Академический Документы

Профессиональный Документы

Культура Документы

Property Digest Week 1

Загружено:

Marvin B. AlcantaraИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Property Digest Week 1

Загружено:

Marvin B. AlcantaraАвторское право:

Доступные форматы

Recommended Book: Commentaries and Jurisprudence on the Civil Code of the Philippines, Vol. II, Arturo M. Tolentino I.

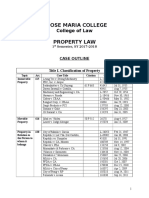

Preliminary Provisions (Art 414) II. Classification of Property (Arts 415-418) a. Immovable Property (Art 415) i. By nature 415 (1) & (8) ii.By incorporation 415 (2), (3), & (7) By destination 415 (4), (5), (6), and (9) iii. By analogy 415 (10) iv. b. Movable Property (Art 416-418) Cases 1. Leung Yee vs. Strong Machinery 37 Phil 644 2. Davao Sawmill vs. Castillo 61 Phil 709 3. Machinery & Engineering Supplies vs. CA 96 Phil 70 4. Associated Insurance vs. Isabeliya 103 Phil 972 5. Mindanao Bus Company vs. City Assessor 6 S 197 6. Bd. Of Assessment Appeals vs. Meralco 10 S 68 7. Tumalad vs. Vicencio 41 S 143 8. Punsalan vs. Lacsamana 121 S 331 9. Makati Leasing vs. Wearever 122 S 296 10. Meralco Securities vs. Central Bd. Of Assessment Appeals 114 S 260 11. Meralco Securities vs. Bd. Of Assessment Appeals 114 S 273 12. Caltex vs. Bd. Of Assessment Appeals 114 S 296 13. Prudential Bank vs. Panis 153 S 390 14. Benguet Corp. vs. Central Bd. Of Assessment Appeals 218 S 271 15. Sergs Products Inc vs. PCI Leasing and Finance Inc. 338 S 499 16. Tsai vs. CA 366 S 324 c. Importance and Significance of Classification i. From the point of view of 1. Criminal law 2. Forms of contracts involving movable or immovables 3. Prescription

4. Venue 5. Taxation ii.Differences between real rights and personal rights Leung Yee v. Strong Machinery Company 37 Phil. 644 Facts: The Compaia Agricola Filipina bought a considerable quantity of rice-cleaning machinery company from the defendant machinery company, and executed a chattel mortgage thereon to secure payment of the purchaseprice. It included in the mortgage deed the building of strong materials in which the machinery was installed, without any reference to the land on which it stood. The indebtedness secured by this instrument not having been paid when it fell due, the mortgaged property was sold by the sheriff, in pursuance of the terms of the mortgage instrument. A few weeks thereafter, on or about the 14th of January, 1914, the Compaia Agricola Filipina executed a deed of sale of the land upon which the building stood to themachinery company, but this deed of sale, although executed in a public document, was not registered. The machinery company went into possession of the building at or about the time when this sale took place, that is to say, the month of December, 1913, and it has continued in possession ever since. At or about the time when the chattel mortgage was executed in favor of themachinery company, the mortgagor, the Compaia Agricola Filipina executed another mortgage to the plaintiff upon the building, separate and apart from the land on which it stood. Upon the failure of the mortgagor to pay the amount of the indebtedness secured by the mortgage, the plaintiff secured judgment for that amount, levied execution

upon the building, boughtit in at the sheriffs sale on or about the 18th of December, 1914.This action was instituted by the plaintiff to recover possession of the building from themachinery company. The trial judge gave judgment in favor of the machinery company. Hence, this appeal. Issue: Whether or not the trial judge erred in sustaining the machinery company on the ground that it had its title to the building registered prior to the date of registry of plaintiffs certificate. Held: We conclude that the ruling in favor of the machinery company cannot be sustained on the ground assigned by the trial judge. We are of opinion, however, that the judgment must be sustained on the ground that the agreed statement of facts in the court below discloses that neither the purchase of the building by the plaintiff nor his inscription of the sheriffs certificate of sale in his favor was made in good faith, and that the machinery company must be held to be the owner of the property Article 1544 of the New Civil Code, it appearing that the company first took possession of the property; and further, that the building and the land were sold to the machinery companylong prior to the date of the sheriffs sale to the plaintiff. But it appearing that he had full knowledge of the machinery companys claim of ownership when he executed the indemnity bond and bought in the property at the sheriffs sale, and it appearing further that the machinery companys claim of ownership was well founded,

he cannot be said to have been an innocentpurchaser for value. He took the risk and must stand by the consequences; and it is in this sense that we find that he was not a purchaser in good faith. The decision of the trial court is hereby affirmed. Davao Sawmill Co. v. Castillo 61 Phil. 709 Facts: The Davao Saw Mill Co., Inc., is the holder of a lumber concession from the Government of the PhilippineIslands. It has operated a sawmill in thesi tio of Maa, barrio of Tigatu, municipality of Davao, Province ofDavao. However, the land upon which the business was conducted belonged to another person. On theland the sawmill company erected a building which housed the machinery used by it. Some of theimplements thus used were clearly personal property, the conflict concerning machines which were placedand mounted on foundations of cement. In the contract of lease between the sawmill company and theowner of the land there appeared the following provision: That on the expiration of the period agreed upon, all the improvements and buildings introduced anderected by the party of the second part shall pass to the exclusive ownership of the party of the first partwithout any obligation on its part to pay any amount for said improvements and buildings; also, in theevent the party of the second part should leave or abandon the land leased before the time hereinstipulated, the improvements and buildings shall likewise pass to the ownership of the party of the

firstpart as though the time agreed upon had expired: Provided, however, That the machineries andaccessories are not included in the improvements which will pass to the party of the first part on theexpiration or abandonment of the land leased. The trial judge found that those properties were personal in nature and as a consequence absolved the defendants from the complaint. Issue: Whether or not the trial judge erred in finding that the subject properties are personal in nature. Held: As connecting up with the facts, it should further be explained that the Davao Saw Mill Co., Inc., has on anumber of occasions treated the machinery as personal property by executing chattel mortgages in favorof third persons. One of such persons is the appellee by assignment from the original mortgages. Article 334, paragraphs 1 and 5, of the [Old]Civil Code, is in point. According to the Code, real property consists of 1. Land, buildings, roads and constructions of all kinds adhering to the soil; 5. Machinery, liquid containers, instruments or implements intended by the owner of any building or landfor use in connection with any industry or trade being carried on therein and which are expressly adaptedto meet the requirements of such trade of industry. Appellant emphasizes the first paragraph, and appellees the last mentioned paragraph. We entertain nodoubt that the trial judge

and appellees are right in their appreciation of the legal doctrines flowing fromthe facts. As a rule, the machinery should be considered as personal, since it was not placed on the land by theowner of the land immobilization by destination on purpose cannot generally be made by a person, whosepossession of the property is only temporary, otherwise was will be forced to presume that be intended togive the property permanently to the owner of the land. In this case, they had stipulated that the land inthe end thereby be acted as an agent for the owner of the land. In this sense the property (machines foruse in the sawmill) became real property. The judgment appealed from is hereby affirmed. Engineering and Machinery Corporation v. CA Facts: Pursuant to a contract, petitioner undertook to install air conditioning system in private respondents building. The building was later sold to the National Investment and Development Corporation which took possession of it. Upon NIDCs failure to comply with certain conditions, the sale was rescinded. NIDC reported to respondent that there were certain defects in the air conditioning system. Respondent filed a complaint against petitioner for non-compliance with the agreed plans and specifications. Petitioner moved to dismiss the complaint on the ground of the 6-month prescription of warranty against hidden defects. Private respondent averred that the contract was not of sale but for a piece of work, the action for damages of which prescribes after 10 years. Issue: Is a contract for the fabrication and installation of a central airconditioning system in a building, one of "sale" or "for a piece of work"? Held:

A contract for a piece of work, labor and materials may be distinguished from a contract of sale by the inquiry as to whether the thing transferred is one not in existence and which would never have existed but for the order, of the person desiring it. In such case, the contract is one for a piece of work, not a sale. On the other hand, if the thing subject of the contract would have existed and been the subject of a sale to some other person even if the order had not been given, then the contract is one of sale. The distinction between the two contracts depends on the intention of the parties. Thus, if the parties intended that at some future date an object has to be delivered, without considering the work or labor of the party bound to deliver, the contract is one of sale. But if one of the parties accepts the undertaking on the basis of some plan, taking into account the work he will employ personally or through another, there is a contract for a piece of work. Clearly, the contract in question is one for a piece of work. It is not petitioner's line of business to manufacture airconditioning systems to be sold "off-the-shelf." Its business and particular field of expertise is the fabrication and installation of such systems as ordered by customers and in accordance with the particular plans and specifications provided by the customers. Naturally, the price or compensation for the system manufactured and installed will

depend greatly on the particular plans and specifications agreed upon with the customers. The remedy against violations of the warranty against hidden defects is either to withdraw from the contract (redhibitory action) or to demand a proportionate reduction of the price (accion quanti manoris), with damages in either case. While it is true that Article 1571 of the Civil Code provides for a prescriptive period of six months for a redhibitory action, a cursory reading of the ten preceding articles to which it refers will reveal that said rule may be applied only in case of implied warranties; and where there is an express warranty in the contract, as in the case at bench, the prescriptive period is the one specified in the express warranty, and in the absence of such period, "the general rule on rescission of contract, which is four years (Article 1389, Civil Code) shall apply". It would appear that this suit is barred by prescription because the complaint was filed more than four years after the execution of the contract and the completion of the air-conditioning system. However, a close scrutiny of the complaint filed in the trial court reveals that the original action is not really for enforcement of the warranties against hidden defects, but one for breach of the contract itself. The governing law is Article 1715. However, inasmuch as this provision does not contain a specific prescriptive period, the general law on prescription, which is Article 1144 of the Civil Code, will apply. Said provision states, inter alia, that actions "upon a written contract" prescribe in ten (10) years. Since the

governing contract was executed on September 10, 1962 and the complaint was filed on May 8, 1971, it is clear that the action has not prescribed. The mere fact that the private respondent accepted the work does not, ipso facto, relieve the petitioner from liability for deviations from and violations of the written contract, as the law gives him ten (10) years within which to file an action based on breach thereof. Associated Insurance & Surety v. Iya [G.R. Nos. L-10837-38. May 30, 1958.] En Banc, Felix (J): 9 concur Facts: Spouses Adriano and Lucia A. Valino were the owners and possessors of a house of strong materials constructed on Lot 3, Block 80 of the Grace Park Subdivision in Caloocan, Rizal, which they purchased on installment basis from the Philippine Realty Corporation. On 6 November 1951, to enable her to purchase on credit rice from the NARIC, Lucia Valino filed a bond (P11,000.00; AISCO Bond 971) subscribed by the Associated Insurance & Surety Co. and as counter-guaranty therefor, the Valinos executed an alleged chattel mortgage on the aforementioned house in favor of the surety company, which encumbrance was duly registered with the Chattel Mortgage Register of Rizal on 6 December 1951. It is admitted that at the time said undertaking took place, the parcel of land on which the house is erected was still registered in the name of the Philippine Realty Corporation. Having completed payment on the purchase price of the lot, the Valinos were able to secure on 18 October 1958, a certificate of

title in their name (TCT 27884). Subsequently, however, or on 24 October 1952, the Valinos, to secure payment of an indebtedness in the amount of P12,000.00, executed a real estate mortgage over the lot and the house in favor of Isabel Iya, which was duly registered and annotated at the back of the certificate of title. Later, Lucia A. Valino failed to satisfy her obligation to the NARIC, the surety company was compelled to pay the same pursuant to the undertaking of the bond. The surety company demanded reimbursement from the Valinos, who failed to do so. The company foreclosed the chattel mortgage over the house as a consequence. A public sale was conducted thereafter by the Provincial Sheriff of Rizal on 26 December 1952, wherein the property was awarded to the surety company for P8,000.00, the highest bid received therefor. The surety company then caused the said house to be declared in its name for tax purposes (Tax Declaration 25128). Sometime in July 1953, the surety company learned of the existence of the real estate mortgage over the lot covered by TTC 26884 together with the improvements thereon; thus, said surety company instituted Civil Case 2162 with the CFI Manila naming Adriano and Lucia Valino and Isabel Iya, the mortgagee, as defendants. On the other hand, on 29 October 1953, Isabel Iya filed a civil action against the Valinos and the surety company (Civil Case 2504 with CFI Manila) praying for a decree of foreclosure of the land, building and improvements thereon to be

sold at public auction and the proceeds applied to satisfy the demands; this pursuant to the contract of mortgage as the Valinos have failed to pay interest for more than 6 months already; the surety company included as it claims to have an interest on the residential house covered by said mortgage. The two cases were jointly heard upon agreement of the parties, who submitted the same on a stipulation of facts, after which the Court rendered judgment dated 8 March 1956, holding that the chattel mortgage in favor of the Associated Insurance & Surety was preferred and superior over the real estate mortgage subsequently executed in favor of Isabel Iya. It was ruled that as the Valinos were not yet the registered owner of the land on which the building in question was constructed at the time the first encumbrance was made, the building then was still a personalty and a chattel mortgage over the same was proper. However, as the mortgagors were already the owners of the lot at the time the contract with Isabel Iya was entered into, the building was transformed into a real property and the real estate mortgage created thereon was likewise adjudged as proper. The residential building was, therefore, ordered excluded from the foreclosure prayed for by Isabel Iya, although the latter could exercise the right of a junior encumbrancer. The spouses Valino were ordered to pay the amount demanded by said mortgagee or in their default to have the parcel of land subject of the mortgage sold at public auction for the satisfaction of Iya's claim. The Supreme Court reversed the decision of the lower court, recognized Isabel Iya's right to foreclose not only the land but

also the building erected thereon, and ordered that the proceeds of the sale thereof at public auction (if the land has not yet been sold), be applied to the unsatisfied judgment in favor of Isabel Iya. The decision however is without prejudice to any right that the Associated Insurance & Surety may have against the Valinos on account of the mortgage of said building they executed in favor of said surety company. Without pronouncement as to costs. 1. Nature of property encumbered is the decisive factor in determination of preferential right The decisive factor in resolving the issue as to which of these encumbrances should receive preference over the other is the determination of the nature of the structure litigated upon, for where it be considered a personalty, the foreclosure of the chattel mortgage and the subsequent sale thereof at public auction, made in accordance with the Chattel Mortgage Law would be valid and the right acquired by the surety company therefrom would certainly deserve prior recognition; otherwise, appellant's claim for preference must be granted. 2. Building always immovable While it is true that generally, real estate connotes the land and the building constructed thereon, it is obvious that the inclusion of the building, separate and distinct from the land, in the enumeration of what may constitute real properties (Art. 415, new Civil Code) could only mean one thing: that a building is by itself an immovable property. Moreover, and in view of the absence of any specific provision to the contrary, a building is an immovable property irrespective of whether or not said structure

and the land on which it is adhered to belong to the same owner." (Lopez vs. Orosa). 3. Building cannot be divested of character as realty when constructed on land belonging to another A building certainly cannot be divested of its character of a realty by the fact that the land on which it is constructed belongs to another. To hold it the other way, the possibility is not remote that it would result in confusion, for to cloak the building with an uncertain status made dependent on the ownership of the land, would create a situation where a permanent fixture changes its nature or character as the ownership of the land changes hands. 4. Execution of a chattel mortgage over a building invalid and a nullity As personal properties could only be the subject of a chattel mortgage (Section 1, Act 3952), the execution of the chattel mortgage covering a building is clearly invalid and a nullity. While it is true that said document was correspondingly registered in the Chattel Mortgage Register, this act produced no effect whatsoever for where the interest conveyed is in the nature of a real property, the registration of the document in the registry of chattels is merely a futile act. Thus, the registration of the chattel mortgage of a building of strong materials produce no effect as far as the building is concerned (Leung Yee vs. Strong Machinery Co., 37 Phil., 644). 5. No right acquired by chattel mortgage creditor who purchases real properties in an extrajudicial foreclosure sale A mortgage creditor who purchases real properties at an

