requested. RESOLUTION NO.94 DATED:30.06.2008 The Resolution No.416, dated:30.6.2008 of the Standing Committee, GHMC is considered. The Corporation accorded approval for rationalizing the schedule of rates to have uniform rates (Town Planning charges & Fees) in the entire GHMC area and also to enhance the rates reasonably as the rates prevailing in erstwhile MCH area / erstwhile surrounding municipalities were lastly revised during 1994-2003. These rates are applicable to the entire GHMC area with effect from 01.07.2008 as detailed in the statement and annexure appended below:

SCHEDULE OF TOWN PLANNING CHARGES & FEES WITH EFFECT FROM 01-07-2008

S. No. 1

1

Section / HMC Act 1955 / Rules 2

388 & Layout Rules 1965 i ii iii

Category 3

Proposed Rs. Per Sq.mt. 4

Unit 6

Minimum Amount 7

Permission to obtain Layout / Sub-division of Site / Plot

Residential Non-Residential Open spaces contribution charges: Un-authorised layouts / sub-division cost of 14% total plot area 15 20 Prevailing Registration Value 1 sq mt. 1 sq mt. 1 Sq mt. 5000 7500 As per Prevailing Rules

388 & Layout Rules 1965

Betterment Charges for Internal Amenities / Works for site / Plot area External Betterment Charges (for Arterial roads, Lung spaces, other city wide amenities)

Residential Buildings

Other Areas B'Hills & J'Hills 125 175 1 Sq mt. of Site Area As per Prevailing Rules

ii

A.

i ii

B.

Commercial / Institutional / Industrial / Cinema Hall / Function Hall / Other Buildings

Other Areas B'Hills & J'Hills 175 225 1 Sq mt. of Site Area As per Prevailing Rules

i ii

-1-

428 to 433 & Building Bye Laws 1981

Permission to Construct or Reconstruct or Additions or Alterations

A.

i ii iii iv v

Residential Building

upto 200 Sq.Mt of plot area from 201 to 500Sq Mt. of Plot area from 501 to 750Sq Mt. of Plot area above 750 Sq Mt. Plot Area High- rise Building 10 50 70 80 100 1 Sq.mt of Built Up Area As per Prevailing Rules

B.

Commercial / Institutional / Industrial / Cinema Hall / Function Hall / Other Buildings

upto 200 Sq.Mt of plot area from 201 to 500Sq Mt. of Plot area from 501 to 750Sq Mt. of Plot area above 750 Sq Mt. Plot Area High- rise Building 50 90 100 120 150 A. Exempted Only from Building Permit Fee B. All other charges as per schedule of rates have to be paid in full. Rates as prescribed for the respective uses. 1Sq.mt of Built Up Area As per Prevailing Rules

i ii iii iv v

C.

i ii

Religious Buildings

Prayer Hall Other than religious structures for Residential / Commercial / Other uses.

D.

Other Buildings

A. 50% of Building Permit Fee to be paid. B. All other charges as per schedule of rates as per uses have to be paid in full. 6% of Construction Cost

Charitable Buildings on submission of Income Tax Returns

ii

Petrol Pump Service Station / Canopy / Cabins / Weighing Bridge, etc., Construction / Establishment of Exhibition Grounds, Fair, Circus, Industrial / Handicrafts / Handlooms Exhibition / Govt. Sponsored Exhibition. Opening of Gate, Window, Ventilators, Opening of Door, Replacement of Shutter etc. Construction of Compound / Boundary Wall

iii

10

1 Sq mt. (Site Area)

As per Prevailing Rules As per Prevailing Rules As per Prevailing Rules

iv

250

Each Opening

20

1 Rmt

444 (a)

A.

Betterment charges for Builtup area (for internal amenities) External Betterment charges for Built up area (External-City-wideamenities)

Individual Residential Building/Prayer Hall Group Housing / High rise Building Commercial / Institutional / Industrial / Other Buildings (Non High Rise) Commercial / Institutional / Industrial / Other Buildings (High Rise) 100 150 175 1 Sq mt. 1 Sq mt. 1 Sq mt.

