Академический Документы

Профессиональный Документы

Культура Документы

Should You Lease or Buy a Vehicle

Загружено:

Linda RodriguezОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Should You Lease or Buy a Vehicle

Загружено:

Linda RodriguezАвторское право:

Доступные форматы

Lease or Buy

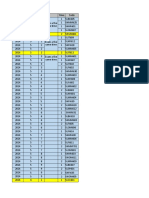

I. Lease Assumptions Refundable Security Deposit First Month's Payment at Inception Other initial costs, if any Monthly Lease Payment For Remaining Term Last Month Payment in Advance? Allowable Annual Mileage - If not applicable, enter "0" Estimated Annual Miles to Be Driven, If not applicable, enter "0" Per Mile Charge for Excess Miles

Type "Yes" or "No"

II. Buy Assumptions Retail Price including sales taxes, title, etc. Down Payment (If paying cash, down payment equals Retail Price) Loan Interest Rate Will Interest Be Deductible Business or Home Equity Interest Resale Value at End of Term - This may equal the lease option price Is the gross loaded wait of the vehicle over 6,000 lbs? The answer is typically yes for large vans, pickups and large sports utility vehicles.

Type "Yes" or "No" Type "Yes" or "No"

III. Common Assumptions Total Lease/Loan Term - 24, 36, 48 or 60 months Discount Percent Tax Bracket - combined federal and state Business Use Percentage

Lease Assumptions $500 $500 $125 $600 Type "Yes" or "No" No 15,000 20,000 $0.10 Buy Assumptions $34,997 $4,000 8.75% Type "Yes" or "No" Yes Type "Yes" or "No" Yes

Common Assumptions 36 8.75% 33.00% 100.00%

The IRS Maximum Annual Depreciation for an Automobile Correct Months Amount 24 0 7,570 10,060 3,060 0 4,900 0 Months Months Months 36 48 60 10,060 11,440 12,710 3,060 3,060 3,060 4,900 4,900 4,900 2,950 2,950 2,950 1,775 1,775 1,775

PV OF IRS DEPRECIATION LIMIT Year 1 Year 2 Year 3 Year 4 Year 5

10,060 PV OF DEPRECIATION Year 1 - 1/2 year Year 2 Year 3 Year 4 Year 5 Year 6 - 1/2 year 0 22,980 0 0 17,300 6,999 11,199 22,980 6,999 11,199 6,719 26,110 6,999 11,199 6,719 4,032 29,000 6,999 11,199 6,719 4,032 4,032 2,016 34,997

22,980

0.2000 0.3200 0.1920 0.1152 0.1152 0.0576 1.0000

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Formula Sheet For Financial MathematicsДокумент4 страницыFormula Sheet For Financial MathematicsMilon SultanОценок пока нет

- Cash Accounts Receivable JournalДокумент56 страницCash Accounts Receivable Journallaale dijaanОценок пока нет

- Glenn D Ellison Solutions To Exercises From Fudenberg TiroleДокумент202 страницыGlenn D Ellison Solutions To Exercises From Fudenberg TiroleMarcosОценок пока нет

- Quiz 3. (2) Adjusting Entries - Attempt ReviewДокумент11 страницQuiz 3. (2) Adjusting Entries - Attempt ReviewErika Yasto100% (2)

- BLR - Electives For MBA Class of 2024 - Sem III & IVДокумент6 страницBLR - Electives For MBA Class of 2024 - Sem III & IVbhagyesh taleleОценок пока нет

- TOPIC 6c - Cost of Capital and Capital StructureДокумент42 страницыTOPIC 6c - Cost of Capital and Capital StructureYasskidayo Hammyson100% (1)

- 3 Economic and Social Issues in ManagementДокумент26 страниц3 Economic and Social Issues in ManagementSidharth ChoudharyОценок пока нет

- Choose A Forex BrokerДокумент1 страницаChoose A Forex BrokerMed MesОценок пока нет

- Dynamix Luma 99acresДокумент26 страницDynamix Luma 99acresSapience RodriguesОценок пока нет

- Economics ActivitiesДокумент5 страницEconomics ActivitiesDaisy OrbonОценок пока нет

- Rural MarketingДокумент9 страницRural MarketingPrashant GurjarОценок пока нет

- A25 Highway Drawing Volume 25.03.22 67Документ1 страницаA25 Highway Drawing Volume 25.03.22 67Monjit GogoiОценок пока нет

- Mindmap Ch1. Indian Economy On The Eve of IndependenceДокумент1 страницаMindmap Ch1. Indian Economy On The Eve of IndependenceAnup DubeyОценок пока нет

- Introduction TeaДокумент2 страницыIntroduction Teaeziest123Оценок пока нет

- The Relationship Between Food and Fuel PricesДокумент2 страницыThe Relationship Between Food and Fuel PricesSamieОценок пока нет

- Saving Account Salary Account Current AccountДокумент32 страницыSaving Account Salary Account Current AccountSamdarshi KumarОценок пока нет

- Format of Bottlers NepalДокумент12 страницFormat of Bottlers NepalReya TaujaleОценок пока нет

- (Lesson Part-I) - Chapter 5. Producer Behavior TheoryДокумент23 страницы(Lesson Part-I) - Chapter 5. Producer Behavior TheoryШохрух МаджидовОценок пока нет

- 10 Ijetmr18 A05 381Документ9 страниц10 Ijetmr18 A05 381Koushik SahaОценок пока нет

- CE and HW On Debt SecuritiesДокумент3 страницыCE and HW On Debt SecuritiesAmy SpencerОценок пока нет

- Alaska License Holder RecordsДокумент3 844 страницыAlaska License Holder RecordsBeth Gmytruk AdairОценок пока нет

- Africa From The OAU To The African UnionДокумент17 страницAfrica From The OAU To The African UniongorditoОценок пока нет

- Economics: Interdependence and The Gains From TradeДокумент32 страницыEconomics: Interdependence and The Gains From TradeHưng Đào ViệtОценок пока нет

- PH Real Estate MarketДокумент36 страницPH Real Estate MarketGino NavalОценок пока нет

- Drycargo 05-2019Документ134 страницыDrycargo 05-2019fracev100% (1)

- Thanks For Your Order!: Billing Information Payment Details Receipt DetailsДокумент1 страницаThanks For Your Order!: Billing Information Payment Details Receipt Detailschalapathi psОценок пока нет

- PAP Form SBI Payment CollectionДокумент1 страницаPAP Form SBI Payment Collectionmanphool singhОценок пока нет

- Hedera Hashgraph Overview 2023Документ14 страницHedera Hashgraph Overview 2023Aritra ChatterjeeОценок пока нет

- GKInvest New Account Types 2022Документ1 страницаGKInvest New Account Types 2022AJI PANGESTUОценок пока нет

- Concept Map 2Документ8 страницConcept Map 2mike raninОценок пока нет