extrajudicial foreclosure sale thereof by virtue of a chattel mortgage constituted in his favor, which mortgage has been declared null and void with respect to said real properties, acquires no right thereto by virtue of said sale (De la Riva vs. Ah Keo, 60 Phil., 899). MINDANAO BUS CO. vs. CITY ASSESSOR FACTS: Mindanao Bus Company is a public utility engaged in transporting passengers and cargoes by motor trucks in Mindanao has its main offices in Cagayan de Oro. The company is also owner to the land where it maintains and operates a garage, a repair shop, blacksmith and carpentry shops; the machineries are place on wooden and cement platforms. The City Assessor of Cagayan de Oro City assessed at P4,400 said maintenance and repair equipment. The company appealed the assessment to the Board of Tax Appeals on the ground that the same are not realty. The Board of Tax Appeals of the City sustained the city assessor, so the company filed with the Court of Tax Appeals a petition for the review of the assessment. The CTA held that the Company was liable to the payment of the realty tax on its maintenance and repair equipment. Hence, the company filed a petition for review with the Supreme Court. ISSUE: Whether or not the machineries assessed by the respondent are real properties? HELD: Paragraph 5 of Article 415 of the New Civil which provides machinery, receptacles, instruments or implements intended by the owner of the tenement for an industry or works which may be

carried on in a building or on a piece of land, and which tend directly to meet the needs of the said industry or works are immovable properties. Movable equipments to be immobilized in contemplation of the law must first be "essential and principal elements" of an industry or works without which such industry or works would be "unable to function or carry on the industrial purpose for which it was established." The tools and equipments in question in this instant case are, by their nature, not essential and principal elements of petitioner's business of transporting passengers and cargoes by motor trucks. They are merely incidentals-acquired as movables and used only for expediency to facilitate and/or improve its service. Even without such tools and equipments, its business may he carried on. the equipments in question are destined only to repair or service the transportation business, which is not carried On in a building or permanently on a piece of land, as demanded by the law. Said equipments may not, therefore, be deemed real property. BOARD OF ASSESSMENT APPEALS V. MANILA ELECTRIC COMPANY 10 SCRA 68 FACTS: City Assessor of QC declared the steel towers for real property tax under Tax Declarations. After denying the respondents petition to cancel these declarations, an appeal was taken with the CTA which held that the steel towers come under the exception of poles under the franchise given to MERALCO; the steel towers are personal properties; and the City Treasurer is liable for the refund of the amount paid.

HELD: The steel towers of an electric company dont constitute real property for the purposes of real property tax. Tumalad v. Vicencio [G.R. No. L-30173. September 30, 1971.] En Banc, Reyes JBL (J): 10 concur Facts: On 1 September 1955 Vicencio and Simeon, defendantsappellants, executed a chattel mortgage in favor of the Tumalads, plaintiff-appellees over their house of strong materials located at 550 Int. 3, Quezon Boulevard, Quiapo, Manila, over Lot 6-B and 7-B, Block 2554, which were being rented from Madrigal & Company, Inc. The mortgage was registered in the Registry of Deeds of Manila on 2 September 1955. The mortgage was executed to guarantee a loan of P4,800.00 received from the Tumalads, payable within one year at 12% per annum. The mode of payment was P150.00 monthly, starting September, 1955, up to July 1956, and the lump sum of P3,150 was payable on or before August, 1956. It was also agreed that default in the payment of any of the amortizations would cause the remaining unpaid balance to become immediately due and payable, the Chattel Mortgage enforceable, and the Sheriff of Manila authorized the Mortgagors property after necessary publication. When Vicencio and Simeon defaulted in paying, the mortgage was extrajudicially foreclosed, and on 27 March 1956, the house was sold at public auction pursuant to the said contract. As highest bidder, the Tumalads were issued the corresponding certificate of sale. On 18 April 1956, the Tumalads commenced Civil Case 43073 in the municipal court of Manila, praying, among other things, that

the house be vacated and its possession surrendered to them, and for Vicencio and Simeon to pay rent of P200.00 monthly from 27 March 1956 up to the time the possession is surrendered. On 21 September 1956, the municipal court rendered its decision in favor of the Tumalads. Having lost therein, appealed to the court a quo (Civil Case 30993) which also rendered a decision against them. On appeal, the case was certified to the Supreme Court by the Court of Appeals (CA-G.R. No. 27824-R) for the reason that only questions of law are involved. Plaintiffs-appellees failed to file a brief and this appeal was submitted for decision without it. Nearly a year after the foreclosure sale the mortgaged house had been demolished on 14 and 15 January 1957 by virtue of a decision obtained by the lessor of the land on which the house stood. The Supreme Court reversed the decision appealed from and entered another dismissing the complaint, with costs against plaintiffs-appellees. 1. Answer a mere statement and not evidence; Allegations or averments determines jurisdiction It has been held in Supia and Batiaco vs. Quintero and Ayala that "the answer is a mere statement of the facts which the party filing it expects to prove, but it is not evidence; and further, that when the question to be determined is one of title, the Court is given the authority to proceed with the hearing of the cause until this fact is clearly established. In the case of Sy vs. Dalman,

wherein the defendant was also a successful bidder in an auction sale, it was likewise held by the Court that in detainer cases the claim of ownership "is a matter of defense and raises an issue of fact which should be determined from the evidence at the trial." What determines jurisdiction are the allegations or averments in the complaint and the relief asked for. 2. Fraud and deceit renders a contract voidable or annullable, and not void ab initio; Claim of ownership by virtue of voidable contract fails without evidence that steps were made to annul the same Fraud or deceit does not render a contract void ab initio, and can only be a ground for rendering the contract voidable or annullable pursuant to Article 1390 of the New Civil Code, by a proper action in court. In the present case, the charge of fraud, deceit or trickery, the conterntions are not supported by evidence. Further, there is nothing on record to show that the mortgage has been annulled. Neither is it disclosed that steps were taken to nullify the same. Hence, defendantsappellants' claim of ownership on the basis of a voidable contract which has not been voided fails. 3. Buildings as immovable The rule about the status of buildings as immovable property is stated in Lopez vs. Orosa, Jr. and Plaza Theatre, Inc., cited in Associated Insurance Surety Co., Inc. vs. Iya, et al. 16 to the effect that the inclusion of the building, separate and distinct from the land, in the enumeration of what may constitute real properties (art. 415, New Civil Code) could only mean one thing

that a building is by itself an immovable property irrespective of whether or not said structure and the land on which it is adhered to belong to the same owner. 4. Deviations allowed, parties treatment of real property as personal property; cases Certain deviations, however, have been allowed for various reasons. In the case of Manarang and Manarang vs. Ofilada, it was held that "it is undeniable that the parties to a contract may by agreement treat as personal property that which by ,nature would be real property", citing Standard Oil Company of New York vs. Jaramillo. In the latter case, the mortgagor conveyed and transferred to the mortgagee by way of mortgage "the following described personal property." The "personal property" consisted of leasehold rights and a building. In the case of Luna vs. Encarnacion, the subject of the contract designated as Chattel Mortgage was a house of mixed materials, and the Court held therein that it was a valid Chattel mortgage because it was so expressly designated and specifically that the property given as security "is a house of mixed materials, which by its very nature is considered personal property." In Navarro vs. Pineda, the Court stated that the view that parties to a deed of chattel mortgage may agree to consider a house as personal property for the purposes of said contract, 'is good only insofar as the contracting parties are concerned. It is based, partly, upon the principle of

estoppel' (Evangelista vs. Alto Surety). In a case, a mortgaged house built on a rented land was held to be a personal property, not only because the deed of mortgage considered it as such, but also because it did not form part of the land, for it is now settled that an object placed on land by one who had only a temporary right to the same, such as the lessee or usufructuary, does not become immobilized by attachment (Valdez vs. Central Altagracia, cited in Davao Sawmill vs. Castillo). Hence, if a house belonging to a person stands on a rented land belonging to another person, it may be mortgaged as a personal property as so stipulated in the document of mortgage. It should be noted, however that the principle is predicated on statements by the owner declaring his house to be a chattel, a conduct that may conceivably estop him from subsequently claiming otherwise. (Ladera vs. C.N. Hodges). 5. House treated by parties as chattel; factors to determine In the contract, the house on rented land is not only expressly designated as Chattel Mortgage; it specifically provides that "the mortgagor voluntarily cedes, sells and transfers by way of Chattel Mortgage the property together with its leasehold rights over the lot on which it is constructed and participation;" whcih could only have meant to convey the house as chattel, or at least, intended to treat the same as such, so that they should not now be allowed to make an inconsistent stand by claiming otherwise.