B.

i ii iii iv

As per Prevailing Rules

225

1 Sq mt.

-2-

G.O.Ms No.439 MA & UD dt:13/06/2007 G.O.Ms No.766 MA & UD dt:18/10/2007 G.O.Ms No.86 MA & UD dt:03/03/2006 (Under rule17) G.O.Ms No.86 MA & UD dt 03/03/2006 (Under rule16) Serelingampalli Circle (CDA area)

Development Charges Impact Fee City Level Infrastructure Impact Fee Special Fees & Other Provisions Value Addition Charges in CDA Area. Rain Water Harvesting Charges

As prescribed by the Government from time to time As prescribed by the Government from time to time As prescribed by the Government from time to time As prescribed by the Government from time to time 1 sq.mt As per Prevailing Rules

310 (2008)

10 All categories of Buildings 8

1 sq.mt of builtup area

As per Prevailing Rules

11

Vacant Land Tax as per Registration Value in Sale Deeds. G.O.Ms No. 538 MA dt:29/10/2001

Vacant Land Tax

0.50 % on prevailing Registration value + Library Cess @ 8% on Vacant Land Tax

Compounding Fee

As fixed by the Govt. From time to time ( Under Schedules "U" & "V" of HMC Act 1955)

12

440

Compounding fee for Violation of Building Regulations within the competence / for Starting the construction before permission (if necessary ) is released

13

399 i ii

Unobjectionable Sunshades, Balconies, Canopy, Steps, etc. Projecting into Street Margins (For one Year)

For Temporary Structure For Permanent Structure 150 300 1 Sq mt 1 Sq mt

Demolition Expenses

2500 per sq. mt. of demolished area or Actual expenses incurred

452(2) & 636 14

In respect of Un- Authorised Construction

456(4)

ii

Removal of Dilapidated Structure

Demolition Cost & Admin. Expenses as determined by Commissioner

-3-

15

Bye laws relating to the Grant of Certified Copies or Extracts from Mpl. Records i ii iii iv

Issue of Certified Copies of Sanctioned Building Plans / Sanctioned Layout Plans

Up to 2 acres extent For every one additional acre of land Building Plan Upto 100 Sq.m of Plinth area. For every Additional 100 Sq.m of Plinth Area. 600 150 Per Copy Per Copy

500 150

Per Copy Per Copy

16

Sec 586 of HMC Act 1955 & Building Bye Laws, 1981and as per G.O. Ms.No. 86 MA dt: 03.03.06

Licence Fee

i Architects / Engineers / Structural Engineers / Town Planners / Real Estate Companies /Developers / Builders Surveyors 10000 7500 5 years 5 years

ii 17

Postage & Advertisement Charges i

ii iii Individual Residential Buildings Group Housing / Commercial Buildings and etc High Rise Building 100 2000 5000 Each case Each Case Each case

Annexure to Schedule of Fees & Charges 1. The 2% of Building Permit Fee / Licence Fee shall be paid along with the Building Application subject to a Maximum of Rs. 10,000/- as initial fees. The balance building Permit / Licence fee together with other fees and Charges shall be levied and collected before the issue of permission / sanction. In case of rejection of the application, the above initial fees would be forfeited. Construction / Erection / Additions / Alternations of buildings, the fees chargeable shall be as the same for erection of new buildings as stated under Sl. No. 3 of Schedule. For additions and alterations in the existing building, the fees shall be chargeable on the proposed added portions only. No permit fee shall be chargeable for re-submission of revised plan by the party within six months where area does not exceed the area of previous sanctioned plan. In case where revised plans are submitted after the expiry of six months and within one year 50 per cent of original permit fee shall be chargeable. If submitted after one year fresh building permit fee under Sl. No. 3 of the schedule of rates shall be collected. In case of additions and alterations of buildings if the use of the sanctioned building is also changed, then the chargeable fees shall be calculated on the use proposed under Sl. No. 3 of Schedule. In case of basement / Cellar / Sub-cellar / Stilt meant for parking no charges under Sl. No. 3 of the schedule shall be collected as per GO Ms. No. 86 MA dt: 03.03.2006. In the case of buildings with principal and subsidiary occupancies in which the fees leviable are different then the fees for the total Building shall be calculated as per the rates for respective occupancies as given under Sl. No. 3 of Schedule. The Building Permit Fee for religious building proposed for prayer halls including Staircase, Balconies, Corridors, Toilets are exempted under Sl.No. 3 C (i) of Schedules, where as the Building Permit Fee for other uses shall be collected under Sl. No. 3 C (ii) of Schedule. If the building application is exclusively for Bore-well / Shutters / Doors / Windows / Ventilators / Gates the Building Permit Fee / Licence Fee shall be collected as prescribed under Sl. No. 3 D (iv) of Schedule. And the same need not be collected for regular building application. The Betterment Charges, External Betterment Charges, Sub-Division Charges and Open Space Contribution Charges on Plot area shall be collected where the sites are not covered by Approved Layouts / Approved Sub-Divisions and previous Sanctioned Plan as prescribed under Sl. No. 1 & 2 of Schedule. The Betterment Charges, External Betterment Charges on Built up area shall be collected in all cases as prescribed under Sl. No. 4 of Schedule. Sd/Special Officer, GHMC

2. 3. 4.

