Академический Документы

Профессиональный Документы

Культура Документы

Practice8D Public Benefit

Загружено:

Wood River Land TrustИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Practice8D Public Benefit

Загружено:

Wood River Land TrustАвторское право:

Доступные форматы

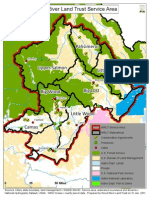

Wood River Land Trust LTA Standard 8: Evaluating and Selecting Conservation Projects

8D: Public Benefit

_______________________________________________ _

Practice 8D: Wood River Land Trust is obligated to uphold the public trust in its conservation activities and to ensure that all projects provide significant public benefit. The public benefit of every fee simple land and conservation easement transaction must be documented, as well as how the benefits are consistent with the Land Trusts mission (Appendix 8B.1 Project Selection Checklist). All conservation easements and baseline document reports must describe the public benefit of easement transactions. For noneasement projects, the staff report must document the public benefit served by the transaction. All projects that the Wood River Land Trust is involved in must conform to applicable federal and state charitable trust laws. If the transaction involves public purchase or tax incentive programs, the Land Trust must satisfy any additional federal, state or local requirements for public benefit. The IRSs conservation purposes test can be used as a guide to test the public benefit of easements and fee simple acquisitions alike, tax deductible or not. In effect, these criteria define conservation values that are considered to be in the national interest (and thus their protection is worthy of federal tax benefits). These criteria are outlined in Practice 8C: Federal and State Requirements and reflected in the Project Selection Checklist.

Standard 8 - Public Benefit / Page 1 of 1 / Approved by the Board November 27, 2007

Вам также может понравиться

- Practice8C Fed State RequirementsДокумент1 страницаPractice8C Fed State RequirementsWood River Land TrustОценок пока нет

- Practice8I&8J PartnershipsДокумент1 страницаPractice8I&8J PartnershipsWood River Land TrustОценок пока нет

- Policy8B Project Selection ProcessДокумент1 страницаPolicy8B Project Selection ProcessWood River Land TrustОценок пока нет

- Policy8K Evaluating RisksДокумент1 страницаPolicy8K Evaluating RisksWood River Land TrustОценок пока нет

- Policy8H Conservation ToolДокумент1 страницаPolicy8H Conservation ToolWood River Land TrustОценок пока нет

- County of Sacramento CaliforniaДокумент11 страницCounty of Sacramento Californiamaweiser1655Оценок пока нет

- Performance Standard 5 - Effective January 1, 2012Документ10 страницPerformance Standard 5 - Effective January 1, 2012IFC SustainabilityОценок пока нет

- 2012 Greening Vacant LotsДокумент134 страницы2012 Greening Vacant LotsRafael MelendezОценок пока нет

- Discretion of My SystemДокумент20 страницDiscretion of My Systemscribduser53Оценок пока нет

- Appendix E Funding SourcesДокумент12 страницAppendix E Funding SourcesFred WilderОценок пока нет

- Property Assessed Clean Energy ProgramsДокумент14 страницProperty Assessed Clean Energy Programsdfong27Оценок пока нет

- National Zev Investment PlanДокумент41 страницаNational Zev Investment PlanFred Lamert100% (2)

- IHRC Project Concept Note (Insert Logo) : Ref. No: Date Received: Date ApprovedДокумент9 страницIHRC Project Concept Note (Insert Logo) : Ref. No: Date Received: Date ApprovedCCIRОценок пока нет

- Uploadedfiles - News - NewsArticles - NewsArticleResources - Water Efficiency As Stimulus and Long Term Investment REVISED FINAL 2008-12-18Документ12 страницUploadedfiles - News - NewsArticles - NewsArticleResources - Water Efficiency As Stimulus and Long Term Investment REVISED FINAL 2008-12-18Rahul GautamОценок пока нет

- Expenditure Direct Support (ExpDS)Документ7 страницExpenditure Direct Support (ExpDS)Bismark D-AОценок пока нет

- Municipal Real Property Asset Management:: An Application of Private Sector PracticesДокумент8 страницMunicipal Real Property Asset Management:: An Application of Private Sector PracticesIsgude GudeОценок пока нет

- Chapter 9 - Benefit & Cost AnalysisДокумент21 страницаChapter 9 - Benefit & Cost AnalysisSana MerajОценок пока нет

- Financing US Renewable Energy Projects Through Public Capital VehiclesДокумент38 страницFinancing US Renewable Energy Projects Through Public Capital VehiclesRujia Grandolin JiangОценок пока нет

- FY 2011 Northeastern Area State and Private Forestry Great Lakes Restoration Initiative (GLRI)Документ11 страницFY 2011 Northeastern Area State and Private Forestry Great Lakes Restoration Initiative (GLRI)Sweet WaterОценок пока нет

- Sector Synthesis of Postevaluation Findings in The Irrigation and Rural Development SectorДокумент19 страницSector Synthesis of Postevaluation Findings in The Irrigation and Rural Development SectorIndependent Evaluation at Asian Development BankОценок пока нет