Moreover, the subject house stood on a rented lot to which defendants-appellants merely had a temporary right as lessee, and although this can not in itself alone determine the status of the property, it does so when combined with other factors to sustain the interpretation that the parties, particularly the mortgagors, intended to treat the house as personality. 6. Estoppel; Party in chattel mortgage cannot question validity of chattel mortgage entered into Inlike in the Iya cases, Lopez vs. Orosa, Jr. and Plaza Theatreand Leung Yee vs. F. L. Strong Machinery and Williamson, wherein third persons assailed the validity of the chattel mortgage, it is the defendants-appellants themselves, as debtorsmortgagors, who are attacking the validity of the chattel mortgage in this case. The doctrine of estoppel therefore applies to the herein defendants-appellants, having treated the subject house as personalty. 7. Chattel mortgage covered by Act 1508, Chattel Mortgage Law Chattel mortgages are covered and regulated by the Chattel Mortgage Law, Act 1508. Section 14 of this Act allows the mortgagee to have the property mortgaged sold at public auction through a public officer in almost the same manner as that allowed by Act 3135, as amended by Act 4118, provided that the requirements of the law relative to notice and registration are complied with. In the present case, the parties specifically stipulated that "the chattel mortgage will be enforceable in accordance with the provisions of Special Act 3135. 8. Mortgagors entitled to remain in possession without rent within redemption period Nearly a year after the foreclosure sale the mortgaged house had

been demolished on 14 and 15 January 1957 by virtue of a decision obtained by the lessor of the land on which the house stood. The CFI sentenced the mortgagors to pay a monthly rent of P200.00 from the time the chattel mortgage was foreclosed until when it was torn down by the sheriff. The Court ruled that the mortgagors were entitled to remain in possession without any obligation to pay rent during the one year redemption period after the foreclosure sale. Section 6 of Act 3135 provides that the debtor-mortgagor may, at any time within one year from and after the date of the auction sale, redeem the property sold at the extra judicial foreclosure sale. Section 7 of the same Act allows the purchaser of the property to obtain from the court the possession during the period of redemption: but the same provision expressly requires the filing of a petition with the proper CFI and the furnishing of a bond. It is only upon filing of the proper motion and the approval of the corresponding bond that the order for a writ of possession issues as a matter of course. No discretion is left to the court. In the absence of such a compliance, as in the instant case, the purchaser can not claim possession during the period of redemption as a matter of right. In such a case, the governing provision is Section 34, Rule 39, of the Revised Rules of Court which also applies to properties purchased in extrajudicial foreclosure proceedings. 9. Rentals received during redemption period credited to redemption price Before the expiration of the 1-year period within which the judgment-debtor or mortgagor may redeem the property, the

purchaser thereof is not entitled, as a matter of right, to possession of the same. Thus, while it is true that the Rules of Court allow the purchaser to receive the rentals if the purchased property is occupied by tenants, he is, nevertheless, accountable to the judgment-debtor or mortgagor as the case may be, for the amount so received and the same will be duly credited against the redemption price when the said debtor or mortgagor effects the redemption. Differently stated, the rentals receivable from tenants, although they may be collected by the purchaser during the redemption period, do not belong to the latter but still pertain to the debtor of mortgagor. The rationale for the Rule, it seems, is to secure for the benefit of the debtor or mortgagor, the payment of the redemption amount and the consequent return to him of his properties sold at public auction. (Reyes vs. Hamada, reiterating Chan v. Espe) 10. Case prematurely filed The period of redemption had not yet expired when action was instituted in the court of origin, and that plaintiffs-appellees did not choose to take possession under Section 7, Act 3135, as amended, which is the law selected by the parties to govern the extrajudicial foreclosure of the chattel mortgage. Neither was there an allegation to that effect. Since plaintiffs-appellees' right to possess was not yet born at the filing of the complaint, there could be no violation or breach thereof. Wherefore, the original

complaint stated no cause of action and was prematurely filed. 11. Courts authority to review errors not assigned Even if there was no assignment of error to that effect, the Supreme Court is clothed with ample authority to review palpable errors not assigned as such if it finds that their consideration is necessary in arriving at a just decision of the case. PUNZALAN V. LACSAMANA Buildings are always treated as immovable or real property under the Code even if it was dealt with separately from the land upon which it stood FACTS: Some land belonging to Antonio Punzalan was foreclosed by the Philippine National Bank Tarlac, Branch in failure of the former to pay the mortgaged fee amounting to P10 grand Since PNB was the highest bidder, the land went to PNB. Sometime 1974, while the property was still in the possession of Punzalan, Punzalan constructed awarehouse on the said land by virtue of the permit secured from the Municipal Mayor of Bamban, Tarlac. Subsequently, in 1978, a contract of sale was entered into by PNB and Remedios Vda. De Lacsamana, whom in lieu of the said sale secured a title over the property involving the warehouse allegedly owned and constructed by the plaintiff. Punzalan filed a suit for annulment of the Deed of Sale with damages against PNB and Lacsamana before the Court of First Instance of Rizal, Branch 31, impugning the validity of the sale of the building, requesting the same to be declared null and void and that damages in the total sum of P23, 200 more or less be awarded to him.

Respondent Lacsamana in his answer averred the affirmative defense of lack of cause of action contending that she was a purchaser for value, while, PNB filed a Motion to Dismiss on the ground of improper venue, invoking that the building was a real property under Article 415 of the Civil Code, and therefore, Section 4 (a) of the Rules of Court should apply. Punzalan filed a Motion for Reconsideration asserting that the action he filed is limited to the annulment of sale and that, it does not involved ownership of or title to property but denied by the court for lack of merit. A motion for pre-trial was also set by Punzalan but was also denied by the court invoking that the case was already dismissed. Hence, a petition for certiorari was filed by the petitioner. ISSUE: Whether or not the judgment rendered by the court is proper. HELD: While it is true that the petitioner does not directly seek the recovery of the title or possession of the property in question, his action for annulment of sale and his claim for damages are closely intertwined with the issue of ownership of the building, which, under the law, is considered immovable property, the recovery of which is petitioners primary objective. The prevalent doctrine is that an action for the annulment or rescission of a sale of real property does not operate to efface the objective and nature of the case, which is to recover said property. It is a real action. Respondent Court did not err in dismissing the case on the ground of improper venue under Section 12 Rule 4 which was timely raised under Section 1 Rule 16 of the Rules of Court. Personal Observation: The venue was improperly laid by the

petitioner in the case at bar. Such ground was sufficient to render dismissal of the case, as the same is one of the grounds provided for under Rule 16 (c) of the Rules of Court. The Denial of Motion to Dismiss rendered by the court in the instant case is appealable. If such denial constitute grave abuse of discretion on the part of the court , Punzalan may file either Prohibition or Certiorari under Rule 65 of the Rules of Court Makati Leasing vs. Wearever Textile Facts: Wearever Textile in order to obtain a financial accommodation from Makati Leasing, discounted andassigned several receivables with the former under a Receivable Purchase Agreement. To secure thecollection of the receivables assigned, Waerever executed a Chattel Mortgage over certain rawmaterials inventory as well as a machinery described as an Artos Aero Dryer Stentering Range. Upon Wearever's default, Makati Leasing filed a petition for extrajudicial foreclosure of the propertiesmortgage to it. However, the Deputy Sheriff assigned to implement the foreclosure failed to gain entryinto Wearever's premises and was not able to effect the seizure of the machinery. Makati Leasingthereafter filed a complaint for judicial foreclosure with the CFI Rizal. RTC then issued a writ of seizure, the enforcement of which was restrained upon Wearever's filing ofa motion for reconsideration. finally issued on 11 February 1981, an order to break open the premisesof Wearever to enforce said writ. The sheriff enforcing the seizure order, repaired to the premises