5. 6. 7.

8.

9.

10.

11.

-4-

-5-

-6-

Вам также может понравиться

- Makati City Permits - and - Clearances PDFДокумент40 страницMakati City Permits - and - Clearances PDFros_ivan50% (2)

- Complaint (Jones v. Flossmoor) (File-Stamped)Документ21 страницаComplaint (Jones v. Flossmoor) (File-Stamped)Lauren TrautОценок пока нет

- Dealing With Construction Permits in TurkeyДокумент5 страницDealing With Construction Permits in Turkeysmimtiaz8958Оценок пока нет

- Circular - MCGM For Fungible FSIДокумент4 страницыCircular - MCGM For Fungible FSIMehul ZaveriОценок пока нет

- Huda - Building Bye LawsДокумент11 страницHuda - Building Bye LawsSaritha Reddy76% (21)

- RIICO Building Bye LawsДокумент21 страницаRIICO Building Bye LawsSohan AdvaniОценок пока нет

- James Coleman's Foundations of Social TheoryДокумент25 страницJames Coleman's Foundations of Social TheoryHaneefa MuhammedОценок пока нет

- CMDA NormsДокумент10 страницCMDA NormskkarukkuvelanОценок пока нет

- Building Fee Schedule of RatesДокумент6 страницBuilding Fee Schedule of RatesRaghu RamОценок пока нет

- Issued Provisional Fire NOC Certificate 1091Документ9 страницIssued Provisional Fire NOC Certificate 1091ram hanumanthaОценок пока нет

- Building RulesДокумент3 страницыBuilding Rulesmunai8100% (1)

- Building Plan Approval ProcessДокумент4 страницыBuilding Plan Approval ProcessvikrameedpugantiОценок пока нет

- 2010 Punjab Municipal Bye Laws AmendmentДокумент9 страниц2010 Punjab Municipal Bye Laws Amendmentvipul_dharmaniОценок пока нет

- Building Permit GuideДокумент22 страницыBuilding Permit GuideDeeksha SahuОценок пока нет

- PC Case # Text Amendment June 20, 2011: Applicant: Property Location: Requested Action: PurposeДокумент5 страницPC Case # Text Amendment June 20, 2011: Applicant: Property Location: Requested Action: PurposeThe News-HeraldОценок пока нет

- Application For Demolition Permit enДокумент6 страницApplication For Demolition Permit enhahaerОценок пока нет

- Background Material For: Ca Rajiv LuthiaДокумент21 страницаBackground Material For: Ca Rajiv Luthiavenka07Оценок пока нет

- Amended Composition Policy 30.5.11Документ2 страницыAmended Composition Policy 30.5.11Abhimanyu BhatiaОценок пока нет

- Building: Permitting and Inspection GuidelinesДокумент9 страницBuilding: Permitting and Inspection GuidelinesAntara DeyОценок пока нет

- Building Permits and Requirements in Damascus TownshipДокумент35 страницBuilding Permits and Requirements in Damascus TownshipTushar RahmanОценок пока нет

- Building Permission ProcedureДокумент6 страницBuilding Permission ProcedureDheska AgungwОценок пока нет

- Building Permit Application GuideДокумент4 страницыBuilding Permit Application GuideZnake Von LucasОценок пока нет

- Building Regulation & RIICO RulesДокумент228 страницBuilding Regulation & RIICO Rulesalok tripathiОценок пока нет

- Building Regulation 240902021Документ21 страницаBuilding Regulation 240902021alok tripathiОценок пока нет

- Building Penalisation SchemeДокумент26 страницBuilding Penalisation SchemepashiОценок пока нет

- Planning Permission and Building License: PreambleДокумент24 страницыPlanning Permission and Building License: PreambleSenthil HariОценок пока нет

- Residental PlotДокумент5 страницResidental PlotXplore RealtyОценок пока нет

- QUOTATIONДокумент4 страницыQUOTATIONJohnMiguelMolinaОценок пока нет

- GO Ms No-171Документ5 страницGO Ms No-171Arunachalam NagarajanОценок пока нет

- Building Permission Guidelines PDFДокумент3 страницыBuilding Permission Guidelines PDFramanaidu1Оценок пока нет