- Financing US Renewable Energy Projects Through Public Capital Vehicles - WWWДокумент38 страницFinancing US Renewable Energy Projects Through Public Capital Vehicles - WWWDrew SmithОценок пока нет

- The Power of Leveraging Section 8Документ34 страницыThe Power of Leveraging Section 8Noah PainterОценок пока нет

- The Benefits of Conservation Planning Toolkit For Tax The Tax ProfessionalДокумент15 страницThe Benefits of Conservation Planning Toolkit For Tax The Tax Professionaljessross5Оценок пока нет

- Technical Assistance Report: Project Number: 53292-001 Transaction Technical Assistance Facility (F-TRTA) August 2019Документ13 страницTechnical Assistance Report: Project Number: 53292-001 Transaction Technical Assistance Facility (F-TRTA) August 2019shreya sheteОценок пока нет

- Fulton County City of Atlanta Land Bank Authority Request For Proposal FinalДокумент23 страницыFulton County City of Atlanta Land Bank Authority Request For Proposal FinalNur Fitri Indah KumalasariОценок пока нет

- CSP Farmers Guide Final September 2009Документ17 страницCSP Farmers Guide Final September 2009eredyОценок пока нет

- BARRETO-DILLON 2010 Budget Allocation and FinancingДокумент19 страницBARRETO-DILLON 2010 Budget Allocation and FinancingShabir TrambooОценок пока нет

- American Recovery and Reinvestment Act of 2009Документ3 страницыAmerican Recovery and Reinvestment Act of 2009StimulatingBroadband.comОценок пока нет

- Deloitte - PPPs in Water Sector - Getting Best Public Policy Outcomes - 2009Документ16 страницDeloitte - PPPs in Water Sector - Getting Best Public Policy Outcomes - 2009pranavp100% (1)

- The Reader: Affordable Housing and The Economic Stimulus BillДокумент12 страницThe Reader: Affordable Housing and The Economic Stimulus BillanhdincОценок пока нет

- General Introduction - LEAP Project The Tools: How To Start Using This Tool Kit?Документ4 страницыGeneral Introduction - LEAP Project The Tools: How To Start Using This Tool Kit?Musa FakaОценок пока нет

- Developing A Framework For Renegotiation of PPP ContractsДокумент123 страницыDeveloping A Framework For Renegotiation of PPP ContractsIrfan BiradarОценок пока нет

- The Low-Income Housing Tax Credit: How It Works and Who It ServesДокумент28 страницThe Low-Income Housing Tax Credit: How It Works and Who It ServesAna Milena Prada100% (1)

- Program Policies: Local Government Innovation FundДокумент8 страницProgram Policies: Local Government Innovation Fundjmrj76Оценок пока нет

- GLEASON, Kelly A. COCKAYNE, James. Official Development Assistance and SDG Target 8.7. 2018.Документ32 страницыGLEASON, Kelly A. COCKAYNE, James. Official Development Assistance and SDG Target 8.7. 2018.BarnabéОценок пока нет

- Financing Local Resilience Actions Investment Programming For ResiliencyДокумент29 страницFinancing Local Resilience Actions Investment Programming For ResiliencyLPPDA DILG LGCDDОценок пока нет

- E J S P A G FY 2011: Nvironmental Ustice Mall Grants Rogram Pplication UidanceДокумент48 страницE J S P A G FY 2011: Nvironmental Ustice Mall Grants Rogram Pplication Uidancegordon100Оценок пока нет

- Atlanta Green City Initiatives Sustainable DevelopmentДокумент9 страницAtlanta Green City Initiatives Sustainable DevelopmentDavid MoruduОценок пока нет

- OCM00503 Reimagine Services Update Council ReportДокумент14 страницOCM00503 Reimagine Services Update Council ReportEmily MertzОценок пока нет

- Form No. 5 Final Report - NGOДокумент7 страницForm No. 5 Final Report - NGOAnishSahniОценок пока нет

- 2008-09 Business Improvement District Budget Reports 2 of 2 PDFДокумент8 страниц2008-09 Business Improvement District Budget Reports 2 of 2 PDFRecordTrac - City of OaklandОценок пока нет

- Ofdb ManualДокумент117 страницOfdb ManualdghettosmurfОценок пока нет

- Review of DWSD Practices and PoliciesДокумент16 страницReview of DWSD Practices and PoliciesjewettwaterОценок пока нет

- Tapping Private SectorДокумент25 страницTapping Private SectorIrenataОценок пока нет

- Demolition Procurement Process ReportДокумент36 страницDemolition Procurement Process ReportClickon DetroitОценок пока нет

- State and Local Green Building IncentivesДокумент11 страницState and Local Green Building IncentiveslaurenjiaОценок пока нет

- Atlanta Falcons Community-Benefits PlanДокумент10 страницAtlanta Falcons Community-Benefits PlanmaxblauОценок пока нет