of Wearever and removed the main drive motor of the subject machinery. CA set aside the orders of the RTC and ordered the return of the drive motor seized by the sheriffafter ruling that the machinery in suit cannot be the subject of replevin, much less of a chattelmortgage, because it is a real property pursuant to Article 415 of the new Civil Code. CA also rejectedthe argument that Wearever is estopped from claiming that the machine is real property byconstituting a chattel mortgage thereon. A motion for reconsideration was filed by Makati Leasing, butit was denied. Hence this petition. Issue: Whether the machinery in suit is real or personal property? Held: If a house of strong materials, like what was involved in the above Tumalad case, may be consideredas personal property for purposes of executing a chattel mortgage thereon as long as the parties tothe contract so agree and no innocent third party will be prejudiced thereby, there is absolutely noreason why a machinery, which is movable in its nature and becomes immobilized only by destinationor purpose, may not be likewise treated as such. This is really because one who has so agreed isestopped from denying the existence of the chattel mortgage. It must be pointed out that the characterization of the subject machinery as chattel by the privaterespondent is indicative of intention and impresses upon the property the character determined by theparties. As stated in Standard Oil Co. of New

York vs. Jaramillo, 44 Phil. 630, it is undeniable that theparties to a contract may by agreement treat as personal property that which by nature would be realproperty, as long as no interest of third parties would be prejudiced thereby. Meralco Securities v. Central Board of Assessment Appeals G.R. No. L-46245 May 31, 1982 [Aquino, J.:] Facts: Petitioner questions the decision of the respondent which held that petitioners pipeline is subject to realty tax. Pursuant to a concession, petitioner installed a pipeline system from Manila to Batangas. Meanwhile, the provincial assessor of Laguna treated the pipeline as real property. So, petitioner appealed the assessments to the Board of Assessment Appeals of Laguna. The board upheld the assessments and the decision became final and executory after the lapse of fifteen days from the date of receipt of a copy of the decision by the appellant. Meralco Securities contends that the Court of Tax Appeals has no jurisdiction to review the decision of the Central Board of Assessment Appeals and no judicial review of the Board's decision is provided for in the Real Property Tax Code. Hence, the petitioners recourse to file a petition for certiorari. Held: it was held that certiorari was properly availed of in this case. It is a writ issued by a superior court to an inferior court, board or officer exercising judicial or quasi-judicial functions whereby the record of a particular case is ordered to be elevated for review and correction in matters of law. The rule is that as to administrative agencies exercising quasijudicial

power there is an underlying power in the courts to scrutinize the acts of such agencies on questions of law and jurisdiction even though no right of review is given by the statute. The purpose of judicial review is to keep the administrative agency within its jurisdiction and protect substantial rights of parties affected by its decisions. The review is a part of the system of checks and balances which is a limitation on the separation of powers and which forestalls arbitrary and unjust adjudications. Judicial review of the decision of an official or administrative agency exercising quasijudicial functions is proper in cases of lack of jurisdiction, error of law, grave abuse of discretion, fraud or collusion or in case the administrative decision is corrupt, arbitrary or capricious MERALCO V BOARD OF ASSESSMENT FACTS:-There are two oil storage tanks installed in 1969 by Meralco on a lot in San Pascual, Batangaswhich it leased in 1968 from Caltex (Phil.), Inc. The tanks are within the Caltex refinery compound.They have a total capacity of 566,000 barrels. They are used for storing fuel oil for Meralco's power plants.-The storage tanks are made of steel plates welded and assembled on the spot. Their bottoms reston a foundation consisting of compacted earth as the outermost layer, a sand pad as theintermediate layer and a twoinch thick bituminous asphalt stratum as the top layer. The bottom of each tank is in contact with the asphalt layer. The steel sides of the tank are directly supportedunderneath by a circular wall made of concrete, eighteen inches thick, to prevent the tank fromsliding. Hence, according to Meralco, the tank is not attached to its foundation. It is not anchored or welded to the

concrete circular wall. Its bottom plate is not attached to any part of the foundation bybolts, screws or similar devices. The tank merely sits on its foundation. Each empty tank can befloated by flooding its dike-inclosed location with water four feet deep.The Board concludes that while the tanks rest or sit on their foundation, the foundation itself andthe walls, dikes and steps, which are integral parts of the tanks, are affixed to the land while thepipelines are attached to the tanks. In 1970, the municipal treasurer of Bauan, Batangas, on thebasis of an assessment made by the provincial assessor, required Meralco to pay realty taxes onthe two tanks. For the five-year period from 1970 to 1974, the tax and penalties amounted toP431,703.96. The Board required Meralco to pay the tax and penalties as a condition for entertaining its appeal from the adverse decision of the Batangas board of assessment appeals.-The Central Board of Assessment Appeals ruled that the tanks together with the foundation, walls,dikes, steps, pipelines and other appurtenances constitute t axable improvements. Meralcocontends that the said oil storage tanks do not fall within any of the kinds of real propertyenumerated in article 415 of the Civil Code and, therefore, they cannot be categorized as realty bynature, by incorporation, by destination nor by analogy. Stress is laid on the fact that the tanks arenot attached to the land and that they were placed on leased land, not on the land owned byMeralco. ISSUE:W/N the oil tanks are considered as real property HELD: YES.-While the two storage tanks are not embedded in the

land, they may, nevertheless, be consideredas improvements on the land, enhancing its utility and rendering it useful to the oil industry. It isundeniable that the two tanks have been installed with some degree of permanence as receptaclesfor the considerable quantities of oil needed by Meralco for its operations.-For purposes of taxation, the term "real property" may include things which should generally beregarded as personal property. It is a familiar phenomenon to see things classed as real propertyfor purposes of taxation which on general principle might be considered personal property. ADDITIONAL: baka lang ipa-compare: The case of Board of Assessment Appeals vs. ManilaElectric Company, 119 Phil. 328, wherein Meralco's steel towers were held not to be subject torealty tax, is not in point because in that case the steel towers were regarded as poles and under its franchise Meralco's poles are exempt from taxation. Moreover, the steel towers were notattached to any land or building. They were removable from their metal frames. CALTEX PHILS. V. CENTRAL BOARD OF ASSESSMENT APPEALS 114 SCRA 296 FACTS: The City Assessor characterized the items in gas stations of petitioner as taxable realty. These items included underground tanks, elevated tank, elevated water tanks, water tanks, gasoline pumps,computing pumps, etc. These items are not owned by the lessor of the land wherein the equipment are installed. Upon expiration of the lease agreement, the equipment should be returned in good condition. HELD: The equipment and machinery as appurtenances to the gas

station building or shed owned by Caltex and which fixtures are necessary to the operation of the gas station, for without them the gas station would be useless, and which have been attached and fixed permanently to the gas station site or embedded therein, are taxable improvements and machinery within the meaning of the Assessment Law and the Real Property Tax Code. Prudential Bank v. Panis [G.R. No. L-50008. August 31, 1987.] First Division, Paras (J): 4 concur. Facts: On 19 November 1971, Fernando A. Magcale and Teodula Baluyut Magcale secured a loan of P70,000.00 from Prudential Bank. To secure payment of this loan, the Magcales executed in favor of Prudential Bank a deed of Real Estate Mortgage over a 2storey, semi-concrete residential building with warehouse space (total area of 263 sq.m.); and granting upon the mortgagee the right of occupancy on the lot where the property is erected. A rider is also included in the deed that in the event the Sales Patent on the lot is issued of Bureau of Lands, the Register of Deeds is authorized to hold the Registration until the mortgage is cancelled or annotate the encumbrance on the title upon authority from the Secretary of Agriculture and Natural Resources, which title with annotation release in favor of the mortgage. The Real Estate Mortgage was registered under the Provisions of Act 3344 with the Registry of Deeds of Zambales on 23 November 1971. Subsequently, the Magcales secured an additional loan from Prudential Bank, secured by another deed of Real Estate Mortgage registeed with the Registry of Deeds in Olongapo City, on 2 May 1973.