- Building Department: 157.01 BUILDING CODES ADOPTED - COPIES ON FILE. Pursuant To Published Notice andДокумент13 страницBuilding Department: 157.01 BUILDING CODES ADOPTED - COPIES ON FILE. Pursuant To Published Notice andapi-345893311Оценок пока нет

- Tower Ordinance Kons. AlДокумент5 страницTower Ordinance Kons. AlBonifacio Diego ChaddzkyОценок пока нет

- The Mist Avenue: Price List For Tower 1 and 3 Effective From 25.02.2013Документ3 страницыThe Mist Avenue: Price List For Tower 1 and 3 Effective From 25.02.2013Raju MahatoОценок пока нет

- Calling Offers For Acquisition of Premises On Lease For Racpc ThaneДокумент7 страницCalling Offers For Acquisition of Premises On Lease For Racpc ThaneUday MitraОценок пока нет

- Dy CH Eng Building Proposal City RTI E18Документ12 страницDy CH Eng Building Proposal City RTI E18Sohail KhanОценок пока нет

- Building Permit RequirementsДокумент84 страницыBuilding Permit RequirementsVandana GuptaОценок пока нет

- Fee and ChargesДокумент27 страницFee and ChargesharishchowdarydtcpОценок пока нет

- MCD-Sanction of MapДокумент83 страницыMCD-Sanction of Mapd_narnolia86% (7)

- MCGM Circular 76c34d458f2582f930879f705b51138fДокумент15 страницMCGM Circular 76c34d458f2582f930879f705b51138fkk hakoba02Оценок пока нет

- Frequently Asked Questions About Mumbai Development PlansДокумент13 страницFrequently Asked Questions About Mumbai Development Plansyash shahОценок пока нет

- SEZ Rules - Reseach NoteДокумент4 страницыSEZ Rules - Reseach NoteAlina SujithОценок пока нет

- Application Form I Psi 2007 Non MegaДокумент7 страницApplication Form I Psi 2007 Non MegaRohan KulkarniОценок пока нет

- Guidelines On Land AllotmentДокумент10 страницGuidelines On Land AllotmentJawwad AhmadОценок пока нет

- Residental Cum Commercial ShiftДокумент5 страницResidental Cum Commercial ShiftXplore RealtyОценок пока нет

- Policy For Dealing Proposals For PermissionДокумент3 страницыPolicy For Dealing Proposals For PermissionNeelesh PatilОценок пока нет

- AGF Procedures and Guidelines: City of Los Angeles Bureau of EngineeringДокумент22 страницыAGF Procedures and Guidelines: City of Los Angeles Bureau of EngineeringalbersstreetОценок пока нет

- Building and Land Use Permit GuideДокумент45 страницBuilding and Land Use Permit GuideAkhilesh Krishna RamkalawonОценок пока нет

- Bungalows Down Payment 15% DiscountДокумент2 страницыBungalows Down Payment 15% DiscountPankaj KumarОценок пока нет

- Hmda Layout Poojitha Tech ParkДокумент3 страницыHmda Layout Poojitha Tech ParkCrazy ProductionsОценок пока нет

- Amendments to Building Rules 2012Документ7 страницAmendments to Building Rules 2012Sridhar NimmagaddaОценок пока нет

- Building PermitДокумент30 страницBuilding PermitChristine Lyza DinamlingОценок пока нет

- Procedure Documents N.O.C.s Required For Approval of APDPMSДокумент3 страницыProcedure Documents N.O.C.s Required For Approval of APDPMSRaghu RamОценок пока нет

- NWMC Draft DCR Govt SubmissionДокумент339 страницNWMC Draft DCR Govt SubmissionAjay MahaleОценок пока нет

- ClearanceДокумент4 страницыClearanceJowaheer BeshОценок пока нет

- PN 1 - 2021Документ4 страницыPN 1 - 2021Grandma WongОценок пока нет

- Construction Excise Tax ProposalДокумент5 страницConstruction Excise Tax ProposalSinclair Broadcast Group - EugeneОценок пока нет

- V (1) 03/sys.: Office of The Commissioner Customs, Central Excise & Service Tax Commissionerate Meerut-IiДокумент8 страницV (1) 03/sys.: Office of The Commissioner Customs, Central Excise & Service Tax Commissionerate Meerut-IiAnkit DattОценок пока нет

- Building Design To Foster A Quality and Sustainable Built EnvironmentДокумент10 страницBuilding Design To Foster A Quality and Sustainable Built EnvironmentkevinbovoОценок пока нет