- Municipal Wastewater Treatment: Privatization and ComplianceДокумент38 страницMunicipal Wastewater Treatment: Privatization and CompliancereasonorgОценок пока нет

- Chapter 5 Public Facilities REV 10 19Документ23 страницыChapter 5 Public Facilities REV 10 19daksh2006meenaОценок пока нет

- Preservation of Recreational WFДокумент30 страницPreservation of Recreational WFDan TurnerОценок пока нет

- Frequently Asked Questions (FAQ) : State Aid: Just Transition Fund (JTF)Документ15 страницFrequently Asked Questions (FAQ) : State Aid: Just Transition Fund (JTF)amicoadrianoОценок пока нет

- Planned Parenthood TITLE X Grant Around 2015Документ219 страницPlanned Parenthood TITLE X Grant Around 20158453210Оценок пока нет

- Asset Management 2001: Australian Procurement & Construction Council IncДокумент29 страницAsset Management 2001: Australian Procurement & Construction Council IncShahab HosseinianОценок пока нет

- Understanding IFC's Environmental and Social Review ProcessДокумент2 страницыUnderstanding IFC's Environmental and Social Review ProcessIFC Sustainability50% (2)

- Friday, August 12, 2011 MemosДокумент32 страницыFriday, August 12, 2011 MemosDallasObserverОценок пока нет

- OMB Decision On PL110080Документ22 страницыOMB Decision On PL110080mikeboosОценок пока нет

- T: F: S: D: B:: O ROM Ubject ATE AckgroundДокумент17 страницT: F: S: D: B:: O ROM Ubject ATE AckgroundNicoleОценок пока нет

- EPA Region 7 Communities Information Digest - August 3, 2017Документ5 страницEPA Region 7 Communities Information Digest - August 3, 2017EPA Region 7 (Midwest)Оценок пока нет

- 17050,17051 - Green BondsДокумент11 страниц17050,17051 - Green BondsLakshya JhaОценок пока нет

- Leveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteОт EverandLeveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteОценок пока нет

- Winter 2011: Crossing The Big Wood RiverДокумент12 страницWinter 2011: Crossing The Big Wood RiverWood River Land TrustОценок пока нет

- Policy8L Nonconservation LandsДокумент1 страницаPolicy8L Nonconservation LandsWood River Land TrustОценок пока нет

- Policy 10ABCD Tax BenefitsДокумент1 страницаPolicy 10ABCD Tax BenefitsWood River Land TrustОценок пока нет

- Appendix8E1 Site Inspection ChecklistДокумент2 страницыAppendix8E1 Site Inspection ChecklistWood River Land TrustОценок пока нет

- Wood River Land Trust Summer Newsletter 2011Документ12 страницWood River Land Trust Summer Newsletter 2011Wood River Land TrustОценок пока нет

- Appendix8B.1 Project Selection CriteriaДокумент2 страницыAppendix8B.1 Project Selection CriteriaWood River Land TrustОценок пока нет

- Appendix8A.1 WRLT Service AreaДокумент1 страницаAppendix8A.1 WRLT Service AreaWood River Land TrustОценок пока нет

- Policy6A-G Financial Asset ManagementДокумент3 страницыPolicy6A-G Financial Asset ManagementWood River Land TrustОценок пока нет

- Appendix7B.2 VolunteerQuestionnaireДокумент1 страницаAppendix7B.2 VolunteerQuestionnaireWood River Land TrustОценок пока нет

- Appendix7B.1 Volunteer Program GuidelinesДокумент1 страницаAppendix7B.1 Volunteer Program GuidelinesWood River Land TrustОценок пока нет

- Appendix7G.2 Employee Housing Assistance FundДокумент3 страницыAppendix7G.2 Employee Housing Assistance FundWood River Land TrustОценок пока нет

- Policy8A WRLT Focus AreaДокумент2 страницыPolicy8A WRLT Focus AreaWood River Land TrustОценок пока нет

- Practice7A-H Volunteers, Staff and ConsultantsДокумент3 страницыPractice7A-H Volunteers, Staff and ConsultantsWood River Land TrustОценок пока нет

- Policy5 Fundraising Legal and Ethical PracticesДокумент2 страницыPolicy5 Fundraising Legal and Ethical PracticesWood River Land TrustОценок пока нет

- Appendix5B1Restricted Gift AcknowledgeДокумент1 страницаAppendix5B1Restricted Gift AcknowledgeWood River Land TrustОценок пока нет

- Policy3D-E-F Board AccountabilityДокумент3 страницыPolicy3D-E-F Board AccountabilityWood River Land TrustОценок пока нет

- Policy3C Board GovernanceДокумент3 страницыPolicy3C Board GovernanceWood River Land TrustОценок пока нет

- Policy3A Board ResponsibilityДокумент1 страницаPolicy3A Board ResponsibilityWood River Land TrustОценок пока нет