On 24 April 1973, the Secretary of Agriculture issued Miscellaneous Sales Patent 4776 over the parcel of land, possessory rights over which were mortgaged to rudential Bank, in favor of the Magcales. On the basis of the Patent, and upon its transcription in the Registration Book of the Province of Zambales, OCT P-2554 was issued in the name of Fernando Magcale, by the Ex-Oficio Register of Deeds of Zambales, on 15 May 1972. For failure of the Magcales to pay their obligation to the Bank after it became due, the deeds of Real Estate Mortgage were extrajudicially foreclosed. Consequent to the foreclosure was the sale of the properties mortgaged to the bank as the highest bidder in a public auction sale conducted by the City Sheriff on 12 April 1978. The auction sale was held despite written request from the Magcales through counsel, dated 29 March 1978, for the City Sheriff to desist from going with the scheduled public auction sale. The issue was raised to the CF Zambales and Olongapo City which, on 3 November 1978, declared the deeds of Real Estate Mortgage as null and void. The bank filed a motion for reconsideration on 14 December 1978, which the court denied on 10 January 1979 for lack of merit. Hence, the petition. The Supreme Court modified the decision of the CFI Zambales & Olongapo, declaring that the Deed of Real Estate Mortgage for P70,000.00 is valid but ruling that the Deed of Real Estate Mortgage for an additional loan of P20,000.00 is null and void, without prejudice to any appropriate action the Government may take against private respondents. 1. Building separate and distinct from the land

In the enumeration of properties under Article 415 of the Civil Code of the Philippines, it is obvious that the inclusion of 'building' separate and distinct from the land, in said provision of law can only mean that a building is by itself an immovable property. (Lopez vs. Orosa, Jr., et al., L-10817-18, Feb. 28, 1958; Associated Inc. and Surety Co., Inc. vs. Iya, et al., L-1083738, May 30, 1958). 2. Building can be mortgaged apart from the land it is built; possessory rights may be validly transferred in a deed of mortgage While a mortgage of land necessarily includes, in the absence of stipulation of the improvements thereon, buildings; still a building by itself may be mortgaged apart from the land on which it has been built. Such a mortgage would be still a real estate mortgage for the building would still be considered immovable property even if dealt with separately and apart from the land (Leung Yee vs. Strong Machinery Co., 37 Phil. 644). Possessory rights over said properties before title is vested on the grantee, may be validly transferred or conveyed as in a deed of mortgage (Vda. de Bautista vs. Marcos, 3 SCRA 438 [1961]). 3. A valid real estate mortgage may be constituted on the building erected on the land belonging to another The original mortgage was executed (19 November 1971) before the issuance of the final patent (24 April 1972) and before the government was divested of its title to the land (15 May 1972), an event which takes effect only on the issuance of the sales patent and its subsequent registration in the Office of the Register of Deeds (Visayan Realty Inc. vs. Meer, 96 Phil. 515;

Director of Lands vs. De Leon, 110 Phil. 28; Director of Lands vs. Jurado, L-14702, May 23, 1961; Pea, "Law on Natural Resources", p. 49). In the case at bar, it is evident that the mortgage executed by Magcale on his own building which was erected on the land belonging to the government is to all intents and purposes a valid mortgage. 4. Public land act and RA 730 not violated in first mortgage As to restrictions appearing to the Magcales title; Sections 121, 122 and 124 of the Public Land Act refer to land already acquired under the Public Land Act or any improvement thereon. Section 2 of RA 730 refers to encumbrance or alienation before the patent is issued because it refers specifically to encumbrance or alienation on the land itself and does not mention anything regarding the improvements existing thereon. Both have no application to the assailed mortgage in the case at bar; as the former, the mortgage was executed before such eventuality, and the latter, it does not encumber nor alienate the land. 5. Mortgage made after issuance of Sales Patent an OCT prohibited; Estoppel does not give validating effect to a void contract As regards the second mortgage executed, such mortgage executed after the issuance of the sales patent and of the Original Certificate of Title, falls squarely under the prohibitions stated in Sections 121, 122 and 124 of the Public Land Act and Section 2 of RA 730, and is therefore null and void. Even if the title was voluntary surrendered to the bank for the mortgage to

be annotated without the prior approval of the Ministry of Natural Resources; in pari delicto may not be invoked to defeat the policy of the State neither may the doctrine of estoppel give a validating effect to a void contract. Indeed, it is generally considered that as between parties to a contract, validity cannot be given to it by estoppel if it is prohibited by law or is against public policy (19 Am. Jur. 802). It is not within the competence of any citizen to barter away what public policy by law seeks to preserve (Gonzalo Puyat & Sons, Inc. vs. De los Amas and Alino, supra; Arsenal vs. IAC, 143 SCRA 54 [1986]). Such does not, however, preclude new contracts that may be entered into in accordance with the requirements of the law. Any new transaction, however, would be subject to whatever steps the Government may take for the reversion of the land in its favor. G.R. No. 106041 January 29, 1993 BENGUET CORPORATION, petitioner, vs. CENTRAL BOARD OF ASSESSMENT APPEALS, BOARD OF ASSESSMENT APPEALS OF ZAMBALES, PROVINCIAL ASSESSOR OF ZAMBALES, PROVINCE OF ZAMBALES, and MUNICIPALITY OF SAN MARCELINO, respondents. Romulo, Mabanta, Buenaventura, Sayoc & De los Angeles for petitioner. CRUZ, J.: The realty tax assessment involved in this case amounts to P11,319,304.00. It has been imposed on the petitioner's tailings dam and the land thereunder over its protest. The controversy arose in 1985 when the Provincial Assessor of Zambales assessed the said properties as taxable improvements. The assessment was appealed to the Board of Assessment

Appeals of the Province of Zambales. On August 24, 1988, the appeal was dismissed mainly on the ground of the petitioner's "failure to pay the realty taxes that fell due during the pendency of the appeal." The petitioner seasonably elevated the matter to the Central Board of Assessment Appeals, 1 one of the herein respondents. In its decision dated March 22, 1990, the Board reversed the dismissal of the appeal but, on the merits, agreed that "the tailings dam and the lands submerged thereunder (were) subject to realty tax." For purposes of taxation the dam is considered as real property as it comes within the object mentioned in paragraphs (a) and (b) of Article 415 of the New Civil Code. It is a construction adhered to the soil which cannot be separated or detached without breaking the material or causing destruction on the land upon which it is attached. The immovable nature of the dam as an improvement determines its character as real property, hence taxable under Section 38 of the Real Property Tax Code. (P.D. 464). Although the dam is partly used as an anti-pollution device, this Board cannot accede to the request for tax exemption in the absence of a law authorizing the same. xxx xxx xxx We find the appraisal on the land submerged as a result of the construction of the tailings dam, covered by Tax Declaration Nos. 002-0260 and 002-0266, to be in accordance with the Schedule of Market Values for Zambales which was reviewed and allowed

for use by the Ministry (Department) of Finance in the 19811982 general revision. No serious attempt was made by PetitionerAppellant Benguet Corporation to impugn its reasonableness, i.e., that the P50.00 per square meter applied by RespondentAppellee Provincial Assessor is indeed excessive and unconscionable. Hence, we find no cause to disturb the market value applied by Respondent Appellee Provincial Assessor of Zambales on the properties of Petitioner-Appellant Benguet Corporation covered by Tax Declaration Nos. 002-0260 and 0020266. This petition for certiorari now seeks to reverse the above ruling. The principal contention of the petitioner is that the tailings dam is not subject to realty tax because it is not an "improvement" upon the land within the meaning of the Real Property Tax Code. More particularly, it is claimed (1) as regards the tailings dam as an "improvement": (a) that the tailings dam has no value separate from and independent of the mine; hence, by itself it cannot be considered an improvement separately assessable; (b) that it is an integral part of the mine; (c) that at the end of the mining operation of the petitioner corporation in the area, the tailings dam will benefit the local community by serving as an irrigation facility; (d) that the building of the dam has stripped the property of any commercial value as the property is submerged under water wastes from the mine; (e) that the tailings dam is an environmental pollution control device for which petitioner must be commended rather than penalized with a realty tax assessment; (f) that the installation and utilization of the tailings dam as a pollution control device is a requirement imposed by law; (2) as regards the valuation of the tailings dam and the