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryОт EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryОценок пока нет

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703От EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Оценок пока нет

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОт EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОценок пока нет

- Judge Flanagan MemoДокумент3 страницыJudge Flanagan MemoTodd FeurerОценок пока нет

- ITB No. 2022 09 and Bidding Documents Procurement of Janitorial Services For The COA Central OfficeДокумент45 страницITB No. 2022 09 and Bidding Documents Procurement of Janitorial Services For The COA Central OfficeCarina Isabel R. De LeonОценок пока нет

- DFSA Business Plan 21-22-Hires SpreadДокумент16 страницDFSA Business Plan 21-22-Hires SpreadForkLogОценок пока нет

- Essential Principles For The Conservation of Liberty 45pgs by Joel SkousenДокумент45 страницEssential Principles For The Conservation of Liberty 45pgs by Joel SkousenlennysanchezОценок пока нет

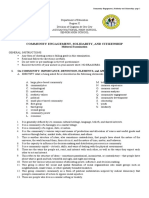

- Community Engagement, Solidarity and CitizenshipДокумент3 страницыCommunity Engagement, Solidarity and CitizenshipEɪ DəОценок пока нет

- 1 - Growth and Direction of International Trade - PPT - 1Документ18 страниц1 - Growth and Direction of International Trade - PPT - 1Rayhan Atunu67% (3)

- Human Rights and Crimes Against HumanityДокумент3 страницыHuman Rights and Crimes Against HumanityAsuderaziye GülmezОценок пока нет

- Financial Transaction Worksheet, Luca ProblemДокумент3 страницыFinancial Transaction Worksheet, Luca ProblemFeiya LiuОценок пока нет

- Bionatura-Icmje-Disclosure Honey-FormДокумент3 страницыBionatura-Icmje-Disclosure Honey-FormJosé SalazarОценок пока нет

- Kmu VS Garcia - DigestДокумент2 страницыKmu VS Garcia - DigestRaiza SarteОценок пока нет

- Book exams at public venuesДокумент7 страницBook exams at public venuesmelindamiguelОценок пока нет

- Kattule LawДокумент132 страницыKattule LawKaran VermaОценок пока нет

- 046 Death and The Kings HorsemenДокумент2 страницы046 Death and The Kings HorsemenMisajОценок пока нет

- Personal Grooming: Looking Best For Your WorkДокумент13 страницPersonal Grooming: Looking Best For Your WorkShai MahadikОценок пока нет

- Course Registration FormДокумент1 страницаCourse Registration FormaleepОценок пока нет

- 1.neetu Singh Case StudyДокумент6 страниц1.neetu Singh Case Studykailash chauhan100% (1)

- S.J. Mukhopadhaya, J. (Chairperson) and Balvinder Singh, Member (T)Документ18 страницS.J. Mukhopadhaya, J. (Chairperson) and Balvinder Singh, Member (T)nkhahkjshdkjasОценок пока нет

- Kajokoto R0002Документ104 страницыKajokoto R0002Jacob KasambalaОценок пока нет

- Sta Rosa v. AmanteДокумент2 страницыSta Rosa v. AmanteSGOD HRDОценок пока нет

- August 2 IndictmentsДокумент6 страницAugust 2 IndictmentsWSYX/WTTEОценок пока нет

- Legal Research Draft FinalsДокумент2 страницыLegal Research Draft FinalsLorden FarrelОценок пока нет

- Final Accounts ProblemДокумент21 страницаFinal Accounts Problemkramit1680% (10)

- Nigerian Journal of Accounting Research paper examines insurance industry's economic impactДокумент10 страницNigerian Journal of Accounting Research paper examines insurance industry's economic impactBrianОценок пока нет

- Filipino Grievances Against Governor Wood: Approved by The Commission On Independence On November 17, 1926Документ30 страницFilipino Grievances Against Governor Wood: Approved by The Commission On Independence On November 17, 1926maria corrine bautistaОценок пока нет

- The Personal Property Security ActДокумент13 страницThe Personal Property Security ActJutajero, Camille Ann M.Оценок пока нет

- Pfa-Short Notes PDFДокумент9 страницPfa-Short Notes PDFAnonymous OPix6Tyk5IОценок пока нет

- LawTG02 PDFДокумент20 страницLawTG02 PDFAdrian SeketaОценок пока нет

- WK 9 DFДокумент5 страницWK 9 DFStaygoldОценок пока нет