submerged lands: (a) that the subject properties have no market value as they cannot be sold independently of the mine; (b) that the valuation of the tailings dam should be based on its incidental use by petitioner as a water reservoir and not on the alleged cost of construction of the dam and the annual buildup expense; (c) that the "residual value formula" used by the Provincial Assessor and adopted by respondent CBAA is arbitrary and erroneous; and (3) as regards the petitioner's liability for penalties for non-declaration of the tailings dam and the submerged lands for realty tax purposes: (a) that where a tax is not paid in an honest belief that it is not due, no penalty shall be collected in addition to the basic tax; (b) that no other mining companies in the Philippines operating a tailings dam have been made to declare the dam for realty tax purposes. The petitioner does not dispute that the tailings dam may be considered realty within the meaning of Article 415. It insists, however, that the dam cannot be subjected to realty tax as a separate and independent property because it does not constitute an "assessable improvement" on the mine although a considerable sum may have been spent in constructing and maintaining it. To support its theory, the petitioner cites the following cases: 1. Municipality of Cotabato v. Santos (105 Phil. 963), where this Court considered the dikes and gates constructed by the taxpayer in connection with a fishpond operation as integral parts of the fishpond. 2. Bislig Bay Lumber Co. v. Provincial Government of Surigao (100 Phil. 303), involving a road constructed by the timber concessionaire in the area, where this Court did not impose a

realty tax on the road primarily for two reasons: In the first place, it cannot be disputed that the ownership of the road that was constructed by appellee belongs to the government by right of accession not only because it is inherently incorporated or attached to the timber land . . . but also because upon the expiration of the concession said road would ultimately pass to the national government. . . . In the second place, while the road was constructed by appellee primarily for its use and benefit, the privilege is not exclusive, for . . . appellee cannot prevent the use of portions of the concession for homesteading purposes. It is also duty bound to allow the free use of forest products within the concession for the personal use of individuals residing in or within the vicinity of the land. . . . In other words, the government has practically reserved the rights to use the road to promote its varied activities. Since, as above shown, the road in question cannot be considered as an improvement which belongs to appellee, although in part is for its benefit, it is clear that the same cannot be the subject of assessment within the meaning of Section 2 of C.A. No. 470. Apparently, the realty tax was not imposed not because the road was an integral part of the lumber concession but because the government had the right to use the road to promote its varied activities. 3. Kendrick v. Twin Lakes Reservoir Co. (144 Pacific 884), an American case, where it was declared that the reservoir dam went with and formed part of the reservoir and that the dam would be "worthless and useless except in connection with the

outlet canal, and the water rights in the reservoir represent and include whatever utility or value there is in the dam and headgates." 4. Ontario Silver Mining Co. v. Hixon (164 Pacific 498), also from the United States. This case involved drain tunnels constructed by plaintiff when it expanded its mining operations downward, resulting in a constantly increasing flow of water in the said mine. It was held that: Whatever value they have is connected with and in fact is an integral part of the mine itself. Just as much so as any shaft which descends into the earth or an underground incline, tunnel, or drift would be which was used in connection with the mine. On the other hand, the Solicitor General argues that the dam is an assessable improvement because it enhances the value and utility of the mine. The primary function of the dam is to receive, retain and hold the water coming from the operations of the mine, and it also enables the petitioner to impound water, which is then recycled for use in the plant. There is also ample jurisprudence to support this view, thus: . . . The said equipment and machinery, as appurtenances to the gas station building or shed owned by Caltex (as to which it is subject to realty tax) and which fixtures are necessary to the operation of the gas station, for without them the gas station would be useless and which have been attached or affixed permanently to the gas station site or embedded therein, are taxable improvements and machinery within the meaning of the Assessment Law and the Real Property Tax Code. (Caltex [Phil.]

Inc. v. CBAA, 114 SCRA 296). We hold that while the two storage tanks are not embedded in the land, they may, nevertheless, be considered as improvements on the land, enhancing its utility and rendering it useful to the oil industry. It is undeniable that the two tanks have been installed with some degree of permanence as receptacles for the considerable quantities of oil needed by MERALCO for its operations. (Manila Electric Co. v. CBAA, 114 SCRA 273). The pipeline system in question is indubitably a construction adhering to the soil. It is attached to the land in such a way that it cannot be separated therefrom without dismantling the steel pipes which were welded to form the pipeline. (MERALCO Securities Industrial Corp. v. CBAA, 114 SCRA 261). The tax upon the dam was properly assessed to the plaintiff as a tax upon real estate. (Flax-Pond Water Co. v. City of Lynn, 16 N.E. 742). The oil tanks are structures within the statute, that they are designed and used by the owner as permanent improvement of the free hold, and that for such reasons they were properly assessed by the respondent taxing district as improvements. (Standard Oil Co. of New Jersey v. Atlantic City, 15 A 2d. 271) The Real Property Tax Code does not carry a definition of "real property" and simply says that the realty tax is imposed on "real property, such as lands, buildings, machinery and other improvements affixed or attached to real property." In the absence of such a definition, we apply Article 415 of the Civil Code, the pertinent portions of which state: Art. 415. The following are immovable property. (1) Lands, buildings and constructions of all kinds adhered to the

soil; xxx xxx xxx (3) Everything attached to an immovable in a fixed manner, in such a way that it cannot be separated therefrom without breaking the material or deterioration of the object. Section 2 of C.A. No. 470, otherwise known as the Assessment Law, provides that the realty tax is due "on the real property, including land, buildings, machinery and other improvements" not specifically exempted in Section 3 thereof. A reading of that section shows that the tailings dam of the petitioner does not fall under any of the classes of exempt real properties therein enumerated. Is the tailings dam an improvement on the mine? Section 3(k) of the Real Property Tax Code defines improvement as follows: (k) Improvements is a valuable addition made to property or an amelioration in its condition, amounting to more than mere repairs or replacement of waste, costing labor or capital and intended to enhance its value, beauty or utility or to adopt it for new or further purposes. The term has also been interpreted as "artificial alterations of the physical condition of the ground that arereasonably permanent in character." 2 The Court notes that in the Ontario case the plaintiff admitted that the mine involved therein could not be operated without the aid of the drain tunnels, which were indispensable to the successful development and extraction of the minerals therein. This is not true in the present case.

Even without the tailings dam, the petitioner's mining operation can still be carried out because the primary function of the dam is merely to receive and retain the wastes and water coming from the mine. There is no allegation that the water coming from the dam is the sole source of water for the mining operation so as to make the dam an integral part of the mine. In fact, as a result of the construction of the dam, the petitioner can now impound and recycle water without having to spend for the building of a water reservoir. And as the petitioner itself points out, even if the petitioner's mine is shut down or ceases operation, the dam may still be used for irrigation of the surrounding areas, again unlike in the Ontario case. As correctly observed by the CBAA, the Kendrick case is also not applicable because it involved water reservoir dams used for different purposes and for the benefit of the surrounding areas. By contrast, the tailings dam in question is being used exclusively for the benefit of the petitioner. Curiously, the petitioner, while vigorously arguing that the tailings dam has no separate existence, just as vigorously contends that at the end of the mining operation the tailings dam will serve the local community as an irrigation facility, thereby implying that it can exist independently of the mine. From the definitions and the cases cited above, it would appear that whether a structure constitutes an improvement so as to partake of the status of realty would depend upon the degree of permanence intended in its construction and use. The expression "permanent" as applied to an improvement does not imply that the improvement must be used perpetually but only until the purpose to which the principal realty is devoted has been accomplished. It is sufficient that the improvement is

intended to remain as long as the land to which it is annexed is still used for the said purpose. The Court is convinced that the subject dam falls within the definition of an "improvement" because it is permanent in character and it enhances both the value and utility of petitioner's mine. Moreover, the immovable nature of the dam defines its character as real property under Article 415 of the Civil Code and thus makes it taxable under Section 38 of the Real Property Tax Code. The Court will also reject the contention that the appraisal at P50.00 per square meter made by the Provincial Assessor is excessive and that his use of the "residual value formula" is arbitrary and erroneous. Respondent Provincial Assessor explained the use of the "residual value formula" as follows: A 50% residual value is applied in the computation because, while it is true that when slime fills the dike, it will then be covered by another dike or stage, the stage covered is still there and still exists and since only one face of the dike is filled, 50% or the other face is unutilized. In sustaining this formula, the CBAA gave the following justification: We find the appraisal on the land submerged as a result of the construction of the tailings dam, covered by Tax Declaration Nos. 002-0260 and 002-0266, to be in accordance with the Schedule of Market Values for San Marcelino, Zambales, which is fifty (50.00) pesos per square meter for third class industrial land (TSN, page 17, July 5, 1989) and Schedule of Market Values for Zambales which was reviewed and allowed for use by the Ministry (Department) of Finance in the 1981-1982 general revision. No serious attempt was made by PetitionerAppellant

Benguet Corporation to impugn its reasonableness, i.e, that the P50.00 per square meter applied by Respondent-Appellee Provincial Assessor is indeed excessive and unconscionable. Hence, we find no cause to disturb the market value applied by Respondent-Appellee Provincial Assessor of Zambales on the properties of Petitioner-Appellant Benguet Corporation covered by Tax Declaration Nos. 002-0260 and 002-0266. It has been the long-standing policy of this Court to respect the conclusions of quasi-judicial agencies like the CBAA, which, because of the nature of its functions and its frequent exercise thereof, has developed expertise in the resolution of assessment problems. The only exception to this rule is where it is clearly shown that the administrative body has committed grave abuse of discretion calling for the intervention of this Court in the exercise of its own powers of review. There is no such showing in the case at bar. We disagree, however, with the ruling of respondent CBAA that it cannot take cognizance of the issue of the propriety of the penalties imposed upon it, which was raised by the petitioner for the first time only on appeal. The CBAA held that this "is an entirely new matter that petitioner can take up with the Provincial Assessor (and) can be the subject of another protest before the Local Board or a negotiation with the local sanggunian . . ., and in case of an adverse decision by either the Local Board or the local sanggunian, (it can) elevate the same to this Board for appropriate action." There is no need for this time-wasting procedure. The Court may resolve the issue in this petition instead of referring it back to the

local authorities. We have studied the facts and circumstances of this case as above discussed and find that the petitioner has acted in good faith in questioning the assessment on the tailings dam and the land submerged thereunder. It is clear that it has not done so for the purpose of evading or delaying the payment of the questioned tax. Hence, we hold that the petitioner is not subject to penalty for its non-declaration of the tailings dam and the submerged lands for realty tax purposes. WHEREFORE, the petition is DISMISSED for failure to show that the questioned decision of respondent Central Board of Assessment Appeals is tainted with grave abuse of discretion except as to the imposition of penalties upon the petitioner which is hereby SET ASIDE. Costs against the petitioner. It is so ordered. Sergs Products v. PCI Leasing Facts: On 13 February 1998, PCI Leasing and Finance, Inc. filed a complaint for sum of money, with anapplication for a writ of replevin. On 6 March 1998, upon an ex-parte application of PCI Leasing, judgeissued a writ of replevin directing its sheriff to seize and deliver the machineries and equipment to PCILeasing after 5 days and upon the payment of the necessary expenses. On 24 March 1998, thesheriff proceeded to petitioner's factory, seized one machinery with word that the return for the othermachineries. On 25 March 1998, petitioners filed a motion for special protective order, invoking thepower of the court to control the conduct of its officers and amend and control its processes, prayingfor a directive for the sheriff to defer

enforcement of the writ of replevin. On 6 April 1998, the sheriffagain sought to enforce the writ of seizure and take possession of the remaining properties. He wasable to take two more, but was prevented by the workers from taking the rest. On 7 April 1998, theywent to the CA via an original action for certiorari. Citing the Agreement of the parties, the appellate court held that the subject machines were personalproperty, and that they had only been leased, not owned, by petitioners; and ruled that the "words ofthe contract are clear and leave no doubt upon the true intention of the contracting parties." It thusaffirmed the 18 February 1998 Order, and the 31 March 1998 Resolution of the lower court, and liftedthe preliminary injunction issued on 15 June 1998. A subsequent motion for reconsideration wasdenied on 26 February 1999. Hence, the petition for review on certiorari. Issue: Whether the machines are personal or real property? Held: The machinery were essential and principal elements of their chocolate-making industry. Hence,although each of them was movable or personal property on its own, all of them have become"immobilized by destination because they are essential and principal elements in the industry." Themachines are thus, real, not personal, property pursuant to Article 415 (5) of the Civil Code. Contracting parties may validly stipulate that a real property be considered as personal. After agreeingto such stipulation, they

are consequently estopped from claiming otherwise. Under the principle ofestoppel, a party to a contract is ordinarily precluded from denying the truth of any material fact foundtherein. Thus, said machines are proper subjects of the Writ of Seizure (compare Tumalad v. Vicencio). The holding that the machines should be deemed personal property pursuant to the Lease Agreementis good only insofar as the contracting parties are concerned. Hence, while the parties are bound bythe Agreement, third persons acting in good faith are not affected by its stipulation characterizing thesubject machinery as personal. In the present case, however, there is no showing that any specificthird party would be adversely affected. TSAI V. COURT OF APPEALS 336 SCRA 324 FACTS: EVERTEX secured a loan from PBC, guaranteed by a real estate and chattel mortgage over a parcel of land where the factory stands, and the chattels located therein, as included in a schedule attached to the mortgage contract. Another loan was obtained secured by a chattel mortgage over properties with similar descriptions listed in the first schedule. During the date of execution of the second mortgage, EVERTEX purchased machineries and equipment. Due to business reverses, EVERTEX filed for insolvency proceedings. It failed to pay its obligation and thus, PBC initiated extrajudicial foreclosure of the mortgages. PBC was the highest bidder in the public auctions, making it the owner of the properties. It then leased the factory premises to Tsai. Afterwards, EVERTEX sought the annulment of the sale and conveyance of the properties to PBC as it was allegedly a violation of the INSOLVENCY LAW.

The RTC held that the lease and sale were irregular as it involved properties not included in theschedule of the mortgage contract. HELD: While it is true that the controverted properties appear to be immobile, a perusal of the contract of REM and CM executed by the parties gives a contrary indication. In the case at bar, both the trial and appellate courts show that the intention was to treat the machineries as movables or personal property. Assuming that the properties were considered immovables, nothing detracts the parties from treating it as chattels to secure an obligation under the principle of estoppel.

Вам также может понравиться

- Final Case Digest Property Updated 1 67Документ79 страницFinal Case Digest Property Updated 1 67kedrick bumanghatОценок пока нет

- SC Upholds DAR Ruling on Land Ownership DisputeДокумент5 страницSC Upholds DAR Ruling on Land Ownership DisputeJonjon BeeОценок пока нет

- Bachrach Motor Co., Inc. v. Talisay - Silay Milling Co. G.R. No. 35223, September 17, 1931, 56 Phil. 117 Romualdez, JДокумент11 страницBachrach Motor Co., Inc. v. Talisay - Silay Milling Co. G.R. No. 35223, September 17, 1931, 56 Phil. 117 Romualdez, JKPPОценок пока нет

- Property Case DigestsДокумент142 страницыProperty Case DigestsMarisol RodriguezОценок пока нет

- Court upholds owner's sole option to sell land with encroachmentsДокумент15 страницCourt upholds owner's sole option to sell land with encroachmentsKate MontenegroОценок пока нет

- Module 6Документ16 страницModule 6Hermay BanarioОценок пока нет

- Quieting Title Action PrematureДокумент60 страницQuieting Title Action PrematurebcarОценок пока нет

- Ayala Land vs. Ray BurtonДокумент10 страницAyala Land vs. Ray BurtonAnonymous wyfks15HUОценок пока нет

- Collado vs. CAДокумент28 страницCollado vs. CAWilfredОценок пока нет

- School of Law: Rizal Memorial College Davao CityДокумент5 страницSchool of Law: Rizal Memorial College Davao CityCrisDBОценок пока нет